To get a consultation

Published: 10/12/2020

What does the concept of bankruptcy or insolvency of a company mean? In what cases is it advisable to carry out this procedure and why? What legal acts regulate the implementation of such an event in Russia? And how does the liquidation of an LLC occur? Let's take a closer look at the main nuances.

The concept of bankruptcy of legal entities and bankruptcy procedures

From a legal point of view, bankruptcy is a special legal situation of a legal entity in which it is no longer able to fully meet its monetary obligations to creditors.

Insolvency or bankruptcy must be proven and confirmed in an arbitration court. It is the presence of outstanding monetary obligations that is a legal reason for creditors to go to court. The composition and amount of the debt is indicated taking into account the date when the interested party files a claim.

The legislation of the Russian Federation establishes the need to undergo several bankruptcy procedures. Their types are enshrined in the Civil Code of the Russian Federation:

- observation. The procedure and scheme of the monitoring procedure are aimed, first of all, at preserving the property owned by the debtor, as well as at the ongoing verification of its financial condition and economic activities;

- financial recovery. The essence of this procedure is that it gives the debtor a chance to improve his current economic situation, for example, through investments, and protect his own organization from further bankruptcy;

- external control. External management as a bankruptcy procedure consists of appointing an arbitration manager who temporarily assumes obligations to monitor the current economic activities of the organization;

- bankruptcy proceedings. This procedure should be understood as certain actions in relation to the debtor, aimed at promptly satisfying the creditors' claims in full. Bankruptcy proceedings are conducted by a bankruptcy trustee;

- settlement agreement. It is a bankruptcy procedure for a legal entity, in which bankruptcy proceedings may be terminated if the reason for this was a settlement agreement between the creditor and the debtor. The settlement agreement is concluded at the mutual request of the parties. The legal nature of the settlement agreement distinguishes it as a special document, which may be the main and only basis for canceling court proceedings.

Types of bankruptcy.

In the legal field, types of bankruptcy are classified into two forms: criminal - fictitious and intentional; and the non-punishable – real and technical.

Fictitious bankruptcy consists of the fact that the head of an enterprise or its owner provides deliberately false information about his financial condition. In deliberate bankruptcy, the manager purposefully brings his enterprise to a state of insolvency.

The second form includes real bankruptcy, in which it is stated that the debtor is completely unable to satisfy the financial claims of creditors. And technical bankruptcy, which only means the inability of the enterprise to pay current claims.

All about bankruptcy of legal entities in the Russian Federation

The grounds for declaring an organization bankrupt, the definition of concepts, the procedure, the rights and obligations of the parties involved - all this is regulated by the articles of Federal Law No. 127-FZ.

The actual inability of a legal entity to fulfill its financial obligations to creditors, pay mandatory payments, and also pay employees, in accordance with the terms of the concluded employment contract, leads to the company resorting to bankruptcy proceedings.

Case Study

As part of the Neftegazoptimizatsiya bankruptcy case, the bankruptcy trustee and the creditor filed a statement to bring Sevryukov and Novikov to justice. Both took turns holding the position of head of the company from October 2011 to February 2021, with Novikov also being a 100% participant in the company.

In their statement, the creditors indicated the date of insolvency as June 2015. The applicant determined the date of insolvency based on the date of entry into force of one of the earliest judicial acts on debt collection from the debtor.

In support of this, the applicants stated that:

- during the specified period, the company incurred debt on loans in the amount of 3 billion rubles;

- by this point the company had actually ceased to operate;

- it followed from the financial statements that the debtor’s activities were unprofitable;

- on the date of initiation of bankruptcy proceedings, CJSC Neftegazoptimizatsiya already had overdue obligations to creditors;

- Moreover, all the requirements were met by judicial acts that came into force.

Moreover, the comrades were also charged with other reasons. Taking into account the above facts, confirmed by deplorable reporting, Novikov and Sevryukov flew into the subsidiary by almost 2.9 yards.

Insolvency (bankruptcy)

In accordance with Article 2 of the Bankruptcy Law, insolvency (bankruptcy) (hereinafter also referred to as bankruptcy) is the inability of the debtor recognized by the arbitration court to fully satisfy the claims of creditors for monetary obligations, for the payment of severance pay and (or) for the remuneration of persons working or working under an employment contract, and (or) fulfill the obligation to make mandatory payments.

The bankruptcy process begins with the filing of an application to the arbitration court to declare the debtor bankrupt. The application can be submitted by the debtor, bankruptcy creditor, authorized bodies, as well as an employee or former employee of the debtor who has claims for payment of severance pay and (or) wages.

How to apply for bankruptcy of a legal entity?

Depending on the applicant applying to arbitration to declare the debtor bankrupt, the content of the application may differ significantly.

It is strongly recommended that you engage experienced lawyers to prepare all the necessary documents, who will help you thoroughly analyze the situation and competently prepare the application and necessary documents.

Do you need the services of a bankruptcy lawyer?

Take advantage of free assistance from an experienced lawyer using the link below.

Consultation is possible online or in our Moscow office. ASK AN EXPERT

General details:

- Name of the court and its address.

- The applicant’s name, his address (legal, actual, for correspondence) and contact information.

- Name and details of the self-regulatory organization from which the arbitration manager is proposed.

- Request for bankruptcy.

- Signature of the authorized person, date, list of documents.

These are general details of a bankruptcy application that must be indicated regardless of who goes to court.

The debtor, declaring his bankruptcy, must indicate in the document in accordance with the provisions of Art. 37 of Law No. 127-FZ:

- Full registration information about yourself.

- The amount of debts and their structure, including the separate identification of various types of claims in accordance with the order of satisfaction - debts under contracts, wages, compensation for harm, etc.

- Justify the impossibility of settlement of your obligations.

- Information about all court cases, enforcement proceedings initiated in the name of the debtor, the amount of debt for each of them.

- Data on all account numbers, banks opened for the debtor.

In the application for declaring the debtor company bankrupt, the creditor, in addition to the above “general” details, will need to indicate:

- Information about the debtor: information from the Unified State Register of Legal Entities, address, contacts.

- Calculation of the amount of claims, including penalties, penalties, etc.

- Description of the essence of the obligation under which the debt arose, supporting documents.

- A reference to a court decision, if one is required to go to court as part of a bankruptcy procedure.

- Confirmation of the fact of the impossibility of satisfying your claims on the part of the creditor and justification for the occurrence of debt: confirmation of shipment of goods, completion of work, etc.

This is a list of mandatory information that must be reflected in the bankruptcy application by the creditor.

Explanation

Insolvency (bankruptcy) of a legal entity is the inability of a debtor recognized by an arbitration court to fully satisfy the claims of creditors for monetary obligations and (or) to fulfill the obligation to make mandatory payments.

The essence of the bankruptcy procedure is that a legal entity that is unable to pay its debts in full pays the debts at the expense of its property, after which it is liquidated. Unpaid debts for which the organization did not have enough funds are written off.

Bankruptcy allows you to clear the economic turnover of debts that still cannot be collected due to a lack of property.

For participants (shareholders), declaring a legal entity bankrupt allows them to start their lives with a clean slate, without being burdened with debts that are unrealistic to pay.

The insolvency (bankruptcy) of a legal entity is regulated by Article 65 of the Civil Code of the Russian Federation (Civil Code of the Russian Federation) and Federal Law dated October 26, 2002 N 127-FZ “On Insolvency (Bankruptcy)”.

The bankruptcy procedure does not apply to state-owned enterprises, institutions, political parties and religious organizations. A state corporation or state company may be declared insolvent (bankrupt) if this is permitted by the federal law providing for its creation. A fund cannot be declared insolvent (bankrupt) if this is established by law providing for the creation and operation of such a fund (clause 1 of article 65 of the Civil Code of the Russian Federation).

The grounds for declaring a legal entity insolvent (bankrupt) by the court, the procedure for liquidating such a legal entity, as well as the order of satisfaction of creditors' claims are established by the law on insolvency (bankruptcy) (clause 3 of Article 65 of the Civil Code of the Russian Federation).

The debtor, bankruptcy creditor, and authorized bodies have the right to apply to an arbitration court to declare a debtor bankrupt (Clause 1, Article 7 of the Federal Law of the Russian Federation of October 26, 2002 N 127-FZ “On Insolvency (Bankruptcy)”).

Required package of documents

The list of documents for both the debtor’s and the creditor’s applications is separately prescribed in the provisions of Art. 38 and 40 of Law No. 127-FZ, respectively.

The debtor must attach to the bankruptcy application:

- Justification for the existence of debt: court decisions, decisions on enforcement proceedings, claims and other demands from creditors.

- Confirmation of inability to meet requirements: account statements with balances and cash flows, balance sheet.

- Constituent documents and extract from the Unified State Register of Legal Entities.

- A list of creditors with a full breakdown of all information - from the name and amount of debt to the full address.

- The founder’s decision or the minutes of the general meeting on the decision to apply to arbitration for bankruptcy, including documents on the election (appointment) of a representative to the court.

- Information about the value of the debtor’s property and other assets (the participation of an independent appraiser is required).

When applying to court for bankruptcy of a creditor (including an employee of a debtor company), in addition to the documents required by the Arbitration Procedure Code of the Russian Federation, you must also attach:

- Confirmation of obligations: court decisions, payslips, information from the FSSP, correspondence with the debtor.

- Evidence of debt: invoices, certificates of completion of work, invoices, etc.

- A power of attorney or other document confirming the authority of the creditor’s representative to go to court.

- Other documents.

If documents are provided in copies, they must be properly certified.

Signs of bankruptcy

1) The presence of a total outstanding debt on obligations in the amount of at least 300,000 rubles (for organizations) and at least 500,000 rubles (for individuals);

2) The outstanding debt is overdue for more than 3 months.

3) Failure to fully satisfy the claims of all creditors for monetary obligations.

All of the above conditions (signs of bankruptcy) must be met simultaneously in order for a person to be declared insolvent (bankrupt).

Bankruptcy procedures

When considering a bankruptcy case of a debtor - a legal entity, the following procedures are applied:

- Supervision is a procedure applied to a debtor in a bankruptcy case in order to ensure the safety of his property, conduct an analysis of the debtor’s financial condition, compile a register of creditors’ claims and hold the first meeting of creditors.

- Financial recovery is a procedure applied to a debtor in a bankruptcy case in order to restore his solvency and repay the debt in accordance with the debt repayment schedule.

- External administration is a procedure applied to a debtor in a bankruptcy case in order to restore his solvency.

- Bankruptcy proceedings are a procedure applied in a bankruptcy case to a debtor declared bankrupt in order to proportionately satisfy the claims of creditors. After the debtor is declared bankrupt, bankruptcy proceedings are introduced.

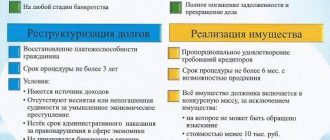

- When considering a bankruptcy case of a citizen, including an individual entrepreneur, the following are applied:

- Restructuring of a citizen's debts;

- Sale of a citizen's property;

- Settlement agreement.

Stage of financial recovery in case of enterprise insolvency

After passing the preliminary stage of observation, a decision is made at the creditors’ meeting on the advisability of introducing rehabilitation procedures. If creditors are confident that the debtor's business can still be saved, they will set a stage of financial recovery. At its core, this is an installment plan for a legal entity to repay its obligations.

The financial recovery stage is introduced for a period of up to 2 years. It involves the development of a debt repayment schedule (debt restructuring), which is subject to approval by the arbitration court. At the same time, fines and penalties for late payments are cancelled, enforcement proceedings are suspended, and the seizure of assets is lifted.

The company's management is not removed from business, but is under the control of the administrative manager. If the company’s obligations cannot be repaid at this stage, then the stage of external management or sale of property is introduced.

Subsidiary liability of managers and owners in case of bankruptcy of an organization

The Bankruptcy Law establishes the possibility of bringing managers and owners of a company to subsidiary (additional) liability in the event of bankruptcy of this organization. Such liability does not always apply, but only when certain circumstances occur (the fault of managers and owners). For these purposes, the Bankruptcy Law introduced the concept:

A person controlling the debtor is a person who has or had, for less than three years before the arbitration court accepted the application for declaring the debtor bankrupt, the right to give instructions that are binding on the debtor or the opportunity, due to being in a relationship with the debtor of kinship or property, official position, or to otherwise determine actions of the debtor...

The persons controlling the debtor may include some managers (management staff) and owners of the company.

Vicarious liability may extend to persons who are recognized as persons controlling the debtor.

Debtor in bankruptcy

For the debtor, the bankruptcy procedure for legal entities may result in the restoration of solvency during rehabilitation procedures or the closure of the enterprise and its liquidation. A debtor in bankruptcy is given the rights to participate in meetings of creditors, appeal the decision of the court and the manager, etc. At the same time, he cannot interfere with the activities of the manager and is obliged to provide all documents upon his request.

As for the management team, it is almost impossible to involve them in payments on debt obligations. The general director himself not only does not bear the costs associated with the bankruptcy of the enterprise, but also continues to receive wages and other payments required by law. The only thing the founders risk is their shares in the authorized capital.

Only if it can be proven in court that it was the actions of management that led to bankruptcy (i.e., the insolvency was fictitious) can the managers be held vicariously liable.

The commencement of insolvency proceedings for a legal entity has a number of important consequences for the debtor.

For your information

During bankruptcy, the debtor cannot make any significant transactions to alienate property; his property is sold at auction, information about his financial situation becomes publicly available.

Structure of the Federal Law of October 26, 2002 N 127-FZ “On Insolvency (Bankruptcy)”

Federal Law of October 26, 2002 N 127-FZ “On Insolvency (Bankruptcy)” is structured as follows:

The law is divided into chapters. For example, “Chapter I. GENERAL PROVISIONS.” There are a total of 12 chapters in the law;

Chapters consist of articles. For example, “Article 11. Rights of creditors and authorized bodies.” There are a total of 233 articles in the law;

Articles may consist of paragraphs. For example, “Article 17. Creditors’ Committee” consists of eight paragraphs. Items are marked with Arabic numerals (1., 2., 3., etc.). It is common practice to divide an article into parts, and then into clauses and sub-clauses, but in the Bankruptcy Law the clause is divided into clauses, and not into parts;

Points are made up of paragraphs. For example, paragraph 3 of Art. 17 consists of seven paragraphs. Paragraphs are not indicated by numbers or letters.

What to do to avoid CO

We cannot give you a universal way to fight off the subsidy - there is none. It works differently in every situation. At the same time, it would be strange to just go and file for bankruptcy on the very first day of delay. Actually, waiting ten years, relying on the help of all the saints, is also not a good format. Here are the basic methods:

Option 1: Notify creditors.

The most obvious and at the same time hardly feasible method is to notify creditors of your insolvency. Those. if you already meet the signs of insolvency, take a piece of paper (or keyboard) and notify your counterparties in writing that there is a financial difficulties, while I would like to receive a product, service or money.

If, after such frankness, the counterparty gives you what you want, it means that he has assessed the situation and, at his own peril and risk, meets you halfway. You act in good faith, which means there are no complaints against you.

In practice, it is clear that everyone will appreciate such honesty... and no one will give you what you want.

But this does not mean that this option cannot be used to resolve issues regarding the subsidy. Here is a whole article with an analysis of a case where we fought off the director from the subsidiary precisely for failure to submit an application. The general director received 75 lyams, and among the creditors was our beloved DIA.

Option 2: Plan to restore solvency.

The creditors' task is to move the starting point of insolvency as far into the past as possible. So you can impose more obligations, and drag people in as much as possible - there are so many genders alone that you can count.

Our task is the opposite - to shift this date as far into the future as possible. What can help with this?

The financial analysis. Having an analysis of the state of your affairs in hand, you will have something to operate with before the court, proving that the company as a whole was ok. Or not ok. Either way, you were in control of the situation. But we recommend reading a separate article about this: “Financial analysis in bankruptcy.”

Anti-crisis plan. If you don’t need an outsider’s view to see the elephant in the room, your weapon is a crisis exit strategy or an anti-crisis plan.

At the same time, the format strategy: “I bought a lottery ticket. I think there’s a chance to win” won’t do. The plan must be drawn up based on the real state of affairs and no less realistic solutions. Moreover, it is important to start implementing it.

The fact is that within the framework of the case of attracting a subsidiary, this plan will be subject to evaluation. In particular, check for the reality and feasibility of what is being described: how objectively it could help the company restore solvency and what actions were taken to implement it. A plan and actions that are incompatible with the life of the company will only make the situation worse.

For example, not long ago we drew up an anti-crisis plan based on the timing of collection of receivables. For this purpose, letters of guarantee for payment within the appropriate time frame were received from the main debtors. In court, we argued that if the gentlemen had kept to the dates they promised, the company would have restored solvency. The court took this into account as proper and conscientious behavior of our client, and the date of insolvency was moved forward, to the scheduled date for collecting receivables, which reduced the volume of obligations imputed under the subsidiary to zero.

An anti-crisis plan can include agreements with investors, concluded contracts with buyers, and much more if you work with creative professionals.

And the last option is to do nothing. Yes, that's possible.

For example, if the calendar shows March 30 and you realize that you have a negative net asset value, freeze your activities. Or stop completely.

Thus, for old debts you will have the usual business risks that your creditors shared with you. Such debts are not included in the subsidy, because do not imply bad faith in your behavior. And you are not gaining new obligations.

What is better: filing for bankruptcy or simply freezing activities? The answer, in fact, is obvious: if there is no risk of being attracted to a subsidiary on other grounds, then we file for bankruptcy. If there are risks, then why make life easier for creditors and complicate your own?

Another question is that 99% of entrepreneurs (and, in fact, general lawyers) are unlikely to fully understand whether the risks of a subsidiary are present or not. Although here everything is simple - just contact Igumnov Group for pre-bankruptcy preparation. We wrote how it works here: part 1 and part 2.

VAT in bankruptcy

Transactions involving the sale of property and (or) property rights of debtors recognized as insolvent (bankrupt) in accordance with the legislation of the Russian Federation (clause 15, clause 2, article 146 of the Tax Code of the Russian Federation) are not recognized as subject to VAT.

This rule was introduced on January 1, 2015 by Federal Law dated November 24, 2014 N 366-FZ.

VAT is not paid only if the debtor is declared bankrupt. This decision is made before the bankruptcy stage of bankruptcy proceedings. At all other stages of bankruptcy, VAT is paid by the debtor.

The regulatory authorities believe that work and services performed by a bankrupt are subject to VAT, since in paragraphs. 15 paragraph 2 art. 146 of the Tax Code of the Russian Federation does not provide for their exemption from taxation (Letters of the Ministry of Finance of Russia dated October 30, 2015 N 03-07-14/62525, dated May 6, 2015 N 03-07-11/26074, Federal Tax Service of Russia dated August 17, 2016 N SD-4- 3/ [email protected] ).

VAT until 01/01/2015

Until 01/01/2015, the sale of bankrupt property was subject to VAT, but this VAT was withheld and paid by the tax agent (clause 4.1. Article 161 of the Tax Code of the Russian Federation - repealed from 01/01/2015).

Good practice

One for all

As part of the bankruptcy case of Armaplast LLC, the bankruptcy trustee filed an application to bring Fayzulin, Virakhovsky and Oserov to subsidiary liability. Actually, each of the three was charged with different reasons:

- Faizulin (the majority participant with a 60% share) was charged with failure to file a bankruptcy petition. Namely, that as a majority shareholder, he did not initiate a meeting of participants to submit an application. Let's just call him “Participant”.

- Virakhovsky (Director 1) led the company from 10/30/2010 to 11/26/2015). The grounds for involvement were charged with failure to file a bankruptcy petition and failure to transfer documents to the manager.

- Osetrov (Director 2) was at the helm from November 27, 2015 to September 27, 2018. Actually, he was brought in for the same reasons as Director 1.

Why did the competition drown so much? After delving into the reports and documents, he discovered that in June 2015, a supply agreement was concluded between them. According to it, Armaplast should have transferred payment no later than 10/09/2015. Actually, that didn't happen.

The Competitor considered that since during all this time the payment had not been transferred, it was from October 9, 2015 that the month’s deadline for submitting the application should have been counted. The law stipulates that the presence of arrears may be correlated with a sign of insolvency. Moreover, at that time, the company's liabilities already prevailed over its assets, which means that the company could no longer fulfill its obligations to creditors. As a consequence, why the hell didn't you apply?

The court thought and thought and this is what it came to.

As of November 2015, there was no requirement in the law that a participant must assemble responsible participants to decide whether to file for bankruptcy. And since there was no requirement, then the Participant has nothing to blame - thank you, free!

What about directors? In general, the very fact that there is a delay does not mean that the director should run headlong with an application. Yes, delay is bad, but if every businessman starts bombarding the court with a statement after the first delay, the economy will collapse, business will die out and we will slide into the Stone Age.

Moreover, movements in the account were carried out even in September 2015. This means, despite the statement about insufficient property, the company had money.

If we remember that from the end of November 2015, Director 2 took the helm, and movements on the account showed that, after all, the date was determined incorrectly, it arrived, as you understand, only to the second director - Osetrov.

Considering that you can fight off a subsidy in different ways, we didn’t stop at one thing:

No man is an island

Here the leader was alone and he faced a life-and-death battle.

The script is standard. The company was declared bankrupt, after which the receiver decided to bring in the former head of the company, Vladimir, as a subsidiary. You know the reason - failure to submit an application.

Based on the available information, since mid-October 2014, the debtor company did not have at least some ability to repay the debt on mandatory contributions to pension and social insurance. Everything seems obvious.

But what the competition did not take into account is that all this time Vladimir did not just sit in a chair and wait for the end, but took real measures. Thus, he drew up a detailed action plan for 2015 and 2021 to restore solvency, as well as a specialist’s opinion on the possibility of executing this plan.

Moreover, the company tried to conduct economic activities. Vladimir provided confirmation in the form of contracts concluded in 2016. For the same transactions that did not lead to success, he provided correspondence.

In general, the court took into account all of Vladimir’s efforts. The competition flew by.

Declaring a legal entity bankrupt

Going to court to declare an enterprise bankrupt is a necessary measure to save an unprofitable business. If the company’s inability to fulfill its obligations was foreseeable, then the founders of the legal entity have the right to apply to the court to initiate bankruptcy. In this case, the chance to minimize financial losses is higher. You can contact a company that will provide you with legal services and significantly reduce the time spent on legal proceedings.

However, the law indicates the debtor’s obligation to submit such an application when the following circumstances occur:

- fulfilling requirements to some creditors will make it impossible to repay obligations to others;

- the authorized body of the company decided to submit the debtor’s application to the court;

- recovery of property will lead to the impossibility of further activities;

- there are signs of insolvency in the organization;

- employee benefit obligations are overdue by more than three months.

Is it worth contacting bankruptcy law firms?

Whether your company needs help with bankruptcy is up to you to decide. In essence, it is expressed in legal advice, collecting documents for the court and drawing up a statement of claim. Then the case will be dealt with by the arbitration manager, then by the external and bankruptcy trustee.

But in any case, the company may need representatives in court and assistance in preparing for the next hearings. If we are talking about a large company with a lot of debts, it is better to use the services of companies that specialize in bankruptcy of legal entities.

Signs of insolvency of a legal entity

Criteria determining the insolvency of a legal entity:

- inability to make payments under contracts, mandatory payments;

- insufficient amount of property and active funds.

Some types of insolvency should be distinguished:

- temporary – allows you to avoid bankruptcy when developing an appropriate anti-crisis strategy;

- chronic - means a significant excess of the share of funds absorbed by various expenses (including fines for non-payment) in relation to profit;

- absolute – financial recovery is impossible or the expected period for it exceeds the limit established by creditors.

Subjects of bankruptcy

- Debtors are legal entities and entrepreneurs.

- Creditors.

- Arbitration managers.

- State authorized bodies.

The goals of bankruptcy are to protect the debtor from the actions of creditors, to protect creditors from the unlawful behavior of the debtor. As a result of the measures taken to improve the health of the enterprise and preserve its vital activity, accumulated liabilities are repaid as much as possible, if possible. If, despite all the measures taken, it is not possible to fully pay off the debts, the debtor is declared bankrupt with the sale of its assets, excluding the company from the Unified Register, that is, the company is liquidated.

Thus, at the local level, the essence of bankruptcy is the restoration of the normal solvency of the debtor and the final fulfillment of obligations through the reorganization or liquidation of the enterprise. The current institution of bankruptcy at the highest level protects the interests of all participants in the procedure and, through the exclusion of unprofitable business entities, is aimed at strengthening the economy and improving the market situation of the country.

Bankruptcy tasks

- repayment of debts to creditors;

- restoration of the conditions necessary for a legal entity to continue its business.

Necessity and benefits of bankruptcy

The popularity of bankruptcy as one of the ways to resolve the issue of financial insolvency of a legal entity is explained by the fact that competent implementation of the procedure effectively protects the interests of all participants.

The advantages of opening a bankruptcy case for the debtor company are obvious and are as follows:

- protection of the organization’s property during the event;

- the ability to continue operations in the event of successful financial recovery;

- removal of seizure from the company's property, which increases the possibilities for settlements with creditors;

- providing a certain time limit for negotiating with creditors regarding debt restructuring;

- writing off part of the debts.

For the creditor, starting bankruptcy is also beneficial. Its main advantages are expressed in the opportunity to take part in the selection of an arbitration manager, as well as guarantees of the legal distribution of the debtor’s property among creditors, which are ensured by strict control over the ongoing process by the arbitration court.

Reasons for the procedure

In accordance with the provisions of the above federal normative act, the grounds for declaring a legal entity bankrupt should be considered:

- the presence of debt to pay creditors' claims for a period of more than three months;

- the total claims against the debtor exceed three hundred thousand rubles;

- presence of delays in obligations to employees in the form of payment of wages and severance pay, as well as in obligations arising as a result of causing harm to the life and health of individuals. The period of such delay required to initiate a bankruptcy case of a legal entity is determined by the arbitration court during the consideration of the submitted application from persons authorized to take such action;

- the presence of delays in the execution of court decisions if a writ of execution was issued based on such a decision.

All these debts can be considered as debts to various groups of creditors, which may also include government agencies and funds.

FAQ

What is the essence of bankruptcy of legal entities?

This is a procedure as a result of which the company will be liquidated, and all its property and assets will be sold to cover debts. As a result, the organization is declared bankrupt and all outstanding debts are written off.

Who is eligible for bankruptcy of legal entities in 2020-2021?

All organizations that have signs of bankruptcy under Federal Law-127. And this means having debts in the amount of 300,000 rubles and overdue obligations for more than 3 months.

Are there differences in the procedure depending on the company's activities?

The Insolvency/Bankruptcy Law allocates separate chapters of proceedings for certain types of activities of legal entities. Excellent procedures are provided for agricultural enterprises, financial organizations, credit companies, developers, and natural monopolies.

Is it possible for a legal entity to be bankrupt by a creditor?

By law, a creditor of a law firm can initiate a bankruptcy case.

How much will the bankruptcy procedure for a legal entity cost?

In addition to the duration, the process is also costly. Even if you do not use the services of bankruptcy support firms, the company will pay several hundred thousand rubles for the participation of managers in the case. Plus will give as payment a certain percentage of the proceeds from the sale of the property. There is no single figure; it all depends on the size of the company and the complexity of the case.

Sources:

- Federal Law-127 On insolvency (bankruptcy).

about the author

Irina Rusanova - higher education at the International East European University in the direction of "Banking". Graduated with honors from the Russian Economic Institute named after G.V. Plekhanov with a major in Finance and Credit. Ten years of experience in leading Russian banks: Alfa-Bank, Renaissance Credit, Home Credit Bank, Delta Credit, ATB, Svyaznoy (closed). He is an analyst and expert of the Brobank service on banking and financial stability. [email protected]

Is this article useful? Not really

Help us find out how much this article helped you. If something is missing or the information is not accurate, please report it below in the comments or write to us by email

Criteria for bankruptcy of an enterprise

Official recognition as bankrupt is not possible in all cases, but only if the conditions specified by Law No. 127-FZ are met. In addition to the mandatory reasons, there are indirect signs by which an experienced manager can already understand that the organization is in crisis. This is, first of all, a lack of available funds; low level of liquid assets; refusal of credit lines by financial institutions; accumulation of debts on wages, taxes, settlements with contractors; low business profitability; tough competition in the market, etc.

But all of the listed basic criteria are still not enough - those debtors who meet the requirements of Law No. 127-FZ can be declared insolvent. These special conditions for the amount and time of debt are listed in Stat. 3, 6 and 33 of the Insolvency Law. What are they?

Main causes of bankruptcy

The most common reasons that can lead a company to bankruptcy may be the following:

- lack of skills and experience of the entrepreneur;

- poor quality or insufficient study of market conditions;

- unexpected surges in supply and demand for manufactured products;

- problems with choosing the type of activity or goods for production and/or sale;

- constant excess of production costs over production costs;

- uncompetitiveness of products;

- poor choice of counterparties (bankruptcy of partners, “busted” banks, etc.);

- difficulties with the economy of the state itself - currency fluctuations or default.

NOTE! All these reasons are interconnected and act objectively. However, preventing and overcoming them depends on all participants in market processes.

Informal signs of enterprise insolvency

In addition to the formal concept and signs of the bankruptcy insolvency procedure described in Articles 2 and 3 of the Federal Law, there are also informal signs of determining the debtor’s inability to conduct further business activities in the proper volume.

- Financial. It consists of identifying sharp jumps in the size of liquid assets, an increase in the enterprise's receivables simultaneously with a shortage of payments for the sold product. There is an increase in wage arrears to employees and a significant drop in profits.

- Documentary. It is reflected in the company’s documentation - the deadlines for its submission are violated, the quality of financial reports deteriorates.

- Managerial. Here the human factor plays the main role - one of the company’s managers concentrates all management on himself, or disperses authority among a large group of people, reducing the level of responsibility. There may also be a violation of the basic principles of pricing, either in the direction of reducing or increasing the cost of products.

Grounds for declaring a debtor bankrupt

- The minimum debt period for declaring an organization bankrupt must be 3 months. from the moment of their occurrence (stat. 3). At the same time, cases on overdue debts over 3 months are accepted for proceedings, and the total period of the procedure can stretch up to 2 years, taking into account the time for reorganization of the enterprise.

- The minimum amount of debt is set at 300,000 rubles. for legal entities (stat. 6), 500,000 rubles. – for individuals, as well as heads of peasant farms (stat. 33).

The specified grounds for declaring bankruptcy work “in pairs”, that is, the presence of only one criterion for initiating proceedings is not enough; the condition for the time of overdue debts and the amount of obligations must be met. If we talk about individual entrepreneurs, you should also remember that according to Stat. 24 of the Civil Code, citizens are liable for their obligations with all the property they own, except for their only housing, personal items, land, pets and other objects prohibited for collection by the civil procedural legislation of the Russian Federation.

Note! Full property liability does not apply to owners of legal entities - the amount is limited by the size of the authorized capital or share in it.

So how do you know when to serve?

If there is a suspicion of insolvency based on objective grounds, you simply need to calculate the value of net assets. Excel and the “SUM” formula will help you.

Subjectively, most often it is the internal feeling that is triggered: something is wrong.

A simple example: Vadim was selling children's toys through an online store. He turned to us when he estimated that he had 25 million worth of loans, but only 23 million worth of toys left: even if he sold them tomorrow, the proceeds would still not be enough.

In general, look at the amount of debts, the delay in days for their payment and compare them with your financial capabilities.

Who can be declared bankrupt

Debtors who fail to make payments on their obligations for more than 3 months may be declared completely insolvent bankrupt. Initiation of the procedure is possible at the request of the enterprise - voluntary bankruptcy or at the request of creditors, as well as authorized bodies. Among the latter, the declaration of insolvency is most often initiated by tax inspectorates, social authorities - the Pension Fund of the Russian Federation or the Social Insurance Fund, the labor inspectorate, and the court.

If an organization voluntarily files bankruptcy documents, the application is submitted to the arbitration court at the place of official registration of the debtor. The form is drawn up in writing, has a unified structure and is signed by the head of the company. Documents confirming the accumulated amount of liabilities must be attached - for example, for tax payments, these can be acts of reconciliation with the Federal Tax Service, decisions or demands for payment of amounts, etc. If there are requests, they should also be presented.

After a detailed consideration of the application and if the evidence presented is justified, the arbitration court may make a decision to initiate bankruptcy proceedings in a simplified or full manner. The sequence of further actions includes monitoring, financial recovery, bankruptcy proceedings directly for the repayment of debts and a settlement agreement.

The organizational and legal form and industry affiliation of a business do not in any way limit the right of a legal entity to initiate bankruptcy proceedings. LLCs, CJSCs, OJSCs, NPFs, individual entrepreneurs, heads of peasant farms, agricultural organizations, financial structures, insurance companies, mutual funds, NPFs, professional participants in the securities market, credit cooperatives (creditor bankruptcy), developers, banks, individuals (by personal bankruptcy of a citizen), etc. The full list is contained in Law No. 127-FZ.

Legal bankruptcy, protecting the interests of the debtor and creditors, includes measures for the financial rehabilitation of the enterprise under the control of the manager. If opportunities are sought for business reorganization, the work is aimed at strengthening the financial and economic activities of the organization with the gradual repayment of all debts and a return to normal functioning.

Bankruptcy procedures for legal entities

Bankruptcy cases for legal entities are complex and multi-stage. The legislation provides for 4 main bankruptcy procedures: supervision, financial recovery, external management and bankruptcy proceedings. Completion of a bankruptcy case is also possible by concluding a settlement agreement.

Each stage, in turn, consists of many actual and legal actions of the arbitration manager, the legal entity itself and creditors.

It is extremely rare that bankruptcy cases go through all stages. Most bankruptcy cases include monitoring and bankruptcy procedures, without encountering the need and possibility of introducing other procedures. Each bankruptcy procedure is introduced by a ruling of the arbitration court based on a decision of a meeting of creditors - after the court has analyzed specific circumstances and entails certain legal consequences. Let's look at each stage step by step.

Subtleties of the settlement agreement

Often, a bankruptcy case is dismissed by a judge as a result of a settlement agreement. This possibility is allowed at any stage of the procedure. A settlement agreement is a document signed by an authorized body from creditors and the management of the debtor enterprise. It contains detailed conditions for the repayment of accounts payable of a legal entity that suit both parties. Often, third parties are involved in concluding a settlement agreement, for example, investors whose funds are planned to be attracted to restore the solvency of the company.

Recognition of the settlement agreement by the arbitration court and the decision to terminate the bankruptcy procedure presupposes compliance with several mandatory conditions. Among them:

- compliance with current legislation on bankruptcy of legal entities;

- taking into account the interests of creditors, which is confirmed by an official decision of a collegial body in the form of a committee or general meeting of creditors;

- documentary confirmation of the authority of the management of the debtor enterprise to sign the document.

Practice shows that preparing and signing a settlement agreement is the simplest and most effective way to terminate a bankruptcy case of a legal entity. Its proper use saves time and money for all interested parties.

Algorithm for submitting documents to court and consequences of appeal

Filing an application to an arbitration court to implement bankruptcy proceedings against a debtor enterprise has its own algorithm, which must be carefully followed, since, otherwise, the application may not be considered by the court as having no basis:

- no less than fifteen days before the date of filing documents with the arbitration court, it is necessary to notify the debtor organization of your intention to initiate bankruptcy proceedings. If the documents are submitted by the founder of the organization or its director, then such a notice is sent, first of all, to all existing creditors of the debtor. Notification occurs through the publication of information about the declared intention in the Unified Federal Register of information on the facts of the activities of legal entities;

- after the expiration of the specified period from the date of publication, if the debtor organization has not begun to take any action to pay off its existing debts, or the total amount of debt exceeds three hundred thousand rubles, although the organization has begun to pay off its existing debts, an appeal should be made to the judicial authorities;

- after the application is accepted by the court for consideration, you should declare your claims as a creditor to be included in the register of claims. In practice, this happens only after the court has considered the possibility of conducting bankruptcy proceedings for the debtor company and has appointed the observation stage.

Participants and initiators of a company bankruptcy case

The current edition of No. 127-FZ identifies several categories of participants in bankruptcy proceedings. These include:

- representatives of the debtor organization. These include: company managers, employees - ordinary and responsible, as well as owners;

- creditors. The list of creditors includes all organizations and individuals who have proven the existence of a legal entity’s debt to them;

- regulatory and authorized government bodies. Their participation in the case is regulated by law;

- arbitration manager. An independent specialist appointed by the arbitration court and directly involved in the bankruptcy procedure;

- arbitration court judge. Cases of financial insolvency of companies fall under the jurisdiction of the arbitration court;

- the person who provided funds for the financial recovery of the debtor company. This participant is present in a bankruptcy case relatively rarely in cases specifically stipulated by provisions No. 127-FZ and regulatory acts supplementing them.

An important feature of the bankruptcy of a legal entity is the ability to initiate the launch of the procedure both by the management of the enterprise and by any of its creditors.

The latter also include employees of the company, to whom there is a debt under the salary, which is also a kind of loan. In addition, such a right is granted to regulatory government bodies.

The current legislation separately stipulates cases when the management of an enterprise is obliged to submit an application to the arbitration court about the need to initiate bankruptcy proceedings. These include:

- inability to pay off the company's debts;

- identifying signs of financial insolvency during the liquidation of a business project;

- obtaining objective information about the stability of losses and deterioration in the solvency of the enterprise.

In the latter case, we are usually talking about an auditor's report or the preparation of an annual report on the company's activities. In each of the listed situations, the head of the organization is given 30 days to make a decision to initiate bankruptcy proceedings. Otherwise, he faces administrative, and if intent is proven, criminal liability.

Start of legal proceedings

From the moment the application is submitted, a temporary manager begins his work, who is determined by the court or the party that initiated the consideration of the case. Payment for the services of such a specialist lies entirely on the applicant’s side and amounts to 25 thousand rubles for one stage.

In order to separate the fact of technical, false and deliberate bankruptcy from the real one, the Federal Law, represented by the Arbitration Court, provides the temporary manager with 7 months. During this period, the duty of the temporary manager is to analyze the financial condition of the entity and identify.

- Is it possible to repay the debt in full by selling part of the company's assets.

- Is there a chance to restore the economic activity of this enterprise by introducing third-party anti-crisis management or applying a set of measures for financial recovery.

- Probability of paying wages to company employees.

- Availability of funds sufficient to cover legal costs.

Based on his work, the arbitration manager draws up a report, which he presents at the meeting of creditors. Also, the anti-crisis manager must provide the parties to the process with a plan for returning the enterprise to solvency, taking into account the following points:

- measures aimed at improving the activities of a legal entity;

- expenses incurred by the debtor;

- the approximate time required to implement the plan.

Owner risks

Starting from the summer of 2021, if the director has not filed for bankruptcy, the beneficiaries are obliged to initiate an extraordinary meeting and oblige him to do so. To convene a meeting, 10 days are given from the moment the business owners learned (or should have learned) that the director did not fulfill his duty to file a bankruptcy petition.

If the owners do not gather for an extraordinary meeting, they will bear subsidiary liability (SB) jointly and severally with the director. And they will be charged with all the debts of the organization that arose after the expiration of a reasonable period for convening, preparing and holding the meeting.

The legislator’s logic is simple: by continuing to conduct business in a state of insolvency, you are setting up your counterparties and deliberately driving them into debt. And this is dishonest behavior for which one must bear personal responsibility.

An exception is made only for owners who do not participate in any way in the company’s activities and at the same time own less than 10% of shares/shares in the company. Hello to Gazprom shareholders!

Procedure for considering a bankruptcy case in an arbitration court

Any interested party can go to court and file a bankruptcy claim. Most often they are the debtor's creditors. But to open a case in court, two grounds must be confirmed: the legal entity has debts in the amount of at least 500 minimum wages and the statute of limitations for these debts is at least 3 months.

The statement of claim submitted by the creditor must be signed not only by the creditor himself, but also by a representative. The court considers the claim within 3 days. After consideration, he accepts it and opens the case, if there are no problems.

After the start of the review, the court determines whether the debtor has any objections to the creditor’s demands. If there are such objections, their validity is checked in the arbitration court. Already at this initial stage, a settlement agreement can be concluded between the parties.

The established procedure for legal proceedings and its principles suggest that the procedure for considering the merits of any bankruptcy case must take place within 3 months from the date of opening of judicial proceedings.

During this period, the judge can make one of several decisions:

- on declaring the said debtor bankrupt and on further opening of bankruptcy proceedings;

- on refusal to declare an organization bankrupt if there are justified reasons;

- on the introduction and appointment of a bankruptcy trustee;

- on the termination of legal proceedings regarding the bankruptcy of the organization.

The fact that a debtor has been declared bankrupt in an arbitration court must be published in the relevant printed publications at the debtor’s expense.

In the event that he does not have funds, publication is carried out at the expense of creditors.

At any stage of the case, the parties may enter into a settlement agreement.

Receivership proceedings in company insolvency proceedings

Bankruptcy proceedings are the final bankruptcy procedure for a debtor enterprise. At this stage, the tasks of the bankruptcy trustee include the maximum satisfaction of creditor claims through the accumulation and subsequent sale of the bankruptcy estate. The decision to start bankruptcy proceedings in the event of bankruptcy of a legal entity must be published in the media. After such a message appears, creditors will have two months to submit their claims.

The deadline for bankruptcy proceedings is six months. But if the allocated time frame seemed insufficient to the manager to search for the legal entity’s assets and organize trading, then he has the right to petition the court to extend this period for another six months.

Important

All the most important functions for managing the company are transferred to the bankruptcy trustee. Its tasks include conducting an inventory, assessing property and organizing auctions. If the debtor has withdrawn his property through dubious transactions in recent years, then the manager has the right to cancel them.

The bankruptcy estate includes all the property and assets of the debtor that belonged to the legal entity at the time of the start of the bankruptcy procedure. These are real estate, industrial complexes, accounts receivable, fixed assets, etc. The need to attract a specialized appraiser to evaluate the bankruptcy estate is decided at a meeting of creditors.

In the event of insolvency, the property of an enterprise is sold through an open auction, which is conducted electronically. Trading is carried out with increasing rates, based on the market value. The most low-liquidity assets are sold at bearish prices.

All proceeds from the sale of property form the bankruptcy estate, which is then distributed among creditors in order of priority. Federal Law-127 contains three creditor levels: • 1st stage – individuals who are responsible for causing harm to life and moral damage; • 2nd stage – employees of the enterprise to whom arrears have accumulated in terms of severance pay and wages. • 3rd stage – bankruptcy creditors, budget organizations.

The principle of priority assumes that payments of each subsequent stage are made only after the previous one has been fully repaid.

Also, current payments, legal costs are repaid from the bankruptcy estate, remuneration is paid to the arbitration manager, etc. The stage of bankruptcy proceedings in the event of bankruptcy of an enterprise ends with the liquidation of the company. As a result, all obligations are removed from her, even if the money was not enough to pay off all debts.

Who cannot be declared an insolvent bankrupt?

In the current economic conditions, no company is immune from the crisis. Even the norms of civil law stipulate that business is conducted at your own peril and risk. Of course, bankruptcy is sometimes the most effective way out to legally cope with problems. And who cannot be declared insolvent according to legal requirements?

Non-profit religious or political organizations, government agencies, and social movements cannot declare themselves bankrupt under any circumstances. For all other entities, recognition of insolvency is allowed only if the listed grounds for bankruptcy are met - the amount of liabilities is from 300,000 rubles. and the repayment period is from 3 months. For citizens, the minimum amount of debt is 500,000 rubles. Individuals are not limited in their ability to initiate the procedure on their own: as in the case of legal entities, this will require submitting an application and attaching all supporting documents. The difference is that bankruptcy of physicists is dealt with not by arbitration courts, but by courts of general jurisdiction at the place of residence.

Conclusion - in this material we examined the main points of recognizing bankruptcy, including signs of insolvency and conditions for declaring a debtor insolvent. The ultimate goal of complex measures, if it is impossible to fully pay off debts, is the liquidation of the enterprise and exclusion from the Unified State Register of Legal Entities/Unified State Register of Individual Entrepreneurs.

What is the risk of bankruptcy?

The risk of bankruptcy can be called the sudden onset of a situation in which an enterprise becomes financially insolvent. The word “suddenly” means that bankruptcy was not caused by the intentional actions of the manager, but happened under the influence of external or internal factors (for example, a default against the background of already material instability).

So, what is the risk of bankruptcy? In the most common formulation, this is an increase in loan rates, an increase in utility bills, inflation, deflation, changes in exchange rates, changes in the political and economic situation in the country, unqualified personnel, irrational distribution of profits, financial miscalculations, professional errors, force majeure... This is not a complete list of risks that threaten the financial stability of a business.