Who pays property tax

Officially it is called personal property tax. It is paid by the owners of studios, penthouses, apartments, apartments, country houses, offices, shops, etc.

Even if a person does not live in this premises, but is its owner, a notification will be sent from the tax service about the need to make contributions.

If the owner owns a share, then the tax will be paid in accordance with its size. The tax presupposes the availability of benefits that apply to vulnerable segments of the population. The largest group is pensioners. They have payment subsidies.

Benefits apply to the following types of premises:

- apartment, hotel;

- separate room;

- country house;

- garage;

- a non-residential building adapted for storage, if its area is no more than 50 sq.m;

- territory for creative purposes.

Similar real estate properties are paid according to a special scheme. For similar apartments, tax will have to be paid only for one of them, for the second one will be charged according to the general rules.

Tax payment is possible through a bank or on one of the state portals. The duty is paid in the year following the end of the tax period.

The amount of cadastral value required for calculation

The tax base is determined as the cadastral value of the object as of January 1 of the year, which is the tax period (clause 2 of Article 375 of the Tax Code of the Russian Federation). Therefore, payment of tax is possible only if this value is determined. If not, you will not have an obligation to pay tax due to the lack of a tax base (clause 2 of Article 375, subclause 2 of clause 12 of Article 378.2 of the Tax Code of the Russian Federation).

Once you have established the cadastral value, you can proceed to determining the tax base and calculating tax (advance payments).

To find out where you can find out the required cadastral value, read the article “How to find out the cadastral value of property?” .

Attention! If the cadastral value is established by the court taking into account VAT, then the taxable base is the value of the property excluding tax. See details here.

How to calculate property tax

There is no need to determine the amount of tax yourself; the tax office will indicate the final figure in the notification.

State duty until 2015

Previously, payments were calculated based on the inventory value of housing. It was determined by the costs of building materials and finishing, and the wear and tear of the building was also taken into account. The inventory value was often lower than the market price.

Tax deduction for area

It does not apply to benefits. The deduction is available to all categories of taxpayers, even if you own a penthouse or one-room Khrushchev apartment.

Property tax is not charged on the area that falls under the deduction. It is paid only from the difference. The area of the apartment is reduced by 20 sq.m., rooms - 10 sq.m., houses - 50 sq.m. And for a small house with an area of 50 square meters, state duty will not be charged at all.

Calculation based on cadastral value

Tax laws must be constantly monitored, otherwise you may end up in an unpleasant situation. Since 2015, regions have switched to calculating real estate taxes based on the cadastral value of housing. Some constituent entities of the Russian Federation began paying under this scheme only last year.

Valuation of housing according to the cadastre includes more factors. It takes into account:

- infrastructure of the area,

- property location,

- availability of parking and a playground near the house,

- market price for analogues and more.

The cadastral price must be current, so it will be recalculated on average once every five years. The frequency of revaluation is determined by local authorities. Frequent periodization is being established, for example, in Sevastopol, Moscow and St. Petersburg they will begin to reassess every three years.

List of objects subject to cadastral value tax

Real estate subject to tax must be included in the list of objects for which the tax base is determined as the cadastral value. This list is compiled by the authorized executive body of your constituent entity of the Russian Federation (clause 1, clause 7, article 378.2 of the Tax Code of the Russian Federation).

The list for the current year must be compiled no later than January 1. It is sent to the tax authorities at the location of the relevant real estate objects and is posted on the official website of the executive body or on the website of the constituent entity of the Russian Federation.

Please note that the list contains a specific property (for example, a building), indicating its cadastral number, full address and KLADR code. If you do not find your property on the list, the calculation procedure is completed.

For more information about which objects can be included in the list, read the material “For which real estate objects is the tax base calculated based on the cadastral value?” .

Payment deadlines and penalties for non-payment of taxes

The Federal Tax Service notifies all taxpayers of the need to pay tax on non-residential premises. This is a receipt indicating the amount of tax to be paid and tax details. Such notifications arrive until October 20.

Important:

If the taxpayer for some reason has not received a tax notice, he is not exempt from paying it. He needs to personally contact the Federal Tax Service at his place of actual residence and receive the details, as well as the amount.

The tax must be paid by December 1 of the current year. You can deposit funds through a bank, online services, post office or at the tax office itself, the main thing is to save the payment receipt.

If the tax has not been paid, the taxpayer may receive an additional notification with information:

- About the amount of tax to be paid

- Amount of penalty

- Deadlines for repaying debt and taxes

- Measures to be taken in case of payment evasion

Important:

after a debt has arisen in the amount of 3,000 rubles or more, the Federal Tax Service may go to court. In practice, it takes up to 6 months to accumulate this amount of debt.

After receiving a court decision, the tax authority has the right to file a claim for the forced recovery of funds from the evader’s accounts, and if not, then against his property. A citizen may also be prosecuted and sentenced to imprisonment.

In addition to penalties, there is also a fine of 20% of the tax if the delay occurred accidentally. If special evasion has been proven, the fine is 40% of the tax amount.

Preparation for calculation

Let's distribute all property recorded in accounts 01 and 03 into 5 groups:

| № | Groups | A comment |

| I | Real estate for which the cadastral value has been determined | The cadastral value of objects is posted on the official website of Rosreestr (https://rosreestr.ru) |

| II | Real estate for which there is no cadastral valuation | Real estate recorded on the balance sheet for which there is no cadastral value |

| III | Objects exempt from taxation | The list is given in paragraph 4 of Art. 374 Tax Code of the Russian Federation |

| IV | Preferential objects | The list is given in Art. 381 Tax Code of the Russian Federation |

| V | Other | Real estate that does not fall into any of the above groups |

How to prove that property is used in the activities of an individual entrepreneur

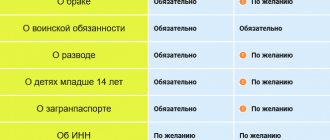

An entrepreneur does not need to prove that the property is involved in business activities. The tax service itself will establish this fact during on-site inspections. To be exempt from paying tax in this case you will need:

- submit an application in free form;

- describe real estate objects that are involved in business activities;

- indicate the tax regime option used.

Entrepreneurs entitled to benefits do not need to attach supporting documents. This procedure has been in place since 2018.

Is it possible to challenge the amount of tax?

Since linking cadastral valuation to taxation leads to an increase in the amount of payment, an inflated valuation can significantly hit taxpayers’ pockets. In this case, there is a mechanism for challenging it and it consists of applying to Rosreestr or the court.

To revise the cost and, accordingly, the tax rate, you also need to prepare the following documents:

- Conclusion of an independent expert, which will indicate the real cost of non-residential premises

- Application (claim in case of going to court)

- Documents confirming ownership of the object (certificate of privatization, purchase, donation or power of attorney)

- Passport and copies

The document package is submitted to Rosreestr, where it is examined by a commission. If it makes a negative decision, you can file a claim in court by submitting the same package of documents and the commission’s decision.

Register now and get a free consultation from Specialists

What premises are considered non-residential?

The main difference between a non-residential building is that it is intended for retail, medical, and sanitary purposes. Economic needs and does not provide for human habitation.

Depending on the purpose of use. Non-residential premises can be:

- Trade used for sale (trade pavilions, shops, stalls)

- Administrative and office buildings

- Warehouse buildings, garages

Classification of such buildings is also possible according to the types of services that are provided (educational, medical institutions, catering buildings, etc.). The main thing that determines such a room is that it is not adapted for normal human habitation. In this case, such a room may or may not have:

- Capital walls

- Floor ceiling

- Sewerage and water supply

Such premises can be located either separately (shops, stalls) or inside a larger building: offices in a shopping center, shops on the ground floor in multi-storey buildings.

Register now and get a free consultation from Specialists

The legislative framework

Owners of non-residential real estate, in particular garages, outbuildings and buildings, warehouses, office and retail premises, should be aware that as property owners they are required to pay taxes annually.

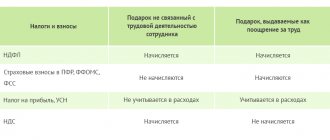

In addition, additional taxes and fees may arise when performing certain actions , such as renting out non-residential property, selling, donating, or providing for free use.

To know what taxes and under what circumstances should be transferred to the treasury of the state or local authorities, when to make payments and how to correctly calculate the amount of payments, you do not need to know everything by heart. It is enough to be able to find the necessary legal provisions.

The first thing we recommend you pay attention to is the Tax Code of the Russian Federation. This regulatory legal act contains all the necessary information for calculating taxes and other mandatory payments. In some cases, it is allowed to establish certain nuances of taxation by other official documents: laws of the constituent entities of the federation, decisions of local councils of deputies.

Reference! How to find out whether all elements of taxation of objects associated with the ownership and performance of various transactions with non-residential real estate are established by the Tax Code of the Russian Federation? If any features may be determined by other laws or regulations, a reference to this is indicated in the code.

For example, for personal property tax, rates may be provided for in documents adopted by local authorities. This is stated in paragraph 3 of Article 406 of the Tax Code of the Russian Federation.

Property taxes are established by the following rules:

- For organizations – Chapter 30 of the Tax Code of the Russian Federation and the laws of the constituent entities of Russia. For example, Law of Moscow dated November 5, 2003 No. 64 or Law of the Novosibirsk Region dated October 16, 2003 No. 142-OZ.

- For citizens and individual entrepreneurs - Chapter 32 of the Tax Code of the Russian Federation, as well as laws of the constituent entities of the federation (only for Moscow, St. Petersburg and Sevastopol) or decisions of deputies. For example, the Law of Moscow dated November 19, 2014 No. 51 or the Decision of the City Duma of the city of Krasnodar dated November 20, 2014 No. 70.

Outside the Tax Code, tax rates, features of calculating the tax base, additional benefits, and rules for making advance payments (for enterprises only) can be established. To search for such documents, it is recommended to use the electronic service posted on the website of the Federal Tax Service of Russia.

Real estate taxation

Non-residential real estate, as well as income received in connection with the use of this property, may be subject to various taxes. At the same time, the types of payments and the features of their collection are not the same for legal entities and individuals , including individual entrepreneurs.

How to calculate property payments to the Federal Tax Service of Russia?

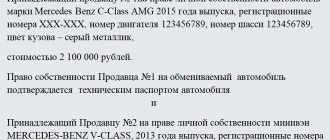

Individuals, including individual entrepreneurs, pay real estate tax once a year until December 1 of the following year. For example, for 2017 the tax must be transferred by December 1, 2021.

The tax authority calculates the tax and subsequently sends a notification to property owners about the need to pay the fee. The payment amount is determined based on the cadastral or inventory value of the property. However, the calculation methods differ depending on the cost used.

Tax rates are also differentiated:

- By category of non-residential premises. According to paragraph 2 of Article 406 of the Tax Code of the Russian Federation, garages and outbuildings on personal subsidiary plots are taxed at a rate of 0.1%; office, retail, premises, public catering facilities – 2%; other premises – 0.5%.

- By locality. Based on paragraph 3 of Article 406 of the Tax Code of the Russian Federation, local government officials can reset rates or increase their size up to three times.

Formula for applying cadastral value:

Tax = cadastral value * rate.

Example: The cadastral value of a garage owned by an individual and located in St. Petersburg is 450 thousand rubles. The tax rate in this city is 0.3%. The annual tax payment is equal to:

450 thousand * 0.3% = 1.35 thousand or 1,350 rubles.

For the transition period from inventory value to cadastral value (within 4 years), a special procedure for calculating tax is provided:

Tax = (tax on cadastral value – tax on inventory value) * coefficient + last paid amount of tax on inventory value.

The coefficient takes the following values:

- 0.2 in the first year after the transition to cadastral value;

- 0.4 – in the second year;

- 0.6 – in the third year;

- 0.8 – in the fourth year.

Let's determine the tax amount based on the data from the first example.

If we take into account that 2021 is the third year of transition to cadastral value, and the last tax payment on inventory value is 1,041 rubles, then the following tax amount will be obtained:

(1,350 – 1,041) * 0.6 + 1,041 = 1,226.4 rubles.

By 2021, not all regions have abandoned the inventory value (14 federal subjects).

Formula for inventory value:

Tax = inventory value * rate * adjustment factor.

The coefficient in 2021 is set at 1.481.

Example: A garage located in Yekaterinburg has an inventory value of 240 thousand rubles. Considering that the cost is below 300 thousand rubles, the tax rate is 0.1%. The tax amount will be:

240 thousand * 0.1% * 1.481 = 0.355 or 355 rubles.

The difference in the procedure for collecting property tax from residential and non-residential properties owned by individuals is only in the amount of tax rates. However, this is not always the case. For example, often the rate for garages and residential buildings and apartments is the same. But for commercial real estate the foreclosure rate is higher.

Conditions for pensioners

For pensioners, subparagraph 10 of paragraph 1 of Article 407 of the Tax Code of the Russian Federation provides for a benefit in the form of exemption from property tax, subject to the following conditions:

- non-residential property should not be used for profit, that is, in business activities;

- exemption occurs only in relation to 1 non-residential property;

- type of preferential non-residential real estate - garage or parking place;

- to receive a preference, you must send an application to the tax authority accompanied by supporting documents;

- by November 1, send a notification about the selected non-taxable object.

Pensioners are not given any benefits for commercial real estate. Accordingly, the procedure for calculating and paying tax on commercial real estate owned by pensioners is similar to the generally established one.

Calculation for legal entities

Legal entities calculate tax independently and report on it quarterly and at the end of the year.

Payment transfer procedure

Payments are transferred as follows:

- advance payments based on the results of the 1st, 2nd and 3rd quarters;

- tax at the end of the year.

Specific payment deadlines are established by the laws of the constituent entities of Russia. For example, in Moscow, advance payments are paid within 30 days after the end of the quarter, and the annual tax is paid before March 30 of the next tax period.

Calculations based on cadastral and average annual value

Payments are calculated in two ways:

- At cadastral value with a rate of no more than 2% (for shopping centers, business centers, office premises, premises intended for trade, public catering and consumer services).

- At the average annual cost with a rate of no more than 2.2% (for other non-residential properties).

Formula using average annual cost:

H = average annual cost * rate - advance payments , where: Advance payments = average cost for the reporting period * rate * ¼.

When calculating tax based on the average annual value, reporting periods are quarter, six months, and 9 months.

Example: An enterprise has a warehouse on its balance sheet, the average cost of which is 1,520 thousand rubles. for the first quarter, 1480 thousand rubles. for the half year, 1445 thousand rubles. for 9 months and 1420 thousand rubles. in a year.

The calculation will look like this:

- payment based on the results of the quarter: 1520 * 2.2% * ¼ = 8.36 or 8360 rubles;

- based on the results of the half-year: 1480 * 2.2% * ¼ = 8.14 or 8140 rubles;

- based on the results of 9 months: 1445 * 2.2% * ¼ = 7.95 or 7950 rubles;

- at the end of the year: 1420 * 2.2% – (8.36 + 8.14 + 7.95) = 6.79 or 6790 rubles.

In total, the company paid 31,240 rubles for the year.

For cadastral value, the same principle applies, but the reporting period is quarters. The formula looks like this:

N = cadastral value * rate – advance payments.