In one of our previous articles on donating a share in an LLC, the authors of the site for free online legal advice have already touched on the topic of donating shares as a transfer of the right to participate in the management of an organization, as well as receiving dividends. However, after the author of the site and practicing lawyer Oleg Ustinov reviewed the formalization of the donation of rights to securities, you have many new questions regarding this topic.

Therefore, today, we will try to highlight in as much detail as possible both the legislator’s position on such transactions and all the non-obvious nuances that are very difficult to notice for citizens who do not have experience in resolving issues related to the legal sphere, but which can cause a lot of problems. So let's get started.

The position of the legislator and the procedure for donating shares in 2021

Let us immediately note that donating securities, including shares, has many rather specific features. For example, one of them is that the main purpose of donating shares is not the actual transfer of this document from the donor to the recipient.

According to the legislation in force in the Russian Federation in 2021, the legislator means a gratuitous donation of shares under an agreement under which the donor undertakes to transfer into the ownership of the donee the right of claim arising from the very concept of a security .

Thus, during the donation of shares, between the parties there is an actual transfer of the right not to the security itself, but to the right to receive profit in the form of dividends from the joint-stock company (CJSC or OJSC) and to the right to participate in the management of this joint-stock company.

Another important feature of this transaction is that the gift of shares applies not only to persons acting as parties to the gift agreement, but necessarily affects the interests of other third parties.

How to draw up a share donation agreement - form and content

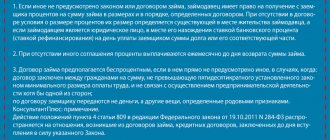

Experienced lawyers, including specialists from our website, recommend drawing up deeds of gift only in writing (even when this is not a mandatory requirement of the legislator). We also remind you that when executing a transaction, the parties must be guided by the information set out in paragraph 2 of Article 574 of the Civil Code of the Russian Federation, which sets out the rules regarding the donation of movable property. To a greater extent, this applies to the so-called documentary shares, because they are presented in paper form, being materialized.

Moreover, if the object of the deed of gift is uncertificated securities that do not exist in material form, the donor will be transferred to the recipient the rights that arise from these securities.

Expert opinion

Oleg Ustinov

Practicing lawyer, author of the website “Legal Ambulance”, one of the co-founders of the “Our Future” foundation.

It is also worth noting that uncertificated securities are not transferred into the ownership of the donee immediately after the conclusion of the gift transaction. Time must pass for such a transfer of rights. Therefore, according to the same paragraph 2 of Article 574, the donation of shares that do not have a paper form must be carried out exclusively in writing.

In 2021, the legislator has not established any special procedure or fixed requirements applicable to the content of the contract. The main rule is still considered to be the designation of the subject of the contract in the agreement (in our case, shares), as well as:

- Quantity of securities transferred;

- par price of shares;

- type of documents;

- name of the organization to which these shares relate;

- other important characteristics.

In addition, the content of the securities donation agreement should not contain any counter obligations and this type of agreement cannot be drawn up in the event of the death of the donor. Otherwise, such donations will be considered void.

ARTICLE RECOMMENDED FOR YOU:

Void gift agreement - what you need to know about the consequences of the transaction

Transfer of ownership of shares - procedure in 2021

By drawing up a gift agreement, the real owner of the shares transfers free of charge along with them the property rights arising from these securities. However, the options for these rights vary greatly and may depend not only on the type of shares themselves (book-entry or documentary type), but also on their actual classification. So, depending on the real subject of rights, which is certified by a certain security, shares can be divided into:

- order;

- bearer;

- nominal.

At the same time, the actual transfer of rights to documentary shares is described in Article 146 of the Civil Code of the Russian Federation, which states that documentary bearer shares can be donated by gift transfer from the donor to the donee. In the same way, you can give order securities free of charge, having previously placed a so-called endorsement on them. In addition, bills of exchange can be gifted in a similar way.

But, in cases of gratuitous donation of registered shares, the documents themselves must also be affixed with a transferable inscription if the transaction is carried out in the manner established by the legislator for assignment (that is, assignment of a claim).

At the same time, the highest degree of complexity arises precisely during the donation of registered shares. The whole point is that the transfer of rights to the party receiving the shares is carried out at the moment of making the corresponding entry in the accounting records, which must be made on the basis of the transfer deed. In addition, the donor and the donee (or one of the parties to the transaction, if the deed of gift has been notarized) must be present during this process.

Lawyer's Note

The uncertificated form of securities, including shares, also affects the procedure for their gratuitous donation. First, the securities must be debited from the account of the person acting as the donor in the transaction. After this, according to his order, the shares must be credited to the donee’s account. At the same time, the rights to this type of shares, as well as the real rights that these papers certify, are considered donated only after the corresponding entry is made in the securities register on his personal account. To carry out this mandatory procedure, the parties must provide the registrar with both the transfer order and the package of documents required for this case, established by the legislator.

It is worth noting that the transfer order itself cannot act as a document equivalent in legal force to a gift agreement. This document only reflects the above-mentioned agreement on the need to write off a certain number of shares owned by the donor from his personal account in favor of the donee, in accordance with subclause 3.9 of the “Procedure for the opening and maintenance by holders of registers of securities owners of personal and other accounts”, as well as subclause 3.4.2 “ Regulations No. 27 (“On maintaining the register”).

Simply put, the transfer order can be considered as a preliminary agreement for the gift of shares concluded between the parties.

Final provisions

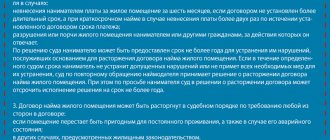

4.1. The Agreement comes into force from the moment it is signed by the Parties.

4.2. The Agreement is drawn up in ________ copies, one for each of the Parties and one for the registering authority (supplemented if real estate is transferred).

4.3. Unless otherwise provided by the Agreement, notifications and other legally significant messages may be sent by the Parties by fax, e-mail or other method of communication, provided that it allows one to reliably determine who the message came from and to whom it was addressed.

4.4. The following are attached to the Agreement:

- Property acceptance and transfer certificate (Appendix No. 1);

- ________________________________.

Tax on gifts of shares in 2021

It is well known that a gift is a bilateral agreement. At the same time, when the donor makes a gratuitous transfer of shares to the donee, the donating party does not generate income, and therefore the taxation established in the case of citizens receiving income tax is not applied to it.

However, a completely opposite situation arises with the donee, who receives property rights and benefits at his disposal without spending his own funds. Therefore, if the value of the object of the gift agreement exceeds the amount of 4,000 Russian rubles, the person accepting the securities into his ownership is obliged to declare income and pay tax (personal income tax), which today amounts to 13% of the total market value of the gift.

When drawing up an agreement, the parties need to understand that the tax on shares will be calculated based on the value of the securities stated in the contents of the deed of gift. If the donor does not provide this information, the amount of mandatory payment to the state will be calculated based on the market value of the donated securities!

In addition, if the role of the donee in the gift agreement is a commercial organization, the cost of the shares accepted by it will be regarded as non-operating income, which will entail the obligation to pay income tax.

ARTICLE RECOMMENDED FOR YOU:

Donation agreement to a budgetary institution in 2021 - current sample, errors, rules

Fable of the case

In 2015, on the basis of donation agreements, Vasilyev V.G. (donor - father) gave V.V. Shkutov free of charge. (donee - son) non-residential premises No. 47 and 48 owned by the donor with a total area of 148.5 and 894.4 sq.m. respectively.

Before concluding the donation agreement, Vasiliev V.G. rented out premises No. 48 to ZAO Tander under real estate lease agreements. Shkutov V.V. After receiving the gift, he continued to rent out the premises to the same company on the basis of additional agreements to the lease agreements.

The inspectorate conducted an on-site tax audit in relation to individual entrepreneur V.V. Shkutov. on issues of correct calculation and timely payment (withholding, transfer) of taxes for the period from 01/01/2015 to 12/31/2017 and insurance premiums for the period from 01/01/2017 to 12/31/2017.

As a result of the audit, the tax authorities came to the conclusion that the entrepreneur unlawfully did not include in income for the purpose of calculating the tax paid in connection with the application of the simplified tax system, the value of real estate received as a gift from an interdependent person in the amount of 9,306,400 rubles.

The inspection determined the cost of non-residential premises No. 47 using the subsequent sale method in the amount of 1,500,000 rubles, while the cost of non-residential premises No. 48 was determined on the basis of expert opinions in the amount of 7,806,400 rubles.

Having considered the materials of the tax audit and the taxpayer’s objections, the deputy head of the Federal Tax Service made a decision to hold the entrepreneur accountable for committing a tax offense provided for in paragraph 1 of Article 122 of the Tax Code in the form of a fine in the amount of 55,879 rubles (taking into account the presence of mitigating circumstances). As a result of the decision of IP Shkutov V.V. it was proposed to pay 558,786 rubles of the single tax paid in connection with the application of the simplified tax system for 2015 and 163,547 rubles 34 kopecks of penalties.

The Department of the Federal Tax Service for the Chuvash Republic left the inspectorate's decision unchanged.

The entrepreneur did not agree with this development of events and appealed to the arbitration court to invalidate the decision of the Federal Tax Service.

But the courts of three instances came to the conclusion that the additional accrual to V.V. Shkutov was legal. tax and penalties and, having established only the presence of mitigating circumstances, canceled the decision of the tax authority only in part of the fine in the amount of 27,938 rubles 50 kopecks.

Agreement of donation of shares in favor of a commercial organization

According to the legislation in force in Russia in 2021, the real owner of securities, including shares, has the legal right to perform any action he wishes in them, without violating the requirements established by the legislator. All this applies to the alienation of shares in favor of other persons.

However, it is worth noting that in cases where the role of the donee in a gift transaction is an individual entrepreneur or a commercial organization, the validity of the gift agreement will completely depend on the legal status of the donor himself.

Thus, the law does not allow the registration of a gift of shares if the parties to the agreement are commercial organizations or individuals whose main professional goal is to make a profit, and the transaction amount exceeds the threshold of 3,000 Russian rubles (more information about this can be found in paragraph 1 of Article 575 of the Civil Code RF). Thus, according to Article 168 of the Civil Code of the Russian Federation, the agreement given as an example will be considered initially void, and the transaction will be considered unconcluded.

A similar situation exists today with deeds of gift for shares concluded between individual entrepreneurs engaged in commercial activities who are not legal entities.

This restriction on donation to a category of persons is associated with their commercial activities , which always imply only making a profit. At the same time, the restriction is aimed, first of all, at protecting the interests and rights of creditors.

But, sometimes in practice there are cases of donation of shares when the parent and subsidiary companies participate in the transaction as parties. Thus, in tax accounting, the actual total value of these shares will be recorded as non-operating income, increasing the tax base, in accordance with paragraph 8 of Article 250 of the Tax Code of the Russian Federation, for calculating income tax. Exceptions can only be cases listed in paragraph 1 of Article 251 of the Tax Code of the Russian Federation, namely:

- if the capital fund of the donee organization existing at the time of the transaction consists of more than 50% of the funds of the donor organization;

- if this fund of the donor organization consists of more than 50% of the funds of the recipient organization.

In these cases, the rules established by Article 575 of the Civil Code, which prohibit the conclusion of donations between commercial organizations, will not be applied to transactions of donation of shares. At the same time, tax legal relations will be applied to such a gift, which in 2021 do not prohibit such transactions.

In addition, it is worth noting that in the listed situations, shares transferred/received free of charge will be regarded as income for tax purposes if, within 12 calendar months, the organization that accepted them alienates these securities to third parties.

However, any legal entity that carries out commercial activities has the legal right to act as a donee in a gift transaction in which the donor is an individual who is not an individual entrepreneur. At the same time, even in this case, you need to be extremely careful! After all, for the most part, such transactions are concluded as feigned gifts, disguising behind a transaction of another type. Therefore, such agreements are under the close attention of tax authorities.

But, if, nevertheless, the gratuitous donation of shares by an individual to a legal entity took place without any violations and the agreement was not challenged in court, income from gratuitously received property rights and benefits will be considered non-operating income, which will be included in the tax base for mandatory payment. As an exception, there are situations in which the donee’s fund includes more than 50% of the contribution of an individual acting as a donor in the transaction.

Continuation of the case

Having found no support in the arbitration courts, IP Shkutov V.V. sent an application to the Constitutional Court of the Russian Federation.

In the ruling dated September 29, 2020 No. 2312-O “On the refusal to accept for consideration the complaint of citizen V.V. Shkutov.” for the violation of his constitutional rights by paragraph 18.1 of Article 217 of the Tax Code of the Russian Federation and subparagraph 4 of paragraph 1 of Article 575 of the Civil Code of the Russian Federation,” the Constitutional Court of the Russian Federation indicated that the legal provision challenged by the individual entrepreneur in itself cannot be regarded as violating his constitutional rights in the aspect specified in the complaint.

The court also indicated that paragraph 18.1 of Article 217 of the Tax Code of the Russian Federation provides for cases of exemption of certain income from personal income tax and, therefore, is aimed at ensuring the rights of taxpayers, and not at limiting them.

In other words, the Constitutional Court of the Russian Federation actually avoided resolving the described legal problem.

Features of donating shares by an individual to a legal entity or individual entrepreneur

Transactions of donating shares to individuals with the participation of legal entities as donors are usually carried out in cases where the donating party is the direct employer of the person accepting the gift of securities or when the donee is a relative of the donor.

Be that as it may, if a gift is made in favor of an individual to a legal entity, then the former will have to pay the appropriate tax, the amount of which is 13% of the market value of the gift, if the real value of this transaction exceeds 4,000 Russian rubles.

ARTICLE RECOMMENDED FOR YOU:

Donation as a gift for generally beneficial purposes

In the judicial practice of the specialists of the Legal Ambulance website, there are many cases when a gift of shares to an employee from the director of a commercial organization was recognized in court as completely legal due to the fact that the gift agreement was not concluded within the framework of entrepreneurial activity. So, don’t be afraid to accept such a gift!

Expert opinion

Oleg Ustinov

Practicing lawyer, author of the website “Legal Ambulance”, one of the co-founders of the “Our Future” foundation.

At the same time, it does not matter at all whether the recipient is an employee of a legal entity - a commercial organization, according to the current legislation of the Russian Federation, is obliged to withhold income tax, that is, 13% of the total value of the securities transferred by it, and then transfer this amount to the budget.

Let us note that if a commercial organization is unable to make payment during the current year, it is obliged to notify the tax service and the taxpayer of this fact in writing. After such notification, the individual acting as the donee is obliged to personally submit an income tax return to the tax office, and then pay the amount calculated by him.

Based on the information described in Article 217 of the Civil Code, some individuals may be exempt from the mandatory payment of income tax. This category includes donees whose value of the accepted gift does not exceed the qualification established by the legislator of 4,000 Russian rubles (28 paragraph 217 of Article 217 of the Civil Code of the Russian Federation).

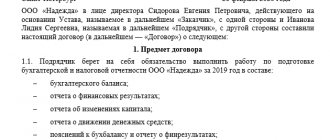

An example from the practice of our lawyers

The commercial organization "Stroymost" at the end of 2021, namely in December, gave its employee certificated shares worth 20,000 Russian rubles for his 55th birthday. Since the employee receives a salary from this company, and also taking into account the fact that during the current tax period he no longer accepted any gifts on behalf of the organization, the company’s accounting department calculated personal income tax according to the formula below:

20 thousand rubles - 4000 rubles = 16 thousand rubles * 13% = 2080 Russian rubles

After this, the retained amount was transferred by the company to the appropriate budget.

Third Parties - Law - Restrictions.

The topic of acquiring shares in a Closed Joint Stock Company has always been relevant, since the transaction itself is associated with compliance with a number of formalities and legally important points.

It's no secret that closed joint stock companies are much larger than open companies, and therefore the distinctive characteristics of these, at first glance, similar organizational and legal forms are quite large.

When establishing any joint stock company, the first thing that focuses on is the ability to dispose of shares. Shares have recently become one of the most common types of equity securities, which could not but affect the practical side of the disposal of this type of property.

Federal Law of December 26, 1995 N 208-FZ “On Joint-Stock Companies” establishes that shareholders of a closed joint-stock company have a preemptive right to purchase shares sold by other shareholders of this company at the offer price to a third party in proportion to the number of shares owned by each of them, if the company’s charter no other procedure for exercising this right is provided.

The company's charter may provide for the company's preemptive right to purchase shares sold by its shareholders, if the shareholders have not exercised their preemptive right to purchase shares.

In an OJSC, it is not allowed to establish the preemptive right of the company or its shareholders to acquire shares alienated by the shareholders of this company. The purchase and sale of shares in a closed joint stock company, as can be noted above, is always associated with the use of preemptive rights, which are given a special place in resolving controversial issues.

There are not many regulations governing the activities of joint-stock companies, and the rules regarding the application of pre-emptive rights in companies are either strictly limited or not clear, which is why judicial practice related to disputes regarding the application of pre-emptive rights today is confidently gaining ground and is a widespread phenomenon .

And yet, let’s try to establish whether a shareholder of a closed company can sell his shares to a third party, that is, not a shareholder of this company, and what he should pay attention to.

From the wording of the article of the Federal Law it follows that closed joint stock companies have a pre-emptive right to purchase shares sold by other shareholders of this company at the offer price to a third party in proportion to the number of shares owned by each of them, unless the company's charter provides for a different procedure for exercising this right.

At least three questions immediately arise. The first question: “If the shareholders exercised their pre-emptive right to purchase shares in proportion, but the shares still remained, how and to whom should they be placed next, the company or a third party?”

Question two: “If all the shareholders of the company decided to exercise their pre-emptive right and redeem the alienated shares according to the law in proportion to their shares, what to do if there were not enough shares and the proportions could not be maintained, what will be the procedure for satisfying applications from shareholders?”

Question three: “Is it possible in the charter to provide for the procedure for the acquisition by shareholders of shares alienated by the company to third parties. Does the company itself have the right to acquire unclaimed shares and sell them to third parties?”

There may be significantly more questions, but is there any point in asking them if the current legislation of the Russian Federation does not provide comments on controversial issues that often occur in practice, but only answers with one wording, for example, “... unless the charter provides otherwise.”

However, Federal legislation establishes the following: “a shareholder of a company who intends to sell his shares to a third party is obliged to notify in writing the other shareholders of the company and the company itself, indicating the price and other conditions for the sale of shares.

Notification of the company's shareholders is carried out through the company. Unless otherwise provided by the company's charter, notification of the company's shareholders is carried out at the expense of the shareholder who intends to sell his shares.

If the shareholders of the company and (or) the company do not exercise the preemptive right to acquire all shares offered for sale within two months from the date of such notification, unless a shorter period is provided for by the charter of the company, the shares may be sold to a third party at the price and on the terms and conditions communicated to the company and its shareholders.

The period for exercising the preemptive right provided for by the company's charter must be at least 10 days from the date of notification by the shareholder intending to sell his shares to a third party, the remaining shareholders and the company.

The period for exercising the preemptive right is terminated if, before its expiration, written statements on the use or refusal to use the preemptive right are received from all shareholders of the company...”

Thus, we received an affirmative answer to the question of whether it is possible to sell shares to third parties. It is much more difficult to carry out this transaction without violating either the rights of shareholders guaranteed by law, or the rights of the participants in the share purchase and sale transaction themselves.

It is obvious that it is impossible to provide answers to all situations in laws, which is why in closed companies it is possible to determine in detail the methods and stages of exercising the preemptive right by shareholders by introducing additional provisions into the company’s Charter.

The company's charter can provide for the terms and methods of payment for alienated shares, as well as the procedure for the acquisition of shares by the company itself and third parties, the procedure for notifying shareholders and reimbursement of expenses related to this notification, indicate the procedure for convening a general meeting of shareholders, at which the issue of selling a block of shares will be discussed and other points.

Let’s say that if a shareholder owns thirty percent of the shares, according to the Charter, he will have the right to convene a general meeting of shareholders, the quorum for making a decision must be 100%. The General Meeting of Shareholders must be accompanied by the presence of the sole executive body, in the person of whom the Company itself is notified.

All these conditions will make it possible to prevent conflict situations between shareholders in the future and to legitimately carry out transactions for the alienation of shares. If the company's Charter does not contain information specifying controversial issues, when selling shares in violation of the preemptive right of acquisition, any shareholder of the company and (or) the company has the right, within three months from the moment the shareholder or company learned or should have learned about such a violation, to demand judicial transfer of the rights and obligations of the buyer to them.

We should not forget about the prohibitions dictated by our legislation. Sale of fewer or more shares than was indicated in the notice, sale of shares at a price different from the offer price in the notice, violation of the procedure for the alienation of shares, as well as their sale after the expiration of the established period, etc. are grounds for declaring such a transaction invalid in court.

Shares may not be sold or otherwise transferred until they have been fully paid for and state registration has been completed. State registration of the issue of shares is carried out only by the Federal Service for Financial Markets.

Features of donating shares between individuals in 2021

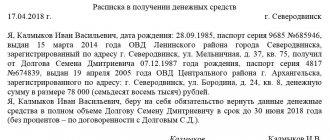

The donation of shares in 2021 by one individual in favor of another individual is subject to mandatory taxation, in accordance with paragraph 7, article 228 of the Tax Code of the Russian Federation. At the same time, it goes without saying that both parties should not be individual entrepreneurs.

The donee, through a deed of gift, receives income in material form. Therefore, this citizen is obliged to personally calculate the amount required for payment, and then transfer it to the budget. As in the previous case, the tax rate today is 13% of the total market value of the received property benefits and rights.

Remember that the value of securities stated in the gift agreement cannot differ from the market value by more than 20% (information from Article 40 of the Tax Code of the Russian Federation). Such transactions are also especially closely monitored by tax authorities, and therefore tax specialists can check how correct the specified amount is.

That is why, when determining the actual value of the securities to be donated, including shares, it is necessary to justify their price by making small explanations for this, which can then be attached to the tax return to save effort and time.

Important

If blood relatives or family members act as parties to the donation, the income that was received when accepting shares will not be subject to taxation! However, when drawing up an agreement, it is necessary to note this fact, indicating the degree of relationship.

In order to understand whether the donor and recipient belong to the category of close relatives and family members, we recommend studying the list published in Article 217 of the Tax Code of the Russian Federation.