Various conflicts and disputes are rightly considered an integral part of communication between people. Most of them are resolved at the everyday level, but a certain part of the disputes is referred to the court for trial.

When considering a civil case by a court, the person who considers his rights to be violated is called the plaintiff, and the violator’s party is called the defendant. One or several people can speak on both sides. Sometimes, while a case is pending, the defendant dies, and the plaintiff must know what to do next.

If the defendant in a civil lawsuit dies

Procedural rights and obligations during legal proceedings in a specific case may be transferred from one person who was a party to a civil proceeding to another person. Procedural succession is the transfer of procedural rights and obligations during the process from one person (a party to the case) to another person who has not previously participated in the case. Procedural succession is possible only in disputes of a property nature. For example, two claims are brought against one person at once: for debt collection and for establishing paternity. After the death of the defendant on the first demand, succession is possible, since the heirs are liable for the debts of the testator to the extent of the inherited property. As for the second requirement, paternity concerns the personality of the deceased himself, and succession is impossible here. At the same time, if the plaintiff was awarded compensation for moral damage, but he died before receiving it, then the collected amount of compensation is included in the estate and can be received by his heirs, who are allowed to participate in civil proceedings as legal successors.

How should a claim be filed?

To make the task easier for the creditor, we offer a statement of claim to collect the debt from the heir. We recommend that you pay attention to the following points.

We have already said that all persons who accepted the inheritance should act as defendants. In this case, the statement of claim must be accompanied by evidence that the defendants have assumed their rights with a clear division of shares.

Naturally, it is necessary to justify the existence of the debt and the circumstances of its occurrence.

In particular, you should refer to the clauses of the loan agreement, the contents of the promissory note, and so on. Of course, you need to provide a detailed calculation of the amount collected, taking into account the penalty and accrued interest.

The pleading part of the claim indicates what amount must be recovered from each heir, taking into account the ratio of their shares in the accepted property.

Of course, like any claim, it must contain as attachments all the documents justifying the need to go to court. It is important to note that for each of the defendants a set of claim materials should be prepared separately.

Despite the fact that there will be several defendants in the case, the state duty is paid once for the entire declared amount.

During the trial, the defendant died, what should I do in this situation?

Dear lawyers, help me understand the following situation: a lawsuit was filed to establish the fact of acceptance of the inheritance, recognition of the right of ownership and invalidation of the certificate of inheritance. The defendant and his children participated in the case as co-defendants (the disputed inherited property, in the form of a land plot, was registered in the name of my uncle and his sons). During the trial, the defendant died. A preliminary hearing has been scheduled, what should I do in this situation? Can I file some kind of petition? Or is the case likely to be dismissed? Thus, in your case, legal succession and, therefore, procedural succession are permissible, especially since the heirs of the defendant are also defendants in the case. In this case, the inheritance includes things and other property that belonged to the testator on the day the inheritance was opened, including property rights and obligations. The court itself, in the process of preparing for the consideration of the case, without a petition, taking into account the circumstances of the case and the scope of inheritance rights and obligations, will suspend the case until the heirs - your defendants in the case - enter into the inheritance.

What to do if the debtor’s spouse dies during the bankruptcy procedure?

Anything can happen. Sometimes the debtor's spouse dies during the procedure. In a marriage, jointly acquired property is the common property of the spouses (as a general rule, the husband and wife each own 50%), they can allocate shares, or have common property. In case of bankruptcy, the bankrupt's share is allocated and sold at auction.

If the debtor's spouse dies during bankruptcy proceedings, two options are possible:

- The spouses have no property to sell. In this case, the death of the bankrupt's spouse will not play a role in the duration of the case itself.

- The spouses have common property for sale. If a husband and wife bought a car during marriage, for example, it will be sold in bankruptcy. But given the death of the second spouse, perhaps the court will suspend the case. In part, this may happen in connection with the search for heirs of the deceased spouse’s share (if the bankrupt is not an heir, for example, when there was a will).

Will a spouse's property be affected by bankruptcy? Related article

According to the law, spouses are each other's direct heirs in the first place. If the husband dies without leaving a will, the wife inherits all his property. If this happened during the bankruptcy of the spouse, then the inheritance will be included in the bankruptcy estate and sold to pay off creditors.

It is impossible to refuse inheritance in such a situation. If the inheritance was received during an extrajudicial bankruptcy, the debtor is obliged to notify the MFC of an improvement in his financial situation.

When a person inherits the debts of a deceased spouse, he wants to get rid of loans and other obligations. This is possible - you need to file for bankruptcy and get rid of debts according to the law, while maintaining your only apartment.

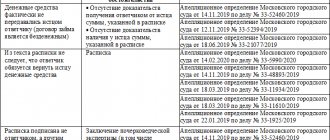

Change of defendant in court (SOJ)

In court it turns out that the defendant whom the plaintiffs claimed died and there are heirs. In this case, the heirs must act as defendants in the claim. So, the court has established the presence of heirs, what further actions will the court take? The court itself informs the heirs of the heirs, is it possible only after the plaintiff himself changes the defendant to a new claim? What if the plaintiff refuses to sue the defendant due to the death of the defendant? terminate the trial. refusal the right to apply again 6. The court refuses to accept a statement of claim brought against a deceased citizen, with reference to paragraph 1 of part 1 of Article 134 of the Code of Civil Procedure of the Russian Federation, since only a person with civil and civil procedural legal capacity can be held liable for a violation of the rights and legitimate interests of a citizen . If a civil case on such a statement of claim has been initiated, the proceedings are subject to termination by virtue of paragraph seven of Article 220 of the Code of Civil Procedure of the Russian Federation, indicating the right of the plaintiff to file a claim against the heirs who accepted the inheritance, and before accepting the inheritance - against the executor of the will or to inherited property (clause 3 of Article 1175 of the Civil Code of the Russian Federation).

Property in bankruptcy after the death of the debtor

The bankruptcy estate includes all the property of the deceased person. But with some exceptions:

- exclude the apartment of the deceased, which is the only housing for the heirs;

- personal items, awards and orders are not for sale.

When the property from the bankruptcy estate is sold, the manager begins calculations. First of all they pay:

- current payments;

- remuneration of the financial manager - 7%;

- legal expenses, costs of storage, valuation, transportation of objects of the bankruptcy estate.

Next - payments according to the order established by law. If there was a child support debt, it will be closed first. Banks, microfinance organizations, collectors, tax authorities, housing and communal services and other legal entities fall into third place, and money is given to them in proportion to the share of the claim in the register.

The benefit for the heirs is that after the procedure, debts are written off completely and irrevocably, even to those creditors who were not included in the register and did not participate in the case. If a microfinance organization or collectors, or perhaps an old friend of a deceased relative, did not have time to participate in the bankruptcy, then they lost the right to collect. Late creditors cannot make claims later. Everything has been written off, the inheritance has been cleared of debt.

Sometimes the procedure is completed before the inheritance is accepted. In this case, the financial manager transfers information about the remaining property to the notary. This property will be passed on to the heirs.

Heirs for whom the deceased's property is their only home are protected by law. They can go bankrupt themselves or carry out the bankruptcy of the deceased: one way or another, they are left with housing.

The defendant died

In 2015, the court decided to dismantle the fence between individual housing construction projects. The defendant died without fulfilling this decision. The enforcement proceedings were closed due to the death of the defendant. Can the plaintiff enforce this decision by the defendant's heir? Greetings! She divorced her husband, the decision came into force on July 27, and on August 1 the defendant died. I haven’t received a court decision, can I challenge it and restore the marriage? The defendant did not consent to the divorce; neither I nor he were present at the trial. The decision was made in absentia.

Please note => When is income tax relief given?

Death of the defendant

Hello. My husband died about 3 years ago. We haven't lived together for more than 10 years. The marriage was not officially dissolved. Now a claim has been sent to my address (where my husband was also registered) from the insurance company for compensation for damages due to an accident (the defendant is the deceased husband). What should I do in this situation? Can they sue me as a legal successor? I didn’t enter into an inheritance, I have no idea whether he had a car, it seems I bought it on a loan, but I don’t know where it was registered to anyone now. Thanks in advance for your answer. From your explanations it follows that the death of the defendant occurred even before the case was accepted for trial. The civil procedural legislation of the Russian Federation does not provide for the possibility of filing a claim in court against a deceased citizen. By virtue of Part 2 of Art. 17 of the Civil Code of the Russian Federation, legal capacity ceased due to death even before the plaintiff filed a claim. Consideration of a dispute in court is possible only if both parties are legal entities, otherwise consideration of the dispute will contradict the principles of civil law. At the time of accepting the statement of claim for proceedings, the court did not have information about the death of the defendant, and, knowing this, was obliged to refuse to accept the statement of claim, and therefore, the proceedings in this civil case are subject to termination on the basis of paragraph. 2 tbsp. 220 of the Code of Civil Procedure of the Russian Federation, since the case is not subject to consideration and resolution in court in civil proceedings on the grounds provided for in paragraph 1 of Part 1 of Art. 134 Code of Civil Procedure of the Russian Federation. Therefore, you can send a copy of your ex-husband's death certificate to the court. They will not be able to recover this damage from you, since in this category of cases there is no succession and the damage is recovered from the owner of the vehicle and the culprit of the accident.

Is it possible to bankrupt a deceased citizen?

Are debts inherited after deathRelated article

According to statistics, more than half of the adult population in Russia pays off loans. But then the man suddenly dies. He still has outstanding obligations: mortgage, credit cards or microloans. And an inheritance. How will events develop?

In case of bankruptcy of a deceased person, recognition of his insolvency means the sale of property and settlements with creditors. The inheritance will constitute the bankruptcy estate. If debts remain after the sale of the bankruptcy estate, creditors will not be able to demand compensation from the heirs.

The deceased may apply for bankruptcy:

- creditors, if the debt is more than 500 thousand rubles, and the delay has exceeded the three-month period;

- heirs;

- The Federal Tax Service as a representative of the state, if the deceased had large debts to the budget (from half a million rubles).

A notary is required to submit an application to the Arbitration Court if a person who was undergoing debt restructuring at the time of death has died. The notary petitions to terminate the restructuring and proceed to the sale of property. At the same time, he is obliged to notify the manager about the inheritance mass.

Conclusion: a person can indeed be bankrupted after death in order to pay off and write off his debts.

If one of the defendants dies

Proceedings in the case are suspended until the heirs of the defendant formalize their rights, that is, receive a certificate of inheritance. In practice, this can wait a very long time, since the law provides that a person must declare his intention to inherit after the death of the defendant no later than six months from the date of his death. The plaintiff in this situation should not get lost and take away the previously submitted documents. After all, if legal relations allow for legal succession, then it is quite possible to file a petition to replace the deceased defendant with his heirs. In principle, the court should not reject such a petition, because according to civil procedure law, succession can take place at any stage of the consideration of the case. A lawyer will tell you how to behave in court, who will also help you avoid wasting time and protect you from possible mistakes.

Bankruptcy after the death of a creditor

What associations do you have when you find out that the bank has burst? Feeling like a holiday? Alas, not this time. When a business entity is dissolved or an individual dies, your debt to them does not go away. It either passes into the hands of third parties or is inherited.

- Bank.

Mostly banks are liquidated through bankruptcy procedures, which they declare themselves or their creditors declare. A temporary administration is appointed. During the period of bankruptcy, the assets of the bank are managed by the Deposit Insurance Agency - DIA.

The office will quickly contact you and tell you where to pay. And she will be right - there will be debt. They will change your details and the recipient of the funds: this may be special. an account opened as part of bankruptcy or another bank that will buy loans from an unsuccessful competitor. Overdue debts can be sold to collectors.

- Individual.

The debt is inherited. This happens not after 40 days, but after six months, through notarized re-registration. The heir of the individual will find you and demand your money back.

If the conversation is about the bankruptcy of a deceased person - for example, your creditor at the time of death was undergoing an insolvency procedure, then the financial manager will make a claim. There are situations when the creditor has no heirs. In this case, nothing will be required from you, and the debt will be written off.

What to do if the defendant dies

Good afternoon. Last July we were involved in a major accident, no one was injured, but the car was very damaged. The person at fault for the accident did not have insured car, our insurance company sent us a refusal to compensate for losses, there was no CASCO for the car. We made an independent assessment, the damage was 250,000 (our car was only six months old at the time of the accident). The culprit did not agree to pay compensation, we went to court. Please tell me what to do if the Defendant does not receive correspondence by mail, and we cannot file a statement of claim without notifying the other party to the Arb. Court? We sent it 2-3 months ago, the notification has not yet arrived and the package of documents has not been returned either returned Elleonora 11-05-2011 13:58

Please note => Benefits utilities for labor veterans living alone in an apartment in the Arkhangelsk region

The death of the appellant as a legal fact in civil procedural relations (Yakusheva N

The death of a person in the system of legal facts is traditionally classified as an event, including when death occurs as a result of murder, since after the killer has committed active volitional actions, the further development of the event occurs against his will, as well as the will of any other persons. ——————————— Krasavchikov O.A. Legal facts in Soviet civil law. M., 1958. S. 165 - 166; Ioffe O.S. Soviet civil law. M.: Legal literature, 1967. P. 246 - 247. By the decision of the Kalininsky District Court of Tyumen dated May 27, 2014, the claims of M.A. were partially satisfied. Appeals against this decision of the court of first instance were filed by M.A., the Ministry of Finance of the Russian Federation, the prosecutor's office of the Tyumen region, and the Regional Ministry of Internal Affairs of Russia for the city of Tyumen. M.A. died on July 1, 2014, however, taking into account the legal position of the Supreme Court of the Russian Federation, reflected in the Review of judicial practice of the Supreme Court of the Russian Federation for the first quarter of 2013, approved by the Presidium of the Supreme Court of the Russian Federation on July 3, 2013, the judicial panel for civil cases The Tyumen Regional Court considered all the appeals and left the decision of the first instance court unchanged, and the appeals against it were not satisfied. The above example also illustrates the thesis that an appeal hearing should take place even if, after the decision of the court of first instance, it is not the appellant who dies, but the other party to the dispute. At the same time, it is necessary to make two important remarks regarding the possibility of considering the case by an appellate court in the event of the death of the appellant, when the nature of the disputed legal relationship does not allow succession. Firstly, if, when considering the case by the court of appeal, it is established that a party to the dispute died before the decision was made by the court of first instance, and the nature of the disputed legal relationship does not allow for succession, then the proceedings in the case are subject to termination on the basis of paragraph seven of Art. 220 Code of Civil Procedure of the Russian Federation. In this case, the legal capacity of a party to the dispute ceased before the court of first instance made a decision, but the court, not having information about the death of a participant in the proceedings, actually resolved the issue of the subjective rights and obligations of the deceased, which is unacceptable. Secondly, if the court of appeal, on the basis of parts 4, 5 of Art. 330 of the Code of Civil Procedure of the Russian Federation will proceed to the consideration of the case according to the rules of proceedings in the court of first instance without taking into account the features provided for by Chapter 39 of the Code of Civil Procedure of the Russian Federation, and it will be established that after the decision of the court of first instance the appellant has died, and the disputed legal relationship does not allow for legal succession, then the proceedings in the case will also subject to termination on the basis of paragraph seven of Art. 220 Code of Civil Procedure of the Russian Federation. When the appellate court proceeds to consider the case according to the rules of proceedings in the court of first instance, without taking into account the features provided for by Chapter 39 of the Code of Civil Procedure of the Russian Federation, the court does not check the legality and validity of the decision of the first instance court, but re-establishes the subjective rights and obligations of participants in legal relations, which is impossible to do in in relation to a deceased person, in connection with which the proceedings are subject to termination. The foregoing allows us to draw some conclusions. If succession in a disputed legal relationship is allowed, then the appellate court is obliged to suspend the proceedings until a successor is determined. If the disputed legal relationship does not allow for legal succession, the appellate court must still consider the case, without suspending the proceedings. However, if a party to the dispute died before the decision was made by the court of first instance, or if the court proceeded to consider the case according to the rules of proceedings in the court of first instance, without taking into account the features provided for in Chapter. 39 of the Code of Civil Procedure of the Russian Federation, and the nature of the disputed legal relationship does not allow for succession, then the proceedings are subject to termination.

Please note => The cost of luggage is paid when traveling on a business trip to an employee of the National Guard

How is bankruptcy carried out after the death of a person?

When submitting an application, you must indicate that the deceased will be bankrupt. It is important. A death certificate is submitted along with other documents. The rest of the procedure is carried out in the same order.

- The court reviews the documents and introduces a procedure for the sale of property. No restructuring is taking place.

- The financial manager creates a register of creditors and a bankruptcy estate from the property of the deceased debtor.

- The heirs have the right to demand that their only home be excluded from the bankruptcy estate if they lived in it together with the deceased. Also, items worth up to 10 thousand rubles may not be sold. The remaining valuable objects will be sold.

- The procedure and timing of the auction are approved, and the property of the deceased bankrupt is sold.

- Next, the financial manager makes calculations, and the court completes the procedure.

As a result, the deceased person is released from financial obligations. In practice, problems arise.

- Financial managers refuse to handle such cases. This is not profitable: such procedures drag on for a long time due to challenges to transactions and disputes with the state. authorities and banks.

- Technical obstacles. Elementary: by law, the debtor is obliged to transfer access to his accounts and cards to the manager. In exchange, a special account is opened in the name of the debtor, where the funds from the bankruptcy estate are received. When the manager makes this demand to the bank, he is told that this is impossible. You cannot open an account in the name of a deceased person, the system does not allow it. We have to prove it. It is also difficult to obtain an extract or certificate on behalf of the deceased.

- Submission of claims to the register of creditors. In practice, courts more easily accept claims that have been settled. For example, a loan agreement under which you do not pay. The bank goes to court and receives an order. Further, when included in the register, the creditor submits this order along with the agreement.

As a rule, debts with judicial confirmation are accepted easily. It’s more difficult with unpaid debts. The deceased will not confirm the fact of the debt, and it is not always known where to look for his documents. If the creditor is an individual with a receipt, it will be difficult for him to prove to the court that the loan was actually provided.

Disputes are also possible regarding the property of heirs. The meaning of the procedure is that the bankruptcy of the deceased is carried out separately. In the event of bankruptcy of the deceased, the property of his heirs should not be affected. But often in a family “everything is common,” and banks insist on selling the inheritance.

Heirs are interested parties in the bankruptcy procedure of individuals - the deceased. Relatives have the right:

- submit petitions;

- appeal judicial acts and decisions;

- attend meetings of creditors, without the right to vote.

How to determine the heir? This status is physical. a person receives on the basis of an application submitted to a notary. Accordingly, if the application has been submitted, then the person has the right to participate in the Arbitration Court process.

A) Replacement in case of death of a party

In the Federal Code of Civil Procedure of Switzerland, in contrast to cantonal law (for example, § 23 of the Code of Civil Procedure of Thurgau), the replacement of a deceased person with a new person, since we are talking about universal legal succession, is not considered as a change in the composition of the participants in the process (paragraph 3 of Article 17). However, in both cases, the heir automatically takes the place of the departing party. Until the issue of accepting the inheritance is resolved, he is a conditional party: in case of refusal of the inheritance, no legal consequences arise for him. Let's look at the above example again and assume that the insurance company and G1 are located or reside in the state of Pennsylvania, and that G1 resides in California. According to the general provisions on the delimitation of federal and state jurisdiction, the dispute between the company and Zh1 falls within the jurisdiction of the Pennsylvania state court. Federal court is not available here since there is no difference in the “citizenship” of the parties. If the case is brought in state court, then it is impossible to involve Z2 since she is not within its jurisdiction. To resolve such conflicts, it is necessary to keep in mind two types of interpleader institutions:

How to bankrupt a deceased person?

If you inherited an inheritance where the amount of the inheritance is greater than the debts, you can file for bankruptcy of a deceased relative. The goal is to deal with creditors at the start and under the supervision of the court, in order to live in peace in the future, without having to fight off each claim individually. And keep part of the property.

What documents are required?

- Application for recognition of bankruptcy, where we indicate the status of the debtor: deceased.

- Documents about his death.

- List of creditors and debtors.

- Transactions concluded in recent years by the deceased.

- Certificates 2-NDFL from the Federal Tax Service.

- Bank statements and other documents from the standard list.

- List of property.

Documents about property and income, pension savings, deposits and accounts can be requested by a notary. You have the right to ask him for such documents. You also need to pay a state fee and remuneration for the financial manager.

How is the procedure done?

- The court orders the sale of property. The heir transfers the bank cards of the deceased to the financial manager.

- Creditors file claims in court. The manager includes claims that the court finds justified in the register of creditors.

- The bankruptcy estate is formed from the debtor's property.

- Next, meetings of creditors are held, the procedure and terms of the auction are approved.

- The property is sold, the manager makes the calculations, and the procedure is completed.

As a result, the debts of the deceased were written off, and there were no claims against the heirs.

It is interesting that funny things sometimes happen in judicial practice. Relatives who paid for the funeral of the deceased demand compensation for funeral expenses from the financial manager. But they are faced with natural refusal. Alas, such expenses cannot be attributed to the obligations of the debtor - this is the will of a relative, a voluntary donation. It will not be possible to claim such expenses.

Do you need advice from an experienced bankruptcy lawyer about a deceased person? Contact us, we will help you! Our company provides turnkey support for bankruptcy procedures. Legal support at all stages of the procedure.

Civil procedural succession

Since in civil procedural succession the legal proceedings continue from the stage at which the replacement of the party occurred and the successor entered into the case, for him everything that happened in the process before his entry into law is obligatory to the extent that they would be obligatory for the person whom the successor replaced (h 2 Article 40 Code of Civil Procedure). Civil procedural succession, in contrast to civil succession, can only be general (universal), since the successor completely replaces the legal predecessor a in the entire scope of his procedural rights and obligations. Civil procedural succession is allowed at all stages of civil proceedings.

If the plaintiff is dead

Since the plaintiff dropped out of the case due to death before the court resolved the case on the merits, the court, in accordance with the requirements of Article 44 of the Code of Civil Procedure of the Russian Federation, had to resolve the issue of replacing him with a procedural successor by considering the civil case on the cassation appeal of Z.P. Beznosova. The plaintiff died, the judge issued a ruling to terminate the proceedings in the case, while the court was obliged to suspend the proceedings. The relationship allows for legal succession (Claim for termination of contracts for shared participation in housing construction, collection of legal penalties, compensation for MV).

Recognize the heirs as legal successors of the deceased plaintiff in a civil case

In the court decision (which came into force in 2006), the following wording is “to recover from the defendant in favor of the plaintiff compensation for the share due to him in the property that is in shared ownership, to exclude the plaintiff after receiving compensation from among the owners by transferring ownership of his share to the defendant." Currently, the “defendant” has applied to the court with an application “for recognition as successors in a civil case” and asks to recognize the heirs as successors of the deceased plaintiff in a civil case dated 2006 on the basis of Article 44 of the Code of Civil Procedure, Art. 52 Federal Law No. 229 on individual entrepreneurs. In 2006, a court decision was made to pay compensation for a ½ share in a one-room apartment in favor of the plaintiff on the basis of Art. 252 of the Civil Code of the Russian Federation, the defendant agrees to pay the agreed amount. The court decision is not executed voluntarily; bailiffs intervene, who in turn, after a certain time, close the enforcement proceedings “in connection with the direction of the ID to the debtor’s place of work.” In 2008, the plaintiff dies without receiving this compensation, the heirs take ownership of this ½ apartment.

24 Dec 2021 marketur 590

Share this post

- Related Posts

- A man without insurance crashed into me

- Usn can sublease property

- Income tax benefit for studying

- There is no light in the house

How will events develop in the event of bankruptcy of a deceased guarantor?

Bankruptcy of guarantors of individuals: how to write off other people's debts? Related article

Let's consider cases where the guarantor dies. Let's imagine a situation: a person was a guarantor for a distant relative for a loan of 2 million rubles for construction. The borrower pays, but his guarantor suddenly dies. What does it mean? Do the guarantee obligations cease along with it?

Oddly enough, but no. You need to understand the following features about a surety bond.

- Obligations under a guarantee can be inherited, in accordance with clause 4 of Art. 367 Civil Code of the Russian Federation. A man dies and his daughter is the heir. She gets a house, a car, a credit card for 50 thousand rubles (or rather, debt) and guarantee obligations. If the daughter refuses, she refuses the entire inheritance. You cannot inherit, for example, only a house and a car, but give up debt and financial obligations.

- A guarantee is usually indicated by specific terms; it is not an eternal obligation. For example, 2 years is indicated. After 1.5 years the guarantor dies. There is still six months for heirs to be found. And while the notary transfers the property to the heirs, the period will happily expire.

But if during this six months the main borrower stops paying, then the bank has the right to file claims against the guarantor. Considering that the guarantor has died, the bank will demand compensation for the loan from the inheritance.