Donation is a type of voluntary transfer of property (movable and immovable). The parties draw up an agreement, indicating the subject of the agreement, the form of the transaction and other nuances. Property rights will come into force from the moment of registration. If the donor dies while the documents are being prepared, the donation process will not be completed. The recipient will have to resolve the issue in court. In turn, the heirs of the deceased have the right to challenge the deed of gift. Such moments are regulated by the norms of the Civil Code of the Russian Federation.

Definitions of the concept of “gift”

The word “donation” means the transfer of certain property free of charge. Property rights are confirmed by drawing up an agreement and passing state registration. Real estate and movable property are transferred by deed of gift.

Capable people who have reached the age of majority or their representatives have the right to carry out gift transactions. It is not necessary to contact a notary office to draw up an agreement. The parties can independently collect documents and write down all the conditions, focusing on examples of agreements posted on the Internet. The deal is terminated only with mutual consent. It is enough to write a deed of cancellation of the donation. A deed of gift is unilaterally recognized as invalid or void only on compelling grounds given in the Civil Code of the Russian Federation.

The legislative framework

Issues related to the entry into force, writing and challenging of a gift agreement are regulated by the provisions of the Civil Code:

| Article number | Description |

| 572 | Definition of the concept of “donation” and features of the procedure. |

| 573 | The recipient has the right to refuse the gift. |

| 574 | Forms of agreement on the transfer of property as a gift. |

| 575 | Cases when it is unlawful to donate property. |

| 576 | Grounds for restricting the rights to manage donated property. |

| 577 | Reasons for the donor’s refusal to fulfill the terms of the agreement. |

| 578 | Features of the procedure for canceling a donation. |

| 579 | Situations when you cannot refuse the terms of a deed of gift or cancel it. |

| 580 | Consequences of harm to the citizen being gifted by the property of the donor. |

| 581 | Succession in drawing up a consensual form of agreement. |

| 582 | Features of the transfer of property in the form of donation. |

Transfer of ownership

The key moment when concluding a deed of gift is the moment of transfer of ownership of the object. By giving an apartment as a gift, the owner loses all rights to this property. At what point does this happen? And when will the new owner be able to dispose of the apartment? To answer these questions, let us turn to the Civil Code.

Article 223 of the Civil Code states that the recipient’s right of ownership arises at the moment of transfer of property. However, if the property requires state registration, then the recipient will become the full rights holder after it is completed. In fact, the deed of gift comes into force after its registration.

Expert opinion

Klimov Yaroslav

More than 12 years in real estate, higher legal education (Russian Academy of Justice)

Ask a Question

There are situations when the donor dies during registration. Will there be any problems during registration? In fact, it is difficult to say unambiguously how events will develop. But there is a risk that the relatives of the deceased may appeal the deal.

Reasons for choosing a deed of gift instead of a will

A will determines the order of inheritance of property after the death of its owner. The deed of gift becomes relevant already at the time of registration in Rosreestr and has two main advantages:

- Transactions involving the transfer of property as a gift are often carried out between family members, so the risk of being deceived is minimal.

- Close relatives are exempt from paying taxes when drawing up a deed of gift. For example, the transfer of an apartment between husband and wife, brother and sister, or grandmother and grandson will be free of charge. In other situations, you will have to pay 13% of the value of the gift.

Whether it is necessary to enter into an inheritance if there is a deed of gift also depends on the desire to specify other terms of the transaction. A will can be drawn up in detail, indicating all aspects relating to property rights passing into other hands after the death of the testator. In turn, the gift agreement must be drawn up in a generally accepted form. The donor has no right to supplement the document with terms and conditions for the transfer of property. The deed of gift has other advantages:

- The owner has the right to independently draw up the document.

- Registration is considered the moment the deed of gift comes into force.

- The received property belongs to the “personal” category, therefore, it will belong only to the citizen being gifted and will be inherited by his relatives. Spouses have no right to claim it.

- It is unlikely to challenge the transaction, since the property passes into new hands during the lifetime of the former owner.

- The notary does not have any special requirements for certification of the document.

The general list of shortcomings of a deed of gift is as follows:

- On the legal grounds described in the Civil Code, interested parties have the right to challenge the transaction and sue the property for themselves.

- The owner of the property loses property rights at the time the transaction is concluded. If we are talking about transferring an apartment, then the former owner will no longer be able to live in it or otherwise dispose of it at will.

- Gifts between non-related parties are taxable.

- An agreement is recognized by the court as sham if it is concluded for the purpose of concealing other frauds with the participation of distant relatives or third parties.

In the case of drawing up a will, the owner can use the property until death. Inheritance rights will come into force only six months after the death of the previous owner.

Focusing on the pros and cons of contracts, the conclusion suggests itself that a deed of gift is more useful to the heirs, and a will is more useful to the heirs.

Functions of deed of gift

The main task of the deed of gift is to formalize the donation transaction. Thanks to it, the new owner of the property will be able to fully use it and, if necessary, confirm that the gift was purchased legally.

Many people do not know which is better - a deed of gift or a will, and also mistakenly assume that the gift agreement can indicate the possibility of transferring real estate into ownership only in the event of the death of the donor. A document containing such a condition is considered void.

There is a fundamental difference between donation and inheritance: in the first case, the transfer of ownership is possible only during the life of the owner, and in the second, property is distributed only after his death.

Important! You can get an answer to one more question - if there is a deed of gift, is it necessary to enter into an inheritance - in the Civil Code of the Russian Federation. It clearly states that when the donee manages to transfer the property to himself under a gift agreement, it becomes his full property, so entering into an inheritance is relevant if he is included in the circle of legal successors and other things that do not belong to him are inherited.

Types of agreement

You can issue one of the following forms of deed of gift:

| Document type | Description |

| Real | The essence of the document is the transfer of property rights at the time of completion of the transaction. |

| Consensual | Property will pass into other hands only under certain conditions specified in the contract, for example, you can write that the recipient will receive the apartment 3 years from the date of drawing up this document. |

| Donation | The donation is for general benefit purposes. The recipient of the property must be a legal entity. The donor has the right to monitor the use of the transferred property, based on the purpose and purpose written in the agreement. |

The agreement is drawn up in writing. According to Article 574 of the Civil Code of the Russian Federation, oral donation is permissible under certain conditions:

- Only movable property is donated;

- the role of the donor is played by an individual;

- the gift should not cost more than 3 thousand rubles;

- the transfer of the gift takes place at the time of conclusion of the transaction.

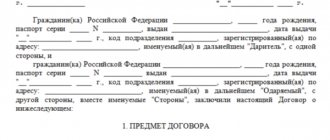

Features of compilation and design

A gift agreement is drawn up between the donor (owner of the property) and the recipient. Contacting a notary is not necessary, but lawyers still recommend having the document certified to avoid controversial issues:

- The notary has the right to act as a witness confirming the legality of the deed of gift.

- Any inaccuracy in drawing up a document leads to disastrous consequences. The notary is not interested in challenging the agreement he has certified, so he will immediately point out controversial issues and advise on options for changing the text.

- The registration authority will refuse to accept a document if the form of writing has been violated. The parties will have to start all over again, which will delay the donation process for another 2-3 months. In turn, the notary would not certify an incorrectly completed agreement.

Depending on the price of the property and the degree of relationship between the parties, the state duty varies from 3 to 20 thousand rubles. Other services (text writing, consultations) are paid separately. The algorithm for writing and registering an agreement on the transfer of property as a gift is as follows:

- Preparation of documentation: Identity card (donor and recipient).

- Certificate of marriage, if one of the parties has one.

- A power of attorney to act on behalf of the owner of the property or the recipient.

- Title papers.

- A document confirming the absence of encumbrances on the property.

- information about the parties;

- property: apartment;

- death of one of the parties;

Separately, you can write down clauses regarding inheritance by gift and death of one of the parties to the agreement.

How much does it cost to inherit an apartment?

Registration of property received by inheritance involves certain expenses.

Factors influencing costs when decorating an apartment include:

- Estimated cost of the apartment;

- Presence of family ties with the deceased owner;

- Drawing up a general Certificate of Inheritance or preparing a separate document for each heir;

- Intermediary services (if any were contacted during the process);

- Agent services for registration of rights to an apartment.

Pay attention! The amount of the state fee depends on the cost of the apartment.

How is the state duty paid?

It is impossible to obtain a certificate without paying the state fee.

The indicator of this payment is calculated as follows:

- If the inheritance is drawn up by persons belonging to the first and second stages of inheritance, namely natural and adopted children, parents, as well as siblings (paternal and maternal), the state duty will be 0.3% of the cost of the apartment. In this case, the amount should not exceed 100 thousand rubles;

- Other heirs pay a state duty in the amount of 0.6% of the cost of the apartment, but not more than 1 million rubles.

When paying the state duty, certain benefits apply to some heirs. Disabled people of groups I and II pay 50% of the amount of the state duty (Article 333.387 of the Tax Code of the Russian Federation).

Completely exempt from paying state fees:

- Heirs who lived together with the deceased owner of the apartment and who remained to live there after his death;

- Citizens inheriting the property of persons who died while performing their civic duty, performing government duties or subject to repression;

- Heirs who have not reached the age of majority or have mental illness.

Cost of inheritance under a will

The amount of expenses depends on whether the heir under the will was related to the testator. If there is no such relationship, then the costs will be higher than for relatives.

A certificate of inheritance is issued by a notary, and you have to pay for each document issued. So, if the heirs agree to receive one Certificate for two, then their expenses will be less. If trusted persons are involved in the inheritance procedure, the costs will increase.

Registration of an inheritance is not so easy, and it is not exactly cheap. The main amount of payments is expected at the final stage, so the heirs have the opportunity to prepare the required amount.

It is important to do everything on time. Compliance with the required deadlines is guaranteed to reduce costs, since registering an inheritance through the court will be much more expensive.

List of circumstances preventing the registration of a deed of gift

The parties do not have the right to draw up a gift agreement in the following cases:

- The donor is an official who is unable to transfer property due to his official position.

- The property is transferred by a person declared incompetent during court proceedings, or a child under 18 years of age. Such persons do not have the right to dispose of property independently.

- The parties to the agreement are the owners of commercial organizations.

- A guardian or trustee is trying to formalize a gift agreement in order to receive the property of the ward.

- The recipient of the gift is an employee of a government institution (educational, medical), and the donor is his client.

- The property being donated has several owners, one of whom is against the transaction.

- The donor has not yet become an heir. Initially, you can only draw up an agreement. It will be possible to register it after completing the process of obtaining property rights.

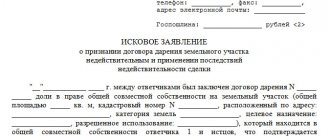

Arbitrage practice

This category of cases is complex in legal understanding. Donation of real estate may be challenged. Dispute methods:

- cancellation of the transfer free of charge (termination of the transaction);

- invalidity of the agreement;

- the nullity of a transaction recognized by a judicial act.

The decision that was made by the judicial authority depends on the circumstances of the particular case, as well as on the facts that indicate the defendant’s bad faith. The plaintiff needs to understand that proof is a responsibility that rests primarily with him.

Donors, the donees themselves, heirs after the donor's death, mortgagees, and creditors can challenge the agreement. What documents are needed to file a claim? The main thing is that there are documents that are evidence of the defendant’s unlawful actions.

In order to challenge a donation, the law established a limitation period. In particular, this is a year to three years. These time intervals are established by law in order to protect the violated rights of the interested party.

Article 578 of the Civil Code of the Russian Federation provides several grounds for canceling a deed of gift:

- The donee committed a crime aimed at the life, health, family members of the donor, as well as his close relatives.

- The donee intentionally caused bodily harm to the other party.

- The donee poses a threat to the thing that was donated, that is, there is a risk that it will be lost.

- If the donor dies later than the donee.

If we talk about these grounds for canceling a donation, this is initiated by the donor himself or his representative. That is, termination of the contract occurs during the life of the donor.

Is it possible to cancel the deal after his death? It is logical that the heirs deal with this issue, since the person who transferred the property or rights under the agreement is no longer alive. A lawsuit is filed, but the heirs must substantiate their application. In particular, the following may be grounds that may prompt a court to revoke a donation after the death of the donor:

1) Incorrectly drawn up gift agreement. Any inaccuracy, blot, or failure to comply with the form will entail the cancellation of the deed of gift.

2) If the subject of the transaction was real estate, the lack of registration of the transfer of ownership of it may cause this issue to be considered in court.

3) The insanity of the person who drew up the deed of gift. Since the donor has passed away, it will be very difficult to prove that he was insane and did not understand what he was doing. Interested parties will have to look for witnesses who can prove the fact of the citizen’s insanity.

4) Illegal execution of a transaction. For example, in a situation where the donor illegally gave a gift, and the recipient, by analogy, accepted it. Such cases are expressly provided for by the current law:

- if the recipient is a person under 18 years of age, their close relatives, legal representatives, and guardians are required to refuse the gift;

- if the gift is planned to be given to civil servants in the course of their professional activities, they are obliged to refuse it;

- if a person is in a hospital, in a social institution, then doctors, heads of departments, nurses, and other employees are obliged to refuse the gift

5) The gift agreement was concluded for the purpose of avoiding paying taxes to the Russian budget.

6) Signing an agreement under the influence of deception or coercion. Most often, such agreements are signed with older people, since they are the easiest to deceive.

7) An attempt was made on the donor's life during his lifetime. After his death, it was proven that the donee had attempted to assassinate him. In addition, he hatched plans to kill him.

The agreement was signed under pressure. Alternatively, the donor could be blackmailed or threatened. For example, the donor realized that the transaction he was making was extremely unprofitable. But he couldn’t do anything; he had to sign it, because people interested in the property began to threaten him.

The agreement was signed under pressure. Alternatively, the donor could be blackmailed or threatened. For example, the donor realized that the transaction he was making was extremely unprofitable. But he couldn’t do anything; he had to sign it, because people interested in the property began to threaten him.

9) The housing that the recipient has accepted gradually falls into disrepair, as he treats it poorly.

10) Death of two parties to the contract: the donor and the donee.

Download: Statement of claim for cancellation of the gift agreement (sample)

The question of who will win in court remains open. Of course, if the plaintiff feels he is right, he is obliged to collect as much evidence as possible on the merits of the case under consideration. For example, if he decided that an uncle or other relative signed a deed of gift for an aunt while in an insane state, it is necessary to find as much evidence of this as possible. Even if the plaintiff is right, and the uncle simply could not give the apartment to the aunt whom he hated all his life, this argument alone will not be enough. The interested party, in order to find justice, is obliged to collect evidence, oral or written, and bring witnesses to court. In this situation, the judge will be able to make a fair and informed decision.

CONCLUSION: After the death of the donor, the contract can be challenged in court. The plaintiffs are interested parties who find it suspicious of a person’s will to transfer property to another person, also on a free basis. The claim is filed in accordance with traditional legal proceedings; its preparation is subject to the rules of Article 131 of the Code of Civil Procedure of the Russian Federation. There is nothing special in this case. Just as in any other case, the plaintiff is required to present evidence of his case.

Main points of fulfillment of the contract after the death of the donor

Two scenarios for the development of disputes regarding the relevance of the deed of gift after the death of the donor stand out:

| Situation | Description |

| The document contains a clause on the transfer of property after the death of the donor. | According to the legislation of the Russian Federation, a deed of gift containing a condition on the transfer of property rights to movable or immovable property after the death of the donor is considered void. Such a clause is valid only for a will. |

| The agreement was signed, but the donor died before going to Rosreestr. | It will be possible to prove the intention of the deceased owner of the property who signed the necessary documents only in court, since Rosreestr employees will not be able to register the agreement in the absence of one of the parties. Relatives of the deceased also have the right to file a claim to invalidate the deed of gift. The likelihood of a positive outcome for the recipient is extremely low. In most cases, property passes to the heirs of the deceased on a general basis. |

Is it possible to cancel a deed of gift: an example from legal practice

Citizen of the Russian Federation N., wanting to transfer the apartment to his daughter, draws up a deed of gift for her. At the same time, fearing that the son-in-law, after receiving the living space at his disposal, will not allow him to continue living on it, he introduces a clause into the content of the contract, according to which the real estate becomes at the disposal of his daughter after his death.

After some time, the daughter turns to Rossreestr employees to register the document. The agreement is being registered. However, a year later N. dies and when her daughter presents her rights to the apartment, her claims are disputed in court by the wife of the deceased, who knew about the existence of a prohibited clause. Since the deal was declared invalid, both the wife and daughter received equal shares by way of inheritance.

Inheritance of property received as a gift after the death of the donee

Inheritance of an apartment or other donated property under a deed of gift occurs on a general basis. An exception is the indication in the contract of a clause on the return of property in the event of the death of its recipient. The giver will receive the gift back. Including a condition for the return of the gift in the contract will not help to return the property if the recipient managed to dispose of the gift before his death:

- sold;

- bequeathed;

- pawned;

- gave;

- rented out.

It is unlawful to demand the cancellation of the transaction and the return of the donated apartment after the death of the donee in the above-mentioned situations. According to the law, the recipient of the property can carry out any actions with the gift, except for causing intentional harm. Going to court will not bring results.

Alternative to donation after death

An alternative is a will . In a will, everyone has the right to dispose of property at their own discretion. To exercise this right, the testator, when drawing up a will, can:

- bequeath all your property to a specific person . However, such wills are most often contested, since the testator often has heirs who have the right to claim an obligatory share in the inheritance;

- bequeath specific property to specific persons . Such wills are difficult to challenge. But the person who draws up the will must ensure that the inheritance (for example, an apartment) is properly formalized and registered with government authorities, since otherwise the heir will not have rights to the unregistered piece of real estate.

Example

The father gave his son an apartment. The contract was certified by a notary. However, the son did not have time to register the apartment in his name before his father’s death. After the death of his father, his wife, with whom he did not live together, but did not formally file a divorce, filed an application to accept the inheritance. The notary established that the apartment donated to the son under the contract has not yet been registered in the son’s name, and on the basis of Part 3 of Art. 572 of the Civil Code of the Russian Federation included the apartment as part of the inheritance. The son filed an application to the court to recognize the donation as valid. Since the son had in his hands the act of acceptance and transfer of the apartment and the title documents on it, the court recognized that in fact the son accepted the gift from the donor and the gift agreement took place. Based on a court decision, the apartment was excluded from the inheritance.

Registration of a gift agreement by an heir

The heirs have full right to dispose of the property inherited under the will. To write a deed of gift, you need to follow the given algorithm of actions:

| Stage | What should the heir do? |

| Entry into inheritance | • Contact a notary office. • Present to the notary documents confirming the right of inheritance: - papers proving the existence of a connection between the deceased and the presumptive heir; - identification; - death certificate; - cadastral passport. |

| Registration of property rights | • Visit the notary's office again. • Provide the following documents to the specialist: - passport; — documents on the basis of which the client has the right to dispose of inherited property; - a check confirming the transfer of money towards the state duty. |

A citizen can dispose of property received under a will from the moment of registration of property rights. The process is complicated by the presence of several heirs. Each of them owns a certain share, therefore, the gift agreement is drawn up only with the consent of all co-owners.

How to inherit an apartment

The procedure for registering an inheritance consists of several stages:

- Issuance of a death certificate of the testator;

- The procedure for removing the deceased owner of an apartment from registration at the place of residence, obtaining documents confirming this fact;

- Visit to a notary office;

- Collection of necessary documents;

- The procedure for assessing an apartment that is inherited;

- Payment of state duty;

- Notarial actions for registration of inheritance, obtaining the appropriate certificate;

- Visiting government agencies to register ownership of an apartment received by inheritance.

The procedure for removing a deceased apartment owner from registration at the place of residence

By law, citizens of the Russian Federation must have registration at their place of residence. When a person registers, he is given a special mark in his passport. After his death, the heirs are obliged to remove the deceased relative from registration.

In a specific case, we consider a situation where the deceased owned an apartment that was being inherited and was registered there.

To deregister, contact the migration service at the place of registration of the deceased. The procedure consists of providing a death certificate and receiving an extract. The document refers to the deregistration of a deceased citizen.

Get a certificate from the housing organization that confirms that the citizen lives at this address. In addition, the certificate must contain information about persons registered at this address together with the deceased before his death.

What documents are needed to register an apartment as an inheritance?

The procedure for inheriting property is quite a complicated thing, as it requires serious preparation of a package of documents.

To visit a notary, prepare the following documents:

- A document confirming the death of the testator;

- A document confirming the deregistration of the deceased citizen (must be obtained from the migration service at the place of registration of the deceased);

- A certificate received from a housing organization or an extract from the house register indicating the last place of residence of the deceased (Form 9);

- Passports of property heirs;

- Documents confirming the presence of a family relationship between the deceased owner of the apartment and persons claiming this inheritance (birth or adoption certificate, marriage certificate;

- Documents of the apartment owner on the right of ownership of this property:

- certificate of ownership (as a result of privatization);

- certificate of inheritance (the apartment was inherited);

- a document confirming the payment of the share, a registration certificate (the apartment was received as a share in the housing cooperative);

- purchase and sale agreement, deed of gift, exchange agreement (as a result of a civil transaction);

- in the event that the apartment was registered as private property before 01/31/1998, an extract from the DPZhF will be required;

- document from the Unified State Register of Rights;

- floor plan and explication of the apartment (obtain from the BTI);

- cadastral passport indicating the cadastral value of real estate (extract from Rosreestr).

It should be noted that the above list of documents is not final. The package of documents can be supplemented during the registration process, it all depends on the specific case.

How does a notary register an inheritance?

Only after all the documents from the list are ready, contact a notary who will open an inheritance case and eventually issue you a certificate of inheritance.

Which notary can handle inheritance cases?

The question of choosing a notary is one of the frequently asked questions in the process of inheriting property. Heirs do not always have an idea of which notary they can contact to formalize their particular case.

If you are registering an apartment that is being inherited by will, then contact the notary who certified this document.

When there is no will or nothing is known about it, go to the notary who is located at the place of residence or registration of the citizen before his death. You can also visit a notary's office, which is located at the location of the main part of the property being inherited.

Who will get the privatized apartment if there are no heirs?

How to correctly register an inheritance for an apartment without a will, read here.

How an apartment is divided between several heirs, read the link:

How is the procedure for determining the appraised value of an apartment carried out?

Is there a need to evaluate the value of an apartment that is being inherited? This procedure is one of the most important in the process of registration of inheritance.

The registration procedure itself involves payment of a state fee. And its size directly depends on the cost of the apartment.

Important! The assessment of value must be made on the date of death of the owner.

The cost of the apartment can be found in several documents. First of all, it is in the cadastral passport. Next, there is another document that can also be presented to the notary, this is a document on the inventory value of real estate (issued by the BTI). In addition, there is a market value of the apartment, which is carried out by a special organization.

The organization making a conclusion about the market value of the apartment must have a special license for this activity (a copy of this document is also given to the notary).

When you present all three documents to the notary's office, the specialist usually takes into account only one of the documents. Usually the lowest cost is taken.

Drawing up an application for the issuance of a Certificate of Inheritance

A certificate can only be issued on the basis of an application.

There is no officially accepted form for this document. But when writing it you should adhere to some rules:

- In the header of the application, write down information about the addressee, namely, the name and address of the notary office where the application was sent, as well as information about you as the applicant (personal information, address);

- In the main part of the application, enter information about the deceased testator, in particular his personal data, date of death, address where he lived before death. In addition, it explains the presence of family ties between you and the deceased (kinship or dependent);

- In the next part of the application, it is necessary to list all objects that are hereditary property;

- And only after all the information described, complete your request. In this case, we mean the issuance of a Certificate of Inheritance;

- Then list the documents you are attaching to your application;

- At the end of the application, put the signature of the applicant and the date of transfer of this document to the notary.

Obtaining a Certificate

The opening of an inheritance occurs at the time of the death of the testator, and the inheritance case will be opened by a notary at the time the heirs submit the appropriate application.

The duties of the notary include a thorough examination of the documents submitted by the applicant, also determines whether the requirements of the heir are justified, and determines his legal capacity.

A certificate of inheritance is issued after the end of a six-month period from the date of death of the apartment owner.

This document has an official form established by the Ministry of Justice of the Russian Federation. The notary prepares two copies of the document, one of which is handed directly to the heir, and the second is filed in the inheritance file and kept by the notary.

At the next stage, the heir should contact the Register of Notarial Actions and put the appropriate signature there.

How is the inherited apartment registered after receiving the Certificate?

Once the Certificate of Inheritance has been issued, it must be registered.

Real estate registration is handled by the Federal Service for State Registration, Cartography and Cadastre. To register, contact the department of this service at the location of the apartment received by inheritance.

To visit the FSGRKK, prepare the following documents:

- Passport;

- Certificate of right to inheritance;

- Technical documentation for the inherited apartment.

Also submit an application for state registration of property rights in the form prescribed by law.

Registration of property rights will last no longer than 30 days. That is, after this period, you become the full owner of the inherited apartment.

Options for challenging a document

When registering a deed of gift in accordance with all the rules described in the Civil Code, the donor has the right to challenge it in the following cases:

| Causes | Description |

| The recipient has died | The document contains a clause on the return of property in the event of the death of the recipient. |

| The donated property is not taken care of. | A citizen who received property as a gift does not comply with sanitary standards and causes intentional damage to property. |

| The donor receives threats from the new owner of the property | The recipient carries out actions that threaten the life of the donor. |

| A pensioner donated his only home | The conditions for the person who decides to make a gift are clearly unfavorable. The legal authority may step in and declare the contract invalid. |

The procedure for revoking a contract takes place in court. If the donor died due to the actions of the recipient, then his relatives have the right to act as initiators of the proceedings.

General points for invalidating deeds of gift

Interested parties may apply to have the gift agreement declared illegal in the following situations:

- the deed of gift contains additional conditions;

- property is transferred to a certain category of persons.

When contacting notaries or realtors, problems with drawing up a document and registering it usually do not arise. Experts know that it is unacceptable to indicate additional conditions prohibited by law:

| Conditions | Description |

| The property is transferred into the hands of the recipient after the death of the donor. | Property is transferred posthumously only to the heirs under a will. The deed of gift is concluded during the lifetime of both parties. |

| The recipient of the property will be obliged to support the donor until the end of his days. | A document containing a requirement to care for and maintain the other party is called an annuity agreement. The deed of gift must reflect a voluntary and gratuitous desire to transfer property to another person. |

| The donor has the right to live in the transferred apartment until his death. | The registration authority will not pass the document. Such conditions are elements of the annuity contract. Exceptions are made only to single pensioners who are donating their only home. The parties must insist on the document being accepted by Rosreestr. |

Interested parties have the right to apply to the court to have the gift agreement declared void if the following categories of citizens act as the donor or recipient of the property:

| Donor | Giftee |

| Civil servants | Other persons |

| Clients | Employees of social institutions |

| Wards | Guardians and trustees |

| A legal entity wishing to preserve property during bankruptcy | Any citizen by prior agreement with the initiator of the transaction |

Consequences of donation after death

Sometimes heirs are faced with situations where, after the death of a relative, it turns out that all or part of his property was donated. In such cases, the recipient of the gift provides the heirs with a gift agreement to confirm his rights.

Heirs have the right to disagree with the testator’s gift in the following cases:

- if at the time of opening of the inheritance (death) the property has not actually been donated (there is a condition in the agreement that the recipient accepts the gift only after the death of the donor);

- if in the deed of gift the donor disposed of property that did not belong to him. Most often this concerns movable property. For example, he donated furniture from his apartment, which belonged in equal shares to his wife.

Additionally

When it is established that the gift agreement is void , this is reported to the notary who is in charge of the inheritance case. In this case, the notary is obliged to be guided by the consequences of a void transaction, which are determined by Part 1 of Art. 167 of the Civil Code of the Russian Federation, that such a transaction does not entail any consequences .

If the testator left a will with the wording according to which he bequeaths to the heirs all his movable and immovable property in certain shares, the gift for a void transaction is included in the inheritance and is distributed among the heirs in those parts determined by the testator.

If a will is drawn up for specific objects of civil rights , then the heirs inherit the inheritance due to them under the will, and the property included in the inheritance as an insignificant gift is inherited according to the rules of inheritance by law.

If the testator did not leave a will , all his property, including an insignificant gift, is inherited among the heirs according to the law.

Grounds for challenging a gift agreement by relatives

According to the law, it is impossible to challenge a document confirming the transfer of property if the donor is still alive and capable. For example, grandchildren do not have the right to sue a grandmother who wanted to give her house to a friend. In this situation, the owner of the property acted at his own discretion and has the right to do so. You can challenge a decision only in court if there are compelling reasons:

- The gift agreement violates the law.

- An imaginary or feigned transaction was made under the guise of writing a deed of gift.

- The donor is fully capable, but did not direct his actions at the time of signing the documents.

- The donee misled the owner of the property.

The deed of gift was issued illegally

The court recognizes the contract as invalid if it is registered illegally:

| Base | Description |

| The donor did not have the right to carry out any actions with the property | The initiator of the proceedings will have to find evidence and present it to the court: • A certificate of absence of property, issued by the BTI. • An act recognizing the documents on the basis of which the donor received the right of disposal as invalid. |

| The person who wished to donate the property did not obtain the consent of the second spouse | Property purchased by a husband and wife during marriage is joint property. One of the spouses has the right to enter into alienation transactions only with the consent of the other. If approval is not received, the contract may be considered invalid. The rule does not apply to personal property. |

| The donated property has several owners, one of whom did not approve the transaction. | Co-owners have the right to carry out transactions for donation, sale and rental of property only with mutual consent. An independent decision is unlawful. The degree of guilt of the recipient is assessed depending on his awareness. If the recipient of the property was aware of the events, then he is an accomplice to the crime. Otherwise, the citizen who received the gift is considered a misled victim. In the first option, the agreement is subject to cancellation, and in the second, there is a possibility that the court will recognize the new co-owner of the property share. |

| The transaction is carried out for the purpose of deception | Fraudsters can fraudulently take possession of the donor's property. For example, offering certain services in exchange for housing and other property. In court, you will have to prove the fact of deception by presenting correspondence, audio and video materials, and witness testimony. |

The likelihood of a positive outcome will increase in the following cases:

- The initiator of the proceedings is the interested person.

- Evidence is presented of the donor's unsuccessful actions to cancel the deed of gift.

The gift agreement is only a cover for other actions of the donor

According to Article 170 of the Civil Code, an imaginary or feigned transaction for the transfer of property as a gift will be canceled for the following reasons:

- The definition of “imaginary transaction” means the commission of actions that did not actually take place. For example, a man was ordered to pay debts on alimony obligations. His apartment was subject to foreclosure. Instead of transferring the property to the bailiffs, the defendant executed an imaginary transaction with his relative. According to the documents, the housing no longer belongs to the debtor, but he continues to use it. The court will invalidate such a transaction by comparing the date of drawing up the gift agreement and the date of the decision to collect the debt.

- Writing a feigned deed of gift means that another transaction is being carried out under the guise of transferring property as a gift. Such fraud is carried out due to the impossibility of including other conditions in the deed of gift, for example, the maintenance of the donor or his care. The parties secretly discuss all the nuances and draw up an agreement. Under the guise of transferring property as a gift, a sale or rent transaction is carried out, which is illegal.

The donor was not aware of his actions when drawing up the agreement

A transaction is considered void if the donor did not control his actions. The moment is regulated by Article 177 of the Civil Code of the Russian Federation:

- The citizen who donated the property is legally capable, but at the time of the transaction was not able to understand what was happening, for example, due to alcohol or drug intoxication. The donor or an interested person has the right to file a claim. The role of the latter may be a relative or a stranger who suffered as a result of the transaction.

- A gift agreement concluded shortly before the donor was declared incompetent can be legally annulled. A guardian caring for a citizen who has transferred property as a gift to a third party must file a claim in court. When considering the case, it will be necessary to prove that the ward was already incapacitated at the time the transaction was concluded. Medical examination and witness testimony will help.

The property owner was misled

Issues related to misleading the donor are regulated by Article 178 of the Civil Code. A transaction can be declared invalid if the recipient deliberately distorted information or did not provide all the information. The claim must be filed by the donor or interested party. The requirements will be satisfied only if there is evidence of a significant mistake by the owner of the property. The judge takes into account the following nuances:

- Reasons for carrying out the transaction, taking into account the financial situation and age of the property owner.

- Availability of other housing if the only apartment was donated.

- Clarification of the rights of the property owner when certifying a document at a notary office.

- The presence of a clause on the donor’s lifelong residence in the donated housing.

The procedure for challenging a deed of gift

Citizens are often interested in the question of whether an apartment under a deed of gift is disputed after the death of the donee or donor. It all depends on the circumstances of a particular case. For example, persons interested in receiving an inheritance can apply for annulment of a transaction if the real estate could be included in the inheritance mass: children, grandchildren, wives, husbands. In this case, the degree of relationship of applicants for property must be taken into account.

Important! After a divorce, a husband cannot claim his wife’s personal property. An equivalent rule also works in the opposite direction: divorce means the termination of all obligations, incl. and property, if a petition for its division was not previously submitted within the established time frame. Former spouses retain only the obligation to raise and support their common children.

Who can challenge a deed of gift

If interested parties have information about the illegality of the transaction or other grounds, they can challenge the registration of the deed of gift. The circle of such persons includes any relatives, regardless of degree (only the order is taken into account), as well as ex-wives if the transaction affects the legitimate interests of a child common to the donor.

State and municipal bodies also have the right to appeal to challenge property transactions if they have learned of a violation of the rights of minors or incompetent citizens (representatives of guardianship or social protection authorities, etc.).

Grounds for challenge

In addition to how a donated apartment is inherited and whether it can be annulled, it is important to know the grounds for challenging:

- The donor being under the influence of alcohol or drugs at the time of execution of the transaction, incapacity. According to the law, transactions on behalf of incapacitated citizens are made on their behalf only by authorized representatives. Here you will need evidence: a court decision, audio or video recordings, witness testimony.

- Concluding a gift agreement under the influence of moral or physical pressure. In this case, after examining the evidence, the court will cancel the deed of gift, and the guilty person will be brought to criminal or administrative liability depending on the severity of the act.

- Absence of written consent to the donation from the second spouse, if the gift was made out of property acquired jointly during the marriage.

Important! When going to court to challenge, you will need any evidence, even indirectly indicating the illegality of the transaction.

Grounds for recognizing a deed of gift as void

A deed of gift is considered void if it is established that it was drawn up in violation and has no legal force. This usually happens in the following cases:

- The gift agreement is filled out incorrectly: the details of the parties or the item (gift) are not indicated; content of blots and errors that significantly distort information.

- The sham of the transaction: the donation was formalized, but in fact the real estate was not registered with Rosreestr. This occurs when the donor wants to hide his property status or prevent others from inheriting property.

- Pretense of the transaction: in order to be exempt from paying state duties and taxes on income, sellers act as donors, and buyers act as recipients.

Time limits for challenging

The statute of limitations for claims to invalidate gift agreements is 3 years. The report begins from the moment of state registration. An exception is cases where circumstances of unlawful transfer of property are identified:

| Situation | Statute of limitations |

| The initiator of the proceedings was not aware of the gift agreement. | The statute of limitations begins from the moment the plaintiff learns about the gift. |

| Relatives of the donor are asking to extend the period for consideration of the case. | Extension is possible for up to 10 years. |

| The donor wants to revoke the deed of gift, but the recipient is against such a decision | The limitation period is 5 years from the date of registration of the contract. |

Third parties can submit an application to a legal authority only within one year from the moment the circumstances are identified on the basis of which it is possible to challenge the deed of gift. The following evidence is weighty for the court:

- Conclusion of a medical examination.

- Documents confirming the presence of alcohol or drug addiction.

- Certificate from law enforcement agencies.

- Receipts containing information about the date of receipt of money by the donor and their amount.

- A court decision declaring the owner of the property incompetent.

- Testimony of witnesses.

What documents are needed to formalize a deed of gift for an apartment?

For mandatory registration of a gift agreement, the documents listed in this list are required:

- passports of both parties to the transaction;

- gift agreement drawn up in 3 copies (one each for the donee, the donor and the state registrar);

- technical passport of the living space received from the BTI;

- cadastral passport;

- documents that prove the legality of the donor's ownership of the transferred property;

- extract from the Unified State Register of Real Estate;

- a certificate from the BTI with the actual cost of housing;

- an extract from the house register confirming the fact that no one else is registered in the apartment except the donor;

- a receipt confirming successful payment of the state fee established for registration of the agreement in the Unified Register;

- consent of other co-owners (optional);

- consent of the spouse (optional);

- notarized power of attorney, if the interests of one of the parties are represented by a third party;

- permission from the guardianship and trusteeship authorities (if necessary).

ARTICLE RECOMMENDED FOR YOU:

Is it possible to donate an apartment with a mortgage?

How to avoid problems

To avoid litigation, participants in the transaction must remember the main points directly related to the gift agreement:

- Independently drawing up a deed of gift in writing, especially in the absence of a relationship between the parties, often leads to litigation. The initiators of the claims are close relatives of the donor.

- When filing an application to challenge a gift agreement, the recipient does not have the right to enter into transactions to alienate property received from the donor.

- Unlike a will, a gift deed becomes effective during the lifetime of the owner of the property. The document comes into force after registration is completed and the state fee is paid.

- After the death of the donor, the deed of gift for an apartment remains valid only if it undergoes state registration. If the procedure has not been fully completed, then according to inheritance law, the relatives of the deceased can lay claim to the property.

- Intentional infliction of irreparable damage to the donated property may become grounds for cancellation of the deed of gift.

- Property tax is paid if there is no relationship between the parties. If the recipient is a resident of the Russian Federation, then you will have to pay 13%. Foreigners are subject to a tax equal to 30% of the total value of the gift.

- The donated apartment is not the subject of a dispute in the event of a divorce, since it is personal property. The exception is cases of investing money in repairs from the family budget. Property will be divided according to the amounts spent.

A deed of gift for an apartment and other property is drawn up during the life of the donor. If desired, the document can be certified by a notary to avoid controversial issues in the future. If the owner of the property dies before the contract is registered, the transaction will not be completed. The death of the donee will not be a reason for the return of property. The gift will be inherited. To challenge the deed of gift, you can go to court. The claim will be satisfied only if there are compelling reasons.

general information

Registration of a deed of gift for an apartment is the legal right of any owner. Naturally, he is obliged to take into account all the conditions for drawing up such a document, since otherwise it will be declared invalid. When drawing up a gift agreement, be sure to remember:

- The agreement cannot be concluded if the owner of the apartment is incapacitated or a minor. It is also prohibited to gift real estate on behalf of the ward to guardians.

- The deed of gift is gratuitous, so there are no additional conditions when transferring the apartment. We are talking about the financial support of the donor, receiving an apartment after his death, etc.

- It is easy to challenge a contract if it was executed with violations. For example, without the consent of the co-owner, under pressure, etc.

The document is drawn up only voluntarily and in the presence of both parties. A gift agreement cannot be executed unilaterally. By law, the recipient is required to express consent (or refusal) to accept the gift. The deed of gift must be certified by a notary. But even this is not enough for the recipient to become the owner of the living space. Both parties must register the document, after which it will receive legal force.

The gift agreement can be divided into several parts:

- Information about the parties. The passport details of the donor and recipient, place of residence and other necessary details must be indicated.

- The subject of the agreement is indicated below. When it comes to real estate, all technical information should be included.

- Special conditions. The parties can write the necessary conditions on the basis of which the apartment will be transferred. Including the conditions for the return of property.

Receiving material assets as a gift is considered as making a profit, therefore individuals are required to pay tax. Its size is 13% of the cost of the apartment. But if the recipient is a close relative of the home owner, then there is no need to pay personal income tax.

The following must be attached to the deed of gift for registration:

- certificate of payment of the state duty (its amount is 2 thousand rubles),

- deed of gift

- civil passports of the parties,

- documents confirming the donor's ownership,

- cadastral passport,

- certificate about all persons living in the living space.

If the gift agreement was drawn up without violations, it has irreversible force. That is, even the donor cannot terminate it without serious reasons. That is why many are interested in who then gets the donated apartment after the death of the donee? In this case, there are two options. Either it is inherited by his relatives, or it returns to the property of the donor.