How does the state help parents of a third child?

It is quite difficult for the average Russian family to raise three children without government support. They need more money to support their family than those who have one child. As a rule, mothers have to go on maternity leave for a long time, which also reduces the total family income.

Land, preferential mortgage and maternity capital

One of the ways of support for families with three or more children is to receive a plot of land, which is registered in the name of all children and parents. The rules and conditions for the allocation of preferential land in a particular region are established by regional authorities.

In addition, the government is constantly developing new support measures aimed at improving living conditions. Until 2022, there is a state subsidy program for families with children who receive a preferential mortgage at 6% per annum.

All parents at the birth of a third child or his adoption after 2006 can use maternity capital. It will not be possible to receive this amount in cash, but you can use the certificate money for legally established purposes.

Early retirement and vacations

Women who have 3 or more children may retire earlier than those who have fewer or no children. With three children, the retirement date is shifted by 3 years, with four - by 4 years, mothers with many children with five children or more will retire at 50 years old. But to do this, the woman must have 15 years of experience and a set number of pension points that will be valid in the year of retirement. For example, in 2021, 21 points must be earned. Moreover, all decrees before children reach 1.5 years of age entitle them to a certain pension point:

- first child – 1.8 points;

- second – 3.6;

- third, fourth and subsequent children – 5.4.

To find out how many pension points have already been accumulated, read Brobank's article.

Fathers with many children do not have the right to early retirement. But they, like mothers, can apply for leave at a time convenient for them, and not according to the schedule approved by the employer. This will be the case as long as three children in the family are simultaneously under 12 years of age.

An additional preference for parents with many children - they cannot be fired without consent if we are talking about the only breadwinner and the youngest child is not yet 3 years old.

Regional maternal (family) capital in the Saratov region

In the amount of 30% of the payment for utilities, calculated on the basis of the amounts actually paid for utility bills, and for those living in houses that do not have central heating - 30% of the cost of fuel purchased within the limits established for sale to the public.

Regional child benefits in the Saratov region in 2021

Large families

Families with three or more minor children, as well as adult children under the age of 23 studying full-time in educational institutions, are recognized.

When applying for payment after six months from the date of birth of the child (from the date the right to EDV arose), it is assigned and paid for the elapsed time, but no more than six months before the date of filing the application for assignment of EDV with the necessary documents attached, and not earlier than since January 1, 2013.

Right to monthly cash payment

(hereinafter - EDV) has one of the parents (adoptive parents) for a third child (natural, adopted) living with him and

each

of the subsequent children (natural, adopted) born between January 1, 2013 and December 31, 2024. When In this case, the average per capita family income should not exceed the average per capita monetary income of the population in the Saratov region for the year preceding the year of application for the assignment of the EDV (the year of receipt of the EDV), calculated by the territorial body of the federal executive body in the field of state statistics for the Saratov Region.

EDV is paid until the day the child reaches the age of three years inclusive

and is assigned from the date of birth of the child or from the date the right to the EDV arises, but not earlier than January 1, 2013, if the application for the appointment of the EDV followed no later than six months from the date of birth of the child (from the date the right to a monthly cash payment arose).

A large family in Russia is considered to be a family with three or more children. The state is trying to support such heroes as best it can. In the article we will look at what they give for the 3rd child and how much in money. We will not discuss whether this is a lot or a little. There are other platforms for this. Our task is to suggest what parents with many children can receive from the state in 2021.

Payments for the third child

The recipient of child benefits most often becomes the mother. But in some cases it may be the father, and even less often, other relatives. In Russia, one-time and regular payments are allocated for each child:

- Benefits for pregnant and postpartum women. Those mothers who work officially can receive the payment. The unemployed will not be able to qualify for this type of financial support.

- A benefit paid to mothers for early registration in the housing complex. Money is allocated only to those who register before the 12th week of pregnancy. These payments are also given only to employed women.

- One-time payment at the birth of the third child. The amount is paid to all mothers - both employed and unemployed.

- Monthly payments for child care. The money can be received by working and non-working parents or other relatives who actually care for the child.

Employed citizens receive more cash benefits than unemployed people. Some families will be assigned other payments, but they are either insignificant in amount or only families with very low incomes can receive them. To appoint them, you will need to confirm your low-income status.

We issue a monthly allowance

This year, a new monthly benefit has been introduced, which can be received for a baby born in 2021. Its size is set depending on the regional subsistence level. As a rule, it is about 10,000 rubles. Benefits are paid until the child reaches one and a half years of age. Payment is assigned directly. Funds are provided subject to these conditions:

- Low income family.

- The first child was born.

- The baby was born or adopted no earlier than January 1, 2018.

Parents, adoptive parents or guardians can receive the payment. Sometimes monthly benefits are waived. In particular, this happens in the following circumstances:

- Deprivation of parental rights.

- The baby went on state support.

- Restrictions on parental rights.

- The baby was temporarily removed from their family on the initiative of the guardianship authorities.

The benefit is expected to increase in the future. You can submit an application to receive payments before the child turns 1.5 years old. If the application is submitted before the baby is six months old, funds are accrued from the date of birth. If the baby is already 6 months old, funds are transferred from the moment the application is submitted.

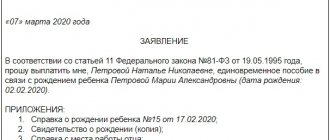

Documents are sent to government service centers or the social security department. These papers are required to be submitted:

- Application for setting monthly payments.

- Birth certificate.

- Bank account information.

- Passport.

- A certificate of income for each parent for the last 12 months.

If the monthly payment is made by one parent, these papers are needed:

- Death certificate, document on deprivation of parental rights or cancellation of adoption.

- Divorce paper.

Funds are credited over 12 months. After this period has passed, a new application for payments is submitted.

One-time payments for the third child

Mothers with three children are given several one-time payments:

| Payments | Characteristic |

| When registering with a medical institution before 12 weeks of pregnancy | The money is usually paid along with maternity benefits. The basis for receiving the amount is sick leave and a medical certificate. The amount of this payment is indexed annually. In 2020, the payment is 675.15 rubles. |

| At the birth of the baby | The payment amount is subject to indexation annually. In 2021, the amount is 18 thousand rubles. |

| For pregnancy and childbirth | One of the parents can receive this money at the birth of the baby. The amount of the amount is determined individually based on wages and other income on which all required taxes and fees have been paid. |

All these benefits are due not only to the third child, but also to the first, second, fourth and subsequent children. It is most convenient to receive them on a debit card. To do this, just provide your bank account details or card number and data.

Who can receive

In 2014, the President of the Russian Federation signed a law according to which families entitled to a free plot of land at the birth of their third and subsequent children can replace it with an apartment. To do this, the family must not have any other living space in their property.

Mortgage benefits

- Mortgage loan with no down payment for up to 30 years.

- Certificate for housing (or for construction) in an amount equal to 90% of the total cost of finished or planned real estate (one of the parents must live in our country for at least 12 years, and the total work experience of mom and dad must exceed 10 years).

- Providing a garden or vegetable plot of land (for life).

- Payment of housing and communal services tariffs with a 50% discount (or monetary compensation for payment).

- Providing children under 18 years of age with prescription medications.

- Priority for admission to kindergartens.

- Free entry to exhibitions, theaters and museums.

- Free education in art, music, and sports schools.

- Providing children with textbooks at the expense of the state;

- Free vouchers to health camps, holiday homes and sanatoriums.

- Tuition fees at higher educational institutions are charged at a 50% discount.

- Providing university students with scholarships.

- Employing parents part-time or working from home.

- Increase of leave for each parent by 5 calendar days.

- First-priority appointment in children's health care facilities.

- Free hot meals for schoolchildren.

The amount of maternity capital for the second and third child has not changed since 2021 and amounts to 453,026 rubles . How to get it and what you can spend it on is described in the corresponding section.

Last year, the federal maternity capital program underwent major changes: payments began to be provided not only for 2, but also for 1 child. The amount of money changed depending on when exactly the children were born.

Saratov families will receive more for the birth of a third child

- 50 thousand rubles at a time for the birth of triplets.

- A benefit in the amount of 10 subsistence minimums when a third child appears in the family. True, if the parents are under 30 years old.

- Financial compensation when the consumer basket grows. The amount of compensation is calculated based on the number of children. In 2021 it is 1.2 thousand rubles.

15 Apr 2021 semeiadvo 1009

Share this post

- Related Posts

- 3 personal income tax 2021 form

- The cost of living today in Kirov

- Benefits for single mothers in 2021, Irkutsk region

- Inventory of fixed assets in 2021 in government institutions in accordance with the standard

Birth payments

Standard maternity leave is 140 days. 70 of them are given before childbirth and the remaining 70 after. In case of childbirth with complications, the leave is extended to 156 days, and in case of multiple pregnancy – up to 194 days.

To receive the payment, a woman at 30 weeks of pregnancy applies for sick leave at the antenatal clinic. In order to fill it out correctly, you need to provide the correct name of the employing organization and the position held by the employee. After this, you can write an application in free form or according to the employer’s sample for temporary absence from work due to childbirth. These documents must be given to the employer. The manager issues an order on maternity leave, which is signed by him and the pregnant employee.

In addition to the sick leave certificate and application, you will need:

- certificate of income for the last 2 years;

- identification document if necessary;

- bank account number or card for transferring money; if the employee has a salary card, then payments will go to her.

To calculate the payment amount, take income for the previous 2 years and divide it by the number of days for this working period. The result obtained is multiplied by the number of days of maternity leave.

For example, in 2 years a woman earned 800 thousand rubles. We divide the resulting amount by 730, the number of days in the period, and we get 1095 rubles. Multiply by 140. The employee will receive 153,300 maternity rubles. The amount for early registration at a medical institution will be added to this if the woman provides a supporting certificate.

Regular payments

Mothers receive monthly child care payments for children under 1.5 years of age. The maximum period of care can last up to 3 years. In 2020, money is given from the birth of a child until he turns 3 years old. The state is responsible for issuing benefits for the period from one and a half to three years. The employer transfers money for children under 1.5 years old.

To calculate the monthly payment, the period for the previous 2 years is also taken into account. But from this period, days are taken away when insurance premiums were not withheld from the employee’s income. Such periods include sick leave and maternity leave. Also, the calculation takes into account the highest and lowest average daily earnings. The minimum income for 2021 is 398 rubles.

The smallest monthly benefit for the first child is 4,852 rubles for full-time employment, but if the mother did not work full-time, then the minimum amount is 3,375.77 rubles. For the second, third and subsequent children, the minimum monthly payment is 6,752 rubles. But the maximum amount is 27,984 rubles.

Latest news on mortgages in Saratov and the Saratov region

Today the press held a round table on the topic “Mortgage during a pandemic: how to benefit.” The main issues for discussion, as follows from the topic, were issues related to the mortgage market, including the development of digital technologies that allow.

Books on home lending

“65.1) income received by the taxpayer during the implementation of measures of state support for families with children, in accordance with the Federal Law “On measures of state support for families with children, regarding the repayment of obligations on mortgage housing loans (loans) and on amendments to Article 13.2 Federal Law “On Acts of Civil Status”.

In the Saratov region, payments for the third child and subsequent ones will increase by 3%. This became known today, September 14, during a meeting of the working group of the social policy committee in the regional parliament.

“The draft law proposes to increase the amount of payment to 10,056 rubles from January 1, 2021, which corresponds to the cost of living for children in 2021, calculated by the Ministry of Labor and Social Protection of the region in accordance with the government decree,” Zhukovskaya clarifies.

On April 21, 2015, the State Duma rejected in the first reading the federal law on increasing the size of one-time payments for a third child to 1.5 million rubles. It was planned that the law would replace the current one on maternity capital and would begin to work from January 1, 2021 to December 31, 2026.

Documents for assigning monthly payments

To receive a regular payment for your third child, collect:

- Application for receiving money.

- A photocopy of your birth or adoption certificate.

- Photocopies of the birth certificates of the remaining children.

- A certificate from the spouse’s employer or place of study stating that he did not apply for these payments.

- If the spouse is unemployed, then a certificate from the social security authorities stating that they have not received payments previously.

- If the applicant works several jobs, then a certificate from the second employer is needed stating that he was not paid benefits at that company.

- A certificate for calculating the amount of benefits. It is only needed if the applicant has worked for another organization for the previous 2 years.

If the child’s mother goes to work before the child is one and a half years old, the payment of benefits stops. At the same time, she retains the right to receive leave; at any time, the woman can again take out maternity leave and continue to be on maternity leave. But the entire package of documents will have to be submitted again. In any case, the employer does not have the right to dismiss the employee or deny the woman this leave until the child reaches 3 years of age.

Options for using maternal capital in Saratov and the Saratov region

- women who gave birth or adopted a third child between January 1, 2012 and December 31, 2021;

- women who gave birth or adopted a 4th or subsequent child during the period from January 1, 2012 to December 31, 2021, if they had not previously exercised the right to family capital in connection with the birth or adoption of a previous child;

- men who are the sole adoptive parents of the 3rd child or subsequent children who have not previously exercised the right to regional maternity capital, if the court decision on adoption entered into legal force in the period from January 1, 2012 to December 31, 2021.

Other measures of social support for families with children using maternal capital in the Saratov region and Saratov

- Improving the family’s living conditions: purchasing residential premises under a purchase and sale agreement in the region;

- construction of residential premises in the region: participation in shared construction of an apartment building, including under an agreement on the assignment of the right of claim, construction of an individual housing construction project with the involvement of an organization carrying out the construction of an individual housing construction project, construction, reconstruction of an individual housing construction project carried out by citizens without attracting an organization carrying out the construction (reconstruction) of an individual housing construction project;

- repayment of the principal debt and payment of interest on loans or loans for the purchase (construction) of residential premises in the region (including mortgage loans) provided to citizens under a credit agreement (loan agreement) concluded with an organization providing credit (loan) under a loan agreement ( loan), the fulfillment of the obligation under which is secured by a mortgage, including with a credit institution.

- payment for paid educational services that are provided under state accredited educational programs by educational organizations located on the territory of the Russian Federation;

Citizens can apply for social support measures directly to social support institutions or to multifunctional centers for the provision of state and municipal services.

When using (quoting, reprinting, etc.) information posted on the official website of the Ministry of Labor and Social Protection of the Saratov Region, a mandatory requirement is a link to the website’s email address (www.social.saratov.gov.ru)

- The opportunity to receive maternity capital has been extended until 2021. Part of the amount will be received in cash.

- In Moscow and the Moscow region, child benefits will be indexed. As a result, their size will increase by 2–3 times. In other regions there will be an increase in inflation. The norm will not affect maternity capital. Its value has been frozen until 2021.

- A preferential mortgage program was introduced. It can be used by families who had a second or third child between 01/01/18 and 01/01/23. Subsidies will be provided from the state budget. The funds will be used to reduce the interest rate to 6%. Let’s say a family received money to buy a home at 9% per annum. She will have to provide an overpayment of only 6%. The remaining 3% will be paid by the state.

Tax benefits for large families

Families in which a third child was born are entitled to land and property taxes and increased tax deductions. The standard deduction for the first two children is 1,400 rubles, and starting from the third, the amount is 3,000 rubles. That is, a large family with three children will save:

(1400+1400+3000) * 13% * 12 months = 9048 rubles.

Some preferences that are given to Russian families with children in the Russian Federation do not depend on the number of children. All payments for children at birth and parental leave are accompanied by a complete exemption of the accrued amount from income tax and insurance contributions.

Also, those payments that the employer pays to mothers with children at their own request are not subject to income tax. But the amount of such financial support for female employees cannot exceed 50 thousand rubles per child.

Some regions approve additional benefits for families with three or more children. But to receive them you will need to confirm your status as a family with many children. For example, they reduce or exempt from transport tax. But such benefits are not approved at the federal level. They are given by regional authorities from the local budget, so they are valid only for residents of certain districts in the Russian Federation.

Procedure for obtaining a certificate

- First of all , it is necessary to give birth to a third child.

- Next, contact your local civil registry office to obtain the baby’s birth certificate.

- Go to the passport office to put all the necessary marks in your passport.

- Get a special certificate here that will confirm your child’s citizenship.

- Submit the entire package of documents to the pension fund.

- Expect a response from the Pension Fund within one month.

- Receive a certificate from your Pension Fund.

- Benefits provided to large families

According to existing legislation, all large families with three or more children are provided with additional benefits.

These include:

- Thirty percent discount on housing and communal services payments.

- Compensation for all fuel required to heat the home - if this family lives in an unheated room.

- Free medicines prescribed by a doctor for a child under six years of age.

- Free travel on public transport.

- First priority for admission

- Free and regular breakfast in schools.

- Free school uniform or any other clothing for attending school.

- Free uniform required for sports activities while the child is in school.

- Free admission to museums , attractions and exhibitions for one full day per month.

- Assistance in organizing a farm.

- Material aid.

- Exemption from full payment of the existing registration fee for individual entrepreneurs.

- Providing all kinds of preferential loans aimed at building your own home.

Regional benefits and relaxations

Families with a third baby claim:

- extraordinary receipt of a place in kindergarten;

- free meals in schools and vocational education institutions;

- benefits for utility bills of 30% or more, depending on decisions made in the region, but in a number of areas only low-income families can apply for it;

- free medicines for children under 6 years of age;

- free travel pass for all children under 16 or 18 years of age.

Carefully study local legislation to know what privileges you can count on in your region if there are three or more children in the family. Some regions help bring first-graders to school, while others provide students with school and sports uniforms and free textbooks.

Obtaining a land plot

Large families with a third child have the right to count on receiving a plot of land for building a household (IZHS). The procedure for providing such property depends on the region of residence of the family. The most developed program is considered to be in remote regions. For example, in the North they give out 2 hectares of land for individual housing construction. A similar rule applies in the suburbs of large settlements. There you can get up to 20 acres of land.

It is worth considering that the land plots are not equipped for living. Over the course of 2-3 years, the owner of the land must build a suitable place for living

house. He has no right to sell the plot.

For those families who do not want to take a plot, but want to purchase one more suitable for them, the region allocates so-called land capital. For example, in St. Petersburg its size in 2021 was 369,779.92 rubles.

Many regions are ready to give money instead of land, because there are simply no suitable plots of land owned by municipalities. And it is large families that will be given priority for receiving a plot.

Matkapital for a third child

Maternity capital is a separate way of state support for families with children. It can be received in most cases by the mother of the children, sometimes by the father or the child himself. Maternity capital is issued in the form of a certificate. It is impossible to cash it out; you can only spend it on those purposes approved by the state.

Starting from 2021, maternity capital began to be paid for the first child in the amount of 466 thousand rubles, for the second and third children they give an additional 150 thousand. After the birth of the third child, the family receives the right to partial repayment of the mortgage in the amount of 450 thousand rubles. The money is allocated once and under one mortgage agreement.

If the mortgage was taken out a long time ago and the remaining debt on it is less than 450 thousand rubles, then the family can use the remaining part for other purposes, but not for the mortgage. At the same time, the year of birth of the child is important; if he was born before 2021, then the state will not issue this amount.

To issue a certificate for maternity capital you need:

- The passport of the mother of the children or a power of attorney for another person, if the woman cannot independently apply for a certificate.

- Birth certificates for all children. If the child was adopted, then the appropriate documents are needed.

- Application for a certificate.

Additional documents will need to be submitted if the family:

- lives in another country;

- one or both parents died or lost their rights to the child.

It was decided to extend the maternity capital program until December 2026, so if a child is born during this period, families will be able to receive this type of government support.

How to get a certificate

After all the documents for maternity capital have been collected, you can submit them to the Pension Fund of the Russian Federation. You can do this:

- By mail.

- Through MFC.

- On the government services website.

- At the local FIU office.

- At the bank when applying for a mortgage.

Keep in mind that the method of receiving maternity capital through government services will speed up the queue at the Pension Fund branch. But he does not cancel a personal visit to the department.

It takes from 5 to 15 days to review the application and documents. After this period, Pension Fund employees will notify the applicant of the decision made. They may refuse if erroneous information is provided in the documents or if any inconsistencies are identified in the originals.

Keep in mind that a family receives the right to receive maternity capital only if they have Russian citizenship. If you don’t have a Russian passport and you live in another country, you won’t be able to get the money.

In addition to maternity capital from the state, you can also receive money from local budgets for your third child. Each region that provides additional support for families with children has its own amounts and rules for receiving them. For example, for residents of the Sverdlovsk region, the amount of regional maternity capital in 2021 is 140 thousand rubles, in the Astrakhan region - 50 thousand rubles, and for families in St. Petersburg - 160 thousand rubles. And this does not cancel the right to receive federal maternity capital, which is issued to all Russian families.

about the author

Klavdiya Treskova - higher education with qualification “Economist”, with specializations “Economics and Management” and “Computer Technologies” at PSU. She worked in a bank in positions from operator to acting. Head of the Department for servicing private and corporate clients. Every year she successfully passed certifications, education and training in banking services. Total work experience in the bank is more than 15 years. [email protected]

Is this article useful? Not really

Help us find out how much this article helped you. If something is missing or the information is not accurate, please report it below in the comments or write to us by email

Preferential mortgage

There are two types of mortgage benefits.

- Compensation in the amount of 450,000 rubles. mortgage loan and interest

Families where the third and subsequent child was born between the beginning of 2021 and the end of 2022 are entitled to it. The benefit is given only once, it cannot be extended to several properties. If the mortgage debt is less than RUB 450,000, the remainder of the assistance is forfeited. The loan for housing or land must be received before July 1, 2023.

Reimbursement of costs is assigned to JSC DOM.RF. The state transfers money to this organization in the form of subsidies. To obtain compensation, the family must provide the borrower’s passport and children’s birth certificates (passports), supporting documents for a mortgage loan and for the purchase of an apartment, room, house or land plot for individual housing construction.

- Family mortgage

A family in which a second or subsequent child was born from January 1, 2018 to December 31, 2022 is entitled to preferential mortgage terms. The loan rate depends on the size of the down payment.

| Down payment amount | Loan rate |

| 50 % | 4,7 % |

| 30 – 50 % | 4,9 % |

| 20 – 30 % | 5,2 % |

| 15 – 20 % | 5,5 % |

The maximum loan amount varies in regions. In Moscow and Moscow Region, in St. Petersburg and Leningrad Region it is 12 million rubles, in the rest - 6 million rubles. The loan term is up to 30 years. You can view the detailed conditions of the program on the DOM.RF website.

Comments: 2

Your comment (question) If you have questions about this article, you can tell us. Our team consists of only experienced experts and specialists with specialized education. We will try to help you in this topic:

Author of the article: Klavdiya Treskova

Consultant, author Popovich Anna

Financial author Olga Pikhotskaya

- Elena

04/13/2021 at 14:54 Good afternoon, if at the time of the birth of the child there was no citizenship, but now it has appeared. Do I have the right to maternity capital?

Reply ↓ Anna Popovich

04/13/2021 at 18:45Dear Elena, yes, but this right arises after both mother and children receive Russian citizenship.

Reply ↓

Cash support for certain categories of citizens

A number of families in Russia have the right to receive additional funds.

The state is ready to provide a mother with three children:

- Federal maternity capital. Money began to be issued in 2007. The parents of the second or subsequent offspring have the right to claim the amount. If in the fall of 2007 there were already two minor offspring, maternity capital is paid for the birth of the third. The purposes for spending funds are strictly defined. They can be used to educate children, improve living conditions, mother’s pension or treatment of a disabled child. In some situations, the father can also receive money.

- Regional maternity capital. Represents an option for additional support. The amount and possibility of receiving funds depend on the region. In some regions of the Russian Federation, the amount reaches 429,000 rubles. However, families can usually receive no more than 100,000 rubles. Depending on local law, the purposes for which funds are spent may vary significantly. A similar rule applies to conditions. Thus, in a number of regions money is provided only to low-income or single-parent families.

- Payments to wives of military personnel. Funds are provided one-time. A pregnant wife has the right to receive 26.7 thousand rubles. Money is given to the wives of military personnel serving under conscription. Payment is provided in the third trimester of pregnancy. Wives of contestants do not have the right to claim funds.

- Benefits for the child of a military personnel. Conscripts are not eligible to receive funds. The amount is 11.3 thousand rubles. and is paid every month until the child reaches three years of age.

- Survivor's benefit. Provided if the father, who was the only working person in the family, died. The payment amount is 2.3 thousand rubles.

- Maternity payments for the birth of the third and subsequent children. The amount is issued in a lump sum. Its size is 50,000 rubles.

- Benefit for fostered children. A method of support is provided to foster families. At a time, adoptive parents will receive about 17,000 rubles. If a disabled child is taken in and is over seven years old or several children are taken into care at once, the amount increases to 129,000 rubles. The amount of the surcharge increases due to the fact that it becomes more difficult to support a minor.

- The child was born into a family living in the Chernobyl contamination zone. For children under one and a half years old they provide 3.2 thousand rubles. If the age of the offspring has reached 1.5–3 years, the payment will increase to 6.5 thousand rubles.

A number of compensations are available only to women who have given birth to 5–10 children. Requirements may vary significantly by region.

Video