Giving an apartment or house to a son, according to an independent sociological survey, is one of the most common options for transferring this type of real estate within a family in Russia. And this is not surprising, because issuing a deed of gift to close relatives has many advantages!

The simplicity of drawing up a document, the absence of taxation of the transaction and the speed of registration of property rights are what made the gift agreement in favor of close relatives so popular in 2021!

However, this does not mean at all that this method of alienation of property does not have “pitfalls” that can not only create problems in the future for each of the parties, but also act as grounds for declaring the transaction invalid.

A practicing lawyer and one of the authors of the Legal Aid website, Oleg Ustinov, will tell you about all this today.

General introductory (but no less important) information

Our regular readers probably know that the legislator allows you to draw up a deed of gift both by resorting to the help of a notary (which, of course, will only be a plus when registering it) and without turning to a specialist. At the same time, we remind you that in cases where the property transferred as a gift is jointly owned, notarization of the transaction is a prerequisite for its completion.

Also, it is worth noting that the transfer of ownership by deed of gift to an apartment, house or other real estate object (including a land plot) is carried out only after the mandatory registration of the gift agreement in Rosreestr.

It is also good that in the case of a gift of real estate between relatives, the recipient is exempt from paying mandatory tax, the amount of which today is 13% of the total market value of housing.

Expert opinion

Oleg Ustinov

Practicing lawyer, author of the website “Legal Ambulance”, one of the co-founders of the “Our Future” foundation.

Also, when making a gift in favor of a young son who has not yet turned 14 years old, the role of the donee, according to current legislation, must be the legal representative of the child (for example, a second parent or a specialist from the guardianship authorities).

Children who are already 14 years old at the time of the transaction can participate in the transaction independently, provided that this participation was authorized by their legal representative.

When registering a deed of gift for an apartment in favor of an adult son who is married at the time of the transaction, this property will be classified as his personal property, and therefore will not be subject to division in the event of divorce proceedings.

Otherwise, the donation of real estate occurs according to generally accepted rules, the main condition among which is compliance with the gratuitous nature of this transaction, which distinguishes it from other transactions of alienation of property. Simply put, when making a gift, the donor cannot demand that the donee fulfill any counter-conditions.

Transaction terms

The rights to the apartment are transferred to the recipient immediately after registration in Rosreestr and delivery of the corresponding supporting paper (if, when drawing up the deed of gift, certain factors for the document to come into force were not indicated, for example, adults, marriage registration).

After the death of the donor, the deed of gift loses its legal force - having received the document in hand, you need to quickly begin the registration process.

Donating real estate to your son in 2021 – features and nuances

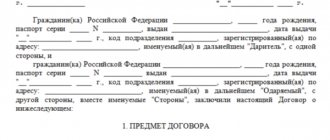

Let us immediately note that all donation agreements whose object/subject is real estate, for the reasons stated above, must be drawn up exclusively in writing! At the same time, notarization of the act remains an optional part of the transaction.

ARTICLE RECOMMENDED FOR YOU:

Garage donation agreement: sample, how to draw up and deadlines

Based on the information established in Part 3 of Article 574 of the Civil Code of the Russian Federation, deeds of gift for real estate are subject to mandatory state registration in Rosreestr!

Lawyer's Note

Also, it is important for the donor parent to take into account the fact that, according to the current legislation (as of 2021), he cannot act in the transaction as the giving and donee party! The whole point is that, based on the norms published in Part 3 of Article 182 of the Civil Code of the Russian Federation, the legal representative of the child cannot make transactions in favor of his own person.

That is why, when donating an apartment, the role of the second party (legal representative of a minor son) must be the second parent or employee appointed to carry out the transaction by the guardianship and trusteeship authorities.

How to give your son an apartment

It’s worth noting right away that, according to current Russian legislation, a parent acting as a donor can transfer an apartment to his son not only in full, but also donate a certain part of it by registering a deed of gift and indicating in it the share of the transferred real estate.

When making a donation of an apartment that was acquired during marriage and is part of the joint property of the spouses, written consent to carry out the transaction in 2021 is a prerequisite! Otherwise, the apartment donation agreement may be declared invalid in court.

Also, when donating a part of residential property, the parties must indicate in the agreement the number of square meters being donated (instead, they can indicate the proportional ratio of the donated part of the apartment - for example, 1/2).

When drawing up a deed of gift, be sure to include in its contents all the information relating to the transferred object of donation, especially the following: floor, real address, total size of the property and size of living space, number of rooms, absence/presence of a balcony, cosmetic condition of the premises, cadastral number, etc.

List of documents for donating an apartment to your son in 2021

Since when registering a donated apartment for a son, it is necessary to re-register ownership with the Rosreestr authorities or the nearest branch of the MFC - let's look at what kind of certificates and acts will need to be provided to the employees of this body without fail.

So, before registering property, the donor and donee must have the following papers in hand:

- Passports of the parties or the birth certificate of the donee, if he is a minor citizen of the Russian Federation;

- several (usually three) copies of the deed of gift - one each for the donee and the donor, as well as 1-2 for the registering authority;

- written notarized consent of the spouse, if the apartment being donated free of charge is part of the jointly acquired property;

- title documentation confirming the ownership of the donor’s real estate (inheritance certificate, purchase and sale or gift agreement, etc.);

- certificate about other persons registered in the donated apartment;

- a certificate stating that there are no encumbrances on this apartment (you can obtain this certificate on the State Services online portal);

- a receipt confirming successful payment of the state fee established by the legislator for re-registration of property rights.

How to give your son a home in 2021

The procedure for executing a contract for a house to a son today is similar to the procedure for transferring any other real estate. At the same time, we remind you that, along with the package of documents listed above, the donor is obliged to provide the specialists of the MFC or Rosreestr with the relevant title documents (in accordance with the norms described in part 1 of Article 552 of the Civil Code of the Russian Federation) for the plot of land on which the main building is erected.

In the event that this land plot is leased by the donor from the state, when drawing up an agreement to donate a house, the right to rent this plot from the state passes to the donee , in accordance with the provisions established by Article 35 of the Civil Code of the Russian Federation.

If a private house is transferred along with the land plot on which the building was erected, the actual area of the plot and all its main characteristics must be recorded in the deed of gift. Also, it is necessary to record in the contents of the contract all technical buildings located on this land plot.

Expert opinion

Oleg Ustinov

Practicing lawyer, author of the website “Legal Ambulance”, one of the co-founders of the “Our Future” foundation.

We remind you that, according to the current legislation of the Russian Federation, as of 2021, when donating a house, the donor also transfers along with it the land plot on which it is located (Article 273 of the Civil Code of the Russian Federation), since the transferred property is inseparable from the land. Moreover, if the gift is a share in the ownership of a private house, the plot of land must be divided and calculated in proportion to the donated share.

In cases where a parent or both parents decide to give their son a certain part of the house, they are obliged to allocate it in kind by conducting an appropriate construction and technical examination, the results of which will include:

- the real market value of the entire house;

- possible land surveying options;

- actual cost of redevelopment;

- possibility of dividing a house, etc.

ARTICLE RECOMMENDED FOR YOU:

Agreement on donation of land between relatives - sample 2021. for MFC

Afterwards, the parties should build a separate kitchen, bathroom and entrance. Thus, if the allocated part of the house meets the established technical requirements, it can be registered in the cadastral register, and then a contract for donating the house to the son can be drawn up in the generally established manner.

How to give your son a garage in 2021

First, it is necessary to determine the type of property to which the property being transferred as a gift belongs. So, if the garage (based on information from Part 1 of Article 130 of the Civil Code of the Russian Federation) relates to real estate, the donation of the garage should be made in the general manner, that is, similar to the donation of most real estate objects, with mandatory state registration of the new owner’s ownership in the MFC or Rosreestr.

At the same time, for the above-mentioned registration, the parties, in addition to the standard package of documents, will need title papers for the land plot on which the garage was built.

Important

If the building is located on land owned by the parents (donor), the transfer of ownership must be formalized in accordance with the general procedure, with the obligatory provision of the relevant documentation and the transfer of all parameters of the building and the site in the deed of gift to the son.

If the garage transferred by the parents to their son is part of the GSK or a garage-building cooperative, the size and procedure for the transfer are regulated by the Charter of this cooperative.

Thus, the son’s ownership right to the garage donated to him by his parent will be formed only after making the full share contribution (based on the provisions given in Part 4 of Article 218 of the Civil Code of the Russian Federation). Simply put, to donate this type of real estate, the recipient needs to repay the share in full, and then provide documents about this to the registration authority.

How much will you have to spend?

Upcoming expenses include expenses for:

- payment of state duty (2000 rubles);

- payment for notary services;

- payment of 13% income tax for recipients who are not close relatives of the donor - the amount of payment is determined from the estimated value of the object received as a gift.

How to give your son a share of an apartment or house in 2021

When giving a child a share of an apartment or house, the deed of gift by the parents can be drawn up in simple written form (provided there is no shared ownership with other persons). In the event that the transferred real estate is owned by several persons, the alienation of part of it becomes possible only after receiving written, notarized consent to the transaction from the remaining owners (according to Part 2 of Article 576 of the Civil Code of the Russian Federation).

In addition, if real estate acting as a gift was acquired by a parent during marriage, according to Part 3 of Article 35 of the Family Code of the Russian Federation, the consent of the spouse will be required for its alienation.

Remember that when one of the parents gives their son real estate or part of it, which is part of the jointly acquired property, the second parent has the right to act as the legal representative of the minor child . At the same time, the remaining part of the apartment or house will remain jointly acquired property and in the event of a divorce will be divided equally.

ARTICLE RECOMMENDED FOR YOU:

Form of car donation agreement (sample)

Thus, nothing prevents one parent from donating his share in an apartment or house purchased jointly with the other parent to his son. All that is required for this is to draw up the appropriate agreement determining the size of the owner’s share, then have it certified by a notary and draw up a donation agreement for the allocated part of the property.

In the event that both parents have an allocated share in a house or apartment and both want to give it to their child, a typical deed of gift is concluded, the contents of which need to fix the size of the gift. At the same time, the father and mother will have to provide title documents for their part.

Also, we note that in this case, each of the parents can act as the legal representative of a minor son or daughter, in accordance with the share donated separately.

However, giving a gift to a minor child is perhaps worth considering in more detail.

Mortgage situation

Separately, it is worth highlighting the situation with mortgage housing. It can also be given as a gift, but this is only possible with the consent of the lender, that is, the bank that holds the property as collateral.

After donation, the bank retains rights to seize the collateral, and the recipient must remember this risk .

It is much easier for a bank to seize mortgaged housing; a court decision is not required for this.

In practice, banks rarely agree to donate apartments that serve as collateral for a mortgage.

You can find out whether it is worth accepting housing with encumbrances as a gift from our article.

Donation of an apartment to a minor child in 2021 - features and pitfalls

According to current Russian legislation, a minor is considered a person who is 14 years old but has not yet reached the age of majority (18 years old). Thus, based on what is described in Article 26 of the Civil Code of the Russian Federation, a minor citizen of the Russian Federation can be present and participate in the execution of a deed of gift in his favor. The gift agreement must be signed by both parties to the transaction and certified by the present signature of the legal representative of the child’s interests.

At the same time, based on the norms and provisions mentioned in Article 28 of the Civil Code of the Russian Federation - when donating in favor of a minor son or daughter who has not reached the age of 14 years - the transaction is formalized exclusively by the child’s representative, without his participation.

Important

After official registration of ownership of the donated living space, the minor will act as its legal owner, although he will not be able to independently dispose of the apartment or house until he turns 18 years old.

If in the case described above, the parents or the child have a desire to sell the gift, then, according to paragraph 2 of Article 37 of the Civil Code of the Russian Federation, the parties will be able to do this only if permission to conduct the transaction is given by a specialist from the guardianship and trusteeship authority, which in 90% can only be obtained if such a transaction is needed to improve the living conditions of the child himself.

Who pays the tax when a parent signs an agreement to donate an apartment for a child?

Based on the content of paragraph 18.1 of Article 217 of the Tax Code of the Russian Federation, any property, including real estate, that acts as the subject of a gift transaction between close relatives is not taxed!

So, after the official transfer of ownership rights to the donee, he will have to pay only property tax (according to the provisions of Article 401 of the Tax Code of the Russian Federation), annually. It is worth noting that, according to the norms of the legislation in force in the Russian Federation, minor citizens are classified by the legislator as full-fledged taxpayers. That is why many donor parents have a question: who will pay the property tax after registering a deed of gift for an apartment for their son or daughter?

Of course, parents can also pay taxes for a minor child. To do this, they only need to indicate the details of their son or daughter. At the same time, in some cases, children can take advantage of certain benefits, which are established for each region separately.

Features of the procedure

The procedure for re-registration of property always involves a number of sequential actions. It is impossible to agree verbally on full ownership, even when it comes to family relationships. Housing can be transferred in various ways, and they are chosen by the subjects of the relationship. As for relatives, the procedure will not be any different, except for some aspects related to paying tax when making a transaction and obtaining additional permits for it.

- re-registration of housing in the name of a son or daughter, in this case it is possible to avoid paying tax or significantly reduce its amount;

- re-registration in the name of a husband or wife, which provides for the need to establish how the apartment was acquired, and if it was purchased during marriage, then it belongs to both spouses equally;

- re-registration in the name of a sister or brother, in this case there are no special features in making transactions;

- re-registration of the apartment in the name of the parents, which can also be carried out according to the general rules of real estate transactions;

- re-registration for grandchildren, there will be no difference here from other options for transferring an apartment to relatives.

This list reflects persons who are recognized as close relatives. Separately, it should be said that only siblings are taken into account here; other relationships are not considered close.

If the recipient of the apartment is a close relative of the owner of the property, then thirteen percent of the tax will not be paid, but only if a gift agreement is concluded.

The reasons why housing is transferred from one relative to another are different. At the same time, one should not confuse bilateral transactions of civil law with inheritance, which is formalized regardless of the will of the person to whom the housing is transferred. This is the main difference from the standard procedure for transferring an apartment, even if it is carried out in relation to a relative, from a will or inheritance by law. It should be understood that the presence of family relations does not make agreements unconditional.