Who pays for sick leave now? When can I expect funds to arrive? And how does everything work now?

Our expert, Anastasia Kutsan, General Director of BUKHSERVICE LLC, answers these questions.

Previously, sick leave was paid for by the employer, but now everything has changed. At the moment, money for almost all benefits, including sick leave, is immediately transferred by the FSS. It turns out that benefits are immediately paid directly to the recipient.

Since January 2021, Moscow, Moscow region, St. Petersburg, Krasnodar, Perm territories, Sverdlovsk and Chelyabinsk regions, as well as the Khanty-Mansi Autonomous Okrug have switched to such direct payment from the Social Insurance Fund. Other cities and regions switched over even earlier.

Who pays for sick leave in 2021

From January 1, 2021, Russia switched to direct payments of temporary disability benefits.

All regions joined the pilot project; the credit system is no longer in effect. This means that employers only pay for the first 3 days of illness; for the remaining days, the Social Insurance Fund pays the insured person directly. The deadline for payment of sick leave from the Social Insurance Fund to an employee from the moment of its delivery, equal to 10 days, is established in Article 15 255-FZ of December 29, 2006. It is counted from the date of receipt of the necessary documents from the policyholder. But there are also exceptions. The Social Insurance Fund pays in full for certificates of incapacity for work issued on the following grounds:

- pregnancy and childbirth;

- caring for a sick family member;

- quarantine of an employee, a child under 7 years of age (subject to attending kindergarten), an incapacitated family member;

- prosthetics in a hospital if there are medical indications;

- sanatorium-resort treatment after medical care.

Instructions for an employee on how to receive money for sick leave from the Social Insurance Fund according to the new rules:

- When an insured employee becomes ill, he or she goes to a clinic or hospital. The doctor opens a sick leave certificate in paper or electronic form.

- The employee is undergoing the necessary treatment. The attending physician closes the sick leave.

- The employee submits a paper certificate of incapacity for work or the number of an electronic certificate of incapacity for work to the accounting department.

- The accountant calculates payments and transmits the register of information to the territorial Social Insurance Fund.

- The fund specialist checks the documentation submitted by the policyholder and transfers the benefit to the specified account.

The questions are answered by the head of the department for coordinating the activities of the territorial bodies of the Fund for the appointment and implementation of insurance payments of the Directorate for organizing the provision of insurance payments of the Social Insurance Fund of the Russian Federation Anna Dobrolyubova .

A fixed-term employment contract has been concluded with the organization. Will I be fired while on maternity leave because the employee who retained his job leaves? What will the benefit amount be?

If you are fired while on maternity leave (that is, your fixed-term employment contract will be terminated upon the return to work of the employee who retained the job) and you are classified as unemployed citizens, then the monthly care allowance for the child will be assigned and paid by the territorial social security authority at your place of residence. Your employer needs to send an information letter about the termination of payment of your monthly child care allowance to the branch of the regional branch of the Federal Social Insurance Fund of the Russian Federation at your place of registration in connection with the termination of your employment relationship.

Additionally, we inform you that currently the minimum amount of benefits for caring for the first child is 2908 rubles. 62 kopecks, for the second child - 5817 rubles. 24 kopecks

Is personal income tax withheld from maternity benefits and monthly child care benefits?

According to paragraph 1 of Art. 217 of the Tax Code of the Russian Federation, monthly child care benefits and maternity benefits are not subject to taxation.

Is maternity leave included in the insurance period?

According to Order No. 91 of 02/06/2007 “On approval of the rules for calculating and confirming the insurance period to determine the amount of benefits for temporary disability, pregnancy and childbirth,” the insurance period includes:

periods of work under an employment contract;

periods of state civil or municipal service;

periods of other activities during which a citizen was subject to compulsory social insurance in case of temporary disability and in connection with maternity.

Periods of maternity leave, as well as child care leave, are taken into account in the insurance period, since during this period the employment contract continues (Letter of the Federal Social Insurance Fund of the Russian Federation dated 08/09/2007 No. 02-13/07-7424) .

The organization has a period of downtime because it is undergoing renovations. I brought a sick note during the downtime. How will sick leave be paid if temporary disability occurred during downtime and ended at the same time?

According to clause 1.5 of Art. 9 of the Federal Law of December 29, 2006 No. 255-FZ “On compulsory social insurance in case of temporary disability and in connection with maternity”, benefits for temporary disability during downtime are not assigned.

Since temporary disability in your case began and ended during a period of downtime, you will not be awarded benefits.

At my main place of work, I am on maternity leave for up to one and a half years, but I continue to work as a part-time worker in another organization. Which employer must pay temporary disability benefits due to a child’s illness?

In this case, a sick leave certificate must be issued for presentation at a part-time job, since it is there that you require release from work (clause 23 of the Procedure for issuing certificates of incapacity for work, approved by order of the Ministry of Health and Social Development of Russia dated June 29, 2011 No. 624n). At the main place of work, in accordance with paragraph 22 of Order No. 624n, the employee is not entitled to a certificate of incapacity for work. At the same time, when issuing a certificate of incapacity for work, the doctor in the line “primary/part-time” emphasizes “part-time”. The benefit must be paid by the employer where the employee works on an external part-time basis, from the earnings accrued at this place of work.

My husband died in Germany during a business trip. On the basis of what documents should social benefits for funerals be paid in such a situation?

In accordance with Part 2 of Art. 10 of Federal Law No. 8-FZ of January 12, 1996, payment of social benefits for funerals is made on the basis of a death certificate. Moreover, this certificate is issued by the civil registry office in the event of the death of a citizen on the territory of the Russian Federation. Germany and the Russian Federation are states that signed on October 5, 1961 the Convention Abolishing the Requirement for Legalization of Foreign Public Documents (hereinafter referred to as the Convention).

Article 2 of this Convention provides that each of the contracting states exempts from legalization documents covered by this Convention and which must be presented on its territory.

According to Article 3 of the Convention, the only formality that can be required to certify the authenticity of the signature, the quality in which the signatory acted and the authenticity of the seal or stamp affixed to the document is the affixing of the apostille provided for in Article 4 of the Convention by the competent authority of the State in which which this document was executed.

Thus, in this case, the assignment and payment of social benefits for funerals must be carried out on the basis of an international death certificate with an apostille.

Can I count on benefits for caring for a child up to one and a half years old if I became a guardian and registered guardianship on a paid basis?

Yes you can. Not only relatives, but also guardians who actually care for the child have the right to such benefits (Part 1, Article 11.1 of Federal Law No. 255-FZ of December 29, 2006). The fact that guardianship is paid does not matter. After all, the guardianship and trusteeship authority can enter into an agreement with the guardian on a paid basis. This is a foster family agreement.

The child turns 7 years old this year. How many days will be paid for sick leave, 60 or 45?

In accordance with Part 5 of Art. 6 of the Federal Law of December 29, 2006 No. 255-FZ, for the illness of children under 7 years of age, from 7 to 15 years old and from 15 to 18 years old, a different limit of paid days for caring for them is established during the calendar year. If a child turns 7 during the year, then the age is determined at the beginning of the year. That is, the maximum limit of paid days is taken according to the child’s age at the beginning of the year, but not more than 60 calendar days per year, if he does not have other diseases.

Can I, as the father of a child, studying as a student in paid courses at a university, count on payment of a lump sum benefit upon the birth of a child, since the mother does not work or study anywhere?

Regulatory legal acts establish the right of persons studying on a paid or free basis in educational institutions of primary, secondary and higher vocational education and institutions of postgraduate vocational education to receive a one-time benefit upon the birth of a child in these educational institutions. Paid educational courses do not apply to the listed types of institutions.

At the same time, since the child’s mother does not work or study, a lump sum allowance for the birth of a child can be assigned to her and paid by the social protection authority at the place of residence (registration).

The employee is on maternity leave to care for a child up to 1.5 years old and works 7 hours a day. Does she have the right to sick pay if her child gets sick?

A woman who is on maternity leave and works part-time has the right to simultaneously receive a monthly allowance for caring for a child up to 1.5 years old, and a temporary disability benefit for caring for this child. The current legislation does not contain any restrictions on the payment of sick leave for part-time workers (Article 93 of the Labor Code of the Russian Federation).

Am I entitled to sick leave to care for a disabled child during his hospitalization for a planned operation?

A certificate of incapacity for work is issued for caring for a disabled child under the age of 15 years - during outpatient treatment or the joint stay of one of the family members with the child in an inpatient medical institution for the entire period of an acute illness or exacerbation of a chronic disease (clause 35 of the Procedure for issuing certificates of incapacity for work , approved by order of the Ministry of Health and Social Development of Russia dated June 29, 2011 No. 624n).

The need for medical care or observation is determined by the attending hospital physician.

I was injured while intoxicated. I was paid sick leave at the minimum rate. It is legal?

The grounds for reducing the amount of temporary disability benefits are:

violation of the regimen prescribed by the attending physician;

failure to appear without a good reason at the appointed time for a medical examination or a medical and social examination;

illness or injury resulting from alcohol, drug or toxic intoxication.

If there are grounds for reducing the temporary disability benefit, the benefit is paid to the insured person in an amount not exceeding the minimum wage for a full calendar month.

I'm on prenatal leave, I broke my leg. Will I be paid sick leave for my injury?

In this case, you will not be paid sick leave, since the injury occurred during maternity leave.

Sick leave can only be issued if, after the end of your vacation, you continue to be ill (clause 22 of the Procedure for issuing certificates of incapacity for work, approved by order of the Ministry of Health and Social Development of Russia dated June 29, 2011 No. 624n).

Temporary disability benefits are not assigned during the period of release of the employee from work with full or partial retention of wages in accordance with the law (Article 9 of Federal Law No. 255-FZ of December 29, 2006).

After my illness, I submitted an application for benefits and sick leave to my employer. A month has already passed, and the employer has not submitted the information to the Social Insurance Fund. What should I do?

In case of violation of the deadlines for transferring documents to the Social Insurance Fund, which is 5 calendar days from the moment of receiving them from the employee, you can contact the supervisory authorities: the prosecutor's office, the court, the State Labor Inspectorate.

It is important for the employee to put the date on the application for payment of benefits at the time of transfer of documents to the accounting department of the enterprise. If this is not done, the employer can set a later date that is convenient for him, and 5 calendar days will be counted from it.

When going to court, the employee has the right to demand that the employer submit documents to the Social Insurance Fund and collect interest from the employer in connection with the late application for benefits.

The Prosecutor's Office and the State Labor Inspectorate may bring the policyholder to administrative liability.

Therefore, if a woman works part-time, the benefit is calculated from the average earnings of the insured person, calculated for the two calendar years preceding the year of temporary disability. Only if she had no earnings or the average earnings calculated for these periods, calculated for a full calendar month, are lower than the minimum wage, then the benefit should be calculated in accordance with part 1.1. Article 14 of Federal Law No. 255-FZ.

How many times is an accountant required to recalculate the amount of benefits if an employee brings certificates from other places of work?

Part 2.1 of Article 15 of the Federal Law No. 255-FZ provides that if the insured person, on the day of applying for benefits for temporary disability, pregnancy and childbirth, monthly child care benefits, does not have a certificate (certificates) of the amount of earnings necessary to assign these benefits in in accordance with parts 5 and 6 of Article 13 of Federal Law No. 255-FZ, the corresponding benefit is assigned on the basis of information and documents submitted by the insured person and available to the policyholder (territorial body of the insurer). After the insured person provides the specified certificate (certificates) on the amount of earnings, the assigned benefit is recalculated for the entire past time, but not more than for three years preceding the day the certificate (certificates) on the amount of earnings was provided.

Thus, the accountant is obliged to recalculate as many times as the employee brings certificates within a three-year period.

Can a pregnant woman work during maternity leave, will she lose her benefits?

Maternity benefits are assigned and paid while a woman is on maternity leave. Benefit - compensation for lost earnings due to vacation. If a woman, having the right to leave, continues to work, then there are no grounds for paying her maternity benefits for the period of work that coincided with the leave period (Federal Law of July 16, 1999 No. 165-FZ “On the Basics of Compulsory Social Insurance ").

The account to which benefits were transferred to me for up to 1.5 years is no longer valid. A new one has been opened. What should I do?

You need to write an application, indicating new bank details. After this, the employer must provide the information received from you to the branch of the Social Insurance Fund at the place of registration. Subsequent payments will be made by transferring funds to a new bank account.

My son is 10 months old. I'm about to return to work from maternity leave on a part-time basis. Will I be paid for sick leave if I or my child gets sick?

The law does not provide for restrictions. If you go to work part-time, you will receive child care benefits, and you will be paid sick leave in case of illness of you or your child (Article 43 of the Order of the Ministry of Health and Social Development of the Russian Federation dated December 23, 2009 No. 1012n “On approval of the Procedure and conditions for the appointment and payment of state benefits to citizens with children”).

In the event of the birth of twins, is it possible to provide parental leave to both the mother and another relative who is actually caring for the children?

In accordance with Art. 256 of the Labor Code of the Russian Federation, leave to care for a child until he reaches the age of three years can be fully or partially used, in addition to the woman herself - the mother of the child, by his father, grandmother, grandfather, as well as another relative or guardian actually caring for him ( parts 1 and 2). There may be different persons on maternity leave for different children, i.e. each of the twins. For example, for one child, leave can be issued by the mother, and for another - by the working grandmother.

Do surrogate and biological mothers have the right to receive sick leave for pregnancy and childbirth?

A certificate of incapacity for work for pregnancy and childbirth is issued to the “surrogate mother” in accordance with clause 46 and clause 52 of the Procedure for issuing certificates of incapacity for work dated June 29, 2011 No. 624n. The issuance of a certificate of incapacity for work to the “genetic mother” (biological) during surrogacy is not provided for by law.

I had a baby. The husband does not work and is not registered with the employment center. What certificates will he need to provide so that I can receive benefits for the birth of a child and for caring for a child up to 1.5 years old?

To assign benefits, you will need to provide certificates from the social protection authorities at your husband’s place of residence stating that benefits for the birth of a child and for caring for a child under 1.5 years of age were not assigned (clause 28, clause 42 of the Order of the Ministry of Health and Social Development of the Russian Federation dated December 23 .2009 No. 1012n “On approval of the Procedure and conditions for the appointment and payment of state benefits to citizens with children”). Certificates are issued for each benefit separately.

I was calculated and paid maternity benefits for 140 days. But I had a caesarean section and extended my sick leave for 16 days. Tell me how to count 16 days. How's the new sick leave? Is the employer paying for the first 3 days?

Maternity benefits are paid in total for the entire period of maternity leave lasting 70 (in case of multiple pregnancy - 84) calendar days before birth and 70 (in case of complicated childbirth - 86, for the birth of two or more children - 110) calendar days after childbirth (Federal Law No. 255-FZ of December 29, 2006 “On compulsory social insurance in case of temporary disability and in connection with maternity”). An additional certificate of incapacity for work (16 days) is a continuation of the insured event (maternity leave) and is paid by the Social Insurance Fund.

I'm on maternity leave. Our company recently increased its salary. Will my monthly child care allowance be increased to 1.5 years?

In your case, the amount of your monthly child care benefit will not increase. The amount of benefits for working women is 40% of the average earnings for the 2 years preceding the year of maternity leave for up to 1.5 years (Article 15 of the Federal Law of the Russian Federation of May 19, 1995 No. 81-FZ “On state benefits to citizens having children").

Is it possible to replace only one year for calculating maternity and child benefits? How many days do you need to be on maternity leave or parental leave before a year can be replaced?

If in two calendar years immediately preceding the year of the insured event, or in one of the specified years, the employee was on maternity leave and (or) child care leave, the corresponding calendar years (calendar year), at the request of the benefit recipient, may be replaced for calculating average earnings by previous calendar years (calendar year), if this leads to an increase in the amount of benefits (Federal Law of the Russian Federation No. 255-FZ of December 29, 2006).

In 2021, earnings for 2014 and 2015 are taken into account. An employee may request to replace both 2014 and 2015, or only 2014 or only 2015.

It is possible to exclude a particular year even if the employee was on maternity or child care leave for one day a year.

I am an individual entrepreneur, in October 2014 I registered with the Social Insurance Fund for voluntary insurance. Can I count on maternity benefits in July 2015? Do I need to pay insurance premiums for the remaining months of 2014?

Policyholders who voluntarily registered with the Social Insurance Fund of the Russian Federation pay insurance premiums based on the cost of the insurance year (Part 3, Article 4.5 of Law No. 255-FZ “On compulsory social insurance in case of temporary disability and in connection with maternity”). Moreover, regardless of the date of entry into a voluntary relationship, the condition for receiving benefits is the payment of insurance premiums for the previous year in full. For 2014, the amount of the insurance premium for the year is 1933 rubles.

Therefore, if you entered into a voluntary relationship with the Social Insurance Fund of the Russian Federation in October 2014 and paid 1933 rubles, then you have the right to benefits in 2015 and do not need to pay additional insurance premiums for the remaining months of 2014.

How to obtain a 2-NDFL certificate about the amount of money paid during the period of parental leave?

You can obtain a certificate of income (benefits paid from the funds of the Social Insurance Fund of the Russian Federation) at the branch of the Fund at the place of registration of your employer.

The certificate is of a declarative nature.

There are several ways to obtain help:

You can personally contact the branch at the place of registration of the employer.

Send an application for the required certificate to the branch at the place of registration of the employer by mail or email.

Your representative can contact the place of registration of the employer with a power of attorney, executed in simple written form, to obtain such a certificate.

An application for a certificate of the amount of benefits paid must be completed in any form indicating the full name, SNILS, passport data, full name of the employer, and residential address.

A certificate of income is prepared within three days from the date of submission of the application.

If it is impossible to receive the certificate in person, it will be sent to you by registered mail with notification.

Every month I received child care benefits on the 3rd–5th. This month is the eleventh. When should benefits be paid?

Payment of a monthly allowance for the care of a child up to one and a half years old to working citizens of the Nizhny Novgorod region is made in the current month from the 1st to the 15th of the previous month.

These deadlines are regulated by Decree of the Government of the Russian Federation dated April 21, 2011 No. 294. Linking a specific recipient to a specific date is not provided.

"Arguments and Facts"

Read the material at the link:

https://www.aif.ru/onlineconf/konsultaciya_specialista_fonda_socialnogo_strahovaniya

When should the money be paid?

The rules regarding how long sick leave must be paid differ for the employer and the Social Insurance Fund: the employer pays for the first three days of sickness. The policyholder calculates his part of the social benefit and pays it on the nearest date of payment of wages at the institution. The Fund transfers funds for the remaining period within the period established in Art. 15 255-FZ.

IMPORTANT!

In addition to the first three days of illness, the employer transfers to the employee a social benefit for funeral and compensation for 4 additional days off to care for a child with a disability. All other social payments and benefits for certificates of incapacity for work are transferred by the Social Insurance Fund.

The procedure for mutual settlements between the insured person and social insurance is enshrined in Federal Law No. 255-FZ. In Part 2 of Art. 15 255-FZ indicates how many days after the FSS transfers sick leave - it must do this 10 calendar days after the employer provides all the necessary information and accompanying documents. The policyholder sends the documentation to the territorial office of the department within 5 calendar days after receiving information from the insured employee.

New payment rules have also been established for child care benefits up to 1.5 years. From 2021, it will be paid in full by social insurance. The regulatory publications of the FSS explain how many days after the FSS pays sick leave to a bank card in 2021 (social benefits up to 1.5 years):

- the first time the money is transferred according to the general rule: the employer transmits information to the fund within 5 days, social insurance processes the request and transfers the funds within 10 days;

- the second and subsequent social payments are automatically transferred during the first 15 days of the month following the billing month.

If an employer violates the deadlines for paying his part of the social benefit, he will be fined and required to pay a penalty for each overdue day (Article 236 of the Labor Code of the Russian Federation, Part 6 of Article 5.27 of the Code of Administrative Offenses of the Russian Federation). If payments from the Social Insurance Fund arrive later, the employee will have to figure out the reasons for this delay. Delay due to the fault of social insurance and the assignment of compensation to the insured person are allowed to be challenged in court.

ConsultantPlus experts discussed how to calculate and pay temporary disability benefits in 2021. Use these instructions for free.

Why are payments delayed?

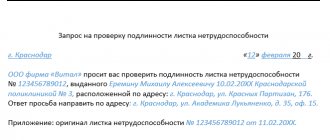

The policyholder is obliged to submit the completed certificate of incapacity for work and accompanying documents to the Social Insurance Fund. Only after this the employee will be paid benefits. The deadline for payment of sick leave from the Social Insurance Fund to an employee from the moment it is submitted is 10 days, the deadline for transferring the sick leave from the policyholder to Social Insurance is 5 days.

If the employer violates the deadline for transferring his part of the benefit (the first 3 days), he will pay a fine and penalty for each overdue day (Article 236 of the Labor Code of the Russian Federation, Part 6 of Article 5.27 of the Code of Administrative Offenses of the Russian Federation). If the deadlines for transferring funds from the Social Insurance Fund are violated, the employee needs to figure out why such a delay occurred and when the money will arrive.

The provisions of 255-FZ establish how many days after the Social Insurance Fund pays sick leave to a bank card in 2021: Social insurance makes payments to the insured person within 10 days (Part 2 of Article 15 255-FZ). The employee checks the status of payment of the sheet in the special Social Insurance information system - the personal account of the insured person. If the sick leave is paid, it is assigned status 080. If the money does not arrive on time, the employee contacts Social Security for clarification.

The main reasons for late payment of sick leave:

- The doctor or policyholder made a mistake when filling out the document.

- The employee provided incorrect (invalid) bank card or account details for transferring funds.

- The employer sent the employee’s certificate late or did not send it in a timely manner.

- The accountant did not include accompanying documents in the payment application and did not create a register.

- There were technical failures in the Social Insurance system.

IMPORTANT!

If the delay occurred due to the fault of the Social Insurance Fund, the employee has the right to request compensation.

ConsultantPlus experts looked at how an employee can receive benefits in the event of an accident at work. Use these instructions for free.

to read.

Why are there delays in payment?

All information about open certificates of incapacity for work is available in the Unified IIS “Sotsstrakh” - a special system of the Social Insurance Fund. The information system user manual contains information on how to find out when the money for sick leave will arrive - you need to check the status in the personal accounts of the policyholder and the insured person. Login to your personal account is carried out using the login and password from the government services portal.

IMPORTANT!

An electronic certificate of incapacity for work paid for through direct payments has status 080. Control and verification of payment after transfer of information to social security is not the responsibility of the employer. After receiving the register, the territorial fund is responsible for the calculations. If an employee wants to find out when he will be paid, he independently contacts the department.

The reasons for delaying money from the Social Insurance Fund are as follows:

- errors in filling out the form by the medical institution or employer;

- incorrect (invalid) details for transferring funds;

- technical glitches.

But there is another reason for delayed payments - employer mistakes. For example, the responsible specialist filled out the sick leave certificate with violations, made a mistake when creating the register, did not transfer all the documents to the Social Insurance Fund, or did not transfer the entire package. In such a situation, the employee acts as follows:

- Calls the territorial social security or checks the sick leave status in the personal account of the insured person.

- Applies in writing to the executor (accountant) for clarification if the fund has confirmed an error on the part of the employer.

- If the employer says that he has handed over everything or refuses to provide information on the certificate of incapacity for work and correct errors, the employee files a complaint with the labor inspectorate or goes to court on the basis of Art. 391, 392 Labor Code of the Russian Federation.

What does status mean?

The status “Document sent for payment” in the Social Insurance Fund is a system designation that indicates the entry of a document into the register for payment of benefits. In fact, the system notifies that the document has been processed, does not contain errors and is included in the order. Most often, this status is followed by information about the transfer from the Social Insurance Fund to the bank account: “Payment execution” or “Payment paid.”

Important: when this status appears, the payment amount is not recorded by the system (usually just the “-” symbol is indicated). There is no need to panic, because many people mistakenly perceive this information as a “zero payment”. The transfer amount will be loaded later, at the time of the actual transfer of funds to the employee’s account.

The processing time for payments to the Social Insurance Fund is constantly decreasing

How to find out when the money will arrive

The money is transferred to a bank card or current account not linked to the card, the details of which were indicated by the recipient of the benefit. If there is no bank card or open account, social payments are transferred by mail. The recipient checks receipts, and if payments are delayed, contacts the territorial social security. For those who are not registered in the personal account of the insured person, there is a FSS hotline for sick leave - 8 800-302-75-49. This number is the same for all subjects of the Russian Federation.

In addition, regional branches of the Social Insurance Fund also provide advisory support. For example, the FSS telephone number for sick leave in St. Petersburg. The line for receiving requests from citizens operates without breaks and weekends.

But where to call about sick leave in Moscow - (495) 650-19-17. In addition, separate lines exist for each territorial department of social insurance in the Moscow region.

How it works

The sick leave payment mechanism is now as follows.

1

The employer pays for the first three days of illness for the employee.

2

The remaining days of sick leave are paid for by the Social Insurance Fund.

3

Tax on income during sick leave will also be withheld differently. Tax for the first three days is withheld by the employer. The tax on the remaining amount is withheld by the FSS, and the fund itself transfers it to the budget.

If you need to return personal income tax at the end of the year, then a 2-NDFL certificate with the amount transferred by the Fund can be seen in your personal account on the State Services portal or received directly at the Fund’s branch.

Normative base

Government Decree No. 2375 of December 30, 2020 “On the specifics of financial support, assignment and payment in 2021 by the territorial bodies of the Social Insurance Fund of the Russian Federation to insured persons of insurance coverage for compulsory social insurance in case of temporary disability and in connection with maternity and for compulsory social insurance from accidents at work and occupational diseases, making other payments and reimbursement of the insurer's expenses for preventive measures to reduce industrial injuries and occupational diseases of workers"

What the employer cannot influence

Often, an employee’s health allows him to perform his work function, because the presence of long-term health restrictions indicates significant limitations in life activity and entails establishing the degree of loss of professional ability, i.e. recognition of an employee as disabled.

Disability, as the loss of the opportunity to work at full capacity, is the object of social insurance (Articles 1.2, 1.3, 2 of the Federal Law of December 29, 2006 N 255-FZ “On compulsory social insurance in case of temporary disability and in connection with maternity”) .

If necessary, a citizen has the right to seek medical help at any institution convenient for him, to any doctor who, if indicated, draws up the relevant documents, including a sick leave certificate.

The very fact of a citizen applying to a medical institution, not to mention information about the disease, is considered a medical secret. Accordingly, neither a medical organization nor any employee of this organization can provide legally protected information to an inappropriate person. In this situation, the employer himself applies.

It is the information protected by law that does not allow the employer to make a request about the employee’s disability to a medical organization, and the medical organization to provide the employer with data about the citizen’s illness.

Maternity leave individual entrepreneur

Typically, maternity leave lasts 140 days - 70 days before childbirth and 70 days after. This period increases with the birth of twins or due to complications. For the calculation, take the average earnings equal to one minimum wage on the day the insured event occurred

In 2021, the Social Insurance Fund will pay approximately 59 thousand rubles for 140 days of vacation - we can say more precisely, knowing the exact dates.

An example of calculating maternity leave for individual entrepreneurs

Individual entrepreneur on maternity leave from January 15 to June 3, 2021. Benefit for each month on maternity leave:

- from January 15 to January 31: 12,792 / 31 × 17 = 7,014 rubles

- from February 1 to February 28: 12,792 rubles

- from March 1 to March 31: 12,792 rubles

- from April 1 to April 30: 12,792 rubles

- from May 1 to May 31: 12,792 rubles

- June 1 to June 3: 12,792 rubles / 30 x 3 = 1,279.2 rubles

Total: 59,461.2 rubles.

What is the responsibility for late submission of documents to the FSS?

Since the employer does not pay benefits from the 4th day of sick leave, this may lead to delays in sending documentation to the Social Insurance Fund. In general, he is obliged to send documents within 5 days. To prevent failure to comply with the deadline, the law provides for liability for employers.

For violation of the procedure and deadlines for sending documentation to the Social Insurance Fund, the employer is held liable in accordance with Part 4 of Art. 15.33 Code of Administrative Offenses of the Russian Federation. The fine is 300-500 rubles. for officials (director and chief accountant).

How sickness benefits are assigned and paid

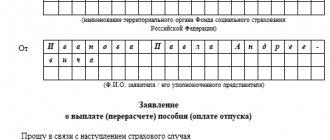

To receive benefits, the employee submits an application to the employer in the form from Appendix No. 1 to Order No. 578 of the Social Insurance Fund dated November 24, 2017. It must indicate how the benefits are paid - to a MIR card, a bank account or through a postal transfer.

Often, the employer prepares such an application independently in an accounting program - the employee is only required to provide information about the account details and the sick leave certificate itself.

An employee has the right to apply to the employer for benefits within 6 months from the end of the insured event or from the establishment of disability. In other words, when the sick leave is closed, it must be submitted to receive benefits no later than 6 months. If you do not meet the deadline, payment of sick leave benefits will be denied (clause 17 of Government Resolution No. 2375 of December 30, 2020).

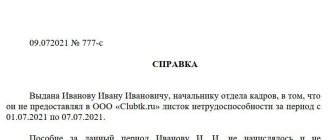

When the employer receives information and documentation from an employee, he processes it and transmits it to the regional department of the Social Insurance Fund. This must be done no later than 5 days from the date of receipt from the employee.

Attention! From 2022, you will no longer need to apply for sick pay. To receive benefits, you only need to provide your electronic sick leave number. Draft law No. 1062568-7 is currently under consideration by the State Duma.

When the documents are submitted and processed, the employer pays benefits for the first 3 days of illness on the next payday, and the Social Insurance Fund pays benefits for the remaining days within 10 days from the date the documents were received by the fund (clause 11 of Government Resolution No. dated 12/30/2020 2375).