Types of child benefits according to law

Before looking for the answer to the question of what documents are needed for child benefits, let’s decide what kind of child benefits exist.

First of all, the types of benefits that citizens with children can apply for are listed in Art. 3 of the Law “On State Benefits...” dated May 19, 1995 No. 81-FZ (see in the figure):

Thus, state benefits for citizens with children can be divided into two groups:

- Benefits paid to women during pregnancy and during maternity leave after the birth of a child.

- One-time and monthly benefits after the birth of a child.

Documents for child benefits must be submitted to the employer at the place of work of one of the spouses or to the social security authority (if a non-working citizen or university student is applying for benefits).

Certain categories of citizens (for example, unemployed parents) can submit documents for applying for child benefits to the MFC.

What does single mother status give to a woman in the Russian Federation?

Registration of the status of a single mother often takes quite a long time, so every woman who is engaged in obtaining such status should familiarize herself with what the status of a single mother gives. Thus, women who have received the appropriate certificate can count on:

- for free provision of linen, clothing and everything necessary for the child during his stay in the maternity hospital;

- If there is a massage therapist in a medical institution to which a single mother is attached by territorial or other principle, then the woman has the right to visit him free of charge no more than twice a week if there are medical indications for receiving his services (the presence of such indications must be confirmed with special medical documentation). Such a woman is not put on a waiting list to visit such a specialist (which is possible due to the large number of patients who are prescribed massage of varying degrees of impact);

- to receive free vouchers to various health camps and centers from medical organizations and institutions where a single mother and her baby are registered. Such vouchers must be provided at least once a year;

- for a woman to receive dairy products for her child until the latter reaches the age of three years;

- For a child, the mother’s status as a single parent means the possibility of free meals at school and kindergarten;

- when entering various educational institutions, a system of benefits for admission to education is available for a child from a single-parent family;

- depending on the region, a single mother has the right to receive a discount of up to thirty percent when enrolling a child in clubs and sections of additional education , if the provision of such additional services is paid (this information must be clarified in a specific municipal entity);

- depending on the region, a single mother may be given a discount of up to seventy percent on kindergarten fees (you should also check with the social security authorities of a particular region);

- for a child raised in a single-parent family, the opportunity may be granted to receive free medications from the recommended list of the Ministry of Health of the Russian Federation, as well as to receive other types of medications at a discount of fifty percent;

- if the income of a woman recognized as a single mother does not allow her to fully pay for utilities, such a woman has the right to apply for various types of subsidies to pay for utilities;

- in the case of cramped living conditions, a single mother has the right to participate in various programs to improve such conditions or to receive a subsidy from the state for the construction or major repairs of existing living quarters to bring it into compliance with sanitary and social living standards defined within the Housing Code Russian Federation;

- in the event of a layoff at the place of work of a single mother for the employer, the legislator significantly limits the possibility of dismissing such an employee if her child has not reached the age of fourteen, and if she is raising a disabled child, then until such a child reaches the age of eighteen (reduce or dismissal can only be done in cases of extreme necessity or on the basis of a special agreement between the parties);

- if the management has agreed in advance on the implementation of her labor functions by a single mother, then she has the right to count on the possibility of fulfilling her labor duties in a shortened mode , for example, on the basis of a shortened working day or working week.

Thus, obtaining the status of a single mother allows a woman to receive a number of benefits from the state. How is this status obtained?

List of documents for receiving maternity benefits

To apply for maternity benefits (M&B), the employee must provide the employer with the following package of documents:

- sick leave;

- application for payment of benefits;

- certificates of the amount of earnings from previous places of work for the estimated 2 years, if any;

- an application to replace the years of the calculation period if the amount of benefits increases when changing periods.

IMPORTANT! The benefit is not paid if the employee applied for it 6 months after the end of the BiR leave (Article 12 of the Law “On Compulsory Social Insurance” dated December 29, 2006 No. 255-FZ).

An addition to the B&R benefit is a benefit in connection with registration in the early stages of pregnancy. The basis document for receiving this benefit is a certificate issued by a medical institution. As a rule, both of these benefits are paid at the same time. Therefore, if the employee submitted a certificate of registration in the early stages of pregnancy along with the documents necessary for payment of maternity benefits, ask her to write one application for both benefits.

The employer, having received the entire package of documents from the employee, is obliged to transfer them to the Social Insurance Fund within 5 calendar days. The fund makes a decision on payment within 10 days and transfers benefits to the maternity leaver.

You will find ready-made instructions for receiving maternity benefits in ConsultantPlus. Get trial access to the system for free and go to the Ready-made solution.

What other payments are due to parents at the birth of a baby?

Maternity benefit for pregnancy and childbirth

Maternity benefits (“maternity benefits”) are paid for leave lasting 140 calendar days (70 days before childbirth and 70 after), 156 days (70 and 86 if the birth was complicated or by cesarean section), 194 days (84 and 110 if you have two or more children).

- Such leave is granted to women, and only to those who are officially dismissed or were dismissed due to the closure of the organization, as well as to female students;

- To receive this benefit, you must present a sick leave certificate for pregnancy and childbirth at your place of work (it is issued at the antenatal clinic at 30 weeks of pregnancy). The deadline for submitting sick leave is no later than 6 months from the end of maternity leave. The employer is obliged to calculate the amount of benefits for you immediately for the entire vacation period and pay you in a lump sum on the next day of payment;

- If you were fired due to the liquidation of the organization, if at the time of dismissal you were pregnant or were already on maternity leave, the state will pay you such benefits. In this case, you need to contact the territorial social security authorities at your place of residence. To calculate benefits, you will need to submit to SOSES a sick leave certificate, a work record book and a certificate from the Employment Center declaring you unemployed;

- If you are a full-time student at a free department of a state educational institution, you have the right to receive maternity benefits. The Federal Social Insurance Fund of the Russian Federation, in Letter No. 02-02-01/08-3930 dated 08/09/2010, explained that maternity benefits are assigned and paid at the place of study on the basis of a certificate issued by a medical institution. The benefit is set in the amount of the scholarship (Article 8 of Law No. 81-FZ).

Maternity benefits are paid for the period of maternity leave. The procedure for calculating maternity benefits in 2016 is determined based on average earnings for the 2 calendar years preceding going on maternity leave, but taking into account new limits (the maximum values of the base for calculating insurance contributions to the Social Insurance Fund).

The amount of maternity benefits for working women is established based on average earnings: it includes all types of payments and other remunerations for which insurance contributions to the Social Insurance Fund of the Russian Federation are calculated.

What amounts are included in the calculation?

Salary, bonuses, vacation pay, financial assistance, compensation for unused vacations, business trips.

What is not included in the calculation?

Non-contributory payments: sick leave payments, benefits, maternity payments, etc.

In this case, the average earnings for the year are taken into account in an amount not exceeding the maximum base for calculating insurance contributions to the Social Insurance Fund:

- For 2011 - 463,000 rubles;

- For 2012 - 512,000 rubles;

- For 2013 - 568,000 rubles;

- For 2014 - 624,000 rubles;

- For 2015 - 670,000 rubles.

If the total earnings for the year are greater than the limit, then the calculation is limited to the specified insured amount.

To determine the average daily earnings for calculating maternity benefits, you need to take the accrued earnings for 2 calendar years BEFORE the year of maternity leave.

When calculating payments in 2021, the amount of earnings for 2 years must be divided by the number of calendar days in this period (730 days) with the exception of calendar days falling on excluded periods.

Excluded periods.

When calculating maternity benefits, it is necessary to exclude calendar days falling within the following periods:

- Periods of temporary disability, maternity leave, parental leave;

- A period of release from work while maintaining earnings.

Vacation days without pay are NOT excluded from the billing period.

Thus, the denominator for benefit calculations can include days from 1 to 730 (or 731 if one of the years is a leap year).

Possibility of changing years to earlier ones

When calculating maternity benefits, a woman has the right to replace the years with any previous ones. If in 2 calendar years immediately preceding the year of maternity leave, or in one of them, a woman was on maternity leave and/or child care leave, the corresponding calendar years, at her request, can be replaced in order to calculation of average earnings in previous calendar years, provided that this will lead to an increase in the amount of benefits.

How to calculate maternity benefits yourself

Algorithm for calculating benefits for women who go on maternity leave in 2021:

average daily earnings = (average earnings for 2014 + average earnings for 2015) / (730 - excluded calendar days);

B&R allowance = average daily earnings * 140.

At the same time, the amount of average daily earnings is limited by law. The permissible maximum is determined as the sum of the maximum base for each year, divided by 730. In 2021, the maximum = (624,000 + 670,000) / 730 = 1,772 rubles. 60 kopecks Values exceeding this amount cannot be taken to calculate benefits.

The final amount to be paid is determined by multiplying the average daily earnings by the number of calendar days on the certificate of incapacity for work.

Total:

the maximum maternity benefit in 2021 will be 1,772.60 * 140 = 248,164 rubles;

The minimum maternity benefit in 2021 will be 203.97 * 140 = 28,555 rubles. 80 kop.

The minimum maternity benefit is calculated based on the minimum wage (in 2021 it is 6,204 rubles). It is received by a woman who has worked for less than 2 years with low wages or had no earnings at all during this period. If a woman has an insurance period of less than 6 months, then the benefit is paid in an amount not exceeding the minimum wage per calendar month, taking into account the regional coefficient, if it is established in the relevant areas.

Monthly allowance for child care up to 1.5 years

For the period of parental leave up to 1.5 years, the employee is paid a monthly allowance. There are two types of leave: leave to care for a child up to 1.5 years and leave to care for a child up to 3 years.

- The right to such benefits can be used by the person who actually cares for the child and is on leave to care for him - mom or dad. If several people provide care, only one of them is entitled to benefits;

- To receive this benefit at the end of maternity leave, you need to write an application at work for parental leave for up to 1.5 years and an application for the assignment of benefits. You will need to provide the original birth certificate of the child, a copy of it and a certificate from the parent’s place of work stating that he does not receive such benefits;

- The benefit amount is 40% of average earnings, but not less than the minimum benefit amount, which in 2021 is equal to 2,718 rubles. 34 kopecks for caring for the first child and 5,436 rubles. 67 kopecks for caring for the second and subsequent children, and no more than the maximum, taking into account the maximum value of the base for calculating average daily earnings. The maximum amount of care allowance in 2021 is RUB 21,554. 82 kopecks: (624,000 + 670,000) / 730 * 30.4 * 40% = 21,554.82;

- If parents are officially unemployed, they can receive one thing: either unemployment benefits or child care benefits.

To receive this benefit, you need to register with the Employment Center, and then contact the territorial social protection authorities. Documents you will need:

- Application for granting benefits;

- Child's birth certificate (and its copy), copy of work record book, passport;

- A certificate from the social security authorities at the father’s place of residence stating that he does not receive this benefit;

- A document confirming the registration of a child with one of the parents in the Russian Federation.

Compensation payments for child care up to 3 years old

Unlike child care benefits, such payments are made only to persons in an employment relationship who are on parental leave for up to 3 years. Compensation payments and monthly benefits are calculated independently of each other. Such persons include the mother, father, adoptive parent, guardian, grandmother, grandfather, and other relative who are actually caring for the baby.

- The amount of compensation payment is 50 rubles. The basis for its accrual is the employee’s application and a copy of the order for child care leave;

- The benefit is also paid if the employee submits an application after 6 months from the date of granting parental leave. In this case, it is accrued for previous periods, but not more than 6 months from the date of submission of the application.

Payments for early registration in residential complexes

This is a one-time benefit in the amount of “300 rubles. plus regional coefficient” you have the right to receive if you work and are registered with the housing complex no later than the 12th week of pregnancy. This benefit is paid simultaneously with maternity benefits. To receive it, you need to submit a corresponding certificate from the antenatal clinic to your employer’s accounting department.

Additional regional benefits

In each region of Russia, additional benefits are assigned and paid in different amounts and according to different rules. For information on obtaining them, you need to contact the territorial social protection authorities at your place of residence.

List of documents for obtaining a one-time benefit for the birth of a child

After the birth of a child, one of the parents has the right to receive a one-time benefit in the amount of 18,004.12 rubles if the child was born before 01/31/2021 inclusive or in the amount of 18,886.32 rubles if the child’s birthday is after 02/01/2021.

The composition of the documents is as follows:

- application for assignment and payment of benefits;

- a certificate from the second parent’s place of work (or from social security if the other parent does not work) about non-receipt of benefits (see sample here);

- birth certificate issued by the civil registry office.

IMPORTANT! If the parents are divorced, a certificate of non-receipt of benefits from the second parent is not needed. Instead, you will need a divorce certificate and a certificate of the child living together with the employee.

We prepare documents for the child

Congratulations on the birth of your baby!

Now you need to take several steps to obtain documents for the child. It's not as difficult as it seems, and some of it can be obtained through government websites.

Here's what you need to do:

- We collect documents from the maternity hospital - an exchange card, coupons No. 3, 3-1, 3-2 birth certificates and a certificate of birth of the child;

- We go to the registry office or MFC - there they give you a birth certificate and certificates for receiving payments;

- We register the child at the place of residence, at the same time citizenship is issued;

- We issue a compulsory medical insurance policy;

- We register the child at the clinic;

- Enrolling your child in kindergarten;

- We receive a one-time benefit.

You can also apply for maternity capital if your newborn child is not your first, and you also have milk and other dairy products for the baby in the dairy kitchen. We will also tell you how to obtain a passport and other documents for traveling abroad.

Documents for receiving child care benefits up to 1.5 years old

One of the parents or any other relative has the right to go on parental leave until the child reaches 1.5 years of age. To assign benefits you will need the following documents:

- employee’s application for benefits;

- child's birth certificate;

- birth certificate of the previous child;

- a certificate from the second parent’s place of work stating that he is not on parental leave and does not receive a monthly allowance. If a parent does not work, he can take such a certificate from social security. If a relative, for example a grandmother, will be caring for the child, such certificates will be needed from both parents.

Read about the minimum and maximum amount of child care benefits in 2021 here.

In order to receive benefits, wives of military personnel must provide, in addition to the above documents, a certificate from a military unit confirming that the child’s father completed conscription military service.

You will find ready-made instructions for receiving benefits for a child under 1.5 years old in ConsultantPlus. Get trial access to the system for free and go to the Ready-made solution.

Single mother status from the legal perspective

The current legislation in the field of family legal relations provides a comprehensive definition of which woman can count on receiving the status of a single mother. In accordance with the provisions of existing regulations, a single mother can be recognized as a woman who raises a child without the help of the biological father for various reasons.

However, not every woman who raises a child alone can count on receiving benefits from the state. Single mother status must be confirmed. First of all, such women include those women who:

- gave birth to a child out of wedlock, without indicating any man as the child’s parent (there is a dash in the “Father” column on the birth certificate) and having issued a special certificate in the registry office in form 25, which confirms the absence of a second parent for the child;

- gave birth to a child out of wedlock or after three hundred days from the date of official divorce;

- gave birth to a child whose paternity was challenged in court by the current or former spouse on the basis of a special genetic examination, even if the child was born within marriage or before three hundred days after the divorce;

- adopted a child without being married or while married, but the spouse refused to participate in the procedure for adoption of the child, of which appropriate documentary evidence was drawn up;

- took a minor child under guardianship if such women do not have a spouse or the spouse refused to take part in guardianship of the child under guardianship.

In the event that a child was born in marriage, but the father does not live with his family, the woman is widowed, or her husband is declared missing or dead by the court, a person is indicated in the birth certificate as the father of the child, and the child himself If any patronymic is assigned, then the woman cannot count on receiving the status of a single mother.

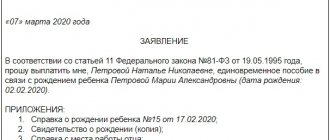

What to include in the application (sample)

As can be seen from the previous paragraphs, regardless of the type of benefit, the recipient must write an application for payment. It reflects the following information:

All information specified in the application must be confirmed by signing. You must also indicate the date the application was submitted.

See below for what an application for child benefit might look like:

It is better to fill out the application at the place where you receive benefits according to the sample proposed by the employer or the social security authority. You should also attach a package of documents (certificates, extracts, copies). We will tell you further about what certificates may be needed to apply for child benefits.

Obtaining citizenship for a newborn.

Issues of Russian Federation citizenship are regulated by the relevant industry law, which stipulates that Russian Federation citizenship is acquired:

- As a result of birth:

- according to the “soil” principle, that is, from birth on the territory of the Russian Federation;

- according to the “blood” principle - one parent is a citizen of the Russian Federation, regardless of place of birth.

- Admission to citizenship.

- Restoration of citizenship.

The fact of citizenship must be documented, otherwise legal representatives will face problems such as:

- Do not leave the territory of the Russian Federation.

- Don't get a passport.

- Upon reaching the age of 14, the teenager will be denied a passport.

- Refused to receive social benefits - maternity capital.

However, it is worth remembering that affixing is optional; no sanctions are provided for the absence of a stamp, except for the difficulties described above.

To obtain citizenship, you must contact the competent migration authority, which is the territorial branch of the Federal Migration Service of the police.

When applying to receive a citizenship stamp, parents provide the following documents:

- Birth certificate.

- Copies of passports.

- A certificate from the consulate if the baby was born in another country.

Obtaining a citizenship stamp is free and is usually issued on the day of application.

Citizenship for a newborn: how to obtain and where to apply.

We collect a set of certificates: about birth, family composition and others

The answer to the question of what certificates are needed to apply for child benefits depends on the type of benefit and who is applying for it. We will focus on the basic certificates required when applying for child benefits.

Certificate of birth of a child (form 24)

This certificate is required when applying for a one-time benefit at the birth of a child (clause 28 of order No. 1012n). A certificate of birth of a child is issued by the civil registry office in form 24, approved by Decree of the Government of the Russian Federation “On approval of forms…” dated October 31, 1998 No. 1274.

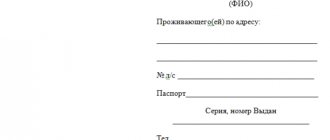

The certificate form is presented below:

This certificate is issued in one copy for registration of child benefits and must be submitted in the original along with the application and other necessary documents.

Certificate of family composition

The registration certificate (Form 9), referred to in everyday life as a certificate of family composition, contains information about all persons registered in a specific residential premises (in an apartment or private house):

To obtain this certificate, you can contact the housing maintenance organization at your place of residence or the passport office. There are also ways to obtain a certificate through the MFC or the State Services portal.

Certificate from the place of work about non-receipt of benefits

When applying for a monthly child care benefit, a certificate from the place of work of the child’s parent who is not applying for benefits is required, confirming the fact of non-receipt of this type of benefit (clause 54 of Order No. 1012n).

Detailed information about such a certificate and its sample can be found here.

If the parents of the newborn are divorced, this certificate is not needed. The benefit is assigned to the parent who lives with the child. When applying for benefits, that parent must provide a copy of the divorce certificate.

Other certificates

In some cases, when applying for child benefits, other certificates may be needed. For example:

- a certificate confirming the fact of disability - when applying for benefits for the adoptive parents of a disabled child;

- a certificate from the Department of Internal Affairs stating that the whereabouts of the wanted parents have not been established, a certificate of the parents being in custody - when assigning benefits in connection with the transfer of a child into guardianship or into a foster family;

- other certificates.

Find out what a certificate of employment looks like and where it is submitted here.

How to get a duplicate birth certificate

A copy may be needed due to the loss of the original or its inappropriate appearance, where letters and numbers have been erased. Getting a duplicate is not difficult, especially if you live in the place where the original was received. Then it is enough to contact the local registry office and write the necessary statement, indicating the reason for requesting a copy. An employee of the institution will issue a receipt for payment for such a service and upon receipt of funds a duplicate will be issued, quite possibly on the same day.

For those who live in a locality remote from the registration authority, there are three options:

- go on your own and repeat the procedure described above;

- send a request by mail, attaching a copy of your passport to confirm your identity;

- notarize a power of attorney for a person living in the desired city and ask him to get a copy.

It is allowed to accept an application and transfer a duplicate to the following categories of citizens:

- guardians;

- parents of a minor;

- relatives of a person who is no longer alive;

- representatives of state-authorized structures.

Today, when receiving a copy of the certificate, you must pay 350 rubles for one copy at the place of request.

When do you need to go to social security with documents?

You must apply for child benefits to social protection authorities if your parents do not have an official place of work or they are full-time students at higher educational institutions. That is, in situations where applying for benefits to the employer is not possible. If one of the spouses works, he should apply for child benefits at his place of work.

The figure below shows what documents may be required for child benefits from social security:

Depending on the type of benefit received, the set of papers submitted to social security may vary. The specific list of documents to be submitted must be clarified with specialists of the social protection authority before starting the procedure for obtaining child benefits.

What you will need for monthly benefits up to 14, 16 and 18 years of age

Low-income families are paid financial assistance until their dependents reach adulthood. Unemployed single mothers and families with an average per capita income below the regional subsistence level receive money from the state. Guardians (trustees) also apply for social benefits from social welfare authorities.

Prepare the following documents for child benefits in social security until the age of 18 (the same for 14 and 16):

- statement;

- for children under 14 a birth certificate, from 14 to 18 - a passport;

- passport of the parent (both parents);

- certificates of family income, family composition, cohabitation;

- confirmation of full-time education of dependents at an educational institution.

Documents for receiving Putin benefits

Currently, there are several payments that can be called “Putin’s”.

Firstly, since 2021, the law “On monthly payments to families with children” dated December 28, 2017 No. 418-FZ has been in force, according to which citizens who gave birth to the 1st or 2nd child in 2021 and after are entitled to so-called presidential payments .

Read more about this benefit in the material “Presidency payments at the birth of a child in 2021 - 2021”

To receive this benefit, you must contact social security (at the birth of the 1st child) or the Pension Fund of the Russian Federation (at the birth of the 2nd child) with a complete package of documents.

The list of papers for both departments will be the same (Appendix No. 2 to the order of the Ministry of Labor and Social Protection dated December 29, 2017 No. 889n):

- application for benefits;

- child's birth certificate;

- documents confirming the citizenship of the Russian Federation of the parent and child;

- information about the income of all family members;

- a certificate from the military commissariat about the parent’s conscription for military service;

- bank account details.

Who can apply for preferential status for a single mother?

In 2021, the legislation of the Russian Federation still does not enshrine a unified understanding of the status of “single mother” . Definitions of equivalent meaning are presented in regulations in various fields. Therefore, the list of requirements for those applying for the position of a single parent depends on the area of benefits in which the mother plans to apply.

For more information about who can legally be considered a single mother, see this article.

For example, to receive relief in the field of labor relations, a citizen must meet the criteria defined in paragraph 2 of clause 28 of the Resolution of the Armed Forces of the Russian Federation No. 1 of January 28, 2014:

- Perform the functions of a parent alone.

- To take care of children in the absence of a father due to his death, deprivation of parenting rights, incapacity, health problems, stay in prison, evasion of child care and financial support.

Labor legislation does not specify as a mandatory condition the absence of information about the father in the birth certificate. A man may be legally established as a father, but still avoid fulfilling obligations or lack the capacity to do so.

Svetlana Anokhina

Family lawyer, website expert

To receive tax benefits, women must meet the criteria clarified by Letter of the Ministry of Finance No. 03-04-05/78050 dated October 30, 2018. It is assumed that a single mother acquires her status (except for the absence of a father in the birth documents) due to the death of the second parent, declaring him dead or missing in court. Divorce and failure to fulfill the duties of the father are not grounds for receiving benefits.

Social benefits are regulated by regulations of regional authorities. Therefore, the requirements for single mothers may differ slightly depending on the area of residence. Usually, social authorities are guided by the fact that the father should not be indicated in the documents in principle (or he should be included only according to the words of the mother, but has no legal rights ).

The procedure for making entries of this type in birth documents is provided for in Art. 17 of Law No. 143-FZ of October 22, 1997 and the Family Code. In particular, the father is not recorded, or is indicated according to the mother, but does not have rights to the child, in the following situations:

- The parents' marriage has not been formalized; there is no statement from both or a court decision to confirm paternity.

- Mom is not married, there is an appeal to indicate the father from her words (at the same time, there was no initiative from dad to include information about him in the birth documents).

- The marriage was dissolved more than 300 days before the baby was born ; there are no other candidates to define themselves as a parent.

- The husband died in a period similar to the previous point.

Who doesn’t make sense to collect certificates and statements to receive benefits?

Clause 4 of Order No. 1012n lists categories of citizens who, even if they have all the necessary documents, are not assigned benefits. These include Russian and foreign citizens, as well as stateless persons:

- Children whose children are fully supported by the state.

Persons who are granted the right to full state support are listed in the law “On additional guarantees for social support for orphans and children left without parental care” dated December 21, 1996 No. 159-FZ.

- Deprived of parental rights or limited in them.

According to Art. 69 of the Family Code of the Russian Federation, parents may be deprived of parental rights if they evade or abuse parental responsibilities, as well as if they abuse children, suffer from chronic alcoholism or drug addiction, or have committed a deliberate crime against a child or another family member.

Child benefits are not provided for those citizens of the Russian Federation who have moved to another country for permanent residence.

We arrange maternity capital

From January 1, 2015, the amount of maternity capital is 453,026 rubles. Citizens of the Russian Federation whose second or subsequent children were born after January 1, 2007 and before December 31, 2021 have the right to receive a certificate for maternity capital. In addition to them, women who have adopted a second or subsequent children have this right, except in cases where they are their stepmothers. The child must also be a citizen of the Russian Federation.

- Men can also receive maternity capital, provided that they are citizens of the Russian Federation who adopted a second or subsequent children no earlier than January 1, 2007. The age of adopted children does not matter;

- To receive a certificate for maternity capital, you need to submit a package of documents, which we will discuss below, to the Pension Fund branch at your place of residence. The application must be reviewed within a month. After the decision is made, you will be notified within 5 days of the issuance of a certificate or refusal. If the decision is positive, you must, within the period specified in the notification, come to your Pension Fund branch to receive the certificate;

- You will be able to dispose of maternity capital no earlier than after the child who gave you the right to receive it turns 3 years old; upon adoption - after 3 years from the date of adoption, with the exception of the case of sending maternity capital to repay a loan to improve housing conditions, which can be used before reaching 3 years from the date of receipt of maternity capital. The upper threshold is not limited.

To obtain a certificate you need:

- Application for receiving maternity capital - the corresponding form can be obtained from the Pension Fund branch;

- Passport;

- Birth (adoption) certificates of all children.

If a man receives a certificate, he must submit documents on deprivation of the mother (parents) of parental rights or documents on the death or declaration of the woman / both parents as deceased. Maternity capital funds can be sent to:

- For children's education;

- To pay for kindergarten;

- For mother's pension;

- To repay a loan to improve housing conditions;

- To improve living conditions.

You can change the purpose - to do this you will need to cancel the first application and submit a new one instead. Maternity capital can be divided and used for various purposes. For example, part of the funds should be allocated to education, and part to cover the mortgage.

How to use maternity capital

To do this you need to submit the following documents:

- Application for disposal of maternity capital - its form can be found on the Internet or obtained from a branch of the Pension Fund;

- Maternity capital certificate or its duplicate;

- Certificate of compulsory pension insurance of the person who received the certificate;

- Passport of the person who received the certificate.

Results

Types of child benefits are listed in Law No. 81-FZ. These include: a one-time allowance for the birth of a child, a monthly allowance for child care, an allowance for transferring a child to a foster family and others. What documents you need to contact your employer or social security agency to apply for child benefits are established in Order No. 1012n of the Ministry of Health and Social Development. The application for payment of benefits must be accompanied by a certificate from the registry office about the birth of the child, a certificate of his birth, a certificate of family composition, a certificate of non-receipt of benefits by the other spouse and other certificates, extracts and copies.

If the parents are deprived of parental rights or the child is fully supported by the state, the benefit is not paid and documents for its registration are not submitted.

Sources:

- Federal Law of May 19, 1995 N 81-FZ “On state benefits for citizens with children”

- Federal Law of December 29, 2006 N 255-FZ “On compulsory social insurance in case of temporary disability and in connection with maternity”

- Decree of the Government of the Russian Federation of October 31, 1998 N 1274

- Federal Law of December 28, 2017 N 418-FZ “On monthly payments to families with children”

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

What is required for payment

First of all, a reason is required - pregnancy and childbirth. This applies to maternity benefits, lump sum payments at birth and monthly care benefits.

Monthly payments to low-income families are provided only if certain conditions are met. For example, Putin’s subsidies are paid for children born after 01/01/2018 and only on the condition that the average per capita income per family does not exceed two times the regional subsistence level. The base value is the cost of living of the working population for the second quarter of the previous year.

For benefits from 3 to 7 years, similar rules apply: money in the amount of 50% of the subsistence level is transferred to those families whose average per capita income does not exceed the subsistence level in the region.

Another important condition: financial assistance is transferred only to one of the parents. Spouses have the right to choose which of them will receive a one-time social benefit at birth and a monthly benefit for up to 1.5 years from the employer. The second parent provides a certificate of non-receipt. Submit documents for obtaining child benefits from 3 to 7 years, if the mother does not work, to the MFC or social protection authorities. Sick leave for pregnancy and childbirth will be paid only by mothers.

IMPORTANT!

Social benefits are intended for children who are citizens of the Russian Federation.

Obtaining a policy for a newborn.

The policy can be obtained at one of the offices of the insurance company that issues compulsory health insurance policies.

To obtain it you will need the following package of documents:

- Parents' passport.

- The child’s birth certificate (this is why it is necessary to obtain it as soon as possible in order to be able to contact a medical institution).

- SNILS (if already issued).

Compulsory medical insurance policy is obtained for no longer than 30 days. However, upon submission of an application, a temporary policy is issued, which begins to be valid on the same day.

Unfortunately, this service is not available in all regions when contacting a multifunctional center, although it is provided in a number of regions. Such information must be clarified at the territorial office of the MFC.

In the absence of a policy, visiting clinics, examinations and dispensing medications will be paid.

It is precisely these negative consequences that will befall parents who do not issue a policy in a timely manner.

Hospitalization or medical care will not be denied, but after it is provided you will have to pay according to the established tariffs.

After issuing the policy, you must come for it in person, as it is issued upon presentation of your passport against signature.

Along with compulsory health insurance, an additional health insurance agreement can be drawn up, according to which your child will have the opportunity to receive those types of services for which you usually have to pay.

The cost and term are an individual criterion of the contract, which is established by the parents and the insurance company by agreement.

Thus, if you have an additional health insurance policy, private clinics are often available, the cost of services of which is covered by insurance.

It is worth paying attention to children who have congenital defects that require constant medical supervision.

How to obtain Russian citizenship for a foreign child born abroad

Let's imagine the situation. The child was born on the territory of a foreign state and received citizenship of the country in which he was born. But later the parents (or one of the parents) decided to move to the Russian Federation and obtain citizenship here.

Of course, foreign children have the right to acquire Russian citizenship. This right is enshrined in Part 6 of Article 14 of Federal Law No. 62 .

It is worth understanding one important point - a young foreigner can become a Russian citizen only in two cases:

- If his father or mother, or both parents are already citizens of Russia , and are now applying for citizenship for their child.

- The parent , a foreign citizen, submits documents for Russian citizenship and registers his son or daughter with him. In this case, the child is included in the application of the father or mother.

If both mom and dad are foreigners who do not intend to become Russians themselves, then it will be impossible for the child to obtain Russian citizenship.

For example, a father and mother have a residence permit in Russia. They do not plan to obtain citizenship. In this case, accepting their son or daughter as Russian citizens is impossible. Even if the child has Russian aunts, uncles, grandmothers, grandfathers.

When does the other parent need to give formal consent?

- GCitizenship

How to make an application for Russian citizenship for a child

- Marina Danilova

- 19.08.2019

In some situations, it is impossible for a child to obtain Russian citizenship without the consent of the second parent, who is a citizen of another state. For example, the mother of a minor is Russian, and through her the child receives citizenship. And dad is a citizen of a foreign country. According to Part 19 of the Regulations (Presidential Decree No. 1325), in this situation, the foreign parent prepares a notarized consent, in which he states that he is not against his daughter or son becoming Russian.

Sample parental consent, photo: GUVM Department of Internal Affairs Ministry of Internal Affairs Directorate of the Federal Migration Service Citizenship of Russia Residence permit RVP MMC

Registration of such consent is required only if the minor lives in the territory of a foreign state .

Consent is NOT required if:

- the minor goes “trailer”, that is, acquires citizenship of the Russian Federation together with his father or mother (the child is included in the application);

- the child lives in the Russian Federation . In this context, residence means having the status of a temporary (TRP) or permanent (PRP) resident.

If these two conditions are met (the child is registered together with a parent + the child lives in the Russian Federation), you can apply for citizenship without the consent of the other parent.

Monthly payments for children from 3 to 7 years old

They can be received by families whose average per capita income does not exceed the subsistence minimum per capita established by a constituent entity of the Russian Federation for the second quarter of the year preceding the year of application for payment. Its value remains 50% of the regional subsistence level for children approved for the second quarter of the previous year. One of the parents or another legal representative of the child who is a citizen of the Russian Federation and lives in Russia can apply for payment.

To receive money, the child must be a citizen of the Russian Federation. If a family has several children aged 3 to 7 years, funds will go to each one. The amounts will be calculated for the period from the date when the child reaches the age of three (but not earlier than January 1, 2020) until the date when he turns 8 years old.

This “children’s” payment was established by Decree of the President of the Russian Federation dated March 20, 2020 No. 199. The basic requirements for the procedure for assigning funds were approved by Decree of the Government of the Russian Federation dated March 31, 2020 No. 384 (as amended, approved by Decree dated April 29, 2020 No. 604).

How is average per capita income calculated?

The income of all family members for the billing period is taken. This is the last 12 months preceding the 6 calendar months before the month of filing the application for payment. The resulting figure is first divided by 12, and then by the number of people in the family.

Let's give an example. Let's say the application was submitted in June 2021. Then the 6 calendar months before the month of filing the application are January-May 2021 (5 months) and December 2021. And the 12 months preceding them are the period from December 2021 to November 2021 inclusive. This means that you need to add up the income of all family members for December 2021 and January-November 2021. The resulting figure must be divided by 12 and the number of people in the family. This will be the average per capita income.

Let’s assume that a family living in the capital, which has two children aged 3 to 7 years, applied for a monthly payment. In the second quarter of 2021, the cost of living in Moscow per capita was 17,679 rubles, and for children - 15,225 rubles. (Decree of the Moscow Government dated September 10, 2019 No. 1177-PP). Thus, if in the above calculation period the average per capita income in a family was less than 17,679 rubles, then 7,612.5 rubles will be transferred monthly for each child (15,225 rubles × 50%).

Calculate wages with deduction of alimony and standard deductions for personal income tax

ATTENTION. The family includes parents (adoptive parents), guardians, their spouses, as well as minor children. The following persons are not taken into account: those deprived of parental rights, those who are fully supported by the state, those serving in the army on conscription, those serving a sentence of imprisonment.

Family income includes:

- remuneration for the performance of labor and other duties (including compensation and incentive payments), for work performed, service rendered, action performed;

- income from business activities and private practice;

- pensions, benefits and other payments received in accordance with federal, regional and local regulations;

- scholarships;

- alimony;

- pension payments to successors of insured persons;

- monthly insurance payments for compulsory social insurance against accidents at work and occupational diseases;

- monetary allowance (maintenance) and food supply for military, police, customs officers, etc.;

- compensation for the performance of state or public duties;

- dividends, interest and other income from transactions with securities;

- interest on deposits;

- income from the sale and rental of property;

- income from copyright contracts, on the alienation of the exclusive right to the results of intellectual activity.

REFERENCE. If a salary or bonus was issued for several months at once, you must proceed as follows. Divide the payment by the number of months for which it was accrued. Include in family income only amounts accrued for the months included in the billing period. The same should be done with proceeds from business activities, private practice and from the execution of civil contracts.

Family income does not include:

- payments for periods preceding the settlement period;

- monthly benefits in connection with the birth (adoption) of the first and second child (they are assigned in accordance with Federal Law No. 418-FZ dated December 28, 2017);

- one-time financial assistance from the federal, regional and local budgets provided in connection with natural disasters, terrorist attacks and other emergency circumstances;

- remuneration for work if it was received by a person who is officially recognized as unemployed (starting from 2021, such amounts will be taken into account).

IMPORTANT . All income must be taken into account before personal income tax. Amounts received in foreign currency should be converted into rubles at the Central Bank exchange rate on the date of receipt.

How to apply for benefits

It is necessary to submit an application in the form approved by Resolution No. 384. The document can be submitted in person to the government agency that deals with social protection, family policy and (or) support of the population in the constituent entity of the Russian Federation. There are other options - send by mail, submit through the MFC, or electronically through the public services portal.

There is no need to attach supporting documents to the application. Officials will request everything they need to verify their right to receive a monthly payment from the relevant departments and organizations. The only exception is information about the birth of a child in a situation where the birth certificate was registered outside the Russian Federation. This information will be requested from parents.

The decision on monthly payment must be made within 10 working days (20 working days in case of failure to receive information from government agencies).

If the application is submitted before December 31, 2021 inclusive, the money will be transferred retroactively for the previous months from the moment the child reaches the age of 3 years (but not earlier than January 1, 2020). The transfer of money will begin in June 2021.

This procedure will apply in 2021 and beyond. If the application is submitted no later than 6 months from the day the child turned 3 years old, payments will be transferred retroactively for the entire period from the moment the child reaches the specified age. If the 6-month period is missed - from the date of application for payment.

The application will have to be submitted annually. Monthly payments for the next year will be assigned no earlier than 12 months have passed since the submission of the previous application.