Civil legislation defines the concept of a contract for paid services as an agreement according to which one party undertakes to provide any services, and the other party undertakes to pay for them.

- Form and sample

- Free download

- Online viewing

- Expert tested

FILES

The subjects of such an agreement can be both individuals and legal entities. The parties under this agreement are referred to as the Customer and the Contractor.

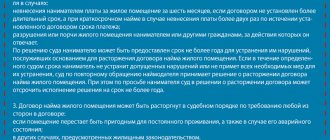

At the same time, there is a certain range of services that fall under the type of contract under consideration. It is defined in paragraph 2 of Article 779 of the Civil Code of the Russian Federation. These services include:

- medical;

- veterinary;

- communication services;

- audit;

- consulting;

- informational;

- other services that do not fall into the category of services provided under contracts, which are specified in paragraph two of this article.

Often, such a transaction is focused on long-term cooperation between Counterparties and is subject to mandatory written documentation.

Below we will look at how a contract for the provision of paid services is drawn up, and what nuances you should pay attention to when drawing up this document.

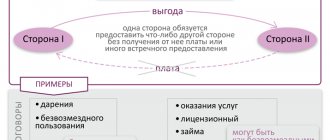

The essence and types of civil contracts

Civil contracts are agreements that are drawn up according to the rules of the Civil Code of the Russian Federation.

The main of these rules (Article 421 of the Civil Code of the Russian Federation) determines the possibility of concluding an agreement on any conditions that suit its parties (unless otherwise established by law for a certain type of agreement). The parties to such agreements can be, in different combinations, both legal entities and individuals (including those acting as individual entrepreneurs), i.e. the agreement can be concluded between:

- legal entities;

- individuals;

- legal entity(ies) and individual(s).

By type, civil law contracts are divided into those drawn up:

- on transactions with property (purchase and sale, exchange, donation, lease);

- performance of work, provision of services.

Despite the fact that the Civil Code of the Russian Federation separates contracts for work and services (their outcome is different - obtaining a result in the first case and carrying out certain actions in the second), the principles for drawing up the contracts concluded under them are very similar. And it is these contracts, in situations where the executor under them is an ordinary individual (not acting as an individual entrepreneur), that attract the closest attention of inspectors. This is due to the fact that taxation of income paid under such agreements is carried out according to special rules.

Below we will look at the features of registration and taxation of a civil contract with an individual performing work for the employer (i.e., who has entered into a contract agreement).

Leave a comment on the document

Do you think the document is incorrect? Leave a comment and we will correct the shortcomings. Without a comment, the rating will not be taken into account!

Thank you, your rating has been taken into account. The quality of documents will increase from your activity.

| Here you can leave a comment on the document “Contract for paid services (standard)”, as well as ask questions associated with it. If you would like to leave a comment with a rating , then you need to rate the document at the top of the page Reply for |

Distinctive features of a contract

Who can become an employer under a civil contract - GPA - with an individual concluded in connection with the performance of work? Any person - legal or natural, and the latter may be an individual entrepreneur or one without this status. In turn, the executor can be either an ordinary individual or an individual entrepreneur.

What distinguishes relations under such an agreement? First of all, the presence of specific work of a certain volume that must be done within a specified time frame. It is allowed for the contractor to carry it out both on his own and by persons attracted by him, using for this purpose both his own materials and equipment, and the customer’s materials and equipment.

In the process of performing work under the GPA, its performer is not subject to the work regime in force at his employer, but is responsible for:

- for the quality of what he or the persons involved did;

- compliance with contract deadlines;

- safety of property and materials transferred to him by the customer.

The specifics of the terms of such an agreement also depend on what type of contract work performed by an individual belongs to (Chapters 37, 38 of the Civil Code of the Russian Federation).

Author of the document

| Contract-Yurist.Ru offline Status: Legal company rating460 84 / 6 Private message Order a consultation | number of consultations: |

| noted as the best: | 5 |

| answers to documents: | |

| documents posted: | 927 |

| positive feedback: | |

| negative reviews: |

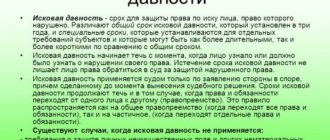

GPA for work between individuals - what are its consequences?

The Civil Code of the Russian Federation does not prevent the conclusion of a civil contract between individuals. However, a number of questions arise here regarding who is responsible for paying taxes on the income received by the executor. Let us recall that each of the parties to such an agreement may be an individual entrepreneur, and due to this, the following options for the parties to the agreement are possible:

- both of them (the employer and the contractor) are individual entrepreneurs;

- the employer is an individual entrepreneur, and the performer is an ordinary individual;

- the employer is an ordinary individual, and the contractor is an individual entrepreneur;

- both of them are ordinary individuals.

In the first option, the relationship is the same as between legal entities or between a legal entity and an individual entrepreneur, i.e., everyone pays the taxes required for him, and the amount of payment under the GPA is a regular settlement between counterparties.

In the second option, the individual entrepreneur, in relation to income paid to an individual, is the payer of insurance premiums and the tax agent for personal income tax withheld from this income.

In the third option, the individual employer does not impose any taxes on the income paid to the individual entrepreneur. The latter makes all the necessary payments from his own income.

And with the fourth option, both parties have a need to make tax payments and prepare reports:

- for the contractor - in relation to the tax on income received, since the individual employer is not included in the number of tax agents (clause 1 of Article 226 of the Tax Code of the Russian Federation);

- from the employer - in relation to insurance premiums from this income (subclause 1, clause 1, article 419, clause 2, article 420 of the Tax Code of the Russian Federation).

The latter requires, accordingly, registration with the Federal Tax Service as a payer of contributions. Thus, both parties with this version of the GPA have consequences that are not desirable in contracts of this kind that are concluded infrequently.

Who are self-employed

Self-employed are individuals who independently carry out certain types of commercial, that is, income-generating, activities. Professional income is the income of such individuals from activities in which they do not have an employer and do not attract employees under employment contracts, as well as income from the use of property.

When applying the new special regime, citizens have the right to conduct types of activities, the income from which is subject to NAP, without state registration as individual entrepreneurs. Self-employed people are also exempt from the obligation to submit personal income tax returns to the tax authority. In addition, those applying this tax regime (entrepreneurs) are given the right to pay contributions to compulsory pension insurance on a voluntary basis.

Income from the use of the special regime should not exceed 2.4 million rubles per year. I would also like to note that under this special regime, income received within the framework of labor relations is not recognized as an object of taxation.

Taxes for parties to a civil contract with an individual

What taxes will arise in a civil contract with an individual? Here, again, everything depends on the capacity in which (an ordinary individual or individual entrepreneur) the performer acts.

An ordinary individual (including an individual entrepreneur who enters into such an agreement as an ordinary individual) will be regarded as an employee registered with the employer under the GPA. And from his income the employer will accrue and pay:

- Personal income tax (except for the situation when the employer is also an ordinary individual), withholding it from the employee’s income (clause 1 of Article 226 of the Tax Code of the Russian Federation);

If you have access to ConsultantPlus, see recommendations from K+ experts on how to calculate and pay personal income tax on payments under service and contract agreements with resident individuals. If you don’t have access, sign up for a free trial access to K+ and learn the procedure.

- insurance premiums for compulsory health insurance and compulsory health insurance (such income is exempt from accrual of contributions to compulsory health insurance in terms of disability and maternity - subclause 2, clause 3, article 422 of the Tax Code of the Russian Federation);

- insurance premiums for injuries, if such a condition is provided for in the GPA (Clause 1, Article 20.1 of the Law “On Compulsory Social Insurance...” dated July 24, 1998 No. 125-FZ).

How to calculate insurance premiums when accepting work under a contract with an individual who is not an individual entrepreneur, experts from the K+ system explained in the Contract Guide. Get free trial access to ConsultantPlus.

An ordinary individual who has entered into a GPA on his own will only have to pay personal income tax in a situation where his employer also becomes an ordinary individual.

An individual entrepreneur who has entered into a relationship under a GPA agreement as an individual entrepreneur will have to accrue and pay all payments required for an individual entrepreneur:

- due to the applied taxation system;

- insurance premiums for compulsory medical insurance and compulsory medical insurance;

- taxes, the accrual of which is required by the presence of an object of taxation.

Find a comparative description of special modes, the use of which is preferred by individual entrepreneurs, here.

Summary

A GPC agreement is not a simple document or formality. Before signing it, you must carefully read all the terms and conditions.

If you do not understand something or doubt that the document protects your interests, be sure to consult with lawyers. A civil law contract is not an employment agreement, where the employee is seriously protected by the norms of the Labor Code of the Russian Federation. Most often, GPC protects the interests of the customer and can have many nuances in relation to the contractor.

Author: Kadrof.ru (KadrofID: 79032) Added: 05/30/2019 at 13:14

To favorites

Comments (43)

Valentina (KadrofID: 100310)

Please tell me, when you work under a civil service agreement, the employer provides income certificates to apply for a subsidy

04/05/2020 at 14:25

Sergey Antropov (KadrofID: 5)

Valentina, if you are asking about a certificate of income in form 2-NDFL, then you can receive such a certificate when working under a GPC agreement. In it, the employer will reflect the income you received and taxes withheld. The issuance of such a certificate is regulated by Art. 230 of the Tax Code of the Russian Federation.

05/01/2020 at 17:37

Natalia (KadrofID: 111378)

Tell me, if a person is employed under a GPC agreement, can he register with the labor exchange?

08/05/2020 at 01:20

Sergey Antropov (KadrofID: 5)

Natalya, no. According to the Law of the Russian Federation of April 19, 1991 N 1032-1 Article 2, such citizens are considered employed, i.e. having income.

08/05/2020 at 22:21

Maxim (KadrofID: 111438)

Tell me, is the existence of a Civil Legal Agreement (CLA) without receiving income for a certain period of time equivalent to conducting business during this period? After all, in fact, since there is no income, then there is actually no activity! And the concluded GPC Agreement is only a formal necessity for the possible conduct of activities.

08/06/2020 at 10:29

Sergey Antropov (KadrofID: 5)

Maxim, the term conducting business is usually used for individual entrepreneurs or organizations. A GPC agreement is concluded with an individual to perform certain work. Therefore, please clarify your question.

08/07/2020 at 22:48

Olga (KadrofID: 112288)

If, as your article says, the main thing is the result, and not the process, is it then legal for the organization to require me to work according to the schedule they have determined (I am not satisfied with such a schedule)?

08/22/2020 at 15:47

Tatiana (KadrofID: 113091)

Can individuals be attracted? Is a person working under a GPC agreement liable for illegal conduct of business activities?

09.09.2020 at 11:34

Sergey Antropov (KadrofID: 5)

Olga, legally no, but in practice it is better to agree with the customer on working conditions acceptable to both parties. After all, the customer can initiate termination of the contract.

09.09.2020 at 22:29

Sergey Antropov (KadrofID: 5)

Tatyana, if you are not disguising your business activities under the guise of GPC, then I see no reason. You pay taxes, you do work.

09.09.2020 at 22:30

Enver (KadrofID: 114155)

Can the employment center check the number and date of the GPC agreement?

09.30.2020 at 21:47

Annushka24 (KadrofID: 114304)

Hello. She worked under a contract for the provision of paid services. During this time I received another education. To receive a tax deduction for training, I asked for a 2NDFL certificate. I was told that I was not entitled to such a certificate precisely because I worked under such an Agreement and did not pay taxes. I objected that, by law, the employer had to pay taxes. I was refused. What to do? Should I file with the Labor Inspectorate or court? Or will everything be useless? I read the contract carefully. The tax issue is not addressed in any way.

04.10.2020 at 01:31

Sergey Antropov (KadrofID: 5)

Enver, I’m not sure that CZ has such capabilities. They are most likely checking to see if any fees have been paid for the employee by the customer. After all, taxes are withheld from payments under civil contracts.

05.10.2020 at 13:48

Yulia Bocharova (KadrofID: 115423)

Tell me whether the amount of contributions should be included in the contract amount, or whether the amount should be included with personal income tax. Now there are disagreements in the institution on this issue. Previously, the amount with personal income tax was indicated, but a new chief accountant came in and now we are calculating all taxes.

10/24/2020 at 07:04

Juliana (KadrofID: 116010)

If I am registered with the Employment Center and receive unemployment benefits and I have registered for a job or part-time job under a GPC agreement, can I lose my benefit payment for the past month? Does the employment center have the right to suspend benefit payments?

02.11.2020 at 15:09

Roman (KadrofID: 116273)

The GPC agreement specifies the amount of 10,000 rubles, after signing the work acceptance certificate, I receive 8,700 rubles, that is, only personal income tax is withheld, and the article states that the employer must pay contributions to the Compulsory Medical Insurance Fund and the Pension Fund. Is this possible or have I misunderstood something? And also, how should my work be reflected on the tax website?

06.11.2020 at 02:01

Sergey Antropov (KadrofID: 5)

Yulia, as far as I know, the contract specifies the amount that includes personal income tax. Tax is withheld when paying money to individuals. face. I think that this can be stated in the documents as a separate paragraph.

07.11.2020 at 22:00

Sergey Antropov (KadrofID: 5)

Juliana, a citizen loses the right to receive benefits after employment. Because ceases to be unemployed. If I understand your question correctly, you have already received what was paid earlier and are not obligated to return it. But since you started working, you no longer have to receive benefits.

07.11.2020 at 22:01

Sergey Antropov (KadrofID: 5)

Hello, Annushka24! When paying money to individuals. For individuals, organizations act as a tax agent and must withhold and transfer taxes to the budget themselves. I assume that the organization for which you worked did not officially carry out the contract and did not pay taxes, and therefore does not want to issue you a certificate. If you worked somewhere else, try to get a certificate there to receive a personal income tax refund.

07.11.2020 at 22:20

Larisa (KadrofID: 116709)

Hello, how can I get Azerbaijani citizens to work for an individual entrepreneur on a patent if they do not have SNILS?

11/13/2020 at 18:41

Vladimir (KadrofID: 116906)

Hello, the employment center sent a letter demanding the return of the paid benefits due to the fact that I was working at that time under a civil service agreement. It turned out that since last year I have been accruing experience at Yandex LLC without payments. What can I do? Can I be sued or forced to return benefits?

16.11.2020 at 21:21

Tatiana (KadrofID: 118674)

I worked under a GPC contract and am a pensioner. I moved to another region and submitted documents to the Pension Fund to reimburse the relocation costs. The Pension Fund requires a certificate stating that I did not receive these payments from the organization with which the GPC agreement is concluded. Is it legal for the Pension Fund to require such certificates and is the organization obligated to issue them?

12/14/2020 at 11:17

Sergey Antropov (KadrofID: 5)

Hello, Vladimir! If you sent a letter, then this question will not be put on hold. It’s better to react, come to the employment center and figure everything out. If, according to the law, you were not entitled to benefits, because... worked, then unfortunately, the benefits will be required to be returned.

12/19/2020 at 12:58

Sergey Antropov (KadrofID: 5)

Hello Tatiana! The Pension Fund of the Russian Federation is a state structure and must act in accordance with the laws. If they ask for a certificate, it means they need it. Therefore, it is better to provide it. The organization must issue it, there are no obstacles to this.

12/19/2020 at 12:59

DMITRIY KOLESNIKOV (KadrofID: 119033)

Is it possible, while working under the GPC, to get another job officially using a work book?

12/20/2020 at 14:31

Annushka (KadrofID: 120205)

Hello. Can I get a job under the civil labor law without resigning from my previous job, where I worked under an employment contract (where I am on maternity leave)?

01/11/2021 at 15:33

Maria (KadrofID: 121179)

Good afternoon Please tell me, if a GPC agreement for the provision of services is concluded with an individual occasionally (2 times a year or once a year), will an employment relationship be considered in this case? The agreement is concluded of a purely civil nature; the frequency of concluding such agreements with the same person is simply not clear. The term for completing services is about 10 days.

01/25/2021 at 21:46

Maria (KadrofID: 121179)

Hello, DMITRIY KOLESNIKOV! Yes, you can, since according to the GPH agreement you perform certain work or services are provided, this is regulated by civil law, not labor law. You have the right to enter into labor relations and these relations, accordingly, will be regulated by the Labor Code of the Russian Federation.

01/25/2021 at 21:54

Maria (KadrofID: 121179)

Hello, Annushka! If you are not a civil servant, you can enter into a civil contract. State owners are increasingly strict in this regard, since a conflict of interest may be perceived, and most often there is a ban on engaging in other income-generating activities.

01/25/2021 at 22:02

Sergey Antropov (KadrofID: 5)

Dmitry, it’s possible, because... work on GPC may not be the main one.

Annushka, I think so, because... You can work part-time. Just in case, I recommend checking your employment contract and checking to see if there are any clauses prohibiting you from working in other places.

01/25/2021 at 22:34

Sergey Antropov (KadrofID: 5)

Good afternoon, Maria! You need to look at the details, but since the services are provided periodically and not constantly, it seems to me that such a relationship is unlikely to be classified as an employment relationship. You can ask the contractor to register for self-employment and work with him in this status. In this case, I don’t see any risks at all, because... a self-employed person can work with a legal entity without any problems. persons and provide them with services at any frequency. You can read more about this mode in the article:

02/06/2021 at 15:00

Alexander (KadrofID: 124264)

I work under a GPC agreement. The customer pays for my services monthly after signing the Certificate of Work Completed. At the moment I am busy looking for another job where I want to get a job according to the Labor Code of the Russian Federation. Accordingly, I want to terminate the GPA, but the terms of termination are not specified in the contract. But there is a general term of the contract in the subject of the contract. The question is whether I have the right to terminate the contract without paying any compensation to the Customer BEFORE the expiration of our contract. I have a GPA until December 31, 2021, and for example, I will find a job in the summer of 2021. Will I be able to calmly terminate the GPA without losses for me? Thank you

03/15/2021 at 21:47

Sergey Antropov (KadrofID: 5)

Alexander, the GPC agreement can be terminated by agreement of the parties. If the customer agrees to terminate the relationship with you, then draw up a corresponding document. In it, write down that the parties have no claims against each other, and all other conditions that are important to you.

03/21/2021 at 19:06

Alexandra (KadrofID: 126088)

Good afternoon. Tell me, how can I conclude a GPC agreement with a citizen of another country (Kazakhstan, Belarus, Ukraine)? What taxes do you need to pay? What are the risks for the customer and the contractor? On the basis of such an agreement, can a citizen of another country stay on the territory of the Russian Federation for longer than 3 months, if a period for completing the work is prescribed (six months, a year)? Will the GPC agreement have the same force as the TD for migration? Is it possible to draw up such an agreement between relatives, one of whom has a Russian passport?

04/20/2021 at 09:22

Sergey Antropov (KadrofID: 5)

Good afternoon, Alexandra!

As far as I know, it is possible to draw up a GPC agreement with a citizen of a country that is part of the EAEU (Russia, Belarus, Armenia, Kazakhstan and Kyrgyzstan) without any problems. The performer is required to have a passport (if it is in a foreign language, then a notarized translation of the document), a migration card and a license (if the performer’s activities are licensed). At the same time, citizens of the EAEU member countries do not require a patent or work permit.

The Ministry of Internal Affairs must be notified of the conclusion and termination of a civil process agreement with a foreign citizen.

If the performer is a resident of Russia (that is, is on the territory of the Russian Federation for 183 days or more during the year), then the personal income tax rate will be 13%. If he is a non-resident, then 30%. Insurance premium rates, as far as I know, are the same as for Russian citizens.

04/24/2021 at 11:29

Irina (KadrofID: 126474)

Tell me, is the existence of a Civil Legal Agreement (CLA) without receiving income for a certain period of time equivalent to conducting business during this period? After all, in fact, since there is no income, then there is actually no activity! Having left my main job, the GPC agreement for joint activities (application of loans from the bank) remained unclosed. I closed it 2 weeks later. The employment center considered this to be my last place of work and prescribed a minimum allowance, although I provided all the income certificates from my main place of work. Is it possible to challenge the decision of the central office?

04/28/2021 at 11:43

Sergey Antropov (KadrofID: 5)

Good afternoon, Irina! Lawyers can give an exact answer to this question. I can assume that the actions of the Central Bank in this case are legal, since the presence of a GPC agreement means that the person works somewhere.

05/01/2021 at 16:10

Alex (KadrofID: 129916)

Hello. The spouse is temporarily unemployed, which is why her parents lose the right to a subsidy for housing and communal services. If a wife gets a temporary job under a civil contract, can the employer issue her a certificate of income and are such incomes taken into account in the average income of family members for six months to calculate the subsidy? Thank you!

07/22/2021 at 13:31

Sergey Antropov (KadrofID: 5)

Hello Alex! From the information that I was able to find, it follows that income from GPC agreements is taken into account when calculating subsidies.

07.27.2021 at 23:17

Meerim (KadrofID: 130258)

Hello! I am not a citizen of Russia and worked under a civil contract and now I am in a position. I wanted to register at the hospital. Is it possible to get a medical pole through GPC?

07/30/2021 at 17:47

Sergey Antropov (KadrofID: 5)

Hello, Meerim! As far as I know, foreign citizens have the right to receive a compulsory medical insurance policy. I recommend that you contact insurance companies. They will tell you exactly what documents are needed to obtain the policy.

08/08/2021 at 12:23

[email protected] (KadrofID: 131830)

Good afternoon, can you tell me that I have an individual entrepreneur, but the employer wants to conclude a GPC agreement with me as an individual and not with an individual entrepreneur, is it possible to do this?

09/07/2021 at 05:23

Sergey Antropov (KadrofID: 5)

Hello! Yes, you can. In this case, you work as an individual. the person and taxes on payments will be paid for you by the customer. He will not be your employer, because... The GPC agreement is not an employment agreement. He will be the customer.

09.12.2021 at 23:06

Form and content of a civil contract with an individual - sample

How is the GPA completed? Since it contains quite a lot of conditions that require special reservations, it is always drawn up in writing. It should reflect:

- names and details of the contracting parties;

- subject of the task entrusted to the performer;

- conditions for its implementation (volumes, quality, timing, ownership of raw materials and necessary equipment);

- cost of work, terms of payment for them;

- rights and obligations of the parties (including the condition on the accrual or non-accrual of contributions for injuries);

- procedure for accepting completed work;

- liability of the parties for violations of the terms of the agreement.

To learn about which points in the GAP you should pay special attention to, read the article “Contract agreement and insurance premiums: nuances of taxation.”

A sample civil legal agreement with an individual, executed by a legal entity, can be viewed on our website:

We do not provide a sample of a civil law agreement between individuals, since there are no special rules for its execution. Only the tax consequences will be special for him.

Results

A civil contract is distinguished by freedom in establishing its terms. The parties to such an agreement can be any person. By type, these agreements are divided into those concluded:

- on property transactions;

- in connection with the performance of work and services.

The greatest number of questions are raised by situations where the contractor under a contract for the performance of work (rendering services) is an ordinary individual. It becomes an employee for its customer, but is not subject to the rules of labor legislation, and its income is subject to taxation in a special manner.

Sources:

- Civil Code of the Russian Federation

- Tax Code of the Russian Federation

- Federal Law of July 24, 1998 N 125-FZ “On compulsory social insurance against industrial accidents and occupational diseases”

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Comment on the rating

Thank you, your rating has been taken into account. You can also leave a comment on your rating.

Is the sample document useful?

If the document “Contract for paid services (standard)” was useful to you, we ask you to leave a review about it.

Remember just 2 words:

Contract-Lawyer

And add Contract-Yurist.Ru to your bookmarks (Ctrl+D).

You will still need it!