In order to reform the judicial system and simplify the procedure for resolving economic disputes, a mandatory pre-trial settlement procedure was introduced into the Civil Code of the Russian Federation. This rule is intended to relieve the judicial system of minor cases and claims that can be resolved in a simplified manner with much less financial and time costs.

Due to the low legal literacy of the population, dispute resolution turned into a lengthy routine that overloaded not only state, but also arbitration courts. With the development of economically active entities in the process of their activities, a huge number of unresolved disputes arise.

Their insignificance in terms of claims, the uncertainty of the sequence of claims and the impossibility of settlement under the existing system created serious confusion. Federal Law No. 47 of 03/02/2017 is intended to relieve the judicial system from such proceedings.

It established the mandatory pre-trial settlement as a necessary norm for resolving economic disputes. In addition, this form of resolution allows you to preserve your business reputation and allows parties to the conflict to continue cooperation, bringing business culture to a new level that was previously unattainable.

A bank’s pre-trial claim is a mild requirement to resolve a controversial issue, without sending the agreement to civil proceedings.

Typically, such a claim is sent to the debtor by mail. It does not have legal force, but thanks to it, you can contact collection officers and resolve controversial issues.

How to write a complaint to a bank correctly

In the upper right corner of the application, indicate the recipient's details: full name, position, address of the main bank office. Then indicate who is making the claim. Remember that on paper you need to indicate your full name only in the genitive case (you are answering the question “from whom the claim is being sent”). Indicate the phone number and address of the sender. There is no period at the end of this entry.

Indent a line and write the word “claim” in capital letters in the middle of the sheet. Then state the requirements for the bank in free form.

Claims are considered by the bank in accordance with internal regulations. A bank employee will inform you about the time frame for receiving a response. Make sure that managers register the application and assign it an incoming number.

How to write a claim to a bank for insurance

According to Article 31 of the federal law “On Mortgage”, the borrower is obliged to insure the purchased property in case of damage or total loss. Other insurances are not required, but banks refuse to issue loans to clients without life insurance. Some credit institutions require insurance in case of job loss or require insurance for the borrower and family members. If the bank illegally imposed insurance services on you, file a claim demanding termination of the insurance contract.

In the application, indicate the number of the loan agreement and insurance agreement. Demand the return of the insurance amount. Few people know, but according to Article 16 of the Law of the Russian Federation, you can return the money paid under the insurance contract.

How to write a complaint to Sberbank

Sberbank is the largest financial institution in Russia, and in the technological age, situations arise when equipment failures occur or there is a human factor in problems. This problem can affect anyone. In order to restore justice and resolve the conflict, you need to know how to write a claim to Sberbank and send it.

To properly file a complaint, you should provide a text with a detailed description of the incident and indicating the department number, city, region, date of the event, as well as participants, preferably with positions and surnames. The complaint must contain the essence, for example, unauthorized debiting of funds from a card, etc., and the purpose, say, return of money, replacement of an ATM, or recovery from a negligent bank operator. At the end, you need to indicate the applicant’s contacts - address, phone numbers, email. The claim must be written in 2 copies, one of which the applicant keeps for himself, and the other sends to Sberbank.

Complaints can be roughly divided into:

- Sent directly to the bank.

- Sent to regulatory organizations.

The first option is preferable in most cases. The client will be able to receive a response faster; on the Sberbank website it is possible to monitor the status of the request. It is also worth noting that the principles of decision-making do not depend on the method of transmitting information. The bank considers both requests from bank clients directly and information from the Central Bank of the Russian Federation in the same way.

When contacting directly, the bank has the opportunity to immediately obtain all the necessary information about the client. If regulatory authorities are involved in the proceedings, they will request all information separately. The client must be prepared to provide it.

If you disagree with the decision, the bank client always has the opportunity to challenge the conclusion with the ombudsman service, which reports only to the president of Sberbank.

As for the ways to file a complaint with Sberbank, there are several:

- Bank office

. It is necessary to personally visit any convenient branch of the institution and check with a consultant about the procedure for further action. - Mobile application and web version of Sberbank Online

. A bank client can write a complaint directly in the application (services “dialogues” or “letter to the bank”, “feedback” page). - Contact by telephone

.

Internet call in Sberbank Online, or application by phone: 900

,

+7 495 500 55 50

.

Sample claim to bank

To send a claim to the bank, on the official resource of this financial institution, a special electronic form is attached - a sample. It must be filled out in accordance with the points of the form.

The sample complaint to the bank contains optimal columns for the most complete information and competent filing of the complaint. Not everyone knows how to correctly express their dissatisfaction, but the form is easy to fill out.

Any bank strives to improve its work and service in order to attract customers. For this reason, claims are processed promptly, and decisions are made, in most cases, in favor of the applicants, if the bank employees are indeed guilty.

Pre-trial claim to the bank

A document in which participants in financial relationships demand the elimination of a violation or fulfillment of obligations under an agreement is a pre-trial claim to the bank. Such letters can be sent by both banks and clients. For example, the bank may require the deposit of funds, and the borrower may restructure illegal or hidden fees.

In agreements concluded between a credit or financial institution and a client, there is always a clause that states that any dispute must be resolved in a pre-trial format. To do this, the parties send claims with a detailed description of violations of articles of Federal laws and other regulations, with a requirement to resolve the situation.

The deadline for consideration of the complaint is specified in the letter. After this time has passed and if one of the parties ignores the claim, you should contact the judicial authorities.

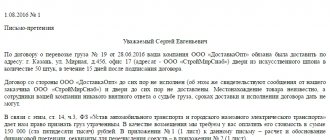

avtoperevozki.png

Third letter: for a refund from the supplier

A letter requesting a refund for a product is no longer so much an application for a refund as a full-fledged financial and legal claim, which must be formalized accordingly.

The content of this letter, which in turn can subsequently become a documentary argument when considering a claim in economic arbitration, must necessarily include:

- a footnote to the provisions of the Goods Supply Agreement,

- indication of non-arrival or inadequate quality of goods;

- failure to fulfill obligations by the supplier regarding compliance with delivery deadlines.

This type of claim for a refund implies the mandatory availability and provision of supporting documents to the bank - a supply agreement and a reconciliation report.

Reasons for filing a complaint

The reasons for filing a claim with the bank may be different. For example, rude staff service or technical failures in the operation of ATMs and terminals, as well as more serious violations of Federal laws.

In most cases, clients demand the return of illegal commission fees under loan agreements that were canceled by a ruling of the Arbitration Court. Well, who wants to voluntarily part with money?

Quite often, outrage is caused by illegal debiting of funds for services that the client did not order. Among the dissatisfaction is the incompetence of bank employees and tellers who provide inaccurate information on certain financial products and services. Also, irritation is caused by the imposition by bank employees of services unnecessary to the client, and annoying advertising SMS mailings from banks. More and more claims are coming from customers who have suffered as a result of fraudulent activities of third parties.

About additions to the application for a refund

Although the main document when applying for a refund is a Letter, it is not always recognized as a self-sufficient document.

In a number of cases (when returning funds for goods, excessively transferred money), the bank can and has the right to request additional documents such as:

- supply contract or agreement;

- Act of reconciliation;

- a copy of the invoice;

- a bank statement indicating that funds have been debited from the payer’s account;

- and so on. settlement and payment documents.

Rules for serving a claim

The rules for submitting a claim to a banking institution provide for several methods.

- Personal delivery of the claim to the manager or employee, who must record the letter as an incoming document, with the number and date of receipt of the correspondence. The client must keep one copy of the claim with the seal and signature of the person accepting it.

- The claim can be sent by mail to the local address of the legal entity, necessarily by registered mail and preferably with return receipt requested. In this case, the receipt of payment and the receipt of the notification must be retained as evidence in case of litigation.

Contracts usually indicate the deadline for filing a claim on a particular issue and the time for resolving the dispute. However, not everyone always responds to complaints in order to resolve the conflict. But this does not mean that it is impossible to achieve justice and eliminate violations.

What to do if blocked

In case of blocking, most citizens prefer to call the bank, confirm the transaction or provide documents indicating the legality of a particular transfer.

However, not every blocking is without consequences for the bank client. Thus, if the card is blocked, the client may be left in a hopeless situation abroad, be late for a flight, disrupt a business meeting, or not pay for a necessary purchase.

In this case, the client has the right to present a claim to the bank or file a claim in court. Practice shows that the majority of such cases are won by bank clients.

Where and how to complain

You can write a complaint or claim regarding violations of consumer rights, laws, or unlawful actions of banking structures to several authorities that supervise the financial environment.

Where and how to complain, if necessary? You can send a complaint to:

- Rospotrebnadzor. Through the official Internet resource, in person to the regional Office, Russian Post.

- Central Bank of Russia. In electronic form on the official website, personally submit to the Headquarters or regional division, by mail.

- Roskomnadzor. To the online reception on the Roskomnadzor website, in person to the regional office or by mail, by registered mail with acknowledgment of delivery.

- Federal Antimonopoly Service. Via the Internet resource or its regional office, send by mail, or take it in person

- Financial Ombudsman. In writing or via the official Internet.

Bank website

On the official website of the credit institution there is a form for citizens’ requests. With its help, you can ask any question regarding the work of the bank or bring your complaints to its management.

The description of the problem should be limited to 5 thousand characters or a letter in text format should be attached to the request. The situation is described briefly and concisely, but in detail. The letter should indicate the number of the department where the applicant’s rights were violated, the names and positions of the employees who committed non-compliance with the law, and the date of the incident.

There it is also permissible to complain about the unprofessionalism of a Sberbank employee or about the service. Without providing details, the problem cannot be resolved. The applicant must clearly formulate the requirements - the result he wants to receive: an apology, a refund, recalculation of the debt or interest.

All requests are assigned a number by which its movement and the presence of a response are tracked. The form must indicate the email address to which the bank sends a letter with the results of studying the application.

Rights of the debtor and obligations of the creditor

In the process of financial and commercial relationships, the parties automatically have both the rights of the debtor and the obligations of the creditor. In the stereotypical thinking model, rights are associated with the lender, and responsibilities with the borrower. However, both one and the other party have both rights and obligations.

Regardless of what is stated in the agreement with the bank, the debtor has the right:

- defend your interests by all legal means;

- demand a reduction in the interest rate on the loan;

- for the return of insurance and hidden fees on a cash loan;

- for early full or partial repayment of the loan;

- for termination, re-registration or deferment of loan payments.

The creditor, in turn, is obliged:

- provide funds in the stated amount and on the terms specified in the agreement with the borrower;

- inform the borrower about all changes to the agreement and debt payments;

- maintain confidentiality regarding the client's financial situation.

Contents and structure of the claim

Although none of the legal acts of the Russian Federation regulates the form and procedure for presenting information in a claim, certain rules will still have to be followed when drawing it up.

The document must contain:

- details, or header - data of the recipient of the claim, address and full name of the responsible employee, if necessary;

- applicant’s data – in addition to the standard decoding of full name and address, you can indicate the number of the concluded agreement;

- name of the document - if it contains the word “claim”, then there will be one less step on the path to filing a claim in court;

- statement of the essence of the problem and calculation of material requirements;

- the time frame within which the client proposes to the bank to correct the violations (this point is also mandatory if the consumer intends to go to court);

- date of compilation and personal signature of the applicant.

Important! When applying, it is better to refer to the norms of local regulations, a signed agreement or legislation. But their absence cannot become a reason for refusing to consider the issue or fulfilling obligations. The bank’s negative response, on the contrary, must be reasoned and based on the “letter of the law.”

In case of violation of consumer rights

The main types of violations of consumer rights when interacting with banking organizations relate to:

- imposing additional services, optional services or insurance;

- providing false information about rates and tariffs;

- hidden commissions and payments;

- violation of terms for the provision of services (transfer of payments, issuance of funds or return of deposit).

In accordance with Art. 29 of the PZPP, a defrauded consumer has the right to demand from the bank:

- compensation for losses incurred (including penalties and penalties for obligations to third parties or the state budget), if they were caused by a delay in the provision of services;

- refusal by the client to fulfill the terms of the contract and its termination without applying the sanctions prescribed in it;

- reducing the cost of services by excluding from the contract clauses containing requirements that contradict the law.

In the paper sent to the bank, all material requirements must be immediately stated, otherwise the financial institution will limit itself to minimal measures. Then, to recover the full damage, you will have to start the claim process all over again.

Claims of this kind must be considered within 10 calendar days, Art. 31 ZPPP.

Lending terms inconsistent with the borrower are a common cause of complaints and claims.

In case of repayment of the loan

In situations where the bank illegally debited funds from the current account to repay a loan payment, doubled or “lost” the payment, improperly charged a commission for early repayment, or increased the rate contrary to legal requirements, the period for consideration of the claim will be longer. Usually this period is established by an agreement with a credit institution, but cannot exceed those specified in Art. 12 of Law 59-FZ (no longer than 30 days from the date of receipt of the application from the citizen).

In addition to the legal basis for the client’s position, the claim letter must contain information about the dates and amount of transfers made, as well as the necessary calculations. If this section seems too lengthy, it can be prepared as a separate annex.

Important! It is useless to challenge the transfer of funds to repay a loan if it was made on the basis of a court decision that has entered into force or the client’s written consent to direct debit from a debit account.