- Signs of declaring an individual bankrupt

- Step-by-step instructions for filing bankruptcy Collection of documents

- Compiling and submitting an application

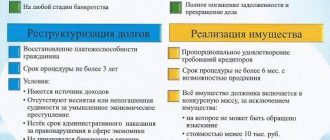

- Debt restructuring

Today, the bankruptcy procedure is used not only for legal entities, but also for individuals. This possibility became a consequence of amendments to No. 127-FZ of October 26, 2002, regulating the procedure for declaring a debtor insolvent. In 2015, after the adoption of No. 154-FZ of June 29, 2015, Chapter X was added to the text of the basic Federal Law, which defines the rules for bankruptcy of individuals. Over the following years, the legal act was repeatedly adjusted, so today the version of the document adopted on 01/08/2020 is in force.

The main essence of bankruptcy is the recognition of a citizen as unable to fulfill financial obligations and pay off creditors. As a result, his property and funds are distributed among the latter, and debts not covered in this way are written off. The initiator of the procedure can be:

- the debtor himself;

- tax office;

- one or more creditors of an individual.

The case is heard by the arbitration court at the place of registration of the debtor.

The new bankruptcy rules have become widely used by individuals, which has made it possible to identify several obvious pros and cons of the procedure. The main advantage of its practical use is the possibility of getting rid of the burden of debt.

This applies equally to current obligations on loans and borrowings, accrued penalties and interest, as well as executive documents for the collection of the debtor’s property.

The main disadvantage is the risk of loss of property and savings, which further increases if the event is not carried out competently. The article contains step-by-step instructions for bankruptcy of individuals in 2021, which will help you understand the legal nuances of the procedure.

Signs of declaring an individual bankrupt

Current legislation establishes two criteria that serve as the basis for launching bankruptcy proceedings:

- The total amount of debts of an individual exceeds half a million rubles. This takes into account loans of all types - consumer, mortgage, microloans, debts to other citizens, the tax inspectorate, the Pension Fund of the Russian Federation and other government agencies.

- Delay in payment of financial obligations is 3 months or more. In this case, we are talking about the period between the planned repayment and the actual payment of the debt.

The bankruptcy procedure for individuals in accordance with rules No. 127-FZ applies only to citizens of the Russian Federation. An important additional basis for the successful implementation of the event is the presence of objective reasons for the debtor’s financial problems.

IMPORTANT! Declaration of bankruptcy will be especially useful if an individual fulfills three mandatory conditions:

- acts as a bona fide debtor who has made all available and possible attempts to resolve problems with creditors (confirmed by correspondence with banks or microfinance organizations);

- does not hide income and property;

- is actively searching for work (registered with the employment service and various employment exchanges).

Under what conditions is a citizen declared bankrupt?

Bankruptcy is understood as the inability of a citizen to repay his debts to creditors. If the value of an individual’s property does not cover his obligations, then he has the right to declare himself financially insolvent.

A citizen is declared bankrupt if the following conditions are met:

- presence of debt from 500,000 rubles.

- delay in payment of debt for more than three months in a row;

- lack of funds to repay debt (complete insolvency of an individual).

The debtor, creditors, tax inspectorate, and pension fund have the right to go to court. A citizen is obliged to file for bankruptcy on his own if he is unable to satisfy the demands of one or more creditors (Part 1 of Article 213.4 of the Bankruptcy Law). The application is sent to the court no later than 30 working days from the day it became aware of it.

An example from judicial practice. Skoda D.S. applied to the arbitration court to declare it insolvent. In support, she indicated that she had a debt in the amount of 512,749.36, collected by a decision of a court of general jurisdiction. When reviewing the documents, the court found that the debtor was not fulfilling his obligations to the creditor and his existing property was not enough to repay the debt. 07/31/2017 with Skoda D.S. the employment contract was terminated. At the same time, she is dependent on a minor child born in 2021. Due to the lack of sources of income, the debtor was declared bankrupt and a procedure for the sale of a citizen’s property was introduced against him (Resolution of the Arbitration Court of the Volga-Vyatka District dated September 11, 2019 in case No. A43-41797/2018).

In the example under consideration, the debtor does not have any property that can be sold. During the bankruptcy process, the financial manager sent requests to Rosreestr, the State Traffic Safety Inspectorate, and other departments that carry out state registration of property owned by citizens. It was established that the debtor does not have any rights subject to registration. In this regard, the financial manager will conclude that it is impossible to repay the debts and will offer to complete the procedure for selling the property. The final decision will be available in January 2021.

Step-by-step instructions for filing bankruptcy of individuals or financial insolvency of citizens

The provisions of Chapter X No. 127-FZ regulate in detail all stages of the bankruptcy procedure for an individual. Clear and consistent implementation of each stage is a prerequisite for the successful implementation of activities and the solution of the tasks facing its initiator.

It is important to understand that the procedure is lengthy, requiring serious financial and time costs. For example, obtaining a court ruling on the start of an event takes from half a month to three.

Further stages are even longer: debt restructuring lasts 4 months, and property sale lasts 5 months. The indicated periods are, in fact, minimal and do not take into account preparatory activities. In practice, it is quite difficult to meet them. Each of the stages is very important and requires a detailed description.

Collection of documents for bankruptcy of an individual in 2020

The first stage of declaring a citizen insolvent is preparatory. It consists of collecting a set of documents, which includes:

- passport and other documentation with personal data about the debtor - marriage and birth certificates of children (if they have not reached the age of majority), guardianship documents, etc.;

- INN and SNILS (copies are provided to the court), an extract from the Unified State Register of Individual Entrepreneurs (USRIP) confirming the absence of individual entrepreneur status;

- documentation of existing income, savings and property - account statements, from the register of shareholders, personal account in the Pension Fund of the Russian Federation, inventory of personal property and other similar documents, the list of which is determined by the nature and types of property of the debtor;

- documentation on the financial obligations of an individual - lending and microfinance agreements, certificates of debt from the tax office and other fiscal government agencies, other supporting documents;

- documents on the debtor’s property transactions completed over the last three years;

- certificate of receipt of unemployed status;

- a description of the financial situation of the debtor, indicating the reason for the impossibility of paying debts and a list of measures taken by the citizen to solve the problems that have arisen.

IMPORTANT! The successful implementation of the bankruptcy procedure largely depends on how complete and exhaustive the list of documents is attached to the application to the court. Therefore, you should not save energy and time while preparing for the trial.

In a situation where loan agreements or documents on other financial obligations of a private person are lost, it is necessary to restore them by contacting a bank, microfinance organization or other individuals acting as a lender. They are all interested in resolving the problem, so in the vast majority of cases there are no difficulties in obtaining documentation.

The validity period of a significant part of the documents from the above list is unlimited. A certificate confirming that an individual does not have individual entrepreneur status is valid for 5 days.

IMPORTANT! In addition to the specified list of documents, a receipt for payment of state duty in the amount of 300 rubles is attached to the bankruptcy application. and depositing 25 thousand rubles with the judicial authority. to pay for the services of a financial manager. An alternative option is to submit a request to defer these costs.

Drawing up and filing a bankruptcy application

The arbitration court located at the place of actual residence of the debtor - permanent or temporary registration - deals with the consideration of cases of bankruptcy of individuals.

It is to this body that an application must be submitted to declare a citizen financially insolvent. The document is prepared either by the debtor himself or by his creditors, which can be either government bodies (IFTS, Pension Fund of the Russian Federation, etc.), or private individuals or organizations.

The application to arbitration must include the following information:

- a list of creditors indicating the debt owed to each of them;

- marital status of an individual, presence of dependents in his care;

- a list of property owned by a citizen;

- the amount of funds in accounts, bank cards and deposits;

- the amount of income at the time of filing the application;

- property transactions completed over the past three years;

- the name of the financial manager or the name of the SRO, the participant of which must be approved by the court in a similar capacity;

- circumstances of the case explaining the reasons for the insolvency of an individual.

Before filing an application with the court, several mandatory actions are required:

- pay 300 rub. as a state duty;

- deposit 25 thousand rubles into a special account of the arbitration court, intended to pay remuneration to the financial manager;

- select the candidate of the latter or SRO, from whose participants it is necessary to select a suitable specialist;

- notify creditors of the application to the court by sending each of them a copy of the application (for individuals in the status of individual entrepreneurs, it is required to post a publication on Fedresurs 15 days before filing the application).

An application for bankruptcy of an individual is submitted in any of three ways at the applicant’s choice:

- During a personal visit to the court office. Two copies of the document are submitted, one of which is stamped with an acceptance stamp.

- Using Russian Post services. In this case, you need to send a notification letter.

- Using the online service My Arbitrator. To do this, you must first register on the State Services portal.

What difficulties will arise?

There is no legal prohibition on independently conducting bankruptcy proceedings. An individual can go through the bankruptcy procedure either independently or by involving a lawyer. Let's figure out what difficulties may arise during an independent bankruptcy procedure:

- Ignorance of legal norms of bankruptcy legislation and lack of legal experience in this area.

This problem is the main one and can become a “stumbling block” in resolving the issue of debt write-off. The first difficulties of an independent bankruptcy procedure may begin with an assessment of your financial situation and taking into account the legal subtleties of the process. For example, the debtor, shortly before filing an application to the court to declare him bankrupt, executed a gift agreement for his property in order to preserve it. However, the unfortunate debtor did not know that before declaring a citizen bankrupt, checks are carried out with his property and finances for the last 3 years (preceding the filing of the application for financial insolvency). Such behavior will not only not help to obtain the desired legal status and write off debts, but can also further worsen his financial situation. - "Bureaucratic red tape."

The reason is clear and understandable. Already at the preparatory stage of the bankruptcy procedure, the debtor will need to collect a rather impressive package of documents to be attached to the application to the arbitration court. A person who is far from the legal field does not always know where and what kind of certificate to get, where to take it, etc. Several weeks of going through the authorities and the popular joke that “bureaucracy is the name of the real universal evil” will seem like the true truth to you. - Choosing the right tactics and behavior in court.

The debtor must clearly and reasonably justify his financial situation and the reasons for its deterioration, attaching supporting documentation. - Search and selection of a financial manager.

As mentioned above, the financial manager is one of the central figures in the bankruptcy procedure. The outcome of the insolvency process largely depends on its effective operation. Select fin. Finding a manager with the required qualifications is not so easy, especially if you have never faced such a choice before. - “Keep your finger on the pulse at all times.”

Declaring a debtor bankrupt is a fairly lengthy procedure. Constantly balancing between court hearings, providing the necessary information, independently studying the legal subtleties, and keeping abreast of everything that is happening is not an easy task. Now, try to combine all this with work, family and everyday activities. It's hard, isn't it?!

Appointment of a financial manager

The functions of coordinator between all participants in the bankruptcy process of an individual are performed by the financial manager. This is a specialist in the field of crisis management, who has the appropriate education and is a member of a specialized self-regulatory organization. Its main task is to maintain a balance of interests of the debtor and creditors.

A complete list of SRO arbitration managers operating in Russia is posted on a specialized federal Internet resource - EFRSB.

The choice of a financial manager should be approached very responsibly, since the efficiency and results of the practical implementation of the event directly depend on him. The main criteria for selecting a specialist are as follows:

- work experience;

- presence of disqualifications;

- duration of previous bankruptcy procedures.

The choice of an unprofessional financial manager or a poorly built relationship with him is fraught with several negative consequences:

- delaying the deadline for declaring a debtor bankrupt to one and a half to two years instead of the usual six to nine months;

- bringing into the case the property of a spouse of an individual;

- establishing signs of deliberate financial insolvency;

- withdrawal from bankruptcy proceedings without announcing reasons (this right is granted to the financial manager by current legislation).

Is it possible to reduce the risks of not being declared bankrupt?

If you turn to specialists for help, then all risks can be predicted already at the examination stage. In addition, some companies take out insurance in case the client is not declared bankrupt. It is important to choose a law firm with a good reputation and extensive experience in obtaining positive resolutions in bankruptcy cases.

Although bankruptcy is a lengthy and expensive process, in the end the debtor is relieved of the debt burden and can breathe freely. If the debtor knows his rights, does not hesitate to contact specialists and acts within the law, then he has every chance of regaining control over his finances and his life.

Options for completing or terminating bankruptcy proceedings

A bankruptcy application filed by an individual or creditors is considered by the Arbitration Court. If there are no comments, he sets a date for the first meeting - usually a month and a half after receiving the document.

If errors, inaccuracies or incompleteness of the received documentation package are identified, the judge makes a decision to eliminate the deficiencies or return the application if submitted to the wrong arbitration court.

The first court hearing is important, since it is where the case is considered on its merits.

The result is the appointment of a financial manager and the transition to one of the next stages of the procedure - restructuring of an individual’s debt, a settlement agreement, or the sale of property after the individual is declared insolvent. Each of the listed options for the development of events should be considered in more detail.

Restructuring an individual's debt

The procedure for debt restructuring in bankruptcy is very different from a regular bank loan restructuring. Its main features are as follows:

- the debtor or his representative does not need to negotiate a revision of the debt repayment schedule with each creditor separately;

- the debt of an individual is fixed - fines, penalties and interest stop accruing;

- the debtor is given 3 years to repay debts or return to fulfilling the payment schedule approved with creditors.

The main stages of bankruptcy debt restructuring are strictly regulated by law. These include the following key stages of the procedure:

- launch of the event . The debt is fixed, any appeals from creditors and collectors to the debtor are excluded, loan payments are stopped until the payment schedule is approved, transactions with property and funds in the amount of 50 thousand rubles or more are not allowed, an account is opened that is used by the debtor to make transactions within the specified amount;

- development of a payment schedule . The maximum duration of the document is 3 years. Partial repayment of debts by writing them off is allowed. The deadline for sending the draft document to the financial manager is two and a half months after the introduction of the restructuring procedure. The main requirement for the amount of debt payments is that it must be equal to the amount of income minus the cost of living and expenses for dependents;

- agreement on the schedule by a meeting of creditors . The restructuring schedule can be developed either by the debtor himself or by any of the creditors. Then the document is approved by the general meeting of creditors;

- approval of the restructuring project by the arbitration court . The final stage of the procedure is approval of the document by the judge. If the validity period of the payment schedule does not exceed 2 years, it may be agreed upon without a decision of the creditors’ meeting. For longer durations, lenders' approval is required.

If the restructuring schedule is not submitted to the court within the above deadlines, a procedure for the sale of the debtor’s property is introduced. Conscientious execution of a document approved by a judge has several consequences for the debtor:

- there is no bankrupt status;

- the next similar procedure can be implemented only after 8 years;

- Within 5 years, when applying for credits and loans, it is mandatory to notify the lender about the completion of the restructuring.

IMPORTANT! A big plus of this solution to the financial problems of an individual is the absence of any other restrictions besides those listed above. For example, a ban on traveling abroad or organizing your own business.

Settlement agreement in bankruptcy of individuals

Another compromise option for terminating bankruptcy proceedings for an individual is concluding a settlement agreement between the debtor and creditors. This method of resolving financial problems is actually a variation of the debt restructuring procedure described above.

The main and only difference is that the legislation does not strictly regulate the requirements for the content of the final document. The terms of the settlement agreement are determined by the direct parties to the case - the debtor and creditors - with the participation of the financial manager.

Submitting a document to the arbitration court for subsequent approval is possible if it is approved by more than half of the creditors. The deadline for filing a settlement agreement is 10 days after signing at a meeting of creditors.

IMPORTANT ! The development of a settlement agreement is permitted at any stage of the bankruptcy procedure. The main advantages of this method of solving problems are the absence of bankruptcy status and the restrictions associated with it.

Sale of property in case of insolvency of citizens

The final stage of the bankruptcy procedure is the recognition of an individual as financially insolvent and the sale of his property. The main task of the financial manager when moving to this stage of the event is to satisfy the demands of creditors.

The legislation clearly defines the grounds for starting the sale of the debtor’s property:

- lack or insufficiency of the latter’s income to restore solvency;

- repeated violations of provisions of a judge-approved settlement agreement or restructuring schedule;

- failure to submit a restructuring schedule within the deadlines established by the court;

- lack of approval of the document by creditors or its non-approval by the arbitration court.

The main stages of the procedure for selling the property of a bankrupt debtor:

- Inventory. In case of voluntary bankruptcy, data is provided by the debtor. They are necessarily checked by the financial manager.

- Formation of the bankruptcy estate. At this stage, the availability of declared property is checked. The only housing (except for that mortgaged) and land, personal items, things worth up to 10 thousand rubles, cash within the minimum wage, etc. are excluded from the bankruptcy estate.

- Analysis of transactions made by an individual over the past 3 years. The financial manager examines transactions with real estate and other assets, canceling them if necessary and including the property in the bankruptcy estate.

- Valuation of the debtor's property. Performed by a professional appraiser. If desired, it can be challenged by the participants in the case with the invitation of an independent specialist.

- Official notice of bidding, registration of participants and holding of the auction. Trades are held in electronic format on one of the electronic trading platforms.

- Repayment of creditor claims. The proceeds from the sale of property are distributed among creditors. Part of them is used to pay legal costs and remuneration to the manager.

- Report of the financial manager in arbitration. Based on the results of the event, the manager reports to the court. If there is not enough money to pay off obligations in full, the individual is declared bankrupt, the remaining debt is written off, and the business is terminated.

IMPORTANT! In most cases, a bankruptcy case ends with the sale of the debtor's property and declaring him bankrupt. This is understandable, since if there are sufficient assets to pay off debts, it simply does not make sense to launch the procedure. It is much easier to pay off debt without additional financial and time costs.

Consequences and features of debt write-off in the bankruptcy procedure of an individual

Declaring a citizen bankrupt has several consequences:

- all debts outstanding through the sale of property are written off, with the exception of alimony, fines in criminal and administrative cases, losses due to negligence or intentional, debts for harm to health and moral damage;

- for 10 years the bankrupt does not have the right to manage a banking organization;

- For 5 years after declaring bankruptcy, management of an MFO or private pension fund and repeated bankruptcy are not allowed, and it is also necessary to notify the financial institution when applying for a loan or loan;

- Working as a general director or joining the board of directors is not allowed for 3 years.

IMPORTANT ! If an individual with the status of individual entrepreneur is declared bankrupt, he is prohibited from engaging in entrepreneurial activity for 5 years.

Features of the simplified procedure

Extrajudicial bankruptcy is regulated by the provisions of §5 127-FZ. It allows, if the conditions set out in the previous section are met, to file bankruptcy for an individual free of charge. Here are excerpts from articles §5 127-FZ, illustrating the features of simplified bankruptcy of individuals through the MFC:

- Enforcement proceedings have been completed against the debtor due to the lack of property on which collection can be imposed, the enforcement document has been returned to the claimant (Part 1 of Article 223.2);

- the debtor files an application for declaring him bankrupt through the MFC at his place of residence (Part 2 of Article 223.2);

- the debtor attaches to the application a list of all creditors known to him and their claims (part 4 of article 223.2);

- During the day, the MFC checks the fact of the return of the writ of execution to the claimant and, upon confirmation, makes an entry about the initiation of extrajudicial bankruptcy proceedings in the federal register, otherwise the application is returned to the debtor (Part 5 of Article 223.2);

- from the day the information is included in the federal register, a moratorium is introduced on satisfying the claims of creditors (Part 1 of Article 223.4);

- if during the procedure the debtor acquires any property (for example, accepts a gift, enters into an inheritance) that allows him to fully or partially repay debts, he must notify the MFC about this within 5 days (Part 1 of Article 223.5);

- after receiving such a notification, the MFC, within 3 days, enters into the federal register information about the termination of the extrajudicial bankruptcy procedure;

- after 6 months from the date of inclusion of information about the initiation of extrajudicial bankruptcy proceedings in the federal register, the procedure is completed, and the debtor is released from further fulfillment of the claims of the creditors indicated in the application (Part 1 of Article 223.6).

Cost of personal bankruptcy

Carrying out bankruptcy proceedings for an individual is accompanied by several mandatory financial expenses. These include:

- state duty (300 rub.);

- remuneration to the manager (25 thousand rubles);

- placement of information in the EFRSB (RUB 430.17);

- payment for services of a third-party legal company (by agreement).

Thus, the minimum amount of associated costs is 30-40 thousand rubles. In practice, their amount is often 150-200 thousand, which must be taken into account when deciding to launch the procedure.

Services and cost

Free consultation on bankruptcy of individuals 0 ₽

More details

Selection and appointment of a financial manager from 15,000 ₽

More details

Preparation and commencement of personal bankruptcy. persons from 15,000 ₽

More details

Legal support for bankruptcy of individuals. turnkey persons from 120,000 ₽

from 80,000 ₽

More details All services

Now that you have found out what documents are needed for bankruptcy of individuals, you need to collect them. Without documents, it is impossible to prepare an application that should be submitted to the Arbitration Court to begin the process.

Appeal to arbitration

Applying to arbitration based on the fact that an individual has been declared bankrupt involves filing an application, a long list of documents and receipts for payment of fees and remuneration in the total amount of 16 thousand rubles. The basis for applying to arbitration is pressure from creditors and an understanding of the impossibility of fulfilling obligations to them for three or more months.

A credit organization also has the right to apply to arbitration by filing an application against a debtor who has accepted obligations to pay loan funds and accrued interest and has not fulfilled them. The amount of debt must be at least 500 thousand rubles.

How to declare yourself bankrupt

The decision to declare an individual bankrupt is made in court. The following may submit an application to the justice authorities:

- the citizens themselves, their heirs (in the event of the death of the debtor);

- creditors;

- authorized government bodies.

If a citizen proves his insolvency in court and a decision is made to recognize the application as justified, bankruptcy proceedings will begin.

Individuals can submit an application to declare themselves insolvent no more often than once every 5 years.

Sale of the debtor's property

The sale of the debtor's property is carried out by a court decision in which the debtor was granted bankrupt status. According to the inventory of property submitted with the application, valuable items and the borrower's real estate are sold at auction at low prices.

Subject to sale are housing (except for the one in which the bankrupt lives), country houses and plots, garages, vehicles, expensive jewelry, and some equipment. Items and real estate put up for auction are sold at a bargain price, significantly below the market price. Only items in good condition and expensive real estate can be sold.

Advice from Sravni.ru: Before starting the bankruptcy procedure, it is worth consulting with an experienced lawyer who will help you draw up an application to the court, collect a package of documents, and conduct the case with the justice authorities.

Law on bankruptcy of citizens and individual entrepreneurs

The Law on Bankruptcy of Citizens and Individual Entrepreneurs describes the main provisions for respecting the rights of individuals and legal entities to restructure and write off debt through bankruptcy proceedings. Many provisions in the bankruptcy law are identical for citizens and enterprises. They include consideration of an application in court on the basis of documents confirming the amount of debt (from 500 thousand rubles), property rights and certificates, income from which indicates the impossibility of restoring creditworthiness. If a person is declared bankrupt, the property listed on the inventory is sold at auction to partially repay the loan.