Reading this article will take you approximately 9 minutes.

We have previously written about the obligations of children to pay parental debts without considering specific situations. In this article we will focus in detail on cases where loans are inherited by minor children. You will learn:

- Can a minor child inherit their parents' debts?

- How is debt repaid by a minor heir?

- How can a child refuse to inherit his parents' debts?

- How to protect a child from inheriting his parents' debts?

- How to keep your child safe Conclusion.

Enjoy reading!

The death of close relatives threatens minor heirs with tangible legal consequences. In the event of the death of parents, there is a need to re-register property rights. This procedure is required to be carried out by official representatives acting in the interests of children.

As a rule, guardians give consent to re-registration, and then monitor the safety of the property until the heir turns 18 years old. Resolving the issue of succession becomes more complicated if, along with valuable things, the obligations of a deceased family member are inherited.

Can a minor child inherit their parents' loans?

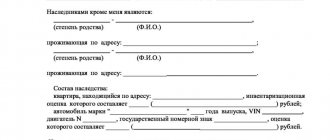

Along with property, the estate includes debts that are inextricably linked with the personality of the deceased. Obligations arising during life can be under existing loans of any type. You can claim rights to the inheritance within six months from the date of death of the testator. To do this, you must contact a notary by submitting an application filled out in the approved form.

You cannot inherit obligations for:

- Payment of alimony.

- Compensation for damage to life and health.

Children have the primary right to inheritance unless otherwise specified in the will. When there are several first-line applicants, the inheritance is divided in equal parts.

The current Russian legislation on inheritance issues does not classify minors as a separate category. Entry into rights and fulfillment of obligations is carried out regardless of age.

Features of the procedure for registering inheritance by minors:

- Children under 14 years of age and adolescents from 14 to 18 years of age, due to their limited legal capacity, do not independently make legally significant decisions.

- Their legal representatives act on behalf of minor heirs. Minors act with the consent of the surviving parent or guardian.

- Representatives of the direct heir are responsible for repaying the debts accepted along with the property. The amount of payments should not exceed the value of the assets received.

- The representative must justify the reason for refusing to inherit. The decision has legal force after receiving prior permission from the guardianship and trusteeship authority.

Thus, along with property rights, children can inherit the debts of their deceased parents. However, the guardians have the final say. The representative may give his consent to the re-registration or refuse to accept the inheritance.

To whom do the testator's debts pass?

An heir can receive an inheritance in two ways: by will and by law. However, for the transfer of debts, the method of obtaining a will does not play any role - they pass to the testator in any case.

Carrying debts include:

- Debts to banks and credit organizations;

- Debts to third parties;

- Other types of debt obligations (for example, rent).

In what case are the debts of the testator transferred to the heir? In the event that he enters into inheritance rights. All debts existing at the time of death automatically pass to him.

The procedure for transferring debts to heirs is determined by Article 1175 of the Civil Code of the Russian Federation. However, not all debt obligations are inherited and the heirs do not always pay them. How and in what cases this happens, we will understand further.

How is debt repaid by a minor heir?

Entering into an inheritance presupposes the full acceptance of property rights and financial obligations. The ratio of debts to assets of the deceased differs in each specific case.

Children who have not reached the age of majority can retain the property of their deceased parents. However, the average child does not have a stable income to pay off inherited debts. In addition, the right to independently dispose of property appears at the age of 18. Until this time, legal representatives are required to pay off inherited debts.

Options for repaying loans by a minor heir:

- When one of the parents dies, the child's legal representative will be the mother or father, unless parental rights are terminated. The child receives the inheritance together with the spouse of the deceased. The division of rights and obligations between the heirs of the first priority occurs equally, unless a different distribution scheme is provided for by the will. In prosperous families, the property of the deceased is used jointly by the heirs, and the breadwinner is responsible for paying off debts. The conditions for repayment of loans should be reviewed through restructuring based on force majeure circumstances. As a rule, the surviving parent assumes responsibility, but situations where the child is the breadwinner are not excluded. In dysfunctional families, there is a risk of disputes over the division of the inheritance. Sometimes it goes to court. The essence of the conflict depends on the specific circumstances. In any case, until a court decision is made on the basis of the studied materials, the current guardian has the right to dispose of the property inherited by the child.

- If there are no living parents or they have been deprived of parental rights, the interests of the child are represented by an individual appointed by the court as a guardian. The minor's interests are usually represented by a person selected from among relatives or family friends. These could be grandparents, brothers and sisters, aunts and uncles. The higher the degree of relationship, the easier it is to take custody of the child. If the orphan does not have close relatives, the guardianship and trusteeship authorities take care of the upbringing and protection of rights. The child may be given up to adoptive parents or sent to a family or regular boarding school. Regardless of who exactly is involved as a representative of the orphan’s interests, the process of inheriting property must be coordinated with the guardianship authorities. Supervision over the observance of the rights and interests of minors involves the management of the inheritance mass.

The guardian is responsible for property and debts, even if the child has almost reached the age of majority at the time of inheritance.

Basic conditions for repayment of inherited loans:

- The debts of the testator are subject to recovery from the successor in an amount not exceeding the value of the property received.

- Repayment of debt can be made through the sale of inherited things or receipt of other income from the property and rights of the testator.

- When there are several heirs, debts are distributed in proportion to the shares of the beneficiaries.

- Loans are inherited with accrued interest, late payments, fines and open enforcement proceedings.

- The terms of the loan remain unchanged, but if necessary, the guardian can submit an application on behalf of the ward for debt restructuring or deferment of payments.

Inheritance of property is often accompanied by the assumption of obligations to repay loans, regardless of whether the heir was aware of their existence. Wherever the inheritance is located and whatever the nature of the inheritance, it is impossible to waive debts by accepting only tangible or intangible assets.

To avoid unforeseen expenses, before submitting an application for re-registration of property, you should contact a notary for advice. The specialist will study information about the estate, and then, based on the data obtained, compile a list of the assets and debts of the deceased.

Distribution among assignees

In this part, the distribution procedure must comply with imperative (mandatory) norms. Here, much depends on the option of dividing the property mass. The rules for filing claims by creditors will depend on how and how many people the estate is divided into. Legislatively, the distribution of responsibility can be made according to the following schemes:

- transfer of an object into the ownership of one person - he is liable for obligations within the framework of 100% of the estimated value of the received object (mass);

- the property was registered as common property, without allocating shares - the owners are jointly liable for the debts of the deceased in the amount of 100% of the value of the entire inheritance;

- the inheritance mass was divided into several parts - each recipient is liable for obligations within the price of the previously received property.

The last option is implemented as follows: the property mass was divided between the three heirs. The first received a car worth 200 thousand rubles, the second received a dacha worth 800 thousand rubles, and the third became the owner of an apartment worth 2 million rubles.

After completion of all procedures, the creditor makes a demand for repayment of obligations to each of the heirs.

With a total debt of 1 million rubles, each recipient will have to contribute an amount that, as a percentage of the total amount, corresponds to the property received.

Consequently, the recipient of the apartment pays approximately 67% of the total debt (670 thousand rubles), the recipient of the dacha - approximately 27% (270 thousand rubles), the owner of the car - 6% (60 thousand rubles). Calculations are made by calculating percentages of the total value of the entire property mass.

How can a child officially refuse to inherit his parents’ loans?

The child, through the guardian, has the right to refuse the inheritance in order to avoid claims for the debts of the parents. The law does not prohibit this scenario if the rights of the minor are respected in full. The legal representative should always consider the interests of the child.

The inheritance should not be of particular value. Otherwise, it is more profitable to repay the loan while preserving the child’s property. It is advisable to assess the risks as the waiver cannot be revoked or modified. The exception is situations when the decision is made under pressure or coercion.

Refusal is appropriate in the following cases:

- The deceased's liabilities greatly exceed the value of the remaining assets.

- Insurmountable difficulties arise with the registration of property.

- An agreement has been concluded between relatives to divide the inheritance.

An application for waiver in favor of third parties is submitted to a notary. It is advisable to contact a specialist within 6 months from the date of death of the testator. This period applies even if the inheritance is accepted. The representative needs to refer to Article 1157 of the Civil Code of the Russian Federation.

There is no need to indicate the personal data of citizens in whose favor the refusal is taking place. However, only relatives of the deceased can accept the inheritance. Refusal to third parties is prohibited to reduce the risk of fraud.

Along with the application you must submit:

- Passport of the legal representative with a note indicating the presence of a child.

- Birth certificate or passport of a child over 14 years of age.

- Death certificate of the testator.

- A will or certificate proving the relationship.

- Certificate of the last place of actual residence of the deceased.

- Consent of guardianship authorities.

- Documents confirming the conditions that are burdensome for the child.

If all relatives write a refusal, the property of the deceased becomes escheat. Debts along with assets become the property of the state. Compensation for losses of the creditor is made from the money received from the sale of property. If the revenue is not enough, the debts are written off.

To refuse an inheritance, it is necessary to obtain the consent of the guardianship authorities. In this case, the property of the deceased cannot be used. The refusal loses legal force if the actual entry into the inheritance is proven. For example, a child living in the apartment of a deceased parent is legally a legal successor.

When real estate is purchased with a mortgage, debt obligations are inherited along with property rights. Of course, guardians who occupy the apartment with their children must pay for such loans.

If in the future it is discovered that the testator’s property has not been previously recorded by a notary, the child will not be able to lay claim to it due to refusal to re-register.

Will it be possible to evade responsibility?

In fact, in principle there are not many options for evading the testator’s debt. Everything may come down to the expiration of the statute of limitations. That is, the heirs pay current bills on time, but the testator does not pay what is overdue. If the management company manages not to file for collection within 3 years, the debt will be written off.

But in practice this is difficult to do, because the Criminal Code has certain methods of influencing debtors. In particular, a shutdown of power supply and some other communications. However, if the apartment is not used (i.e. the power outage is not critical), and they successfully hide from the management company, and the latter, in turn, does not go to court, then after 3 years it will be difficult to present anything. And the most that the heirs will have to do is pay their own debts. The amounts will be lower due to the exclusion of electricity payments. But as calculations show, “the game is not worth the candle.” And therefore it is better to somehow pay off the housing and communal services debt.

How to protect a child from inheriting parental loan debts?

Proper processing of a loan will help protect loved ones from financial problems in the event of the borrower’s death. There are several ways to avoid debt burden due to inheritance of debts.

The bank offers:

- Life and health insurance. In the event of death or long-term disability of the debtor, payment is made by the insurance company.

- Guarantee under a loan agreement. The borrower's outstanding debt is collected from the guarantor of the transaction. The guarantor may subsequently demand compensation from the heirs for losses.

- Providing collateral. The property used for security is subject to transfer to the lender in the event of non-repayment of the loan.

- Attracting a co-borrower. In the event of the death of one of the loan recipients, the debt is repaid by the remaining borrowers.

Modern financial products make it possible to take care of the interests of heirs at the stage of concluding a loan agreement. A small overpayment for insurance or the availability of collateral will help not only to obtain favorable lending conditions, but also to protect loved ones in the event of force majeure situations.

Conclusion

Transferring an inheritance to minors is a complex procedure, especially if property rights are renounced due to debt obligations. In order to competently represent the interests of the child, the guardian will have to study the norms of the current legislation. Otherwise, the financial burden that arises after receiving an inheritance may provoke financial difficulties. If the circumstances are unsuccessful, the guardian risks losing the right to represent the interests of the ward.

Options for solving the problem and some nuances

Here, creditors and heirs are given complete freedom for actions and decisions . Firstly, they can always independently agree on a mechanism for fulfilling obligations. This can be either a one-time payment or an installment plan drawn up in the form of a separate agreement.

Secondly, the conclusion of a new loan agreement, or the continuation of the previous agreement, is not allowed. It is also not allowed to increase the body of the debt - after the death of the testator, this value does not increase.

The recovery of objects is provided - the heirs can always provide the received property to the creditor . This option is more convenient when the amount of debt is equal to or exceeds debt obligations. The easiest way is to give your car or dacha to a conventional bank, thereby saving yourself the hassle of selling it. After fulfilling the obligations to the required extent, any claims of the creditor will be illegitimate.

Is it possible to find out if there are debt obligations?

You can find out about the existence of debt obligations directly from the notary who opened the inheritance. But it is necessary to understand that not all creditors may know about the death of the debtor and, in accordance with the law, they can then go to court with a claim against the heirs.

It is necessary to review all the documents that the testator had and analyze them. Perhaps there is a loan agreement, a credit card, a receipt, a receipt for utility bills, all this will help to estimate the amount of the testator’s debts.

In addition, on the bailiffs website you can see the availability of initiated enforcement proceedings. To do this, it is enough to enter the full name of the testator, and information about the date and number of the enforcement proceeding, the amount of debt on the principal debt, the enforcement fee and contacts of the bailiff who is handling the case will be available.

Video about utility debt

- Due to frequent changes in legislation, information sometimes becomes outdated faster than we can update it on the website.

- All cases are very individual and depend on many factors. Basic information does not guarantee a solution to your specific problems.

That's why FREE expert consultants work for you around the clock!

- via the form (below), or via online chat

- Call the hotline:

- Moscow and the Region

- St. Petersburg and region

- Regions

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

From what moment does the countdown begin?

Is there a possibility that the countdown could start again?

In our particular case, the limitation period begins on the day following the due date for payment of housing and communal services. However, there are cases when the limitation period is interrupted and begins to run again.

There are only two cases when the limitation period is interrupted:

- filing a claim for forced repayment of debt;

- recognition of debt by the defendant.

The grounds for recognizing a debt may include partial repayment or negotiations on a deferred payment. Also, you should not pay for any month of this period, no matter who, the debtor himself or a member of his family, or even his neighbors.

Also, do not forget that signing acts of reconciliation with representatives of housing and communal services can serve as a basis for recognizing the debt , because by putting his signature on the act, a person makes it known about his notification of non-payment and agreement with this.

If these facts exist, the limitation period begins anew. It should be noted that these facts must have occurred during the 3-year period in question.

departmentsud.ru

I have a question: which of my sister and I should pay the debt for utilities, and how should I deal with this situation in general? Answered by Pogodina Svetlana Nikolaevna Lawyer You need to accept an inheritance. Now this can be done in court. The statute of limitations for utility debts is 3 years.

As an owner, you will have the right to dispose (sell, donate, etc.), own (rent, redevelop, etc.), use (reside). If you rent out an apartment, you will quickly pay off your utility debt.

Questions on the topic: “My Law” is a legal portal that provides a free online consultation service with lawyers.