When the donor or recipient does not need to pay tax

According to Russian legislation, if an individual or legal entity gives money as a gift, then he does not need to submit 3-NDFL to the tax authority. This procedure must be carried out by the donee, since it is he who receives the income from this financial transaction.

Sometimes there are cases when the donor receives a writ of execution from the tax authorities. The letter states the need to immediately declare your income and pay taxes.

In this case, there is no need to worry, since employees at the tax office most often receive information about the alienation of property or real estate, assuming that the owner has made a profit.

A person can write an explanatory letter to the specified address, attach a gift deed to the letter, or simply ignore the message.

Judicial practice of donating money

Disputes related to the gift of funds are resolved by the parties to the transaction or interested parties in court. Judicial practice highlights several points when they are most often disputed.

The greatest difficulty arises in cases where the object of the gift is money for the purchase of certain property , for example an apartment. If the donee is married, then often during a divorce the second spouse tries to sue her part as jointly acquired property.

To prevent this from happening, it is necessary to prove in court that the property was purchased with donated funds. To do this, you will need statements from bank accounts, or donation and sale agreements, which indicate the numbers of all transferred banknotes.

Example

Citizen P. filed a claim in court for the division of a two-room apartment, acquired jointly during his marriage with citizen I. The defendant explained to the court that the housing was indeed purchased during marriage, but with money given to her by her parents as a wedding gift. She provided a notarized written agreement for the donation of a sum of money, which indicated the specific purpose where they were to be spent, and also contained the numbers of banknotes, which also appeared in the apartment purchase and sale agreement. Therefore, the court, on the basis of the evidence presented, refused to satisfy citizen P.’s claims, thereby recognizing that the apartment, acquired, although in marriage, but with money donated to citizen I., is her personal property.

When considering this type of case during court proceedings, it becomes necessary to track the intended use of the donated funds, that is, whether they were actually used to purchase the disputed apartment. Such situations arise due to the fact that there is a time gap between the actual donation of money and the purchase of an apartment.

And since, to a greater extent, in such cases, transactions are concluded orally, this leads to the fact that agreements drawn up retroactively are presented to the courts. The second party begins to challenge them as imaginary, pointing out the discrepancy between the date of the document and its actual preparation, as well as the absence of a real transfer of funds.

Additionally

Consensual agreements are often subject to disputes in court, under which money is promised to be given to the donee after the death of the donor. Such transactions are initially void on the grounds provided for in paragraph 3 of Article 572 of the Civil Code.

In cases where a donation is made under the influence of delusion, threats, violence, or is made by an incompetent person, it may be declared invalid if these facts can be proven during legal proceedings.

If compelling evidence is presented to the court, it is possible to exercise the donor’s right to refuse to fulfill the donation of money in the future or to cancel an already executed agreement.

Most cases in judicial practice show that the more persistently the plaintiff seeks to protect his rights, providing as much evidence as possible in the case, including the use of witness testimony, the greater the chance that the court will take his side.

In what cases do you need to pay tax?

Gifts are considered to be receipt of unplanned income. If they are not exempt, the donee must file a return and pay tax.

If the gift falls into one of the following categories, then the citizen should contact the tax authority to fill out the appropriate application form:

- apartment;

- stock;

- shares;

- securities;

- car.

This list is given in letter dated February 21, 2012 No. 03-04-05/6-200 from the Ministry of Finance of the Russian Federation.

Please note that money is not included in the list!

Non-obvious solutions to complex accounting issues

Welcome to the website of the Online School “Become a Chief Accountant!”

January 2021

Misconception

Any funds (money) received as a gift by one individual from another individual are subject to personal income tax.

In fact.

Everything is exactly the opposite. Funds received as a gift by an individual from another individual are not subject to personal income tax (NDFL) .

In this case, it is necessary to properly formalize the donation transaction.

For personal income tax purposes, the monetary amount of the gift does not matter.

Legal basis:

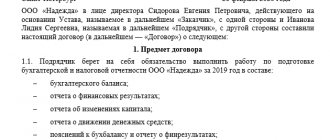

Requirements for a money donation agreement

In accordance with paragraph 1 of Art. 572 of the Civil Code of the Russian Federation, under a gift agreement, one party (the donor) gratuitously transfers or undertakes to transfer to the other party (the donee) an item of ownership or a property right (claim) to himself or to a third party, or releases or undertakes to release it from a property obligation to himself or to a third face.

In accordance with paragraph 1 of Art. 128 and paragraph 2 of Art. 130 of the Civil Code of the Russian Federation, money refers to movable things (cash) or property rights (non-cash funds).

In accordance with paragraph 2 of Art. 574 of the Civil Code of the Russian Federation and clause 1 of Art. 161 of the Civil Code of the Russian Federation, an agreement on the gift of money between citizens in an amount exceeding 10,000 rubles must be concluded in writing. For an amount less than 10,000 rubles, the gift agreement can be concluded orally.

In any case, a gift agreement, which contains a promise of a gift in the future, is concluded in writing.

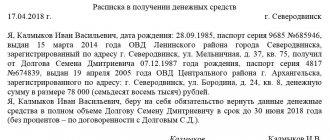

It is advisable to formalize the transfer of cash with a receipt.

Taxation under a monetary gift agreement

In accordance with Article 41 of the Tax Code of the Russian Federation, income is recognized as an economic benefit in monetary or in-kind form , taken into account if it is possible to assess it and to the extent that such benefit can be assessed, and determined for individuals in accordance with Chapter 23 “Income Tax on Individuals”. persons" of the Code .

According to paragraph 1 of Article 210 of the Tax Code of the Russian Federation, when determining the tax base for personal income tax, all income of the taxpayer received by him both in cash and in kind , or the right to dispose of which he has acquired, as well as income in the form of material benefits are taken into account , determined in accordance with Article 212 of the Code.

In clause 18.1 of Art. 217 of the Tax Code of the Russian Federation establishes the following benefit.

Income in cash and in kind received from individuals as a gift , with the exception of cases of donation of real estate, vehicles, shares, interests, shares, unless otherwise provided by this paragraph.

Income received as a gift is exempt from taxation if the donor and recipient are family members and (or) close relatives in accordance with the Family Code of the Russian Federation (spouses, parents and children, including adoptive parents and adopted children, grandparents and grandchildren, full and half (having a common father or mother) brothers and sisters).

It is the second paragraph of this rule that is misleading, creating the appearance that gifts only between close relatives (family members) are not taxed.

However

— Letter of the Ministry of Finance of Russia dated December 6, 2019 N 03-04-05/95034 states “... funds received free of charge from an individual are not subject to personal income tax.”

— Letter of the Federal Tax Service of Russia dated July 10, 2012 N ED-4-3/ [email protected] states the following: “Paragraph 2 of the considered paragraph of the Code applies only to those cases when the subject of the gift agreement is real estate, vehicles, shares, shares, shares Income in the form of other property and property rights not related to the specified list, received under a gift agreement, is not subject to taxation for the purposes of Chapter 23 of the Code, regardless of whether the donor and recipient are family members and (or) close relatives.

— in the Letter of the Federal Tax Service of the Russian Federation for Moscow dated 03/05/2009 N 20-14/4/ [email protected] similar explanations are given “... income of an individual in the form of funds received from other (other) individuals by way of gift, not are subject to personal income tax, regardless of whether the donor and recipient are family members and (or) close relatives in accordance with the Family Code of the Russian Federation.”

The letters of the Ministry of Finance of the Russian Federation also note that the application of the benefits specified in clause 18.1 of Art. 217 of the Tax Code of the Russian Federation does not affect the status of the donee - resident/non-resident. (Letter of the Ministry of Finance of the Russian Federation dated May 15, 2019 N 03-04-05/34692).

From the above it follows that, regardless of whether the donee is a tax resident or not, his income - a gift in the form of cash - is not subject to personal income tax.

A button to download or print the article will appear here if you are logged into the site. (To enter the site, scroll down the page and log in or register)

Dependence of the tax amount on the size of the gift in monetary equivalent

The amount paid as tax depends on the value of the gift. If it is indicated in the gift deed, then the task is much simpler.

For example, in 2021, P. A. Lozhkov received a gift from his aunt in the form of an apartment in Novokuznetsk worth 2 million rubles. By April 30, 2021, he managed to submit a declaration to the tax authority. The tax amount is set based on the total cost of the apartment: 2,000,000 * 13% = 260,000 rubles.

Citizens can deliberately lower the price of real estate so that the donee saves money and contributes a smaller amount. However, specialists from higher authorities can set their tax amount based on the market value of housing. The same applies to those cases when the contract does not indicate the price of the gift.

Inspectors determine values based on the housing cadastral passport. However, the legislation does not clearly define the procedure for setting prices, therefore, if the owner does not agree with the calculated price, he can indicate his own.

The legislation does not establish a limit on transferred funds. The main thing is that the donee can pay the tax on time.

VAT on gifts

When giving gifts to both employees of an organization and its clients, there is a gratuitous transfer into the ownership of an individual of any property or property right (Article 572 of the Civil Code of the Russian Federation).

In turn, the object of VAT taxation is transactions involving the sale of goods, works and services on the territory of the Russian Federation (clause 1, clause 1, article 146 of the Tax Code of the Russian Federation). Moreover, sales in this norm also means the transfer of ownership of goods, works and services free of charge.

Thus, goods donated free of charge to employees or clients (potential clients) of an organization as gifts are subject to VAT taxation on a general basis.

At the same time, the tax base for these transactions is determined in accordance with paragraph 1 of Art. 154 Tax Code of the Russian Federation. That is, based on the market (purchase) value of gifts, taking into account excise taxes (for excisable goods) and without including value added tax.

In turn, the market value of gifts purchased by an organization can be confirmed on the basis of invoices or delivery notes from suppliers (letter of the Ministry of Finance dated October 4, 2012 No. 03-07-11/402).

At the same time, VAT amounts presented to the donor organization when purchasing gifts are allowed to be deducted (Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated June 25, 2013 No. 1001/13).

Deadlines for filing a tax return and paying taxes

According to the tax code, 3-NDFL must be filed no later than April 30 of the following year after receiving the gift.

After reviewing the declaration, the person will receive an answer as to whether they need to pay tax. If the result is positive, payment must be received no later than July 15 of the corresponding year.

For example, in 2015, Yu. L. Belova, I. K. Ivanov’s second cousin, gave her uncle a dorm room. Since the girl is not a close relative of the citizen, Ivanov filed a tax return with the appropriate authority by April 30, 2016 and paid a tax of 13% of the total cost of the room by July 15, 2021.

Advantages of notarization

Notarization confirms that the transaction occurred between legally capable persons. Certification of the fact of transfer of money will prove the validity of the document when trying to challenge it in court. Sometimes such conflicts arise between relatives if someone feels deprived.

Additional benefits:

- guarantee that the agreement is drawn up correctly and there are no problems with registration;

- choosing the most appropriate form of gratuitous transfer of money for a particular case. The notary professionally evaluates various situations and offers the optimal solution;

- clarification of the rights and obligations of the parties to the transaction.

In our notary office, you can draw up and certify a gift agreement without days off. The list of required documents can be found by calling.

How to prepare and submit a tax return 3-NDFL

The procedure for submitting 3-NDFL to the tax office is as follows:

- Filling out the form. To properly formalize it, it is recommended to visit the official website of the tax office.

- Sending the document to the tax authority at the place of registration. This can be done in two ways: contact the nearest branch in person or send scanners of certificates and a completed application by email.

When donating money, it is recommended to draw up an appropriate agreement with a notary so that there are no serious consequences after making the gift. Not all persons are subject to taxation, but only those who are not close relatives.

Procedure for completing the donation procedure

You can use the services of a notary or do without one. The money must be the property of the donor. Donation of funds involves written or oral form. Documents required to complete the written procedure:

- consent of the recipient;

- passport;

- TIN;

- document from Rosreestr (if a legal entity appears);

- other documents and agreements, depending on the parties involved.

If the amount of the gift is above 3 thousand rubles, they cannot make transactions (Article 575 of the Civil Code of the Russian Federation):

- representatives of minors and incapacitated persons on their behalf;

- employees of educational, medical, social organizations and citizens receiving education, treatment, etc., their relatives;

- those working in government positions, civil servants, municipal and bank employees (in connection with the performance of labor duties);

- commercial organizations among themselves.

Contract form

A deed of gift is a formal agreement drawn up between several persons and obliges one of them to transfer money or property to the other free of charge. If, according to the terms of the document, the recipient party must somehow compensate for the income with reciprocal actions (services or transfer of something), it is considered invalid.

Two forms:

- Oral. A minimum of three persons must be present: the parties and the witness. To record the agreement, you need to draw up a receipt for receipt of funds.

- Written. An agreement is drawn up and signed by the parties.

The first form does not require the rules of a paper agreement and involves the gift of money only between individuals. This is the so-called real transaction, the fact of its conclusion coincides with the moment of transfer of money. If the gift is made from a legal entity or individual entrepreneur and its amount is higher than 3 thousand rubles, then it is necessary to conclude an agreement in writing.

- All elderly Russians will be tested for coronavirus

- What is a state of emergency and state of emergency during an epidemic?

- How can a pensioner get 2,000 rubles for purchases at Pyaterochka?

In some cases, it is advisable to give movable property to loved ones, for example, to your own child, and to enter into a written agreement. If, for example, parents want to give money to newlyweds, they can secure the gift in case of divorce, when the other half will assert their rights. In this case, a target gift agreement is drawn up for one of the spouses - the son or daughter of the donors. Only he can manage finances.

How to issue a deed of gift

The agreement contains the following information:

- Donor's name;

- information about the recipient;

- passport details;

- sum;

- currency;

- date and signatures.

The registration procedure includes a number of sequential actions:

- It is better to contact a notary and present the required package of documents. He will draw up the paperwork according to all the rules, indicating the amount.

- After signing, both parties take receipts confirming that the specialist has received the necessary documents.

- After the transaction is completed, the notary issues a deed of gift. Both parties take a copy of the concluded agreement.

- The recipient of the money receives a Certificate of Ownership of the funds.

- The party who received the income has the right to use the money at its own discretion, incl. do shopping.