Features of calculating limitation periods for receipts

Based on the current one, the validity period of a receipt for a loan of money is three years and is valid in the general manner in the absence of additional circumstances in the case. General conditions include the availability of documentation indicating the fact of concluding a debt transaction, but they do not indicate a specific period. Then the calculation period begins from the moment when the plaintiff claims a violation of the agreement. If the defendant does not pursue the goal of paying off debt obligations in the future, the period is not calculated.

Points related to calculating the statute of limitations on debt obligations deserve special attention:

- When the receipt indicates a specific date for the return of funds, the limitation period is calculated from this date. It is allowed to fill out an application on the day when the money must be returned to the lender

- Some individuals, when filling out a receipt, forget to indicate the exact date of the refund. Then the beginning of the calculation is the date of filing the application for a claim to repay the debt. It is recommended that you make your claim in writing so that it can be used as evidence in legal proceedings if necessary.

If the receipt contains the signatures of both parties, and it is in writing by hand, it has legal force, even if it is not certified by a notary.

How long is a debt receipt valid?

The validity period of a receipt from the debtor is regulated on the basis of Article 196 of the Civil Code. This concept refers to a set period of time during which the document comes into legal force. At this time, the citizen who loaned the money has the right to initiate legal proceedings. LID (statute of limitations) controls the validity of the receipt. Today this time is limited to three years.

Often, citizens incorrectly interpret the established procedure by law, which is why they cannot fully defend their right to return lost funds.

Calculation is impossible from the first day in the following situations:

- If the agreement was established verbally

- Conclusion of an agreement confirming the oral procedure for financial cooperation

- Transfers of funds between individuals.

Article 200 of the Civil Code establishes the right of calculation from the moment the lender learns of the offense committed. In this situation, the main position of the creditor is to return his money within the time frame that was specified during the agreement process.

In accordance with the issued receipt, the return must be made:

- On a set date, which must be fixed in the document

- When no date is specified, refunds will be made upon formal first request.

After the first demand, when no return occurs, such actions may be qualified as an infringement of creditor rights.

Compilation rules

If you decide to complete the transaction through a notary, then you don’t need to worry about how to draw up this document. An employee of a notary office will independently prepare all the necessary papers, register the transaction in state accounting registers and issue special forms.

Questions arise when filling out the form yourself. It is permissible to use a receipt form, entering the necessary details and conditions into it, or draw up a document yourself.

Instructions on how to correctly draw up a receipt for the transfer of money from one person to another:

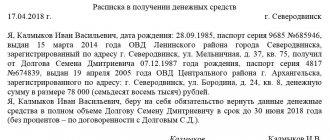

1. Place and date. First of all, indicate the place and time of drawing up the document. The place is the locality in which the transfer of funds takes place, and the time is the date. For example, indicate: “Samara city 03/12/2020”.

2. Information about the parties to the transaction. Disclose the information one by one: first indicate the details of the person issuing banknotes, then write down the details of the recipient (see at the end of the article). What information to disclose depends on the status of the parties.

If one of the parties is an individual, then enter his full name in the receipt template. fully. Then write down your passport details or details of another document proving your identity. If the party is an individual entrepreneur, then add his TIN and OGRNIP to the details.

If the participant in the transaction is a legal entity, then indicate:

- last name, first name and patronymic of the head of the company;

- job title;

- full name of the legal entity;

- TIN, OGRN of the organization.

If the party is an authorized representative, enter:

- his last name, first name, patronymic;

- passport or other identification document details;

- date and number of the power of attorney;

- information about whose interests the representative is acting in.

3. Now write down how much you are transferring, indicate in what currency the transaction is being made. Indicate the amount not only in numbers, but also in words. Use this option to indicate the amount: 120,000 rubles (one hundred twenty thousand rubles 00 kopecks).

4. Include information about the grounds and obligations. Describe in detail the basis on which money is transferred from one party to the other. For example, transferring an amount into debt, receiving a loan from an employer. Also describe what obligations each party assumes when making a transaction: the borrower undertakes to repay the debt within ____ calendar months. In this case, specific dates and deadlines for return must be indicated.

5. Additional terms of the transaction (optional: used if necessary). Indicate the purpose for which the money is transferred: to buy a car or to pay for treatment. They provide for the amount of payment for the use of borrowed capital - this condition is not mandatory, but is often used. Specify: the borrower agrees to repay 100,000 rubles plus a use fee of 1,000 rubles.

They also determine the rules for the return of money or establish the procedure for offsetting the advance received. It will not be superfluous to describe the responsibilities of the parties and the procedure for resolving disputes.

The finished document is signed by the borrower - the recipient of the money. By this he personally assures that he received the money. The completed receipt in one copy is kept by the lender and is confirmation of the fact of transfer of banknotes or goods.

Changing statutes of limitations

In a standard situation, if the limitation period for a receipt begins to run, it is not interrupted. But current legislation predetermines a number of circumstances that explain the borrower’s inability to repay the money within the established time frame. Circumstances may vary which may cause the statute of limitations to be extended, suspended or reinstated.

Suspension

The basis for suspending the statute of limitations is the following series of circumstances:

- If an additional mediation agreement is drawn up

- The legislative act on the basis of which the document is considered valid loses its force and cannot serve as a regulatory lever for the relationship between lenders and borrowers

- One of the parties to the transaction must go to the place of military service

- Moratorium imposed by the current government

- Another set of circumstances recognized as insurmountable and independent of the actions of the borrower.

The period may be suspended if one of the factors remains in effect for six months.

Interrupt

It is possible to interrupt the limitation period between individuals in the following situations:

- The debtor will commit actions that indicate that he does not refuse to repay the debt and acknowledges its existence

- Both parties decide to mediate

- The completed claim is sent to the court for consideration.

Recovery

Restoration of deadlines is possible only under certain conditions:

- If the plaintiff missed the statute of limitations for reasons that the court recognized as valid

- The reasons for which the pass was allowed were valid for six months from the end of this period.

If these circumstances exist, the statute of limitations is restored and the countdown begins anew.

Deadlines for handwritten documents

Important! In the case of a simple paper receipt, Russian legislation does not establish a procedure or requirement for certification by a notary. If there are signatures on both sides, the document has legal force and can be used in legal proceedings in a simple written form or a completed handwritten receipt. However, the statute of limitations can only be affected by the content of the requirements specified in the document.

There are certain requirements for the content of the receipt, which must include the following information:

- Data about the lender and borrower

- The size of the transaction that is planned to be concluded: the amount of funds that will be transferred to the borrower and the currency.

The legislation does not provide for a clear format for drawing up an agreement. The main thing is the presence of the points listed above. The receipt should not contain typos or grammatical errors. Otherwise, the document will be declared invalid.

If the receipt does not indicate a deadline

Depending on the relationship between the lender and the borrower, as well as on a number of other factors, the loan repayment period may not be agreed upon. That is, there is no indication by what time the borrower must repay his debt to the lender.

The law on this state of affairs states that the creditor can at any time make a demand for repayment of the debt. This is directly stated in paragraph 2 of Art. 200 GK. Thus, the limitation period will be calculated from the date when the creditor presents a written demand to the borrower to repay the debt.

The receipt may also indicate a “grace” period. That is, borrowed funds are provided for a specific period. After its expiration, the borrower becomes obligated to repay it, and the creditor has the right to demand fulfillment of obligations by the debtor.

Attention! Our qualified lawyers will assist you free of charge and around the clock on any issues. Find out more here.

What to do if the deadline expires and the debt is not repaid?

If the debt receipt has long lost its relevance, and the funds have not been returned, it is necessary to initiate legal proceedings and understand whether this document is significant evidence that the debt was never returned. To ensure that the document actually has legislative force, it is necessary to check the availability of the mandatory data discussed above.

If mandatory information is available, each lender can be sure that the document has legal force even after the statute of limitations has expired.

A document in the correct format should also contain:

- Date of drawing up and repayment of the agreed debt amount

- The interest rate that applies to the loan

- A number of additional conditions, if available, within the framework of current legislation.

It is recommended that the receipt be completed by hand, in a written format, since the printed format is the easiest to challenge by the defendant. It is worth noting that in this situation it makes no difference whether witnesses were present. This fact will be relevant only if there was an oral agreement and all the terms of the transaction were discussed.

In practice, recovering a debt by initiating legal proceedings is a lengthy process. There is no specific format for submitting an application to the courts. Allows the use of a regular, abbreviated format indicating the main request for the case.

The main thing is not to forget to pay the fee so that the court accepts the case for further consideration. If the receipt has been issued and has legal force, then the likelihood of the debt being returned is high, even after the statute of limitations has expired.

Why do you need a receipt?

A receipt is a document that confirms that money was transferred from one individual or legal entity to another person as a loan or for other reasons.

The receipt contains information about how much money was given, under what conditions, and in what period it should be returned to the lender.

In cases where disagreements arise between the creditor and the debtor and one of them decides to go to court, it is the receipt that becomes the official document that proves the fact of the transfer of money, and also shows the conditions for their use and the time frame within which they should have been received given back.

A receipt is not one of the mandatory documents that must accompany the transfer of cash (by the way, in relations between citizens there are no such documents at all), but it is recommended.

What to do if the statute of limitations has expired?

Article 199 of the Civil Code provides for the possibility of considering a case in court, even if the statute of limitations on debt receipts has already expired. This means that the lender has the right to file an application with the court even after all the deadlines have expired. It is important to note that the court also cannot refuse to consider a case on its own initiative in accordance with the same article, since the rights of the plaintiff will be violated.

The situation can only change if the defendant appears at the court hearing and points out the fact that all deadlines have long since expired. Only on this basis can the court make a negative decision in the further procedure for collecting funds from the defendant.

There are other situations when the deadline has passed, and the borrower returns part of the debt.

In this case, Article 203 of the Civil Code applies, indicating the following aspects:

- Since the debtor is aware of the fact of unfulfilled obligations and the existence of a debt to creditors, the term of the claim may be interrupted. As soon as the break is completed, the period is reset to zero and begins to run again. The time that passed before the break is not taken into account

- Availability of new opportunities to update the LED

- The claims made by the plaintiff determine the statute of limitations.

Article 205 of the Civil Code also makes it possible to restore the LED. Then the existing circumstances must be recognized as a valid reason why this fact occurred. The rights of citizens on the basis of current legislation must be protected. If the existing circumstances occurred within six months from the date of expiration of the LED, the reasons may be valid.

For variety, we present below possible methods of collection.

Peaceful solution to the issue

You go to the debtor and try to negotiate a return without going to court.

Let's imagine the situation. You gave a distant relative $20,000 against a receipt for home renovations. The return period is 2 years. Ok, 24 months are up, you wait, but nothing happens. A relative does not answer the phone, although you know where he works and where he lives.

You go to him and appeal to his conscience. He lowers his eyes to the floor and says something like “maybe I’ll give it back later, there’s no money now, his wife is pregnant, the cow is sick, the roof is leaking in the barn,” and so on.

There are two possible options:

- you are trying to get into a position and draw up an additional agreement under which he will return the money to you, say, in a year;

- you understand that no one is going to repay your debt voluntarily, and you are thinking about further actions.

In practice, additional expectations, agreements and attempts to resolve the issue peacefully do not bring results if the debtor a priori does not want to return the money. You will only lose time, your money and faith in people.

Submitting official claims

This is already a more effective method. If your debt is not returned within the stipulated time, you can file a formal claim and send it to the person’s place of residence.

The claim must:

- indicate legal norms for debt claims, referring to them;

- demand a refund;

- indicate further intentions - that you are going to forcibly recover the money through the court.

It is better to draw up a claim with lawyers and send it by registered mail. Be sure to keep the second copy with you and wait for the mail notification - it can be attached to the statement of claim as a supporting document.

If the debtor does not return the money after receiving an official complaint, you can prepare documents for the court.

Appeal to the court of first instance

Proceedings should begin if, within 30 days of receiving the claim, the debtor has not contacted you and has not repaid the debt.

You can contact:

- to the magistrate's court;

- to a court of general jurisdiction.

As a rule, they usually go to the magistrate's court - the case is considered in a shortened time, and the creditor receives a court order. The order has the force of a full court decision. It allows you to start enforcement proceedings and return the money on receipt through bailiffs.

Obtaining a notary's executor's inscription

The return method is used if the debt document was notarized.

All you need to do is contact a notary and submit a package of documents for verification. After a thorough analysis, the notary will issue a writ of execution, with which you can contact the bailiffs at the FSSP.

Contacting third parties to draw up an agreement for the assignment of the right of claim or enforcement

We are talking about collection agencies that professionally collect overdue debts.

Note that this method works 100% only in the bank-collector chain, where the sale of overdue loans is carried out in bulk. Collectors do not like to deal with private creditors.

Typically, cooperation with them is carried out on the following conditions:

- the creditor turns to the magistrate for an order to settle the debt - sometimes collectors make such demands in order to protect themselves;

- the percentage for services will be significantly higher than in the format of cooperation with banks. Collectors may demand at least 40-50% of the money collected from the debtor.

Seeking help from debt collectors will work if the debtor does not pay the money when given the opportunity. Simply put, dynamite in all available ways.

It is possible to collect money through the court using a promissory note

The creditor may initiate foreclosure proceedings based on the promissory note. It is advisable that all the circumstances of the debt registration be indicated there, and that notarization be present.