How is sick leave paid for part-time work in 2020-2021?

The way in which sick leave for a part-time worker is paid for in 2020-2021 depends on the place where the part-time worker was registered for work in the 2 years preceding the year of incapacity for work.

It may turn out that he worked: 1. For the same employers as in the year when he went on sick leave.

2. With other employers, not those for whom he works in the year he went on sick leave.

3. With the same employers, but also had other jobs.

Paying sick leave to a part-time worker has its own peculiarities in each case. First of all, from the point of view of determining the employer who is obliged to provide compensation to the employee for certificates of incapacity for work.

For information on the rules for applying for a job on an external part-time basis, read the article “How to properly apply for an external part-time job?” .

If you have an internal part-time worker, then you can calculate and pay sick leave for such an employee using a Ready-made solution from ConsultantPlus. To see explanations, get a trial access to K+. It's free.

Part-time job

The current regulations governing the work of part-time workers provide for many restrictions, and failure to comply with them may result in the organization and its officials being brought to administrative liability.

Fund inspectors, judging by arbitration practice, take sick pay for part-time workers very seriously, trying to find payments in violation of the law. After all, FSS officials have the right not to accept such expenses as credits for compulsory social insurance (clause 3, clause 1, article 11 of Law No. 165-FZ).

The current regulations governing the work of part-time workers provide for many restrictions, and failure to comply with them may result in the organization and its officials being brought to administrative liability.

Especially for workers employed in more than one company, a certain algorithm for calculating benefits is prescribed in Article 13 of Federal Law No. 255-FZ of December 29, 2006 “On compulsory social insurance in case of temporary disability and in connection with maternity.” In addition, on April 6, 2012, the Ministry of Justice of Russia registered Order No. 31n of the Ministry of Health and Social Development of Russia dated January 24, 2012, which introduced changes to the Procedure for issuing certificates of incapacity for work, approved by Order No. 624n dated June 29, 2011.

Based on reading the document, you can create three algorithms for calculating benefits for a part-time worker. Let's look at them.

Who pays sick leave for a part-time worker?

In this case, 3 scenarios are possible:

1. When the employee worked for the same employers for 2 years preceding the year in which the sick leave was issued.

In this case, all current employers are responsible for paying sick leave to the employee.

IMPORTANT! When applying for sick leave, the employee will need to make as many copies (originals) of sick leave as there are employers to whom he plans to apply for benefits. A separate sick leave must be issued for each employer.

2. When the employee worked for other employers during the 2 years preceding the sick leave.

Here an employee can apply for sick leave from any of their current employers. In this case, the employer paying sick leave will take into account the income that its employee received from other employers when calculating benefits.

IMPORTANT! In this case, the employee issues 1 sick leave (for the employer where he plans to receive benefits), but must also provide confirmation of his income from other employers for the billing period (2 years).

3. When an employee, during the 2 years preceding the year in which part-time sick leave is paid, worked both for current employers and for others.

In this case, the employee has the right to take out sick leave from any of his current employers.

Each of the described scenarios has its own nuances, determined both by the peculiarities of registering sick leave and by the applied rules for calculating payments for it.

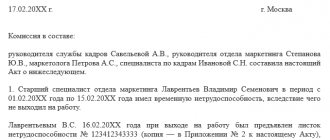

How to register a part-time worker

Internal part-time workers do not present any new documents to the employer - you already have them, but bureaucracy still cannot be avoided.

To register an internal part-time worker:

- draw up and sign the second employment contract in two copies: keep one for yourself, give the second to the employee;

- fill out the second personal card with the data of the second employment contract;

- issue a second hiring order and familiarize the employee with it against signature within three days;

- entry in the work book - only at the request of the employee.

Registration of sick leave when working part-time: nuances

In scenario No. 1, paying sick leave to a part-time employee involves each employer receiving certificates of incapacity for work from the employee.

Each sheet must indicate that the person works part-time. In addition, the sheets must indicate the number of the sheet that is provided to the accounting department at the main place of work. That is, an employee receives several paper sick leaves - for each place of work.

As for electronic certificates of incapacity for work (ELS), according to the new Procedure for issuing sick leave (approved by order of the Ministry of Health dated September 1, 2020 No. 925n, introduced from December 14, 2020), one electronic sick leave is generated for a part-time worker, the number of which is provided to each employer.

In scenario No. 2, registration and payment of sick leave to an external part-time worker is carried out differently.

The employee provides only one sick leave - to any of his current employers. This applies to both paper and electronic sick leave.

In the appropriate scenario, the employee’s sick leave will need to be supplemented with:

- a certificate confirming receipt of income from another employer (or several certificates - if there are several other employers);

- a certificate from another employer (several certificates) stating that they did not make sick leave payments.

In scenario No. 3, the procedure for registering sick leave also has its own peculiarities.

The employee can submit:

- one certificate of incapacity for work for any of the employers for whom he works;

- several sheets - one for each current employer.

In this case, one ERN is also formed, but the employee provides its number to either one or several employers.

Moreover, if sick leave is provided to one employer, then it must be supplemented with the same documents that are used in scenario No. 2.

You can find out how an employer can fill out a sick leave certificate issued to an external part-time worker in the Ready-made solution from ConsultantPlus, having received trial access for free.

Who are part-time workers?

Part-time work means that one person performs different functions or holds several positions at the same time.

The question arises: is sick leave paid to external part-time workers in 2021? All people get sick, no matter how much work they do. A certificate of temporary incapacity for work is not always issued due to an employee’s illness; it is provided for a period of temporary incapacity for work in connection with pregnancy and childbirth for women and for parents who are caring for a sick child. In all cases, part-time workers have equal opportunities to receive benefits as other employees. According to the norms of the Labor Code of the Russian Federation, there are two types of part-time work:

- internal, when an employee combines several positions, but in one company;

- external, when a citizen is officially employed by two or more employers, but with one as a main employee, and in other companies he works as an external part-time employee.

Regardless of which of these types is applied, the employee is entitled to part-time temporary disability benefits if he gets sick, has issued a sick leave certificate from a medical organization and provided it or an electronic document number to the employer.

Since 2022, all temporary disability certificates have been transferred to electronic format. But for now there are paper documents that are issued by a medical organization, and the employee brings them to the organization where he is employed.

Read more - “Filling out a sick leave certificate - a step-by-step guide.”

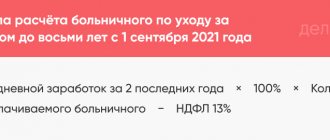

Calculation of sick leave for an external part-time worker: nuances

How part-time sick leave is paid also depends on the specific scenario applied in the legal relationship between the employee and his current or former employers.

In scenario No. 1, benefits are calculated by each employer, based on the employee’s average earnings for the period of validity of the employee’s employment contract with this employer.

In scenario No. 2, a company that has received documents on income from other employers calculates sick leave for a part-time employee based on the employee’s total earnings for the 2 years preceding the year in which the sick leave is issued, taking into account income that occurred in other places of work.

Scenario No. 3 is characterized by the fact that the employer calculates the amount of payment for sick leave based on data on earnings received either from him alone, or based on the total earnings of the employee, taking into account his other places of work (provided that the latter submits all the necessary documents for this) .

An example of calculating benefits for an external part-time worker who changed his main place of work during the billing period, from ConsultantPlus Ivanov N.S. started his new main job in January 2021. For 2021, he received payments subject to insurance contributions for VNiM in the amount of 426,800 rubles. At the previous main place of work in 2021, payments subject to insurance contributions for VNiM were accrued in the amount of RUB 394,000. In the organization Zarya LLC, where Ivanov works as an external part-time worker on a part-time basis (0.5 rate), payments for which insurance premiums for VNiM are calculated amounted to: in 2021 - 279,180 rubles; in 2021 - RUB 293,490. Ivanov N.S. was on sick leave from January 20 to January 24, 2021 (5 calendar days). You can view the entire example in K+. Trial access to the material is free.

You can find out more about the procedure for calculating sick leave benefits here.

What will an internal part-time worker receive?

For an internal part-time worker, the doctor issues only one copy of the certificate of incapacity for work, since he has only one employer. Let's figure out how sick leave is paid for internal part-time work in 2021 - the sick leave is transferred to the accounting department of your only employer for calculation. This single employer makes the calculation based on the employee’s total length of service and his average daily earnings, which is determined by the calculation method for two calendar years. The calculation of sick leave includes income from both the main place of work and combined positions based on accounting data.

IMPORTANT!

In 2021, the employer calculates and pays sick leave for part-time work and the main place of work only for the first three days of incapacity for work. The remaining period is directly paid by the Social Insurance Fund based on information received from the organization where the person is employed.

Internal part-time work does not affect the calculation of sick leave, since wages are summed up and taken into account in full depending on length of service.

ConsultantPlus experts have compiled a guide on how to work with sick leave in 2021. Use these instructions for free.

Maximum and minimum amount of payments for part-time sick leave: nuances

Typically, a part-time worker works less than 8 hours in each company. In this case, the amount of sick leave is determined:

- based on the average earnings of a part-time worker for the 2 years preceding the one in which the person went on sick leave, if the average earnings are greater than the minimum wage;

- based on the minimum wage, if the average salary is less than the minimum wage, and in this case the share of the minimum wage is taken into account, determined in proportion to the actual standard of working hours of the employee under the contract.

Example

Ivanov has been working part-time for 3 years, 2 hours a day, at Fregat LLC and receives 5,000 rubles per month. He goes on sick leave in September 2020 and registers it with each of his employers, including Fregat LLC. Let’s agree that before this he had not been sick for 2 years and received his entire salary every month.

When calculating sick leave, an accountant will determine the minimum average earnings at the current minimum wage:

12,130 / 4 = 3,032.50 rub. (2 hours is ¼ of a standard workday of 8 hours).

Average earnings calculated according to the minimum wage are 99.70 rubles. (3,032.50 × 24 / 730).

Average earnings calculated by income are 164 rubles. 38 kopecks (5,000 × 24 / 730).

Calculations for sick leave should be made based on Ivanov’s actual earnings.

In this case, the upper limit of sick leave payments is set in the amount of the maximum amount of the insurance base for each employer who received sick leave from an employee. This is due to the fact that each employer pays social security contributions for a part-time employee separately, from its own funds, and thus applies the upper limit only for itself.

An example of calculating benefits for an external part-time worker based on the minimum wage from ConsultantPlus Ivanov N.S. started his new main place of work in January 2021. For 2021, he was accrued payments subject to insurance contributions for VNiM in the amount of 114,230 rubles. At the previous main place of work in 2021, payments subject to insurance contributions for VNiM were accrued in the amount of RUB 82,650. In the organization Zarya LLC, where Ivanov works as an external part-time worker on a part-time basis (0.25 rate), payments for which insurance premiums for VNiM are calculated amounted to: in 2021 - 21,400 rubles; in 2021 - 48,800 rubles. Ivanov N.S. was on sick leave from April 13 to April 17, 2021 (5 calendar days). See the full example in K+. This can be done for free.

Read more about the rules for applying limits when calculating temporary disability benefits in the materials:

- "Maximum amount of sick leave";

- "Maximum amount of benefit for temporary disability."

Why does a part-time worker have the right to sick pay?

The legislation of the Russian Federation equates part-time work to official work activity, since it is also formalized by contractual relations. A person who combines two or more positions within one organization is an internal part-time worker , and someone who works for several employers is an external part . In any form of part-time work, remuneration is made with appropriate contributions to social funds, which guarantees compensation payments in case of disability.

NOTE! Any forms of part-time work that are not formalized by an employment contract and are not accompanied by insurance contributions cannot be considered part-time work; therefore, they do not in any way guarantee the right of employees to social protection, including the provision of paid disability leave.

By signing an order appointing an employee to a part-time position, the employer assumes insurance obligations in relation to the new employee. These obligations begin from the date the order is signed. From this day on, the part-time employee has the same insurance guarantees as employees from the main staff.

Results

Payment of sick leave to part-time workers in 2020-2021 is carried out taking into account earnings paid by both current and former employers of the employee who issued the certificate of incapacity for work, and has a number of nuances depending on the specific situations that have developed in legal relations with employers.

These situations determine the list of documents that an employee needs to receive compensation for sick leave, as well as the principles for calculating the corresponding compensation. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Dismissal of part-time workers

An employment contract can be terminated if a part-time employee is replaced by an employee for whom this position will be the main one. Companies with a small document flow often need a part-time accountant. Then the business grows, they hire a new full-time employee, and part with the part-time employee. This is fine.

Give your co-worker at least two weeks' notice. To do this, prepare a written notice and present it to the employee against signature. After this, issue a dismissal order, pay wages and compensation for unused vacation. Such dismissal is possible if the employment contract is concluded for an indefinite period. But a fixed-term employment contract cannot be terminated for this reason.

If a part-time worker resigns of his own free will, the procedure is the same as for regular dismissal. The only difference is in the work book, where the entry is made at the request of the employee.

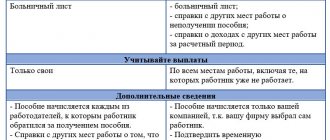

Which employer should pay the benefit?

An external part-time worker may have two or more employment contracts concluded with different employers. Each employer pays contributions to the Social Insurance Fund for him. To understand which of them should receive disability benefits, let us turn to Art. 13 of the Law of December 29, 2006 No. 255-FZ “On compulsory social insurance...”. According to paragraph 2 of this article, situations may arise:

- Situation 1. At the time of the onset of illness, Vasily worked at Lida LLC and at your Vera LLC for the previous two calendar years. Disability benefits will be paid to him by both employers - you and Lida LLC. At the clinic, Vasily will take two certificates of incapacity for work - for the main employer and for the additional one. You are an additional part-time employer, so a special mark will be placed on your copy - a tick in the “Part-time” column.

- Situation 2. At the time of the onset of the disease, Vasily works at Lida LLC and for you, but for the two previous years he worked at completely different enterprises. The disability benefit will be assigned and paid by one of the current employers - you or Lida LLC. In this case, Vasily has the right to choose himself from whom he will receive benefits. Typically, employees weigh the level of salary and time worked, and choose the employer from whom the amount will be higher.

- Situation 3. At the time of the onset of illness, Vasily works at Lida LLC and for you, but for the two previous years he worked either for his current employers or for some others. Disability benefits can be paid either for all places of work, or for one of the last places of Vasily’s choice.

- Situation 4. Vasily lost his ability to work due to illness or injury within a month from the date of dismissal. Disability benefits will be assigned and paid by the insurer at the last place of work or the territorial Social Insurance Fund.

If Vasily decided to receive benefits from several employers at once, then accountants will calculate it based on the average earnings for the time worked only in his company.

But let’s imagine that a man chose only your company to calculate benefits. Then, in order to make correct calculations, you will need information about his earnings from other places of work (certificate in form No. 182n), and also that those employers at the same time do not accrue him disability benefits for this illness.

You have the right to request such certificates (clause 5, 5.1 of Article 13 of Law No. 255-FZ).

If an employee cannot obtain a certificate from the employer, for example, the company has ceased operations, he can obtain such information from the Pension Fund.

You have 10 calendar days to accrue benefits from the date the employee submits the documents you need (sick leave and certificates from other employers). The money must be received by the employee on the nearest salary payment date after the date indicated on the certificate of incapacity for work.

How benefits are calculated for external part-time workers

Sick leave is paid from two sources: the first 3 days - at your expense, and for the rest of the time (starting from the 4th day) the Social Insurance Fund pays. Sick leave related to child care is fully covered by the Social Insurance Fund.

Since January 1, 2021, the “Direct Payments” project from the Social Insurance Fund for sick leave and maternity benefits has been operating in all regions. If previously the employer paid for the benefit from its own funds, and then returned the money spent from the Social Insurance Fund, now the fund will not reimburse expenses (the procedure for switching to direct payments is enshrined in Article 6 of the Law of December 29, 2020 No. 478-FZ “On Amendments...” ). The exception is the first 3 days of sick leave: the employer still pays for them at his own expense.

This means that the accountant needs to calculate and pay disability benefits only for the first 3 days of sick leave. The rest will be calculated and paid by the FSS itself. However, he will need information from you about your average earnings, the period of the insured event, the billing period, etc. You must provide all this in a package of documents or an electronic register with the relevant information.

Having received a certificate of incapacity for work from the employee and an application for payment of benefits, the employer must provide information to Social Security within 5 calendar days to receive the payment. Within 10 calendar days, the fund will make a decision on the assignment and payment of benefits. Thus, the employee will receive benefits in 2 stages:

- for the first 3 days of illness - from the employer to the salary card;

- for other days - from the Social Insurance Fund to a bank account or by postal transfer.

If the employee’s illness lasted only 3 days, then there is no need to contact the Social Insurance Fund. The fund makes payments only from the 4th day. And even if the enterprise cannot pay the benefit, then the territorial Social Insurance Fund pays it, but only its part - from the 4th day of illness.

How to confirm part-time earnings

Earnings received in the billing period, which are taken into account when calculating benefits at the place of payment, are confirmed by a certificate of the amount of earnings. Mandatory social insurance contributions must be calculated on this amount for the two calendar years preceding the year the employee was dismissed or the year the person applied for a certificate, as well as for the current year.

The certificate contains information on the number of days of illness, maternity leave and child care leave, as well as periods during which the employee retained his average earnings, but no contributions were accrued. This data is necessary for calculating maternity and child benefits, since these days are excluded from the calculation period.

The employer is obliged to issue it to the employee on the day of dismissal or upon a written request from an employee who has already resigned. The certificate form was approved by order of the Ministry of Labor of the Russian Federation dated April 30, 2013 No. 182n.

Sample of filling out the certificate

Read more…

If your company is liquidated, then you must issue a certificate of average earnings to employees on maternity leave for the 12 calendar months preceding the month of dismissal during maternity leave or the month of parental leave.

This is due to the fact that benefits in these cases are calculated in the same way as vacation pay - earnings for 12 calendar months are divided by 29.3 and 12. There is no unified form for such a certificate, so it is compiled in any form, including income in each month , which are involved in the calculation of vacation pay, not benefits.

Calculation of benefits based on the minimum wage

Law No. 255-FZ provides for the calculation of benefits for temporary disability based on the minimum wage established by federal law on the day the insured event occurs.

Reference

The minimum wage amount was 5,205 rubles in 2013, and 5,554 rubles from January 1, 2014.

Thus, the average earnings, on the basis of which benefits for temporary disability are calculated, are taken equal to the minimum wage if:

- the insured person had no income during the billing period,

- the average earnings determined for this time period, calculated for a full calendar month, are below the minimum wage established by federal law on the day of the onset of illness (Part 1.1 of Article 14 of Law No. 255-FZ).

That is, the calculation of temporary disability benefits in such cases is made from 24 times the minimum wage: 5554 rubles. x 24 months = 133,296 rubles.

An employer for whom an employee began working part-time in the year of temporary disability and did not have payments in the billing period is obliged to provide that employee with benefits if he is selected as the source of the benefit. If benefits are paid by each employer, then in order to calculate average earnings, payments received by the insured person for the previous two years from other policyholders cannot be taken into account.

Consequently, on the basis of the submitted certificate of incapacity for work, the organization in which the employee began working part-time in the year of the onset of temporary disability and did not have payments in the billing period must issue him a benefit calculated on the basis of the minimum wage.

Commentary by an expert from the journal “Regulatory Acts for Accountants” to the Letter of the Social Insurance Fund of the Russian Federation No. 15-03-14/12-13959 dated November 14, 2013 “On payment of sick leave to an external part-time worker”

How to fill out a sick leave certificate correctly?

The e-book “Sick Leave” will help you correctly determine your average daily earnings, calculate the amount of temporary disability benefits, and correctly fill out your sick leave so that social insurance will accept the amounts paid as offset.

Common mistakes when working with part-time workers

Labor law expert, publisher of the Aktion-MCFER media holding, Veronika Shatrova, notes three common situations that can lead to serious fines from the labor inspectorate:

“Firstly, there are employees who can work part-time only with the permission of their main employer. In particular, this rule applies to the heads of the organization - Art. 276 Labor Code of the Russian Federation. At the same time, it doesn’t matter what kind of activity the manager plans to do part-time: run another company or become a teacher. Therefore, if you hire a part-time manager, be sure to require an additional document - consent. Violation of this rule will cost the company 50,000 rubles under Art. 5.27 Code of Administrative Offenses of the Russian Federation.

Secondly, if this is a former civil service employee, do not forget to notify him of his employment according to the general rules . The fact that such notice was sent during the main employment of your part-time worker does not matter. Otherwise, the company risks running into a fine of up to 500,000 rubles under Art. 19.29 Code of Administrative Offenses of the Russian Federation.

Thirdly, many companies continue to mistakenly believe that since a part-time worker works no more than half the working time and receives a proportional salary, then vacation only for half the days of the generally established number of rest days. Such a misconception threatens the company with another fine from the labor inspectorate of up to 50,000 rubles - in case of a primary violation. And up to 70,000 ₽ - if repeated. These are the sanctions established in Art. 5.27 Code of Administrative Offenses of the Russian Federation.”