Alimony payments in 2021

Alimony is the amount that one of the parents pays for the maintenance of minor children: buying food, clothing, paying for education, etc.

These payments cannot be waived . These are mandatory payments, and their payers are divided into two groups: the first pay voluntarily, the second only through the court. But sometimes you have to go to court even if there is good will. For example, a party agrees to pay alimony, but the claimant is not satisfied with its amount. Then the court will determine the amount of child support for the minor child.

Alimony payments are assigned in a flat amount or as a share of the payer’s income . In practice, a share of income is assigned if the party has a permanent official income. For example, a white salary. Then the amount of alimony for one child will be equal to ¼ of the income, for two - ⅓, for three or more - half of the income.

A fixed payment is assigned to those who do not have an official or permanent income. Also, a fixed amount is often prescribed for individual entrepreneurs. The court does not take fixed alimony payments out of the blue; it focuses on the subsistence level.

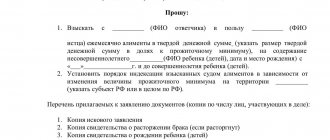

What documents are needed to submit an application for the collection of alimony in a fixed amount?

To file a claim for alimony, you will need the following documents, copies of which must be attached to the claim:

- ♦ certificate of marriage or divorce;

- ♦ child’s birth certificate;

- ♦ documents confirming that the child lives with the plaintiff, this could be a certificate from the management company, a court decision to determine the child’s place of residence with the plaintiff;

- ♦ documents that confirm the plaintiff’s income and expenses, in particular expenses for the child associated with his maintenance, attendance at clubs, etc.;

- ♦ if there is information about the defendant’s income, then copies of the relevant documents must be attached;

- ♦ documents that confirm the level of support for the child before a dispute arises between the parents regarding the maintenance of the child and the payment of alimony.

If the plaintiff does not have any documents, he can file a petition with the court to request certain documents, but it is necessary to attach copies of evidence confirming that the plaintiff independently tried to obtain the relevant documents, i.e. it is necessary to attach copies of requests that the plaintiff sent to certain bodies (organizations) to obtain documents.

Voluntary alimony payments

The procedure for withholding alimony in the presence of good will is simple. It is enough to bring to the accounting department of the company where the payer works an application to withhold alimony from the salary. In the document please indicate:

- the date from which alimony is paid;

- alimony amount - fixed or share;

- timing of transfer of money in favor of the recipient;

- recipient's bank details.

Please attach a copy of the alimony agreement to your application. If alimony is established through the court, then instead of an agreement, bring a writ of execution.

When establishing alimony payments through the court, the judge relies on the current minimum wage. The minimum wage in this case is the minimum payment of child support . In 2021, the minimum wage is 12,130 rubles. That is, the amount of child support for 1 child is at least ¼ of the minimum wage or 3,032 rubles. 50 kopecks, for 2 people - 4,043 rubles. 33 kopecks, for 3 or more children - 6,065 rubles.

There is an important feature: if the payer works officially, but pays alimony below the amounts mentioned above, the claimant can contact the bailiffs or tax authorities . In this case, the authorities will organize an inspection of the enterprise and determine why the employee receives a salary below the minimum wage.

The paying parent may not have official income. Then the court focuses on the cost of living for the child in the region. Such payments are usually fixed and change only when the cost of living changes . Solid alimony is subject to annual indexation; shares are not indexed.

The subsistence level is the basis for the minimum amount of child support payments. The court may set the amount of alimony to be collected and more if the other parent provides evidence that the alimony payer can pay that much.

Accrual conditions

The decision to pay can be made by both parents amicably - in a voluntary agreement signed by both of them and notarized.

For example, indicate that the father will pay 10,000 rubles monthly for the maintenance of the child. But it must be taken into account that this amount should not be lower than that if he paid alimony in proportion to his income. That is, in this case, his income should not exceed 40,000 rubles.

Or the decision is made by the court, but subject to a number of conditions:

- the second parent (in our case the father) does not have a regular income or other income,

- the amount of his income changes from month to month;

- he receives income in kind (not in monetary terms);

- wages are paid in foreign currency (even if partially);

- if the assigned amount of payments as a share of income significantly violates the interests of the child and his mother.

In other cases, alimony is assigned only in proportion to the income of the alimony payer.

Forced collection of alimony

Not all parents are willing to pay child support. It is possible to collect alimony from draft dodgers only through a court that issues a writ of execution . After receiving the sheet, it can be presented to the bailiffs for execution within 3 years.

You can do it without bailiffs. If you know where the alimony payer works, send a writ of execution to his employer . The company is required to withhold alimony from all income it pays to him.

The paying parent may not have official income. Then the bailiffs will seize all the income that the alimony payer receives. If there are none, the recovery will be directed to the property of the debtor. For each day of delay in alimony payments, interest will be charged - 0.5% of the total amount of debt for late payment .

In 2021, the legislator plans to make changes to the punishment for alimony evaders. The Ministry of Justice proposed to amend Article 157 of the Criminal Code of the Russian Federation . Now the punishment for evasion ranges from correctional labor to imprisonment for up to 1 year.

The courts refuse to initiate criminal cases, since the draft dodgers have found a way out - paying little and rarely. In this case, due to the imperfection of the article, the court loses the grounds for initiating a case. The Ministry of Justice is now developing amendments that will close this loophole.

Can the amount of alimony change?

Yes, it is quite. A parent who bears a heavy burden of caring for children cannot, a priori, remain without the help of his former partner or the state. If significant circumstances, marital status or income levels change, the amount of alimony may be reduced or increased.

The plaintiff or defendant, when filing such a demand in court, is free to decide for themselves how much alimony can be applied for if it is reduced or increased. To increase or reduce the amount of maintenance, you need to file a claim to change the amount of alimony.

IMPORTANT: If the alimony payer suddenly lost his job and source of official income. Then the bailiffs will consider his obligations based on the average salary in the region or country.

Example: Alexey Petrov paid ¼ alimony for his minor son Sergei. Having been laid off, Petrov did not join the Labor Exchange; he worked for private individuals.

The bailiffs calculated the alimony debt for six months based on the average salary in the region of 28,000 rubles.

¼ of this amount amounted to 7,000 rubles, and for six months - 42,000 rubles in alimony.

Indexation of child support in 2021

Indexing has already been discussed above. It concerns only fixed alimony that is established by the court. Shares are not indexed. Indexation is directly proportional to the indexation of the cost of living.

The need for indexing is due to the following. Collecting alimony from evaders can take a long time. And, for example, the amount of alimony assigned in 2005 will be negligible in 2021. Therefore, the increase in the amount of debt is tied to the increase in the cost of living. Consequently, the draft dodger's debt will increase annually.

The cost of living for the first half of 2019 is now known. It was established by Order of the Ministry of Labor and Social Protection of the Russian Federation No. 561n dated 08/09/2019. The same amount will become the minimum wage and subsistence level for 2020. For the working population - 12,130 rubles, for children - 11,004 rubles. This is what we should proceed from when calculating alimony.

How to determine the required payment amount

In the payment agreement, the amount of alimony can be set by the parents themselves on a voluntary basis. There are cases when parents agree on a one-time payment of alimony in a large amount at once. And after that they no longer have any claims to each other.

For example, the father immediately paid 3,000,000 rubles for the maintenance of the child and is not obliged to pay anything more. These funds may, for example, be in his account on demand.

Or maybe the father left his child real estate worth several million rubles and is also not required to pay any more alimony. But such options should suit both parents.

Otherwise, the amount of payment is determined by the judge during the consideration of the case based on the claimant’s claim.

The court examines:

- financial situation of the plaintiff and defendant,

- the latter's income.

- The judge will definitely be interested in the question of whether the alimony payer has another family and children from his second marriage.

Taking this data into account, the judge decides to set a fixed monthly payment.

The issue of a lump sum payment can also be submitted to the judge's permission. But in practice, these issues are more often resolved privately rather than in court.

If the payer does not have a permanent job and a stable income, then the amount of alimony that he must pay is established in a proportional ratio, depending on:

- on the number of children he has,

- from the average salary,

- or on the size of the subsistence minimum established at that time in a particular region of the Russian Federation.

Here, the amount of alimony, by definition, will be fixed, since the decision on the amount of the average salary or subsistence minimum is made by the Government of the region at a certain time and for a certain period. If the size of these payments changes, the size of the payments will also change.

As sad as it sounds, fathers often underestimate their income and submit “fake” salary certificates to the court. Or they deliberately do not get officially employed at all and receive their salary “in an envelope.” Therefore, it would also be a good idea for the plaintiff, in her own interests, to check this information and, if necessary, report it to the court.

How to calculate payments?

It should be remembered that you should not operate with amounts “taken from the ceiling.” The court will not take into account the plaintiff’s unfounded claims - receipts and checks on the basis of which the calculation was made must be attached to the application (find out what sample statements of claim for alimony in a fixed amount look like here).

Example. After the divorce, the mother was left with 2 children (4 and 10 years old), who lived in abundance from birth. My father's official salary is 12 thousand. He has a substantial bank account in a foreign bank, which his ex-wife knows about.

Not wanting to be content with alimony of 4 thousand (1/3 for two children, SK Art. 81), she collected checks and receipts for 3 months, after which she made simple calculations: 32.5 thousand rubles were required for the children’s monthly needs.

The father refused to pay any amount over 4 thousand, being confident that the court would not take into account the fact that he had a bank account abroad.

Having considered all the details and received confirmation of the evidence provided by the woman, taking into account the extremely low earnings of the plaintiff, the intractable nature and dishonesty of the defendant, the court awarded the father alimony: 1/3 of the official earnings plus 11,000 for each child, paid monthly.

How much is the fine if child support is not paid (new law)?

The debtor is subject to a fine if he fails to make payments. Article 115 of the Family Code established a penalty of 0.5 percent for each day without payment.

The debtor will not just pay the penalty. The spouse calculates the penalty and files a claim to the court to collect the penalty for alimony. The application is submitted to the magistrate if a dispute over payments has previously been considered.

Part 3 of Article 29 of the Civil Procedure Code gives the right to choose. The claim is filed in the place where the defendant or plaintiff lives. The fee is not paid, since plaintiffs are exempt from the fee for alimony applications.

5 nuances about calculating the penalty:

- The penalty is calculated for each day of delay.

- The delay is counted from the first day of the month following the month in which the spouse did not make the payment.

- Periodic payments reduce the principal amount due.

- The penalty cannot be reduced.

- It is taken into account whether the debtor is to blame for not paying alimony on time. If the debtor’s salary was delayed at work or the bank did not transfer the funds on time, no penalties are imposed.

An example from the practice of the Kamchatka Territory Magistrate Court. The judge denied the plaintiff a penalty for child support (according to the new law of 2016). Grounds for refusal: the employer lost the writ of execution, so alimony was not withheld from the defendant’s wages. The defendant is not at fault.

What is alimony paid in a fixed amount?

The standard form of alimony is calculated as a percentage of the parent’s official earnings: 25% – 33.33% – 50% for 1 – 2 – 3 children, respectively (SK Art. 81).

Such alimony will be requested by a court order (Civil Procedure Code Art. 122), unless the situation is complicated by establishing paternity, numerous writs of execution by the plaintiff and other circumstances requiring a thorough trial.

Important! Going to court on an alimony issue is permissible only if the parents cannot agree on their own, that is, there is no valid notarized alimony agreement (IC Art. 83 clause 1, 100 clause 2).

Fixed alimony is awarded only by a court decision (Civil Procedure Code subsection II), while the simplified scheme with the issuance of a court order is excluded in this case (Resolution of the Plenum of the Supreme Court No. 9 10/25/1996, as amended on 05/16/2017, paragraph 11).

The grounds for requesting fixed alimony (SK Art. 83) are:

- discrepancy between shared alimony and actual expenses for the child;

- infringement of the baby’s interests and the impossibility of maintaining his usual conditions;

- variability of parent's earnings;

- earnings in currency or in kind, as well as combined payment for his labor;

- problems with official employment or lack of work;

- earning income outside of Russia.

Child support is levied on almost all of the parent’s income that can be discovered (PP No. 841 07/16/1996, revised 04/09/2015).

The exception is targeted benefits and compensation payments aimed at maintaining the life and/or health of a needy citizen (Federal Law No. 229 on individual entrepreneurs 02/10/2007 edition 28/12/2016 art. 101).

Fixed child support does not depend on the official earnings of the estranged parent, but is directly tied to the volume of the children's consumer basket in the region of residence.

When assigning fixed alimony, the court takes into account all types of income of the defendant that the plaintiff can detect and reasonably prove their existence and amount.