Refunds for services not provided: law on consumer protection

Basic Law regulating the rights and protection of the interests of the customer No. 2300-1 dated 02/07/1992 (as amended on 06/04/2018).

Article of the Law regulates the consumer’s right to refuse an agreement for the provision of services, provided that the customer will reimburse the contractor for the costs incurred by the latter in connection with the fulfillment of the obligations assigned to him by the agreement.

At the same time, the law gives the consumer of services the right to refuse reimbursement of expenses incurred by the contractor if, within the framework of the concluded contract for the provision of paid services, the contractor violated one or more essential terms of the transaction or the legal requirements for the provision of services. At the same time, the consumer who did not receive the service on time has the right to refuse to perform it and receive a refund for services not provided (Article 28, paragraph 1, 3 of Law No. 2300-1). If the contractor refuses to provide services (if the consumer has not accepted the service), he cannot demand payment and reimbursement of his costs under the contract (Clause 4, Article 28 of Law No. 2300-1).

Is it possible not to return money if you were unable to provide services due to coronavirus?

Due to the spread of the coronavirus epidemic in the country, many public events planned for April-May of this year have been cancelled. At the same time, businesses faced many questions. Do I need to return the advance payment for services not provided? Do customers need to pay penalties and fines? Is it possible to cancel the contract and do without a refund? What should I do? We have analyzed several specific situations.

I am a school photographer and have several contracts to photograph senior classes for April and May. An advance payment of 50% was received, but the shooting was canceled due to the ban on public events. Now clients are demanding a full refund of money under contracts. Am I obligated to return the money?

Yes, you are required to return the prepayment received to your clients. In accordance with Art. 32 of the Law of the Russian Federation dated 02/07/1992 No. 2300-1 “On the Protection of Consumer Rights”, the consumer has the right to refuse to fulfill the contract for the performance of work and provision of services at any time at his own discretion.

In this case, the consumer will have to pay you only the costs actually incurred by you related to the fulfillment of obligations under the concluded agreement. Therefore, if you did not incur any expenses under the concluded contracts, then you are obliged to return to your clients the prepayment received in full.

We planned entertainment events for May and took advance payment from clients. Mass events were canceled due to the spread of the coronavirus epidemic. It was not our fault for non-fulfillment of contracts. Do clients need to return prepayments received?

The customer is obliged to pay only for the services actually rendered to him. Services that were not provided are not subject to payment. At the same time, civil legislation provides for only one situation when the contractor has the right to demand payment from the customer for services not provided.

This is possible only if it is impossible to fulfill the contract for the provision of paid services due to the fault of the customer (clause 2 of Article 781 of the Civil Code of the Russian Federation). For example, when the customer damages the contractor’s equipment or does not show up at the agreed time to receive the service.

Coronavirus, temporary closure of shopping and entertainment facilities and cancellation of public events do not apply to the above cases. Therefore, you, as a contractor, have no grounds for withholding the prepayment made under the contracts.

In order to be exempt from contractual penalties, how can we confirm in court the existence of a force majeure circumstance due to coronavirus?

Various orders, decrees, resolutions and laws of regional and local authorities will help prove in court the fact of non-fulfillment of a contractual obligation due to force majeure. These acts and decrees must directly indicate that the economic rights and freedoms of organizations and individual entrepreneurs were indeed temporarily limited in the region.

Such acts may include, for example, decrees of the mayor's office on the introduction of a high alert regime in the region, acts of local administrations on temporary restrictions on road traffic, on the closure and suspension of the activities of organizations and institutions, etc.

If we are talking about international contracts and agreements, then the circumstance of force majeure in them is recorded and confirmed by the Chamber of Commerce and Industry, which, at the request of the party to the contract, issues a certificate of force majeure (Article 15 of the Law of the Russian Federation of July 7, 1993 “On Commerce and Industry chambers in the Russian Federation").

We are an event studio that provides our clients with services for holding holidays and official events. Due to restrictive measures, the execution of some of the concluded contracts failed. Is it necessary to return the advance payment if the contracts contain a force majeure clause?

The introduction of temporary restrictive measures due to coronavirus can be classified as force majeure, that is, force majeure. However, the presence of force majeure does not relieve the parties to the contract from fulfilling their obligations. Force majeure only exempts from liability for non-fulfillment or improper fulfillment of obligations under the contract.

According to the law, if the contractor proves that the proper performance of the service turned out to be impossible due to force majeure, that is, extraordinary and unavoidable circumstances, he is released from the penalty and fine under the contract, but not from his obligations under it.

In other words, due to the coronavirus, you may not have to pay a penalty or a contractual fine, but you will still have to return the prepayment received.

I am self-employed, providing photography and videography services. For contracts concluded before the introduction of restrictive measures, I took an advance payment from clients. I cannot return it due to lack of money - I have already spent it. Can I request a postponement of the shooting date due to force majeure?

Force majeure in itself is not a basis for changing the terms of the contract at the request of its parties. But the contractor has the right to demand changes in its terms, including the execution period, due to a significant change in the circumstances from which the parties proceeded when concluding the contract (Article 451 of the Civil Code of the Russian Federation).

At the same time, this does not mean that the customer is obliged to agree to the postponement of the contract. In any case, he has the right to refuse the contract and demand the return of the prepayment paid on the basis of Art. 32 of the Law of the Russian Federation of 02/07/1992 No. 2300-1 on the protection of consumer rights.

Thus, the issue of postponing filming to a later date should be resolved by agreement with customers.

We supply construction materials to bases and stores. Due to the closure of manufacturing plants, deliveries of some product items were overdue for several weeks. Are we obligated to pay contractual penalties if contracts contain a force majeure clause?

You can avoid paying a penalty if you prove the following circumstances:

- the closure of manufacturing plants was due to the adopted regional acts introducing a high-alert regime, which also provides for the suspension of the work of these plants;

- you could not purchase building materials from other suppliers (at the same prices and without additional costs that would not suit buyers).

If it is established that you could have purchased and supplied the same products at a comparable price from another manufacturer, you will not be able to invoke force majeure. In this case, the contractual penalty will have to be paid.

Due to non-working days declared by the President, the activities of our organization were suspended. Are we obligated to fulfill previously concluded contracts, the execution of which was already overdue?

Yes, your obligations under concluded agreements continue to apply until they are fully fulfilled. Restrictive measures, including non-working days declared in April and May, can be classified as force majeure. At the same time, force majeure circumstances do not terminate the debtor’s obligation and are not grounds for termination of the contract if performance remains possible after they have ceased to exist. This is directly stated in paragraph 9 of the resolution of the Plenum of the Armed Forces of the Russian Federation dated March 24, 2016 No. 7.

Your clients can refuse the contract and thereby terminate its validity. This right is granted to them in accordance with Art. 32 of the Law of the Russian Federation of 02/07/1992 No. 2300-1 and Art. 782 of the Civil Code of the Russian Federation.

But if your clients do not refuse the contract, then you, as the debtor, after the resumption of your organization’s activities and the lifting of the non-working hours and temporary quarantine measures, will be obliged to fulfill the obligation within a reasonable time. That is, within the new deadlines agreed with clients.

We are a tourist center. In February, we entered into several agreements for the organization of recreation and leisure activities for May 2021. We took an advance payment from clients, which was spent, among other things, on the purchase of drinks and semi-finished products for preparing meals and snacks. Now, due to the coronavirus, clients are demanding a full refund of their prepayment. Should we return the prepayment?

Your clients act as consumers. And according to the law, the consumer, at his own discretion, has the right to refuse the contract for the provision of paid services at any time (Article 32 of the Law of the Russian Federation of 02/07/1992 No. 2300-1). However, this does not mean that you are obliged to return the previously received advance payment in full.

In the event that the impossibility of fulfilling the contract arose due to circumstances for which neither party is responsible, the customer is obliged to reimburse the contractor for the expenses actually incurred by him (Clause 3 of Article 781 of the Civil Code of the Russian Federation).

In your situation, the execution of contracts was prevented by temporary restrictions adopted by the authorities due to coronavirus. That is, we are talking about force majeure. Therefore, you must return the prepayment to your clients, but only in that part that was not spent on organizing recreation and leisure, on the purchase of drinks and food. You are not required to return money spent on fulfilling obligations under contracts.

Is it possible, due to the declared state of high alert, to postpone the execution of a contractual obligation without the accrual of penalties and interest?

A high-alert regime declared in the region does not in itself constitute a basis for postponing the deadline for fulfilling an obligation (if the organization and its counterparties continued to operate as usual). But if, due to this regime, the fulfillment of an obligation has become truly impossible (for example, due to the closure of an organization or the cancellation of public events), then this will be considered force majeure.

In this case, the deadline for the execution of the contract may be postponed by agreement with the customer. In this case, the contractor is not responsible for delay in fulfilling the obligation due to force majeure. Also, the contractor is not liable to the client for losses caused by delay in fulfilling the obligation (clause 3 of Article 401 of the Civil Code of the Russian Federation).

Thus, if your client has not lost interest in fulfilling the contract, the deadline for fulfilling the obligation under it can be postponed without the accrual of fines and penalties.

Refund to the service consumer

The procedure for returning funds for services not provided is regulated by the provisions of Article 28 and the above law, and consists of three main stages:

- establishing the fact of non-provision of services;

- drawing up a claim for the return of paid funds and presenting it to the contractor;

- waiting for the executor's decision and return of the money paid.

If the dispute is resolved peacefully, at the stage of returning funds to the customer of the service, the conflict is considered resolved. If the contractor refuses to satisfy the claim, the service consumer has the right to turn to a third-party organization (this may be a regional or territorial department for the protection of consumer rights, a branch of Rospotrebnadzor, etc.), or to file a claim for consideration in court.

How to write a letter of claim for a service not provided?

The first thing you need to do to get your money back for a service not provided is to write a letter of claim. The document states the following:

- own initials;

- residential address and contact telephone number;

- information about the agreement concluded between the parties (date of signing, type of service and whether it was provided);

- grounds for refund of advance payment for services not provided;

- references to legislative acts.

At the end, the writer of the claim letter for an unprovided service puts down the date and signs.

An approximate sample of a letter of claim in case of violation of terms under a service agreement can be

Sequencing

Making a claim

When writing a complaint to the contractor, you should adhere to the rules for preparing official documents. A correctly drawn up claim sample for a refund for services not provided must contain:

- information about the customer of the service - last name, first name, patronymic (in full spelling), passport details, address, telephone number;

- information about the contract for the provision of services – number and date of the contract, type of service ordered, deadlines for execution, cost of the service;

- information about the contractor’s violation of the terms of the contract for paid services (indicating the volume of unprovided services, refusal to fulfill obligations);

- information about funds paid under the agreement - the amount and form of payment;

- an indication of a violation of consumer rights, which represents a violation of the terms of the contract for the provision of paid services;

- statement of demands for reimbursement of funds.

When writing a claim, it should be taken into account that financial disputes are considered only with the provision of supporting documents, therefore you should attach photocopies of documents confirming the conclusion of the transaction, the fact of prepayment for services that were not provided (agreement for paid services, checks, receipts, payment orders, warranty cards and so on.).

Filing a claim

The claim can be submitted to the contractor in several ways:

- when applying in person - in this case, you should have a second copy of the claim with you, on which the recipient must make a note of receipt, putting the date and time of delivery of the document, and his signature;

- by sending by postal service - in such cases, you should send it by a valuable letter with a notification and a description of the attachment. With this form of filing a claim, proof of its receipt by the contractor will be the post office’s mark on delivery of the item to the addressee in the notification form.

From the moment the claim is served, the contractor is given a strictly limited time to make a decision. The deadlines for the return of funds for services not provided are established by the norms of Art. 31 of the Law of the Russian Federation “On the Protection of Consumer Rights”. The law allows 10 calendar days to make a decision and voluntarily return funds to the consumer. The calculation of the period begins from the moment the contractor receives the claim.

What to do if the service does not meet the stated requirements?

First, try to resolve the issue peacefully. To do this, we draw up a claim - the main condition under which the consumer can defend his rights in the event of their violation.

A letter of claim is submitted in cases where:

— the contractor violated the deadline for providing the service;

— the contractor provided a low-quality service and, as a result, the customer did not receive the expected result.

The content of the claim depends on the specific complaints of the victim, therefore it is drawn up in any form. However, it is recommended to adhere to certain rules when compiling it:

— in the title part, indicate the name of the document and the number of the service agreement;

- in the introductory section - details of the parties (full name, name of the legal entity, actual and legal address, residential address);

- in the descriptive part, provide basic information about the contract and list specific violations of the transaction. This part needs to be given special attention, supported by references to clauses of the contract and laws, photo or video materials, conclusions of experts in a certain field and other arguments confirming the poor quality of services provided;

- state your requirements.

Legislation protecting consumer rights (clause 1, article 29) allows you to require:

- free elimination of deficiencies;

- relative reduction in cost;

- covering the costs of eliminating deficiencies on our own or by third parties;

- gratuitous production of another thing from only-begotten material of the same quality;

- repeated execution (meaning a service of material origin).

Please note! When performing the task again, the consumer is obliged to return the item previously transferred to him by the contractor.

The letter is signed, dated and sent to the place where the poor-quality service was provided or to the address specified in the contract.

Note! The contractor is not exempt from paying a penalty for late provision of services, even if he has satisfied the requirement to eliminate defects free of charge or re-provide them.

The deadlines for eliminating deficiencies and compensating for losses are indicated by the customer in the text of the claim, taking into account sufficiency and reasonableness.

It didn't work out peacefully. What to do?

If the conflict between the customer and the contractor has not been resolved through a claim procedure, the service consumer has the right to go to court to resolve the dispute and make a decision on reimbursement of funds for services not provided.

In this case, the statement of claim in the informative part does not differ from the claim written earlier to the contractor, only the “header” of the document – the addressee – changes, and additional information about the refusal of the contractor to voluntarily satisfy the legal demands of the consumer is added to the statement.

The statement of claim should be accompanied by copies of all evidentiary documents, including the claim previously filed against the executor. The original documents are presented to the court directly during the court hearing.

When filing a claim for the return of funds for services not provided, the plaintiff, in accordance with paragraph 3 of Article 17 of the Law of the Russian Federation “On the Protection of Consumer Rights,” is exempt from paying state duty. At the end of the hearing, if the court decides in favor of the plaintiff, the court will place this burden on the service provider.

Arbitrage practice

There are many examples from judicial practice when the consumer won and fully returned the advance payment for an unused service, and the contractor was also awarded a fine and a penalty. Below is an example of such a case.

An example from judicial practice on the return of funds to the customer for a service not provided

Ivanova N.L. filed a statement where the bank was the defendant. A loan contract was signed with the organization. The terms of the contract included collective insurance against illness, loss of work and force majeure. Having received the loan funds, within 14 days the borrower sent the insurance company a demand to terminate the contractual relationship and return the amount of the insured event. A refusal was received and recommendations were given to address this issue to the bank. The customer did not receive any response to the claim from the financial institution. Then the consumer was forced to go to the judicial authority. The judge ruled that the plaintiff's interests had been grossly violated, citing Article 32 of Law 2300-1. Insurance and monetary compensation for moral damage were collected from the financial organization.

Return of money in accounting

Refunds can be made in two ways:

- in cash – if payment under the contract for paid services was made by the customer in cash;

- non-cash payment – if payment was made from a card or bank transfer, or if the customer specified this requirement separately.

The posting of accounting transactions when returning money deposited in cash at the cash desk and funds transferred from a card or by payment order will vary.

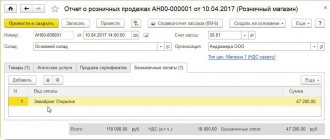

Let's look at an example of how a refund should be processed for services not provided, transactions through the cash register and the bank:

- non-cash payments:

D62.01 K51 – return to the customer of funds received as payment for services. The amount transferred from the account is indicated.

D62.02 K51 – return of advances paid to the customer of services. The amount of the advance payment to be returned is indicated;

- cash payments:

D62 K50.01 – return of cash to the consumer for services not provided.

How is the service paid if the deadline for its provision is missed?

Any service must be provided in compliance with the deadline provided for in Art. 27 Federal Law No. 2300-1. By virtue of this norm, the deadline is established:

- In the contract.

- In legislation regulating the provision of certain types of services.

If the deadlines are violated, due to the requirements of Art. 28 Federal Law No. 2300-1, the customer has the right:

- Assign a new deadline for the performer to fulfill the obligation.

- Refuse services and obtain them from a third party.

- Submit a request to reduce the amount of payment for untimely rendered services.

- Refuse the services of the performer.

The consequence of delaying the provision of services is the possibility of the customer to demand compensation from the contractor for losses incurred. By virtue of Art. 15 of the Civil Code of the Russian Federation, losses are understood as both direct actual damage and lost profits. In this case, the fact of incurring losses will have to be proven.

Service Provider Responsibility

The limits of the contractor's liability for failure to provide services or poor quality provision of services under the contract are established by the norms of Art. 393 of the Civil Code of the Russian Federation, according to which the dishonest actions of the contractor can result in serious financial losses for him - in addition to the direct return of the full amount of funds paid by the customer, the service provider may be required to pay losses, penalties, interest, etc.

Moreover, it should be noted that the concept of dishonest actions of the contractor is considered quite broadly by the provisions of this article, and covers not only compensation for actual damage or lost profits incurred by the customer. In cases where the contractor, having ignored the terms of the contract, forced the customer to enter into a new relationship with another service provider, the court may oblige the contractor to compensate for the difference in material costs.

Consumer rights in case of deficiency in service and work

Make a claim

If the service is provided poorly or a defect is found in the manufactured item, the customer can make claims from Art. 29 of the Law:

— eliminate the defect free of charge;

— make a discount on your order;

— repeat the work or service free of charge with the return of the defective item to the contractor;

— give the order to another contractor or eliminate the defect yourself and demand reimbursement of expenses;

- refuse the order and return the payment - if the defect is significant or is not eliminated within the agreed period.

The requirement is chosen by the consumer, not the performer. Anything from this list cannot be prohibited by contract - Art. 16 of the Law.

For visible defects, the customer makes a claim during acceptance of the work or even during execution. For hidden ones - within the warranty period. Without a guarantee - within a reasonable period of two years, and five - when the result of the work is real estate.

To establish the presence of a defect in the work and its cause, an examination is carried out. While the guarantee is valid, the contractor pays for the examination. The customer shall reimburse the payment if it turns out that the defect in the work was caused by his fault. Without a guarantee, on the contrary: the customer pays, the contractor reimburses if the reason was due to improper execution of the work.

Ask for damages

The consumer has the right to ask for compensation for his losses that occurred due to poor quality of service or work.

Calculate penalties

For violation of the deadline due to elimination of deficiencies or repetition of work, the contractor pays the consumer a penalty in the amount of 3% of the price of the order or stage of work. Penalties cannot be calculated greater than the price of the order or its stage.