Legal regulation of banking activities in Russia is carried out by the Constitution, the law “On Banks and Banking Activities” and “On the Central Bank of the Russian Federation”, as well as other regulatory legal acts.

For violation of the law, financial and credit organizations may be subject to various types of liability - from disciplinary to criminal. For example, according to Article 15.26 of the Code of Administrative Offenses, if a credit organization violates the standards established by the Central Bank, it will receive a warning or a fine.

If the bank and its representatives, by their actions or inactions, violate the material rights of a citizen or any regulated procedure, then this citizen has the right to seek protection in court. But first, you usually need to go through claim proceedings.

Simply put, you shouldn’t immediately run to court. First, try filing a complaint against the bank. In the vast majority of cases, this is enough to solve the problem. We will tell you how and where to complain.

Completing a complaint correctly

In this case, there is no unified form of the document. Claims can be presented arbitrarily: if you place the details not on the right, but on the left, or instead of the word “complaint” you write “application”, this will not be an error. However, it is better to be guided by the general requirements for written statements.

- A cap. In the upper right corner you must indicate who the complaint is coming from (your personal information, including address and contact phone number) and to whom the complaint is addressed. If you do not know the name of the required official, write simply “Head of <name of financial and credit organization>.”

- Title. Write the word “complaint” in large letters in the middle of the line.

- Factual circumstances of the case. State what rights you think have been violated by what actions or inactions of the bank. Give reasons. Describe when, at what time and under what circumstances the incident occurred, or when you discovered the fact of the offense. Is anyone specific to blame for what happened? If yes, please provide the person's first and last name.

- Applications. Back up your indignation with written evidence. Attach to your complaint a copy of the loan agreement, a receipt for payment for a particular service, an account statement, and so on.

- Requirements. Formulate what specific decision you expect regarding your complaint: “I ask you to eliminate the consequences...”, “give a legal assessment...”, “punish the perpetrators...” and so on.

- Date and signature. Don't forget to indicate when the complaint was filed and also endorse it.

When making a complaint, you should not curse or swear. Extra epithets and details only complicate understanding and, therefore, delay the proceedings.

Follow the rule: less emotions - more facts.

Any more or less large credit institution has a department for handling claims, where, as a rule, they try to solve problems without washing dirty linen in public.

Research shows that a customer who complains and is heard becomes a regular and loyal customer. Banks value their reputation and know that if a dissatisfied customer is simply brushed aside, he will tell his friends about it, and they will tell theirs.

The Lifehacker Telegram channel contains only the best texts about technology, relationships, sports, cinema and much more. Subscribe!

Our Pinterest contains only the best texts about relationships, sports, cinema, health and much more. Subscribe!

Therefore, the first thing to do when a conflict situation arises is to contact the bank itself.

The processing time for written complaints by credit institutions is usually seven to ten banking days.

During this time, the bank will conduct an internal investigation, develop solutions to the problem and offer them to you orally (by phone) or in writing.

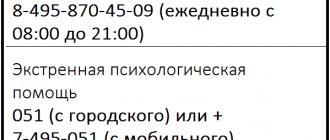

As practice shows, the fastest response is to complaints received through Internet resources and hotline numbers. They are usually processed the same day.

| Bank | Phones | Online reception |

| Sberbank | 8-800-555-55-50; +7-495-500-55-50; 900 (available in Russia for subscribers of MTS, Megafon, Beeline and Tele2) | sberbank.ru |

| VTB 24 | +7-495-777-24-24 (for Moscow); 8-800-100-24-24 (for regions) | — |

| Rosselkhozbank | 8-800-200-02-90; +7-495-787-7-787; +7-495-777-11-00 | rshb.ru |

| Alfa Bank | +7-495-78-888-78 (for Moscow and the Moscow region); 8-800-2000-000 (for regions). | alfabank.ru |

| Tinkoff Bank | 8-800-333-777-3 | tinkoff.ru |

If the bank did not satisfy your complaint or you are dissatisfied with the decision, you can write a negative review on a thematic website or forum, or contact one of the supervisory authorities.

Individual approach

Headquarters lawyers also resolve private issues. For example, during the pandemic, problems related to the banking sector became relevant.

“There were a lot of loan applications when banks for some reason did not accommodate entrepreneurs halfway. For example, the bank sharply limited loan limits for one trading company. We quickly got involved, checked that the entrepreneur met all the criteria established by the bank, talked with the bank, and the entrepreneur increased the loan to 500 thousand, which helped him avoid a cash gap,” says Anatoly Maltsan.

Another illustrative story is the refusal of a large bank to issue a loan to the owner of a chain of children's art supply stores for employee salaries at the zero percent promised by the Government. The situation was complicated by the fact that the entrepreneur was in self-isolation with two small children and could not come to the meeting at the bank. After the intervention of the headquarters, the loan was issued based on documents signed remotely.

Banki.ru and other popular ratings

Let us repeat, banks value their reputation and do not like public proceedings.

Many financial institutions have special employees who monitor reviews and are responsible for feedback. If such an employee sees a complaint on the Internet about the bank he represents, he will try to respond as quickly as possible. Your message will be passed on to the responsible persons or they will tell you the algorithm of actions.

One of the most authoritative resources in this regard is the information portal Banki.ru. It was launched in 2005 and today is one of the most cited financial media resources on the Runet.

The name speaks for itself: on the site you will find ratings of Russian banks by level of service and quality of services, ratings of the most profitable deposits and ratings of loans with the lowest rates.

You can leave a complaint about a particular bank in the “People’s Rating” section or on the forum in the “Conflict Situations” topic. Representatives of more than 220 Russian banks respond to customer reviews.

The problem should be presented briefly, unemotionally and to the point, as is the case with written appeals. The moderator will not allow messages containing insults or obscene language.

In the popular rating "Banki.ru" you can complain about a bank employee, erroneous debiting of funds, incorrect operation of an ATM and other problems that concern you personally. There is no point in being outraged by legal, but, in your opinion, unfair actions (“Arbitrariness: my sister has nothing to pay her loan, the bank has seized the property!”).

When can a service be considered poorly provided?

Any services provided with the following violations will be considered low-quality:

- The result of the contractor’s actions was causing material damage to the customer, harming his life and/or health;

- During the execution of the work, technology was violated and low-quality materials were used;

- The service does not meet the parameters and requirements specified in the agreement;

- The purpose of the service order was not achieved.

Any reason why you considered the service to be poorly provided will need to be justified and supported by relevant evidence in the complaint. It is permitted to use video and photographic materials, copies of guarantees and work acceptance certificates, results of an independent examination, receipts confirming payment, copies of service agreements, etc.

Association of Russian Banks and Financial Ombudsman

The Association of Russian Banks is a non-governmental non-profit organization founded in 1991. It consists of 522 members, including 350 credit organizations. The Association includes all the largest banks in Russia, 19 representative offices of foreign banks, 65 banks with foreign participation in the authorized capital, as well as the “Big Four” audit companies.

The Association not only protects the interests of credit institutions in legislative, executive and law enforcement agencies, but also strives to improve the work of banks. To do this, there is a section on the official website of the Association where anyone can file a complaint against any bank.

The complaint will be posted on the website of the Association of Russian Banks in public access.

Bank representatives can comment on complaints.

In 2010, the Federal Law “On an alternative procedure for resolving disputes with the participation of a mediator (mediation procedure)” was adopted and came into force on January 1, 2011. At the same time, on the initiative of the Association of Russian Banks, the institution of a financial ombudsman was established in 2010. This was the next step towards building a dialogue between banks and clients.

A financial ombudsman is an impartial, unbiased and at the same time influential person who can help negotiate with the bank.

It doesn't punish banks or tell customers what to do. He acts as a mediator between the first and second and helps to reach a compromise. For example, the financial ombudsman can offer mutually beneficial conditions for loan restructuring for the bank and the client.

You can contact a public mediator in the financial market here.

Requirements that can be presented to the contractor

In a complaint against the contractor, you can demand repeated provision of services, but of a higher quality, reduction in the cost of work, elimination of malfunctions and defects at the expense of the defendant and within the due period (agreed in advance by the parties), return of the money paid to the contractor, taking into account the costs incurred by the customer (losses from downtime production, material and moral damage). The requirements in the document must be clear and specific, indicating amounts, deadlines and other important details.

Rospotrebnadzor

Banks serve clients, and therefore, if controversial situations arise, you can apply to the Federal Service for Supervision of Consumer Rights Protection and Human Welfare to protect your rights.

File a complaint with Rospotrebnadzor →

What you can complain about to Rospotrebnadzor:

- Inclusion in the contract of provisions that infringe on consumer rights (Article 16 of the Law “On Protection of Consumer Rights”). For example, limitation of jurisdiction, the right to unilaterally change the contract.

- Insufficient or unreliable information about services (Articles 10 and 12 of the Law “On Protection of Consumer Rights”).

Laws regulating collection activities

To determine the grounds for filing complaints against debt collectors, you need to know the law that governs their work.

Collection companies are professionally engaged in debt collection, and their work must comply with Law No. 230-FZ - this is the main governing document in the field of collection activities, defining the rights and responsibilities of debt collectors. If collectors violate the law and the rights of the debtor, they face administrative or even criminal liability.

It is difficult to independently understand the norms of laws and judicial practice if you do not have a legal education. We have written down the main articles to refer to when talking with a debt collector and when preparing a complaint.

You can also contact our lawyers, who will explain the nuances of the legislation and help you correctly draw up a complaint or application against debt collectors.

Federal Antimonopoly Service

The Federal Antimonopoly Service (FAS) is an executive body that monitors compliance with competition and advertising laws.

A typical subject of a complaint to the FAS: the bank received a competitive advantage over other credit institutions because it misled customers (for example, it offered a deposit at a reduced interest rate), and then changed the terms of the agreement.

Unfair competition entails the imposition of an administrative fine on officials in the amount of 12,000 to 20,000 rubles, on legal entities - from 100,000 to 500,000 rubles (Article 14.33 of the Code of Administrative Offenses).

You can also complain to the FAS about SMS spam that comes from banks.

In accordance with the law “On the Procedure for Considering Citizens’ Appeals,” the Federal Antimonopoly Service must, within 30 days, consider the complaint, conduct an inspection and, if violations are identified, issue an order to eliminate them.

File a complaint with the FAS →

Please note that this page has an email to which you can send a request if you need to attach several files. For example, screenshots of online advertising for a bank.

Warranty repair conditions

Each warranty has its own terms and conditions that must be reviewed before purchasing the item. Failure to comply with them may result in cancellation of the opportunity to repair the product free of charge. Most often, the warranty terms indicate the following items:

- The cause of the breakdown must not be mechanical damage to the product.

- The facility was used only for its intended purpose.

- Product defects arose due to the fault of the manufacturing party (poor assembly, defective part).

At the same time, the service center does not have the right to demand that the buyer provide a receipt, technical documentation, packaging or other documents or objects related to the device.

The store may also insist on an examination. The goods are sent for examination solely at the expense of the seller, because it is not a prerequisite for the warranty. If the buyer refuses inspection, he loses the right to warranty.

The terms of warranty repairs are set by the parties themselves, but they cannot exceed 45 days. If the service center retains the goods even due to reasons beyond their control, they must pay compensation to the consumer.

If warranty repairs cannot be carried out due to the fault of the service center, they may offer the buyer to send the product to another branch, or pay compensation to the consumer.

Read what is included in the car warranty and how to get warranty repairs.

And here is information about what a claim is and how to file it.

Follow the link to the article “How can you return an item without a tag, but with a receipt.”