When a loved one passes away, his relatives may face material questions regarding the legacy of the deceased. Successors must understand that the procedure for entering into an inheritance is not always simple and they will have to put in a lot of effort before accepting their share. If a person wants to receive the property of the testator, then he should learn more about the main documents confirming the right to inheritance.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

+7 (499) 938-81-90 (Moscow)

+7 (812) 467-32-77 (Saint Petersburg)

8 (800) 301-79-36 (Regions)

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

How can you justify your rights?

The right to receive the property of the testator in the event of his death arises from a certain circle of persons established by law. In this case, the successors will be the relatives and friends of the deceased. If the deceased left behind a will, then the distribution of the inheritance will be made on the basis of the information contained in it.

Thus, a person can justify his right to the testator’s share if he has family ties with the deceased or if he is included in the circle of successors by a testamentary document.

It should be remembered that inheritance by law presupposes the acceptance of property in the order of priority.

Based on the above, in order to confirm the right of inheritance with a notary, a person must have a will in hand, where he is indicated as a successor, or submit documents from which it is possible to determine the presence of family ties with the deceased.

Successors can enter into inheritance only after the death of the testator, therefore, in order to confirm the right, it is necessary to submit relevant death documents.

Papers containing information about the place of residence and registration of the deceased are needed to determine the place of opening of the inheritance and the appropriate place of application of the successor to enter into the inheritance.

And finally, one cannot do without documents identifying the identity of the heir - without them it is impossible to find out information about the person and whether he has rights to the inheritance. This may be a citizen’s passport or other document permitted for these purposes by law.

Does a notary have the right to revoke a will if the testator dies?

When reviewing the will, carefully study the text, amounts, numbers - you may be interested in many things regarding the distribution of the inheritance. Cancellation implies complete cancellation. In fact, the notary has no right to do this without permission. But if gross violations, discrepancies and inconsistencies are revealed, this is possible. But in this case we are talking not about annulment, but about the redistribution of inherited values.

Can a will be changed?

This is possible if there are documents confirming the legality of the claim. The death of the heir specified in the document is also a sufficient reason for annulment. But, if in the latter case the notary himself decides to carry out the procedure and does not issue a certificate for a non-existent person, then in all other situations the participation of judges is required.

Cancellation of a will due to a notary error

This development of events also happens. The human factor is always present, but you need to understand that we are not talking about typos. The judge will consider the plaintiff's arguments, review the documentation and express his opinion on names, mail addresses, text and amounts. But if there is a typo, it will not be possible to cancel the certificate. It’s a different matter when there is an error in the description of the inheritance, the dates or other information do not correspond.

Deadline for entry

The law establishes a certain period during which the legal heir can exercise his right and accept the inheritance.

This should be done within six months after the date of opening of the inheritance. According to the law, such a day is the date of death of the testator or the entry into force of a court decision declaring him dead.

If the deceased has a child who has not yet been born, the time for opening the inheritance is postponed until his birth.

If during the allotted period none of the successors declared their rights and did not enter into the inheritance, or there are no recipients at all, then the inherited property goes to the state.

If there are compelling reasons, it is possible to extend the period for accepting the inheritance. To do this, after 6 months, you will need to apply to the court with a corresponding application and confirm valid reasons that prevented you from entering into an inheritance - serious illness, traveling abroad, insurmountable situations, etc.

Is it possible to accept an inheritance after the fact? The answer is presented in the article “How the procedure for actual inheritance is carried out.” You can find out whether the loan is inherited here.

Inheritance by will

The Civil Code gives priority to a will.

The testator can appoint anyone as heir (even just acquaintances or even an organization), he can reduce (increase) the share of the heirs, he can completely deprive them of the inheritance.

If he bequeathed only part of the property, then the rest will be divided among the heirs according to the law.

According to the Civil Code, there is a rule of secrecy of a will: people who know about the will cannot disclose the contents of the will without the consent of the testator.

Among the heirs there are people who, regardless of whether they are indicated in the will or not, or whether they are included in the appropriate queue, can receive part of the inheritance.

This right has:

- disabled spouse and parents;

- disabled or minor children of the deceased;

- disabled dependents of the deceased (even in the case when they are not considered heirs by law, but before the death of the testator they lived with him for at least 1 year and were dependent on him.

Regardless of the contents of the will, they are entitled to at least half the share of what would be due to each person upon inheritance by law.

If any of the heirs is under 14 years of age or incapacitated, then the application for inheritance is submitted by their representative (parent, guardian, trustee). If the representative is himself an heir, he can give only one statement - on behalf of himself and on behalf of the ward.

People from 14 to 18 years old write a statement on their own, but act with the consent of their representatives. Persons who have been recognized by the court as partially competent give a statement on their own, but act with the consent of the trustees.

Within six months after the death of the testator, the heirs submit an application for entry into the inheritance.

Documents confirming the right to inheritance by law

When assessing a person’s right to receive the testator’s property, a notary is guided only by official documents. Based on this, the right of the heir cannot be confirmed by testimony regarding his family and marital relations, being dependent on the deceased and other facts.

As practice shows, the main documents that confirm the right to receive a share and the inclusion of a person in the queue called by law to inherit are the following documents:

- certificate of registration of marriage relations;

- birth certificate;

- information from the internal documentation of the civil registry office - record books, various registration papers, information from the archive, etc.;

- official documentation and certificates from state or executive institutions regarding the degree of kinship and marital relations with the deceased;

- papers containing information from the applicant's employer or testator - personal file data, information from the human resources department, etc.;

- data entered in the citizen’s passport, for example, about children and registration of marriage relations;

- an agreement on the calculation of alimony payments, orders or resolutions of judicial authorities on the establishment of alimony, from which it can be concluded that the successor was dependent on the deceased;

- various types of certificates confirming the age pension or disability of the heir;

- documents from government agencies about a person’s education or disability.

If it is not possible to submit the specified documents, then it will not be possible to resolve the issue of entry without going to the courts.

How many queues are there?

If inheritance is carried out without a will by law, then the successors can enter into a share in the order of priority regulated by the Civil Code of the Russian Federation. Current legal regulations establish eight lines of succession.

The queues depend on the degree of family ties connecting close people, taking into account kinship by blood or kinship equated to it by law. The number of births separating the successor from the testator is such a degree, for example: the first line is parents and children, the second is grandparents and grandchildren, the third is great-grandfathers and great-grandchildren.

In addition, the first priority of inheritance also includes the spouse of the deceased, who, along with blood relatives, participates in the distribution of property.

It should be noted that the spouse must be entitled to the property that he owned before the marriage was registered, and the share of property that was acquired during family life.

The spouse's obligatory share is not included in the estate - the remaining property will be distributed among all successors.

Notary fee (cost) for issuing a certificate

When receiving a certificate of inheritance, you must pay a state fee. Depending on the degree of relationship, the size of the tariff established by Art. 333.24 of the Tax Code of the Russian Federation:

- for heirs of the first and second priority (except for grandparents) - 0.3% of the value of the inherited property in the part that is due to this heir. The limitation on the maximum amount of state duty in this case is 100,000 rubles;

- for other heirs - 0.6% of the value of the inherited property in the part that is due to this heir. The limit on the maximum amount of state duty in this case is 1,000,000 rubles.

In cases where the value of the property is unknown, it can be determined by specialized organizations .

Payment for carrying out activities to evaluate the inherited property is carried out at the expense of the heirs or one of them, by agreement. In extreme cases, such issues can be resolved by a judicial authority. And in some (exceptional) cases, payment for assessment activities is made from the funds of the inherited property.

The legislation establishes (clause 1 of Article 333.25 of the Tax Code of the Russian Federation) that the assessment must be carried out at the time of opening of the inherited property.

However, property does not always need to be valued. The Tax Code of the Russian Federation stipulates that the state fee should be calculated when issuing a certificate of title to inherited property based on the following options for the value of such property:

- inventory value;

- cadastral value;

- market value;

- nominal value.

In this case, the notary is not authorized to demand a document confirming a particular value of the property. If there are several documents that confirm the value of the property and this value differs, in this case the calculation can be made from the lowest value of the property.

Information

In accordance with Art. 333.38 of the Tax Code of the Russian Federation, there is a category of persons and types of property, upon inheritance of which citizens entering into inheritance rights are exempt from paying the fee or do not pay it in full upon receipt of the certificate.

Such benefits arise in the following cases:

- upon entry into the inheritance rights of citizens with disabilities of the first and second groups, payment of the state duty is carried out in the amount of 50% of the amount of such duty;

- upon entry into the inheritance rights of citizens living together with the testator and inheriting after his death, this residential building and the plot on which this house is located;

- when inheriting deposits, wages, insurance amounts, royalties;

- when inheriting property, if the testator died while performing duties or tasks in connection with his official position, etc. ;

- if the heirs are minors, minors and incapacitated citizens;

- other persons established by law.

In addition to paying the state fee, the notary is usually paid for his technical or legal work . Tariffs for such work are not clearly regulated by law and can be set by notary offices independently.

It should be noted that the notary has no right to charge fees for such services or impose services on citizens. Such services can be provided by a notary only with the consent of the citizens themselves.

To resolve disputes regarding the calculation and application of state duty calculations by notaries, citizens have the right to apply to the courts to protect their rights and legitimate interests.

Example

Citizen “P” applied to the district court to establish the cadastral value of a residential property in an amount equal to its market value. In substantiating her claims, citizen “P” indicated that she is the heir to this property. When paying the state fee for issuing a certificate of inheritance, the notary calculated the tariff based on the cadastral value of the property. However, the plaintiff does not agree with this cost, since she believes that the cost is too high. In order to confirm her arguments, citizen “P” turned to independent experts to conduct an independent examination of the market value of home ownership. Experts have calculated the market value, which is 200,000 (two hundred thousand) rubles less than the cadastral value.

The applicant asks the court to establish the cadastral value of the home ownership equal to the market value determined by experts.

Having studied the case materials, heard the parties, and analyzed the current legislation, the court came to the conclusion that the stated requirements were satisfied for the following reasons:

- establishing the market value of an object is a legal way to clarify the cadastral value of an object;

- the assessment was carried out by specialists legally and in accordance with the requirements of laws and regulations;

- the inflated cadastral value of home ownership entails the burden of mandatory payments, the amount of which depends on the cadastral value of the property.

List of papers for registration according to the will

If there is a will, it itself will be the main document indicating that the successor has the right to accept the inheritance.

The testamentary document left by the testator must be drawn up in accordance with the law and certified by a notary, who enters information about it into a special register.

There may be several testamentary documents, but the grounds for the right of inheritance arise only from the last will drawn up by the person. A special notary mark should indicate how old the document is.

Who can become the heir

In Russia there are only two orders of inheritance:

- by will (the testator left a notarized will, or certified by another person who is allowed to perform such actions);

- according to the law (starting with spouses and children, and ending with stepsons and stepdaughters). The heirs are grouped into seven queues. The queues depend on the degree of relationship. Among one queue, the inheritance is divided equally. An exception is made for persons inheriting by right of representation (if the heir died before the inheritance was formalized and the inheritance is registered in the name of the heir's heirs).

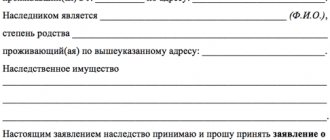

What to show to the notary

To enter into an inheritance, you need to contact a notary with a certain package of documents. The main documents that must be filed within six months after the opening of the inheritance are originals and copies of the following documents:

- death certificate;

- for the right to inheritance in order of priority: documents on birth, registration or divorce, change of personal data of the successor;

- a certificate from the place of residence of the deceased, form 9, or a house register, if the testator lived in the house (the documents must contain information about the persons living with him);

- to enter into an inheritance under a will: a testamentary document with a notary note stating that this is its latest version;

- a passport or similar document that allows you to certify the identity of the successor;

- a power of attorney or other representative document, if a representative or guardian is acting in the case.

Additional documents depend on the actions of the remaining heirs, the availability of real estate and other factors.

They can be:

- refusals of other successors to accept the inheritance;

- documents for housing;

- acts of valuation of real estate and other property;

- papers on living space planning, real estate passports;

- documents for vehicles;

- deposit papers;

- other documents that the notary cannot do without in this case.

The difference between opening an inheritance and opening an inheritance case

It would seem that these two expressions should have the same meaning. But this is far from true.

The inheritance opens regardless of the wishes and actions of the heirs. At the same time, opening an inheritance case is an action that is possible after the appropriate initiative of the heirs.

By turning to the notary with an application to accept the inheritance, the legal successors thus give impetus to the opening of an inheritance case. The opening of a case occurs without the intervention of heirs only if initiative is taken by creditors.

By whose will an inheritance case is opened, this is the result of active actions. Opening an inheritance does not require any action. The opening of an inheritance does not always lead to the simultaneous opening of an inheritance case.

The process of inheriting the property of a deceased owner is carried out on the basis of law. In the event that the heirs have additional questions about the procedure, they should refer to Section V of the Civil Code of the Russian Federation.

Papers evidencing the composition of the property

The property included in the estate can be determined using documents on the deceased person’s ownership of them.

Real estate

The list of documents confirming the right to inheritance upon receipt of real estate contains the following papers:

- documents confirming the ownership of housing (sale and purchase agreements, donations, information on privatization, etc.);

- 2 copies of the BTI certificate;

- original and copy of technical and cadastral passport data;

- living space assessment report;

- extract from the state register of rights;

- certificate of registration of the right, if its occurrence occurred later than 1998.

Automobile

If the inheritance includes motor vehicles, then you will need car registration documents, a registration certificate for the car and expert assessment data about its market price.

Contribution

The notary should provide information about the branch of the bank, pension institution or employer if the share of the inheritance contains a contribution to a banking organization, unreceived pension payments or earnings. The notary office itself will take care of obtaining the necessary documents.

Land plot

To receive a land plot by inheritance, you need title documents, papers on land ownership, data from the cadastral passport of the object, an extract from the register of rights and a document on the estimated value of the area.

As with housing, if ownership came after 1998, you need a certificate of registration.

What consequences may arise after the revocation of the will?

The main problem is that after the certificate is annulled, redistribution of shares of the inheritance between relatives is inevitable. When there is no will, rights to property are transferred according to priority. There are 7 queues in total. In addition to blood ties, marriage ties and children born outside the family are taken into account if the fact of paternity is established and documented.

In addition to relatives, dependents who were supported by the deceased during his lifetime are entitled to inheritance. There is a deadline set by the state. It is necessary that care be taken for a year or more before the death of the testator. The result of the cancellation of a certificate issued by a notary is the transfer of the inheritance to third parties, including partially if the applicants belong to the same line or are obligatory heirs.

Grounds for invalidating a will

When talking about sufficient conditions for annulment of a certificate of inheritance, the following facts were meant:

- The notary made gross mistakes that distorted the situation and allowed for legal discrepancies.

- The testator was incapacitated at the time of registration of the will, and the notary may not have known about it.

- The name, patronymic, surname, and passport details of the legal successor do not correspond to the actual ones, and the property is registered incorrectly.

- Documentation was drawn up under pressure, threat of physical harm, etc. The fact of entry is canceled if the heirs are recognized as unworthy.

The last paragraph means that the successor did not care about the inheritance and its owner, carried out illegal actions in relation to it, tried to influence the decision, etc. But the notary did not have this information.

How to re-register a deposit in Sberbank

If the share includes a deposit in Sberbank, then the conditions of inheritance are not regulated by the procedure for entering into an inheritance according to law or by will. In this case, a testamentary disposition applies, and to accept a deposit at a banking institution it is not always necessary to contact a notary.

To receive a contribution as part of an inheritance, you will need a document confirming the personal data of the heir, papers confirming the death of the testator who made the testamentary disposition and bank statements.

The bank does not notify successors about the deposit, so if the deposit is not accepted by the heirs, it will remain with the state.

Is it possible to receive an inheritance abroad? The answer is presented in the article “How to receive inherited property abroad.” You can find out how to search for an inheritance here.

Is a certificate needed?

Obtaining a document attesting to inheritance rights from a notary's office is mandatory if the testamentary disposition for the deposit was executed later than February 2002. If the document was drawn up in February of this year or earlier, then there is no need to obtain a certificate from a notary.

Where to go

The application is submitted to the last place where the deceased was registered.

When it is unknown or if it is abroad, you need to contact the place where the inherited property is located in Russia. When you first contact the notary, you must submit:

- passport and copy;

- death certificate of the testator (and a copy);

- The secretary's work is paid.

After receiving the application, the notary opens a case.

In the inheritance case, all documents (applications, copies of documents) from all interested parties are collected. Keep in mind that the heirs of a person who lived in a certain territory must come to the specific notary to whom this territory is assigned. But if the last place of registration of the testator was Moscow, the heirs can go to any notary in the capital who has the right to draw up inheritance matters.

And further. You cannot refuse part of the inheritance. If the heir accepts at least part of the inheritance, then he is obliged to accept the rest.

In what case should you go to court?

If for some reason it is impossible to provide documents to formalize the inheritance, including papers confirming the relationship with the testator, the successor will have to go to court to establish such a legal fact. The court's decision on this issue will serve as confirmation of the heir's right to the property of the deceased.

To competently substantiate your position in court hearings, experts recommend seeking the services of experienced lawyers in civil and inheritance matters.

Even if the successor was unable to confirm his rights by presenting papers or during court proceedings, he can be recorded in the notary's document on the right to inheritance with the consent of the remaining applicants receiving the share.

Recognition of inheritance as accepted

The inheritance is considered to belong to the heir from the day when it was opened.

This time does not depend either on the time of actual acceptance or on the time of state registration of property rights. This is important, in particular, for inheriting real estate.

When inheriting, the following important point must be taken into account.

If reconstruction has been carried out in the inherited property, then, even though the notary will give a certificate, the heir will not be able to register the right to this property with the UFGR. After receiving the refusal, he needs to go to court with a claim for recognition of ownership of the reconstructed object. All interested parties are involved (municipal property departments; local departments of construction, architecture and urban planning; land resources department) and a technical conclusion is provided, approvals from the Ministry of Emergency Situations and the SES.

To successfully accept an inheritance and avoid legal mistakes, it makes sense to contact a qualified specialist.

Legal provisions

As a result of the succession process, property rights are transferred from the former owner to the heirs. The procedure is carried out after the death of the testator. Civil legislation stipulates that successors can receive the inheritance mass based on the established priority. It is provided for persons related to the deceased and is enshrined in the provisions of the laws. Also, the basis for the distribution of inheritance can be a will. Not in all situations, the heirs agree with the will of the deceased, which is reflected in the will.

Applicants for property may be persons who are not reflected in the drawn up order, but who have the right to an obligatory share. Also, the spouse who was left without an inheritance can file a claim.

Expert commentary

Potapova Svetlana

Lawyer

It can often happen that the successor learns about the death of the owner of the property after a significant period of time. Accordingly, the period for entering into inheritance rights has already expired. It also happens that an existing will is hidden by interested parties for several years. The party cites the above arguments as justification for the filed claim.

Donation agreement and will: can it be replaced or not?

To understand the situation, you need to understand the difference between these documents:

- Deed of gift . The document is drawn up during the lifetime, and the property is transferred to the applicant immediately after signing or within an agreed period. In any case, the successor becomes the owner until death is recorded.

- Will . It is also drawn up by a notary who issues the certificate. The inheritance is used after the death of the testator. Cancellation of a will is possible if the previously disputed property was transferred into ownership under a gift agreement.

It is considered a mistake to think that after drawing up a testamentary document, the owner cannot dispose of the property at his own discretion. When considering a case, dates and numbers should be of primary interest to you. The conflict begins when the inheritance was donated, but the notary did not know this and issued a certificate.

Fake information

The range of false information includes both falsification of documents by the heir and deliberate actions of the notary.

For example, an heir may provide a falsified birth certificate, marriage certificate, or other document that provides the basis for a call to inheritance. The notary, in turn, may turn a blind eye to dubious documents or be careless in checking and identifying the circle of heirs.

Important! Liability for the falsity of information lies with both the person who provided it and the person who, under reasonable circumstances, would have suspected the falsification.