How does the state financially support single mothers?

It is impossible to find out what payments a single mother is entitled to from just one regulatory legal act (LLA).

“Preferential” and “compensatory” norms are contained in both federal, regional and local regulations. A single mother can count on support from the state:

- on a general basis (benefits and payments due to all mothers in Russia);

- according to additional criteria (if he confirms his preferential status: as a single mother, large or low-income family, etc.).

A single mother receives the main types of benefits at her place of work (maternity and child benefits). Here, the status of a single mother does not give special privileges - all women have equal rights to receive them.

To find out whether a single mother can count on additional state support, she should contact the local administration or social security authority at her place of residence.

Since 2021, social support for citizens is provided using criteria of need. The principle of “a little bit for all benefit categories” was replaced with targeted social support (only for citizens in real need). This approach is also applied when providing benefits and benefits to single mothers in 2021.

If you have access to ConsultantPlus, find out what benefits and social guarantees a single mother or father can count on. If you don't have access, get a free trial of online legal access.

Amount and types of payments

Benefits approved at the federal level are similar for two-parent and single-parent families. The status of “single mother” will not be a reason to pay a large amount. Exceptions are possible at the regional level. Local authorities set the amount of payments on an individual basis based on current regulations. A number of circumstances can affect the amount of the benefit:

- number of dependents on support;

- availability of official employment;

- monthly family income;

- carrying out work during pregnancy.

The voiced points can change the amount of the benefit. It is enough for a woman to provide authorized persons with documentary evidence of the circumstances.

There are several payment options available to single mothers. Each of them is provided for a specific purpose. The following list will help you get acquainted with the conditions for receiving:

- Funds provided to pregnant women. The amount of payment depends on the course of pregnancy and the severity of childbirth.

- One-time payment on the occasion of the birth of a child.

- State assistance provided to pregnant women in the early stages.

- Benefit provided to mothers after childbirth.

- Monthly payments until the child reaches 3 years of age.

- Regional subsidies for low-income mothers raising minor dependents.

- Additional assistance in connection with the birth of 2 and subsequent children. The calculation takes into account the subsistence level (LS) of the locality.

- Maternity capital allocated by the state to improve the living conditions of the family.

Some of the announced subsidies become relevant when the first child is born or in the process of bearing it. The remaining payments are intended for mothers who gave birth to 2 or more children. To avoid losing money due to the expired deadline for submitting documents, it is recommended that you familiarize yourself with all the points in advance.

Payments upon birth of a child by an employed mother

The state stimulates the birth rate by allocating funds to “newly made” mothers. The “single” status does not affect the situation. The list of types of benefits provided to women upon the birth of their first child is given in the table:

| Type of payment | Sum |

| Subsidy provided as compensation for pregnancy and childbirth | The basic payment amount is 34 thousand 530 rubles. 100% of the salary is compensated, but not less than the stated amount. The calculation is carried out from the 7th month of pregnancy until the 70th day after the birth of the child. |

| One-time transfer of funds in early pregnancy | 613 rub. |

| Payment in connection with the birth of the first child | 16 thousand 350 rub. |

| Monthly allowance for the maintenance of a dependent (up to the age of three) | The payment will be 40% of the mother’s income up to 1.5 years and 50% up to 3 years. The amount cannot be less than 3 thousand rubles. |

| State assistance to low-income families with minor children | Varies by region. |

| Additional payment provided to mothers, according to the decree of the head of state dated November 28, 2021 | Approximately 10 thousand rubles are allocated. The amount is tied to the minimum wage of the region, so it may be different. |

Payments are relevant for working women. In the case of the birth of 2 or subsequent children, new subsidies are added to the list. The general list of compensation for single mothers with many children is presented in the table:

| Subsidy type | Sum |

| Monthly payment for the birth of a second child | 40% of income, but not less than 6 thousand rubles. Payments continue for up to 1.5 years. |

| Maternal capital | 453 thousand are provided one-time for the purchase of living space. Additional payments to maternity capital are possible and are established by the constituent entities of the Russian Federation. |

| Payment for 3 children | Set at the regional level. |

Subsidies for unemployed mothers

Employers do not have the right to fire employed pregnant women at will. The rights of expectant mothers are protected by Article 261. Labor Code of the Russian Federation. The situation is different when trying to find a job while pregnant. The probability of finding a suitable vacancy is virtually zero. Women can only count on a few payments allocated in a fixed amount by the social protection authorities at their place of registration:

- One-time payment after the birth of the first child.

- Monthly benefit until the child reaches 1.5 years of age.

- Funds provided by the state to low-income families (one-parent, one-parent) with minor children.

- Maternal capital. The certificate can be used when the second or subsequent child reaches 3 years of age.

- Subsidies allocated monthly until the age of 3 children. The amount of payments is set at the regional level.

A non-working single mother will in any case receive a payment after childbirth, an allowance until the child reaches 18 months, and maternity capital if she has 2 or more children. Other subsidies may not be relevant due to budget constraints.

Maternity payments and child benefits for a single mother

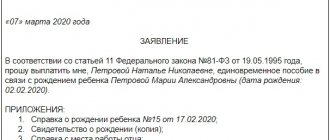

What payments are due to a single mother in 2021 under federal law? The types of benefits to which she is entitled (on a common basis with other citizens with children) are listed in Art. 3 of the Law “On State Benefits for Citizens with Children” dated May 19, 1995 No. 81-FZ.

The figure below shows the types of benefits for all expectant mothers (before the birth of the child) and after the birth of the baby:

The amount of benefit for a single mother in 2021 depends on her average earnings over the previous two years or on the minimum wage. To receive benefits you need to contact your employer. He will transfer the necessary documents and information to the FSS, which will pay the money. A non-working mother should contact the social security authorities for benefits.

We tell you more about what benefits each mother is entitled to at the birth of children in the materials of the section “Children’s benefits in 2021 - 2021 (amount, required documents)”.

Find out about the nuances of assigning, calculating and paying maternity benefits from the articles in our special section.

We will tell you further what other advantages, privileges, compensations and benefits exist for single mothers in 2021.

Algorithm for receiving benefits

Mothers who have an F-25 certificate and other evidence justifying their right to state assistance have the right to apply for a subsidy. If the requirements are not met, the request will be denied. To avoid wasting time, it is better to act according to the generally accepted algorithm:

- Get certificate F-25. To complete the document, just leave a dash in the “father” column. Registry office employees issue confirmation of status.

- Collect documents:

- passport;

- child metric;

- certificate of assignment of “single mother” status;

- extract from the house register;

- certificate from the social protection fund (if unemployed);

- personal income tax certificate 2 issued by the employer.

- Submit your application and collected documentation to authorized persons. If a woman works officially, then a package of papers is submitted to the personnel department or accounting department. Otherwise, the documents will be accepted by the social protection department at the place of registration.

- Wait for the result of the request consideration. Usually it takes about 10 days.

- Get a subsidy. In a year you will have to confirm your marital status. If the woman gets married or the father of the child is revealed, many payments will automatically stop.

A single mother in Moscow can apply for benefits due to her status not only by contacting the social security authorities, but also through a multifunctional center or the official website of the mayor of Moscow. The first option involves a visit to one of the MFC branches for the purpose of further transfer of documents to the authorized bodies. In the second case, the procedure is carried out remotely. The user just needs to register and select the required service.

The “single mother” status will allow a woman to receive a number of child support benefits. The amount of payments is set at the federal and regional levels. Documents for receiving subsidies are submitted to the accounting department, social security agency or multifunctional service center. If we are talking about residents of Moscow, then remote contact through the city mayor’s website is acceptable.

Free dairy kitchen: how accessible is it for a single mother?

The opportunity to receive free dairy products at the dairy kitchen is one of the social support measures. Not everyone can enjoy this privilege. The list of persons, standards for issuing special food, as well as the list of organizations supplying dairy products for dairy kitchens are determined by local authorities.

Recipients of special food usually include children from large and low-income families, bottle-fed babies, disabled children and other categories of people in need. Local authorities can also grant pregnant and nursing mothers the right to receive special food.

If a single mother in her region of residence falls into these categories, she must not only confirm her right to special food (for example, document the status of a low-income family), but also regularly update her prescription at the medical institution where the baby is registered.

Thus, not all single mothers can count on free food in a dairy kitchen, and the process of obtaining the right to a dairy kitchen is quite labor-intensive. But there are also many benefits from receiving such government support: children receive high-quality, varied and fresh food, and mothers can use the saved funds for other priority needs for the child.

Grounds for termination of payments

By law, child benefits cease to be paid due to the abolition of the basis for their assignment. At the regional level, the reasons may differ slightly.

For example, local authorities in Moscow have established the following grounds for terminating the payment of monthly child benefits:

- the child has reached the age from which benefits are not paid;

- the child is deregistered at the place of residence;

- the family has a high level of income;

- the child died;

- have not applied for benefits for more than 6 months;

- a legal court decision has entered into force, on the basis of which the child is declared missing;

- the minor is employed and engaged in entrepreneurial activity, which is equivalent to full legal capacity.

In regions, the reasons for terminating the payment of child benefits may differ, which in practice happens very rarely.

Advantages of a single mother when registering a child for kindergarten

What benefit does a single mother receive when her child enters a preschool institution?

A single mother has the right to count on priority enrollment of her child in the group. To resolve this issue, you must contact the administration of the preschool institution directly. The status of a single mother allows you to speed up the process of getting your child into kindergarten if there are no other preferential applicants (for example, children from large or low-income families). If there is also a queue among beneficiaries, it will not be possible to “jump” over it.

A single mother can also count on compensation for part of the monthly parental payment (clause 5 of Article 65 of the Law “On Education in the Russian Federation” dated December 29, 2012 No. 273-FZ).

The amount of such compensation is established by regional authorities taking into account the criterion of need, but not less than:

- 20% of the SRRP (average parental payment) - for the first child;

- 50% of the SRRP for the second child;

- 70% of the SRRP is for the third and subsequent children.

A single mother will not be able to use the above privileges if we are talking about a commercial kindergarten. Only state, municipal or departmental preschool institutions can reduce parental fees.

Thus, in 2021, child benefits for a single mother sending her child to kindergarten are not provided for by law. But this category of mothers can count on certain privileges.

Tax benefits and deductions

For single parents, double personal income tax deductions are provided for children. Let us remind you that a tax deduction is not compensation or payment, it is a documented right that exempts part of the income from personal income tax.

The amount of standard tax deductions for 2021 for single parents:

| Personal income tax deductions for children for single mothers | Who does the tax benefit apply to? | |||

| For each dependent under 18 years of age. and for each full-time student, graduate student, resident, intern, student, cadet under the age of 24 years. | For each dependent, if the minor is under 18 years of age. is a disabled child, or a full-time student, graduate student, resident, intern, student under the age of 24, if he is a disabled person of group I or II | |||

| on the first | on the second | on the third and every subsequent | ||

| Single mother (parent), adoptive parent who is providing for the minor | 2,800 rub. | 2,800 rub. | 6,000 rub. | 24,000 rub. |

| To a single guardian, trustee, foster parent who is caring for a minor | 2,800 rub. | 2,800 rub. | 6,000 rub. | 12,000 rub. |

An example of determining the amount of a deduction: employee Morkovkina D.A., who is a single mother, has an only disabled daughter of 8 years old.

The amount of deduction due to her will be 26,800 rubles. based on:

- 2,800 rub. (RUB 1,400 * 2);

- 24,000 rub. (RUB 12,000 * 2).

That is, the amount is 26,800 rubles. monthly excluded from taxation until the mother’s income exceeds 350,000 rubles. in year.

The child went to school: what kind of government support can a single mother count on?

When a child goes to school, the mother has more costly tasks: where can she get additional funds to buy a school uniform, can her child eat in the school canteen for free, and what kind of benefit can a single mother receive in 2021 in connection with such expenses?

Federal legislation does not provide for special monthly “school” benefits for a single mother in 2021, which will help her provide decent support for her child while studying. We can only count on the support of local authorities.

Municipalities define the categories of those in need in different ways (usually large and low-income families, sometimes single mothers), and also set the amounts of benefits and compensation in their own way based on budgetary capabilities.

Funds are allocated:

- for the purchase of stationery and other school supplies;

- two hot meals a day for children in school canteens;

- partial compensation of tuition fees in art and music schools (up to 30%);

- discounted vacation vouchers (once every 2 years);

- other benefits and compensation.

Regional regulations for single mothers may provide one-time cash payments for the purchase of school clothes, sports uniforms, or provide the opportunity to purchase these items in discount stores. In some regions, authorities pay for travel and meals for schoolchildren.

Current 2021 subsidy amounts for single mothers living in Moscow

Starting in 2021, regional benefits for Moscow residents who raise children alone have been increased. The increase extended to virtually all forms of payments. Detailed information is given in the table:

| Type of subsidy | Description |

| Payments intended for low-income families | The benefit is paid to mothers with an income below the subsistence level in the capital, which is 16 thousand rubles. per capita. For children under 3 years old, 15 thousand rubles are allocated, and for children under 18 – six thousand rubles. Previously, the amounts were 2-3 times less. |

| Inflation compensation | Payments are intended for single mothers in Moscow who support more than 3 dependents. Until 2021, their size was 750 rubles. Now the amount has increased to 1.5 thousand rubles. |

| Payment due to rising food prices | The amount of compensation for income above the monthly minimum is 300 rubles. Citizens earning less than the subsistence level receive 600 rubles. |

| Benefit provided to mothers caring for disabled children | The payment is guaranteed to parents raising a child with 1-2 disability groups. Until 2021, the amount was 6 thousand rubles. Now 12 thousand rubles are transferred. A similar subsidy is provided to a single mother who has received a disability. |

| Adoption benefit | A mother who decides to adopt a child will receive 16 thousand 874 rubles. If a minor has a disability, then the amount increases to almost 129 thousand rubles. Previously, 16 thousand 350 rubles were paid. and 124 thousand 930 rubles. The increased amount of the subsidy is also relevant for the simultaneous adoption of several children who are related (brothers or sisters). |

Separately, it is worth highlighting the allowance in Moscow for a single mother, paid at a low level of income (less than the subsistence level for each family member). The state must pay 750 rubles. in order to maintain an optimal standard of living. The rest of the subsidy is calculated depending on the age of the child. For dependents from 1.5 to 3 years old, 4.5 thousand rubles are allocated, and for children 0-1.5 years old and 3-18 – 2.5 thousand rubles.

Preferential use of the pool for children with one parent

In order to preserve and strengthen the health of children, regional and municipal authorities may provide preferential conditions when paying for the cost of physical education, health and sports services. But only in the case when these services are provided by institutions that are part of the state system of physical education and sports.

For example, such benefits are provided for in paragraph 7 of Art. 32 of the Law “On Social Support for Families with Children in the City of Moscow” dated November 23, 2005 No. 60. You can find out about the benefits provided in the field of physical education and sports on the official websites of sports institutions - on the website of the Moscow Department of Sports in the section “Preferential Services”, preferential benefits are listed categories of citizens who have the opportunity to receive physical education, health and sports services at the Olympic Village sports complex (use of swimming pools and a gym, visits to children's swimming sections). Beneficiaries include children from large and low-income families, orphans and disabled children. To obtain subscriptions on preferential terms, you must contact the administration of the sports complex with documents.

Assistance of 5,000 rubles for children under three years of age.

Children under three years of age whose mothers are eligible to receive maternity capital - due to the coronavirus epidemic and government support - will be provided with assistance.

The payment will be 5,000 rubles from April 2021 and will last three months.

In this case, payments will be from the budget, and not from maternity capital.

Children born before March 31, 2021.

Travel reimbursement and free entry to the zoo

Are there benefits for single mothers in 2021 to reduce travel costs and expenses for cultural events for their children?

Taking children to the zoo and not worrying about paying for travel on city public transport - such benefits can be enjoyed, for example, by capital families with children (Article 26 of the Law “On Social Support for Families with Children in the City of Moscow” dated November 23, 2005 No. 60). Children living with one parent are not included in a separate category of beneficiaries, but enjoy the same privileges.

Children with Moscow registration who have not reached the age of 7 years have the right to:

- for free travel on buses, trolleybuses and trams (public urban passenger transport);

- free entry to zoos, cultural and recreational parks, exhibition halls and museums run by the capital’s government.

Benefits do not apply if the child is visiting a private museum or using other means of transport (for example, private taxis or commercial shuttle buses).

If a single mother lives in a small locality, she will not need this kind of benefits - the village may not have public transport, much less a zoo.

The legislative framework

Within the framework of Part 1 of Article 39 of the Constitution of the Russian Federation, everyone is guaranteed social security by age, for raising children or in other cases. This norm is strictly implemented by assigning several types of benefits to women caring for infants and then for growing children.

Federal laws regulate only general rules for compliance with constitutional guarantees , on the basis of which single mothers, like other parents, are entitled to a number of payments. In particular, financial assistance is assigned within the framework of:

- Federal Law No. 81 from birth to one and a half years;

- Federal Law No. 418 from 0 to 3 years, but subject to certain conditions;

- Decree of the President of the Russian Federation No. 199 from 3 to 7 years, in some cases.

But a single mother fulfills her responsibilities independently, and therefore, the financial burden for her increases. And legislators understand this, as well as the fact that targeted assistance is only possible at the local level (in your region of residence). That is why, in order to protect the interests of both children and their mothers, the powers to assign additional support to women carrying out parental responsibilities alone have been transferred to the subjects of the federation.

In turn, already at the regional level in each region and territory through legislation:

- Preferential categories have been defined;

- Additional financial support measures have been assigned;

- A number of benefits and the procedure for their provision have been established.

Since targeted types of assistance are paid only within the framework of local laws when moving to another region for permanent residence, a woman loses the right to payments to her previous address and gains the opportunity to apply for them in another region .

Women who have adopted a child are treated the same as mothers who gave birth to a child on their own. And they have the right to claim all social benefits that are established for other mothers in the general manner.

Reimbursement for telephone costs

Are there benefits for single mothers in 2021 to pay for communication services?

Compensation payments for telephone payments personally for single mothers are practically not found in regional legal entities. Although this type of social support exists for low-income and large families. For example, in Art. 17.2 of Law No. 60 for metropolitan families with three or more children, one of the parents (guardian, guardian, stepmother or stepfather) is provided with monthly compensation for using the telephone. This type of social support is provided until the youngest child in the family reaches the age of 18.

You should not expect full reimbursement for landline phone costs or reimbursement for cellular phone costs. Regions usually provide payments “per telephone” as a percentage of the approved subscription fee tariff.

Up to what age are benefits paid?

Single mothers, being a socially less protected category of the population, are interested in how long they will receive child benefits. It should be noted that all women are paid benefits until the child reaches one and a half years of age.

Still, employed mothers have more rights. They are forced to take a break from work and take parental leave. They are paid benefits until the child reaches 3 years of age. After the child turns 3 years old, only low-income people and those mothers raising a disabled child will receive payments.

If all the family's monthly income is below the subsistence level, regional authorities can assign benefits that are paid until the child turns 18 years old.

Does a single mother get free housing?

The status of a single mother in itself does not give her the opportunity to count on free housing. There is no such privilege in the law. But in combination with other conditions (for example, low income, a certain age of the mother, etc.), a single mother can participate in special housing programs.

For example, she can take part in the Young Family program. To do this, she must be no more than 35 years old, and she must prove that her family needs improved living conditions.

The program does not provide free housing, but allows you to receive partial financing for the purchase from the local budget. At the same time, the program participant must have his own funds or a source of their receipt to make the mandatory down payment.

In addition, to solve housing problems, a single mother can try to get on the waiting list for social housing. There are also a number of conditions, the fulfillment of which is checked when placing a single mother on the social housing queue (the presence of a disability in the mother or child; a diagnosis of an illness of a family member confirmed by a medical institution that is unacceptable when living together in the same living space; unsuitability of housing for habitation).

Documents for processing payments

To apply for benefits and additional benefits, the mother should collect a package of the following documents:

- Application for benefits.

- Baby's birth certificate.

- Certificate of cohabitation of mother and child.

- Other documents, depending on the benefit for which the single mother is applying.

A certificate of joint residence can be obtained at the passport office at the place of registration. All necessary documents should be taken to the social protection department or MFC. The task of social protection employees is to check the specified information, visit the family in person, and, based on the data received, draw up acts on the cohabitation of the applicant and the child.

As soon as the application for payment of benefits is accepted by the social security authorities, accrual begins to occur. Payments are made until the child reaches adulthood. In some cases, benefits may be paid only for up to three years.

If a mother and baby live in a place other than their place of registration, the woman will have to take a certificate from the social security authorities regarding registration. The certificate must indicate that the single mother does not receive any payments at the place of registration. Then the benefit will be paid at the place of residence.

If a woman is employed, then part of the benefits should be arranged with the employer. The benefit paid from Maternity Capital funds is assigned by the Pension Fund.

Results

What compensation, benefits and other payments are due to single mothers in 2021 can be found out from the social security authorities or the municipality. Like all expectant mothers, single mothers receive maternity benefits, as well as child benefits (one-time and monthly). As additional support from the state, depending on the region of residence, they can count on free special food (dairy kitchen), reimbursement of expenses for clothing and stationery for schoolchildren, free travel on public transport, etc. To receive such preferences in most regions, in addition The status of a single mother must also meet other criteria (large families, low income, etc.).

Sources:

- Tax Code of the Russian Federation

- Labor Code of the Russian Federation

- Law “On state benefits for citizens with children” dated May 19, 1995 No. 81-FZ

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Labor benefits for single mothers

The Labor Code of the Russian Federation establishes the following guarantees for single parents:

- A ban on dismissal of a single mother raising a disabled child under the age of 18. or a minor under the age of 14 years. (Part 4 of Article 261 of the Labor Code).

- Providing annual paid leave at any convenient time at the request of a single parent raising a child under 12 years of age. (Article 262 of the Labor Code).

- Limitation of night work and overtime work, involvement in work on weekends and non-working holidays, assignments on business trips, provision of additional leaves, establishment of preferential labor regimes (Article 264 of the Labor Code).

In addition to generally accepted guarantees, employers have the right to introduce additional benefits and privileges. For example, collective agreements of institutions establish annual additional leaves without pay at a convenient time for up to 14 calendar days (Article 263 of the Labor Code).

Refusal to recognize a woman as a single mother

In some situations, a refusal to obtain such status may be possible:

- The spouses are divorced, but the woman does not receive alimony (alimony can be demanded through the court)

- If paternity has been established, but the father does not actually help the child (paternity can also be deprived through the court)

- Death of a spouse (the child is assigned a survivor's pension)

- Adoption of a child upon marriage

- In some cases, it is required that in the birth certificate there should be a dash in the father column, since there is no regulatory regulation on establishing the status

- Child born within 300 days of divorce

- Providing false information

Help in form 2

By order of the Ministry of Justice dated October 1, 2018. No. 200 approved Form 2, in accordance with which a certificate of “single mother” status is issued. Please note that previously a certificate in Form 25 was in force.

The following data is entered into Form 2:

- child (full name, date and place of birth);

- mothers (full name, citizenship);

- father (full name);

- registration number;

- information that information about the father is indicated from the words of the mother;

- date and signature of the head of the civil registry office.

Such a certificate gives reason to believe that the mother is the only parent. When applying to government agencies to receive benefits, you will need to present this document.

Can a father get single status?

In legislative documents there is no concept of a single father, however, the concept of “single parent” is found, which, according to a literal reading, is confirmation that a single father can count on the same privileges as a single mother.

Fathers can apply for certain concessions:

- raising minors whose mother has been deprived of parental rights;

- children whose mother is presumed dead;

- having documents that confirm the fact of maintaining the child and living together with the father without the presence of the mother.