The insurance policy form has 5 empty lines so that the policyholder can add persons who are allowed to drive a vehicle. However, their number is not established at the legislative level. Consequently, the owner of the car can allow an unlimited number of drivers to drive it. In this case, he will need a compulsory motor liability insurance policy without restrictions.

What it is

OSAGO without restrictions is an insurance policy, the terms of which allow the driver to transfer control of the car to an unlimited number of persons.

A typical contract includes the owner and a maximum of 5 people who are also allowed to drive. As a rule, this is a narrow circle of people: relatives, personal driver, some employees. If the owner wishes to expand this list, this can be done for an additional fee.

However, there are also cases when there is a need to issue compulsory motor liability insurance without restrictions. This means that anyone with a driver's license can drive a car. Such conditions are very convenient for large automobile enterprises and for companies providing taxi services. For legal entities For individuals, the price for insurance without restrictions, which is also called “multidrive”, is often justified and affordable.

This type of insurance is available to both legal entities and individuals. The document is filled out in the same way as a regular MTPL, but in the table where the persons in respect of whom the agreement is concluded are listed, dashes are placed. In the form of the electronic MTPL policy, these columns remain empty. At the top of the table, a check mark is placed opposite the unlimited number of persons allowed to drive the vehicle.

Positive and negative sides

Among the disadvantages of an unlimited policy, it should be noted:

- high cost - a policy that does not provide for a limitation on the number of persons will cost almost twice as much (80%);

- use of the discount for the absence of an accident is only for the vehicle owner.

The advantages of an open contract are:

- The ability to transfer control of the machine to any person who has a certificate of the required category.

- There is no need to contact the insurer each time to add a new driver to the policy.

- The most convenient option for legal entities with a large fleet of vehicles.

In any case, open insurance is popular among vehicle owners due to the convenience and ability to use the car under any circumstances, as well as the more loyal attitude of sellers. Drawing up such an agreement is much easier and faster.

Pros and cons of an open vehicle

An open vehicle has its drawbacks. Despite the fact that such a document in a sense gives freedom of action, not all of its conditions can be considered beneficial. Advantages:

- There is no need to supplement the insurance contract in advance by adding another driver to it;

- It is possible to put behind the wheel any person who has a driver’s license of the appropriate category;

- When registering, you do not need to provide the insurer with the rights of all persons admitted to management;

- If one vehicle is used by a wide range of people, be it relatives or employees of the enterprise, it is possible to arrange a multi-drive in the shortest possible time;

- It is advantageous to take out open insurance at a young age and with little experience.

Let's simulate a situation: the policyholder attends an event on the other side of the city and drinks alcohol. For some reason, it is inconvenient for him to leave the car so far from home. If a motorist has compulsory motor insurance without limiting the number of drivers, he can call any relative, friend, acquaintance, employee, etc. and ask him to drive. Using a regular policy, the owner will have to visit the insurance company in advance and add another driver to the document who can drive his car, which is difficult to provide for in the current situation.

Now let's talk about the disadvantages of an open auto citizen. Perhaps someone will consider them insignificant against the background of the listed advantages. So, the disadvantages of OSAGO insurance without restrictions:

- The driver's bonus-malus coefficient (BMC) is not taken into account. Only the accident-free rate of the policyholder and the vehicle is taken into account, and not of all persons allowed to drive.

- When calculating the cost of open insurance, the increased CO ratio is taken into account. Provided that a regular policy is issued, KO=1. When it comes to insurance without restrictions, this figure increases to 1.8. Thus, its cost increases by as much as 80%.

The use of the KO coefficient is regulated by Directive of the Central Bank of the Russian Federation No. 3384-U. This document indicates the values of this indicator for a regular policy and for an open motor vehicle policy. In the latter case, the basic cost of insurance is multiplied by an increasing factor of 1.8.

As for the KBM, it can affect the cost of an open vehicle title only if the vehicle title is renewed with the same insurer. Otherwise, it is equal to 1. The amount under the insurance contract may also be reduced due to the driving experience and age of the owner.

OSAGO calculator online

How can I find out the size of my discount?

From January 1, 2013 There is a unified OSAGO database in which data on the accident-free behavior of each driver is stored.

Find out your KBM yourself

You can, for example, through the service

on the RSA website

. Fill in the necessary fields: full name, date of birth, series/number of rights and the very important column “Start date of the contract” here you must enter the date when the policy has already ended, because only after the end of the policy does the RSA database issue a new KBM.

Current situation with technical inspection!

As of July 30, 2012, changes in the maintenance procedure came into force. The diagnostic card was equated to a technical inspection ticket.

Nowadays, after passing a technical inspection, maintenance centers issue a diagnostic card, rather than a maintenance coupon, on the basis of which a compulsory motor liability insurance policy can be issued in the future. It is impossible to buy OSAGO without a valid diagnostic card!

For all our clients who do not have a diagnostic card, we provide assistance in its prompt preparation. For more complete information on this issue, please contact our specialists.

What is the cost of MTPL without restrictions in 2021?

MTPL calculator 2021 will help you find out the price of insurance without restrictions in a particular case.

Many potential buyers of such a policy begin to think and doubt whether it is profitable to issue it? After all, the traffic police rarely stops a car, and the fine for lack of insurance is relatively small. We recommend that you resolve the issue with the policy once and for all, because the cost of compulsory motor liability insurance without restrictions is approximately one and a half times higher than usual. The difference is really negligible! When calculating the amount, a correction factor of 1.8 is used. However, the difference with the price of a regular policy is not so significant.

How much does OSAGO cost without restrictions?

As mentioned earlier, an open policy costs an order of magnitude more than a standard insurance contract with a pre-agreed list of persons allowed to drive a vehicle. What is taken into account when calculating the cost of a car license:

- basic cost of insurance (for each category of vehicle there is its own tariff established by law);

- power characteristics of the car;

- territory coefficient (different for each region);

- bonus-malus coefficient of the car owner and all registered persons;

- number of persons allowed to drive a vehicle;

- age and driving experience of the policyholder;

- seasonality of vehicle operation;

- insurance period;

- whether there were violations of traffic rules and compulsory insurance rules, which are regulated by law.

For example, the cost of insurance for a passenger car with a limited number of permitted drivers over 22 years of age and with more than 3 years of experience is approximately 8,500 rubles. Then, all other things being equal, an open vehicle license, which does not provide a list of persons who have access to driving the vehicle, will cost 15,300 rubles, which is 80% higher.

Changes in accounting for KBM

As mentioned earlier, when issuing an insurance policy, the KBM is taken into account. This coefficient changes annually and can either reduce or increase the cost of the contract. It all depends on the number of emergency situations in which the driver got into through his own fault. If there were none during the year, the price of insurance will decrease. If the policyholder is at fault for more than one accident, the cost of the vehicle title may increase.

In a situation with a standard contract, when calculating its value, the bonus-malus of all persons included in the policy with a limitation is taken into account. As for open insurance, only the owner is included in the contract, therefore, when extending the insurance period, only his CBM is taken into account. If a new document is concluded with another insurer, then this coefficient is equal to 1.

Features of calculation of KO

The KO coefficient depends on the type of insurance contract. Provided that a certain circle of persons allowed to drive a car is included in the motor vehicle registration, it does not affect the cost of insurance. If we talk about multidrive, then in this case the KO significantly affects how much more it will cost. Its values are given in the table.

| Type of insurance policy | KO coefficient |

| Standard | 1 |

| Open | 1,8 |

Thus, this indicator increases the cost of open insurance by 80%.

How does unlimited compulsory motor insurance affect other coefficients?

The calculations already indicated the impact of a policy without driver restrictions on other components of the calculation. However, it is worth emphasizing this point separately:

| Coefficient | Dependence on compulsory motor liability insurance without restrictions |

| TB | It does not directly affect, but the insurance company has the right to set the TB value depending on various conditions, incl. restrictions on drivers may also affect |

| CT | Does not affect |

| KBM | Makes it equal to 1, and does not affect the amount of the CBM discount for drivers who are not owners |

| PIC | Makes it equal to 1 |

| KO | Takes values:

|

| KM | Does not affect |

| KS | Does not affect |

How to calculate the cost of a policy without restrictions

You can determine the amount that you will have to pay for compulsory motor insurance without restrictions in the following ways:

- calculate manually using a formula;

- use the online calculator, which can be found on our website above.

The formula for calculating an open vehicle license looks like this:

St = Bt*Kt*Kbm*Kvs*Kpr*Km*Kpi*Kss*Ko*Kn ,

Where

St is the calculated cost of insurance;

Bt – the basic tariff for compulsory motor liability insurance according to the law;

Kt-Kn – coefficients.

All necessary indicators for calculation, namely the values of the base rate and coefficients, are given in the Central Bank Directive No. 3384-U.

In order to calculate the amount of auto insurance using an online calculator, you do not need to know the coefficients. It is enough to enter information about the owner and characteristics of the car in the appropriate fields.

Do I need a power of attorney?

Now powers of attorney have long been canceled. This means that the power of attorney does not need to be presented to the traffic police officer during the inspection. This is confirmed by clause 2.1.1 of the Traffic Regulations, which regulates the list of documents that the driver must have with him.

As for registration, a power of attorney is needed only if a policy is issued at the office of an insurance company. That is, if you need to insure a car that you do not own, you must have this document. It is drawn up by the owner of the car and certified by a notary. You can also order a power of attorney from a lawyer, but you will still need to get it certified by a notary. It's a completely different matter when registering online. In this case, it is enough only to know the passport details of the vehicle owner and the characteristics of the car. If the owner of the vehicle entrusts you with this information for insurance, you can fill out the form above and the insurance will be sent to your email as usual 3-5 minutes after payment.

How to change limited insurance to unlimited?

As a rule, the car owner chooses a certain type of insurance due to significant circumstances. If the situation takes a different turn and there is a need to replace the standard policy with an unlimited one, this can be done at any time during the current insurance period. In such cases, the law remains on the side of the MTPL owner - he can use another insurance program without waiting for the expiration of his contract.

First you need to visit the insurance company and write a statement. It must indicate what changes should be made to the insurance contract. After this, the employee checks the data and calculates the amount that must be paid additionally when replacing the policy. In this case, the old contract is withdrawn, and a new one is given in return - unlimited. If the insurer did not replace the contract, but simply made amendments to the existing document, this is a serious violation that indicates its incompetence.

It is worth noting that the owner will have to pay a considerable surcharge for an open car license. If an open car license is issued by another company, the policyholder pays its full cost.

Guilty without guilt

Our reader, a young car enthusiast from Tula, Andrei, issued an MTPL electronically via the Internet.

However, the policy turned out to be false. I had to buy a new policy and pay an 800 ruble fine for driving without insurance. Kaluga resident Igor Konstantinovich was even less fortunate: he found out that his policy was fake when he became the culprit of the accident. I had to pay for the damage out of my own pocket. This happens: scammers issue policies on false forms.

For example, they use real forms, but from an insurance company that is already closed. They fill out the policy with errors so that it is later declared invalid. Fake websites are being opened on the Internet. When paying with a card, their details may be stolen.

Do I need a power of attorney for a car if the insurance is unlimited?

Multidrive owners often wonder: does the driver need a power of attorney to drive a car? No, according to the established rules, this document is not required for driving. When driving onto the roadway, the driver must have with him:

- driver's license with the appropriate category;

- compulsory car insurance policy;

- vehicle certificate.

After the adoption of Government Resolution No. 116 of November 12, 2012, these are all the documents that you need to carry with you. If the car is the owner of the enterprise, then the driver will need a waybill. It must contain information about the vehicle and the route.

In what cases is a power of attorney still needed? It will be needed if someone acts on behalf of the owner in the following cases:

- registration of insurance;

- concluding a transaction for the purchase, exchange, or donation of a car;

- registration of the car.

KBM

Bonus-malus (BMB) is a driver’s individual discount coefficient for accident-free driving in a specific car. It takes into account how many times the car owner applied for compensation when drawing up a previous compulsory insurance contract.

The cost of unlimited compulsory insurance is calculated based on the vehicle owner’s BMI, that is, only the owner’s personal coefficient is taken into account. However, the value of this indicator is tied not only to the driver, but also to the car. When changing a vehicle under a newly concluded contract, the previous “merits” are reset, and the motorist is assigned the original class 3.

Form form and example of filling out the policy

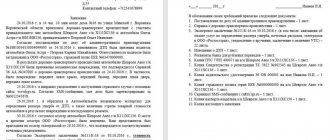

The insurance contract form looks like this:

What the completed insurance policy looks like:

In this example, you can see that the checkbox in item 3 is in the top cell, and the table fields are filled with crosses. But there are other options, for example:

In this case, the lines are simply crossed out.

How to recognize clone sites

It should be remembered that the law prohibits issuing electronic policies through intermediaries; this right is granted only to the insurance companies themselves, reminds Irina Timonicheva.

The list of insurers that can issue electronic policies is published on the official website of the RSA.

Usually the fake website has a design similar to the original one. The domain name differs from the real one by one or more letters. You can find out the address of this website on the official website of the Bank of Russia.

One of the signs of fraud is paying for the policy online, through an electronic wallet. Real insurance companies go through the bank

Recently, the Yandex search engine has introduced marking of insurance company websites. It is a blue circle with a checkmark and the inscription “Central Bank of the Russian Federation”. You can see the icon in the search results next to the company name. The marking confirms that this is the official website of the organization.

Sometimes scammers manage to create the opportunity to switch from a real site to a fake one. Remember that when moving to new resource pages, only the last letters in the address bar should change.

One of the signs of fraud is payment for a policy issued online through an electronic wallet. Real insurance companies usually process payment through a bank.

Advice from the Central Bank

New base rate and tariffs for MTPL 2021

In 2021, new basic values are used to calculate the cost of compulsory motor liability insurance. They have been introduced for all categories of vehicles. Legislation has established the lowest and maximum values of the indicator. Each insurer can choose any MTPL tariff that suits it from January 1, 2021 from a given range.

Attention! The insurer can choose a base rate, and the insurance premium will be calculated according to it. The indicator must be approved by the organization and sent to the Russian Union of Auto Insurers and the Central Bank of Russia. The insurance company does not have the right to change the tariff after this as it wants. Each change must be registered with the CBR and RSA.

The MTPL table allows you to find out about the base rate corridor:

| Vehicle type | Base rate | |

| Minimum value, rub. | Maximum value, rub. | |

| Categories “A” and “M” – motorcycles and mopeds | 694 | 1407 |

| Category “B” and “BE” – passenger cars of individuals | 2746 | 4942 |

| Categories “B” and “BE” – passenger cars used for taxi work | 4110 | 7399 |

| Categories “B” and “BE” – passenger cars for organizations | 2058 | 2911 |

| Category “C” – trucks weighing up to 16 tons | 2807 | 5053 |

| Category “C” – trucks weighing over 16 tons | 4227 | 7609 |

| Category “D” and “DE” - buses used for taxi work or transportation of passengers | 4110 | 7399 |

| Category “D” and “DE” – buses with up to 16 seats | 2246 | 4044 |

| Category “D” and “DE” – buses with more than 16 seats | 2807 | 5053 |

| Trams | 1401 | 2521 |

| Trolleybuses | 2246 | 4044 |

| Tractors and road special equipment | 899 | 1895 |

The change in MTPL tariffs compared to the previous year occurred downwards and upwards for different categories. Thus, for motor vehicles, the figures decreased from 867-1579 rubles.

In what cases are corrections allowed in compulsory motor liability insurance?

Making corrections to the policy, without replacing the document, is possible only in the following cases:

- There are typos and minor inaccuracies. In this case, the correction is confirmed by the entry “Believe Corrected”, the signature of an employee of the insurance company, and the seal of the organization. The date the amendment was made to the document must be indicated.

- When replacing the passport of a technical device or license plates of a car. In this case, new data is entered on the back of the document or in the “Special notes” column. The entry is confirmed by the seal of the organization.

Advantages and disadvantages

Unlimited insurance is offered at a higher cost, so the program is not beneficial to all vehicle owners. Before purchasing it, the policyholder is recommended to familiarize himself with all the advantages and disadvantages that the “multidrive” has.

The main advantages of an open policy without restrictions are:

- The ability to drive a car to any authorized person, without the need to draw up trust papers.

- No additional payment for including additional persons in the insurance, in contrast to a policy with restrictions.

- Thanks to the KMB, the cost can be significantly reduced provided there is trouble-free driving.

- There is no need to contact the insurance company every time if the car is provided to a new person to drive (for example, when hiring a personal driver).

The main disadvantages include the high price (even with a franchise), as well as the lack of control on the part of the owner over who uses the car and when. This increases the likelihood of the car being used by criminals. The owner has to strengthen the vehicle security system.