What payments to expect at birth

At the birth of a child, these funds are provided:

- Monthly payments.

- One-time support.

- Providing a certificate.

To receive funds, you need to process payments.

Privileges

Pregnant women are given a birth certificate. This document refers to three papers:

- For presentation to representatives of the antenatal clinic.

- For the maternity hospital.

- For presentation to representatives of the clinic.

If two or more babies were born, you can receive maternity capital. Its size is approximately 453,000 rubles. Funds are allocated for established purposes.

If there are three or more children, a family is considered to have many children. Such a family is provided with additional benefits and compensation.

In addition, the wives of men serving in military service are provided with the following aids:

- A one-time payment of 25,900 rubles.

- Monthly payments of 11,100 rubles.

Compensation is provided if the child does not receive a place in kindergarten.

There is also a program “Housing for young families”. Let's consider its conditions:

- Age up to 35 years.

- Availability of real estate with an area of up to 15 square meters. m. for one person.

- Availability of income certificate.

Not only families, but also single mothers can participate in this program. Funds can be used for construction, purchase of real estate, or obtaining a mortgage.

FOR YOUR INFORMATION! There are many child benefits available. There are programs aimed at all parents. There are also benefits available under certain circumstances.

Providing subsidies

At the regional level, authorities are seeking to introduce additional incentives for large families. Thus, in some Russian regions (this depends on the number of similar families in the region and its financial security) it is possible to obtain a subsidy for the construction of your own housing, obtaining property under a social tenancy agreement free of charge, obtaining a loan or a preferential loan for the purchase of building materials. It is also possible to immediately take out a mortgage without depositing funds.

What other payments are due at the birth of a fourth child and what additional payments are provided? In addition to the above, regional authorities are introducing additional payments for low-income families in the amount of one and a half to fourteen thousand rubles. Most payments are valid until children are 18 years old, but it is possible to extend them up to 23 years in some regions of the Federation if the child has entered education or under other conditions.

Federal benefits in 2021

In 2021, the amount of federal payments has changed. It was increased, including through indexing. Let's look at the benefits:

| Name of payments | Size |

| One-time benefit for women who registered before 3 months | RUB 632.76 |

| One-time payment | RUB 16,873 |

| B&R manual | 100% of the average salary (not less than 43,652 rubles) |

| Benefit for a military spouse | RUB 26,720 |

| Care allowance | 40% of average earnings if a person is employed. 3,163 - unemployed persons. 3,796 - for persons receiving the minimum wage. If two or more children are born, the benefit will be 6,327 rubles |

| Payment for a child born into a military family | RUB 11,451 |

The amount of payments increased by 3.2%. This is exactly the amount of indexation calculated on the basis of inflation.

Benefits for expectant mothers who registered before 3 months of pregnancy

A woman who registers before 12 weeks of pregnancy receives a one-time benefit. The mother can receive the payment until the baby is six months old. If a woman is not employed, she must contact the social protection authorities for registration. If the mother has an official job, she needs to go to the employer to register. Funds are transferred for each baby born.

The one-time payment is 613.14 rubles until February 1, 632.76 rubles from February 1, 2021. To receive funds, you need to provide the employer with these documents: sick leave according to the BiR and a certificate of timely registration.

One-time payment at the birth of a baby

When a child is born, a one-time payment of 16,873.54 rubles is provided. This payment can be made until the baby is six months old. Both parents and guardians can receive the payment.

One-time payment amount:

- 16,350.33 rubles - from January 1, 2021.

- 16,873, 54 - from February 1, 2021.

If three or more children are born or taken into care at the same time, the one-time payment will be 5,000 rubles. All payments are made before the child reaches six months.

B&R manual

The amount of maternity benefits is determined depending on earnings. The company's accountant must first calculate the average daily earnings and then multiply the result by 140 days. If twins are born, the average daily earnings are multiplied by 194 days. If a woman does not work, she will not receive any benefits. This is due to the fact that she did not pay taxes for a long time.

Baby care allowance

This benefit is paid to any person who cares for the baby: father, mother, grandmother, grandfather. The amount of the payment is determined by the person’s earnings. The benefit amount is 40% of the average monthly earnings for the last 2 years. These are monthly payments.

Payments for children of military personnel

A woman can receive payments if her spouse is a military serviceman. To process payments you need to prepare these documents:

- Application requesting payment.

- A copy of your birth certificate.

- Certificate confirming military service.

- A copy of the marriage certificate.

The papers are sent to the social security service. They are reviewed within 10 days. A person receives payments monthly until the 26th. Funds are sent to the applicant's account. They are received before the child reaches 3 years of age. Payments stop if the man leaves military service.

Changes in the accrual of maternity benefits in 2021

Maternity leave is a period provided by the employer in connection with pregnancy and childbirth. Let's look at the main changes in payments:

- The amount of earnings taken into account when determining maternity benefits cannot exceed the maximum base for payment of insurance premiums.

- The calculation period for 2021 is 2021 and 2021.

- The average daily salary is 2,017.81 rubles.

- The B&R benefit is up to 282,492 rubles.

- Assistance for B&R is, taking into account the minimum wage, up to 43,652 rubles.

If you need to determine the minimum amount of maternity leave, the minimum wage is taken into account in the calculations. Let's consider the minimum accrual amounts:

- 43,652 rubles for 140 days - for childbirth without complications.

- 47,597 rubles for 156 days - for childbirth with complications.

- 56,967 rubles for 194 days - for the birth of two or more babies.

If an employee’s income for the year was more than 755,000 rubles, maternity benefits are calculated from this maximum amount.

Regional payments

Parents can receive funds through regional programs, i.e. adopted only in certain constituent entities of the Russian Federation.

Moscow program

Moscow residents receive one-time payments. For one child, the benefit will be 5,500 rubles, for two or more – 14,500 rubles.

Luzhkov payments

Luzhkov's payments appeared in 2004. They were approved by the Moscow Government No. 199-PP dated April 6, 2004. Receiving them in 2018 is subject to the same rules as before. Payments are provided if parents meet these requirements:

- Age up to 30 years.

- Permanent residence in Moscow.

- Russian citizenship for at least one of the parents.

The amount of payments is equal to five times the subsistence level adopted in 2021. If there is a second baby, the payment will be equal to seven times the subsistence minimum. If a third child is born, the payment will be ten times the monthly minimum. The benefit is paid for each child.

IMPORTANT! If there are more than three children in a family, a one-time payment of 50,000 rubles is assigned.

What kind of benefit are we talking about: who is entitled to receive

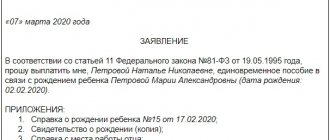

This article will discuss the monthly payment that is prescribed when a second child appears in a family before he reaches the age of 1.5 years in accordance with the Law “On State Benefits for Citizens with Children” dated May 19, 1995 No. 81-FZ.

In general, the rules for calculating this benefit are similar to the rules used when calculating the amount of benefits for the firstborn. However, the order of birth (adoption) of children and their number is still an important nuance when calculating the minimum payment amount.

We issue a one-time benefit

The size of the one-time benefit was 16,873 rubles. You need to start applying for this benefit before the child turns six months old. To receive funds, you must send an application to the HR department. If the parent is not employed, you need to go to the social service. If a woman is studying, you need to contact the dean’s office of the educational institution. The following documents will be required for registration:

- Application requesting assistance.

- Birth certificate.

- An extract from the housing department stating that the applicant lives with the child.

- Pension certificate.

- Passports.

- Copies of the work book.

- A document confirming that the family has not previously received benefits.

Unemployed persons must present a copy of their passport, as well as a work record book. If the payment is made to the USZN, you need to present these documents:

- Application.

- Passport.

- Birth certificate.

- A document confirming cohabitation with the newborn.

The amount of payment issued by the USZN is 5,000 rubles.

We issue a monthly allowance

This year, a new monthly benefit has been introduced, which can be received for a baby born in 2021. Its size is set depending on the regional subsistence level. As a rule, it is about 10,000 rubles. Benefits are paid until the child reaches one and a half years of age. Payment is assigned directly. Funds are provided subject to these conditions:

- Low income family.

- The first child was born.

- The baby was born or adopted no earlier than January 1, 2018.

Parents, adoptive parents or guardians can receive the payment. Sometimes monthly benefits are waived. In particular, this happens in the following circumstances:

- Deprivation of parental rights.

- The baby went on state support.

- Restrictions on parental rights.

- The baby was temporarily removed from their family on the initiative of the guardianship authorities.

The benefit is expected to increase in the future. You can submit an application to receive payments before the child turns 1.5 years old. If the application is submitted before the baby is six months old, funds are accrued from the date of birth. If the baby is already 6 months old, funds are transferred from the moment the application is submitted.

Documents are sent to government service centers or the social security department. These papers are required to be submitted:

- Application for setting monthly payments.

- Birth certificate.

- Bank account information.

- Passport.

- A certificate of income for each parent for the last 12 months.

If the monthly payment is made by one parent, these papers are needed:

- Death certificate, document on deprivation of parental rights or cancellation of adoption.

- Divorce paper.

Funds are credited over 12 months. After this period has passed, a new application for payments is submitted.

Benefits for Muscovites with many children

The capital has provided special benefits and gubernatorial payments for large families:

- Cancellation of fees for kindergarten.

- 50% discount on public transport for schoolchildren and full-time students.

- Free sports clubs.

- Reimbursement of part of the price of lunches for students or free meals.

- Free parking for parents of three, four or more children.

- Removing family vehicle taxes.

- Discount ticket to the Bolshoi Theater.

- Visiting city baths without paying for services.

- Priority acquisition of a plot of land.

- Additional payment to the pension payment for mothers who gave birth to 10 children or more.

- Free medicines for minor children.

We arrange maternity capital

Capital is assigned when a second or subsequent child appears on the account. If the capital was not registered for the second child, a family capital certificate is provided at the birth of the third child. Money can be received by both a woman and a man. The second payment is issued if the person is the sole adoptive parent of two or more children. The corresponding decision of the judicial authority must come into force from the beginning of 2007 to December 31, 2021. The size of MK is 453,000.26 rubles.

The money is paid from the Pension Fund. You can receive them either at once or in part. The purposes for which funds are spent are stipulated by Federal Law No. 256 “On additional measures of state support” dated December 29, 2006. Let's look at them in more detail:

- Improving living conditions.

- Payment for the child's education.

- Compensation for the purchase of equipment and services for the social adaptation of a disabled child.

- Creation of a funded part of a woman’s labor pension.

Previously, parents could receive a lump sum payment from the capital. However, this program was closed in 2021. Maternity capital is registered with the Pension Fund. You need to go to the branch at your place of residence. You can contact the authority at any time. To confirm your rights to capital, you must present a personal certificate. Pension Fund employees are presented with the following documents:

- Statement.

- Passport of both father and mother.

- Baby's birth certificate.

IMPORTANT! All payments given in the article must be formalized. They are not automatically provided at the birth of a child. To obtain them you need to collect documents. A birth certificate is required. Parents should also not forget that some benefits require registration within a certain time frame. As a rule, this is 6 months from the date of birth of the baby. If parents do not make it on time, they will not receive any money.

Who receives cash assistance for children from 3 to 7 years old?

Payments for children who are already 3 years old, but not yet 7 years old, are also not paid to all families with children. The condition is stipulated that the family income should not be more than 1 subsistence minimum per person. To receive benefits, you need to write an application and attach to it a document that confirms the small income in the family. A certificate of earnings can be obtained from the accounting department of the company where you work. Such payments can be made online through the State Services portal.

The law on calculating payments for children from 3 to 7 years of age has not yet entered into force, but will take effect retroactively - that is, all due payments can be received starting from January 1, 2021. In the first year of such a program, parents will receive only half of the established subsistence level. This amount will increase from 2021.