Home /Articles on bankruptcy of individuals

Author of the article: Konstantin Milantiev

Last revised February 13, 2021

Reading time 5 minutes

Statistics show that pensioners are one of the most vulnerable social categories of the population. Small pensions, health problems, savings - all these factors do not contribute to a happy and fulfilling life, as a result of which people are forced to take out loans. Banks are in no hurry to issue loans to pensioners, and this leads them to MFO offices, where interest rates are inflated and conditions are not the most favorable.

Naturally, it is difficult to pay off the daily growing debt from a pension, and then a debt hole arises, from which only bankruptcy of the pensioner will help to get out. Where to apply for bankruptcy recognition for pensioners and what is needed for this, we will consider further.

Is bankruptcy possible for pensioners?

In Russia, since 2015, the Bankruptcy Law has been in force, allowing you to write off debts and officially declare yourself an insolvent person. This method is suitable for all individuals, including pensioners.

What is personal bankruptcy? This is a legal procedure carried out through the court. A pensioner can file for bankruptcy on his own, or the process can be initiated by his creditors - representatives of banks and microfinance organizations.

Can a pensioner file for bankruptcy? What do you need to go to court?

- Debts from 300,000 rubles.

- Overdue loans for a period of 90 days.

- Other compelling reasons for going to court (for example, providing certificates of illness).

Let's also figure out what needs to be taken to court? First of all, you need documents that will confirm that you really have nothing to pay off the loans. Your task is to prove that you took on debt obligations when the financial situation was good, but something changed and problems arose with payment.

Specifically, you will need to submit an application. A sample application to the court can be downloaded on our website; the document must contain the reasons that prompted you to declare bankruptcy. They must be documented. For example:

- medical reports about the disease (yours or a loved one);

- death certificate of the spouse (if he was the sole breadwinner of the family);

- loss of a job (entries from a work book, for example);

- loss of ability to work (if we are talking about the bankruptcy of a disabled pensioner, then a certificate of disability and relevant certificates are needed);

- guarantee (if the debtor has not repaid the debt and it has been transferred to you as a pensioner guarantor).

Thus, if you have all the individuals suitable for bankruptcy. persons conditions, you can go to court.

Settlement agreement

When the debt hole gets deeper, a person decides to declare bankruptcy. Agreeing with creditors to resolve your problems amicably is always better than going through the procedure of debt restructuring and selling property. If the pensioner understands that he can get a job in order to pay off creditors or knows another way out of the situation, he can initiate a settlement agreement with a request to defer payment.

A bankrupt pensioner can get a free consultation with a lawyer online. Don't waste your time thinking about how to get out of a difficult situation. It is difficult for older people to understand legal issues. Write a question, briefly describe the problem and wait for the lawyer’s response.

How to file bankruptcy for a pensioner: advice from lawyers

So, what should a pensioner consider when going to court to have his or her insolvency declared?

- Bankruptcy without property.

According to statistics, most citizens apply for bankruptcy without any property other than their only home. But courts do not always accept such statements. The debtor must have funds to pay court costs.Accordingly, in the absence of property, you must prove that you have the funds to pay all the costs of the financial manager (postage, publications in the official publication).

- Loyalty to pensioners.

Both in relation to a working pensioner and an unemployed person, the courts usually show loyalty. If necessary, you can agree to pay, for example, for the services of a financial manager a little later, after submitting the application and documents. - Search for a financial manager.

It should be found in advance and agreed upon to conduct the bankruptcy procedure. Otherwise, most likely, the case will remain without consideration. - Stopping calls from banks and debt collectors

after the first court hearing. After the first court hearing, collectors and banks will no longer bother you. If for some reason their calls and visits continue, you can safely contact law enforcement agencies to protect your interests. - The cost of bankruptcy proceedings

for a pensioner. If you do not have property suitable for sale, the average cost of bankruptcy will be 60-80 thousand rubles. Turnkey bankruptcy costs from 95,000 rubles in installments with a guarantee of debt write-off. - Choice of procedure.

If you do not have a stable source of income, we recommend that you immediately apply for the sale of property, bypassing debt restructuring. You will save at least 25,000 rubles and significantly reduce the time of the trial. - Deadlines.

In terms of terms, bankruptcy of citizens lasts 6-8 months - if there is no property.

How to quickly get your pension back after being declared bankrupt

The pension payment does not stop during the procedure. As noted above, the Pension Fund cannot credit it to the financial manager’s account. If the latter has abused his position and disposes of pension payments, it is necessary to immediately challenge the actions in court. The size of a pension exceeding one minimum wage must be justified by the costs of treatment, care or preferential payments (special length of service, military and veteran bonuses, payments for government awards), which cannot be subject to restrictions due to bankruptcy.

Articles:

Termination of bankruptcy proceedings for an individual

Bankruptcy of individual entrepreneurs in 2021: step-by-step instructions, features and consequences for entrepreneurs

What happens to the pension if an individual goes bankrupt?

Perhaps one of the most pressing topics is pensions in bankruptcy. In case of bankruptcy, all income and accounts of the debtor are managed by the financial manager. What to do with a pension, since this is often the only source of income for a pensioner?

Don't worry, your pension won't be taken away in case of bankruptcy. According to the legislation, it is calculated monthly in the amount of the designated subsistence level (it is different in each region).

For example, in Moscow for pensioners it is about 12,000 rubles. Accordingly, monthly payments in bankruptcy cannot be less than the specified amount.

It is important to note

that pension deductions should be taken care of in advance. When the court orders the sale of property, you will need to submit a corresponding petition for consideration by the court (if the financial manager does not do so).

In the process of selling property, we recommend assisting your financial manager; he will carry out almost all activities himself: publish information in the Federal Resources Agency, hold meetings of creditors, check your accounts, your property, and so on. Further, upon completion of all procedures and checks, the court issues a final decision to write off the debt.

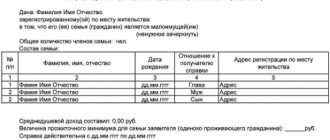

Documents required for filing an application

A citizen can prepare documents and submit an application either independently or seek help from a law firm. The cost will depend on the region and company tariffs. Retirees can choose organizations that offer benefits to older people.

The list of papers includes:

- applicant's passport;

- TIN, SNILS;

- document confirming marital status;

- all information about existing debt, this includes loan agreements, promissory notes, tax service requirements;

- an inventory of the property that belongs to the applicant as a property;

- register of creditors indicating the amount of debt for each of them;

- certificate of pension amount;

- receipt of payment of state duty - 300 rubles and remuneration to the manager in the amount of 25,000 rubles.

A set of documents is attached to the application.

Why is legal support important for pensioners with loan debtors?

The trial is a whole complex of events and procedures where preparation is of great importance. In judicial practice, there are often refusals to consider applications due to insufficient preparation - the absence of certain documents, missed deadlines, and so on.

Consulting a lawyer at the initial stages will help you avoid common mistakes. In addition, a lawyer will help:

- make an application;

- collect documents;

- select a financial manager;

- understand the intricacies of the judicial process;

- draw up complaints and petitions;

- lift restrictions on traveling abroad;

- preserve the property, if any.

Legal support is especially important in Moscow, where cases are streamlined due to the high workload of courts. To avoid standard refusals and other risks of premature completion of the bankruptcy process, it is better to take care of legal support in advance.

Judicial practice in 2021

As we wrote above, the courts usually treat pensioners favorably.

An example is case No. A19-21428/2015 dated February 25, 2021, where bankruptcy was recognized in relation to a man born in 1954. The debt to banks amounted to more than 1 million rubles, there was no money in the accounts or property (except for the funds needed to pay court costs). Bankruptcy was declared in due time.

You can also cite as an example a new case No. A60-46639/2018 dated November 9, 2021, the decision was made in the Arbitration Court of Yekaterinburg. The debtor, a female pensioner, filed a petition to exclude the pension from the bankruptcy estate, and the petition was granted in full.

If you are interested in bankruptcy or have a difficult financial situation, please contact our specialists. We will tell you how to declare bankruptcy for a pensioner and provide support during all court hearings.

Get a free consultation with a credit lawyer right now - by phone or online chat.

Bankruptcy of a pensioner Bankruptcy of individuals individualsJudicial practiceBankruptcy lawyer

Author of the article Konstantin Milantiev

Publications 222

More information →

about the author

Expert in the field of bankruptcy of individuals. He has been an active arbitration manager since 2015. Konstantin’s publications are published in various expert publications and media. Active participant in conferences, seminars and discussions on amendments to the current legislation of the Russian Federation on bankruptcy.

Rate this article

104 likes

Share with friends:

Advantages and disadvantages of bankrupt status

Bankruptcy of individuals persons - the procedure is not cheap, and this is one of the main disadvantages for many citizens. Also, during the proceedings, the debtor has no right:

- without the consent of the financial manager, buy or sell movable and immovable property, pledge it;

- take out new loans or borrowings, as well as act as a guarantor, without notifying the credit institution of your bankruptcy;

- manage funds in your bank accounts.

There are some restrictions after the procedure is completed. For 3 years you cannot manage a legal entity (but you can own a share), for 5 years you can be the head of a microfinance organization, an insurance company, or a non-state pension fund. And you cannot become the head of a credit organization for 10 years.

Everyone decides for themselves how significant these disadvantages are. However, for the majority, bankruptcy through the court is the only chance and a civilized, legal way to get rid of the debt burden. After declaring a citizen bankrupt:

- He has the right not to pay the obligatory payments accumulated by this time (except for those that arose after being declared bankrupt - taxes, fees, housing and communal services).

- He has the right not to pay the claims of creditors - all such transactions will henceforth be considered only within the framework of a financial insolvency case.

- The accrual of penalties (interest), fines and other sanctions on existing debts ceases.

- Enforcement proceedings for property collections are terminated: bailiffs stop withholding money from salaries, arrests, bans, etc. are lifted.

That is, after an individual is declared bankrupt, any demands from creditors are considered unfounded and, therefore, not subject to execution.