All interested parties know that alimony is paid from absolutely all income of the alimony payer. And if they are collected even from unemployment and disability benefits - divorced fathers and mothers argue - then they should even more so be collected from the money received for the sale of the apartment.

This idea causes joyful inspiration among alimony recipients and mortal horror among alimony payers. After all, we are talking about money, without exaggeration, huge money!

Real estate forms the basis of the well-being of the majority of Russian citizens; as a rule, it is the most expensive property that a person owns. And even the most conscientious and loving fathers are not delighted with the idea that from 25 to 50 percent of the funds received from the sale of their apartment will have to be given to the children from their first marriage.

Will it be necessary or not? Disputes on this topic have not subsided for more than 10 years. And there's a reason for that.

In this article we will talk about it, and also consider how things really are, and whether you will have to pay an additional amount of alimony after selling the apartment.

Where is the panic coming from?

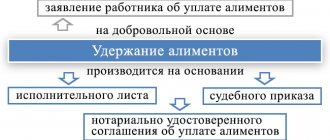

It all started in 2008, when Government Resolution No. 841, adopted back in 1996 and containing a list of income subject to alimony deductions, was once again updated.

The list of “alimony-taxable” sources of income included the item “income received under an agreement between individuals.” The seemingly innocent formulation caused unexpectedly violent consequences.

The fact is that the purchase and sale agreement for an apartment also formally falls under the definition of “agreement between individuals.” And, despite the fact that the legislators did not have anything like this in mind, “legal wars” began - lawyers for alimony recipients, foaming at the mouth, argued in court that alimony after the transaction should be collected, alimony payers (also not without the help of lawyers) did their best fought back.

And it no longer mattered who won in the end - panic began. And, to be honest, practically from scratch. Because the key concept for the alimony payer in the new formulation was not “an agreement between individuals,” but “income.”

Is income from the sale of an apartment not income?

From a household point of view, of course, income. Like, there was no money, I sold the apartment - and here they are, a whole bunch. What is this if not income?

Legally, the sale of property has nothing to do with income! We'll explain why below.

However, some lawyers insisted (and continue to do so even a decade after the adoption of the controversial amendment) on treating the purchase and sale of an apartment as a source of income. True, they calculate the amount of income differently:

- Some - the entire amount received for housing

- The second is the difference between how much the apartment cost when purchased and how much it was sold for.

- Still others - that if the apartment was sold for the purpose of investing in the purchase of a new home, then there is no income. And if for another purpose, there is a fact of receiving income.

The confusion is aggravated by the position of the Tax Code: since personal income tax is charged on the sale of housing, that means it is income! Otherwise, why would funds be subject to income tax?

In fact, none of the above legal interpretations are correct. And the tax department has its own logic and its own motives. They have nothing to do with the legislative framework and rules for collecting child support.

From an economic point of view, income is an increase in material assets. Their increase. As a result of the sale of property (including apartments), no increase occurs. The asset is simply modified - it was in its natural form, but has turned into a cash equivalent. While remaining property, not income. Alimony is collected specifically from the income of the alimony payer.

In other words, the sale by the alimony payer of an apartment that belongs to him is not a basis for collecting additional alimony from him. Because money received for an apartment is not income. This means that the court cannot assign either a percentage deduction or a fixed amount, no matter how much the alimony recipient strives to the contrary.

But there are no rules without exceptions. The money received from the sale of an apartment does not at all have some exceptional properties that prohibit its use as alimony payments. For example, if there is a debt, the bailiffs do not care where to collect it from.

Or, if the funds are not invested in a new home, but are in the account. The recipient of alimony has the right to file a lawsuit to increase the amount of alimony - after all, the financial situation of the alimony payer has changed, he has become a wealthier person. Consequently, the amount of monthly payments may be increased.

In addition, there are situations when alimony from money received from the sale of real estate can still be collected.

What is important when transferring real estate

Having analyzed all the fears and risks of transferring property to pay alimony, remember:

- Talk with the other parent and draw up an agreement in which you must specify how child support will be paid (by transferring the apartment into the hands of the child);

- If a parent is not enthusiastic about the idea of selling a home, then they can enter into a gift agreement to account for child support.

- If only the parent paying child support is the owner of the residential premises, then he has the right to transfer ownership rights to his child. This will be considered a way to pay off alimony.

- All documents must be certified in writing by a notary.

The court will always side with the minor, so oral settlement agreements will not help you during the trial.

Cases of paying alimony from the sale of an apartment

In this section, we will look at in what cases a contract for the purchase and sale of housing is still the same “agreement between individuals” that was discussed in the additions to Resolution No. 841. That is, an agreement that generates income from which alimony must be paid.

Not only entrepreneurs can legally receive income from the sale of real estate. A private individual has the right, on completely legal grounds, to buy an apartment, renovate it and sell it at twice the price. In this case, income will undoubtedly be received. At the same time, it will not be either wages or income from business activities (after all, there is no registered business entity). How then to collect alimony from him?

It was this “gap” that the amendments to the alimony resolution closed. And similar ones - for example, lease agreements for an apartment or part of an apartment.

That is, alimony is collected on the basis of an “agreement between individuals” if the alimony payer:

- I bought an apartment, made good repairs in it and sold it for a profit

- He acquired a plot of land, built a house and outbuildings on it, and then sold it, receiving several times more money than he invested

- I bought an apartment, renovated it and rent it out

If the situation is this, and the alimony payer has not paid alimony from the income received voluntarily, the recipient of the alimony may sue. Payment will be assigned.

Of course, not from the full cost of the property sold and not from the amount specified in the lease agreement. But only from the profit received as a result of transactions. That is, from the amount that is obtained after deducting the cost of housing and the cost of repairs/depreciation (if renting).

Example 1

Citizen A, after a divorce, purchased a neglected old apartment for 1.5 million rubles. Being a construction specialist, he independently updated the pipes and wiring, laid tiles, laid floors, replaced windows, doors, and plumbing. After which he sold it for 3.5 million rubles.

His ex-wife B filed a lawsuit to collect alimony for a joint child from the income received by A under the purchase and sale agreement. A presented to the court the agreement concluded when purchasing the apartment and receipts for the purchase of all materials used for repairs. In total, his costs amounted to 3.1 million rubles. Thus, the profit from the transaction was 400 thousand rubles. From this amount, 25% of alimony for one child was collected.

However, situations with the sale of an apartment at a price significantly higher than its original cost are not always so simple. Sometimes such a sale is not a way to generate income at all. But the alimony payer has to prove this in court.

Example 2

When spouses A and B divorced, their joint property was divided into shares of equal value: A received an apartment, and B, with whom the joint child remained, received a country house and a car.

B got married again, “gave birth” to another child, and over the next few years doubled the market value of his apartment by remodeling and making decent repairs. He then sold it and bought a larger apartment for his new family.

B filed a lawsuit, demanding to collect alimony from the profit received from the transaction, since the apartment was sold for more than its original cost. The court rejected the claim, not seeing a source of income in the real estate sale transaction. Despite the fact that the market value of the apartment has increased since the moment the property was divided, the additional funds cannot be considered profit. The fact of purchasing a new home excludes it. But he did not make a profit because he invested all the funds received in new housing.

ATTENTION! If you are an alimony payer and are renovating your apartment, considering the prospect of its subsequent sale (especially without buying a new home), keep all financial documents - receipts, agreements with repairmen, etc. They will be useful in court if suddenly a lawsuit is filed against you to collect alimony from the income received. The costs of increasing the market value of housing will be deducted by the court from the profit. If such a situation occurs and there are no supporting documents, submit a request for an examination that will determine at least the approximate cost of repairs.

Apartment – to pay off debts

In this section we will no longer talk about the voluntary sale of an apartment by the alimony payer. And about cases (in fairness, it must be said, quite rare) when his property is seized and sold in the course of enforcement proceedings for the collection of alimony arrears.

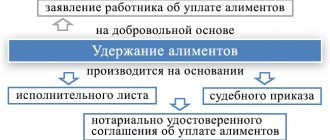

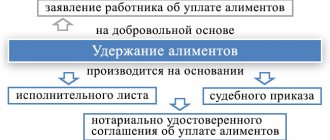

There is a clear sequence of forced debt collection:

- First of all, accounts are seized, and funds are forcibly written off from them in favor of the alimony recipient

- If the funds available in the accounts are not enough to cover the debt, valuable movable property may be seized: securities, a car, art, electronic and household appliances. The property is sold and the funds are used to pay off the debt.

- The seizure of real estate is imposed last. This requires an extreme degree of debt and a huge amount of unpaid alimony. The debtor's only home, as a rule, is not seized. However, the latest additions to Article No. 446 of the Code of Civil Procedure of the Russian Federation make it possible to do even this. True, in the event that the size of the living space is twice the minimum standard per tenant (for example, the alimony payer lives alone in an apartment larger than 36 sq.m). Such housing can be sold at auction, the amount corresponding to the debt is withdrawn to pay it off, and the rest is returned to the owner.

That is, theoretically, it is possible to lose your home for alimony debts. Let us repeat - such an outcome requires many years of persistent, malicious evasion of parental responsibilities to the child. Just try not to let it get to that point.

Frequently asked questions

Is it possible to leave a receipt for payment of alimony by providing an apartment?

The receipt has no legal significance and is easily disputed in court. It is better to conclude an agreement with a notary, but it does not cancel alimony obligations if the property is provided as alimony.

Who becomes the owner of the transferred property?

According to the law, alimony is paid to provide for the needs of the child, but is received by the mother, who is the legal representative. However, the property must be registered in the name of a minor, since it is transferred in his interests. If this is not done, the ex-wife may subsequently refuse to re-register documents for the child.

Apartment as alimony payment

There is another aspect to the connection between real estate and alimony. One of the provisions of the Family Code provides for the transfer of residential real estate to the child instead of monthly payment of alimony.

That is, the father leaves the child his share in the apartment that previously belonged to both parents, or the apartment that he received after the division of property, and child support obligations are removed from him.

Such a transaction is formalized through a voluntary notarized agreement. It includes a clause stating that the father draws up an agreement to donate his property to the child or children, and the mother, as a result, waives claims for monthly alimony payments until they reach adulthood.

Some men see this as the best solution. Life begins “from scratch” - there is no home, but there is no long-term alimony “bondage”. It is only important to do and arrange everything correctly. Agreements “in words” can be fraught with very unpleasant consequences.

Example 3

During the divorce, spouses A and B divided between themselves an apartment worth 6 million rubles. They didn’t want to sell their living space or continue to use it together. The court decided that since the child will live with his mother (A), she should remain in the apartment, paying B compensation for his share (3 million rubles).

The former spouses verbally agreed that B would take only 2 million, and the rest would be considered alimony payments until the child reaches adulthood. However, after a fairly short time, B discovered a summons in his mailbox ordering him to appear in court as a defendant in a case for the collection of alimony.

Since A took out a loan to buy out her ex-husband’s share in the apartment, after thinking about it, she decided that it would be easier to repay the loan if child support was still received - after all, she had to pay the bank monthly. She collected documents confirming her difficult financial situation (certificates of salary and the amount of loan obligations), and filed for collection of alimony from her ex-husband, citing concern for the child.

Since the court, when considering “alimony” cases, always first of all protects the interests of minors, the claim was satisfied. At the same time, I lost the opportunity to buy comfortable housing and found myself having to pay 25% of my salary monthly.

Through the court

In court, the transfer of real estate into ownership is carried out only to pay off alimony debt.

Housing is sold at auction after the claimant contacts the bailiffs with a corresponding application. It will not be possible to cancel alimony obligations for the future through the court by transferring property - this way only money is recovered.

The woman with whom the child remains has several options to receive property:

- Divide the property. The plaintiff is paid compensation equal to his share in the housing. Subsequently, you can collect alimony.

- Draw up an alimony agreement.

Possible options

To terminate alimony obligations if alimony is not collected in court, a woman may simply not apply to the court, having drawn up an agreement with her ex-spouse.

If the funds have already been collected in court, it will not be possible to refuse them - this will violate the interests of the minor. Termination of obligations will occur only upon the occurrence of any of the grounds specified in Art. 120 IC RF.

Cancellation of obligations under the agreement is carried out upon the expiration of its validity period or upon the occurrence of the grounds provided for by it (clause 1 of Article 120 of the RF IC). However, the latter does not mean that the property can be transferred - the likelihood of consent to have the transaction certified by a notary is close to a minimum.

Legal assistance

Child support cases are quite often complex. When it comes to alimony from the sale of an apartment, it is complex and confusing by definition. Since the law (in this case, Resolution No. 841) formally allows for conflicting interpretations, it is not easy to win such a dispute. Especially for a person who does not have relevant experience.

Most often, alimony payers suffer because they cannot prove to the court the fact that they have no income from the sale of an apartment and suffer huge unlawful losses. The injured party may also be the recipient of alimony, who knows that, showing a meager official income, the alimony payer receives a substantial profit from the resale of apartments, but does not pay alimony from it.

In any case, a qualified family lawyer or lawyer with many years of trial experience can provide invaluable assistance and protect the legal rights of his client. You can find such a lawyer on Prav.io.