Last modified: February 2021

Before going on vacation, an employee has the right to count on receiving mandatory vacation pay, calculated based on average earnings for the last period, however, in some cases, in addition to the usual calculation, employees are entitled to financial assistance for their vacation. This payment is not mandatory under the Labor Code of the Russian Federation, but may be regulated by individual federal regulations and a collective agreement. To receive financial assistance, you should study the procedure adopted at the enterprise when an additional amount is paid.

How is the provision of financial assistance during the next vacation regulated (article of the Labor Code of the Russian Federation, etc.)?

The Labor Code (hereinafter referred to as the Labor Code) does not explain the concept of material assistance if it is provided when an employee goes on his next annual paid leave.

This term is used in practice and is enshrined in other legal acts, which, as a rule, are local in nature. At the same time, the regulation of such payments follows from a number of labor legislation, including the Labor Code. See the material “Regulations on the provision of financial assistance to employees” for more details.

If such assistance is not actually a social benefit and is established as a supplement to the salary and other allowances, then its regulation is carried out in accordance with Part 1 of Art. 129 Labor Code, i.e. as a component of wages. In this case, this payment is established by a local legal act or follows from departmental regulations and depends on the results of the employee’s work activity or has a fixed amount and is paid in any case when the employee goes on annual leave.

At the same time Art. 40 of the Labor Code provides for the possibility of using a collective agreement at a specific enterprise or other organization, which is concluded between representatives of the employer and the workforce. This act regulates not just labor, but social and labor relations. According to Art. 41 of the Labor Code, such an agreement, among other things, may include conditions governing the possibility of providing employees with financial assistance due to certain circumstances. In this situation, assistance is a social benefit and is provided if the employee is in need.

In addition, the regulation of such payments to a certain extent is carried out by the norms of tax legislation concerning the rules for calculating the tax base and the amounts for which insurance payments are calculated - Art. 217 and 422 of the Tax Code (hereinafter referred to as the Tax Code). On a number of issues, it makes sense to apply the practice developed by the courts. One of the most significant in regulating the issue under consideration is the Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated May 14, 2013 No. 17744/12 in case No. A62-1345/2012.

The limit of financial assistance, not subject to personal income tax and insurance contributions, is 4 thousand rubles. in year.

The rules for calculating tax and insurance contributions from financial assistance, as well as the procedure for reflecting payments in accounting, were explained by ConsultantPlus experts. Get trial access to the system and proceed to a Typical situation with a calculated example.

Read how to reflect financial assistance in 6-personal income tax here.

Grounds for refusal

A manager can legally refuse to pay financial assistance only in the absence of a corresponding clause in the collective agreement. The opposite case indicates a violation of labor laws.

An employer has the right to refuse employees if:

- the worker worked for less than six months;

- vacation is issued with subsequent dismissal;

- This is maternity leave.

Form and content of an application for financial assistance for vacation, sample

An application for financial assistance for vacation does not have a legally established form. In this regard, its form can be either free or enshrined in the internal legal act of the organization. In this case, in any case, one should not forget about compliance with the rules of office work and the requirements of labor and tax legislation, since this is important, for example, for the correct calculation of corporate income tax and insurance premiums payable, as well as withholding personal income tax from workers.

Taking into account the practice of labor relations and the rules of personnel records management, the application must contain:

- data of the addressee (the official competent to make a decision on the payment of financial assistance);

- information about the employee who sent the application (name, birth details, registration address, position held in the organization, pension insurance certificate number and taxpayer number);

- grounds for payment - the reasons why the employee asks for assistance (depending on the specifics of its establishment at the enterprise);

- indication of the amount of payment (if permitted by internal regulations);

- information about the leave granted to the employee, including its time frame and date of departure (payment is made exclusively when annual leave is granted);

- date of referral and signature of the employee.

Specific rules for drawing up such a statement should be contained in the instructions for office work in the organization, as well as in the document regulating the issues of making financial payments. You can find a sample application for assistance when going on your next vacation on our website (after downloading, you can use it as a basis when drawing up your own version).

When is payment of financial assistance for vacation made?

The employer makes financial payments for vacation in accordance with the rules approved by the internal document of the enterprise (collective agreement or regulations on remuneration). In any case, in order to make a payment, it is important to comply with a number of conditions determined by current legislation and judicial practice (for example, the appeal ruling of the Krasnoyarsk Regional Court dated September 3, 2014 in case No. 33-8545/14), according to which it is necessary:

- establishment of such a payment in a written document with legal force (or the willingness of the employer’s representative to make such a payment if there is sufficient authority to do so);

- the location of the recipient of such assistance on the staff of the organization;

- providing the employee with annual paid leave (as a rule, the payment is one-time in nature and when the leave is divided, it is paid when the first part is provided);

- the employee writing a corresponding statement;

- existence of grounds for receipt if the payment is of a social nature and is not established for all employees without exception as an additional payment to the salary.

In the case where the obligation to pay financial assistance for vacation is enshrined in a regulatory legal act and/or internal act of the organization (including a collective agreement), the employer cannot refuse to provide it.

Find out also “Is financial assistance for vacation included in the calculation of vacation pay?”

Option 1. Prize

Labor incentives mean specific forms and amounts of remuneration received by an employee, subject to the fulfillment of certain standards. If the payment of an incentive bonus is provided for in an employment or collective agreement, then it can be taken into account as part of labor costs ( clause 2 of Article 255 of the Tax Code of the Russian Federation). If the transfer of the bonus is not provided for by an employment or collective agreement, then it will be impossible to recognize such an expense for profit tax purposes (clause 21 of Article 270 of the Tax Code of the Russian Federation).

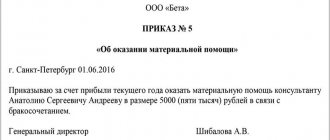

Order for financial assistance for vacation

The order of the head of the organization (as well as a branch or separate division), on the basis of which the employee is accrued the required financial assistance paid for vacation, must comply with the rules of office work. It is important to ensure that it contains:

- a list of legal acts on the basis of which the order is issued and the payment is made (taxation and calculation of insurance premiums will depend on this);

- information about the employee’s application, as well as a description of the circumstances (financial situation, going on vacation, etc.);

- an exact indication of the amount of assistance due;

- list of orders for accounting (need for accrual, timing of issuance, procedure for making payments, etc.);

- details of the internal act that allow it to be individualized (as a rule, date and serial number);

- signature of the manager or other authorized person;

- printing (if available and necessary).

In general, an order for financial assistance corresponds to the form of any other personnel order, differing only in content.

For a sample order for financial assistance, see here.

How to take into account financial assistance for vacation when calculating taxable profit? Find out the answer to this survey in ConsultantPlus by getting free trial access to the system.

How is the amount calculated?

The main questions arise when calculating the amount of financial assistance. The manager has the right to personally

approve a certain payment. The amount of financial assistance is calculated based on the following factors:

- work experience;

- average monthly wage;

- tariff schedule.

The calculation is regulated by internal labor acts and is considered individually or is prescribed in advance in the contract.

Is financial assistance available for leave upon dismissal?

Questions about the provision/non-provision of financial assistance, which is provided for vacation, often cause disputes between the parties to labor relations, as evidenced by the extensive practice of courts at various levels. The judicial authorities have generally developed a unified position regarding such disputes, which makes it possible to say definitively whether such a payment is due if a person resigns.

In particular, the Supreme Court of the Republic of North Ossetia-Alania, in its appeal ruling dated August 12, 2014 in case No. 33-943/14, clearly indicated that the plaintiffs cannot demand payment of financial assistance for their annual leave, since they were not on it , the rules for monetary compensation for vacations established in the relevant legal act do not provide for such payment. A similar position follows from the appeal ruling of the Kaliningrad Regional Court dated October 7, 2015 in case No. 33-4953/2015, according to which the plaintiff had the right to receive one-time assistance for her vacation, although she was on it for only 1 day, since the right to such payment is established by a number of regulations relating to the remuneration of state civil servants in the region.

A number of conclusions follow from the above:

- Upon dismissal from work, an employee can receive financial assistance only if it is provided for by legal acts or an employment contract.

- As a general rule, financial assistance for leave upon dismissal can be provided if the person actually goes on leave (at least for 1 day), as follows from the very name of the payment.

- Only if a legal act or agreement of the parties establishes the possibility of receiving financial assistance for vacation along with compensation for unused vacation, such a payment can be received by the resigning (dismissed) employee.

In addition, it should be taken into account that Part 2 of Art. 127 of the Labor Code provides for the possibility of providing, by agreement of the parties, a dismissed employee (upon his personal application) with unused vacations, after which the legal termination of the employment relationship occurs. In this case, financial assistance, which is paid specifically for the vacation, must be provided without fail.

Read more in the material “Financial assistance upon voluntary dismissal.”

Features of provision

Financial assistance to employees is paid once a year when taking annual leave. If it is divided into parts, then the employee receives benefits on the first exit. If a worker takes leave with subsequent dismissal, financial assistance is not provided for him. When leaving work, an employee has the right to receive vacation compensation. In this case, financial assistance is also not established. The amount of financing is determined by the accounting department in agreement with the manager.

Results

Thus, financial assistance when providing the next annual paid leave is paid in accordance with a local legal act or (in some cases) on the basis of regulatory legal acts (for example, in the case of municipal or state civil servants). It may take the form of a social benefit and depend on the occurrence of certain circumstances or act as a component of the salary paid in any case to the employee when going on vacation. As a general rule, such assistance can be provided only if you are actually on vacation, therefore, if you quit your job and receive compensation for unused vacations, it is impossible to receive it.

Sources:

- Tax Code of the Russian Federation

- Labor Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

How much will be deducted from financial aid?

If, before a vacation, an employee is awarded a bonus for achievements in work, the allocated amount is included in the salary, and the entire amount is taxed. And financial assistance for all kinds of personal circumstances is not subject to insurance deductions, only if it does not exceed 4 thousand rubles. They will deduct 13 percent only from the excess amount.

Find out what you can get a 13% tax deduction for in 2021 →

Thus, if it is known that 5 thousand have been allocated, the amount will remain in hand minus 130 rubles, which went to income tax on the excess thousand.