Rights and obligations of the parties

4.1. The mortgagor is obliged. 4.1.1. Use the Pledged Item in accordance with its intended purpose. 4.1.2. Not to take actions that entail a change, termination of the right of pledge or a decrease in the value of the Pledged Subject, with the exception of a decrease in value due to depreciation during normal operation of the Pledged Subject. 4.1.3. Do not dispose of or encumber the pledged item with any obligations (sell, assign rights, donate, lease, transfer as a deposit, etc.) without the written consent of the Pledgee. 4.1.4. Take all necessary measures appropriate to the circumstances to ensure the safety of the Pledged Subject, including its protection from attacks by third parties. Immediately notify the Pledgee of circumstances that may arise that may lead to seizure, encumbrance, reduction in value or deterioration of the Pledged Subject. 4.1.5. Provide the Pledgee with the opportunity to inspect the Pledged Subject during the period of validity of the pledge agreement. 4.1.6. Provide the Pledgee with the composition and grounds for residence of persons living in the Pledged Subject. 4.1.7. Provide the Pledgee with notarized obligations on his own behalf and from his family members living with him to release the Pledged Subject within 30 calendar days in the event of a legal claim against the Pledged Subject. 4.1.8. Insure the Pledged Item in favor of the Pledgee for an amount not less than its estimated value against the risks of loss or damage. Until the obligations under the Agreement are fully fulfilled, annually renew the insurance contract for the Pledged Subject on the same terms. Provide the Pledgee with copies of the insurance contract and rules certified by the insurance company. 4.1.9. Pay taxes, fees and other payments that are due from him as the owner of the Pledged Subject. 4.1.10. Carry out current and major repairs of the Pledged Subject. 4.2. The mortgagee is obliged. 4.2.1. Do not transfer your rights under the Agreement to another person by assigning the right of claim. 4.3. The pledgor has the right. 4.3.1. Use the Collateral in accordance with its intended purpose. 4.3.2. Alienate the Item to another person of the pledge (sell, donate, exchange, transfer as a deposit, etc.) only with the written consent of the Pledgee. 4.3.3. At any time, repay early the obligations under the main agreement secured by the collateral agreement. 4.3.4. At any time before the moment of its implementation, stop foreclosure on the Pledged Subject by fulfilling the obligation secured by the contract or its overdue part. 4.3.5. Bequeath the Pledged Subject. 4.4. The pledgee has the right. 4.4.1. Require the Pledgor to provide documents and information to verify the Pledged Subject according to the documents, the actual presence, condition and conditions of its use. 4.4.2. Require the Pledgor to take measures necessary to preserve the Pledged Subject. 4.4.3. Act as a third party in court when considering a claim regarding the Pledged Subject. 4.4.4. In case of alienation of the Pledged Subject in violation of clause 4.3.2. of this agreement, at its own discretion, demand: - recognition of the transaction for the alienation of the Pledged Subject as invalid with the application of the legal consequences provided for by the legislation of the Russian Federation; — early fulfillment of obligations secured by the contract with foreclosure of the Pledged Subject, regardless of who is its current owner, if it is proven that at the time of acquisition of the Pledged Subject, the acquirer knew or should have known about the violation of the conditions of clause 3.3.2. agreement upon alienation of the Pledged Subject. In this case, the acquirer of the Pledged Subject, jointly and severally with the Pledgor, is liable for the obligations secured by the agreement. 4.4.5. In the event of a gross violation by the Pledgor of the obligations of clause 3.1 of this agreement, demand early fulfillment of the obligations secured by the agreement. If the demand is not satisfied within 30 calendar days, foreclose on the Pledged Subject. 4.4.6. Receive compensation from the insurance compensation for loss or damage to the Pledged Item, unless the loss or damage to the Pledged Item occurred for reasons for which the Pledgee is responsible. 4.4.7. In the event of a real threat of loss, shortage or damage to the Pledged Subject through no fault of the Pledgee, demand replacement of the Pledged Subject, and if the Pledgor refuses to comply with this requirement, foreclose on the Pledged Subject before the deadline for fulfillment of the obligation secured by the Agreement. 4.4.8. Receive compensation at the expense of the Pledged Subject in cases where the Pledgee actually bears the costs of preserving and maintaining the Pledged Subject. 4.4.9. Transfer your rights under the Agreement to another person by assigning the right of claim. The assignment by the Pledgee of its rights under the Agreement to another person is valid if the rights of claim against the Pledgor under the main obligation secured by the Agreement are assigned to the same person. 4.4.10. To foreclose on the Subject of Pledge before the deadline for fulfilling the obligation secured by the pledge in accordance with Federal Law No. 102-FZ dated July 16, 1998 “On Mortgage (Pledge of Real Estate).”

Documents for completing a transaction

To successfully pledge an apartment to a notary, you must provide the following documents:

- documents establishing ownership of real estate or land;

- a certificate confirming state registration of ownership of the object;

- cadastral and technical passports of the property, extracts from the Unified State Register body;

- a report on the assessment of the value and condition of the pledged item, a copy of the loan agreement.

In addition, a pledge agreement is required, which is drawn up in writing - a total of 4 copies are required. The first is handed over to the notary for certification, the second remains with the pledgor, the third with the bank, and the fourth is sent to a special authority for subsequent state registration.

Conditions for foreclosure on collateral

5.1. Foreclosure of the Pledged Subject occurs in accordance with the current legislation of the Russian Federation. 5.2. Foreclosure on the Subject of Pledge to satisfy the claims of the Pledgee may be applied in the event of failure to fulfill or improper performance by the Pledgor of the obligation secured by the contract under circumstances for which he is responsible. 5.3. Foreclosure is not allowed if: - the amount of the unfulfilled obligation is less than five percent of the valuation of the Pledged Subject under the agreement; — the period of delay in fulfilling the obligation secured by the contract is less than three months. 5.4. When foreclosure is made on the Subject of Pledge out of court, the Subject of Pledge is transferred into the ownership of the Pledgee or sold in the manner established by the current legislation of the Russian Federation. 5.5. If the amount received from the sale of the Pledged Subject exceeds the amount of the Pledgee's claim secured by the contract, the difference is returned to the Pledgor no later than ten calendar days from the date of sale.

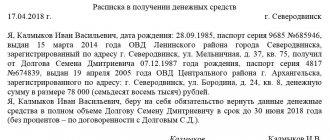

Receipt

This option is suitable if you are lending a small amount to friends or relatives. It is the simplest and only requires that the debtor himself write the text of the receipt.

It indicates the full name of the borrower and the lender, as well as the amount of the loan and the period during which it will be repaid. If the debt will be repaid in parts, then it is possible to describe a payment schedule. You should not forget to write the place and date of birth of the debtor. This will be useful if the money is not returned and you need to go to court and then receive a writ of execution. The latter must indicate the defendant’s place of birth. Without this information, it will not be possible to obtain a writ of execution. It is also necessary to indicate the passport details and address of the person who gives or borrows money.

The loan amount is recorded in numbers and words. At the end of the text of the receipt the date of signing, signature and its decoding in the form of full name or initials and surname are indicated.

The need for passport data and addresses for temporary or permanent registration lies in the fact that there are cases when the receipt is issued in printed form, and the signature is such that it is not possible to establish that it belongs to a specific person. Sometimes even graphological examination is powerless. In such a situation, the document cannot be accepted by the court as an evidentiary fact.

But many people perceive the receipt simply as a piece of paper that means nothing. Actually this is not true. A receipt is an important document. To give it greater legal significance, it makes sense to have it certified by a notary. This procedure is inexpensive and will protect the interests of the lender from an unscrupulous debtor. But it is worth noting that, according to judicial practice, it is quite difficult to return money on the basis of one receipt. Often I consider it only as a document that confirms the transfer of money. Therefore, its text must be approached extremely responsibly and all the above points must be spelled out.

Notaries recommend using a receipt only when the amount of debt is relatively small.

You cannot indicate the amount of penalties or repayment terms on the receipt. These clauses are specified in the collateral agreement.

Experts advise transferring money not in cash, but by bank transfer. A certificate of the transaction can serve as evidence in court.

Force Majeure

9.1. The Parties are released from liability for complete or partial failure to fulfill obligations under the contract if the failure to fulfill obligations was the result of force majeure, namely: fire, flood, earthquake, strike, war, actions of government authorities or other circumstances beyond the control of the Parties. 9.2. The Party for which it has become impossible to fulfill its obligations shall immediately notify the other Party of the occurrence of force majeure circumstances and provide supporting documents. 9.3. The Parties acknowledge that the insolvency of the Parties is not a force majeure circumstance.

The Agreement is drawn up in 3 (three) original copies in Russian.

Appendices 1. Agreement …………………………… from “…..” …………………. 20….. g.

Loan agreement

The second document that ensures the return of money on a debt is a loan agreement. It, too, as in the receipt, indicates the full name, passport details and registration addresses at the place of residence of the parties. The amount and term of the contract must be written down in numbers and deciphered in words. The conditions for full and partial early repayment are prescribed, as well as the interest rate on the loan. In the interest clause, it is recommended to indicate the conditions for a possible rate reduction if the money is returned before the due date.

Specialists in loan agreements recommend indicating the judicial authority to which the lender will contact if necessary.

One of the necessary items is the method of repaying the loan. Repayments can be made either in cash or by transfer to a card or current account. If the payment is non-cash, then the details for performing transactions are indicated.

The document must also record the fact of transfer of funds when this occurs in cash.

The loan agreement must have a section on penalties. It is necessary to indicate what penalties the debtor will be required to pay if the deadlines are violated.

For an agreement to have legal force, it must be signed in the appropriate form. If the loan amount exceeds 10 thousand rubles, then only written form is allowed.

Attention! When the interest rate is specified in the agreement, the lender will have to pay 13% income tax.

When signing a document, two witnesses may be present to confirm the transaction.

Notarization is also recommended. The presence of a notary at the transaction guarantees that the parties to the agreement performed their actions voluntarily and in a capable state. Accordingly, in the future the borrower will no longer be able to refer to the fact that he was forced to receive a debt or that he did not understand what he was doing.

In addition, the notarial form of concluding relations allows you to collect funds without involving the judiciary. If the lender does not receive the money within the specified period, he can contact the notary for a writ of execution. After putting down the appropriate mark, you can immediately contact the bailiffs.

Validity

The term of the agreement should be understood as the period during which the mortgagor undertakes to fulfill his obligations. Any contract must have a start date and an end date. On the date of completion, all obligations of the mortgagor must be fulfilled in full.

Interest on debt

Most often, borrowing money between friends or close relatives does not include interest payments. But this loan option is also possible and this issue is regulated by the norms of the Civil Code of the Russian Federation. The interest rate, according to the law, is established by decision of the parties and is specified in the security document.

If the amount of interest is not specified, then the creditor has the right to receive an amount that is calculated at the refinancing rate at the time of full repayment of the debt or part of it. The calculation is carried out taking into account the lender’s place of residence or address if the lender is a legal entity.

It is also recommended at the time of registration of documents to discuss the issue of reducing interest in case of early repayment of money.

It’s also not worth setting an unreasonably high interest rate, because in this case the contract can easily be declared invalid due to onerous conditions.