General information

The writ of execution on the payment of alimony is transferred to the organization in which the parent works after the completion of the divorce process. At the same time, the writ of execution contains information about the position of the alimony worker, the average monthly salary, and also indicates the name of the enterprise itself. Funds are transferred from each employee’s salary in a predetermined amount.

Despite the parent’s obligations to pay monthly child support for children who have not reached the age of majority, no one has the right to oblige the employee to resign from his position. An employee can resign voluntarily or be fired by a manager. There may also be a transfer to another branch or organization or a transfer to another workplace.

Important: the dismissal of an alimony payer is practically no different from the dismissal of other employees.

But the accounting department often does not know what to do if the alimony provider quits, and who informs the bailiffs about this, since, taking into account Article 111 of the Criminal Code, it is not the parent, but the employer, who is responsible for paying alimony.

Failure to comply with all dismissal rules will result in administrative liability. If the organization does not take the necessary measures after the dismissal of the employee and does not timely submit the writ of execution to the relevant structures, then the consequences will be very sad:

- the alimony payer will automatically be a debtor;

- the organization, taking into account the law, is guilty of failure to fulfill its immediate obligations.

In order to prevent misunderstandings after leaving the position of the alimony worker, the organization’s accountant is obliged to notify the executive authorities about this.

The notification itself must be drawn up according to the sample and signed by the company’s management. The writ of execution is returned to the bailiffs.

Employer's actions

If the director of a company does not want to receive a fine or inspection, he must comply with the requirements of the law. It must be remembered that after the dismissal of an employee, you have only three days to notify the bailiffs.

In addition, you will need to give them the writ of execution on which the penalties were made. You can also inform the bailiffs of the employee’s new place of work if you have such information.

Upon dismissal, the employer will have to report in documents that:

- for how long the alimony was collected;

- what amount was collected over the entire period;

- the amount of monthly penalties;

- amount of debt, if any.

Legislative acts on dismissal

Most employers do not know what to do if the child support worker quits his job. In this case, the procedure is specified in Article 111 of the Criminal Code. Taking into account this article, an organization that withholds alimony by a court decision or a notarized certificate is obliged to notify the executive service of the employee’s dismissal. A period of 3 days is given for this.

At the same time, the legislation regulates what the recipient of alimony should do if the alimony provider quits. If the employer has information about the new place of employment of the alimony payer, then he is obliged to provide this information to the other parent as well.

During the transition to another place of work, the parent who is involved in paying child support does not have the right to hide his place of employment. He is obliged to inform the employer and bailiffs about the change, as well as the person to whom he pays alimony. A certificate of additional income, if any, is also required. Failure to comply with these obligations may result in administrative liability.

With severance pay

Severance pay, according to Article 178 of the Labor Code of the Russian Federation, is compensation payments aimed at providing a citizen with a means of subsistence during the period of employment in a new job, after leaving the previous one as a result of the liquidation of the enterprise or staff reduction.

The withholding of alimony from severance pay is directly related to who is receiving it. In accordance with Article 101 of the Law on Enforcement Proceedings, collection cannot be taken against him if alimony is paid to adult family members.

But with minor children the situation is completely different. The fact is that, in accordance with Article 82 of the Family Code of the Russian Federation, the list of income from which accruals are made in favor of minors must be approved by the government. This list was put into effect by Decree of the Government of the Russian Federation No. 841 of July 18, 1996. And in accordance with it, severance payments are income subject to withholding of alimony.

Therefore, if collection is carried out in favor of a minor child, from severance pay, the funds are withheld in accordance with the general procedure.

Features of dismissal

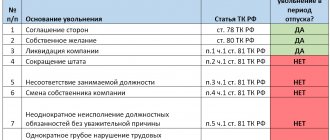

The fact that an employee is considered a child support worker does not at all protect the person from dismissal. The employer has the right to dismiss this employee, like any other. How to fire a child support worker:

- systematic absenteeism;

- avoidance of direct official duties;

- reduction of employees;

- insufficient qualifications.

All this is clearly stated in Art. 81 Labor Code of the Russian Federation. If there are compelling reasons, an employer can fire a child support payer in the same way as an employee who is not burdened with monthly payment obligations.

Payments for which alimony is not charged

Not all types of income fall into the category of other, that is, there are transfers from which the alimony provider is not required to transfer money.

These include:

- payment for “harmfulness” - compensation for employees working in conditions of increased danger;

- payment for property.

The second option involves a situation where an employee receives a new uniform on a regular basis. But if he has kept his uniform well and can wear it for another period, then money is paid instead of things.

Healthy! Not all amounts received by an employee are classified as income. For example, payment for “harmfulness” is not part of the salary, but compensation for unused vacation is.

Process description

Regardless of what was the basis for terminating the agreement between the employee and the employer - failure to fulfill direct job responsibilities or the employee’s own initiative to vacate his position - the dismissal process must be fully complied with. For example, when a person is removed from his position for absenteeism, the further process will be as follows:

- determination of the presence of absenteeism and confirmation in writing (drawing up a report, etc.);

- determining the grounds for absenteeism - a valid or disrespectful reason;

- registration of direct dismissal, taking into account the legislative code, indicating the reason in the personal file, as well as the work book.

Since the presence of a minor child to whom child support is paid is not considered a “mitigating circumstance,” an employee can be dismissed under the general scheme and on the same grounds as other employees. The only peculiarity is the increase in bureaucratic procedures and the mandatory implementation of the following formalities upon dismissal:

- sending a notice to the other parent who receives child support payments;

- drawing up and sending executive documents and notices to executive authorities.

The employer is responsible for timely notification of executive authorities.

By agreement of the parties

When an employment contract is terminated by agreement of the parties, the employee is paid a salary on the last day of payment for the time actually worked, as well as compensation for vacation that was not used during the working period. Additional payments under labor legislation are not provided for on this basis, since the parties voluntarily agreed to terminate the employment relationship.

Consequently, alimony upon dismissal by agreement of the parties is withheld from all of the above payments. Regardless of who and on what basis they were accrued during the work of the alimony worker.

Withholding of funds must be carried out from amounts from which personal income tax has already been calculated, since these payments are not subject to personal income tax benefits.

Registration requirements

Most often, personnel employees are responsible for issuing written notifications to executive bodies. A notice of dismissal of an employee must be drawn up clearly in accordance with the template established by law. Only in this form will the document be accepted for consideration. The notification must be in the form of a statement. The document must contain:

- table of contents of the notification;

- date of dismissal and termination of the agreement;

- the position held by the employee before the end of the employment contract;

- total amount of compensation.

The document must contain: the seal of the organization, the signature of the manager and the date of the notification.

You also need to promptly notify the other parent of the terminated employee.

The husband or wife, as well as the child, have every right to know about the status of the employee. This notice must indicate from what date and for what reasons the employee was dismissed and, accordingly, was transferred to the status of “debtor”. At the top you must indicate the name of the enterprise itself, then indicate all the information about the recipient to whose name the notice is sent. For example, “Executive organization in the OSB for the St. Petersburg joint-stock company.” Then, in the next line, enter the full name of the person who receives alimony. For example, “Recipient of alimony Elena Aleksandrovna Naumenko.” Next, enter “Message about the dismissal of an employee.”

Further text in the notice displays information about the basis for the employee’s dismissal, for example, under an article in accordance with the Labor Code or on his own initiative.

If the employment agreement is terminated due to failure to fulfill required obligations or regular absenteeism, then the notice must indicate the article under which the employee was dismissed.

Is it possible to fire a child support worker?

First, it should be said that paying child support is the obligation of the parent who does not live with the child. Moreover, such an employee will be considered a child support provider only when there is a court decision. A peaceful settlement of the issue completely relieves the employer of the obligation to withhold the amount of alimony payments and to warn anyone about the employee’s dismissal.

If the bailiffs contact the employer with a writ of execution, the latter must assume the responsibility for withholding alimony from wages.

By the way, recently changes were made to the legislation, according to which the indexation of alimony payments, if necessary, should also be carried out by the employer, and not by the bailiff, as before.

When there is an alimony worker at an enterprise, the manager may have a question: is it possible to fire such a person? Here we need to consider specific circumstances:

- If an employee wants to resign of his own free will, no one can stop him. The only thing an employer can do is force them to work 2 weeks, and this is not always possible. Moreover, even the need to pay alimony cannot become an argument for refusing dismissal. The employee is free to decide whether to work or not. Even the court cannot force him to do this.

- There are also no obstacles to dismissal by agreement of the parties.

- If the employer wants to fire an employee, then the availability of alimony payments is not a priority right over other employees in the event of a layoff, nor is this an argument in the case of dismissal under other headings.

The main thing is to carry out the dismissal procedure correctly. And then you will be able to avoid fines and other misunderstandings.

Sending a notice to the bailiffs

Article 111SK states that the employer must send a notice to the executive organization within 3 days from the date of dismissal of the employee. But there are no clear deadlines for the return of the writ of execution. The best solution is to send a notice on the second day after the employee is released from his position. There is no need to delay, since penalties are provided , taking into account Article 17.15 of the Code of Administrative Offenses:

- a fine of 60-110 thousand rubles, which is paid by the enterprise for late notification;

- a fine of 10-25 thousand rubles for an employee who neglected his obligations.

You can submit all documentation to the executive service by mail. A letter is sent to the alimony recipient in the same way.

How long does it take to pay child support after dismissal?

The table of contents of any writ of execution directly indicates the date by which the due payments must be made. As a rule, this is the beginning/end of the current month, when all formal employees are paid the wages stipulated by the agreement. If withholding is intended, the responsible accountant must calculate the required interest on alimony in advance and transfer these amounts to the direct account of the territorial FSSP within 3 days.

The deadline is usually indicated in the writ of execution itself, which is available to the formal employer. But in practice this period does not exceed approximately 3 days. This rule also applies to deductions upon final dismissal - funds are transferred to a direct account no later than the exact date specified in the existing writ of execution. After the last payment, this sheet must be returned to the territorial FSSP due to the dismissal of the payer.

Accounting responsibilities

After the accounting employee is relieved of his position, he needs to carry out the appropriate work - collect a personal file and send the documents to the organization’s archives. This document should contain the following acts:

- photocopy of the dismissal order;

- a photocopy of the writ of execution, which contains data about funds withheld from wages and the remaining amount of payments;

- a list of documents that are in the personal file;

- photocopies of notices that were sent to the recipient of alimony and the bailiffs.

If the organization has a documentation book, then an appropriate note must be made in it, indicating the date of sending the notice and dismissal.

Methods for sending notifications

The employer does not have much time to notify the services. He needs to notify the executive body and the recipient of alimony 3 days in advance. It is noteworthy that there are no such exact deadlines for sending a writ of execution in the legislation. However, it is recommended that you submit these two documents together to avoid potential problems.

It is better to submit a notification as early as possible. There are several ways to transfer it to bailiffs:

- by contacting the executive body;

- sending the entire package of documents along with attachments by courier;

- by sending the papers by mail (and this must be a registered letter with a notification - this way you will have evidence that the employer has fulfilled its obligations in a timely manner and in full).

It can be much more difficult to give notice to the recipient of alimony. Usually the documents are sent to him by mail, since he may live in another city or region.

It is recommended that you make copies of all submitted documents and keep them as additional evidence. If the organization keeps a log of outgoing documentation, then information about the notification should be entered there as well.

Particular difficulties may arise when dismissing an employee retroactively. It is better not to resort to this method if you do not want to answer to the bailiffs and subsequently pay a fine. In this case, the dismissal procedure should be carried out as expected.

Retroactive notice

It often happens that an employee introduces ambiguity into the process of employment, dismissal from a position, or continuation of work in his place. For example, he periodically decides to write a letter of resignation, and then changes his mind. The management of the organization faces a difficult question regarding what can be done when dismissing an employee retroactively. Since this is a violation of the law in the form of failure to comply with deadlines.

For documents not sent on time and certain other inconsistencies, the employer may be punished in the form of penalties.

Therefore, in this case, it is important to explain the reasons for the untimely submission of notice to the bailiffs. If regular absenteeism was noted, the employee failed to cope with his job obligations, or periodically committed unlawful actions, the employer will be able to dismiss the employee on his own initiative, indicating the appropriate article. In this case, the retroactive dismissal of the alimony payer is not a violation of the law.

Alimony from vacation compensation upon dismissal

Money for unused vacation can be paid upon dismissal or transfer from the enterprise, or can be used to offset the vacation provided at the new place of work.

They are paid in proportion to the number of vacation days that were not used for all previous working periods.

This payment is not on the list limiting foreclosure, which is contained in the Federal Law regulating enforcement proceedings, and in government list No. 841 it is included among other types of income.

In connection with these circumstances, regardless of who the alimony was withheld from the employee’s salary, the company’s accounting department is obliged to calculate it in the amount of compensation for vacation. But at the same time, do this from the amount remaining after tax deductions.

Employer's liability

The dismissal of the alimony payer does not at all mean the end of obligations for the corresponding payments.

After sending a notice of termination of the employment agreement to the other parent, he can control the subsequent process by inquiring from the bailiffs about the receipt of data regarding the new place of work. Notice must be sent to the parent on the day of termination of the agreement. Timely notice is clearly stated in labor laws. Being late, even one day, is considered grounds for initiating an administrative case.

The employer can be held liable for failure to comply with the mandatory rules for dismissing the alimony payer. This includes:

- fine 30-120 thousand rubles. for an enterprise and 10-25 thousand rubles. for management for lately sending a document with information about funds withheld from wages.

- fine 3-5 thousand rubles. from the enterprise, 400−600 rub. from management - for untimely notification of executive bodies about the termination of the agreement.

Bailiffs have the right to monitor and analyze the work of the HR department, as well as monitor the fulfillment of obligations to pay alimony.

Being aware of the rules for terminating the employment agreement of alimony payers and the deadlines for fulfilling obligations regarding the provision of documents to executive bodies, you don’t have to worry about problems with the law.

Is alimony withheld upon dismissal?

The collection of child support is carried out on the basis of Resolution No. 841, which establishes the mandatory payment of:

- from severance pay, which is paid to the employee upon dismissal;

- with compensation for unused vacation.

In the case of alimony obligations in relation to adult disabled relatives - wives, parents or adult children - recovery from compensation upon dismissal of the alimony obligee is not made - Art. 101 Federal Law “On Enforcement Proceedings”.

Important! Alimony for vacation compensation is charged only if it is provided in monetary terms. When transferring leave to a new place of work, if the transition is carried out within the company, or when taking leave before dismissal, deductions are not made.

The employer is obliged to fully pay off all parties to the alimony legal relationship and only after that transfer the employee’s personal file to the archive.

Collection of alimony after dismissal

Regardless of the availability of work, a citizen is obliged to participate in the material support of his child. If he evades fulfilling his obligations, the recipient has the right to go to court to change the method of collecting alimony. When alimony payments are assigned as a percentage of income, lack of work does not allow alimony to be withheld due to zero earnings.

This situation has several options:

- Transfer of obligations to a fixed rate.

- Calculation of alimony as a percentage when receiving unemployment benefits.

- Calculation of alimony as a percentage, taking into account the average wage established in the territory of the Russian Federation.

The recipient of the funds or the bailiff can initiate a change in the terms of payment of alimony by going to court. If, after changing alimony payments, a citizen refuses to participate in the maintenance of the child, he will be brought to civil, administrative and then criminal liability.

Other nuances and responsibilities of the employer

Theoretically, the issue of providing for joint children concerns exclusively their parents and relatives. In reality, ex-spouses most often cannot solve the money problem on their own. In this regard, the Family Code provides for the obligation of employing organizations to facilitate in every possible way the employees’ fulfillment of their parental duty, Art. 111 IC RF.

In this sense, delay in sending enforcement documents, inaccuracy, unreliability of the data set out in the notice will be considered an administrative offense within the meaning of Art. 17.14 Code of Administrative Offenses (for a more detailed assessment, use the current version of the Code of Administrative Offenses with comments).

Fines:

- to company officials – 15 – 20 thousand rubles;

- for a legal entity – 50 – 100 thousand rubles.

In addition, do not forget that when dismissal by transfer to another employer, the former employer must not only inform the bailiffs and the recoverer about this. At the same time, it is necessary to transfer the original writs of execution to the new employer, attaching to them information about how much debt the alimony holder had left on the day of separation from the employee. It is clear that the transfer of the package of documents must be done against the signature of the manager or person responsible for personnel production.

Despite the fact that family matters should not concern work, many employers, sooner or later, are faced with the need to comply with court decisions to withhold child support from the salary of one of the employees. This obligation can be put to an end either by full repayment of obligations in favor of the claimant or by the dismissal of the alimony provider. In both cases, the bailiffs must be notified about this in a timely manner.

Procedure for collecting payments

If funds were withheld from the ex-husband in shares of the salary, but he quit his job and has no other sources of income, then, obviously, this procedure for executing the decision cannot be further implemented. There is no income, there is nothing to withhold and shares.

There may be several options for the development of events:

- The claimant will go to court and, citing the norms of the Family Code of the Russian Federation, will demand payment of a fixed sum of money. That is, collection will be carried out according to a new writ of execution. There are grounds for this if the husband quit his job. The law says that a fixed amount of money can be obtained if the alimony worker’s earnings are: unstable, collection in shares is impossible or difficult. But the problem is that even if the court authorizes payments in a fixed amount, it will be difficult for the payer who does not really work to fulfill the obligation. Where will he get the money? Therefore, debt will accumulate, which can be collected in court along with penalties and other losses. The amount of the penalty, according to Art. 115 of the RF IC, is determined at the rate of 0.5% for each day of delay.

- If the claimant does not try to change the order of payment of alimony, then the writ of execution remains the same, but the calculation of alimony is carried out in a slightly different way. Another “alimony base” is not the level of income that was before the dismissal, but the average level of wages in the country. It is determined by Rosstat. On the official website of the department you can find open access statistics for each region and for the country as a whole. Few payers benefit from accumulating payment arrears, calculated from the average salary. Because the amount of average earnings is not determined entirely objectively. No, maybe from the point of view of statistics, as a science, all calculations are carried out correctly. In fact, it turns out that the salary that is considered average is quite difficult for an ordinary citizen to earn. Employers, as a rule, offer less money.

How can you pay alimony when you quit your job if there is no real income, and allowing the accumulation of debt, calculated as a share of the average earnings in Russia, is not profitable? There is one way out of the situation.

Reducing the amount of alimony for those who have lost their jobs: methods and reasons

Despite the obligation to support the child until adulthood, the law provides for the opportunity for the alimony payer to reduce its amount.

Thus, the Family Code indicates that it is possible to reduce alimony or be exempt from paying it if the payer’s family or financial situation has changed (for example, the payer lost his ability to work due to some illness (and ended up unemployed), children appeared in the second marriage, etc.). To do this, you need to file a corresponding statement of claim with the court, in which you must indicate exactly what circumstances prevent payments from being made in the same volumes.

When considering the case, the court will take into account the financial and family situation of each party, as well as other circumstances important to the case.

What other methods can you use to pay less?

- The simplest and most difficult at the same time is to come to an agreement with your ex-wife. You can offer her to pay a smaller amount, but help with the child more often: meeting her after school, taking her to activities, picking her up on certain days, buying food, clothes, etc. A good relationship with the ex-wife is very important here, because if the amount of child support has already been established in the same amount, but in fact is paid in less, she has every opportunity to go to court to recover the underpayment. The solution here may be to obtain receipts from the child’s mother, where the required amount will be indicated.

- Some alimony payers who have children from a current marriage use a rather risky way to reduce alimony by turning the current wife to court, since modern legislation does not prohibit married spouses from demanding funds for child support through the court. So, if a parent has two children, one from each marriage, the court will withhold 33% of all income from them. This means that only 16% will go from the budget for a child living separately instead of 25%.

- If the child has property that generates income, you can try to use this to justify your demands for a reduction in child support payments, even if you are not unemployed.

- If the payer has reason to believe that he is not the biological father of the child, then by challenging his paternity in court, he will be released from alimony. But the main thing here is to prove that you were not aware of this fact at the time of the birth of the child.

Termination of alimony payments

Article 120 of the Family Code (as of 2019) lists all the grounds upon the occurrence of which the obligation to pay alimony can be considered terminated. These include:

- For alimony paid by agreement:

- death of one of the parties;

- expiration of the agreement;

- the occurrence of an event that is provided for in the agreement as a basis for termination of payments.

2. For alimony that is ordered by the court:

- death of the payer or child;

- the child's coming of age;

- adoption of a child.

As you can see, there is no reason to lose your job, so you cannot count on a complete cessation of payments just because you “don’t have a job.”

How bailiffs calculate alimony for those whose place of work they do not know

As soon as the bailiffs received a writ of execution - no matter from a former employer or from an ex-wife - the counter for alimony arrears is turned on. Bailiffs calculate it as a percentage of the average monthly salary in the Russian Federation. When I write this article, the average monthly salary is about 43 thousand rubles per month.

Since, according to the writ of execution, the father must pay 25% of income monthly, it turns out that alimony should be about 11 thousand rubles: 43,000 R × 25%. As far as I understand, this is exactly what your ex-husband does: he sends you about 11 thousand every month. Then, formally, he is not a debtor for alimony until it is proven that he is hiding income.

Let me remind you that because of a child support debt in the amount of over 10 thousand, a person can easily, for example, have his driver’s license suspended and prohibited from traveling abroad.