19.07.2019

0

8522

4 min.

One of the social guarantees of the Russian state is compensation for a period of temporary disability due to illness. The source of financing for this payment is the social insurance fund, to which the employer makes contributions for all of its employees. The benefit is provided upon presentation of a certificate from a medical institution.

Basic Concepts

A sick leave certificate is a document issued by licensed medical institutions, which indicates the period of temporary incapacity for work of a person. The form has a unified form approved by the Ministry of Health and Social Development. In 2021, an electronic form of the document will also be acceptable. The grounds for issuing a sheet include:

- injury or illness of the employee himself;

- restorative procedures, aftercare;

- illness of one of the family members who requires care;

- pregnancy and childbirth.

Filling out the form is the responsibility of employees of medical institutions, and control over the correct formation of the document is exercised by the employer. His interest is based on the fact that management pays compensation from its own funds and then requests them from the Social Insurance Fund. Errors and inaccuracies in the form will lead to refusal from the fund.

The amount of payment is determined by several parameters:

- average salary;

- insurance experience;

- number of days of incapacity.

It is important to know! The employer calculates the payment based on the provided certificate, which indicates the third point and his information about salary and length of service. If an employee brings data from previous or other places of work about his earnings, then the accounting department must recalculate the amount.

Payment of sick leave in 2021

The benefit is paid for calendar days, that is, for the entire period of incapacity for which the sick leave was issued. There are several exceptions; their full list is contained in paragraph 1 of Article 9 No. 255-FZ of December 29, 2006. The amount of the benefit depends on the employee’s insurance length:

- if the length of service is less than 6 months, the monthly benefit amount is equal to the minimum wage, taking into account regional coefficients established in the region or locality;

- if the length of service is less than 5 years, the benefit amount is 60% of average earnings;

- if the employee’s work experience is from 5 to 8 years, the amount of sick leave is 80% of average earnings;

- if the length of service exceeds 8 years, the amount of sick leave is 100% of average earnings.

If an employee stops working for the organization, but within 30 days after dismissal he becomes unable to work due to injury or illness, he must be paid 60% of his average earnings. For information on the dependence of the amount of benefits on length of service in different cases, see Art. 7 No. 255-FZ dated December 29, 2006.

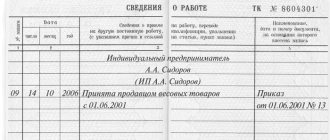

Calculate your length of service according to your work record book. It includes work under an employment contract; state civil, municipal, military and other service; activities of individual entrepreneurs and other activities during which the person was insured in case of temporary disability or maternity.

Reasons for recalculating sick leave after payment

The accounting department of an enterprise calculates sick leave based on the data it has. Along with this, they may be incomplete, for example, if a person works part-time or has recently joined a specific company. Considering that the basis is the average daily income for the last two years, it is beneficial for the employee to provide information from previous employers.

Reasons for recalculation

There are several grounds for recalculating already paid temporary disability benefits. These include:

- The emergence of new information about the employee’s earnings, for example, receiving certificates of income from previous places of work.

- Detection of facts of employee dishonesty - provision of knowingly false information about sick leave or salary.

- Errors in calculations made by an accountant.

If management has doubts regarding the authenticity of the submitted documents, then an authorized employee has the right to submit a request to the Social Insurance Fund in order to clarify the information.

Regulations

The regulatory act governing the rules for recalculating sick leave is Article 15, Article 255 of the Federal Law. Let's consider several provisions of the document:

- You can apply for benefits within three years after your right to it arises. If the payment did not take place due to the fault of the employer, the period is not limited.

- Excessively transferred funds due to the fault of the accounting department will not be recovered from the person.

- If inaccurate information about income or sick leave is discovered, leading to an overpayment, the employer has the right to write off up to twenty percent of wages as debt.

All of the above aspects apply to both temporary disability benefits and payments in connection with pregnancy and childbirth.

Billing period

In accordance with Article 14, Article 255 of the Federal Law, the calculation period for calculating sick leave benefits is two calendar years. Moreover, all 730 days are taken into account, without excluding weekends, holidays and other periods.

It is important to know! The period counts from the day the illness or other event subject to insurance began (the need to care for a relative, prosthetics, pregnancy, and so on). If a person had no income or it was less than the minimum wage, then the basis for calculation will be the minimum wage established in the region of residence.

An employee who was on maternity leave in the previous two years has the right to change the calculation period to the one when she worked. You cannot take any years, but only those preceding the insured event associated with the birth of a baby.

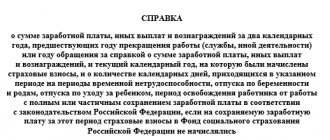

The need for a salary certificate

In order to legally recalculate the amount of compensation for the period of incapacity for work, you must provide your current employer with a certificate in Form 182H. It is issued to citizens in two cases:

- upon dismissal;

- former employees upon written request.

The employee has the right to receive the document for three years; it is during this period that he has the right to apply for disability benefits, which will take into account income from his previous place of work.

It is required to provide either the original certificate or a certified copy of the document (notarized or by the employer himself). Sick leave will be recalculated even if compensation has already been transferred. Based on the information received, the accountant will be able to determine the difference and transfer it to the employee.

If, for objective reasons, an employee cannot obtain a certificate from his former employer, then he submits a request to the Pension Fund for information about his income. This procedure takes more time, but is used in practice. As a rule, this is done if the company where the person worked is liquidated or located in another region.

How to fill out this application

One copy of the application must be completed. The form consists of two pages; no calculation data is required. The document will only serve as an accompanying document for income certificates, on the basis of which the payment will be recalculated.

What you need to indicate in the form:

- Name of the employing company or full name of the individual entrepreneur-employer.

- Full name of the applicant employee.

- The payment that needs to be recalculated. Here you need to tick the type of benefit.

- Reasons for recalculation. For example, providing income certificates while the employee was working for another employer. In this case, the payment will be changed upward.

- Information about the insured person. Write your last name, first name, patronymic, date of birth, SNILS number. The employee signs and indicates the date of submission of the document to the employer.

After submitting the application to the accountant, the data is checked, the accountant signs, dates, and enters the organization’s phone number and email. Then the application is sent to the FSS.

For your information! The accountant himself may ask the employee to fill out such an application if he suddenly sees inaccuracies in previous calculations.

Recalculation procedure

The recalculation of sick leave on the basis of new certificates from previous places of work is of interest to the employee himself, so the initiative should come from him. This is done in two steps:

- Obtaining data from previous employers in documentary form.

- Submitting an application in free form with attached certificates.

Based on the received materials, the accounting department, firstly, checks the accuracy of the information, secondly, makes a recalculation, and thirdly, submits a request to the Social Insurance Fund.

The money is transferred to the employee within fifteen days with the next salary or advance payment. As noted above, if an employee cannot obtain a certificate from a previous employer, then he asks management to make a request to the Pension Fund. Based on data from the Pension Fund, additional payments are calculated and sick leave from the previous period is recalculated.

Personal income tax withholding period for sick leave

The date of personal income tax withholding in accordance with paragraph 6 of Article 226 of the Tax Code of the Russian Federation for sick leave is determined in the same way as for other income: this is the real date of payment of temporary disability benefits in full or for the first 3 days. As of this date, personal income tax should be calculated.

If, due to circumstances, the actual date of payment of income differs from the expected one or the income is paid in installments, then the personal income tax will have to be reviewed and clarified.

| 1C:ITS For information on personal income tax on temporary disability benefits, see the reference book “Income Tax for Individuals” in the “Personnel and Remuneration” section. |

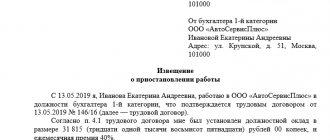

How to write an application for recalculation of sick leave

An application for adjustment of social benefit payments is submitted to the accounting department of the employing organization. Along with the application, you must also submit a documentary basis - a certificate of average earnings. Government Decree No. 294 of 04/21/2011 states that an application for payment and recalculation of sick leave benefits can be signed by an accountant or not: an accounting employee helps in filling out the application, but only the applicant signs the document.

Expenses are reimbursed in the same way as regular sick leave. The policyholder submits to the territorial body of the Social Insurance Fund an application from the employee, the basis for the adjustment (form 182n) and a corrected certificate of incapacity for work with the specified amount of average earnings and social benefits. If reference document 182n is not available, the basis for the additional payment is information on average earnings received from the Pension Fund.

ConsultantPlus experts figured out how to recalculate sick leave benefits. Use these instructions for free.

to read.

Here's how to write an application for recalculation of sick leave after maternity leave or other cases:

- Indicate the full name of the applicant (insured person) and the name of the territorial branch of the Social Insurance Fund.

- Describe the request - recalculate previously paid benefits.

- Determine the payment method and enter the MIR card details.

- Enter personal information about the recipient of social benefits - full name and date of birth, passport details and place of registration, contact information.

- List the documents that are attached to assign payment.

- Indicate the information necessary to assign social benefits: the name and telephone number of the policyholder, estimated information about average earnings and final payment.

- Indicate the date of completion and sign the application.

Developer response

In the situation you described, in April 2021 for May 2021, a negative recalculation of temporary disability benefits occurs.

Is it possible to reflect a negative recalculation of sick leave benefits for 2020 in personal income tax reporting for 2021?

If this negative recalculation is reflected in the personal income tax accounting for the month of detection (in April 2021), then in Appendix 1 Certificate of income and tax amounts of an individual of report 6-NDFL for 2021 for the employee for April 2021 under income code 2300 A negative amount of income will be reflected, which is not acceptable. In 1C: ZUP, the following approach is used in accounting for personal income tax: negative amounts cannot be allowed in the context of months of the tax period and income codes in Appendix 1 Certificate of income and tax amounts of an individual in the 6-NDFL report. Thus, in the document Reversal of accrual 00ЗК-000001 dated 04/30/2021, sick leave for May 2021 is reversed, which in the personal income tax accounting is attributed by the program to May 2021. The validity of this approach is confirmed by letters of the Federal Tax Service of Russia dated 01/27/2017 No. BS-4-11/ [email protected] (question 2) and No. BS-4-11/ [email protected] dated July 21, 2017 (question 8).

How to reflect in personal income tax reporting a decrease in income calculated by personal income tax, as well as withheld / refunded tax

Neither the Tax Code of the Russian Federation nor the explanations of the regulatory authorities currently provide instructions on how to take into account negative recalculations of income and the resulting amounts of excessively withheld personal income tax. Controlling authorities have repeatedly expressed the opinion that amounts transferred from the funds of the tax agent, and not the taxpayer, are not transferred tax on personal income, since clause 9 of Article 226 of the Tax Code of the Russian Federation prohibits the payment of personal income tax at the expense of tax agents.

Since there is no certainty on the issue of reflecting personal income tax when an employee returns the amount previously paid to him, several options are possible, each of which has its own advantages and disadvantages.

In the situation under consideration, in March, employee Ivanova E.N. deposited a debt in the amount of RUB 4,697.76 into the cash register. (reversal of accrual -5,399.76, increased by the amount of excessively withheld personal income tax in the amount of 702). On May 28, 2021, at the time of payment of sick leave benefits and withholding personal income tax, income in the amount of 4,697.76 rubles. was actually received by the employee, tax in the amount of 702 rubles. was retained in full compliance with the requirements of Chapter 23 of the Tax Code of the Russian Federation.

First option

Since the amount paid was reduced by the amount of tax, there is every reason to believe that the tax was withheld, and therefore at the time of transfer of this tax to the budget these were the funds of the taxpayer, and not the tax agent. In this scenario, the amount of personal income tax transferred to the budget ceases to be a tax. Therefore, the organization can return this amount of overpaid tax from the budget or offset against the payment of other taxes (overpayment cannot be offset against future personal income tax payments - clause 1, article 78 of the Tax Code of the Russian Federation Letter of the Federal Tax Service dated 02/06/2017 N GD-4-8/ [email protected] ). Taking this into account, from the salary for April 2021 (the month in which the sick leave for May 2021 was reversed), the organization had to transfer to the budget 702 rubles more than reflected in account 68.01.1 for the organization (that is, not reduce the payment by the amount of negative personal income tax for the employee). For this

- in the program, in the initial statement for the payment of sick leave (Statement to the bank 00ZK-000018 dated May 29, 2020), the cancellation of the previously withheld tax in the amount of 702 rubles should be reflected. To do this, you should clear the basis document in the decoding of the amount to be paid (Sick leave 00ЗК-000010 dated May 29, 2020), and in the tabular part of the personal income tax for transfer by employee, delete the line with the personal income tax withheld from sick leave in the amount of 702 rubles.

- submit an adjustment to 6-NDFL for the first half of 2021, where in Section 2 in the corresponding personal income tax deduction block (line 100 - 05/29/2020, line 110 - 05/29/220, line 120 - 06/01/2020) reduce the total indicators in lines 130 and 140 for an income of 5399.76 rubles. and sick leave tax 702 rubles. respectively.

- the decrease in income, calculated and withheld tax should also be reflected in Section 1 of the updated 6-NDFL reports for the first half of the year, 9 months and 2021 on lines 020, 040 and 070, respectively.

- the tax agent must submit to the tax authority updated information on the income of individuals in Form 2-NDFL for 2021.

note

! If an organization, when transferring personal income tax to the budget for April 2021, nevertheless reduced the personal income tax withheld from other employees by 702 rubles, and did not return it to the tax authority upon application, then the inspectors may have questions.

Where and when to submit it?

According to current legislation, you will have to submit an application for recalculation of sick leave after providing a certificate with new information. It must be taken to the accounting department of the organization in which the employee currently works. Sometimes an employee does not have the opportunity to obtain a certificate on his own, for example, if the company is located in another region or has closed. Then, in writing, he asks the current management to obtain this information from the Russian Pension Fund. The request must be sent to the Pension Fund within 2 working days.

Let us remind you that this year the application and payment procedure has changed. This is due to the fact that from January 1, 2021, all regions of the Russian Federation are switching to direct payments of benefits from the Social Insurance Fund (Article 6 of the Federal Law of December 29, 2021 No. 478-FZ). Let us recall that every year new subjects of the Russian Federation joined the FSS pilot project, approved by Government Decree No. 294 of April 21, 2011; this year the process was completed.

Until now, employers made payments on their own, and then the necessary expenses were reimbursed by the Social Insurance Fund (by reducing the amount of insurance contributions). Now the offset mechanism is canceled and benefits are paid directly by the Social Insurance Fund. The order is as follows:

- The employee submits an application in the established form for the Social Insurance Fund to the accounting department at work.

- The employer sends it to the Social Insurance Fund within 5 working days.

- After receiving the application and documents, the Social Insurance Fund makes adjustments to the sick leave sheet within 10 calendar days and pays benefits directly to the employee’s personal account. Remember that from July 1, 2021, money will be transferred only to a card with the Mir payment system.

IMPORTANT!

The law allows you to recalculate sick pay for the last 3 years before receiving a request from the employee. Correction of the amount of benefits paid earlier is not provided (Part 1 of Article 14, Part 2.1 of Article 15 of the 255-FZ).

How long to wait for recalculation

When the application is accepted, the employer is obliged to make adjustments to the sick leave within 10 calendar days. Here is an example of how benefits are calculated based on an employee’s application to calculate average earnings for calculating sick leave based on new data. Klara Konstantinovna Konstantinova has been working for the company since 2021. At the beginning of 2021, she was sick for 15 days. To pay her sickness benefits, earnings for 2021 and 2021 are taken into account. There was no data for this period, so the calculation was made according to the minimum wage (12,000 rubles):

disability benefit = minimum wagex24/730xnumber of sick days = 12000x24/730x15 = 5917.80 rubles.

Later, Konstantinova K.K. brought a certificate of income in form 182n and wrote an application for recalculation. Average earnings for 2021 reached 380,000 rubles, for 2021 - 397,000 rubles. The recalculation is done as follows: disability benefit = 380,000+397,000/730×15=15,965.75 rubles. The additional payment will be:

15,965.75 – 5917.80 = 10,047.95 rubles.

If the benefit has not yet been transferred to the employee, then you only need to correct the data. If you have already paid, you will have to recalculate the amount and pay the missing money within 15 days, on the day when the company pays wages (Part 1 of Article 15 255-FZ). Remember: the employer does not pay the entire benefit from his own funds, but only 3 days, the rest - directly from the Social Insurance Fund budget.

Personal income tax accounting in “1C: Salary and personnel management 8” (rev. 3)

We will consider the features of calculation and recalculation, accounting and reflection in personal income tax reports from sick leave in the 1C.Salary and Personnel Management 8 program, edition 3, using the following examples.

Example 1

| Worker S.S. On June 18, 2018, Gorbunkov submitted sick leave to the accounting department for the period from June 11, 2018 to June 16, 2018. The benefit on the same day was registered in the program with the document Sick Leave No. 1 and calculated. Payment of benefits is scheduled for June 29, 2018 during the interpayment period. However, the circumstances were such that the payment was made along with the salary on 07/03/2018. |

As a result of calculating benefits using the Sick Leave

5,979.45 rubles were accrued.

The date of actual receipt of income corresponds to the expected payment date of 06/29/2018. The actual payment was made on 07/03/2018. Therefore, the date of actual receipt of income changes.

After payment of benefits on 07/03/2018, the date of actual receipt of income is 07/03/2018.

In Example 1, the estimated payment date and the actual payment date refer to different months of the tax period - 2021 - and to different reporting periods - the II and III quarters, respectively.

In Form 6-NDFL, this disability benefit is not reflected in the half-year report, but is displayed in Sections 1 and 2 of the 9-month report, which complies with legal requirements.

When will sick pay be recalculated?

Federal Law on Social Insurance No. 255-FZ of December 29, 2006 establishes three cases in which the employer is obliged to recalculate sick leave for the previous period:

- Obtaining new information about the employee’s earnings for the billing period.

- Dishonesty of the employee: presentation of a false certificate of incapacity for work or certificate of income.

- Calculation errors: arithmetic or due to incorrect application of legal regulations.

The employer is obliged to recalculate sick leave if the employee, after accrual of benefits, brings certificates of earnings from previous employers received during the billing period. The benefit is recalculated three years before the date of receipt of new information about the employee’s income. For a longer period, accruals are not corrected or recalculated (Part 2.1 of Article 15 255-FZ).

IMPORTANT!

In a situation of prolonged illness and the issuance of a new certificate of incapacity for work, the working period is not recalculated due to long sick leave. The calculation period for the continuation of the BL is similar to that used when calculating the primary one.