Does a legal entity have the right to enter into free civil contracts?

Any civil law contract is considered to be for compensation by default, unless it expressly states otherwise (Clause 3 of Article 423 of the Civil Code of the Russian Federation). Under a gratuitous contract, one party, having provided something to the other (goods, services), does not receive any reciprocal provision. If the contract provides for at least the most insignificant consideration, in value terms not comparable with the cost of the goods and services received, then such a contract is considered compensated.

The conclusion of gratuitous agreements between legal entities is generally not prohibited by law, but in practice it may be difficult or even impossible.

Thus, the subject of an agreement between legal entities should not be the donation of things worth more than 3,000 rubles (subclause 4, clause 1, article 575 of the Civil Code of the Russian Federation).

Two commercial firms, one of which is the founder of the other, cannot enter into an agreement on the gratuitous transfer of property for use (clause 2 of Article 690 of the Civil Code of the Russian Federation).

It is problematic to enter into a gratuitous agreement for a transaction that essentially involves the receipt of benefits by any of the parties - for example, when concluding an agreement for agency services.

In turn, if we talk about common types of gratuitous contracts, these include:

- the above-mentioned agreements on donation, transfer of property for use (unless their conclusion is prohibited);

- storage agreement;

- representation agreement;

- loan agreement.

ConsultantPlus experts explained when legal entities can enter into a free transaction (agreement). Get trial access to the K+ system and upgrade to the Ready Solution for free.

Financial assistance from the founder. How to choose the least risky basis for receiving money

If there is an acute shortage of funds and difficulties in obtaining a bank loan, the company can be helped out by its own founder (participant), if his financial condition allows it. The lawyer of the company receiving such support is faced with the question of how to formalize the transfer of money. There are several ways: gratuitous transfer (targeted financing), interest-free loan, additional contribution to the authorized capital, contribution to the property of a limited liability company.

The effectiveness of any of these methods depends not only on the ease of registration, but also on possible civil risks and tax consequences. And those, in turn, are associated with the peculiarities of each specific situation - who is the participant providing financial assistance (individual or legal entity), what is his share of participation in the authorized capital of the receiving company, in what organizational and legal form is the company receiving assistance created ( limited liability company or joint stock company). An analysis of all possible aspects will help you choose a specific basis for transferring funds.

Free transfer of funds

The easiest way to provide financial assistance in terms of registration is the usual gratuitous transfer of funds by its participants into the ownership of the company. It is safe to use only when the participant helping the company is an individual.

Registration procedure

In practice, the gratuitous assistance of the founder is most often formalized in a targeted financing agreement. Although this type of contract is not named in the Civil Code, it is permissible by virtue of paragraph 2 of Article 421 of the Civil Code. Financial assistance is also practiced on the basis of a joint decision of the management bodies of the parent and subsidiary companies, after which the parent company transfers money to the account of the subsidiary. However, in arbitration practice there is still no clear opinion on whether the financial assistance of the founder is a gift prohibited between commercial organizations. Therefore, in this option there is a civil risk of the transaction being declared invalid if the participant transferring money to the company is also a legal entity.

Tax consequences

Funds received free of charge are not subject to income tax if the share of participation of the transferring party in the authorized capital of the receiving company is more than 50 percent (subclause 11, clause 1, article 251 of the Tax Code of the Russian Federation). This rule applies regardless of the status of the participant who provided gratuitous assistance (legal entity or individual). If the share of participation of the company providing funds in the authorized capital of the receiving party is less than or equal to 50 percent, then the gratuitous assistance is subject to income tax in full (clause 8 of Article 250 of the Tax Code of the Russian Federation). Receipt of funds in the form of financial assistance is not subject to VAT (subclause 1, clause 3, article 39, clause 1, article 146 of the Tax Code of the Russian Federation).

Increase the authorized capital

When the company receiving financial assistance is a limited liability company, the receipt of funds from a participant can be arranged by increasing the contribution to the authorized capital (Clause 2, Article 17 of the Federal Law of 02/08/98 No. 14-FZ “On Limited Liability Companies” ). True, there is a limit on the deposit amount. If at the end of the financial year the value of the company’s net assets is less than the increased authorized capital, then it will have to be reduced (clause 3 of Article 20 of Law No. 14-FZ). Otherwise, the tax inspectorate has the right to demand the liquidation of the company (for example, the resolution of the Federal Arbitration Court of the Volga-Vyatka District dated January 23, 2009 in case No. A43-6947/2008-19-203). Therefore, if the amount of expected financial assistance is greater than the size of net assets, it is better to choose another basis for transferring funds. In a joint stock company, financial assistance from a shareholder in the form of an increase in the authorized capital is also possible. But only by placing additional shares (Article 28 of the Federal Law of December 26, 1995 No. 208-FZ “On Joint-Stock Companies”). Due to the fact that the registration of receiving funds from a shareholder is complicated by the issue process, for a joint-stock company, increasing the authorized capital is not the best option for transferring money.

Registration procedure

The procedure for increasing the authorized capital of a limited liability company is established in Article 19 of Law No. 14-FZ. It depends on how many members of the company will make additional contributions - all (then clause 1 of Article 19 of Law No. 14-FZ applies) or only some of them (then clause 2 of Article 19 of Law No. 14-FZ applies).

If all participants agree to finance the company, the procedure begins with convening a general meeting. It is necessary to make a decision on increasing the authorized capital by making an additional contribution. Within two months from the date of such a decision (unless another period is established by the company’s charter), the participants transfer funds to the company’s account.

No later than one month from the end of the deadline for making additional contributions, another general meeting of participants will be required. It must decide to approve the results of making additional contributions from participants (Clause 1, Article 19 of Law No. 14-FZ). Within a month after this decision is made, it is necessary to submit documents for state registration of changes in the charter (on the size of the authorized capital and an increase in the nominal value of the share of the participant who made an additional contribution).

If financial receipts are not expected from all participants, then the procedure for making additional contributions is slightly simplified. Participants wishing to make these contributions submit appropriate applications to the society. Then a general meeting is convened, which decides to increase the authorized capital and make appropriate changes to the charter. It also sets a deadline for making additional deposits. Documents for state registration of changes in the charter are submitted within a month after the transfer of additional contributions to the company by all participants who submitted the application, but no later than six months from the date of the decision of the general meeting to increase the authorized capital.

If there is a delay in making a decision on approving the results of making an additional contribution and on making changes to the charter, the increase in the authorized capital is considered invalid. The same consequences have the delay in submitting documents for state registration of changes to the charter (clauses 1 and 2 of Article 19 of Law No. 14-FZ). In this situation, the company is obliged to return additional deposits to participants (Clause 3, Article 19 of Law No. 14-FZ). But in fact, the company can dispose of the funds received almost immediately after receiving them; there are no prohibitions on this. Even if, due to a violation of the registration procedure, the increase in the authorized capital is declared invalid, the transfer of funds can be reclassified as targeted financing or a loan. To do this, you just need to sign the appropriate agreement.

Tax consequences

The option to increase the authorized capital has virtually no tax risks for the receiving company. Receipt of funds as an additional deposit is not subject to VAT (subclause 4, clause 3, article 39, subclause 1, clause 2, article 146 of the Tax Code of the Russian Federation) and is not taken into account as income when taxing profits (subclause 3, clause 1, art. 251 Tax Code of the Russian Federation).

Contribution to the property of a limited liability company

An alternative option for financial assistance to the company from its participants is making contributions to property. This is only possible in limited liability companies (Article 27 of Law No. 14-FZ), since there is no similar provision in the Law “On Joint-Stock Companies”. The company can use the received contribution for any purpose; there are no restrictions in the legislation. The company does not have any counter-obligations towards the participant who made the contribution. This method is applicable only if the company has one participant or when all participants agree to provide financial assistance. Article 27 of Law No. 14-FZ does not provide for the possibility of making contributions to property by individual members of the company.

Registration procedure

To make a contribution to the property, a decision of the general meeting of company participants is required (Clause 1, Article 27 of Law No. 14-FZ). And if the company has only one participant, his decision is sufficient (Article 39 of Law No. 14-FZ). But since such a contribution does not affect the size of the authorized capital and shares of participants (clause 4 of Article 27 of Law No. 14-FZ), there is no need to make changes to the charter and register them with the tax authorities. Therefore, this option is simpler in terms of timing and registration method than increasing the authorized capital. But only in the case where the company’s charter already stipulates the obligation of participants to make additional contributions. Otherwise, you must first introduce such a provision into the charter (which requires convening a general meeting of participants), register this change, and only then convene a new meeting of participants to decide on making contributions to the property.

Tax consequences

As noted earlier, the receipt of funds is not recognized as an object of VAT taxation. Therefore, the receiving company has no reason to pay tax. For profit tax purposes, a contribution to the company’s property is considered as property received free of charge (Clause 2 of Article 248 of the Tax Code of the Russian Federation). Consequently, income does not arise only if the share of the participant making the contribution in the authorized capital of the receiving company is more than 50 percent (clause 8 of Article 250 of the Tax Code of the Russian Federation). Contributions of other participants are subject to income tax. Therefore, taxation can be completely avoided only in a situation where the contribution is made by the only participant in the company.

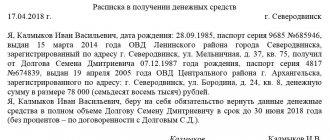

Interest-free loan

Financial assistance in the form of interest-free loans is often practiced between companies and their participants. Loans are possible in any situation, regardless of the legal status of the lender and the organizational and legal form of the borrowing company. With this option, unlike the previous ones, the company receives money on a repayable basis, but due to the absence of the obligation to pay interest, this is still tangible support. Taking into account the mutually beneficial relationship between the borrower company and its participating lender, you can immediately set a long loan repayment period or increase it by separate agreement of the parties if the financial condition of the borrower does not improve by the end of the initial period.

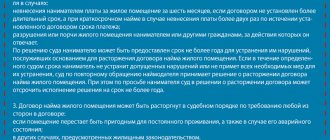

Debt forgiveness

It happens that the option of an interest-free loan is used when the return of money is not expected - in fact, only to “cover up” the gratuitous transfer of funds. At the end of the loan term, the parent company forgives the debt. But this option can also be regarded by the court as a prohibited gift between commercial organizations if the lender is a legal entity. Taking advantage of this, the lender may demand the return of the loan amount, citing the invalidity of the debt forgiveness agreement (for example, if after some time the relationship between the parent and subsidiary company deteriorates).

The relationship between the creditor and the debtor for debt forgiveness is qualified as a gift if the court has established the intention of the creditor to release the debtor from the obligation to pay the debt as a gift. Then debt forgiveness is subject to the prohibition established in subparagraph 4 of paragraph 1 of Article 575 of the Civil Code. And the absence of the creditor’s intention to reward the debtor can be evidenced, in particular, by the relationship between debt forgiveness and the creditor’s receipt of property benefits under any obligation between the same persons (clause 3 of the information letter of the Supreme Arbitration Court of the Russian Federation dated December 21, 2005 No. 104).

It can be assumed that by forgiving the debt of a subsidiary, the parent company receives a property benefit due to its personal interest in the economic situation of the subsidiary. However, there is no arbitration practice that would confirm this conclusion. Courts do not recognize debt forgiveness as a gift if the lender has forgiven only part of the debt in exchange for voluntary payment of the remaining part (decision of the Federal Arbitration Court of the North-Western District dated 10/09/08 in case No. A21-3512/2007) or when the debt is forgiven to pay off another debt (resolution of the Federal Arbitration Court of the West Siberian District dated January 22, 2009 No. F04-248/2009(19774-A46-13). Courts, as a rule, recognize unconditional forgiveness of a debt in full amount as void (resolution of the Federal Arbitration Court of the Moscow District dated November 25, 2008 in case No. KG-A40/10973-08).

Tax consequences

Operations for the provision of loans are not subject to VAT (subclause 15, clause 2, article 149 of the Tax Code of the Russian Federation). Therefore, neither the company providing the loan nor the company receiving it pays VAT on this transaction.

The borrower does not include the amount of the loan received in the tax base for income tax, and the lender also does not pay this tax on the amount of the repaid debt (subclause 10, clause 1, article 251 of the Tax Code of the Russian Federation).

In connection with taxation, the borrower is most interested in the question: should he pay income tax due to the fact that the loan is interest-free? The concept of economic benefit in the form of interest savings exists only for personal income tax (that is, for individual borrowers). The income tax does not have such a taxable object, so there is no need to pay tax. Officially, the Federal Tax Service of Russia recognizes this position (letter dated January 13, 2005 No. 02-1-08/ [email protected] ). However, in practice, territorial inspectorates sometimes try to charge borrowers additional income tax on unpaid interest, considering the loan a “free service received.” However, the courts recognize this practice as illegal (resolution of the Presidium of the Supreme Arbitration Court dated August 3, 2004 No. 3009/04, resolution of the Federal Arbitration Court of the Moscow District dated June 19, 2007 in case No. KA-A40/5440-07).

In the case of debt forgiveness, the borrowing company includes the loan amount that it does not need to repay in the income tax base as property received free of charge. But if the share of the lending company in the authorized capital of the borrower exceeds 50 percent, then the amount of the forgiven debt is not taxed on the basis of subparagraph 11 of paragraph 1 of Article 251 of the Tax Code. The Ministry of Finance of Russia adheres to the same opinion (letters dated 03/03/09 No. 03-03-06/1/106, dated 03/06/09 No. 03-03-06/1/112), which means that the likelihood of a dispute with the inspectorate on this issue is minimal .

It is easier to register a contribution to the authorized capital if the LLC has one participant

When there is only one participant in a company, he makes a decision on increasing the authorized capital, the amount of the contribution, the procedure and deadline for making it (Clause 1, Article 19, Article 39 of Law No. 14-FZ). No later than a month from the date of expiration of the deadline for making an additional contribution, the participant transfers funds to the company’s account, and then decides to amend the charter. Changes are registered based on the above decisions of the sole participant and a document confirming the contribution.

Possible claims by tax authorities against the company member who transferred the money. What you can object to the inspection Free assistance

The inspection may equate the transfer of funds to the sale of goods subject to VAT. The fact is that “goods” for tax purposes are any property that is sold or intended for sale (clause 3 of Article 38 of the Tax Code of the Russian Federation). And by “property” we mean types of objects of civil rights related to property in accordance with the Civil Code (clause 2 of Article 38 of the Tax Code of the Russian Federation), including money (Article 128 of the Civil Code of the Russian Federation). At the same time, “sale of goods” is considered to be the transfer of ownership of goods both on a compensated and gratuitous basis (clause 1 of Article 39 of the Tax Code of the Russian Federation).

What to object

This point of view is not consistent with the Tax Code. The transfer of funds, if it is not related to payment for goods, work, services or property rights, is not in itself considered a sale by virtue of subparagraph 1 of paragraph 3 of Article 39 of the Tax Code.

Contribution to LLC property

Tax authorities also sometimes equate this operation with the gratuitous transfer of goods and require VAT to be paid.

What to object

According to subparagraph 4 of paragraph 3 of Article 39 of the Tax Code, the transfer of property that is of an investment nature is not recognized as a sale (and therefore not subject to VAT). The list of possible investment transactions in this article is open. Investments are understood, in particular, as funds invested in business or other activities in order to make a profit or achieve another beneficial effect (Article 1 of the Federal Law of February 25, 1999 No. 39-FZ “On investment activities in the Russian Federation carried out in form of capital investments"). A contribution to the property of a business company increases the size of its net assets. And this indicator affects the distribution of the company’s profit between participants (Article 29 of Law No. 14-FZ). Therefore, the participant’s contribution to the company’s property is ultimately aimed at making a profit, and therefore is of an investment nature and is not subject to VAT. The courts are of the same opinion (resolution of the Federal Arbitration Court of the Central District dated February 20, 2007 in case No. A-62-3799/2006).

The most effective ways to apply for gratuitous assistance for specific situations Gratuitous transfer (targeted financing)

Ideal for the case when financial assistance is provided by a participant who is an individual and his share of participation in the company is more than 50 percent. There is no risk of invalidity of the transaction (the prohibition on donation does not apply), there are no tax consequences.

Contribution to LLC property

Suitable when the LLC charter already provides for the founder’s obligation to contribute to the property and provided that the company has only one participant. A simple method of registration (no need to make changes to the charter) and no tax consequences.

Capital contribution

Can be applied in other cases of receipt of financial assistance by a limited liability company. A complex method of registration, but the risks of the transaction being declared invalid are minimal and there are no tax consequences.

Free provision of property preservation services

In the general case, an agreement for the storage of a thing transferred from one person to another implies remuneration (clause 1 of Article 896 of the Civil Code of the Russian Federation). However, the parties have the right to include provisions in such an agreement under which the party that accepted the item for storage will not receive payment for services rendered (clause 5 of Article 896 of the Civil Code of the Russian Federation).

In addition, the very possibility of free storage is provided for in clause 2 of Art. 897 Civil Code of the Russian Federation. It also says that the depositor must reimburse the custodian for the costs associated with ensuring the safety of the thing, but again unless otherwise provided by the agreement.

In practice, a gratuitous contract for the provision of property preservation services concluded between legal entities may be part of a legal relationship in which the depositor, in turn, provides any services related to his type of activity to the custodian free of charge. For example, related to representation.

Free representation agreement (with an attorney)

A representation agreement involves the delegation of powers from one legal entity to another in order to perform certain legal actions on behalf of the first (and at the expense of the first) (clause 1 of Article 971 of the Civil Code of the Russian Federation).

By default, such an agreement is supposed to be drawn up on a reimbursable basis, unless its provisions (or the law) provide otherwise (clause 1 of Article 972 of the Civil Code of the Russian Federation). But if the provisions of the law require the principal to pay remuneration to the attorney in certain cases, then the parties will not be able to enter into a gratuitous agreement (clause 4 of article 421, clause 1 of article 422 of the Civil Code of the Russian Federation).

If the condition on remuneration or non-provision of remuneration is not reflected in the contract in principle (and is not regulated by law), then the work of the attorney in any case must be paid at the market price of similar work (clause 2 of article 972, clause 3 of article 424 Civil Code of the Russian Federation).

Final provisions

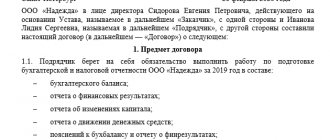

This section contains general information based on the content of the contract. Thus, the conditions for drawing up the contract may be indicated, that is, in how many copies it is drawn up. Also, from what moment does the contract begin to have legal force, and in what order can the transaction be terminated? The design of such a section looks like this:

This document is drawn up in 2 (two) copies, one copy for each party. This agreement has legal force from the moment it is signed by the Counterparties and terminates after the Parties fulfill their obligations under this agreement. This agreement may be terminated unilaterally at any time during its validity. In case of unilateral refusal to fulfill obligations, the party initiating the termination of the contract is obliged to notify the other party of its intentions no later than 1 (One) calendar day.

At the end of the document, the details of the parties are indicated and after signing the agreement, the contract is considered concluded.

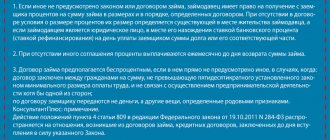

Free loan agreement

Gratuitousness in terms of credit legal relations between legal entities can be understood as:

1. Provision by one legal entity to another of a loan without interest (or subject to subsequent forgiveness of interest).

2. Providing a loan by one legal entity to another with its subsequent complete write-off.

It is important that both types of legal relations do not include agreements that can be qualified as gift agreements during a tax audit. In this sense, the Federal Tax Service will have the least number of questions regarding the loan agreement, which was initially concluded without interest.

But there will be noticeably more questions if the interest or the debt as a whole is forgiven by the lender (through the conclusion of a separate agreement). If the parties cannot prove that the donation did not take place, then such an agreement may be declared invalid (clause 3 of information letter No. 104).

You can argue for the lack of intention to reward the counterparty when writing off a debt by reflecting in the loan (interest) forgiveness agreement the desire to forgive the debt based on considerations of benefit. It may consist in maintaining a trusting relationship with the counterparty and the opportunity to continue cooperation with him subsequently.

These are the main types of gratuitous agreements between legal entities. Despite their differences, it would be legitimate to identify a number of generalized features that characterize all the types of agreements considered.

Duties of the parties

This section sets out the obligations between the Counterparties. Such a clause may indicate various obligations by mutual agreement of the parties, but we will focus on the basic wording. So this section looks like this:

The Contractor undertakes to: Perform the installation of air conditioners of the Subtropic SUB-07HN1_18Y brand in three work rooms of the Center (rooms numbered 343; 344; 345). Provide air conditioner installation services properly. The criterion for the quality of work performed is the normal functioning of air conditioners in work rooms. Complete the work within 2 (Two) calendar days from the date of conclusion of this agreement. The Customer undertakes to: Provide assistance when the Contractor performs the work in the form of providing all necessary documentation related to the fulfillment of the obligation under the contract. Provide the necessary conditions for the Contractor to carry out the work. Upon completion of the work by the contractor, accept these works by drawing up an act of acceptance and transfer of completed work.

What are the general characteristics of a gratuitous contract?

We can talk about such signs as:

1. Absence (in some cases) in the contract of provisions providing for strict liability of the parties for failure to fulfill their obligations.

Actually, such provisions may not be included in the contract if the parties do not consider them significant (clause 1 of Article 432 of the Civil Code of the Russian Federation).

Or, on the contrary, it must be included if the provisions of the contract need to show that the party performing the duties free of charge does so in order to obtain benefits. And if the other party violates its obligations, the first will apply strict sanctions against it - as a tool to compensate for the costs incurred. Such costs may be expressed, for example, in transportation costs for the transportation of gratuitously transferred property, which the other party suddenly refused to accept.

2. Superficial regulation of securing obligations (use of collateral, prepayment, financial guarantees).

But in some cases such regulation cannot be avoided, for example, if a gratuitous loan agreement is drawn up.

It is noteworthy that a gratuitous civil law contract can be drawn up outside the jurisdiction of the Civil Code of the Russian Federation. Let's study this nuance in more detail.

Responsibility of the parties

The text of the document contains information about the circumstances in the event of which the parties bear mutual financial liability. This clause is an integral component of this type of agreement. These provisions are written as follows:

The parties bear financial responsibility for non-fulfillment or improper fulfillment of their obligations under this agreement. In the event of damage to the Customer, work rooms, air conditioners when performing the work specified in the paragraphs of this document, the contractor bears financial liability. In the event of equipment breakdown due to the fault of the Contractor, which arose during the installation process, the Customer has the right to demand compensation for damage.

Is a gratuitous contract possible outside the jurisdiction of the Civil Code of the Russian Federation?

Indeed, a gratuitous (as well as paid) agreement between legal entities may be concluded in a form not provided for by the Civil Code of the Russian Federation or other laws (clause 2 of Article 421 of the Civil Code of the Russian Federation). At the same time, the norms of the Civil Code of the Russian Federation and other laws can be applied to individual events within the framework of the legal relations of the parties on the principle of analogy of law.

In addition, a legal entity has the right to enter into gratuitous legal relations not only under an agreement (as a bilateral transaction), but also on other grounds, perhaps not provided for by law, but provided that they do not contradict it (subparagraph 1, paragraph 1, article 8 Civil Code of the Russian Federation).

Examples of gratuitous contracts, the drafting of which is not regulated by the Civil Code of the Russian Federation (but may be regulated by its provisions based on the principle of analogy of law):

- about sponsorship;

- voluntary compensation for damage;

- partnership;

- protection of confidential data;

- lending using bills of exchange.

Of course, it is possible to conclude various gratuitous agreements between Russian and foreign companies. Moreover, if such agreements are concluded in the jurisdiction of international agreements signed by Russia, then when considering the legal consequences of these agreements, first of all, international norms are applied (Clause 2 of Article 7 of the Civil Code of the Russian Federation).

Results

Gratuitous and compensated agreements can be concluded by Russian legal entities both provided that such agreements are within the jurisdiction of the Civil Code of the Russian Federation, and when concluding agreements not named in the code. If the agreement is nevertheless named in the Civil Code of the Russian Federation, then it can be gratuitous for legal entities provided that there are no restrictions on this - those provided for by law (as in the case of a gift agreement), dictated by the content of legal relations on the merits (as in the case of a commission agreement). The conclusion of an agreement outside the jurisdiction of the Civil Code of the Russian Federation does not exclude the application of the provisions of the code to it on the principle of legal analogy.

You can learn more about the application of civil law in corporate legal relations in the articles:

- “Essential terms of the purchase and sale agreement under the Civil Code of the Russian Federation”;

- “Violation of the terms of the contract for the supply of goods.”

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Item

Information about the subject appears in the initial paragraphs of this document. The subject in this case is the services themselves, which are provided free of charge. It will look like this:

The Contractor undertakes to provide the services specified in the contract, and the Customer undertakes to accept them. The Contractor provides the following services: Installation of air conditioners of the Subtropic SUB-07HN1_18Y brand in three work rooms of the Center (rooms numbered 343; 344; 345), located at the address: Kurgan region, Kurgan city, Mashinostroiteley Avenue 333B. The contractor can provide services both personally and with the involvement of third parties. The period for installation of air conditioners is 2 (Two) calendar days from the date of signing this agreement. Carrying out the work does not entail payment, since the contract is concluded free of charge.