What does a cadastral valuation specialist do?

A cadastral specialist performs many functions. He establishes the boundaries of land plots and real estate, conducts an examination of property objects and performs a cadastral assessment of the value of buildings and structures.

To work in this specialty, you must have knowledge in the field of land management and metrology, as well as understand the legal foundations of cadastral activities.

You can acquire the relevant skills and master a profession remotely. Training in professional retraining courses is carried out on the basis of existing higher professional education.

Job responsibilities

The state cadastral appraiser determines the amount of tax that the owner is obliged to pay to the state. The objects of assessment by a specialist can be land plots, as well as any forms of real estate owned by both individuals and legal entities.

The services of independent cadastral appraisers are used when it is necessary to calculate and dispute the amount of real estate tax.

The employee's main tasks include:

- Visiting the site and analyzing its characteristics

- Collection of information on pricing factors

- Grouping by type of use

- Establishment of the tax base

- Calculation of cadastral value

- Determining the market value of an object

- Drawing up an expert opinion and written explanations

- Interaction with executive authorities

- Defense of the conclusion at the request of the court

Career and salary

The average salary of a cadastral valuation specialist is 40,000 – 45,000 rubles per month.

Jobs in this specialty can be found in companies specializing in construction expertise, real estate agencies, as well as departments of the land cadastral service, Rosnedvizhimost and Rostekhinventarizatsiya.

Having experience working with the Rosreestr portal and the public cadastral map is an advantage when finding a job.

Where to study?

At the International Academy of Expertise and Valuation you can obtain the profession of cadastral appraiser in 6 months on the basis of higher professional education:

- One of the most affordable prices in Russia

- Fully distance learning from the comfort of your home

- Diploma of professional retraining of the established form

- Certificate of compliance with professional standards worth 10,000 rubles. For a present!

- Valid license for educational activities

- More than 10,000 graduates from 85 constituent entities of the Russian Federation.

You can find out more details and apply for training here: https://cadastral-assessment.maeo.rf

Tax calculation

Since the task of the Bureau of Technical Inventory is to carry out calculations depending on the cost of real estate, taking into account the costs of its construction and actual wear and tear, the resulting price does not correspond to the actual value. The cadastre, in turn, takes into account many more nuances, including the prestige of the object and comfort. Here the result is closest to the market price, therefore it is most relevant for taxation. In general, this is the main difference between cadastral value and inventory value.

Referring to the Tax Code of the Russian Federation, the amount of real estate tax is formed by subtracting the price of twenty meters of square meters of real estate from the cadastral value. You also have to pay a tax for using a communal apartment, but its amount is half as much, that is, ten square meters are deducted. But for owners of private houses this is already fifty square meters. The number of owners does not matter. Only one tax deduction is levied per real estate property. That is, if two people live in the premises, then they can freely share all rights and responsibilities among themselves.

Briefly about the cost of the cadastre

The main points for assessment according to the real estate cadastre were taken from the land tax. When determining the calculation of this cost, the category of the site, as well as its location, are taken into account. Such an assessment is also necessary for renting these plots, but mainly for calculating the amount of tax payment. The cadastral value is recalculated once every five years.

For land plots, the concept of standard value is used, which is used in cases where the value cannot be determined from the cadastre. But there are also circumstances in which only the standard value is applied, for example, when applying for a loan for the acquisition of a plot of land, including state-owned land.

Local governments are given the right to change this value, but within amounts not exceeding 25 percent, and from the market value - no more than 75 percent.

We recommend that you read:

Tax on cadastral value of real estate

Who has the right to evaluate property?

In order to evaluate real estate, specialized organizations are involved that have the right to engage in this activity and have the appropriate license to carry out this work.

There is one more condition: in order to engage in this type of activity, you must pass a certain competitive selection.

This procedure is set out in the Federal Procurement Legislation. In case of incorrectly performed work and incorrectly determined cost, the appraiser bears the responsibility for the corresponding risks. Insurance is at least 30 million rubles. The condition for receiving public funds for performing this work is the presence of a positive examination of the work performed and the approval of its results.

Challenging, deadlines and shortcomings

It is equally important to know some differences regarding issues of contestation and some other nuances. So, for example, to challenge an inventory assessment, you need to:

- File a claim in court at the location of the property, where the defendant will be the party who conducted the assessment. Legal entities file a claim in the arbitration court;

- Attachment of an inventory passport of the object, title papers for it and an independent examination report (if necessary).

The cadastral valuation is also contested when a claim is filed against the party that carried out the valuation, with the appendix of a cadastral passport, notarized title documents, papers indicating that the value was determined unreliably, and a report on the assessment of the market value, if it has changed.

There are no deadlines for challenging the inventory price, but for challenging the cadastral value, they are six months from the date when the relevant information was entered into the unified state real estate register.

Both assessments have a drawback, for example, the inventory assessment is already outdated, since it was developed back in the 1960s and takes into account few parameters. Cadastral valuation, in turn, is also far from perfect. It requires frequent revision as its relevance often changes.

Briefly about inventory value

Based on the calculations made by BTI employees, real estate is assessed. It consists of the original cost spent on construction, multiplied by the wear rate over a certain period of time. The inventory was carried out as follows:

- Specialists from the Technical Inventory Bureau visited the immediate location of the facility and checked the current state of individual structural elements of the building, including their finishing and the material from which they are made.

- These data were subsequently subject to verification with the original data.

But then the procedure was simplified, and real estate valuation data began to be entered automatically with previously specified coefficients for inflation and time.

If you need to know what the inventory value is, you just have to look at the registration certificate for the property.

Assessment procedure

When interested in the differences between cadastral value and inventory valuation, it is very important to pay attention to the methods used. The Technical Inventory Bureau has been approaching this procedure very scrupulously and methodically for many years. The cadastre does its job much faster. If we look at the step-by-step actions, they consist of:

- The administration makes a decision on a planned revaluation;

- Preparation of a list of immovable objects by Rosreestr that will be revalued (information is available in the unified register);

- Rosreestr's involvement of an appraisal firm on a competitive basis;

- Carrying out the procedure by a cadastral appraiser in accordance with current coefficients and regulatory documents;

- Conducting an examination by a self-regulatory body;

- Receipt of information by local government bodies and their publication;

- Entering data into a single database.

A licensed appraiser, who can be ordered for an independent examination from a special company conducting this type of activity, can explain the difference between cadastral and inventory values.

The essence of different assessments

Cadastral and inventory prices may differ not only in their intended purpose and determination principles. There are some factors that real estate owners need to know.

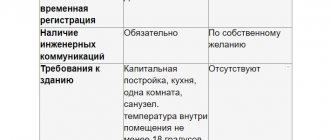

| What is the difference | Inventory | Cadastre |

| Taxation | Calculation of taxes until 2015 | Tax calculations from 2015 |

| Main settings | Costs of construction and construction work, including wear and tear and connection of technical communications | Real estate segment, year of construction, location, area, infrastructure |

| Difference with market price | About 10 times less | 1.5-3 times less |

| What is it for? | Privatization (in some cases), inheritance | Does not play a key role in transactions |

| Who issues | Bureau of Technical Inventory (information until 2013), Rosreestr (since 2013) | Rosreestr |

| Where is it mentioned | Technical passport for the real estate, certificate of inventory value of the property | Cadastral passport |

| Right to receive | Owners, their guarantors by power of attorney, tenants (tenants) | Open information posted on the official website of Rosreestr |

| How to get | Present your passport and title documents | Have access to the Internet |

| Right to dispute price | The information on the basis of which the assessment work was carried out is unreliable | The information on the basis of which the appraisal work was carried out is unreliable, the date of determination of the cadastral value and the market price are the same |

Inventory revaluation

Challenging an inventory assessment is within the competence of government agencies, but the initiator of this procedure is an individual or legal entity who is the legal owner of the object.

The assessment is also carried out by government specialists. Planned - in accordance with the decision of the local government, repeated - at the request of the owner, forced - by court decision. In accordance with federal standards, planned inventory assessments are carried out en masse, geographically. If we are talking about a challenge, the real estate falls under individual consideration by a special commission. Even if the case is sent to court and the plaintiff hired qualified independent experts who gave their opinion, the court must order repeated work to ensure the rationality of the claims.

When revaluing, it is important to keep in mind that planned evaluation work is distributed according to related technical characteristics of apartment buildings. Despite the fact that the evaluation principle is similar, there are several formulas for calculating the price. The final assessment must be displayed in the electronic database of Rosreestr or in the archives of the Bureau of Technical Inventory.

How realistic is the new estimate?

Inventory and cadastral value have something in common. The cadastral valuation includes some parameters that are also important in the BTI assessment. The new system takes full account of;

- Full location of the property;

- Total area;

- Year of construction of the facility and its commissioning;

- Construction material that was used;

- Close location to a water body;

- Distance between the object and the center of the populated area;

- Market price of the property;

- Distance to bus station, railway station;

- Other significant regional factors that influence price formation.

Overall, the difference between the two estimates is clear. However, inventory was used not only in the taxation system. Nowadays it still remains relevant, but in other areas, especially in privatization.

Today, the inventory value is no longer used when setting prices when selling real estate, but the cadastral value is necessarily taken into account. Without it, it is impossible to conclude a deal correctly, since it is impossible to reliably determine the value of the object.