- Concept of donation

- Challenging a gift agreement

- How to challenge a gift agreement

- Grounds for challenging a gift agreement

- Is it possible to cancel a deed of gift?

- Who can challenge a gift agreement?

- Can relatives challenge a deed of gift during the life of the donor?

- Time limit for challenging a gift agreement

A gift agreement, like any other transaction, can be challenged in court if there are grounds provided for by the current civil legislation of the Russian Federation.

Donations are often contested by the donors themselves, who for one reason or another have changed their minds about donating the property and want to return it. Also, quite often, after the death of the donor, his relatives want to challenge the gift agreement, believing that the transaction could have been made contrary to the will of the donor.

Many people are concerned about who can challenge the gift agreement, whether it is possible to challenge the gift agreement during the life of the donor, whether it is possible to challenge the deed of gift after the death of the donor, whether the donor’s heirs can challenge the gift agreement, etc.

Grounds for cancellation of a gift agreement

The grounds for canceling the deed of gift are determined by Art. 578 Civil Code of the Russian Federation:

- intentional killing of the donor by the donee, causing bodily harm;

- participation of the donor in bankruptcy proceedings;

- death of the donee before the donor.

There are also additional grounds on which the deed of gift is not cancelled, but is declared invalid, and the rules on the invalidity of transactions are applied to it. Let's consider the reasons for cancellation and other nuances in detail.

Attempt on the life and health of the donor

If the donee makes an attempt on the health and life of the donor, the latter has the right to demand the cancellation of the gift agreement (hereinafter - DD) in court. A similar right is granted when a crime is committed against close relatives of the donor: spouse, parents, children.

What evidence is used in court:

- police certificates;

- medical certificates;

- witness's testimonies.

If the perpetrator is convicted under the Criminal Code of the Russian Federation or brought to administrative responsibility, a verdict or court decision that has entered into force will be required.

Case study:

The woman gave her daughter an apartment as a gift. After the transaction was concluded, the recipient began to systematically beat the donor, trying to force her to leave the living space. After the last beating, the woman called the police and went to a medical facility to have the beatings removed.

An administrative case has been initiated under Art. 6.1.1 Code of Administrative Offenses of the Russian Federation. When the court decision came into force, the donor filed a claim to cancel the deed of gift to the district court, presenting evidence.

Based on the results of the consideration of the case, the deed of gift was cancelled. The daughter's ownership rights ceased, and the mother again became the owner of the apartment.

Murder of the donor by the donee

If the donee, after registration of the deed of gift, intentionally killed the donor and guilt is proven, the heirs of the latter have the right to demand cancellation of the deed of gift by going to court.

The evidence used is the medical examination report on the cause of death, the final verdict and other evidence indicating the guilt of the donee.

Case study:

The man gave his son a house with a plot of land. After some time, a conflict arose between them, a few hours after which the recipient killed his father. Investigative authorities and the court found that the son is guilty under Part 1 of Art. 105 of the Criminal Code of the Russian Federation.

The verdict came into force, and the perpetrator was sentenced to 7 years' imprisonment. The donor, in addition to his son, had a daughter who, in the absence of a deed of gift, could inherit and receive real estate. She went to court to cancel the DD, the claim was granted.

Poor treatment of gift

Cancellation due to careless handling of the donated item is possible if it is of non-property value to the donor and there is a risk of its irretrievable loss.

Possible evidence:

- expert opinion;

- witness statements;

- certificates from government agencies.

Case study:

In the Mironov family, the Dodge car was passed down from generation to generation by men, representing family value. The estimated cost of the car is 30,000,000 rubles and is considered a rarity. In 2017, the father issued a deed of gift for his son’s coming of age. According to the document, Dodge is transferred into the child's ownership free of charge.

At the time of the transaction, the car was in perfect condition and had not been used on public roads. After completing the documents, the recipient began to drive it, did not monitor its serviceability, and got into accidents several times.

The donor demanded that the deed of gift be canceled peacefully, but he did not agree to return the car. Then the man went to court. As evidence of non-property value, photographs are presented, which show that the car was indeed passed down through generations as a family heirloom. Witnesses were also brought in, and an expert opinion was presented on the presence of significant damage due to the fault of the donee.

Having considered the case, the court canceled the DD on the basis of clause 2 of Art. 578 of the Civil Code of the Russian Federation, the car was returned to the previous owner.

Donor's bankruptcy

If an individual entrepreneur or legal entity donates a valuable item at the expense of funds used for activities, and then within six months applies to an arbitration court to declare himself bankrupt, the creditor has the right to demand cancellation of the transaction.

Important! The property of an individual entrepreneur is recognized as all valuables owned by a citizen. An LLC owns only the property that is on the organization’s balance sheet. The joint liability of the founders occurs in exceptional cases.

If the donor survives the donee

If the DD indicates the possibility of cancellation, in the event of the death of the donee before the donor, the latter has the right to go to court to cancel the document. If such an opportunity is not provided, the property will be inherited by the legal successors.

As proof, a certificate of death of a citizen, as well as the DD itself, is sufficient.

Case study:

A man gave a friend one of his apartments as a gift, and a month after the transaction, the recipient died. According to the terms of the DD, in the event of death, the donation is canceled. To do this, the previous owner went to court. A decision was made, the citizen was able to return the property to ownership.

Briefly: the gift agreement is canceled on the grounds specified in Art. 578 of the Civil Code of the Russian Federation: at the request of the creditor when the donor is declared bankrupt, the likelihood of irretrievable loss as a result of mistreatment of the gift by the recipient, premeditated murder or an attempt on the life of the donor by the second party to the transaction.

State duty, cost of claim and processing time

Claims regarding the cancellation of gift agreements are considered by courts of general jurisdiction. The state duty for such cases is regulated by Article No. 333.19 of the Tax Code of the Russian Federation. Its size depends on the so-called claim price. The higher it is, the higher the duty.

The value of the claim is the value of the disputed property. Although the transaction of donating real estate itself is free of charge, the object of donation has a very high price. It is indicated by the plaintiff filing an application to cancel the deed of gift. It is recommended to write the cadastral price rather than the market price. Then the duty will be slightly lower.

When is a gift deed invalid?

There are additional grounds on which the DD is disputed, and if the decision is positive, the donated property is returned to the original owner.

They are provided for in Art. 166-179 Civil Code of the Russian Federation:

- The DD was issued on behalf of a minor in violation of the norm prohibiting donation;

- the deed of gift was drawn up without complying with the form or other conditions;

- the property was donated without the consent of the donor’s spouse;

- the contract was concluded on behalf of an incapacitated or partially capable citizen;

- the transaction was made under threats or influence of violence;

- recognition of the transaction as imaginary or feigned.

Let us consider in detail additional reasons used to invalidate transactions.

Donation on behalf of a child

According to Art. 575 of the Civil Code of the Russian Federation, property cannot be donated on behalf of a child under 14 years of age.

Violation of legal requirements

Violation of legal norms means incorrect preparation of the deed of gift, failure to comply with the procedure for registration:

- the contract does not indicate the specific subject of the donation or information about the donee;

- the deed of gift is subject to notarization, but there is no signature or seal of the notary;

- the form was not followed: for a mandatory written transaction, an oral form was used, etc.

Important! Oral donations of real estate are not permitted. DD is subject to state registration and is drawn up in writing for subsequent submission to Rosreestr. Without it, the re-registration of property rights will be denied, and nothing will have to be contested.

Feigned and imaginary transactions

In Art. 170 of the Civil Code of the Russian Federation states: a transaction made for the purpose of covering up another transaction is considered sham. Often people use the opportunity to avoid paying personal income tax when selling property, and instead of a purchase and sale agreement, they draw up a deed of gift. Such a document is considered void and is rarely challenged in the courts on these grounds.

Imaginary is a transaction concluded without the purpose of creating a legal agreement. Typically, imaginary DDs are drawn up when the debtor wants to avoid seizure and confiscation of his property. Legally, the property becomes the property of another person, but in fact the donor continues to use it.

Most often, imaginary DDs are declared invalid at the initiative of creditors.

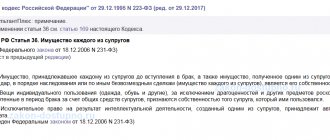

Lack of spouse's consent

In Art. 35 of the RF IC states that when concluding transactions with common property, the consent of the second spouse is required. Property acquired from the moment of marriage registration until divorce at the registry office or the entry into force of a court decision is recognized as common property.

The spouse who has learned about the donation of real estate has the right to demand recognition of the transaction, completed in notarial form or subject to state registration, on the basis of paragraph 3 of this article, if his consent has not been received.

Note! The consent of the spouse is drawn up in writing and certified by a notary. If the couple has entered into a prenuptial agreement that establishes a separate property regime, and the donor transfers his property, the permission of the second spouse will not be required.

Deed of gift on behalf of an incapacitated person

Clause 1 clause 1 art. 575 of the Civil Code of the Russian Federation prohibits donations on behalf of an incapacitated citizen. DD is canceled at the initiative of the guardianship authorities, guardian or prosecutor's office - it all depends on the specific situation.

Drawing up a contract under the influence of misconception

Under error according to Art. 178 of the Civil Code of the Russian Federation implies:

- admission of an obvious clerical error or typo by a party to the transaction;

- the donor does not understand the nature of the transaction or the circumstances of its completion;

- there are doubts regarding the identity of the donee.

Representatives of government agencies in the interests of the donor, as well as he or his guardian, have the right to demand cancellation of the DD in such a situation.

Transaction under the influence of violence, threats

Violence is not only a physiological, but also a psychological impact on a person. This also includes threats.

If a DD is drawn up under the influence of beatings or blackmail from the recipient, it can be declared invalid by proving the specified circumstances in court.

Briefly: the agreement is declared invalid on grounds that entail the invalidity of transactions: registration of a DD by an incapacitated citizen, violent actions against the donor, lack of permission from the spouse, unlawful alienation of a child’s property.

Is it possible and how to challenge a gift agreement?

Is a gift agreement valid after the death of the donor?

Nuances that should be taken into account by the donor

The recommendations of this section concern not those donors who seek to challenge the transaction, but those who, on the contrary, are interested in drawing up a legally pure Donation Agreement that does not provide grounds for challenge on formal grounds. They are as follows:

- If the donor is married and writes a deed of gift for an apartment that is joint marital property, he must not only obtain the personal consent of his “half,” but also formalize notarized consent for the donation on the part of the husband or wife.

- If the object of donation is not in the sole ownership of the donor, but only in shared ownership, the other owners must give the same consent

- If the donation occurs through a representative, the notarized power of attorney in his name must indicate not only the personal details of the principal, but also an exact indication of the subject of the donation. That is, address, area, characteristics of the living space.

If any of these requirements are violated, any court will cancel the gift agreement without the slightest doubt.

What gifts can be returned by canceling the deed of gift?

Almost any gifts can be returned. The easiest way is to cancel a written contract - it already confirms the fact of the transaction. It is more difficult with an oral gift: you will need witnesses and other evidence confirming the transfer of the gift.

Let's consider what gifts can be returned, and what are the features of return.

Apartment

The deed of gift for real estate is drawn up in writing, and the transfer of ownership is registered in Rosreestr.

When going to court, you must provide your copy of the DD and evidence confirming the grounds for cancellation.

Land plot

A plot of land according to the DD is alienated along with the buildings located on it. Cancellation of a deed of gift is possible for any of the reasons presented above.

If the court decision is positive, you need to contact Rosreestr to register ownership.

House

If a private house is donated, the DD transfers ownership of the plot of land on which it is located.

To visit the court, it is recommended to take in advance documents confirming the fact that the property belongs to the plaintiff, as well as stock up on evidence. You will also need a deed of gift.

Cash

As with a car, when transferring money as a gift, it is not necessary to draw up a deed of gift in writing.

The recipient has the right to spend money at his own discretion, therefore, careless handling, entailing the risk of irretrievable loss, cannot be used as a basis - the court will refuse to satisfy such a claim.

If, after donating a large sum, the recipient beats the donor or deliberately takes his life, the chance of revocation is higher.

Other gifts

Others mean any other gifts not listed earlier: furniture, household appliances, jewelry, expensive smartphones, and even pets.

The latter also belong to the property of a citizen, and the cost of a purebred cat can be 1 million rubles.

The transfer of such gifts is usually carried out orally, and it is extremely problematic to cancel their gift.

When can a deed of gift not be cancelled?

Based on Art.

579 of the Civil Code of the Russian Federation, it will not be possible to cancel the DD if the gift is of a small value up to 3,000 rubles. Even children can give such gifts, but with the consent of their parents. Written form is not required here. Case study:

A man gave a woman earrings worth 2,900 rubles. The couple broke up after some time, and he decided to return the gift to give it to another girl. My ex-girlfriend refused to return it. There are no grounds for going to court: if the transaction price does not exceed 3,000 rubles, it cannot be canceled. Decoration can only be returned by agreement.

Briefly: you can return any gifts whose value exceeds 3,000 rubles.

Conflict situations with relatives

Attention! Often, giving an apartment to relatives is more profitable, for the simple reason that those closest to them do not have to pay tax when they receive real estate as a gift.

But if it so happens that a person decides to donate his apartment to someone else, it will not be possible to simply appeal his decision. But here are the reasons why the debate makes sense:

- The relative who entered into the contract is deprived of legal capacity.

- It is possible to prove that the donor was drunk or on drugs before entering into the contract.

- There is evidence of pressure being exerted on the apartment owner.

- The consent of the second spouse or other co-owner of the apartment, required for the transaction, was not obtained. If this fact was also known to the person to whom the apartment was donated, then he can be considered an accomplice in the fraudulent scheme. Otherwise, the recipient is considered to be in good faith, but he still has to confirm this during the trial.

Who has the right to demand cancellation of the deed of gift?

The legislation defines the circle of citizens who can apply to the courts to annul a DD.

They refer to the interested parties:

- donors;

- representatives of creditors;

- heirs;

- third parties: guardians, representatives of government agencies, etc.

A lawyer has the right to act on behalf of the plaintiff, but this will require a notarized power of attorney.

Donor

The donor may file a claim for cancellation on any of the grounds presented above.

Bank

The bank has the right to demand cancellation if it acts as a creditor of the donor and wants to achieve inclusion of his property in the bankruptcy estate during the bankruptcy procedure. A transaction is canceled if it was completed no more than six months before the start of the arbitration process.

Heirs

Successors may seek annulment of the transaction in the event of the death of the donor due to the fault of the donee, if it is established by the court.

Third parties

Guardians, representatives of guardianship authorities or the prosecutor's office usually act as third parties, acting in the interests of citizen donors.

How to file a claim?

To write a statement of claim, you need to know the requirements established by law for drawing up this document. It must clearly formulate the plaintiff’s demand for his intention to cancel the deed of gift. In this case, there must be a reference to federal law.

When filing a claim, the document must indicate:

- passport details of the plaintiff and the person who received the apartment as a gift, indicating their registration address;

- the reason for filing a claim based on the provided evidentiary documents, a list of which should be listed and indicated that they are attached to the application;

- at the end of the text the date of drawing up the document and the confirming signature of the plaintiff himself or his representative are indicated.

The number of copies of the document must be designed to be provided to all parties to the process under consideration.

How to cancel a deed of gift through the court: step-by-step instructions

The procedure for canceling a DD in court consists of several stages:

- The plaintiff collects documents and evidence.

- A statement of claim is being filed.

- The state duty is paid in accordance with the norms of the Tax Code of the Russian Federation.

- The documents are submitted, the judge makes a decision to initiate proceedings.

- Trials are scheduled.

- A decision is made.

- The parties receive certified copies of the decision.

- Based on the results of the proceedings, the gift is returned to the donor, heirs, or everything remains unchanged.

Let's look at each step in detail.

Step 1: Preparation of evidence and documents

You need to start with preparing the evidence base, because... It is the plaintiff who bears the burden of proof - in the Russian Federation there is a presumption of innocence. Based on the evidence, an application is drawn up, then it is used in the process of considering the case.

Step 2: drawing up a statement of claim

The application is drawn up in accordance with the requirements of Art. 131 Code of Civil Procedure of the Russian Federation. It is necessary to list all information relevant to the case.

Sample statement of claim

The statement of claim must include information about:

- date, place, time of registration of the canceled DD;

- Full name, residential address of the defendant;

- Full name, place of residence of the plaintiff. You will need passport information;

- grounds for cancellation of the DD.

It is necessary to outline the requirements: cancel the contract, terminate the defendant’s ownership rights. At the end the signature of the plaintiff is placed.

Sample statement of claim for cancellation of a gift agreement:

Step 3: payment of state duty

For individuals, the state duty is 300 rubles, organizations pay 6,000 rubles.

Money is deposited in any convenient way. Payment details can be found on the website of the judicial authority.

Step 4: Submitting documents to the court

Before going to court, you must send the claim and copies of documents to the defendant by registered mail. A receipt receipt will be provided along with other information to confirm shipment.

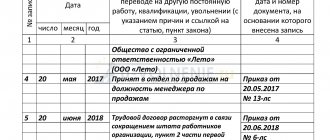

What documents are attached to the statement of claim:

| Main list | |

| Name | Where to get |

| Passport | Department of Internal Affairs of the Ministry of Internal Affairs |

| Gift deed | Drawed up by the parties themselves or by a notary |

| Receipt for payment of state duty | Financial institution, ATM at the place of payment, online service |

| Additional documents | |

| Judgment or court decision | Court at the place of consideration of the case |

| Medical certificates about battery by the donee | Health care institution |

| Technical expert report on damage to the donated property | Expert organization with state accreditation |

| Other evidence confirming the existence of grounds | Depending on the situation |

Note! Documents are submitted to the court at the defendant’s place of residence. If the DD of real estate is cancelled, at the address of its location.

Step 5: Case Review

Submitted materials are considered for up to two months, but if the proceedings are suspended by a court ruling, the period may be extended.

Step 6: Making a decision

The decision is made by the judge alone in the deliberation room, then announced to those present in the conference room. The circumstances of the case and the grounds on which it was accepted are indicated.

Step 7: Get a copy of the solution

Within 5 days after the decision is made, the decision is issued against signature to the participants in the proceedings.

Statute of limitations

Voidable transactions are declared invalid within 1 year from the moment the plaintiff became aware of the grounds for canceling the DD. For void transactions, a period of 3 years is established from the date of commencement of execution.

If a third party who is not a party to it has learned about a void agreement, the period begins to run from the date on which he learned about the fulfillment of the terms of the transaction.

Briefly: to cancel a gift, you need to prepare documents and evidence, submit them to the court, participate in the trial and receive a certified copy of the decision. In the future, it is provided for re-registration of ownership.

Legal support! Legal assistance WhatsApp +79169906144

Is it possible to challenge a deed of gift? A donation can be challenged if there are certain grounds provided for by law. In most cases, donation is challenged only in court. In this case, it is necessary: to have grounds for challenging the transaction (if there are no grounds, it is pointless to challenge the transaction, since the plaintiff’s wishes alone are not enough for the court to recognize the transaction as invalid or void).

What to do after canceling the gift agreement?

When canceling the DD, the donee undertakes to return the gift in its original form, and in case of complete or partial loss, pay monetary compensation to the other party.

If the deed of gift for real estate is cancelled, the plaintiff, after the court decision comes into force, needs to come to Rosreestr and submit documents to register himself as the owner.

State fee for registration of property rights

In fact, the donor was previously the owner of the donated property, and the cancellation of the deed of gift does not provide grounds for exemption from re-registration of the transfer of ownership. Citizens pay 2,000, organizations – 22,000 rubles.

Example of duty calculation

For a claim worth no more than a million, the fee is 5,200 rubles, plus 1% of the amount exceeding 200 thousand rubles.

That is, challenging the deed of gift for an apartment worth 1,000,000 rubles, the plaintiff will pay:

5200+ (800,000:100 x 1) = 13,200 rubles.

If the apartment is being built for more than a million, a different formula applies. 13,200 rubles, plus 0.5% of the amount, over a million. That is, when challenging a deed of gift for an apartment worth 2,000,000, the plaintiff must pay a fee:

13,200 + (1,000,000:100 x 0.5) = 18,200 rubles.

The maximum possible fee is 60 thousand rubles.

The period for considering a claim and making a decision on it, according to the regulations of Article No. 154 of the Code of Civil Procedure of the Russian Federation, is a maximum of two months.

Arbitrage practice

To cancel a DD, plaintiffs usually collect a good evidence base, but even under this condition, the courts do not always satisfy the requirements.

However, there are still examples of positive solutions:

- Decision No. 2-597/2019 2-597/2019~M-515/2019 M-515/2019 dated June 13, 2021 in case No. 2-597/2019;

- Decision No. 2-3438/2019 2-3438/2019~M-1925/2019 M-1925/2019 dated June 10, 2021 in case No. 2-3438/2019;

- Decision No. 2-1303/2019 2-1303/2019~M-739/2019 M-739/2019 dated June 7, 2021 in case No. 2-1303/2019.

Legal advice: before going to court, agree with the witnesses of the transaction to testify, because They play a big role when courts make decisions.

Lawyer's answers to popular questions

I gave the apartment to my son, he sold it. Can I challenge a deed of gift? I was against the sale.

No. After completing the DD and registering the donee as the owner, you have lost the right to the property. He can dispose of it at his own discretion.

I was beaten by my son, to whom I gave the property. She didn’t contact the police and didn’t film the beating. Is it possible to cancel a gift agreement?

Cancellation in this case is problematic, because It is medical certificates and materials from the police that confirm the existence of grounds. Witnesses can be brought in, but the chance of satisfying the demands will be minimal.

I want to cancel the deed of gift, but I missed the statute of limitations. What should I do?

If the deadline was missed for valid reasons, submit an application for reinstatement and provide evidence: a medical certificate of illness, information about long-term care for a seriously ill relative, etc.

She filed a lawsuit to cancel the donation, but the court refused to satisfy the demands. Is it possible to challenge the decision?

Yes. The decision comes into force one month after its adoption in final form. During this time, you have the right to file an appeal to a higher authority.

The court canceled the gift agreement, now I want to register the previously donated property in my name. I'm in another city. Is it possible to submit documents through State Services?

No, at the moment this option is not provided. Submit an application to Rosreestr at your location or issue a power of attorney for another person so that he can do everything through the MFC at the address where the property is located.

Supporting documents

The process of proof is very complex. Applicants will have to prove the illegality or insignificance of the gift. It is necessary to submit documents that will confirm the intent of the donee or the fact that the donor was completely unaware of the meaning of his actions:

- examination of the mental state of the donor

- medical records

- receipts confirming receipt of money for the “donated” apartment

- documents declaring the donor incompetent

- certificates from law enforcement agencies

- witness statements

The deal is being challenged in court. It is difficult to challenge a deed of gift, but it is quite possible if there is appropriate evidence.