6

After a person dies, his property goes to his heirs. If the testator managed to leave a will, the inheritance of assets occurs on the basis of his last will. The absence of an administrative act triggers inheritance of property by law. The issues of opening an inheritance are dealt with by an authorized person - a notary. He is entrusted with the functions of distributing property between applicants.

The question arises, how to find out about the opening of an inheritance and contact a notary? Indeed, situations can be different: distance from the place where the inheritance was opened, several objects of inheritance, ignorance about the opening of the case, employment and other factors. Let's try to figure out how and where an inheritance is opened, who manages it, and what the heirs need to do.

The concept of opening an inheritance

The concept of inheritance is defined as the sum of all rights to the property of a deceased citizen and his obligations, passing to the heirs. The Civil Code of the Russian Federation (hereinafter referred to as the Civil Code of the Russian Federation) devoted a chapter to the procedure for transferring rights and obligations from the deceased to the heirs. In it, the legislator enshrines the concept of inheritance, the grounds for the emergence of the right to inherited property, legal facts entailing significant consequences, property that is recognized and considered as an inheritance mass and which testators can receive by inheritance, the procedure for obtaining and registering property rights in the order inheritance, as well as documents that must be provided in cases of various disputes related to inheritance, including when establishing the place of opening of the inheritance.

The opening of an inheritance is a legal fact, a procedure according to which persons can declare rights to a citizen’s property. The transfer of rights from the testator to the heirs is preceded by the death of the citizen. The death of a citizen is confirmed by a death certificate. The basis for issuing a certificate is a medical certificate of death, which states a significant fact - the date of death.

A death certificate is a document with which the inheritance case begins with a notary and from the moment of its issuance the entire procedure for registering an inheritance is linked.

A citizen who does not show up at his place of residence for a long period of time may be declared dead by the court. In this case, the date of death of the citizen is considered to be the date the decision enters into force.

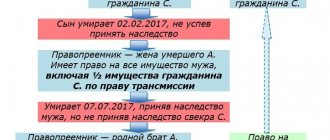

From the moment of death of a citizen, the Civil Code of the Russian Federation determines the time of opening of the inheritance. The moment of opening the inheritance and the time of opening the inheritance are identical concepts. It is on the day of opening of the inheritance that the legal successors have the right to inheritance and it is from this day that the inheritance procedure begins. If the heir dies after the opening of the inheritance, the right to inherit his share passes to his heirs.

How much do you need to pay to open a business?

It is impossible to answer this question unequivocally. The state fee varies and depends on the location of the notary. In Moscow and other large cities you will have to pay a large amount. In addition to accepting the opening application, they pay for additional services, which are used after the opening. Even collecting documents and obtaining duplicates will incur additional costs. It is also worth adding transport costs.

The participation of a lawyer is paid. The initial consultation is free. Just call or ask questions online. However, situations are different, and the lawyer will suggest specific actions after reading the documentation and receiving detailed information. Confidentiality is guaranteed, as reflected in the contract. Going to court also involves paying state fees. We need to admit the fact - pay the money. But these costs are not final.

In the Russian Federation, income tax is levied only on transactions involving monetary consideration. Becoming the owner of an inheritance after opening does not mean receiving income, i.e. you will not have to pay tax. However, when registering the right to inheritance, a fee is charged. Its size depends on the category of the legal successor:

- Close relative . Applicants from the first line of inheritance fall here. These are parents, children, spouse. The state will require 0.3% of the cost.

- Other relatives . Nephews, grandchildren, grandparents, cousins and second cousins will pay twice as much - 0.6% of the cost.

- Third parties . When receiving an inheritance based on the opening of the process, when there is a will or in fact, people also spend 0.6%.

- Mandatory heirs . When during the opening process it turns out that there is a possibility of obtaining a share, the amount of the duty is the same - 0.6%.

But indirect taxation applies to vehicles and real estate (apartments, houses, dachas, garages, parking spaces, land plots, agricultural land).

And those who, as a result of the opening, will become owners of shares and deposits will pay even more. Here we are talking about the opportunity to earn income. The current value of securities (bills, bonds) is assessed, and 13% is charged from it if the heir is a citizen of the Russian Federation, and 30% if he is a non-resident. The same metrics come into play when successors wish to sell what they acquire after opening.

What parameters make up the sum?

It is necessary to assess the feasibility of opening and participating in the division of inheritance before filing an application. Evaluated:

- Amount of state duty . The parameter depends on the degree of relationship, the category of the successor, the method of opening, and the price of the inheritance.

- Volume of tax collection . Determined by citizenship, the value of the property, and the desire to dispose of the property immediately after opening.

- Lawyer's fee . Pricing is influenced by time costs, degree of participation, the need to travel, and the number of services.

- Notary fee . It varies in different localities. The amount of work that the notary must perform after opening also plays a role.

Do not forget about the debts that follow the deceased. These are obligations associated with the inheritance and the testator. When the apartment is re-registered, it will be necessary to pay off the overdue utility bills. Banks will begin to demand money for loans. Any creditor has the right to claim funds from the heir within three years after taking ownership. After attempts to resolve the problem out of court, a lawsuit is filed, which will require additional costs.

Keep in mind that any document issued by government agencies requires payment of a state fee. This is payment for the work of officials, archives, etc. Only taking into account all of the above can one determine how appropriate it is to resort to discovery and participate in the process. Expenses stretch over six months, and the amount can increase if you act “blindly”. An experienced lawyer will handle the case in such a way that the risks of incurring material costs are minimal.

How to open and accept an inheritance

The opening and acceptance of the inheritance occurs in the following order: The heirs, having learned about the opening of the inheritance, i.e. about the death of a citizen, in order to formalize rights in accordance with the law of the Russian Federation, they turn to a notary by writing a statement that expresses consent to accept the inheritance. The application form is developed by the notary independently, and its form is given to the heir to fill out. The application is recognized as a fact of legal significance, confirming the will of the heir to consent to receive the inheritance. The absence of such an expression of will entails consequences in the form of a notary’s refusal to take action to issue a certificate.

An heir who permanently resides with the owner of the property until the day of his death is considered to have actually accepted the inheritance. To register the rights, he needs to obtain a certificate of the right to inheritance from a notary within 6 months from the date of opening of the inheritance. As a basis for proving the fact of acceptance of the inheritance, a certificate of residence or registration at the place of establishment of the inheritance case may be submitted.

Documents to confirm the fact are individual in each case and the notary makes a decision in each case separately. In addition, heirs who have paid the debts of the testator, received funds for him, preserved or protected the inherited property, or entered into management or ownership of the inherited property may be recognized as having actually entered into the inheritance. If the notary refuses to recognize the applicant as an heir, the fact of acceptance of the inheritance may be challenged in court.

The procedure for opening an inheritance case

When it comes to receiving an inheritance, the time to act comes after the death of the owner, even if there is a will. The document itself, or rather, a copy of it, can be stored in the personal belongings of the testator. As a general rule, if the expression of will has not been formalized, the division is made between the primary legal successors - mother, father, son, daughter, spouse. When they are not there or a refusal is issued, the property is received by representatives of the second, third, etc. queues (up to the seventh).

But there are people who have the right to an obligatory share of the property remaining after the death of the testator. The opening date indicates the beginning of the period during which the application is submitted. A portion equal to the share of the primary legal successor is allocated from the inheritance. Having determined that there is an opportunity to obtain property, it is necessary to prepare documents. The minimum kit includes a passport and papers indicating relationship.

To receive an inheritance under a will, a passport is sufficient. If it is necessary to include property in the estate, documentary evidence is required that the inheritance actually belonged to the testator. Documents identifying them and the conclusion of the evaluation commission will also be required. After the preparatory stage, you will have to visit a notary to open an inheritance case.

A statement is being written. It is important to do this on time. The opening of the inheritance is the day when the death of the testator is recorded. After this, a period of six calendar months is allotted. Next comes the time of the notary's work. The papers are being checked, the facts are established and compared, and a decision is made to recognize the legal heir. After this, a certificate of inheritance is issued, on the basis of which the right to ownership is re-registered. Only after this can property be sold, donated, or exchanged.

Choosing a notary

If you need to re-register an inheritance after the death of a relative, contact the notary office at the place of its registration. When there are many of them in the area, they go to the one who deals with the affairs of people whose last names begin with a certain letter. Another option assumes that a situation arises when this is not possible. In this case, they turn to the notary at the location of the majority of the inheritance mass. Most often this is housing.

When there is a will, from the moment it is announced, applications are submitted to the same notary office. Previous manipulations are taken into account: the testator writes the will and registers it, the paper is stored in a sealed envelope, a copy is given to the testator.

Opening involves printing out the documentation and disclosing the contents to persons who have the right to claim participation in the division of the inheritance. For convenience, it is necessary that one person conduct the inheritance business.

Drawing up an application

The beginning of the opening period, the official application, is the fact of writing the application. The legislation, in particular the Civil Code of the Russian Federation, does not establish a unified form. But there is a set of general rules according to which handwritten text is placed on an A4 sheet. It is important that the statement has legal force. This concept requires the applicant to indicate a number of mandatory attributes, including:

- date of writing;

- event city;

- title of the document (highlighted in font);

- details of the notary at whose office the inheritance is opened;

- personal and contact information;

- signature with transcript.

The opening procedure involves writing an application in your own hand. You must have a passport and documents confirming your right to claim an inheritance.

What should be in the document?

Everyone understands what a statement is. Mandatory attributes for a document to have legal force are specified by law. But there are general requirements for the text itself. The speech is laconic, short, succinct. Lyrical digressions, mention of third parties, explanations of personal attachment are unacceptable. It is necessary to briefly describe the purpose of the application - opening a business and the desire to register an inheritance.

If it is intended to open and accept an inheritance by law, the degree of family ties is indicated. Actual acceptance will require proof of cohabitation. The situation with a will is different in that there is no need to do all this. It is enough to provide your passport details for identification. The text is schematically divided into sections:

- Explanatory . Contains information about the testator, the date of death, and the inheritance itself. The reasons for the application and the details of the applicant, indicating the relationship, are also described.

- Evidence-based . Evidence of the legality of the opening of the inheritance is provided. It is allowed to indicate specific articles of the law that allow the entry procedure to be carried out.

- Demanding . The applicant turns to the addressee with a request to open the inheritance, and the time of opening is indicated by the notary when he makes the appropriate note. Only after registration the document is legally acceptable.

Before this, the state fee is paid. The receipt is attached to the application and provided along with the evidence. The right to inheritance is confirmed by a will or papers explaining the relationship of the heir to the testator by kinship. The composition of the inheritance is also indicated, for example:

- apartment;

- house;

- country house;

- automobile;

- values;

- personal belongings;

- securities;

- deposits.

The obligatory share is allocated when providing documents confirming being a dependent for more than a year.

Don't delay if you don't have enough documents. Write an application, take your passport with you, attach what you have. The final list differs due to many factors. Here is the composition of the hereditary mass, the method of discovery, the procedure for acceptance, etc. A specialized lawyer or notary will tell you what is required in your case. It matters who opens the inheritance. The procedure differs in different cases.

Opening a case

When an inheritance is divided according to the law, you can go in two ways: act through a notary’s office or the court. The latter is resorted to when there is disagreement or it is necessary to establish facts. Thus, the court decides to include property in the inherited estate, to recognize the citizen as an heir, and the testator as deceased. The judge will distribute the shares and issue a corresponding order.

To initiate a lawsuit, you will have to pay a state fee and file a statement of claim. When an inheritance is opened, only legally correct official evidence of the arguments presented and witness testimony are taken into consideration. The fact that the case is open indicates that there is an additional period of six months for re-registration of property. Otherwise, you will have to file a claim to restore the deadlines, which will lead to costs.

Upon actual acceptance, they contact local authorities. A statement is being written. It is important that the day of death of the citizen who left the inheritance is the beginning of the six-month period before the opening of the process. Accepting an inheritance through a notary office is different. The range of responsibilities is increasing. Costs may increase if you have to contact and order additional services. The scope of the notary's capabilities is limited, but it is necessary to use it to the fullest extent.

Actions of a notary

After an oral application, notary staff provide bank details for payment of the state fee and issue a form or sample application. Its writing involves providing documents according to the list. As part of the acceptance of the inheritance, the text of the will is announced. Its compliance with the rules is checked. When the notary office believes that there are disagreements with current legislation, contact specialists to conduct legal monitoring.

Comparison of the submitted documents with the details specified in the will on the day it was drawn up, checking the accuracy of each letter in the documents is the responsibility of the notary. To ensure that the distribution of shares of the inheritance is lawful, after the opening, he looks for potential heirs, as well as applicants for the obligatory part of the property. Notifications are sent. Applicants appear at the notary's office and indicate their intention to accept the property. Failure to appear is a formal refusal. 6 months are allotted for this.

When the will has not been formalized at the time of death, opening a case involves determining the order of successors. Close relatives have priority. Their rights are equal. So, if from the 1st to the 5th stage no one has made a claim, the property is transferred to all representatives of the 6th stage. The obligatory share is taken regardless of the presence of a will. It must be remembered that compulsory heirs are minor children (natural and adopted), as well as disabled dependents who receive financial support from the testator for at least a year before his death.

The overall result of the notary’s participation is the issuance of a certificate of inheritance. It is considered to be a paper certified by a notary, which indicates that a particular citizen is the successor. This is a person from the list of applicants at the time when the inheritance was opened. The certificate allows you to obtain information about inherited objects and re-register ownership in your name. This document does not give you the right to sell, give, exchange, or use for your own purposes. Unless we are talking about actual acceptance.

List of documents required for the procedure

Having determined the place where to go to open, begin collecting documentation. The main list includes an identity card. This is sufficient if there is a will. All that remains is to verify the details and re-register the inheritance. The situation is different if it is divided according to law. According to the rules of this procedure, the degree of relationship is taken into account. It is necessary to prove who the potential heir is to the testator.

This means that the time has come to collect certificates and extracts confirming the birth crossings. When they are lost, it is necessary to obtain duplicates from the registry office, passport office and other government agencies. Recognition of family ties through the court is also possible if there are grounds for it. Thus, children born out of wedlock can become heirs and receive a mandatory share if they prove a blood connection. A claim is filed and a hearing is held.

To include valuables in the list of inheritance requiring discovery, you will need reasons. Prove with facts that the things belonged to the testator. Bring witnesses if necessary. In order to identify and divide the property, a formal appraisal report from an independent commission will be required. This is for the case when you have to divide objects that are indivisible in kind, for example an apartment. You can’t make a separate entrance, you can’t install a second bathroom. But you can pay a share. To determine the amount of payment, a market value assessment report is used.

But the main thing is that a death certificate will be required to open it. This is the key document. There is no fact of death - no discovery. Inherited property becomes the property of third parties only after death is certified. In addition to the certificate, a judicial act is needed if the situation requires it. So, for example, this happens if a person goes missing, most likely he is already dead, but the body has not been found. A citizen is considered dead 5 years after disappearance. In such cases, the opened case lasts six months starting from the date of publication of the resolution or from the day specified in it.

Sometimes it is better to entrust the collection of documents to a lawyer, since there can be a lot of papers, which depends on a number of factors (type of inheritance, form of opening, etc.). It will be necessary to submit official requests to government services, which are not required to provide information to ordinary citizens. As part of the discovery, the lawyer will do everything himself. The basis is a trust management agreement, if we are talking about securities and deposits, as well as a notarized power of attorney indicating the list of powers. The service is convenient when the inheritance is located in another city. A law office will save not only money on travel and accommodation, but also time.

Do not forget that debts are transferred along with the inheritance. The fact of their presence may be unknown. To avoid becoming a victim of a situation where creditors demand payment for the bills of a deceased relative, contact lawyers who can double-check whether there are any risks. Each document appearing in the case requires legal monitoring, which means the mandatory participation of a lawyer. His presence is especially necessary if you have to go to court when other applicants do not agree with the result of the discovery and do not want to give up the inheritance.

Is there a deadline for accepting an inheritance?

According to the law, a period is a certain period of time during which certain actions must be performed. In the inheritance procedure, the term disciplines the participants in the relationship, provides guarantees of the inviolability of property rights, and its importance is important. Article 1154 of the Civil Code of the Russian Federation indicates that an inheritance is accepted within 6 months from the date of opening of the inheritance, which is counted from the date of death of the person. The notary accepts the application expressing the will of the heir during this period. Acceptance of the inheritance in fact occurs within the same period, and from the day the inheritance is opened, the heir must perform actions that indicate the acceptance of property from the deceased.

It is believed that such a period is sufficient for the heirs of the deceased citizen to decide whether to receive the inheritance or refuse it. An application submitted after the deadline has expired is not recognized and does not confirm the fact of acceptance of the inheritance. To protect rights in such a situation, the heir must file a claim in court. If during the proceedings it is recognized that the deadline was missed for a good reason and there are documents confirming this circumstance, the state body will restore the deadline by decision.

How to determine the place of opening of the inheritance

According to the Civil Code of the Russian Federation, the place where the inheritance is opened coincides with the residential address of the deceased citizen or, in his absence, the location of the largest share of the property. In other words, the place where the inheritance is opened is the fact of the testator’s residence at a certain address or the fact of the location of the property. Documents confirming the residence of the deceased and the place of opening of the inheritance are submitted simultaneously with the time of filing the application for acceptance of the inheritance.

If the place of opening of the inheritance cannot be identified, citizens have the right to go to court by writing an application to establish the place of opening of the inheritance.

The meaning and concept of place, opening of inheritance is recognized in that the heirs can apply for the acceptance and issuance of a certificate from one notary whose notary office is located in the same district.

When resolving disagreements about establishing the place of opening of the inheritance, the court will be interested in the location of the testator’s property and what documents confirm this. The fact that all heirs apply to one office where the notary is located contributes to the optimal protection of the rights of all heirs.

Why is an assessment needed?

The basic stage of registration of ownership of a land share or other property is assessment. This is a process to determine the value of property that passes to successors by right of inheritance.

The choice of valuation method remains with the heir; there are three in total:

- cadastral;

- inventory;

- market

The procedure is regulated by the legislative framework, where the main one is Federal Law No. 135 of July 29, 1998. Separate paragraphs from the Civil, tax and other codes of the Russian Federation also apply. The government has developed a mechanism and standards for federal assessment. Thus, a special legal regime has been created to carry out the process.

Note! Most inheritance cases require an assessment so that the heir can fully assume inheritance rights. The assessment act serves as the basis for paying the state fee, without which the matter will not proceed further.

Therefore, it is important to evaluate the property in the prescribed manner. In addition, having information about the value of the inheritance will allow the shares to be distributed among the heirs.

Valuation price of inherited property

The activities of the institution that performs the procedure are carried out on a paid basis. According to the norms of Federal Law No. 135, appraisers can charge fees for services provided (Article 14). The price depends on the type of property being inherited.

| Cost of assessment (RUB) | |||||

| Real estate | Vehicles | Other property | |||

| Apartment | from 3 thousand | Auto | 2.5–5 thousand | Stock | 2–10 thousand |

| Earth | from 2.5 thousand | Motorcycles | from 4 thousand | Share in LLC | 10–15 thousand |

| Garage | 2–3.5 thousand | Trailers | 2 thousand | Weapon | up to 1 thousand |

| A private house | from 15 thousand | Copyright | from 10 thousand | ||

| Commercial real estate | from 25 thousand | ||||

The price should be set at the stage of signing the contract, and this is a mandatory point (Article 10 of Federal Law No. 135). This condition will help avoid conflicts in the collaboration process.

What types of inheritance are there?

According to the Civil Code of the Russian Federation, there are two types of inheritance:

- in law;

- by will.

According to the law, property is inherited for which there was no order from the deceased citizen. Heirs by law inherit property according to the order of which there are eight in the Russian Federation. The heirs of the corresponding line are called upon to inherit. If there are no heirs in the corresponding line, heirs in the next line are called upon to inherit. The fact of acceptance of the inheritance is confirmed by the will of the successor in the form of filing an application accepted by a notary. The opening of an inheritance, the procedure for its acceptance, the grounds for receipt, the procedure for formalizing and registering rights are the same for both inheritance by law and inheritance by will. The documents that need to be submitted to confirm the property rights of the testator do not depend on the type of inheritance. When inheriting both by law and by will, the place of opening of the inheritance is also the last place of residence of the deceased.

Inheritance by will is carried out if there is an order from the owner regarding the fate of the property on the day of death. The opening of an inheritance, both by will and by law, arises from the date of death of the testator. When accepting an application, the notary first checks the existence of the fact of inheritance under a will. The deadline for accepting an inheritance both by law and by will is the same.

Cost of notary services

Receiving an inheritance entails certain financial costs. The lion's share of them falls on the state duty established for the registration and issuance of an inheritance certificate. The amount of the payment will vary depending on the nature of the relationship with the testator.

If the inheritance is drawn up by children, parents, the spouse of the deceased, as well as his siblings, the duty will be 0.3% of the value of the inheritance, but not more than 20 thousand rubles. For all other heirs, the payment amount is twice as large (but not more than a million).

However, there are a number of duty benefits. If the conversation is about real estate, people do not make payments if they live in an apartment (house) with the testator at the time of his death.

There is no fee for the certificate of inheritance of a bank deposit. In addition, minor heirs are exempt from payment. This is stated in paragraph 5 of Article 333.38 of the Tax Code of the Russian Federation.

In addition to the state fee, you must also pay for the work of the notary.

It includes:

- providing consultations;

- searching for the necessary information in state registers;

- preparation of requests to the BTI;

- notarization of copies of documents.

Depending on the region and the composition of the property, notary services can cost from two thousand rubles.

What documents are needed to register rights?

In the Russian Federation, to confirm the existence of the right to inheritance and register rights to it, the notary is provided with the following documents:

- application for acceptance of inheritance;

- a certificate from the place of residence of the testator, if the inheritance case has not previously been opened by other heirs;

- documents that prove the identity of the heir;

- death certificate, if the inheritance case has not previously been opened by other heirs;

- documents confirming the testator's rights to property.

After filing an application for inheritance, an application for issuance of a certificate of inheritance is submitted. Documents are provided in originals. From all of the above, it follows that the opening of an inheritance occurs at the time of the citizen’s death. A properly established fact of death is recognized as the basis for opening an inheritance. The fact of declaring a citizen dead in court entails the same legal consequences as the fact of death established by a doctor.

The concept of inheritance is the transfer of inherited property.

Legally significant facts of death, acceptance of inheritance, the presence of documented rights to the property of the testator in legal practice are recognized as the basis for the transfer of rights.

Author of the article

If there are not enough or missing documents

The legislation provides for conditions when it is possible to inherit even if documents are lost. However, the procedure becomes significantly more complicated.

Lack of documentary evidence is possible under the following conditions:

- loss;

- impossible to find;

- unformed/not processed.

And also, the successor may not always not know what property was left to him as an inheritance under the will. Accordingly, it is impossible to collect the necessary extracts that need to be submitted to register rights.

At the first stages of the inheritance case, it is possible to provide only basic information - draw up an application and confirm family ties.

Confirmation of relationship

The established procedure requires confirmation of the fact of family relationships. This can be done by submitting the relevant documents issued by the Civil Registry Office.

These include:

- birth certificate;

- divorce/marriage;

- a certificate confirming the fact of changing the surname (first name, patronymic).

If they have been lost, they can be restored by contacting the department where the primary version was issued.

As a rule, difficulties begin at this stage. Since not all information may be at the disposal of the heir, it is not easy to find a specific registry office or go to the required region.

The law allows you to submit a request to the relevant government agency. A duplicate will be provided within the specified time. However, things are not always successful.

It happens that the registry office lost information. In this case, it will be extremely difficult to restore the document. In this case, the court must establish the fact of family relations.

For property

The situation with confirming the rights of the deceased to property is much more complicated. Often the heir does not know about the existence of this or that real estate and movable property, not to mention the availability of the relevant documents.

Such situations are possible under the following circumstances:

- a child from his first marriage inherits property, but has not previously communicated with his father (less often his mother);

- inherited by a distant relative;

- a citizen who is not a relative was allocated a share under a will;

- the heir lived outside the country for a long time.

This can be corrected with the help of a lawyer who specializes in inheritance matters. The list provided by the notary should be carefully studied. After this, the lawyer will provide information about where and on what grounds you can obtain this or that certificate or extract.

To obtain duplicates, you should contact the appropriate organization. The successor must submit requests, but formulate them correctly.