A counter-purchase of an apartment is an operation when a person transfers ownership of his home and at the same time acquires another property. That is, he does not receive money for the sold housing, but immediately transfers it to another person. If a bank takes part in the scheme, then the funds are transferred through it. The money is stored in a safe deposit box and is received by the owner of the property the client wants to buy.

The essence of the counter transaction is that 2 transactions are carried out simultaneously: the sale of one and the acquisition of another apartment. The advantage of this type of purchase is that the buyer is insured against a situation where he has money in his hands, but does not have an apartment. As practice shows, more than half of all transactions are a counter purchase of real estate.

What is a counter purchase? Why is this type of real estate transaction so common? Many people want to buy a larger apartment or change their area of residence, but there is no real money for this. Selling your home and looking for a new place is a rather lengthy process, so it is not always suitable. As a rule, you can manage the following resources: your own real estate, mortgage or subsidies.

The counter-purchase of an apartment is suitable for many people because it provides an opportunity to get a new home in the absence of real funds. Most people in this scheme find the only option to change apartments.

In counter purchases, it is not uncommon for a realtor or real estate agent to participate. It is on their shoulders that the search and preparation of all documents falls. This is quite a difficult job, but it cannot be done without it. Let us repeat that most of the transactions in the real estate market are counter purchases of housing.

What does counter purchase of an apartment mean?

A counter-purchase of an apartment is a procedure as a result of which the seller sells the property and receives money for it, and immediately uses it to purchase a new home. In fact, two transactions are made: one for the sale of old real estate, the second for the purchase of a new one. They take place simultaneously or with a minimum interval of time.

Important! There may be several properties being sold or purchased. For example, in the event of a divorce, spouses can sell one apartment and purchase two others with the proceeds. Or vice versa - one owner can sell three apartments and in return buy only one larger area.

Difficulties during the procedure

Organizing a transaction yourself is a very responsible undertaking. In addition to the risk of running into scammers, there are other difficulties:

- Synchronization of actions. The apartment must be purchased in a short time. The price of real estate changes every day. Therefore, there is a risk that the savings may not be enough for the option you like.

- Documenting. All papers must be drawn up taking into account all the nuances: the terms for transferring the amount, including prepayment, and the possibility of living for a certain time on the sold square meters are specified.

- Checking the “purity” of the transaction. There are several parties involved in this chain. In Soviet times, such procedures were called “complex exchanges.” In order for all documents to be prepared legally and without pitfalls, it is necessary to check the history of the property.

Counter purchase of an apartment in a new building

Apartments in new buildings are sold by developers under an equity participation agreement (DPA) or a sales and purchase agreement (SPA). The DDU is concluded if the house has not yet been put into operation. If there is already a certificate of commissioning, a WPC is drawn up.

Several transaction options are possible with the developer:

- Sale of old housing in exchange for new one. The construction company purchases the client's property and in return provides him with a new apartment.

- Sale of living space to an individual with subsequent purchase from the developer.

In both cases, two DCTs are issued if the construction has already been completed. In one contract, the client is the seller and the company is the buyer. On the second side, they change places.

If an individual buys an old home, the procedure will look like this:

- The owner-seller sells the property to another person by concluding a contract with him and taking a deposit or the full amount from him. Documents are submitted for registration.

- After the sale of the old home, a contractual agreement is drawn up with the developer, and the transfer of ownership is registered again.

Note! Selling an apartment against a new building will take less time from the developer. But it is unlikely that it will be possible to sell it for the average market price: a specialist will be invited to evaluate it, who will try to reduce the cost as much as possible.

Contents and sample agreement

When filling out a contract with an individual buyer and a developer, it is important to indicate the essential terms of the transaction, information about its subject and participants:

- Full name, date of birth, passport details, registration addresses of the buyer and seller.

- Name, address, INN, OGRN of the construction company.

- Information about the apartment: address, number of rooms, area, floor, cadastral number.

- Cost of housing, payment procedure and terms.

- Responsibility of the parties for violation of obligations.

- Rights and obligations of the parties to the transaction.

- Date of compilation and signature.

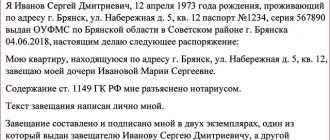

Sample contract

Documentation

To sell real estate the owner will need:

- passport;

- extract from the Unified State Register of Real Estate;

- title document;

- registration certificate

The buyer can also request a certificate of absence of debts for housing and communal services and an extract from the house register.

When acting as a buyer after selling a home, all you need is a passport.

How long does it take to sell an apartment?

Preliminary agreement for the purchase and sale of an apartment under a Sberbank mortgage

We evaluate the possibilities

The first step that anyone who wants to change their living space takes is their own marketing research. It comes down to studying advertisements for the sale of apartments and rooms: the property owner estimates how much his property might cost and tries on counter options. If this is a typical housing, there are many analogues in the catalogs. Just a year ago, this method of assessing opportunities worked well. Today, listings include many overvalued properties, while a rare transaction does not occur without haggling. At the same time, sellers of apartments of the most popular sizes and in popular areas are reluctant to make concessions, while at the same time, the demand for other options offered at “charged” prices is close to zero. How to assess your capabilities in the current conditions? It is worth contacting a real estate agency. You will not lose anything: initial consultations with real estate companies are always free.

Counter purchase of an apartment on the secondary market

A counter transaction for the purchase and sale of real estate on the secondary market takes place according to the following scheme:

- The owner sells one apartment and at the same time finds another.

- If a new home is found, but the old one has not yet been sold, a preliminary agreement is concluded, according to which the owner undertakes to purchase the apartment immediately after the sale of his home.

- There is a buyer for the old apartment, a contract is signed with him, and the documents are sent for registration.

- Simultaneously with the execution of one contract, another is concluded, but with the seller of the new living space.

- Calculations are being made.

Example: A woman decided to sell her apartment and buy a house. The advertisement has been posted. While potential buyers came for inspection, she found a suitable house and entered into a pre-sale agreement, according to which she undertakes to complete the main contract with the seller within 6 months.

A buyer for the apartment was found after 3 months. Immediately after the settlements, the woman signed a contract with the seller of the house.

Legal advice: drawing up a pre-contract with the seller of a new property when the old one has not yet been sold is always a risk. If a person does not manage to sell his home within the established time frame, he will still have to enter into a basic contract with the seller and look for money to pay off. It is better to carefully weigh everything before such a transaction.

Contents and sample of the preliminary agreement

The pre-contract contains the same information as in the main example presented above. But the parties are obliged to indicate within what period the main DCP must be drawn up.

Sample PDCPFeatures of the agreement

The counter purchase of an apartment differs from a regular transaction, and drawing up an agreement for this transaction also has its own characteristics.

If we compare it with the purchase and sale, then there is one nuance that must be indicated in the document. Selling an apartment is possible only when purchasing another home. If a new apartment has already been found, this is also indicated in the contract. This is extremely important, because if purchasing a new home through this scheme does not work out, then it will be possible to return the previous apartment. Another important point that must be included in the counterpurchase agreement is the deadline for vacating the premises. The most suitable scheme is the following: a person receives an oncoming living space and transports all his belongings there. A certain amount of time is given for this. Next, the home is transferred to the buyer.

Apartment exchange with surcharge

If two parties are involved in a transaction and instead of a written contract they draw up an exchange agreement, both simultaneously act as both sellers and buyers.

By law, both participants are obliged to transfer housing to each other with or without additional payment. What does a counterpurchase look like under an exchange agreement:

- One owner finds another and agrees to inspect the property.

- If both parties are satisfied with everything, an exchange agreement is drawn up.

- Documents are submitted for registration. The transfer of ownership of both apartments is registered simultaneously.

Important! Exchange transactions are regulated by Ch. 31 Civil Code of the Russian Federation. The parties have the right to independently determine the cost of their housing. If an agreement cannot be reached, they can resort to the services of an appraiser, and divide the costs equally.

Contents and sample agreement

The exchange agreement must indicate:

- Information about the participants in the transaction.

- Information about real estate objects.

- Amount to be paid additionally, payment method and terms.

- Cost of both objects.

- Procedure for changing and terminating the contract.

- Guarantees of the parties to the transaction.

- Rights and responsibilities under the contract.

- Date and place of preparation, signatures of the parties.

Documentation

To formalize the exchange agreement, both parties are required to submit a complete package of documents for their apartments and passports. You will need technical passports, extracts from the Unified State Register, and title documents. Certificates of absence of utility debts and extracts from house books are also provided to confirm that no one is registered in the living space.

Main stages

Generally speaking, such operations take place in 2 stages:

- searching for a buyer for an old home and selecting another apartment;

- making a counter purchase.

As we said earlier, the participation of a realtor in such transactions is necessary, since it is very difficult to prepare all the paperwork on your own and avoid problems.

So, in the first stage, several sub-points can be distinguished:

- housing assessment and price setting;

- searching for a replacement apartment;

- selling your real estate.

First you need to start selling your own home. It is extremely important to adequately evaluate the apartment, otherwise the transaction may be delayed. The best option is to focus on the average price on the real estate market and search for similar apartments. Let's say the apartment will be sold for 4 million rubles.

Now you need to find an apartment to purchase. As a rule, these are more expensive housing that have a larger area or are located in a better area. Note that the purchased object has a higher price, and therefore the difference is covered by credit funds or personal savings.

After this, you need to start selling the apartment and prepare documents. An agreement is concluded with the other party to the transaction and an advance is made. The first stage ends when a buyer for the apartment has been found and housing has been selected for a counter purchase.

How to register ownership rights during the counter purchase of an apartment?

When purchasing real estate at the same time, documents are submitted to register the transfer of ownership only after signing the DCT or exchange agreement.

What should be done:

- Make an appointment at Rosreestr or MFC.

- Come on the appointed day to submit documents. The presence of all participants in the transaction is required.

- Sign applications and submit documents.

- Wait until the registration of the transfer of ownership is completed.

As a result, a new extract from the Unified State Register and an agreement with a registration note must be issued.

Documentation

The registrar is provided with a third copy of the DCP (the other two remain with the seller and buyer). You will also need passports, title documents, and a registration certificate.

State duty

The registration fee is paid by the buyer - 2,000 rubles. For organizations it is higher – 22,000 rubles. According to the exchange agreement, 2,000 rubles. Both the seller and the buyer pay immediately, since the transfer of ownership is registered simultaneously for two objects.

Deadlines

If you contact the MFC, registration will take 9 working days. If you submit documents to Rosreestr directly, the period is reduced to 7 working days. If the contract is certified by a notary, he himself will transfer the documents to Rosreestr, and the period will be reduced to 3 working days.

Possible problems

As we said earlier, the counter purchase of an apartment is a popular transaction in the real estate market today.

This means that almost any lawyer can help with its preparation and settle all formalities. However, when there are many participants in the process, problems can arise. The most difficult thing is to draw up contracts in a long chain. The fact is that a successful transaction is only possible if all participants fulfill their responsibilities. That is, the last seller must ensure payment of the money, regardless of the actions of other parties. Since the transfer of funds is carried out along a chain, the transactions of all persons are interconnected and some failures cause problems for other participants. How to guarantee the safety of the operation? Are there any mechanisms?

Quite often, clients change their minds and simply break the contract, and do not bear any responsibility for this. However, there are certain ways to get rid of such actions and secure the obligations of all participants in the operation. In addition to the main agreement, additional agreements or receipts may be concluded that will provide for penalties in case of refusal.

To be fair, it is worth noting that realtors in most cases try to protect their clients and discourage them from entering into any agreements. As a result, unscrupulous clients do whatever they want, but no one can influence them and the entire transaction is jeopardized.

Advantages of counter transactions

Selling with a counterpurchase has several advantages:

- Quick check-in. If the documents are signed by all participants at the same time, you will be able to move to a new apartment immediately after registering ownership and handing over the keys.

- Saving. For support of two simultaneous transactions, realtors will take more money than for one, but less than for two different transactions completed over a long period of time.

There is also a drawback. This is complexity and the possible formation of a long chain of participants, which makes the deal likely to fail. The parties depend on each other, and if one refuses to sign the contract, they will have to look for other housing options.

Selecting an object

Before you go to view objects you meet, be sure to try to bring the wishes of all family members to a common denominator at a family council. If your requirements are not clearly formulated, then you will waste time on viewings. In terms of speed of registration, the ideal counter-purchase option for you would be an apartment offered on a direct sale basis: there is a chance of completing it in two to three weeks. This is how much time it usually takes to prepare and finalize all the necessary documents. But ideal situations are rare.

Lawyer's answers to frequently asked questions

How to pay taxes when purchasing an apartment?

If the seller owned the sold apartment for more than 5 years, he is exempt from paying personal income tax. Personal income tax of 13% is paid on income calculated from the difference between the purchase price and the proceeds. Expenses for the purchase of sold housing will have to be supported by documents.

If there are no supporting documents, you can take advantage of a tax deduction in the amount of RUB 1,000,000. to reduce the tax base. This amount is deducted from the proceeds.

I agreed with a person on the counter sale of real estate in my favor, but at the last moment he canceled everything. What to do?

If the agreement is oral, nothing can be done - no one has the right to force a person to enter into an agreement. If a preliminary agreement was drawn up with or without a deposit, you can demand the conclusion of the main one through the court.

Is it possible to easily purchase a home for a child if his other apartment is for sale?

Yes. Counter transactions are most often used when selling real estate to minors. According to the law, they must be provided with equivalent housing; without this, the guardianship authority will not give permission to sell.

In 2015, my husband received an apartment under a gift agreement, a year later they sold it and bought another one for an equal price. We are going to get a divorce now. Can I claim a purchased apartment if it was purchased with money received from the sale of a gift?

In theory, this is possible, but in practice, the spouse can prove in court that the property was acquired using funds from the sale of a donated apartment, and it will not be possible to divide it.

We are going to buy a two-room apartment, they buy a one-room apartment from us with our additional payment. What is better: to issue two DCTs for each transaction, or one exchange agreement?

It’s easier to draw up two DCTs; this is more common for both realtors and participants in the transaction. But if the exchange agreement is contested, all parties will receive their property back without losing anything. If the contract is disputed, there is a chance that the housing will be returned to the seller, and the buyer will receive compensation for its cost for several more years.

How to find a buyer or seller

The real estate market in 2021 is focused on the affordable housing sector. This should be taken into account when putting up a large property for sale. The more expensive the apartment is, the longer buyers will have to wait. Therefore, first you need to put your home up for sale, and then start looking for a suitable apartment.

As soon as you put your apartment up for sale, the first visitors will be “tourists”. This is what realtors call those who are just asking the price, looking closely, or generally representing the interests of real estate agencies.

Moreover, there will be many more “visitors” from the latter category. During telephone conversations, try to find out the intentions of the interested party: this way you will save your time.

Look around too - become a “tourist”, take a closer look at the options . This way you can find a suitable partner faster.

Save your time and effort - hire agents. In general, the process of buying counter housing is subject to some difficulties. You can carry out some stages yourself, while others require certain knowledge and experience.

Desires and possibilities

A counter-purchase is not the easiest option to change your living conditions. For example, you can use other methods to improve. For example, you can take out a mortgage or installment plan. And when the old apartment is sold, contribute this money to repay the loan.

To determine if trade-in is right for you, use these tips:

- Conduct your own housing market research. Understand what you have and what you want to get in the end. Assess the possible amount of additional payment or benefit when concluding a transaction. If you own a standard or, as it is also called, standard housing, then on websites or in newspapers you can find many options with an approximate price.

- Decide whether you can carry out the transaction yourself. We recommend contacting specialists. Counterselling gives too many opportunities to unscrupulous people.

- Calculate whether you will have to pay taxes. If yes, do not forget that all responsibility for timely completed declaration and payments lies with you. Don't forget about this when planning your expenses.

But the best thing to do is consult with an experienced real estate professional. He will be able to explain to you what you can expect, in what time frame, and how profitable such a deal will be in your case.