Cadastral valuation of land: procedure and methods for calculating the value of land plots

For many years, the state used the concept of inventory value of land for tax purposes. It was far from the market price, so the amount of land tax turned out to be extremely insignificant. The situation changed dramatically when the concept of “cadastral value of land” entered legal practice, significantly approaching the market price. And now the size of payments tied to the results of cadastral valuation of land may turn out to be impressive. Let's take a closer look at what the features of cadastral valuation are for different types of land, how it is carried out, and most importantly, why it is important that the information in the Unified Register corresponds to the real value of the site.

What is a cadastral valuation and why is it needed? The State Land Cadastre (register) is a systematized and ordered list of all plots of land in Russia. In other words, it is a database of all territories. Each site has its own description and accompanying documents. Total accounting allows you to evaluate land use, identify trends and avoid violations. In addition, each plot of land is also a piece of real estate that can be sold or bought. In this situation, the question of determining value arises. To avoid disagreements, a cadastral valuation of land is carried out.

Cadastral value is one of the main characteristics of a site. Cadastral valuation of land plots allows this value to be identified and officially recorded. This is necessary to solve a whole range of problems:

- At the state level - to create a unified system of taxation of lands that are state or privately owned, which allows for the most accurate calculation of taxes, filling budgets, and making forecasts regarding tax collections.

- At the level of constituent entities of the Russian Federation - for making decisions on the rational use of land, privatization, distribution and redistribution, issuing construction permits - in a word, for effective land management.

- At the level of private owners - for fair calculation of taxes, for determining market value, for purchasing and selling, leasing, investing in land, etc.

Land plots that have undergone cadastral valuation are entered into the Unified Register indicating not only the identified value, but also the owner. An extract from the register is a direct confirmation of the legality of land use. The specified amount is used to calculate property tax. Cadastral valuation of land and real estate is carried out before any transactions: sale, donation, rental. This indicator is necessary for calculating rent for the use of state lands. Based on it, government subsidies are calculated. The cadastral value becomes the starting price when putting up land for auction.

In Russia, a large number of federal laws, standards and regulations relating to land valuation have been developed and put into practice. Among them:

- Land Code of the Russian Federation;

- Federal Law of July 29, 1998 No. 135-FZ “On Valuation Activities in the Russian Federation”;

- Federal Law of July 3, 2021 No. 237-FZ “On State Cadastral Valuation” (in force from 2021, with the exception of the provisions on conducting an extraordinary state cadastral valuation, which come into force from 2021);

- Federal Law of July 24, 2007 No. 221-FZ “On Cadastral Activities”;

- Federal Law of July 13, 2015 No. 218-FZ “On State Registration of Real Estate” (effective from 2021 with the exception of certain provisions that come into force from 2020);

- Order of the Ministry of Economic Development of Russia dated June 7, 2021 No. 358 “On approval of methodological instructions on state cadastral valuation”;

- Order of the Ministry of Economic Development of Russia dated September 20, 2010 No. 445 “On approval of the Guidelines for the state cadastral valuation of agricultural land”;

- Order of the Ministry of Economic Development of Russia dated February 15, 2007 No. 39 “On approval of Methodological Instructions for the state cadastral valuation of lands in settlements”; Order of the Ministry of Economic Development of Russia dated August 12, 2006 No. 222 “On approval of the Guidelines for determining the cadastral value of newly formed land plots and existing land plots in cases of changing the category of land, the type of permitted use or clarifying the area of the land plot”;

- Order of the Ministry of Economic Development of Russia dated December 8, 2015 No. 921 “On approval of the form and composition of land survey plan information, requirements for its preparation” (valid from 2021);

- Order of the Ministry of Economic Development of Russia dated March 1, 2021 No. 90 “On approval of requirements for accuracy and methods for determining the coordinates of characteristic points of the boundaries of a land plot, requirements for accuracy and methods for determining coordinates of characteristic points of the contour of a building, structure or unfinished construction site on a land plot, as well as requirements to determine the area of a building, structure and premises" (valid from 2021); Decree of the Government of the Russian Federation of August 25, 1999 No. 945 “On the state cadastral valuation of land”;

- Decree of the Government of the Russian Federation of April 8, 2000 No. 316 “On approval of the Rules for conducting state cadastral valuation of land”;

- Federal Assessment Standard (FSO No. 1) “General concepts of assessment, approaches to assessment and requirements for assessment”;

- Federal Valuation Standard (FSO No. 2) “Purpose of Valuation and Types of Value”;

- Federal Assessment Standard (FSO No. 3) “Requirements for an assessment report”;

- Federal Valuation Standard (FSO No. 4) “Determination of the cadastral value of real estate objects.”

Thus, laws and regulations determine who has the right to conduct an assessment, how often, by what methods, according to what algorithm, etc. A serious approach allows us to identify the objective value, prevent violations and facts of illegal use or sale of land.

Procedure

Currently, the function of conducting state cadastral valuation of land plots is assigned to the Federal Service for State Registration, Cadastre and Cartography (Rosreestr), which is under the jurisdiction of the Ministry of Economic Development of Russia. Federal Law No. 237-FZ, which entered into force in 2021, provides for the introduction of the institute of state cadastral appraisers and the vesting of powers to determine the cadastral value of state budgetary institutions (GBU). The law assigns responsibility for the work of government agencies to conduct cadastral valuations to regional authorities. According to the new document, assessments according to the new rules in all constituent entities of the Russian Federation will be carried out starting in 2021, but regions, at their discretion, can switch to a new format of work starting in 2021. State assessment of land should be carried out no more than once every 3 years and at least once every 5 years - at the same time for all land plots located on the territory of an administrative-territorial unit. For Moscow and St. Petersburg, the deadline is set at least once every 3 years. The frequency is determined by the changing situation on the real estate market and the general economic situation. The decision to assess the value of land is made by the authorized body of the constituent entity of the Russian Federation, and it also prepares a list of plots. The territory is then divided into assessment zones. Belonging to a particular zone affects the value of the site, determines the conditions for its use, the amount of property tax, while the objects on the site are not taken into account, that is, the site itself is assessed as “conditionally undeveloped”. The following stages of the procedure can be distinguished:

- preparation of an information base: analysis of the local land market, the price range for land plots of various categories and locations, study of legislation, judicial practice, etc.;

- dividing the territory to be assessed into zones and blocks;

- formation and justification of cost indicators that will be used in cadastral valuation; determining the value of land within each zone;

- registration of cadastral land valuation results, entry into the State Land Register.

To obtain objective information about the value of land, correct calculation of tax, sale (purchase) of land for a fair price, etc. A clearly regulated procedure for conducting cadastral valuation of land is required. However, an absolutely clear methodology has not currently been developed, so conducting an independent assessment in a commercial organization often helps to challenge the established cadastral value. If land owners who do not agree with the cadastral assessment of their property were able to challenge it or the registering authority independently identified errors, a recalculation of the land tax (LT) is made.

Methods for assessing the cadastral value of a land plot

In addition to the cadastral value of land, there is the concept of market value. The main difference between a cadastral valuation and a market valuation is that in the first case the value of a group of objects is determined, and in the second - one specific object. This allows you to better take into account all the factors affecting the cost. Taking into account supply and demand, seasonality and competitiveness, both cadastral and market values are determined.

This is a more flexible indicator that reflects factors such as seasonality, competitiveness of the property being assessed, and prices for similar plots. The market value of a land plot cannot exceed the purchase price of a similar property. An important figure for calculations is the specific indicator of the cadastral value of 1 m² of land. It is determined for different categories of land, types of use or individual cadastral blocks based on methodological recommendations for each category. The final cost of the plot is the result of multiplying the area by the specific cadastral value of 1 m² of land. If an object provides for several types of permitted use, therefore, several specific indicators, the maximum is selected among them.

The main factors influencing the cadastral value of a land plot are:

- The type of permitted use is established by acts of state authorities and local self-government.

- Land area.

- Location of the land plot.

The assignment of a land plot to a specific type of use is subject to rules. If real estate objects are located on the land, then the purpose of the site must correspond to the use of these objects.

When assessing land, two methods can be used: income and comparative.

- The comparative approach is used to evaluate typical plots of land whose market value is well known. The approach is based on comparison of information on sales prices of similar land plots (substitution principle). For comparison, 3 to 5 analogues are selected. Accordingly, the approach can only be applied in cases where there are offers on the market for the sale of similar plots.

- The income approach is based on determining the amounts of expected income (rent) from the commercial exploitation of land. They can be calculated based on data on previously received income. Obviously, the method is applicable only to those objects that bring profit to the owner. Regardless of the chosen method, the appraiser uses data such as the presence of infrastructure, communications, type of relief, soil condition, etc. His task is to determine the real price of land as objectively as possible.

Features of cadastral valuation of lands for various purposes

Calculation of cadastral value depends on the purpose of the land plot. So, if we are talking about the state cadastral valuation of lands of settlements, rural and urban settlements, gardening associations, etc., they use data from statistics of market prices for such objects, as well as data from other methods of land valuation. This means that for such sites a comparative approach prevails. Cadastral valuation of agricultural lands located outside urban and rural settlements, forest lands is carried out according to the income approach - the rental income indicator is taken into account. It, in turn, depends on soil fertility, technological properties, location and other factors. For each factor, their own integral indicators are derived. Cadastral valuation of land plots outside the city limits, belonging to other categories, is carried out on the basis of capitalization of estimated rental income (if the land generates income). This, in particular, applies to recreational facilities, subsoil use, etc.

Rules and conditions for making changes to the Unified State Register of Lands

Information on the cadastral value of a land plot obtained as a result of the assessment is entered into the Unified State Register of Lands. However, data may change over time, sometimes before the next assessment is due. For example, a citizen changed the type of permitted use of land and received the right to reduce the amount of tax. However, there will be no recalculation until the changes are reflected in the Unified Register. In order to avoid contradictions that may hinder purchase and sale transactions and other real estate transactions, the law provides for early amendments to the cadastre.

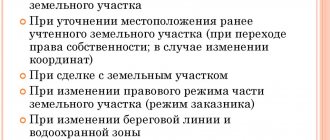

This can be done in the following cases:

- when the area of the site changes;

- when the address or description of the location of the land changes;

- when forest, water and other natural objects appear (disappear) on the site;

- when transferring land from one category to another;

- when restricting or changing the rights of the owner.

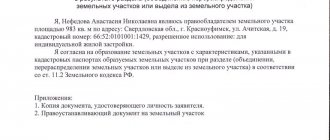

Only the owner of the plot or his representative with a notarized power of attorney can apply for changes to the Unified Register. The applicant must document the changes to be entered into the register. For example, if we are talking about transferring land to a new category, you should obtain an act from local government authorities approving a new method of using the land. The owner applies with this document and application to the Rosreestr office. After the changes have been made, he needs to obtain an extract from the territorial cadastral chamber and make sure that the information entered is true.

In practice, each case is individual, therefore, in order to correctly prepare documentation and carry out any operations related to land, it is recommended to seek the help of qualified specialists. The issues of establishing the objective cadastral value of land should be given priority attention. An incorrect cadastral valuation or out-of-date information in the register leads to the owner paying an increased amount of tax or receiving less money from the commercial use of the land. That is why it is important not only to timely monitor the situation on the land market, but also to use the services of professional appraisers with extensive experience.

Source: Komsomolskaya Pravda

Assessment methodology

In general, cadastral valuation uses the same methodology as assessing the market value of land plots. As is known, for land valuation, the most applicable is the comparative approach. The essence of the approach comes down to searching and analyzing information on analogous objects and comparing them with the one being assessed.

The income approach is applicable only to land plots that are planned to be used for commercial purposes (most often these are plots leased for agricultural needs). This approach takes into account the potential profit that an investor can receive from the planned use of the land.

The cost approach is practically not applicable to the valuation of land plots, since rights to land plots arise on their own and do not require special costs. However, it is used if the site is quite unique and it is difficult to select analogue objects for it and, accordingly, carry out an assessment using a market approach. If the site is not planned for commercial use, then it is permissible to evaluate it using a cost approach, which will take into account existing improvements, permitted use, and the quality of the land.