At some point in life, people are faced with the death of loved ones. After realizing this news, the question arises about organizing the funeral and inheriting the property of the deceased. Usually this process is carried out by close relatives of the deceased, paying expenses from personal savings.

Sometimes a citizen managed to save for a funeral, having bank deposits during his lifetime. Therefore, the question arises: how to get money from the deceased’s savings book for burial, and how to inherit this property in the future?

Few people know the answer, despite the fact that it is clearly regulated by law. We will analyze this situation in detail, explaining all the nuances, and give useful advice and recommendations.

Money on accounts and cards

Often, after death, people still have bank cards or deposits.

Even if relatives do not know about them, they can be found when opening an inheritance case. The notary submits requests to banking organizations about the presence of the deceased’s accounts, deposits and funds in them. As soon as information about death enters the bank's system, any transactions until the inheritance is received will be blocked. Therefore, money from the accounts can be received through inheritance by law or by will.

There is also a simplified method - testamentary disposition. The scheme of its operation is described in Article 1128 of the Civil Code of the Russian Federation (Civil Code of the Russian Federation). But the order must be executed during the life of the testator. The order is drawn up on a special bank form, which indicates to which person or several persons funds can be paid from the account and in what amount. You can order the transfer of funds after death not only to relatives, but also to any other persons and organizations.

The order can be rewritten many times depending on the circumstances. It can include conditions for receiving money: for example, money will be issued in the event of the birth of a child or receipt of higher education. The document has the force of a notarized will, which means that the heirs will not need to perform any additional actions at the notary after entering into the inheritance.

In addition, a certain amount can be given by testamentary order even before entering into an inheritance for the organization of the funeral of the deceased person to whom the deposit or account belonged. The amount of such an amount is limited to 100,000 rubles and is indicated in the notary’s decree.

The document is drawn up at the bank, but in order to receive money from it, you will still have to present the bank with a notary’s certificate of entry into inheritance rights. This is simply a more convenient way of inheriting a deposit than under a regular will: it is drawn up at the bank and there is an opportunity to receive funds for the funeral.

Read on topic: 10 facts about inheritance that you might not know

Many relatives are in a relationship of trust, use each other’s bank cards and accounts, and know each other’s passwords. And there is a temptation to withdraw funds before the bank blocks the account. But it is not recommended to do this, especially if other heirs besides you are laying claim to the funds. Unauthorized withdrawal of funds may result in legal proceedings, and the misappropriated money will have to be returned.

Even if a relative has issued a power of attorney with the right to receive funds, after his death it will not be possible to receive money under it. This restriction is prescribed in Article 188 of the Civil Code of the Russian Federation. A power of attorney becomes invalid after the death of the person who issued it.

Deposit search

Deposits in the bank are subject to bank secrecy. Therefore, it may be difficult for a potential heir to obtain such data directly. Here are the deposit search options you can use:

- if a passbook, agreement or other document on an account is found in the personal belongings of the deceased, they must be submitted to the notary’s office;

- if the heirs have information about specific banks in which the deceased kept money, you can fill out an application to search for a deposit (for example, Sber carries out such a search for free);

- A notary has the right to make inquiries to any banking institutions, which will be the best option when searching for deposits and accounts.

Loan debts

Deceased relatives can leave behind not only property, but also debts, for example, on a loan. By law, debt repayment falls on the heirs. If there are several relatives and they all inherit, then the loan debt is divided among them in the amount of the awarded shares.

The heir should not pay more than what was received as a result of inheritance. According to Article 1175 of the Civil Code of the Russian Federation, each of the heirs is liable for the debts of the testator within the value of the property transferred to him.

Relatives may not pay loan debts only in two cases. The first is refusal of inheritance. If you know that a deceased relative has one or more unclosed loans, and the amount of inherited property is less than the debt, then you can refuse to accept the inheritance. In this case, the bank will not be able to demand payment of the debt.

The second case is the presence of issued insurance. If the relative who took out the loan took out insurance that covers the risk of death, the bank will demand payment of the debt from the insurance company. This type of insurance implies payment of the full amount of the debt, including interest. In the event of the death of the borrower, relatives will need to contact the bank and insurance company and provide the necessary documents. Usually we are talking about the heir’s passport, the borrower’s death certificate and an insurance policy. But the insurer also has the right to request additional documents: a medical report on death, the borrower’s medical record in order to trace the medical history that resulted in death.

Insurance companies may refuse to pay if the cause of death is unknown or the deadline for filing a claim for payment is missed. Therefore, you need to carefully study the insurance contract, which stipulates all these conditions.

If you do accept debt in the form of an unpaid loan, then you can reduce the amount of accrued interest. Interest and penalties for late payments on a loan are usually accrued by the bank even after death, until it is provided with documents confirming the death of the borrower. This is illegal. Debts passed by inheritance are calculated from the moment of death, and not from the date of acceptance of the inheritance. When penalties are assessed, you must contact the bank with an application for recalculation of interest and penalties. If the bank refuses to recalculate them, then you will have to go to court. As practice shows, courts in such disputes side with the debtor’s heirs.

How to receive money from Sberbank by inheritance without a will

In the absence of administrative documents, inheritance of such property occurs in the general manner. If the account owner did not have time to sign off the property, then the contribution will be included in the inheritance along with other property.

In this situation, inheritance of the deposit will occur according to law. When receiving the property of the deceased according to the law in accordance with Art. 1142 of the Civil Code of the Russian Federation, the parents, children and spouse of the deceased investor have priority rights.

The procedure for inheritance is the same as in the case of a will. Relatives of a deceased citizen need to contact a notary. The key point is the deadline for filing papers - 6 months. If applicants do not submit documents, then relatives of the next line are called upon to inherit. This includes siblings and grandparents of the deceased subject.

After receiving the inheritance certificate, the recipients must contact the bank. Money is issued upon application. If the heir recognized the ownership of the deposit through the court, then when submitting the application it will be necessary to provide a court decision.

Pension

Pension payments are made monthly, including for the month in which the citizen’s death occurred. The payment does not depend on the date of death - it must be accrued for the entire month. That is, even if death occurred on the first day of the month, accrual must occur in full for the entire month. If the amount accrued is incomplete, you can go to court. The process of calculating pensions stops on the first day of the month following the day the pensioner died.

Often pensioners do not withdraw accrued pensions from their account, and they continue to be stored there. The procedure for receiving them is prescribed in the second part of Article 10 of the Law “On Insurance Pensions”. The article says that relatives can receive money only if two conditions are met:

- these must be close relatives (children, spouses, parents, grandchildren, brothers and sisters, if they are disabled and were dependent on the deceased);

- these relatives must live with the pensioner at the time of death.

Relatives who did not live with the deceased cannot claim a pension, even if they are close.

If a relative meets the conditions for receiving a pension, then he must submit an application to the territorial body of the Pension Fund of the Russian Federation within six months from the date of death of the pensioner. A sample application can be downloaded here.

The following documents must be attached to it:

- applicant's passport;

- death certificate of the pensioner;

- a certificate from housing authorities about registration and living together with a pensioner, documents confirming kinship (birth certificate, marriage certificate of parents).

The Pension Fund can consider the application within seven months from the date of death of the pensioner. Payment of pension savings occurs before the 20th day of the month following the month the decision on payment was made. If not one, but several close relatives apply for payment of pension savings, the amount will be divided between them in equal shares.

If, within six months from the date of death of the pensioner, such an application is not received at all, or there are simply no persons who meet the conditions described above, pensions will be inherited on a general basis (clause 4 of Article 10 of the Law “On Insurance Pensions”).

Inheritance of foreign deposits

Receiving deposits in foreign currency follows the same scheme as in rubles. As for deposits located abroad, it will be more difficult to access money.

Difficulties in inheriting foreign deposits:

- Remoteness of the banking institution . Any bank transactions are usually carried out only after the identity of the applicant has been established. Similar procedures occur when a citizen visits a branch of a financial organization. Therefore, you cannot do without the help of an experienced lawyer.

- The need for accurate information about the availability of a deposit. Sometimes finding money abroad is almost impossible. The heirs will only have to rely on the legislation of individual countries. It happens that after the contract expires and there is no contact with the account owner, the bank itself may initiate the search for him.

The easiest place to find a deposit is in Switzerland. There is a special organization there - the Swiss Banking Ombudsman. The institution helps relatives find inheritance in the country. The service is provided on a paid basis.

Phone number

The phone number remains valid even after the death of the owner. Telecom operators don’t care whether the owner of the number is dead or not, as long as money is received at the number and calls are made. To block a number, you need to not perform any active actions with the SIM card and after six months contact the mobile operator with a death certificate. In this case, the contract for using the number is terminated automatically, and the number will no longer be used.

If there is no money in the account to write off the subscription fee, the provision of communication services is suspended, and you cannot go into the red.

The situation is more complicated when the number of a deceased person must not only be blocked, but re-registered to another person. To do this, the heir under the will needs to come to the office of the telecom operator and provide a passport, a copy of the death certificate and a certificate of inheritance. The heir by law must present a document that confirms the degree of relationship.

Sometimes operators also ask for a certificate of right to inherit a telephone number. However, the telephone number does not relate to inherited property, and notaries refuse to issue such a certificate.

Some operators may not even be able to reassign a number to another person without the direct participation of the number owner. It is better to clarify this and the list of documents with your mobile operator.

If relatives need to continue to use the number of the deceased, then they can simply top up the account to avoid blocking and use it as usual.

Joint property

The bank deposit is the joint property of the spouses . Any property acquired by spouses during marriage is their joint property (Article 34 of the RF IC).

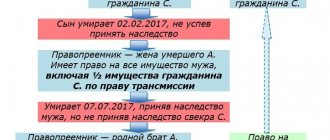

Consequently, the spouse has the right to withdraw ½ share of the deposit from the bank before entering into inheritance. To do this, you must obtain a certificate of allocation of the marital share. The second part of the deposit is divided equally between the heirs.

The exception is the situation when the spouses have drawn up a marriage contract. If there is an agreement, the spouse has the right to the share specified in it. A prenuptial agreement may recognize the contribution as the contributor's personal property or increase the spousal share.

Example. The citizen made a cash deposit. Heirs of the 1st line are a wife and an adult daughter. The deposit was opened during the marriage. Therefore, half of the amount belongs to the wife of the deceased man. The second part is divided between the wife and daughter of the testator. As a result, the wife’s part amounted to ¾, and the daughter owns ¼ of the deposit amount.

Rules of the law on heirs

Russian laws have approved a list of those who receive the right to inherit savings:

- Citizens specified by the testator in his will. They are not necessarily relatives of the testator. There are cases of their exclusion from the list of recipients, which is indicated in the notarial paper.

- Persons designated as recipients of savings by testamentary order of the owner of the savings book.

- In the absence of official orders regarding the inheritance, first-degree relatives (spouses, children, parents) become his successors.

- If there are no first-line recipients (they died before the opening of the inheritance or their relatives voluntarily abandoned it), then the right to receive inheritance savings is transferred to candidates from the next lines.

- Dependents who lived on the support of the deceased for at least 1 year before his death.

- Outsiders who are not related to the deceased can receive money from the savings book if they were involved in organizing the funeral. As monetary compensation for financial expenses, these people can expect to withdraw the deceased's savings.

In the absence of official orders regarding the inheritance, his successors become first-degree relatives (spouses, children, parents).

Only after 6 months from the date of death of a person, his relatives have the opportunity to obtain the status of heirs. If time is missed, the successor is forced to apply to the courts to restore his rights. A document demonstrating a valid reason for such a loss of time must be presented.

You might be interested in:

VTB mortgage refinancing in 2019

Possible difficulties

The inheritance procedure is often associated with some difficulties:

- Missing the application deadline;

- disagreements between legal successors, which may result in a lawsuit;

- refusal of the bank to receive savings legally.

The successor can defend his interests in court. If they missed the deadline for entering into an inheritance, then they can only restore it through the district court.

On our website you will find information not only on how to correctly inherit a bank deposit, but you will also be able to familiarize yourself with the rules of inheritance of various real estate, apartments, houses, land plots, businesses, cars, and you will also be able to find out whether it is possible to inherit a savings account. part of the deceased's pension.

Power of attorney

If citizens cannot resolve issues related to receiving an inheritance themselves, they have the right to involve third parties. The successor's representative has the right to contact the bank and the notary in his place. The basis for applying for and receiving funds is a notarized power of attorney, which gives the representative of the legal successor all the necessary powers.

How to avoid getting into trouble: nuances when inheriting money

Inheriting a deposit in the event of the death of the depositor has a number of nuances. It must be remembered that:

- the financial institution is not obliged to notify all relatives of the deceased about the existing deposit;

- even without having in hand documents confirming the existence of a deposit, you can organize a search for it by engaging a notary;

- when opening a deposit during marriage, the other half has the right to 50% of the entire amount as jointly acquired property;

- minor heirs can receive funds after reaching 18 years of age, but upon receipt of permission from the guardianship authorities, guardians can also use the deposit, provided that the funds are spent on the maintenance of children;

- if the testamentary disposition was drawn up before March 1, 2002, then to withdraw the deposit it is not necessary to provide a certificate from a notary.

If disputes arise, the heirs can go to court.

The procedure for inheriting funds in the bank

The procedure for inheriting funds stored in banks is no different from the procedure for inheriting other property.

According to Article 1174 of the Civil Code, any inherited property, including funds in bank accounts, can be used to pay expenses related to:

- illness and funeral of the testator;

- protection of inheritance and its management;

- execution of the will.

These expenses are paid in the order in which they are listed above. For these needs, no more than 100,000 rubles can be issued from a bank account within six months from the date of opening of the inheritance. For this purpose, the notary issues a special resolution.

The order can be canceled if the client draws up a notarized will, in which a different order will be given in relation to the specified funds - this is a general procedure. A special procedure for cancellation, amendment - submission to the bank in which the testamentary disposition is stored, a notarized order for cancellation, amendment.

The rule established by Article 1149 of the Civil Code, that disabled children, spouses, parents, and dependents of the testator inherit at least half of the share that would accrue to each of them if the inheritance were carried out by law, also applies to funds for which a testamentary order was issued. Also, the spouse, the owner of a share of funds in the accounts of the deceased, acquired jointly, has the right to receive it.

The remainder will be distributed among the persons specified in the order in the shares provided by the manager, or in equal parts, in accordance with Article 1150 of the Civil Code. According to the rules of Article 39 of the Family Code, spouses own jointly acquired property equally, unless an agreement was concluded between them in which they prescribed a different ratio.

Withdrawing money from the deceased's accounts by power of attorney

During his lifetime, the depositor can write a power of attorney to dispose of the deposit to a third party: a relative or not. Using this power of attorney, a citizen can withdraw and replenish the account at his own discretion (for example, to pay for treatment when the depositor himself is in the hospital).

By law, such a power of attorney has legal force until the death of the investor. After this, the right cannot be exercised, no matter who the trustee is to the testator.

If for some reason (for example, due to ignorance of the fact of death) the trustee withdraws money after the death of the investor, the court will recognize this fact as illegal enrichment.