What is the state duty for a gift agreement 2021 between relatives and strangers, and whether it is possible to pay less than expected - today the expert of the Legal Ambulance website and practicing lawyer Zhanna Surikova will tell you.

First, I would like to remind you of one of the basic principles and conditions for concluding a deal. A gift agreement for real estate, movable property, as well as things, securities and other property (for example, a gift for a share in an LLC) is characterized by a gratuitous transfer of property from the donor to the donee on a voluntary basis, which determines the procedure for paying funds for its execution and registration .

Since one party voluntarily decides to reduce its property by increasing the property of the other, which will receive the object of the transaction without spending its own funds on its acquisition, it is the donee who must pay the duty. But it's not that simple.

State duty for registering real estate in 2021

In fact, the amount of state duty paid in 2021 will depend on the method of registration of the transaction. So, its participants can try to carry out the transaction and register ownership rights themselves or entrust all issues related to the deed of gift to a notary, the tariffs and methods of selection of which we described in the article at the link.

At the same time, the amount of the state duty for state registration of ownership in the Rosreestr of the donee party for real estate received as a result of the conclusion of a deed of gift also depends, in accordance with paragraph 22 of Article 333.33 of the Tax Code of the Russian Federation, and on the status of the parties, amounting to:

- 2,000 Russian rubles – for registration of individuals;

- 22,000 Russian rubles – for organizations and legal entities.

The amount of state fees listed above for registering a real estate donation agreement (land, house, apartment, garage, etc.), as well as the Tax Code regulating these amounts, is valid throughout Russia. It is better to deposit these amounts through a bank, and a receipt for successful payment can be obtained there.

Note from site lawyer

When registering property rights through the MFC, the state fee can be paid at one of the terminals located in the building of the multifunctional center.

When paying the state fee, be sure to keep the receipt confirming the success of the transaction, because it must be attached to the package of documents required to register the rights of the new owner of the property.

ARTICLE RECOMMENDED FOR YOU:

Conditions of the gift agreement - essential and additional

State duty for gift shares in an apartment

The established state fee for registering ownership of a share of an apartment that was received as a result of concluding a gift agreement, in accordance with clause 23.1, clause 333.33 of Article of the Tax Code of the Russian Federation, is 200 Russian rubles .

State duty for a gift of land

According to the current legislation in Russia, namely, the information specified in subclause 24.1 333.33 of Article of the Tax Code of the Russian Federation, the amount of the state duty for registering the ownership of a new owner of a land plot, if the donee is an individual, is 350 Russian rubles .

At the same time, the state contribution paid by the donee to register ownership of a share of agricultural land, in accordance with subparagraph 26 of Article 333.33 of the Tax Code of the Russian Federation, is only 100 Russian rubles.

The legislative framework

The main provisions on donation issues are set out in Chapter 32 of the Civil Code (Civil Code) of the Russian Federation. The main feature of this bilateral transaction is the transfer of property and valuables, without receiving remuneration in any form. Otherwise, the transaction will be considered compensated, and taxation will be different.

Parties to the agreement and their responsibilities:

- The donor in one way or another transfers the full volume or part of his property without receiving material benefits from this transaction;

- The donee, who is also the recipient, has the right to accept or refuse the gift.

The refusal is motivated by the reluctance to have that part of the property that is transferred by the donor (Article 577 of the Civil Code). Thus, a share in an apartment obliges him to maintain the premises in proper condition and pay for utilities on an equal basis with other residents. In case of violation of the terms of the agreement or inappropriate attitude towards the gift, the recipient may be considered unworthy.

Expert opinion

Klimov Yaroslav

More than 12 years in real estate, higher legal education (Russian Academy of Justice)

Ask a Question

Important! The conditions for canceling a gift agreement are described in Article 578 of the Civil Code of the Russian Federation - an attempt on the life and health of the former owner, handling of the subject of the agreement leads to its irretrievable loss.

Registration of a deed of gift - legal advice:

Who pays the state fee for a gift deed in 2021

Answering the question of who pays the state duty for a donation agreement for real estate and movable property, it is worth noting once again that as a result of concluding the transaction in question, the donor voluntarily agrees to increase the recipient’s property at the cost of reducing his own, and the latter does not pay him the gift in money or services, it is logical that the obligation to pay the state duty falls on him.

Taxation of the transaction

Many visitors to the Legal Ambulance website confuse two completely different, but related concepts when concluding a gift - tax and state duty. The amount of tax today is still 13% of the total market value of the gift object , which was specified by the parties in the agreement and parties included in the category of close relatives, which the law classifies as:

- Children;

- spouses;

- sisters;

- brothers;

- grandfathers;

- grandmothers,

- parents (both natural and adoptive);

- grandchildren.

Other relatives (for example, uncles and aunts) are considered distant and transactions with them are subject to taxation.

Is it possible to indicate another value instead of the cadastral value?

Yes, according to paragraph 5 of Art.

333.25 of the Tax Code of the Russian Federation, donors and recipients have the right to choose themselves what value to take as the transaction amount - cadastral, inventory or assessed (market). The inventory value is almost always less than the cadastral and market value, which means you will have to pay less to certify the contract.

But the catch is that to do this, the notary will have to provide certificates for each cost. The notary will find out the cadastral value himself, a certificate of inventory value is taken free of charge from the BTI, but the estimated (market) value is determined only by appraisal companies and this service is paid (clause.

8 tbsp. 333.25 Tax Code of the Russian Federation).

The cost of assessment in each region is different - from 4 thousand rubles.

Prepare a deed of gift from a notary or yourself

The parties to the transaction may decide to have a notary accompany the donation transaction, which is not required by law, but is highly recommended, since by using the services of a professional, the risks of future conflicts with the participants and their heirs, which often end in litigation, can be reduced to almost zero. expenses and breach of contract.

ARTICLE RECOMMENDED FOR YOU:

Agreement on donating property to a grandson or granddaughter

When completing a transaction with a specialist, the cost of the deed of gift will depend not only on the estimated total value of the object of the donation, but also on the notary’s tariff, according to Article 22.1 of the “Fundamentals of the legislation of the Russian Federation on notaries.”

Close relatives according to the Family Code of the Russian Federation

The concept of family relations from a legal point of view has a complex interpretation. As such, there is no general definition in legislation, so controversial situations often arise. Depending on the area of law, different citizens who have both blood and non-blood ties can be considered relatives.

- How to deal with loneliness in old age

- Galette cookies - composition and calorie content, step-by-step recipes for cooking at home

- Rassolnik with barley and pickles - step-by-step recipes for cooking with meat, fish or vegetables with photos

A more complete concept is given in Article 14 of the Family Code. It is based on blood ties along descending and ascending lines:

- parents;

- children;

- grandmother;

- grandfather;

- grandchildren;

- brothers;

- sisters.

Brothers and (or) sisters are the closest relatives according to the Family Code, regardless of whether they are full-blooded (have common parents) or half-bred (step-fathers who have only a father or mother in common). Spouses are not considered either close or distant relatives. They belong to the category of persons who are in a legal union, and when giving or inheriting, this connection is paramount.

- The connection between aging, gut and allergies

- Exercises in the pool for weight loss

- New rules for hotels

State duty when registering a deed of gift for money

Also, it is worth noting another common situation - the donation of funds, more details about which can be found by clicking on the dedicated link. Please note that when donating money, no state duty is charged due to the lack of the right to transfer ownership rights.

However, when donating money, it is worth considering two other important sources of spending:

- notary fee;

- taxation of donations of funds.

So, according to paragraph 4 of Article 22.1 of the “Fundamentals of Notaries”, when drawing up a deed of gift for money from a notary, you will need to pay:

- for transactions with amounts up to 1,000,000 Russian rubles – 2,000 rubles + 0.3% of the total amount of the transaction;

- when donating up to 10,000,000 Russian rubles - 5,000 Russian rubles and 0.2% of the amount exceeding 10,000,000 Russian rubles;

- if the donor gives an amount of more than 10,000,000 to the donee, the latter will pay 23,000 Russian rubles and 0.1% of the transaction amount, but not more than 500,000 Russian rubles.

How is tax paid?

Since you can gift an apartment to a relative without paying taxes only in the case of a close relationship, the rest of your relatives should study the rules for declaring and paying income tax. The payment is not credited immediately at the time the transaction is completed. During the entire tax period, the gifted relative uses the property at his own discretion.

The obligation begins at the end of the year during which the transaction was concluded. Next year, before April 30, the relative who received the apartment as a gift contacts the Federal Tax Service at the address of residence and submits a completed income declaration (drawn up in form 3-NDFL). After submitting the declaration, until July 15, a deadline is given for depositing the amount into the budget according to the details specified by the tax authorities.

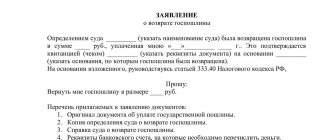

Invalid transaction and penalties

Unscrupulous citizens, when drawing up a gift deed that disguises another transaction, should be prepared to pay a state fee for declaring the deed of gift invalid in court. The same applies to those persons who did not take into account all the rules established by law when drawing up the act or did not include certain non-obvious conditions in it.

Therefore, we recommend that you ask our experienced lawyers a free question and learn about all the intricacies and pitfalls of your particular situation in 5 minutes! Don't risk your future and the well-being of those close to you!

Based on a court decision on the invalidity of the gift agreement, in accordance with paragraph 1.1 333.19 of Article of the Tax Code of the Russian Federation, it will be necessary to pay:

- if the contract is declared invalid and the claim is recognized as less than 20,000 Russian rubles, the amount of the state duty will be approximately 400 rubles;

- when filing a claim in court for an amount less than 100,000 Russian rubles, the amount of state duty will be 800 rubles and 3% of the total transaction amount;

- if a deed of gift is declared invalid with an amount less than 200,000 Russian rubles, you will need to pay 3,200 Russian rubles and 2% of the amount specified in the agreement as a gift;

- if the court invalidated an agreement to donate an amount less than 1,000,000 Russian rubles, you will have to pay 5,200 Russian rubles and 1% of the total transaction amount as a state fee;

- in case of termination of a deed of gift drawn up for an amount exceeding 1,000,000 Russian rubles, the state duty will be 13,200 Russian rubles and 0.5% of the total transaction amount, but not more than 60,000 rubles.

ARTICLE RECOMMENDED FOR YOU:

Donation agreement for a share of land

When challenging a deed of gift for an apartment, the state duty is calculated according to a similar principle after an expert assessment of the market value of the donated property!

You can learn more about challenging a transaction from this expert video:

Instead of an afterword

As you can see, the state duty for a gift agreement 2021 between relatives and strangers is a mandatory condition in most cases of alienation of property using the method in question. Considering the complexity of registration and many nuances, we recommend that you draw up a deed of gift through a notary, having first received a free consultation on our website !

Previous

Gift deed Donation agreement with a notary - cost in 2021

Next

Gift State registration of a gift agreement in Rosreestr