About six years ago, the family of Anton and Vasilisa found themselves in a very difficult situation. Just imagine: Anton was set up by his business partner, saddled with a huge debt to his counterparties. At that time, Vasilisa was five months pregnant and was left without income - the trading company where she worked had completely reduced its regional branch. Plus, they already had a loan of 700 thousand rubles and a mortgage debt of about 2 million rubles.

The situation was further aggravated by the fact that a month after the birth of the child, Vasilisa’s mother became seriously ill. Treatment required funds that were unaffordable for the family. Loan debts continued to accumulate, and the couple had no choice but to turn to the bank for help.

The lender was sympathetic to their situation. With the permission of the bank, the spouses sold the collateral in order to completely close the first loan, and contributed the rest of the amount to partially repay the mortgage. After which they forgot about payments for two years.

The family moved from a mortgaged apartment to a rented one. Both their phone numbers had changed and the bank was unable to contact the defaulters directly.

When the financial situation leveled out a little, Anton himself turned to the bank to find out how things were going with the loan. And, to my horror, I found out that during this time huge fines and penalties had accumulated, which the family was not able to pay off, given the presence of other debts.

After consulting, the couple decided to file for bankruptcy.

On what grounds can you become bankrupt?

The bankruptcy procedure for individuals in the Russian Federation is described in Chapter 10 of Federal Law No. 127 of October 26, 2002. Federal law applies to all types of debt, including mortgages, consumer loans, or car loans. However, personal bankruptcy will not get rid of some other debts, for example, alimony obligations or compensation for health damage.

Individuals can obtain bankrupt status by court decision starting in October 2015. From September 2021, people can be declared bankrupt without going to court.

Bankruptcy is possible if:

- An individual does not have the ability to repay all debts to creditors within the prescribed period. At the same time, your own property and income received will not be enough to fulfill your obligations.

- The amount of the debt exceeds 500 thousand rubles, and the delay in payment is more than 3 months after the due date of the next payment. Moreover, if a person does not have any ways to improve his material well-being or property to pay off debts, declaring bankruptcy becomes mandatory. The process goes through the court, where the debtor independently submits an application within 30 days. If you are late in filing an application, the court will issue a fine in the amount of 1,000 to 3,000 rubles. In addition to the debtor himself, creditors or the tax service can sue for bankruptcy of an individual.

- The amount of an individual’s debt ranges from 50 thousand to 500 thousand rubles, and the bailiffs did not find any property with which to cover the obligations. In this case, out-of-court bankruptcy is possible.

Before bankruptcy begins, the court will verify that the applicant:

- a conscientious borrower and has made attempts to independently resolve the situation with creditors; for example, written correspondence with the creditor is suitable for confirmation;

- does not hide income and property;

- is looking for sources of income, does not give up trying to get a job, and is registered at the labor exchange.

In Russia, persons without Russian citizenship will not be able to go through the personal bankruptcy procedure.

Procedures (stages) of bankruptcy

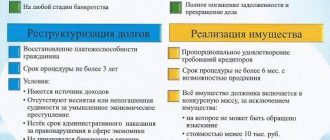

The following bankruptcy procedures exist for individuals:

- debt restructuring,

- sale of property,

- conclusion of a settlement agreement.

It is advisable that you be accompanied by a lawyer (or better yet, a bankruptcy lawyer) in all these procedures. He will help you draw up a restructuring plan, when selling property, he will achieve exclusion from the register of property that cannot be foreclosed on, and he will protect the transactions you made on the eve of bankruptcy from challenge.

Restructuring

From the date the court issues a ruling on the introduction of debt restructuring, the following consequences occur:

- a moratorium on satisfying creditor claims is introduced;

- the accrual of penalties and interest ceases;

- previously imposed arrests and other restrictions on the disposal of property are lifted;

- Only with the consent of the financial manager can you make transactions for the acquisition and alienation of property worth more than 50 thousand rubles, for obtaining and issuing loans, obtaining loans, and transferring property as collateral.

Restructuring a citizen's debts is aimed at restoring his solvency by changing the terms and conditions for fulfilling monetary obligations.

Restructuring is introduced only for citizens who:

- have a stable income,

- have no criminal record for economic crimes,

- have not committed administrative offenses, such as theft, deliberate bankruptcy,

- Over the past five years, they have not undergone bankruptcy proceedings, and over the past 8 years, they have not undergone debt restructuring.

For example, Resolution of the Arbitration Court of the Moscow District dated July 27, 2021 in case No. A41-65821/2020. The citizen asked to introduce a procedure for the sale of property in relation to her, but the loan introduced a procedure for debt restructuring. In support of the cassation appeal, she points out that she does not have a higher education, sufficient work experience, and has no income, and therefore a debt restructuring plan cannot be approved for her, but at the same time she is registered with the labor exchange. In this connection, the court decided that it was likely that she would be employed and that her solvency would be restored.

Restructuring plan

The restructuring is carried out based on the plan. The plan may be proposed by the debtor himself or by creditors. The draft plan must be submitted to the financial manager no later than 10 days after compiling the register of creditors' claims. The plan must be approved by a meeting of creditors and approved by the court. The maximum period for its implementation is 3 years.

During the execution process, the plan may be changed or canceled by a court ruling. No later than a month before the expiration of the plan, the financial manager is obliged to prepare a report on the results of its implementation and send it along with documents to bankruptcy creditors and to the court.

Sale of a citizen's property

If restructuring cannot be carried out in relation to the debtor or the plan has not been provided or approved, then the sale of property is introduced for a period of no more than six months, which can be extended by the court.

The sale of the debtor's property is the sale at auction of a citizen's property and the repayment of creditors' claims using the funds received in proportion to their debt in the order of legal priority.

Out of turn, the claims of creditors for current payments are repaid at the expense of the bankruptcy estate.

Register requirements are satisfied in the following order:

- First of all, damage to life and health caused by the debtor is compensated, and alimony is paid;

- secondly, severance pay and wages of the debtor’s employees are paid;

- thirdly, settlements are made with other creditors.

All of a citizen’s property and income constitute the bankruptcy estate. The bankruptcy estate may include the property of a citizen, constituting his share in the common property, which may be foreclosed on in accordance with civil law and family law. The creditor has the right to make a demand for the allocation of a citizen’s share in the common property in order to foreclose on it.

The bankruptcy estate does not include:

- the only living space

- the land underneath it,

- household items, with the exception of luxury items,

- child support,

- pensions and benefits,

- funds in the amount of the subsistence level for the debtor himself and his dependents.

The court also has the right to issue a ruling on a temporary restriction of the right to leave the Russian Federation until the date of the ruling on the completion or termination of bankruptcy proceedings.

For more details about the composition and inclusion in the bankruptcy estate, read the article

Settlement agreement

The settlement ends the bankruptcy case. It can be concluded during any bankruptcy procedure.

The settlement agreement determines the procedure for repaying the debt, is concluded between the debtor and the bankruptcy creditors and is approved by the arbitration court.

If the debtor does not comply with the terms of the agreement, then the bankruptcy case is resumed and the sale of property is introduced against the debtor.

What are the consequences of bankruptcy through court?

Carrying out the process of personal bankruptcy of an individual through the court will cause different consequences for the debtor:

| Positive | Negative |

| Accumulated debts will be written off, and you will no longer have to communicate with creditors and collectors regarding already accumulated debts | Bankruptcy status affects business reputation. Some employers do not want to cooperate with such persons. In addition, the bankrupt will be denied a loan for at least 5 years |

| The debt will stop increasing. The creditor will suspend the accrual of late fines, penalties, penalties and any other sanctions against the debtor | During the bankruptcy procedure, the debtor will have limited access to property and finances. Most often, you will be able to spend no more than 50 thousand rubles per month. Disposition of the remaining income will go to the financial manager |

| Creditors will not take more than the accumulated debt. They will not be able to seize personal belongings that are necessary for the debtor’s life, and the only living space, unless it is pledged under a mortgage | It is prohibited to cross the border during the bankruptcy procedure. You can travel outside the Russian Federation only for a good reason and with the consent of the participants in the trial |

| Even if it is not possible to pay off all debts due to the fact that there are not enough funds from the sale of property and other income, the debt will be written off and there will be no more obligations. This does not apply to alimony and other non-creditor payments. | After being declared bankrupt, you cannot go through the bankruptcy procedure again for 5 years through the court and 10 years out of court. |

Additional disadvantages of declaring bankruptcy:

- You cannot hold leadership positions or take part in the management of the organization for 3 years;

- with the status of “bankrupt” you cannot act as a co-borrower or guarantor for 5 years.

The debtor pays for bankruptcy proceedings through the court. The total costs of the process reach tens or even hundreds of thousands of rubles and may be beyond the means of some citizens.

Creditors or the Federal Tax Service file a lawsuit to declare the debtor bankrupt only because in this way they will be able to at least partially compensate for their losses.

Appointment of a financial manager

The functions of coordinator between all participants in the bankruptcy process of an individual are performed by the financial manager. This is a specialist in the field of crisis management, who has the appropriate education and is a member of a specialized self-regulatory organization. Its main task is to maintain a balance of interests of the debtor and creditors.

A complete list of SRO arbitration managers operating in Russia is posted on a specialized federal Internet resource - EFRSB.

The choice of a financial manager should be approached very responsibly, since the efficiency and results of the practical implementation of the event directly depend on him. The main criteria for selecting a specialist are as follows:

- work experience;

- presence of disqualifications;

- duration of previous bankruptcy procedures.

The choice of an unprofessional financial manager or a poorly built relationship with him is fraught with several negative consequences:

- delaying the deadline for declaring a debtor bankrupt to one and a half to two years instead of the usual six to nine months;

- bringing into the case the property of a spouse of an individual;

- establishing signs of deliberate financial insolvency;

- withdrawal from bankruptcy proceedings without announcing reasons (this right is granted to the financial manager by current legislation).

Stages of bankruptcy through court

Bankruptcy of an individual through the court consists of several stages:

- filing an application with the court;

- court hearing;

- making a decision.

The entire process from filing an application to being declared bankrupt lasts from 7 to 10 months. When using a restructuring plan and other stages, the procedure may take much longer.

The maximum restructuring period is 3 years. The process of selling the debtor's property lasts up to 6 months, but can be extended at the request of creditors. Therefore, the final period can last up to 3-4 years.

Submitting an application

A citizen of the Russian Federation is declared bankrupt by decision of the Arbitration Court. To start the process you will need:

- Write a statement declaring yourself bankrupt.

- Submit documents on accumulated debts.

- Attach evidence of your financial insolvency.

The statement describing the debt indicates:

- volume and period of arrears on debts;

- names of creditors in the approved form;

- loan agreements and other documents confirming debts;

- information about existing property;

- reasons that influenced the deterioration of financial condition;

- the name of the self-regulatory organization that will appoint a financial manager for the period of the bankruptcy procedure;

- receipt of payment of state duty;

- a receipt for depositing 25 thousand rubles to pay for the services of the financial manager or a petition to defer the payment of money until the court date, if necessary by the applicant.

The application also includes information about income and assets in Russian and foreign banks. In some cases, you can enter into the text the maximum amount that the debtor is willing to spend on the services of a financial manager during the personal bankruptcy procedure.

You can submit an application to the Arbitration Court in person at your place of registration or through the State Services portal.

Judicial review

At the request of the debtor or creditors, the Arbitration Court schedules a court hearing. If a person is able to prove that he does not have the ability to repay the debt and the situation will not change significantly in the near future, the court will begin proceedings. If an individual fails to do this, the bankruptcy application will be rejected.

The court will definitely check the financial situation of the debtor, real income and property owned. If the court suspects that a fictitious bankruptcy is being carried out, the individual faces administrative, and in especially serious cases, criminal liability. This is possible if a person tries to mislead the court, hide his real income or property.

When checking the debtor's position, the financial manager may recommend that the court invalidate some dubious transactions. Usually we are talking about transactions that were concluded within the previous 3 years. They could be:

- sale of property at a reduced price

- sale of property to persons who are related to the debtor;

- donation of property.

Most other transactions are not cancelled, but creditors can challenge their legality in court.

Bankruptcy process

After the application for bankruptcy is accepted, fines and penalties are no longer accrued for the applicant’s debts. The bank, collectors or other creditors will no longer be able to demand anything or even contact the debtor. All issues related to debts will go to the financial manager, who is registered with the SRO on the website of the Central Bank of the Russian Federation.

Depending on the agreements reached between the creditor and the debtor, one of three options is possible:

- Settlement agreement. If the parties reach a compromise, they can sign a settlement agreement at any time before filing for bankruptcy. Communication takes place through the financial manager. Some creditors make concessions: they agree to write off a certain part of the accumulated debt or provide a deferment of payments. In case of a settlement agreement, the bankruptcy procedure is suspended, the financial manager’s powers are removed, and the debtor begins to fulfill the terms of the agreement.

- Debt restructuring is possible for a maximum of three years. At the same time, the person must not have an outstanding conviction for economic crimes or other bankruptcy for 5 years. In addition, the applicant's debts must not have been restructured in the previous 8 years and he has regular income. During the restructuring, the debtor cannot manage the money in his accounts, except for the amount of 50 thousand rubles. If this money is not enough, the court may increase the amount. When paying off debts under the restructuring plan, there will be no recognition of bankruptcy. If the plan fails to be implemented, the third stage begins.

- Sale of property. This stage occurs if neither the first nor the second option worked. After the debtor is declared bankrupt, his property is sold to cover his obligations to creditors. The financial manager, together with creditors, determines the deadline and the competitive list of property that will be sold. The debtor will be left with personal household items and the only housing that is not under a mortgage. The money from the sale of property will be given to creditors; if there are more debts than the proceeds, they will be written off.

After the sale of the property, the court, based on the report of the financial manager, completes the bankruptcy procedure. After this, the former borrower no longer owes anything to his creditors and receives bankrupt status.

Step-by-step instructions for filing an application by a debtor

To initiate bankruptcy proceedings, follow these instructions:

Step one. Assess the presence of the above conditions for declaring you bankrupt.

There are a number of undesirable and even dangerous transactions for the debtor.

Thus, you cannot give real estate, vehicles and other valuable property or sell them to relatives and friends at a reduced price. You cannot pay off a debt to one of the creditors if there are outstanding claims of other creditors. All these transactions will be subsequently challenged and declared invalid.

For example, Resolution of the Moscow District Arbitration Court dated July 30, 2021 in case No. A40-54287/2018. The ball declared the apartment donation agreement invalid. The apartment, although it was registered in the name of the debtor’s wife, was jointly acquired property. There is no evidence that the apartment was purchased by the debtor's wife with personal funds that belonged to her before marriage, or from the sale of property received as a gift or by inheritance.

A complete list of such transactions is presented in the article.

Attention!

To assess the prospects of your case, contact a qualified lawyer at the first sign of insolvency.

He will analyze your situation and suggest further steps.

The lawyer will warn against making transactions that may later be challenged by the financial manager. It will also help you decide what is best in your situation : initiate bankruptcy proceedings or try to solve the problem in other ways (agree with creditors on installment plans or deferred payments, request mortgage holidays).

Order an assessment

A qualified specialist will tell you about the consequences of bankruptcy and assess the possibility of losing your only home.

In addition, a number of claims are not satisfied in bankruptcy (alimony, compensation for damage to health and property, bringing to subsidiary liability for the debts of one’s own or the company headed). Therefore, if there are no other debts besides these, then it is not advisable to submit an application.

Step two. Preparing a bankruptcy petition

Prepare an application for declaring you bankrupt and collect the necessary documents.

In your application please indicate:

- name of the arbitration court (at your place of residence),

- your name, address, phone number,

- the amount of creditors' claims,

- amount of debt,

- information about your property,

- name and address of the self-regulatory organization of insolvency practitioners.

Please attach to your application:

- receipt of payment of state duty (300 rubles),

- a receipt for sending copies of the application to creditors,

- a receipt for depositing money with the court,

Attention! Deposit funds with the court (25,000 rubles) to pay remuneration to the financial manager. Another person can contribute them for you. You also have the right to request a deferment pending a review of the validity of your application.

- copy of passport, SNILS, INN, certificate of presence/absence of registration as an individual entrepreneur,

- documents confirming the existence and amount of debt (agreements, certificates, payment schedules, claims, court decisions, payment requests),

- list of creditors,

- inventory of property and documents confirming ownership of it,

- information about income (certificate in form 2-NDFL, work book, certificate from the Pension Fund or certificate from the Employment Center about the status of unemployed),

- copies of documents confirming marital status, presence of children, marriage contract (if any),

- information about bank accounts,

- documents on transactions completed over the past three years,

- other documents.

To avoid making mistakes at the very beginning, contact a qualified lawyer to draw up an application. He will take into account all the nuances and help you collect all the necessary documents, as well as select SRO insolvency practitioners.

List of all bankruptcy documents in one file

List of documents for the debtor

View document

Application for declaring an individual bankrupt. 2021 template

Step three. Submission of an application by the debtor

Submit an application to the arbitration court at your place of residence in one of the following ways:

- by mail,

- by contacting the court office,

- in electronic form through the My Arbitrator system

The court verifies the validity of the application within a period of 15 days to 3 months.

The court may make one of the following rulings:

- On recognition of the said application as justified and the introduction of restructuring of the citizen’s debts;

- On recognizing the said application as unfounded and leaving it without consideration;

- On recognizing the said application as unfounded and terminating the bankruptcy proceedings of the citizen.

The arbitration court will make a ruling recognizing the application as unfounded if:

- the claims of the bankruptcy creditor or authorized body are satisfied or found to be unfounded,

- the requirements are not confirmed by a judicial act that has entered into legal force,

- There is a legal dispute between a creditor and a citizen.

If in this case there is another application for bankruptcy, then the court will leave the application without consideration, if there is no application, it will terminate the case.

In addition, the case will be dismissed unless the citizen’s insolvency is proven.

Attention! For fictitious or deliberate bankruptcy the following are provided:

-administrative (Article 14.12 of the Code of Administrative Offenses of the Russian Federation); -criminal liability (Articles 196, 197 of the Criminal Code of the Russian Federation).

What are the costs of pursuing bankruptcy through court?

Personal bankruptcy of an individual through the court is a paid procedure. The list of costs includes:

- state fee of 300 rubles, which must be paid before filing an application with the court;

- a fee of 400 rubles for each publication of information in the EFRSB, this could be information about restructuring, bidding or a court decision;

- expenses for document flow between government agencies and creditors through postal delivery;

- publication of information about the stages of the process in the Kommersant publication for 7,000 - 12,000 rubles each;

- payment for the services of a financial manager from 25,000 rubles for each stage of bankruptcy;

- in most cases, 7% of the amount of debts that the manager was able to return to creditors is added to the fixed fee for the services of the financial manager.

Bankruptcy of an individual by court will cost the debtor at least 45,000 rubles, but in most cases the price reaches 90,000 - 120,000 thousand. Extrajudicial bankruptcy can be carried out free of charge.

Sale of the debtor's only home in bankruptcy

If the borrower at fault was unable to peacefully resolve the debt issue with the bank, the collateral and other valuables are subject to sale. First, a financial expert evaluates the apartment, then he draws up a list of property and sets a date for the auction.

After the sale of a mortgaged apartment, no more than 80% of the proceeds go to pay off the mortgage and other debts, the remaining funds go to pay legal costs. If there is money left after satisfying creditor claims, it is returned to the client. In reality, the amount of debt often exceeds the market value of the mortgaged apartment. The uncovered loan balance is written off by the bank.

This situation makes it possible to buy your apartment at a debtors’ auction at a reduced price (a bankrupt can take advantage of the first right of redemption).

When can you avoid going to court?

From September 1, 2021, every Russian can submit an application for simplified bankruptcy to the MFC. This opportunity arose because when conducting an inventory of property, 70-80% of bankruptcy applicants did not have any property identified. At the same time, it is necessary to pay for the judicial procedure, and not all citizens who have fallen into debt bondage have this opportunity.

With the help of bankruptcy, without involving the Arbitration Court, debts on credits, loans, taxes, car fines, and court debts are written off. At the same time, obligations for alimony or compensation for damage to property or health will remain.

You can be declared bankrupt without going to court if three conditions are met simultaneously:

- The amount of accumulated debt is from 50 thousand rubles to 500 thousand rubles, including accrued interest, penalties, penalties and any other penalties. If the amount of debt exceeds 0.5 million rubles, you will have to go to court.

- One of the creditors has already tried to compensate for their losses, but the bailiffs did not identify income or property from which this could be done. At the same time, court proceedings are closed at the time of filing an application for out-of-court bankruptcy. If the FSSP continues the process, the MFC will reject the application.

- None of the creditors went to court again for debt compensation, provided that previous attempts were unsuccessful and there are no open cases against the debtor. The availability of enforcement proceedings can be checked on the FSSP website or through State Services.

If at least one of the listed conditions is not met, bankruptcy proceedings can only be carried out in court.

What awaits co-borrowers during bankruptcy?

If the borrower is declared bankrupt in court, then his debt obligations to the bank remain in the same amount, but are transferred to the co-borrower or guarantor.

This happens according to the following algorithm:

- During the procedure for declaring a borrower insolvent, the debt is partially written off by covering it with funds received from the sale of property or restructuring of the unpaid amount on the mortgage. After declaring a client bankrupt, the credit institution has no right to make any demands on him.

- If the debt is not fully repaid, the balance must be covered by the co-borrower of the bankrupt client.

Expert opinion

Irina Bogdanova

Expert in the field of mortgage lending.

This can be avoided in the event of bankruptcy of the co-borrower. Therefore, both need to file a claim. Since a marriage partner is often a co-borrower on a home loan, you should file for bankruptcy together.

Bankruptcy of a co-borrower

What awaits the main borrower if a co-borrower is declared financially insolvent:

- the banking organization will demand that the debt be repaid ahead of schedule so as not to lose money if the borrower becomes insolvent;

- in case of delays, the lender puts the collateral property up for auction to compensate for losses;

- the organization that provided the housing loan asks the client to officially confirm income and checks whether it is sufficient to make monthly loan payments;

- The bank recommends changing the co-borrower (guarantor).

That is why you should not skimp on insurance when applying for a mortgage. Then, in unforeseen situations, the debt burden will fall on the company from which the borrower purchased the policy.

Difference between judicial and extrajudicial bankruptcy

The judicial and extrajudicial bankruptcy procedures differ in several parameters:

| Parameter | Through the Arbitration Court | Without trial |

| Where to apply | To court | At the MFC |

| Availability of expenses for bankruptcy of an individual | Eat | No |

| Amount of accumulated debt | There are no restrictions on the maximum amount of debt to creditors, but not less than 500,000 rubles | Debt range from 50,000 rubles to 500,000 rubles |

| Additional conditions for other enforcement proceedings | No conditions | Enforcement proceedings must be terminated at the time of filing the application with the MFC |

| Duration from filing an application to being declared bankrupt | From several months to 3-4 years | 6 months |

The consequences for a bankrupt are the same, and they do not depend on the method of carrying out the procedure.

Who is this procedure suitable for?

The institution of personal bankruptcy has been developed in many countries, but in the Russian Federation, until recently, only legal entities could declare themselves insolvent (bankrupt).

Declaring yourself bankrupt is not as easy as it seems at first glance, because you will have to part with your property. Therefore, before starting bankruptcy proceedings and collecting documents in court, you need to analyze your situation and make sure that this case is legally compatible with insolvency law.

In what cases can you file for bankruptcy?

- The amount of debts to creditors must be at least 500,000 rubles;

- The period of the admitted overdue debt is at least 3 months;

- When repaying a debt with monthly payments, a person is left with an amount less than the subsistence level;

- Bankruptcy of a deceased citizen when inherited debts remain

According to the Federal Law on Insolvency (Bankruptcy), every citizen of Russia can recognize himself as uncreditworthy. An exception is some categories of debtors:

- persons previously declared bankrupt (less than 5 years ago);

- persons who have undergone a debt restructuring procedure over the past 5 years;

- citizens with a criminal record for financial and economic crimes (outstanding).

Also, persons who have been held liable for deliberate or fictitious bankruptcy will not be able to declare themselves bankrupt.

Consequences of bankruptcy without trial

An out-of-court bankruptcy procedure will lead to both positive and negative consequences for the debtor. Most of them are the same as in the trial:

| Positive | Negative |

| Creditors or collectors will not contact the debtor until the simplified bankruptcy procedure is completed | For 6 months before the completion of the extrajudicial bankruptcy procedure, the applicant will not be able to become a borrower, guarantor or co-borrower |

| After the commencement of simplified bankruptcy, none of the debts listed in the application will be able to be collected through the court. | Bankruptcy status remains for 5 years. During this period, most lenders will refuse to issue loans and loans. |

| Lenders will stop charging fines and penalties, so the debt will not be greater than at the time of filing the application | After being assigned bankrupt status, you cannot carry out the procedure for repeated extrajudicial bankruptcy for 10 years and through the court for 5 years |

| The status of “bankrupt” will be assigned 6 months after filing the application. The procedure cannot last longer than this period | Managerial positions are prohibited for up to 3 years after bankruptcy |

| Extrajudicial bankruptcy is free for the debtor | A bankrupt person is prohibited from taking part in the management of a legal entity for 3 years. |

Additional restrictions for a bankrupt are that he will not be able to hold positions in the management bodies of a credit organization for 10 years and 5 years if we are talking about an insurance company.

How to pay all the bills and not go out on the street?

Given their decreased incomes, Russian citizens are trying to get rid of debt slavery at any cost. A clear trend is being observed: people have stopped taking out new loans and are trying to pay off existing ones: at the beginning of the year, 17% less new loans were issued than old ones were repaid (this data was provided by the United Credit Bureau).

Citizens are paying off excess loans, trying to pay off at least one of them. In the country, approximately 15 million people are servicing more than two loans at once, but their number is rapidly decreasing. This is not surprising, because the more loans the payer has, the more difficult it is to repay them all.

In such a situation, there is a benefit from restructuring: a citizen has the opportunity to get rid of an excessive debt load and “calmly” pay to someone who can still do it. Banking institutions also benefit from the procedure - they get a chance to repay part of the debt. Restructuring is impossible for those citizens who have an outstanding conviction for economic crimes, with certain types of administrative offenses, as well as those who have already been declared bankrupt within five years before the restructuring.

Stages of bankruptcy of an individual without going to court

Extrajudicial bankruptcy of an individual consists of three stages:

- submitting an application to the MFC;

- making an entry in the EFRSB;

- carrying out bankruptcy without involving the court.

Simplified bankruptcy cannot last more than six months, so all stages go faster than with the participation of the court.

Contacting the MFC

When carrying out a simplified bankruptcy procedure, the application is submitted through the MFC. Attached to it is a list of all known debts, in the prescribed form.

There is no point in keeping silent about any debts or, on the contrary, exaggerating them; all data will be double-checked. If you do not indicate any of the creditors in the application, after the personal bankruptcy procedure, the individual will remain a debtor to them.

Entering data into the bankruptcy register

Within 1 working day, the MFC will check:

- the amounts of debts to creditors indicated in the application;

- whether bailiffs tried to collect debts;

- whether enforcement proceedings have been completed on the FSSP website.

If errors are identified in the data, the MFC will return a statement explaining the reasons within 3 business days. A repeated application can be submitted only after a month.

If no errors are identified during the check, the MFC will enter the information into the EFRSB within 3 working days. After this, the process of bankruptcy of an individual will begin. Information about the start of extrajudicial bankruptcy will be sent to:

- in the FSSP;

- the court at the place of residence of the applicant;

- banks in which the applicant’s accounts and deposits are open.

The accrual of fines and penalties will stop for all debts that were indicated in the application.

Carrying out extrajudicial bankruptcy procedures

If within 6 months after making an entry in the EFRSB, the applicant’s financial situation improves - an inheritance or a lottery win appears, the income can be used to pay off debts. The debtor is obliged to notify the MFC of any financial and property changes within 5 working days from the date of their occurrence.

All creditors who are indicated in the application for extrajudicial bankruptcy may from time to time request information about the debtor from Rosreestr or the tax office. This procedure is provided so that a person cannot hide changes in his financial or property situation.

If within 6 months creditors appear who are not listed in the application, they can sue the potential bankrupt. The creditors listed in the application can also go to court if it turns out that the debtor:

- underestimated the amount of debt and did not meet the limits sufficient for out-of-court bankruptcy;

- hid any property;

- did not send information about the improvement in financial situation to the MFC.

If the court recognizes the creditor's appeal as justified, the out-of-court bankruptcy will be suspended. After this, an individual will not be able to file for bankruptcy out of court for 10 years.

If no violations on the part of the debtor or changes in his income and property occur within 6 months, a confirmation will appear in the Unified Federal Register of Bankruptcy Information. The individual will be given bankrupt status and all debts included in the application will be written off.

Main stages of the procedure

The entire bankruptcy procedure for a citizen can be divided into 4 stages that must be completed in order to be freed from debts:

- Collection of documents, preparation, filing an application to the court.

- Court hearing on the case. At the first meeting, the court determines how appropriate it is to conduct bankruptcy proceedings. A financial manager is also appointed here.

- Restructuring. The point of this process is to agree on a payment schedule to repay debts to all creditors. This stage can be skipped if the court grants the relevant petition, since a citizen’s income does not always allow one to calculate such a schedule.

- Sale of property. The final stage of the procedure. The financial manager initiates auctions at which the citizen’s property (bankruptcy estate) is sold. The proceeds go to pay off the debts of the creditor; if there is not enough money, the remaining debts are written off. If there is no property and income at all, no auction is held, and debts are almost always written off - except in cases of deliberate bankruptcy.

Debts are considered closed 6 months after the sale of a citizen’s property. However, there are a number of debts that cannot be written off through bankruptcy: alimony, compensation for physical and moral harm, debts on subsidiary liability.

What debts will not be relieved by bankruptcy of an individual?

During the bankruptcy process, a person’s debts will not be written off:

- for compensation for harm to life, health, moral damage and alimony;

- for payment of wages and severance pay;

- when brought to subsidiary liability;

- for compensation for losses that were intentionally or carelessly caused to a legal entity of which the person was a participant;

- for compensation for damage to property caused intentionally or through negligence.

Extrajudicial bankruptcy will not get rid of debts either:

- not included in the list of debts to creditors, which was attached to the application for extrajudicial bankruptcy;

- appeared during the period of extrajudicial bankruptcy.

In addition, a person will not be released from debts if any of two circumstances arise:

- The bankruptcy was recognized as fictitious and a criminal case was initiated on this fact.

- It was revealed that the applicant had committed fraud, evaded payment of debts, provided false information to creditors, and disposed of or concealed his property.

If you are inattentive to the process or try to mislead the court, you may not only not receive bankruptcy status, but even become accused in a criminal case.

How to keep a mortgaged apartment during bankruptcy

There are several ways to avoid losing your apartment during bankruptcy proceedings:

- involve the board of trustees (if minor children live in the residential area, then until they turn 18, the apartment remains at the disposal of the bankrupt person);

- take a loan from a private company and buy an apartment at a bankruptcy auction at market value;

- resort to debt restructuring, which will allow it to be repaid according to a newly developed scheme (the process can last up to 3 years);

- refuse to pay the mortgage, then the debt obligations will be transferred to the co-borrower and the guarantor.

Even government benefits will not help in the fight with banking structures for an apartment mortgaged, for example, maternity capital used as a down payment.

The only amendment: the guardianship and trusteeship authorities will take part in the case. Children must be allocated a share of at least 8% of the total living space. But in practice this rarely happens.

What is considered the only residence?

The only housing is considered to be where the debtor and his family can live all year round in decent conditions. If we refer to Article 446 of the Code of Civil Procedure, such living space must be withdrawn from the bankruptcy estate at the auction of the debtors. An exception, according to paragraph 1 of the mentioned article, is the subject of a mortgage, which is not considered the only dwelling.

Expert opinion

Irina Bogdanova

Expert in the field of mortgage lending.

The mortgaged apartment is subject to sale, and everyone living in it (even minor children) will be forcibly evicted.

Will the apartment be taken away from the mortgage debtor?

Many unscrupulous borrowers believe that if the mortgaged property is their only home, then it will not be taken away to pay off the debt. In fact, this rule does not apply to the pledged object, and it is not excluded from the bankruptcy estate (Article 131 of Law 127-FZ “On Bankruptcy” dated October 26, 2002).

Expert opinion

Irina Bogdanova

Expert in the field of mortgage lending.

An encumbered apartment is not fully the property of the borrower until he pays the bank. He can use it, but has no right to sell it or give it to anyone.

Such an object is recovered in accordance with the norms of the Civil Procedure Code, Federal Law No. 138, Art. 446, as well as on the basis of the provisions of the “Mortgage Law” No. 102-FZ.

How can you save your mortgaged home before bankruptcy?

There are several options that will help the borrower save mortgaged housing without going through bankruptcy:

- Apply for a credit holiday - a temporary deferment of payments until the financial situation stabilizes. Perhaps the bank will make concessions and agree that the client will pay only interest for a certain period.

- Resort to loan refinancing - recalculating the mortgage loan at a lower rate or extending the installment period. Many banks do not refuse this to bona fide borrowers. Options for refinancing:

Bank Loan amount, up to Bid Mortgage term up to 30,000 rub. from 9.8% up to 30 years old Go up to 30,000 rub. from 8.7% up to 25 years Go up to 30,000 rub. from 8.7% up to 25 years Go

- Restructure a loan - change the mortgage payment schedule, extending payments over a longer period. As a result, monthly payments are reduced, and the client can pay off the debt without harming the family budget.

- Take advantage of installment payments through government support. Families with small children, participants in military operations and other socially vulnerable citizens have the right to subsidies in the amount of 30% of the amount of debts.

Is it possible to save real estate during bankruptcy proceedings?

The only chance to save a mortgaged apartment (house) during the bankruptcy process is to go for restructuring. If the payment schedule is changed by the court or directly by the bank, the borrower will not receive bankrupt status, and his property will not be sold at the debtors’ auction.

This procedure is available to the borrower under the following conditions:

- there are no outstanding economic convictions;

- you have income that allows you to pay off your mortgage loan under the new scheme;

- over the previous 8 years, the citizen has not resorted to loan restructuring;

- for the last 5 years he has not initiated bankruptcy proceedings.

The parties can also sign a peace agreement. After it is approved in court, the procedure for declaring the borrower insolvent is suspended.

Summary

Proceeding through the courts for personal bankruptcy is an expensive procedure that may be too large for some debtors. Therefore, if all the conditions for the simplified procedure are met, you can resort to it, then there will be no costs.

It is not easy for any bankrupt to restore his reputation, regardless of whether he went through a judicial or extrajudicial process. The worst thing is if a person needs borrowed money. Information about damaged credit history is stored in the Credit History Bureau for at least 10 years from the date of the last payment. However, from 2022 this period will be reduced to 7 years. Therefore, bankrupts will be able to start a new financial history with a clean slate if they do not take out loans or accumulate other debt obligations for 7 years after bankruptcy.

Read about what a debt hole is and how to get out of it without bankruptcy.

Who is recognized as unemployed from the point of view of the law?

The status of unemployed in the Russian Federation has both official and unofficial character. In a broad sense, any person who is left without work is unemployed. From a legal standpoint, everything is somewhat more complicated.

Law No. 1032-1 On employment in the Russian Federation

Article 3. Procedure and conditions for recognizing citizens as unemployed

- Unemployed are considered able-bodied citizens who do not have a job or income, are registered with the employment service in order to find suitable work, are looking for work and are ready to start it.

Source

To obtain official unemployed status, a person must register with the employment service and go through the procedure for recognizing a citizen as unemployed:

- Contact the Employment and Employment Center at your place of residence with an application for the provision of government services to assist in finding a job.

- Within 10 days, contact 2 employers who will be provided by the Employment Center.

- On the 11th day, the employment service makes a decision to recognize the person as officially unemployed. A copy of the decision is given to the unemployed citizen.

In 2021, this can be done online through government services.

The status of unemployed provides a citizen with the opportunity to receive unemployment benefits, material support from the state and certain benefits, while in no way preventing him from applying to the court to declare him bankrupt.

The unemployed should not be confused with disabled citizens. These are two different statuses. Disabled citizens are a separate category of persons who cannot work due to age or health status: disabled people, people who have reached retirement age.

Anyone who is not able to work can become unemployed and declare themselves bankrupt, but the court will not have questions about the lack of work for those who are not able to work, so it is not necessary to register with the Central Bank. The right to bankruptcy is not tied to employment and, in general, to the availability of income. We talked in separate notes about the bankruptcy of a pensioner and a disabled person.

FAQ

How many times can an individual become bankrupt?

You can obtain bankrupt status once every 5 years, when the procedure is carried out through the court, and once every 10 years, in case of extrajudicial bankruptcy. If we take into account the period for carrying out the entire procedure, the period between bankruptcies will be even longer.

What happens if debts exceed 500,000 rubles and an individual does not file for bankruptcy?

According to the bankruptcy law, the debtor is obliged to file for personal bankruptcy if the debt has reached 500,000 rubles, and he realizes that he will not be able to return it by the deadline established by the contract. If you do not comply with this norm, you will be fined from 1000 to 3000 rubles. It will have to be paid if you file for bankruptcy after the expiration of 30 days or in the case where bankruptcy is initiated by creditors or the Federal Tax Service.

Can a pension, scholarship or any other social benefits be taken away to pay off bankruptcy debts?

All income of the debtor, during bankruptcy proceedings through the court, goes to a single account, which is controlled by the financial manager. If the benefit is the only source of income and it does not exceed the subsistence level, no one will apply for it.

Can guarantors and co-borrowers suffer from bankruptcy proceedings for an individual?

And both the guarantor and the co-borrower will suffer during the bankruptcy procedure. The guarantors are responsible for the debts of the borrower as well as himself, so their income will also be taken into account during the procedure.

Where to find a financial manager to go through bankruptcy through court?

On the website of the Central Bank of the Russian Federation in the registers section there is a list of self-regulatory organizations. There is also a list of all arbitration managers in the form of a pdf file.

Sources:

- Federal Law “On Insolvency (Bankruptcy)” dated October 26, 2002 No. 127-FZ (latest edition)

- Register of SROs on the website of the Central Bank of the Russian Federation

- Unified Federal Register of Bankruptcy Information

- FSSP website/li>

- State Services Portal debt verification page

- Appendix No. 1 to the order of the Ministry of Economic Development of the Russian Federation dated August 5, 2015 No. 530 List of creditors and debtors

about the author

Klavdiya Treskova - higher education with qualification “Economist”, with specializations “Economics and Management” and “Computer Technologies” at PSU. She worked in a bank in positions from operator to acting. Head of the Department for servicing private and corporate clients. Every year she successfully passed certifications, education and training in banking services. Total work experience in the bank is more than 15 years. [email protected]

Is this article useful? Not really

Help us find out how much this article helped you. If something is missing or the information is not accurate, please report it below in the comments or write to us by email

Bankruptcy of a citizen: general provisions

Bankruptcy is the inability of a citizen to fully satisfy the claims of creditors for monetary obligations, recognized by an arbitration court or resulting from an out-of-court procedure.

When can you start bankruptcy proceedings?

As a general rule, when the amount of all claims against the debtor is at least 500,000 rubles, and the delay in execution is at least three months.

Attention! The indicated amount does not take into account sanctions for violation of obligations (penalties, fines).

The procedure can be initiated in two ways:

- according to the debtor himself,

- according to the statement of his creditor (more about this here).

When the debtor:

| obliged to apply? | entitled to apply? |

| No later than 30 days from the moment he learned that he is not able to repay all monetary debts and their total amount is 500 thousand rubles or more. | When he realizes that he has signs of insolvency and will not be able to fulfill all the requirements within the prescribed period. In this case, the amount of these requirements does not matter. |

You are considered insolvent if you meet at least one of the following criteria:

- you have stopped paying debts that are already due;

- payments on loans and other payments overdue by more than a month account for 10% of all your obligations;

- the amount of your debt is greater than the value of your property;

- The bailiff has completed enforcement proceedings against you due to the lack of property that can be foreclosed on.

The debtor must prove his insolvency.

For example, Resolution of the Arbitration Court of the West Siberian District dated May 20, 2021 in case No. A46-12039/2020. The claim was denied, the case was dismissed, since the total amount of the debtor's total accounts payable was less than five hundred thousand rubles. Evidence of the debtor foreseeing his bankruptcy due to the inability to fulfill an obligation to the creditor has not been reliably confirmed; the bona fide purpose of obtaining the emergence of a plurality of credit obligations has not been disclosed.

Attention!

If you are an individual entrepreneur, then you must, no less than 15 days before filing an application with the arbitration court, publish a notice of your intention to file such an application on the website www.bankrot.fedresurs.ru.

When can a creditor file an application?

A creditor may file for bankruptcy of a debtor when his monetary claims against the debtor are confirmed by a court decision that has entered into force. But there are exceptions.

A court decision is not required for the following requirements:

- on payment of mandatory payments;

- confirmed by a notary’s writ of execution or based on notarized transactions;

- recognized as a debtor;

- under loan agreements with banks;

- on the collection of alimony for minor children.

Attention! Before filing an application with the arbitration court for claims not based on a court decision, creditors are required to publish a notice about this on the website www.bankrot.fedresurs.ru

Comments: 4

Your comment (question) If you have questions about this article, you can tell us. Our team consists of only experienced experts and specialists with specialized education. We will try to help you in this topic:

Author of the article: Klavdiya Treskova

Consultant, author Popovich Anna

Financial author Olga Pikhotskaya

- Anna

08/09/2021 at 17:13 useful material

Reply ↓ - Basil

04/12/2021 at 17:26“There is no point in keeping silent about any debts or, on the contrary, exaggerating them; all data will be double-checked. “What’s the point of submitting a list of debtors at all if Big Brother already knows everything?

Reply ↓

- Oleg

03/24/2021 at 03:10Quite a complete summary. I searched a lot, but often I come across rewrites from people who don’t know. Everything is complete here and there are links for deeper reading. Well done Claudia (with such knowledge, you can write your middle name).

Reply ↓

Klavdiya Treskova

03.30.2021 at 21:17 Post authorThank you very much, Oleg, for your positive review of the material, I hope it was useful for you.

Reply ↓

Advantages of Legal Bureau No. 1

Don't know how to solve the problems that have arisen? Do you need help with bankruptcy if you have no property? Contact Legal Bureau No. 1. Among our advantages:

- extensive experience in handling bankruptcy cases;

- professionalism of employees - the work experience of each full-time lawyer is from 10 years;

- free consultations;

- comprehensive customer support at all stages of the procedure;

- objective assessment of each specific situation, forecasting the result, determining optimal solutions taking into account the main nuances;

- collection and preparation of documents necessary to initiate and complete the procedure;

- fair prices.

If you find yourself in a difficult situation and cannot find the right way out, contact Legal Bureau No. 1 by phone or through the website. We will provide qualified support and do everything possible to solve your problems with minimal reputational and financial losses.

You are bankrupt. How to live further?

If you become bankrupt once, then banks will continue to provide you with money with great caution. Your history will forever be marked with this label. Let’s say that after 10 years an individual is a reliable payer of bills, earning good money, but the bankruptcy status cannot be avoided. Although the law provides the opportunity for those who take out new loans to pay off old ones to “jump off”, making any profit or ensuring a quality life will become unrealistic.

If this is a restructuring, after three years the borrower realizes that he did not have any money, that is, he returned “to nothing,” only without creditors.

Cases of bankruptcy of individuals are considered by State Arbitration Courts. According to legislators, arbitration judges have greater skills than their colleagues in courts of general jurisdiction, because arbitration judges deal with bankruptcy cases of organizations. Previously, the entry into force of the law was delayed precisely because the courts were unprepared.

“The difficulty is not in knowledge, but in the fact that arbitration courts have a staff shortage,” reports Kravtsov. Six months ago, they began to carry out a massive recruitment of personnel to consider bankruptcy disputes.

Analysts have predicted a significant increase in queues at arbitration institutions. Today, filing a claim with the arbitration court takes two hours, and after the influx of bankrupts it will take twice as long. If today court hearings are held in increments of 1.5 months, then it will increase to 2 months. Perhaps, for the first time, to consider cases of bankruptcy of individuals, the courts will be forced to introduce a separate working day, which will reduce the time for consideration of other types of cases.

If the initiator of a citizen’s bankruptcy is the bank itself, it is necessary that the court recognizes the right to claim the debt. The court may extend this procedure for more than a month.

Bankrupt, but owes money

Option two: the person has no source of income. Then the court declares him bankrupt. This may happen automatically if the restructuring plan is not submitted within the allotted time or if it is not approved by creditors.

From this moment on, the financial manager receives the right to dispose of the debtor’s accounts and property. Almost all debts will be written off by the court, and the property will be sold (sold) at auction. It is prohibited to sell a single home under hammer if it is not collateral for a debt. As for mortgaged housing, it will not be taken away if it is the only one and minors are registered in it. Only the property of the debtor and his legal wife (husband), but not other family members, can be sold.

You will still have to pay: alimony and many other debts that are not related to loans and credits. Other questions are also open, for example, whether there is an option to file for bankruptcy due to debts that arose before the law came into force. It is not very clear whether a person has the opportunity to declare himself bankrupt as a citizen if at the same moment he is going through the bankruptcy process as an entrepreneur. The Supreme Court (SC) must explain these and other aspects - it will publish a resolution of the plenum on bankruptcy.

Bankruptcy is not a cheap pleasure

The costs for the arbitration manager will be over 10 thousand rubles (this is the remuneration of the financial manager, regulated by law). In addition, it is also worth considering the cost of specialists.

Bankruptcy of each person individually is an unprofitable and labor-intensive process, both for the state and for lawyers. So, for example, it happened with the law on free legal assistance: lawyers were offered to advise citizens for 1.5 thousand rubles - they, of course, most of them refused.

The same fate awaits the new law. Law firms will file bankruptcy claims in “packs”—30 people each—since the procedure and documents are the same, and if you collect 25 thousand from each, it will be more profitable,” adds Kravtsov.

- Whatever path you choose, it will still end with the amount of money not increasing. Therefore, the only normal recommendation is the following: do not take out loans at all,” the expert adds.

Bankruptcy background (numbers and statistics)

World practice believes that “bad” loans are those for which the overdue period is more than three months. There are several million such debtors in the country. But not everyone can bankrupt themselves. The United Credit Bureau (UCB) says that about 580 thousand Russians are subject to the bankruptcy law, which is about 1.5% of the total number of borrowers with overdue payments.

Today, more than 39 million people in Russia pay on loans - this is about half of the country’s economically active population (77.2 million people, according to Rosstat as of June 2015). As reported by the Bank of Russia, as of August 1, 2015, individuals are required to repay 10.4 trillion rubles on loans. It follows from this that a large number of people still cannot cope with the task of paying off their debt obligations.

Therefore, there is only one way out - to contact experienced lawyers who will suggest a way out of the current circumstances and will take charge of resolving your credit issues. FINEXPERT 24 employs specialists with extensive experience. In 2015-2016 alone, the company’s efforts successfully completed 100% of bankruptcy cases for individuals and legal entities.