Civil Code in Art. 421 gives citizens freedom to enter into agreements. That is, no one can be forced to sign an agreement. When it comes to a transaction where one party is the consumer, this right is supported by Art. 16 of the Law on Consumer Protection (CPR).

The norm prohibits obliging the buyer to purchase a product or service together with another. Nevertheless, buyers often have to face the situation of imposing additional services. Let's figure out what it is and how to deal with it.

Legislation of the Russian Federation

Article 421 of the Civil Code of the Russian Federation reflects the fundamental principle according to which the parties to the contract are free to choose any conditions that do not contradict the law. Compulsion to enter into an agreement is unacceptable, except in legally established cases.

The Civil Code of the Russian Federation, the Code of Administrative Offences, the Law on the Protection of Consumer Rights and other special norms establish the procedure for concluding public transactions. Its goal is to prevent infringement of consumer rights.

Dear readers! To solve your problem right now, get a free consultation

— contact the lawyer on duty in the online chat on the right or call: +7 (499) 938 6124 — Moscow and region.

+7 (812) 425 6761 — St. Petersburg and region. 8 (800) 350 8362 - Other regions of the Russian Federation You will not need to waste your time and nerves

- an experienced lawyer will solve all your problems!

When a service or product is considered imposed

Entrepreneurs (legal entities) extracting additional profit insist on their demands by:

- Concluding a deal on unfavorable terms. The buyer (recipient) is forced to purchase an accompanying item along with the necessary product. The price increases by the cost of the unnecessary product.

- Refusal to conclude a public contract. For example, insurers refuse to enter into a MTPL contract without a set of additional services attached to it.

- Carrying out work without the customer’s consent and demanding payment in excess of what was agreed upon. The situations are most often found in household contract agreements.

- Termination of an agreement unilaterally as a penalty for failure to fulfill obviously illegal obligations. For example, realtors enter into exclusive agreements, according to which property owners are prohibited from putting their property up for sale on their own.

- Inclusion of an illegal penalty in the terms of the contract. Example: a consumer leaves a deposit for a deferred item, and if the transaction fails, it turns into a fine.

- Carrying out warranty service work in exchange for the purchase of additional services or goods.

Attention! These situations should not be confused with legal actions:

- Offering a set of items assembled by the manufacturer and offered as a complete product (for example, a sushi making kit).

- Selling one product with another as a gift.

- Availability of interconnected services. An example would be the actions of a bank to insure a loan provided against non-repayment by the client.

Consumer rights

When concluding a public contract, the rights of the buyer must be respected:

- do not interfere with free will;

- take into account the interests of the acquirer;

- provide all necessary information;

- do not offer products using prohibited methods;

- the terms of the contract should not be deliberately unfavorable;

- exclude restrictions not provided for by law;

- do not cause losses.

Actions of the buyer (customer) whose rights are infringed:

- refuse to conclude the contract and return the money;

- require a legal agreement;

- invalidate the transaction;

- recover losses incurred, moral damages;

- take measures to restore rights;

- seek protection.

Informing about refusal to perform an operation

The State Duma also adopted in the first reading amendments obliging financial institutions to inform their clients about the refusal to carry out a transaction.

According to current legislation, such refusals are possible in cases where, for example, the bank considers a particular transaction suspicious or was unable to obtain documents confirming the user’s integrity. At the same time, the credit institution is not obliged to explain to the client the reasons for blocking the account or refusing to carry out the transaction.

As a result, blocking a current account without warning may result in the company being unable to pay suppliers or pay salaries to employees on time.

It is reported that this bill was developed on behalf of the President after his meeting with women entrepreneurs, held on March 7, 2018.

In accordance with the draft law, the bank will be obliged to provide the client with information about the reasons and time for making such a decision within 5 working days from the date of refusal to carry out a transaction. About the author

Olga Pikhotskaya is a financial expert. Higher education with a degree in Finance from the Donetsk National University of Economics and Trade named after Mikhail Tugan-Baranovsky. She worked for five years at the First Ukrainian International Bank. Olga has a certificate from Home Credit Bank for completing training under the FinClass program. In 2021, she confirmed her knowledge by receiving the “Chief Financial Analyst” and “Outsourced Financier” awards from the Bank of Russia. [email protected]

Is this article useful? Not really

Help us find out how much this article helped you. If something is missing or the information is not accurate, please report it below in the comments or write to us by email

Imposition of services

It is difficult to prove violations and defend rights without the help of a specialist. It is easier to prevent a problem if you have information about its sources.

By phone

In situations where advertising is illegally turned into a service, money is debited, and the rights of the communication recipient are infringed by the actions of advertisers or telephone scammers. Mailings do not apply to them, because... do not incur material losses.

When issuing a loan

Common violations of consumer rights in accordance with Article 16 of the PZPP in the banking sector occur when issuing loans:

- Inclusion of account servicing fees in the main agreement. This function is a loan account agreement and cannot be included in a loan document. The commission is introduced only by agreement with the client.

- Establishing restrictions on the disposal of funds. This restraint is manifested in the bank defining an unfavorable condition for the client, according to which the date of fulfillment of the payment obligation is considered to be the time of receipt of funds into the bank account. By law, the execution date is the moment the money is deposited into the client’s account opened by the financial institution for these purposes.

- The presence in the loan agreement of a condition on additional paid services received without the client’s consent. For example, a bank joins a borrower to a life and health insurance contract and collects compensation for the insurance premium.

Mobile operator

Telephone violations are directly related to the operator, who changed the tariff and/or added additional options without the will of the subscriber. They usually learn about the imposed service after payment has been issued.

Housing and communal services

The law defines a minimum list of services and work provided by the management company. Outside the list, all additional activities are provided based on the decision of the general meeting of residents or under an individual agreement with a specific owner.

For example, security of the territory and maintenance of the intercom are provided by agreement with the residents.

Medical institutions

The provision of medical care is often accompanied by additional services, which include the following:

- help is not actually needed, but is accepted by the patient out of ignorance;

- instead of free manipulations, commercial ones are offered, but the contract is not drawn up and the client’s refusal to use preferential domestic drugs is not accepted;

- they bill for work that was not initially specified, but was performed by the physician at his own discretion. In case of financial difficulties, they offer to apply for a loan;

- are invited to undergo a free consultation, which turns into trial procedures at a discounted or full price.

Failure to comply with government regulations

The number of charges related to failure to comply with legal orders of state control (supervision) and municipal control bodies on time will be significantly reduced. Now Art. 19.5 of the Code of Administrative Offenses of the Russian Federation provides for 47 compositions, including a general one. For each special offense, the punishment is more severe than for the general offense.

A similar article of the draft contains only one general clause (the amount of the fine will not change), from which there are only three exceptions. We are talking about failure to comply with the instructions of the regulatory authority on time: - in the field of procurement; — state defense order; — media, mass communications, information technology and communications (only for telecom operators).

In other chapters of the project, several more allegations of non-compliance with regulations (in particular, the Central Bank of the Russian Federation) are recorded. Nevertheless, we believe that even with these few provisions taken into account, large fines for failure to comply with regulations will be imposed less frequently than now.

How to refuse an imposed service

The sequence of refusing forced options is the same in all cases.

- Require timely information to make the right choice.

- If you independently discover an imposed service, you should refuse the unnecessary service and offer to voluntarily eliminate the violation with reimbursement of expenses.

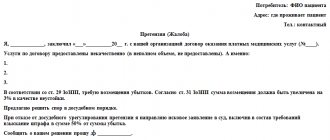

- Submit a written claim outlining all the circumstances of the case, calculations of the losses incurred and a request for their elimination.

- If results are not achieved, complain to supervisory and/or judicial authorities.

Important! All actions and documents proving infringement of consumer rights should be recorded in writing, using audio or video recordings, and witnesses should be involved.

Nuances that arise in specific situations

By telephone Distributors of advertising by telephone know that they can advertise products only with the consent of the subscriber.

To avoid problems, they will stop calling if you ask them to do so and warn them of the possible consequences. It will be possible to influence very annoying distributors or those using auto-dialers only by sending a complaint to the administrative authorities (Rospotrebnadzor, FAS).

To recover damages incurred due to the time-based payment system for telephone communications during the period of advertising broadcasting, present a claim to the violator with a transcript of calls from the operator.

Housing and communal services

Amounts billed on housing and communal services payment receipts that go beyond the established limits can be checked by requesting decrypted information about the charges from the management company. The response will show whether there are forced services that can be refused in writing.

Mobile operator

The contracts fix the tariff and the entire list of services. In practice, when selling a SIM card, documents in fine print are required to be certified. Usually no one reads them. The mobile operator abuses this by including unnecessary options. Only after a written request or complaint are violations eliminated.

When receiving loans

In relations with banks, situations with infringement of consumer rights are resolved on the basis of established judicial practice. Before concluding a contract, you must carefully (preferably with a specialist) study the terms. Under the current contract, you can file a claim or go to court.

Medical institutions

The peculiarity of relationships with medical institutions is that in almost all cases they voluntarily eliminate violations of consumer rights in order to avoid inspections by Rospotrebnadzor and compensation, in addition to losses, for moral damages.

It is enough to record a violation and file a claim.

How to restore violated rights

If a consumer has discovered certain violations of his legal rights by a seller or organization providing services, he can request compensation for illegal fees. When the violating organization refuses to satisfy the client’s demands, he has the right to file a complaint about illegal actions with supervisory government authorities.

Rospotrebnadzor

This structure is the main government agency guarding consumer rights. The client may contact Rospotrebnadzor with a complaint about any actions of the seller of goods or services that violate the provisions of Federal Law No. 2300-1.

To do this, an official complaint is filed, which details the circumstances of the violation - in this case, the fact of imposing paid services. After a citizen’s appeal, the institution’s employees, within a month, check the information contained in the complaint and take action against the violator.

Federal Antimonopoly Service

FAS is authorized to investigate violations related to artificially inflated tariffs for services. For example, this applies to the activities of management companies or other organizations. FAS employees have the right to verify the competence of setting tariffs also for communication services and city carriers.

Prosecutor's office

The prosecutor's office should be contacted if the consumer suspects the seller of deliberate fraud for the purpose of enrichment.

Deliberate imposition of paid services, coupled with deliberate misleading of the client, is a classic example of fraud on the part of the selling company or service provider.

Court

The judicial authorities are the most extreme authority, rendering its verdict on the fact of the identified violation. The consumer himself or the prosecutor's office or Rospotrebnadzor has the right to bring the case to court if serious violations are detected on the part of a negligent seller. Based on the statement of claim, the judge conducts a hearing on the merits of the case and renders his verdict.

Where to go for imposed paid services

The rights of the victim are protected administratively.

Rospotrebnadzor

The powers of the authority include monitoring compliance with legislation on the protection of consumer rights with the right to initiate administrative proceedings. The complaint received against them will be considered, and measures will be taken to eliminate the violation within one month.

The prosecutor's office oversees compliance with laws, rights and freedoms of citizens. Based on the application addressed to the prosecutor's office, an inspection is carried out, and the materials are transferred to Rospotrebnadzor to initiate an administrative case.

FAS. A claim can be sent to the FAS if the actions of the seller (performer), in addition to violations of consumer rights, involve unfair competition.

How to act as a consumer

In order to protect yourself from the imposition of services on the consumer, you need to perform the following actions.

note

The legislator determines the jurisdiction of the seller when attempting to deceive the buyer. Thus, if the amount of the claim is less than 50 thousand rubles, they are considered by district courts. If the amount is larger, the case is transferred to the magistrate’s court. Read more about jurisdiction - read this article

- Carefully study the contract before putting your signature on it. Some clauses of the contract may assign the consumer the obligation to perform additional actions, and then it will be much more difficult to challenge their completion.

- Before concluding a transaction, find out from the seller or contractor the terms of purchase of goods or provision of services. In particular, you need to find out about the opportunity to refuse additional services and purchases.

- If a consumer has a disagreement with an employee of an organization, the first thing to do is try to resolve it with the help of the manager.

- If it was not possible to resolve the issues that arose orally, then the consumer needs to put his complaints in writing and send them to the head of the organization. The letter is drawn up in 2 copies. One remains with the consumer, the second is sent to the addressee by registered mail with notification of receipt.

- If the requirements set out in the letter are refused, the consumer must contact third-party organizations to protect their rights. Depending on the situation, these may be public organizations, authorities or the court.

The rules for protecting rights from an imposed service are not contained in the articles of the Civil Code of the Russian Federation, but, as in any other case, the consumer will need to prove the existence of violations on the part of the contractor. Evidence may include written documents, audio and video recordings, witness statements, etc.

Responsibility

This is an administrative offense. The Criminal Code of the Russian Federation does not provide for criminal liability for this act. Damages caused are recovered through civil proceedings.

Administrative responsibility is indicated by parts 1 and 2 of Article 14.8 of the Code of Administrative Offenses of the Russian Federation. Punishment in the form of a fine is imposed on an official from 500 to 2000 rubles, and on an organization - from 5000 to 20,000 rubles.

Civil liability arises under Article 393 of the Civil Code of the Russian Federation in the form of compensation for losses for all expenses incurred, including lost profits. The size and existence of costs must be proven by the buyer (customer).

Violation of sanitary and epidemiological requirements

Violation of requirements for buildings, structures, equipment and transport

According to the project, the fine will be for officials from 10 thousand to 20 thousand rubles, for individual entrepreneurs - from 15 thousand to 30 thousand rubles, for organizations - from 50 thousand to 100 thousand rubles.

An alternative punishment for legal entities and individual entrepreneurs will be a ban on activities for up to 30 days. Let us remind you that according to the draft this is the maximum period of the ban. Now business can be suspended for a period of up to 90 days.

The draft provides for the same penalties not only for violation of requirements for buildings and structures, equipment and transport, but also for residential, industrial and public premises.

Now the fine for officials and individual entrepreneurs is the same - from 1 thousand to 2 thousand rubles. Organizations pay from 10 thousand to 20 thousand rubles. Instead of a fine, they may impose suspension of activities for up to 90 days.

Violation of product safety requirements

A new offense is going to be introduced for manufacturers, performers and sellers. We are talking about violation of sanitary and epidemiological requirements regarding product safety. They must be established by technical regulations and documents adopted in accordance with international treaties of the Russian Federation.

Officials will face a fine of 10 thousand to 50 thousand rubles, individual entrepreneurs - from 20 thousand to 50 thousand rubles, companies - from 100 thousand to 1 million rubles. Instead of a fine, they will be able to impose a ban on activities for up to 30 days.

Arbitrage practice

The precedents that have emerged in the course of judicial activity make it possible to highlight the basic procedure for the protection of infringed rights:

- restoration of violated rights by invalidating the contract containing the imposed service;

- reimbursement of expenses incurred;

- punishment of attackers through state coercion.

Being in a position more dependent on circumstances, the consumer must understand that providing complete information about a product (service) prevents the bulk of violations, and protecting rights by professional methods helps to compensate for material and moral damage.

This point is often interpreted very arbitrarily by managers. A citizen who does not understand the law will not always be able to recognize a forgery, so it is better to turn to lawyers.

Dear readers! To solve your problem right now, get a free consultation

— contact the lawyer on duty in the online chat on the right or call: +7 (499) 938 6124 — Moscow and region.

+7 (812) 425 6761 — St. Petersburg and region. 8 (800) 350 8362 - Other regions of the Russian Federation You will not need to waste your time and nerves - an experienced lawyer will solve all your problems! Or describe the situation in the form below:

Insurance

It seems that everyone already knows that banks do not have the right to impose insurance.

It is required only if you take out a loan secured by property. For example, when purchasing an apartment with a mortgage, you need to insure it from damage under Federal Law No. 102-FZ of July 16, 1998 (as amended on August 2, 2019) “On Mortgages (Pledge of Real Estate).” Otherwise, obtaining a policy is voluntary. But there are three important points here.

Without insurance, a loan may not be given

The bank strives to earn more and at the same time tries to protect itself from non-return of money. Taking out a policy allows you to kill two birds with one stone. Without insurance, a loan may simply not be issued. After all, the bank is not obliged to report why you were not approved for a loan.

If you nevertheless succumb to persuasion and take out a policy, you have 14 Directive of the Bank of Russia dated November 20, 2015 N 3854-U (as amended on August 21, 2017) days to cancel it.

You may not notice that you have insurance

It happens that people sign an insurance agreement as part of a general package of documents, simply without knowing it. To avoid getting into such an absurd situation, read the contract carefully. All pages.

As a last resort, you have the same 14 days to refuse.

With insurance, a loan is more profitable

The bank has no right to impose insurance, but it does have the right to encourage you to take out insurance. Let's say offer a lower percentage. With long-term loans, the savings can be impressive.

But do not rush to enter into an agreement with the company that the bank offers you. Typically, each lending institution has several accredited insurance companies, and their prices can vary significantly. Consider the options and choose the best one.

The Lifehacker Telegram channel contains only the best texts about technology, relationships, sports, cinema and much more. Subscribe!

Our Pinterest contains only the best texts about relationships, sports, cinema, health and much more. Subscribe!

SMS notification

This service is useful: when messages about all transactions are received, it is easier to monitor the status of the account and notice if fraudsters have gained access to it. But now many banks have applications that send push notifications. They come to the same phone for free (or for a fee - it’s better to clarify this specifically for your institution). In addition, you may not actively use all cards and accounts, which means you may not need messages for them.

Usually they charge a little for SMS information, but regularly. And the end result is an offensive amount. Keep this in mind before agreeing to connect.

Commissions

Commissions for transactions without which it is impossible to provide the service are illegal. But this does not mean that they do not continue to be imposed on the sly. After all, if you don't get angry or complain, no one will know about the violations. Therefore, keep track of this moment.

But there are also completely legal commissions. For example, you decide to make an early payment on your mortgage. According to the agreement, you must notify the bank about this 10 days in advance, but you don’t want to wait. In order to meet you halfway and transfer money today, they have the right to charge you a commission. Take this into account when you want a little more from an institution than you are entitled to under the contract. Sometimes it's an act of goodwill, sometimes it's a paid service. Calling it imposed is not always correct, but it’s worth keeping in mind.