Failure to fulfill any obligation results in liability. This did not bypass the payment of alimony. The first thing that is applied to the violator is the imposition of a fine, penalty or penalty, and sometimes all at once. If you officially receive alimony for your child and at some point the payments stopped, you need to contact the bailiff service to clarify the situation with the delay in payments or their regular non-receipt. To do this, you first need to write a statement of claim for the collection of alimony arrears and penalties.

In what cases is it possible to receive a penalty for alimony debt?

A penalty is a penalty that is assessed when financial obligations are not fulfilled. A penalty for alimony is applied in cases where the debt has arisen due to the fault of the payer. So, you can count on payment of a penalty under the following conditions:

- The alimony payer openly declares that he does not intend to pay alimony;

- The alimony debt is more than 4 months;

- The payer submits false information to the bailiffs: hides his income or location;

- Alimony payments were not received by the recipient even after administrative measures of liability were applied to the debtor in accordance with the Code of Administrative Offenses of the Russian Federation;

- There was a notification of a decision to apply criminal penalties;

- The debtor has not worked for a long time and does not take any measures to find a job.

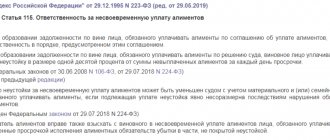

Payment of the penalty is provided for in Article 115 of the Family Code and Article 330 of the Civil Code.

This is not a complete list according to which the court can order the payment of a penalty. In such situations, it is important not for the defendant to prove his innocence, but rather for the plaintiff, when applying, to provide the maximum amount of evidence that will indicate guilt on one or several of the above points. Thus, the penalty for alimony will be calculated only if the guilt of the alimony payer is confirmed.

Reasons for payment

Art. 115 of the RF IC provides for 2 formal grounds for collecting penalties for overdue alimony payments.

- Penalty for debt formation, provided for by agreement between parents. Collection of alimony is carried out in accordance with the rules defined in the text of the agreement. The law does not establish a minimum or maximum amount of sanctions applied in the event of debt formation. The calculation method is also set by the parents.

- Penalty provided for in Part 2 of Art. 115 RF IC. Penalties for overdue alimony are calculated every day and amount to 0.5% of the amount owed. It is used if a court decision is made to recover funds for the maintenance of a minor.

Determination of the amount of the penalty

The responsibility for calculating the amount of the penalty falls on the shoulders of the bailiff. He uses a special formula.

Formula

According to the Family Code, the penalty for each day of delay is 0.5%. So, the calculation formula is as follows:

Penalty = amount of debt for the month * number of days of delay * 0.5%.

Examples

For better understanding, let's give an example. The alimony debt is 2 months: April and May. Child support is paid in proportion to the parent's income. For April, the amount of alimony was 14,500 rubles, and for May, 15,100 rubles.

Penalty amount:

- For April: 14500*30 (days in a month)*0.5% = 2175 rubles.

- For May: 15100*31 (days in a month)*0.5% = 2340 rubles.

- Penalty amount: 2175+2340=4515 rubles.

Total: the debt for two months amounted to 29,600 rubles and the amount of the penalty for late payment was 4,515 rubles.

How to calculate correctly and who should do it

Important! The penalty is calculated by the bailiff, but upon a separate application from the recipient of alimony payments.

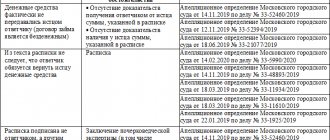

The calculation of the penalty is presented in the form of a table. On the left are the dates when payments with amounts should be received, and on the right it is indicated whether this amount was paid and in what volume.

The next, third column indicates the number of days (calendar) - the period of delay. This is the difference between the values of the first and second columns.

The fourth column contains the payment amounts multiplied by the date difference and a special coefficient of 0.005.

All results obtained in the fourth column are summarized, and the total amount of the penalty is calculated.

Such a table is often compiled by specialists - responsible employees of the bailiff service, but for this purpose a statement is written. The calculation table is attached to the court application. The decision is made by the court in the presence or without the presence of the defendant.

How to draw up a statement of claim for the collection of arrears and penalties for alimony?

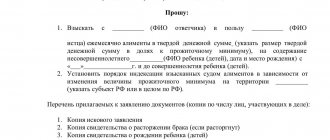

There are no strict rules for writing statements of claim, however, there are a number of requirements that are established in Articles 131-132 of the Civil Procedure Code, which must be followed when writing a statement of claim. So, we will present you with the correct structure and form of writing an application to collect alimony debt.

- In the header we write the name of the judicial authority, address;

- Below we indicate personal information about the plaintiff and defendant: passport details, residential address, telephone number;

- In the middle is the title of the document;

- From the red line we describe the essence of our appeal: the amount of debt, data on the writ of execution for the collection of alimony or a notarial agreement, a description of the circumstances, whether similar cases have been repeated before;

- In the main part we indicate the articles of the law on the basis of which you have the right to demand a penalty;

- Briefly describe what you want to achieve through your appeal;

- List of documents that are attached to the statement of claim;

- Date, signature.

The claim for the recovery of alimony penalties is written in two copies. The second copy is sent to the defendant.

The requirements described above must be adhered to, if only to ensure that your claim is not returned or your application is refused altogether. To avoid the most common mistakes, it is best to familiarize yourself with a visual example of a statement or look at a sample on the information stand in court.

State duty and its amount

The issue of paying state fees in cases of collection of penalties for alimony arrears is controversial.

According to the general rules for calculating state fees for court proceedings in alimony cases, in accordance with subparagraph 14 of paragraph 1 of Article 333.19 of the Tax Code of the Russian Federation, a state fee of 150 rubles should be paid. Although some lawyers take the position that a claim for the collection of alimony penalties is a category of cases about the protection of the rights of minors, which means that according to the general rules of the Family Code, state duty should not be paid at all. On the other hand, a penalty according to the norms of Civil Law is an independent measure of protection of the material rights of individuals, which means that according to the general norms of the Code of Civil Procedure of the Russian Federation and the Tax Code of the Russian Federation, when filing such a claim it is necessary to pay a fee in the amount of 4% of the total amount of the claim.

In order to avoid refusal to accept a claim for judicial proceedings due to insufficient payment of the state duty, it is recommended to first contact the very court where you plan to file the claim for clarification regarding the required amount of payment of the state duty. But according to the general rules of the Code of Civil Procedure of the Russian Federation, the amount of state duty for civil claims for the recovery of a penalty depends on the total amount of the claims presented; you should be prepared for this.

Required documents

Documents must be attached to the statement of claim, without which your request will not be considered. In normal cases, the following papers are submitted:

- Applicant's passport;

- A document on the legal collection of alimony - a writ of execution, a court order or an alimony agreement;

- Child's birth certificate;

- Certificate from the bailiff about the amount of debt;

- Certificate stating that the child lives with the plaintiff;

- Receipt for payment of state duty;

- Evidence confirming the fact of non-payment of alimony.

Documents, as well as the application itself, are submitted in two copies. You must have with you not only copies, but also originals.

As for paying the state fee, this obligation is removed from the plaintiff, since the interests of a minor child are represented first (Article 333.36, paragraph 1 of the Tax Code of the Russian Federation). After the decision is made, the defendant will have to pay the state fee. In order for the decision to be positive, you must document the existence of arrears in alimony or untimely payment.

What actions should be taken to collect penalties for non-payment of alimony?

The amount of debt is determined by the bailiff who conducts enforcement proceedings (Article 113 of the RF IC). The calculation of alimony debt is carried out by the bailiff based on the amount of alimony determined by a court decision or an agreement on the payment of alimony.

When calculating the debt for alimony collected as a share of the debtor's earnings, the bailiff bases his calculations on the basis of the earnings and (or) other income of the debtor for the entire period of formation of the alimony debt.

If during the period of debt formation the debtor did not officially work or did not provide certificates of his income, then the bailiff calculates the alimony debt based on the average monthly salary in Russia, which was established during the period of debt formation.

The average monthly salary in Russia is determined by the Federal State Statistics Service and is published quarterly on the official website of this department.

If the parties do not agree with the calculation of the debt determined by the bailiff, then they have the right to appeal the decision on the calculation of alimony debt to a higher official or to the court (Chapter 18 of Federal Law No. 229 “On Enforcement Proceedings”).

Consideration of the claim and making a decision

Issues related to the penalty are resolved by the magistrate court, therefore the application must be submitted there at the defendant’s place of residence (Article 28 of the Code of Civil Procedure of the Russian Federation). If the amount of debt exceeds 50,000 rubles, then the claim document is submitted to the district court. In the district court, the amount of the claim does not matter.

After considering the case, a court hearing is scheduled; it can take place either in the presence of both parties or in the absence of one. The judge makes a decision based on Federal Law No. 229. The decision must be motivated and justified (Articles 195.198 of the Civil Code of the Russian Federation). The order is transferred to the bailiff service, where enforcement proceedings are initiated to return the debt and charge a penalty. The bailiff returns the debt according to the amount specified in the writ of execution. For this purpose, various measures are used - this could be the seizure of property, blocking of a bank account, a ban on leaving the country, etc. If the alimony payer has a permanent place of work, the bailiff will oblige the employer to reimburse the debt from wages.

The plaintiff can control the process of collecting alimony by the bailiff and achieve the required result from them. If you are negligent, you can file a complaint.

In isolated cases, the judge may exempt the defendant from paying alimony penalties and the entire amount of the debt, if the debt arose not through his fault. The basis for refusing a statement of claim is the provision of Article 330 of the Civil Code, where the very concept of “penalty” is defined. When released from debt payment, the defendant must prove his innocence.

Who can apply

If, for good reason, the legal representative of a minor does not have the opportunity to independently file a claim to claim a penalty for alimony received for the child, he has the right to ask the prosecutor to do this.

For this purpose, a separate application is sent, which sets out the request and the reasons for the impossibility of filing a claim independently.

It follows from Article 45 of the Civil Code of the Russian Federation that the prosecutor has the right to personally file an application with the court if there is a need for state protection of family, motherhood and childhood.

The prosecutor acquires the entire range of rights that the plaintiff has, with the exception of signing a settlement agreement.

Watch the video. Penalty for non-payment of alimony: how to collect and how to reduce

Arbitrage practice

Citizen Mikhailova filed a claim in court with a previously calculated penalty amount of 11,250 rubles based on the existing debt for 7 months - 37,850 rubles. After considering the application, the magistrate made a decision to reduce the amount of the penalty as a result of the fact that the defendant’s income decreased for objective reasons and he had a child from his second marriage. As a result, the court decided to pay the entire amount of the debt and penalties, but at the same time revised the amount of alimony in order to reduce it, since the amount of penalties does not correspond to the financial situation of the payer.

As you understand, when a debt arises, you first need to contact the bailiff service to obtain a certificate about the amount of debt and the amount of the penalty, and only then go to court. With a statement of claim for collection, you can force the defaulter not only to repay the debt, but also to reimburse the amount of the penalty for each day of delay.

Deadlines for filing a claim

Attention! When collecting penalties, as well as alimony payments, the general statute of limitations for filing claims is three years.

But there is a peculiarity here. The three-year rule generally applies. But some cases are exceptional. For example, if the plaintiff has evidence of the validity of his failure to apply for a three-year period, and the defendant cannot explain why he did not pay alimony. Despite its obligation, the court has the right to collect a penalty for a period exceeding three years.

Consideration of the case

During the trial, the plaintiff will have to prove that the defendant is at fault in causing the delay. Judicial practice does not involve placing the burden of proving the contrary on the other party. To increase the likelihood of making the necessary decision, it is recommended to contact a lawyer specializing in family matters.

The proceedings will end with one of the following outcomes:

- the requirements will be fully satisfied;

- the penalty will be partially collected;

- the plaintiff will be refused.

During the hearing, there are additional ways to put pressure on an unscrupulous defendant.

- Initiation of administrative liability for non-payment of alimony (fines).

- Expanding claims to include damages. The plaintiff will have to prove that it arose due to the fault of the parent and its amount is not covered by the penalty.

- If there are signs of a crime, you can contact law enforcement agencies. In this case, the defendant may lose his freedom.

Is it possible to challenge or reduce penalties?

Regardless of the arguments and evidence, the defendant may file an appeal on formal grounds. This will only delay the entry into force of the court decision (30 days from the date of adoption).

If the defendant intends to defend his interests, he will succeed in a number of cases.

- In case of delays in payment of earnings.

- If the delay occurred due to the fault of the accounting department, which did not withhold alimony.

- When a parent is ill and does not allow them to earn money.

- If the plaintiff has not handed over the writ of execution to the bailiffs or the employer.

- In case of force majeure (accidents, natural disasters).