Enforced debt collection begins with the creditor filing a lawsuit. However, the debtor also has ways to protect his rights, which he can use within the framework of the judicial procedure. An objection to a statement of claim for the collection of debt on a loan is one of these methods, which allows you to express disagreement with the presented requirements and justify your position. However, this document must be drawn up and submitted correctly, taking into account all procedural requirements.

When can you file an objection?

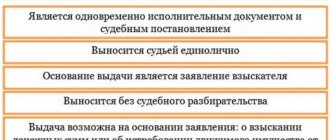

The bank goes to court when the borrower does not fulfill his obligation voluntarily. The judicial stage is necessary for the purpose of initiating enforcement proceedings, in which it will be possible to enforce the decision. And if the issue cannot be resolved by order, the claimant must file a claim.

In the claim, the bank expresses its position regarding the dispute. The circumstances of the case, information about the concluded agreement, payments made, delays and other factors that are important within the framework of the proceedings are indicated. However, the debtor does not always agree with the creditor’s position in one way or another.

An objection is filed precisely in case of disagreement with the bank’s requirement. There are two main situations possible:

- the debtor does not fully recognize the claim and objects to the satisfaction of the claim;

- the debtor admits the claims only partially and asks to refuse specific points.

If the claim is partially accepted, the objection most often indicates the need to reduce the amount of debt, penalties, refusal to foreclose on some property, and so on.

An objection to the claim may be filed at any time, before the court leaves for the deliberation room. However, if the court considers that the document is being submitted only to delay the process, it may refuse to accept it. Therefore, it is recommended to submit the paper on time, preferably at the beginning of the process.

Reasons for drawing up

In case of judicial collection of a loan, banks, as a rule, require the defendant to repay the entire loan amount, taking into account interest and penalties. Often the final amount of debt becomes simply unaffordable for the borrower. In this case, you can file an objection to the loan court, protesting the bank’s opinion and its conditions for closing the debt.

As a rule, debtors demand from the court:

- Debt restructuring, changing the collection method;

- Reduction or cancellation of loan penalties;

- Reducing the final amount of recovery.

The main opportunity to reduce the bank's requirements is to recognize the disproportion of the penalty and interest on the debt (Article 333 of the Civil Code of the Russian Federation). The borrower may also refer to the deterioration of his financial condition.

The debtor may also file a counterclaim, which will be considered within the same proceeding for debt collection.

You can file an objection for other reasons. For example, if the creditor previously violated the terms of the loan agreement, consumer rights or the procedure for pre-trial settlement of a debt payment dispute.

You can also find out what to do if the bank sues for non-payment of a loan by reading here.

Making an objection

It is not necessary to submit your objection in writing. The defendant's position will be heard as part of the trial. The party will be given time to express its opinion about the claim, its validity and proportionality. However, a more effective option is a written objection .

The document must contain the following information:

- details of the court to which the document is submitted;

- applicant's details;

- information about the plaintiff and third parties;

- name of the application;

- information about the claim to which an objection is being filed;

- claims with which the applicant disagrees to one degree or another, as well as justifications for his position, including references to regulations;

- the pleading part, which indicates the requirement to refuse to satisfy the plaintiff’s demands in one or another part;

- list of applications.

At the end of the document there is a date and signature.

Download the objection to the statement of claim / general form (sample / form)

Remember that the outcome of the case may depend on the correctness of the objection . If you need help preparing this document, please write about it using the form below >>

Recommendations to the defendant

The loan agreement can be challenged due to its lack of funds. To do this, it is necessary to prove that the subject of the loan agreement was not actually at the disposal of the borrower, that is, the money was not actually transferred to the plaintiff (clause 1 of Article 812 of the Civil Code of the Russian Federation

).

The plaintiff is required to prove the fact of transfer of money under the loan agreement. Otherwise, it is necessary to point out to the court the absence of such evidence. Moreover, if the loan agreement must be concluded in writing (Article 808 of the Civil Code of the Russian Federation

), challenging it due to lack of money through testimony is not allowed.

The exception is cases where the agreement was concluded under the influence of deception, violence, threat or a combination of difficult circumstances, as well as by a representative of the borrower to the detriment of his interests (clause 2 of Article 812 of the Civil Code of the Russian Federation

).

As an argument when challenging a loan agreement due to lack of funds, one can cite the fact that the plaintiff at the time of drawing up the receipt did not have funds in the amount indicated in the receipt. For example, this may be relevant in cases where the amount claimed by the plaintiff is many times higher than the average income of the plaintiff. In such cases, the court may oblige the plaintiff to provide evidence that he has such an amount when concluding a loan agreement.

Due to lack of money, only a loan agreement can be challenged (clause 1 of Article 812 of the Civil Code of the Russian Federation

). If the obligation to return funds on the basis of a receipt arose from another obligation (for example, from a purchase and sale agreement), it cannot be challenged for lack of money.

If it does not follow from the text of the receipt that the funds were transferred to the defendant on the terms of repayment, it can be stated that there was no fact of concluding a loan agreement, and therefore that the defendant has no obligation to repay this loan, provided for in Art. 309 Civil Code of the Russian Federation

(for example,

the appeal ruling of the Moscow City Court dated February 14, 2020 in case No. 33-5990/2020

).

If the signature on the receipt was not made by the defendant, this must also be stated when considering the case in order to appoint and conduct an appropriate examination (for example, the appeal ruling of the Moscow City Court dated November 14, 2019 in case No. 33-52460/2019

).

To make a decision in favor of the defendant when considering a claim for debt collection under a loan agreement on the basis of a receipt, it is necessary to prove the circumstances indicated in the table.

How to file an objection

The easiest option is to file an objection in person, during the trial. A copy will need to be made for each party so that they can review the applicant's position.

Copies are made not only of the objection itself, but also of all attachments. You also need to remember that a copy is submitted to the court and to all third parties participating in the process.

But the defendant does not always have the opportunity to participate in the trial. In this case, you can submit an application in the following ways:

- Send by mail to the court address.

It is imperative to indicate in the objection the case number and the name of the judge who is considering it. This will eliminate the possibility that the document will not reach the desired office.

- Use the application form on the website of the relevant court.

However, this will require an electronic digital signature.

- Submit documents through the office.

This can be done in person or through a representative in advance. It is recommended to check with the secretary when the document will reach the judge, since the papers are not sorted and handed over immediately. If the meeting is soon, you can ask for an urgent transfer; usually the office staff will accommodate the applicants halfway.

The objection can also indicate a request to consider the case in the absence of the applicant, so as not to draw up a separate document.

It is permissible to transfer the document in any available way, the main thing is that the objection is received by the court.

How to correctly write an objection to a bank’s claim to collect a loan to the court

The right to file an objection is regulated by Article 149 of the Code of Civil Procedure of the Russian Federation. By the way, this right belongs not only to the plaintiff, but also to other interested parties to the dispute. For example, third parties may also object to requirements that in one way or another relate to their interests.

The text of the objections is drawn up at your own discretion, but some rules must be followed:

- the document must contain the correct name of the court, it is advisable to indicate the case number and parties, and indicate your procedural status.

- disagreement with the claims must be clearly and clearly expressed, and arguments and evidence must be provided.

- at the end of the text there should be an appeal to the court - this can be either a request to completely reject the plaintiff’s evidence and recognize his claims as unfounded, or a request to reduce the amount, etc.

- It is advisable to attach to the objection the evidence that the defendant refers to, even if similar evidence already exists in the case. It is convenient for the judge and other participants to immediately compare the defendant’s arguments with the attached document, rather than again turning to the case materials. For example, if the debtor refers to a difficult financial situation, then you can attach a certificate of family composition, information about income from the tax office, etc.

- a copy of the objections with all attachments must be sent by registered mail to all participants in the process, providing the court with a postal receipt.

Is it possible to challenge or reduce the amount of the claim?

The objection helps express the plaintiff's position. Many points cannot be expressed orally as clearly as on paper, so it is recommended to draw up the document if there is a real opportunity to challenge the claim in one part or another.

You can challenge a claim only if there are good reasons , for example:

- The plaintiff demands funds for the period that was paid.

For example, the loan is collected in six months, while the plaintiff managed to make the first two payments.

- The agreement was signed by another person.

In this case, an examination will be required.

- The claims were calculated incorrectly.

It will be necessary to provide a counter payment. The court will compare them and decide which one is correct.

- The evidence used by the plaintiff cannot be used by the court due to its illegality or groundlessness.

- The penalty is disproportionate.

It can be reduced, but for consumer loans, at the moment, there is a significant limitation on such payment, which practically eliminates its accrual in a disproportionate amount.

There may be other reasons that will make it possible to prove and substantiate the disproportionality or completely unfoundedness of the claim. However, one objection is sometimes not enough. It is necessary to prepare evidence confirming the text, for example, checks indicating loan repayment.

What will happen next?

After the appeal is filed, the court must consider it and decide whether to accept the defendant’s application or not. Such an appeal is a good opportunity to express your disagreement with the bank’s claim and the conditions for paying off the loan debt, showing your interest in the process during the consideration of the case.

An objection that has been supported by evidence and has legal grounds will be accepted for proceedings. The borrower will have a chance to reduce the lender's requirements and the amount of the amount collected. Remember that a simple application, without documents and legal grounds, will be rejected.

Let's sum it up

An objection is filed if the defendant does not agree with the plaintiff’s demand in whole or in part. The document can be filed at a court hearing or transmitted earlier, including via mail. The court has the right to accept an objection before going to the deliberation room. It is recommended to attach evidence to the objection that further supports it.

Read: Loan restructuring – what is it and how to restructure loan debt

Objections on rehabilitative grounds

Financial difficulties will not be considered exonerating circumstances unless they arose with the participation of third parties or as a result of events that the debtor could not prevent.

Accordingly, rehabilitating circumstances may include:

- theft of property confirmed by the initiation of a criminal case;

- already initiated proceedings to declare the debtor bankrupt;

- delays in wages, liquidation of the enterprise, serious illness, etc.

Ideally, you can talk about all this with the creditor himself before the claim appears. Banks, for example, often meet their debtors halfway. Unfortunately, this approach rarely works with microfinance organizations, all of whose work, as a rule, is subject to the principle of the greatest risk of non-repayment of borrowed funds.

Objection to the statement of claim dated June 18, 2018.

There are no special requirements for filing objections to a claim in the Civil Procedure Code of the Russian Federation. However, based on general logic, they must contain those details that will allow the court to establish from whom they come and in what civil case they are filed.

This norm clearly defines the volume of information provided and establishes the circle of persons to whom credit institutions and banks can provide information on accounts and deposits of individuals. Consequently, information constituting banking secrecy includes information about transactions, accounts and deposits of clients and correspondents, as well as information about the client.

A loan is a big responsibility; the borrower personally confirms that he is ready to pay the amounts specified in the agreement. There are many reasons why there is a delay in payment and subsequent accrual of fines and penalties. In order to collect debt on a loan, the bank has the right to file a claim in court.

INUSTA

Thus, taking into account the denial of the fact of receipt of funds by the defendant, the above confirms that loan agreements between the plaintiff and V. were never concluded.The text of the receipt (L.D. 96) in principle cannot be interpreted in any intelligible way. Not a single sentence in the document contains common sense. No sentence on the receipt is related to any other sentence on the receipt. In general, the receipt is a heap of absurdity, nosense, and nonsense:

V-(man) provides his details

B reports the receipt of the amount by another person (woman)

Receipt follows from an unidentified person - a certain B-va

V-reports that he undertakes to return it is not clear what (“their”, but not the amount)

V-reports that the receipt was drawn up on a non-existent date

The amount of 49 thousand dollars, according to B-v, USA, in 1999 -2001 is a fortune. It’s hard to believe that B-v, a sane, literate person with a higher education, the director of a large industrial and trading complex, could give someone that kind of money without a proper agreement. It is even more difficult to believe that he could be content with such a “receipt” as confirmation of the contract.

Truly, it is not for nothing that contracts sometimes contain a preamble: “acting in a strong mind and sound memory...” - in this case, the receipt should have included the preamble: “acting in a state of extreme madness, completely devoid of memory, in the name of glorifying nonsense, being fans of the absurd, sides of this receipt..."

The Civil Code of the Russian Federation (Article 431) established that the literal meaning of a condition is clarified by comparison with other conditions or the meaning as a whole.

However, not a single condition of the receipt can be compared with another condition or with the meaning of the document as a whole in the absence of one.

The law does not provide for the contents of the receipt. There are no generally accepted rules for its preparation, however, from the general requirements for contracts, one can come to the conclusion that a receipt for a loan agreement must contain all the essential terms of the loan agreement, otherwise it cannot be distinguished from receipts for other agreements - commission, storage, expedition, etc.

The receipt itself is not a transaction. This is also evidenced by current judicial practice (for example, Resolution of the Federal Antimonopoly Service of the Ural District dated July 3, 2003 N F09-1692/03-GK, Resolution of the Federal Antimonopoly Service of the Northwestern District dated September 21, 2007 in case No. A56-44572/2005).

It follows from the above that the vagueness of the receipt does not allow the plaintiff to put forward specific demands and objections based on it from the borrowing relationship: in particular, the claim that the limitation period was interrupted by filing a claim in 2004 and the objection that the limitation period expired on August 31, 2003 cannot be substantiated .

In addition to the above, the main feature of a loan agreement is missing - the actual transfer of funds from the lender to the borrower.

The absurdity and meaninglessness of the receipts have their own, unfortunately, sad explanation. V. wrote the text of both receipts in connection with his dependent official position on B., as a guarantee of loyalty, and being in difficult living conditions, on the brink of poverty, which witnesses can confirm.

One of the receipts directly indicates the dependent and labor nature of the documents (L.D. 95): the money had to be not only worked out, but worked out “without regard to labor and time costs.” In fact, we are talking about the fact that a person simply sold himself into slavery for 2 years - he could be required to work 24 hours a day, 365 days a year with the maximum effort of all possible efforts.

The employer wanted to guarantee himself a devoted attitude towards him on the part of the employee and protect himself from a possible severance of labor relations, which witnesses can confirm.

V. worked as B.’s assistant: he drove him around Moscow and the region in a car, guarded him, delivered documents, money, correspondence, and transported his friends and relatives. All this was done in connection with the activities of B-va as the owner of the XXI holding, as well as as an ordinary person

V worked as a nominal deputy general director of NPP A LLC, a member of the XXI aviation holding, subordinate to B.:

signed documents (financial and tax statements, contracts) that B-v pointed out to him, conducted business negotiations,

In connection with the signing of financial documents, he assumed the risk of filing claims from law enforcement agencies.

- enrolled after a probationary period, but before that B-v set a mandatory condition - a guarantee of V-n’s boundless devotion. A mandatory condition for V-s passing the probationary period and his employment was that V-s wrote a so-called “receipt” for $39,000, which B-s personally forced V-s to write.

Formally, V-n worked completely for two years and therefore worked off the alleged debt on one of the receipts.

The fact that V-n worked at NPP “A” LLC in the period from 07/08/1999 to 09/23/2001, that is, for two years, is confirmed by V-n’s work book.

The fact of labor relations between V and B can be confirmed by witnesses.

Witnesses are also ready to confirm that V’s performance of the functions of a nominee director and, accordingly, the signing of financial documents without understanding the substance of the texts of the documents he signed.

Witnesses can confirm that B-you and B-his employees were forced to sign documents.

Thus, these documents, written under duress, represent nothing more than security given under duress for the performance of labor functions and personal loyalty (Articles 329-330 of the Civil Code of the Russian Federation). Writing such documents is a direct violation of the Labor Code of the Russian Federation in terms of compulsion to work, the extent of minimum responsibility and the freedom to terminate the employment contract.

In view of the above, these receipts should also be considered void, which is what V-n filed.

The amount of 49 thousand US dollars is a significant amount. This amount is even more significant in the aftermath of the 1998 financial crisis and the redenomination of the ruble. At that time, such an amount was practically a fortune; it could buy three large apartments in the center of Moscow.

At the same time, such a significant amount is not given to a close person, a driver, or a nominal director.

All this casts doubt on the reality of such a loan in principle.

Moreover, the plaintiff’s income was no more than 8 thousand rubles per month.

All this is the basis for checking the actual earnings of B-va in 1999 - 2001.

A separate basis for declaring transactions void is violation of the requirements of the currency legislation of the Russian Federation.

Taking into account the above, on the basis of these rules of law, I ask the court:

refuse B-vu N.G. in satisfying the claims in full, to satisfy V.’s demands and recognize the receipts as void and the loan agreements as unconcluded.

Representative of V-on A.M. lawyer R.B.

Page 3