Home / Salary disputes / Find out what to do if you worked unofficially and were not paid your salary?

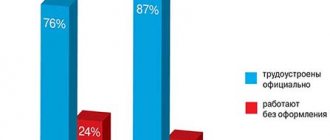

Most employees try to find an employer who provides official employment and regular wages, however, there are many enterprises in the labor market that hire workers without an employment contract. As a rule, these are small companies or individual entrepreneurs. Often, refusal to conclude an agreement occurs on the initiative of an employee who would not like to pay taxes and other mandatory contributions to pension and insurance funds from his salary.

But such carelessness of the employer and employee negatively affects the employee himself, since his rights are practically not protected by labor legislation. For example, a manager can easily fire his employee or leave him without salary. What to do if you worked unofficially and were not paid your salary?

Wages are not paid at all or are delayed: what to do?

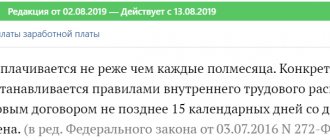

Paying employees wages in full and on time is one of the main responsibilities of the employer.

Delays in wages are considered a serious violation of labor laws, which may result in penalties including criminal liability. Types of employer liability for delayed wages:

The legislation provides for serious liability for the employer in such cases. However, it is more important for the employee to get the money he earned as quickly as possible, and not just to punish the unscrupulous employer. Therefore, he needs to take the initiative into his own hands.

Where to turn if your salary is not paid? There are several legally permitted mechanisms for influencing the employer in order to resolve the issue of unpaid wages. Some of them allow workers to achieve the desired result with the help of pre-trial activities. If the efforts made are not crowned with success, working citizens are left with judicial procedures for collecting wage debts. In addition, the law does not prohibit going to court without going through pre-trial mechanisms.

Find out what to do if your salary is delayed for a long time in ConsultantPlus. Study the material by getting trial access to the K+ system for free.

How to punish an employer for delay - legal ways

If payment for the provision of work duties is delayed by more than 15 calendar days, even an officially employed employee has the right to suspend work until he receives the payments due to him. If the employee is hired “under the table”, then it will not be possible to prove his case peacefully - he will have to immediately file a claim against the employer.

In case of serious violations of labor legislation by the employer, the prosecutor, and then the court, can bring the employer to administrative and even criminal liability. At the same time, awarding bankrupt status to an organization or individual entrepreneur will not “save” it from paying salaries to employees.

Moreover, the employer is additionally charged fines and penalties for violating the terms and volume of payments to his subordinates. And if it is proven that superiors forced their subordinates to work “in the dark” or “in the dark” through deception or blackmail, administrative liability will no longer be an option.

Unfortunately, there are no other legal ways to punish an employer for late or non-payment of wages (besides those already described above). The best option (in terms of the cost of effort and the effectiveness of the event) is to collect evidence of the fulfillment of labor duties and send it along with the application to the state labor inspectorate.

We resolve the issue of salary debt directly with the employer

Employees often encounter a situation where an employer does not pay wages . The question immediately arises: where to go if you don’t get paid?

Before complaining to regulatory or law enforcement agencies, contact your employer directly. Before your visit, prepare - fill out a written complaint in two copies and give one of them to the head of the enterprise. In your complaint, state the essence of the problem (what amount and since when you have not been paid), and also indicate your details (full name, position, department) and a request for payment of the debt. You will have a second copy of the document in your hands, which needs to be registered with the secretary. This is your safety net - a registered claim will confirm the fact of contacting the employer if you have to go to court with the issue of unpaid wages.

Most likely, you will be denied registration of a claim. In this case, feel free to send it by registered or certified mail with a description of the attachment. The fact that the claim has been sent to the employer will be confirmed by a postal receipt and a postal worker’s mark on the enclosure inventory.

It is possible that the employer, after your visit and receipt of the claim, will pay off the salary debt. But often attempts to resolve the issue directly with the employer are unsuccessful.

What to do if wages are not paid? You can try another legal way.

Why does informal employment persist?

Is it possible to work without registration? Unofficial employment is a violation of the law, because of which many workers have already suffered.

Payment of wages depends only on the wishes of the employer.

During employment, no documents are drawn up, salaries are not processed through the tax office, which threatens large fines for the boss.

There are a lot of risks from any job - sometimes your salary is paid in a smaller amount and with delays, sometimes you work without payment at all. It is difficult to prove the employer’s guilt and his obligations, which are not secured by any documents, but only in exceptional cases.

ATTENTION! Saving on taxes (13% of salary for an employee, 34% for an employer) turns into deception and disappointment for workers. In such cases, you cannot do without the help of an experienced, qualified lawyer.

If a woman worked unofficially, she cannot count on maternity pay, and such employees are not paid sick leave. An employer can only help financially at his own request by providing funds for treatment. Working time is not taken into account in the insurance period, and even a high salary cannot affect the size of the pension.

What should an employee do if wages are not paid: an alternative method

Are you not getting paid? Try to resort to another procedure for influencing the employer provided for by law - do not go to work. According to Art. 142 of the Labor Code of the Russian Federation, if wages are delayed for more than 15 days, the employee has the right to suspend work. Perhaps such forced inaction of the workforce will prompt the employer to quickly raise funds, and further trips to the authorities will not be necessary.

The mechanism for legal suspension of work is prescribed in Art. 142 Labor Code of the Russian Federation. The employee is required to do only one thing - notify the employer in writing. See below for what such a notification might look like:

From the date of filing such a notice, the employee may not appear at his workplace until the employer notifies him in writing of his readiness to repay the salary debt. During forced absence, the employee retains his average earnings.

It is necessary to take into account this nuance - the law does not allow certain categories of workers to suspend work if wages are not paid. And in certain cases, suspension of work is not permissible at all:

If, according to the law, you do not have the right to suspend work due to delayed wages or this measure does not have the desired effect on the employer, try another out-of-court method of collecting wage debt.

What does an employer face for unofficial employment?

The employer is obliged to conclude an employment contract with the employee, as well as to perform all the actions that are provided for by the Labor Code of the Russian Federation when hiring an employee; failure to comply with them threatens the employer with punishment established by law.

Thus, for violating the legislation on labor and its protection (Article 5.27 of the Code of Administrative Offenses of the Russian Federation), the employer may be subject to an administrative penalty or his activities may be suspended for a certain period .

Also, an employer who does not fulfill the duties of a tax agent faces criminal liability under Art. 199.1 of the Criminal Code of the Russian Federation. The sanction of this article, in addition to a large fine, also provides for imprisonment for up to two years.

[ ]

Appeal to the labor dispute commission is a legal way to influence the employer

If wages are not paid or are delayed, the employee may try to influence the employer through the labor dispute commission (LCC). But only if such a commission is created in the organization.

KTS is a special structure at the enterprise:

- created to resolve individual labor disputes (including regarding non-payment or delay of wages);

- formed from representatives of the workforce and representatives of the employer;

- performing its functions and vested with powers in accordance with Art. 384-390 Labor Code of the Russian Federation.

What is the advantage of contacting CTS? Isn't it better to immediately contact the prosecutor's office or court? The main advantage of resolving a dispute in the CCC is the relative speed of achieving a result (compared to the time frame for judicial collection of wages) and less red tape with documents. The commission must consider the employee’s appeal within 10 days. And after making a decision, the employer must comply with it within 3 days after the 10 days provided for appeal have expired.

The certificate issued by the CTS is forcibly enforced by a bailiff (Article 389 of the Labor Code of the Russian Federation). Judicial procedures take considerable time and take a lot of effort - you need to comply with certain regulations, collect documents in the proper form, etc. And the CTS is located directly at the enterprise and has all the necessary information without additional confirmations or requests.

Unfortunately, CTS is an extremely rare phenomenon in our modern life. They have been preserved only at large enterprises, where regulations for resolving labor disputes have been established and have been in effect since Soviet times, there is a strong trade union and an active workforce. Most medium and small companies do not create CTS.

If your company does not have a CTS or is inactive, try influencing the employer through the labor inspectorate.

Consequences

Working informally has both disadvantages and advantages that are worth considering. What negative consequences can work without an employment contract have for an employee of an organization:

- The employer does not accrue payments required by labor legislation, including temporary disability benefits and sick leave.

- An employee who worked unofficially is not paid maternity benefits and child benefits up to 1.5 years.

- An unregistered employee may be left without bonuses, additional payments, or allowances.

- There is no officially prescribed vacation, and employees without an employment contract are not paid vacation pay.

- The employer may not increase the wage rate for night shifts, weekends and holidays.

- With unofficial registration, the boss pays wages at his own discretion: he can delay it or leave the employee without the money he earned.

- No entry is made in the employee’s work book, as a result of which he loses his seniority.

- Salary and length of service in this job will not be taken into account when calculating your pension.

- If you receive an injury of any severity at the workplace, the employer may not pay financial compensation.

- An employer may dismiss an informally employed employee without giving reasons at any time.

- Most employers do not pay the promised amount without an employment contract.

- The head of an organization can fire an employee without pay or severance pay.

Without concluding an employment contract, the employer and employee are both liable before the law. The first violates labor laws, and the second does not pay income tax. The positive aspects of informal employment include the following facts:

- Without an agreement, alimony, fines and other penalties cannot be collected from an employee’s income by court order.

- An employee who is employed informally has no legal responsibility to his employer.

- An unregistered citizen is often satisfied with a salary that is higher than the salary for an official position due to non-payment of 13% taxes.

- If necessary, the employer will not sue an unofficial employee to prove financial liability to the organization.

Based on the above arguments, informal employment has more disadvantages than advantages. Therefore, when getting a new job, you should take into account every nuance, including not forgetting about the possible consequences of unofficial employment.

Credit

Currently, most Russian banks are loyal to persons who are not officially registered at work, as well as to citizens who work in an organization under an employment contract, but have a small official salary. For categories of persons who cannot submit a personal income tax certificate 2 to a banking institution, various loan programs have been developed.

Basically, bank representatives offer informal working clients small loans with a high lending rate. The borrower's solvency can be evidenced by the presence of real estate, a vehicle, statements of deposits in bank accounts and a positive credit history. In this case, the bank reduces the risk of loan non-repayment.

Complaint about non-payment of wages to the labor inspectorate

A complaint about unpaid wages filed by an employee with the State Labor Inspectorate may also force the employer to pay back wages to employees. A complaint may provoke an unscheduled inspection of the organization with the subsequent issuance of an order to repay salary debts and punishment of the manager. A complete list of consequences of citizens applying to the labor inspectorate for restoration of violated rights (including late payment of wages) is presented in the figure:

The application (complaint) is drawn up in free form. Labor inspectorates may also use unified forms for citizens’ appeals. They can be obtained by visiting the inspection office in person.

Modern technologies make it possible to file a complaint through the website of the regional labor inspectorate.

What to do if you don’t get paid when you work unofficially?

According to Article 67 of the Labor Code of the Russian Federation, the existence of an employment relationship can be confirmed even if the employee has not entered into an official employment contract with an organization or entrepreneur. The Labor Code states that one proof of the applicant's permission to perform his duties on behalf of or with the knowledge of the employer is sufficient to obtain monetary guarantees from the employer.

The psychological factor is also important. Many people are afraid to report non-payment of wages during unofficial employment, fearing that they, too, will be punished for “menial” work. However, there is no need to be afraid. If the employer refuses to officially accommodate the employee, then this indicates a violation of the law only on the part of the employer.

Two “categories” of workers may suffer from non-payment of wages:

- Those who are employed “in the gray” – a contract has been concluded, but according to it the employee receives the minimum wage, and the rest of the amount is paid to him “in an envelope”, the so-called black salary.

- “Menial” work implies a complete lack of documentation of activities—unofficial employment. In such conditions, applicants are most vulnerable, because the employer can at any time reduce their salary or simply stop paying it.

Experts say that the first thing to do if funds are not paid is to talk to the employer and try to resolve everything peacefully.

You can independently draw up two copies of the application and indicate in it the requirement for repayment of mandatory payments. If another representative of the company puts any mark on such a statement, the papers may have the desired psychological effect on the employer.

If peace negotiations do not lead to anything, and the employer still does not pay wages, you will have to contact the regulatory authorities.

We recommend reading: Criminal liability and fines for employers for non-payment of wages.

Where to go if unpaid wages are not paid?

A deceived employee who is employed unofficially, who is not paid a gray or black salary, can solve his problem in several ways by contacting the controlling organization.

Where to complain:

- to the state labor inspectorate - a sample application for non-payment of wages;

- to the prosecutor's office;

- to court.

Let us consider the algorithms for processing documents in more detail in each individual case.

How to complain to the State Labor Inspectorate?

Any citizen can apply to the State Labor Inspectorate (GIT), which is part of the Federal Service for Labor and Employment, including those who work unofficially.

It is necessary to submit an application to the State Tax Inspectorate regarding the existence of abuses manifested on the part of the employer in the form of non-payment of wages and their delay.

The application must be submitted in writing in person or by post, but sometimes electronic options are also considered if you leave them in your personal account on the official website of Rostrud.

A statement of complaint about unpaid wages must include the following items:

- information about the inspection to which the complaint is being submitted;

- contact information about the applicant;

- information about the employer;

- description of the violation committed and its circumstances;

- employee's demand for payment of debt.

Within 30 days after receiving the application, the State Tax Inspectorate is obliged to conduct an unscheduled inspection of the organization specified in the complaint. If inspectors discover a violation in the payment of wages to hired personnel, the employer will receive an order with demands to repay debts to employees and pay due wages.

In addition to the debt, the employer is obliged to pay interest and penalties for violation of the Labor Code.

Prosecutor's office

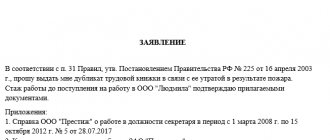

An application to the prosecutor's office against an employer who does not pay wages is submitted in writing and contains the same points as when submitted to the State Tax Inspectorate. An important nuance is that copies of documents confirming the employer’s labor violation must be attached to the application. We will talk about what can be collected from unofficial employment or non-payment of unpaid wages at the end of the article.

After receiving the evidence, the prosecutor will conduct an inspection and, if violations are found, demand that they be eliminated.

The prosecutor also has the right to initiate legal proceedings against a dishonest employer.

Going to court

This method is “heavy artillery” if preliminary appeals to the State Tax Inspectorate and the prosecutor’s office did not help. You can contact the district court at the place of residence of the employee, the location of the employer, or the place where work duties are performed.

Experts recommend filing a claim under the guidance of a legal consultant. He will help you submit your petition correctly and use all the “evidence” correctly.

In order for a claim to be considered, you need to collect as much evidence as possible, which may include:

- video and audio recordings;

- witness statements;

- pay slips, statements, cash receipts, copies of account books or handwritten sheets of paper.

Sometimes, to justify the amount of debt, you can rely on average salaries for similar vacancies or on Rosstat data.

When the claim is accepted, the judge will announce the circumstances and date of the preliminary hearing and conference dates. According to Article 154 of the Code of Civil Procedure of the Russian Federation, the final decision must be made no later than two months from the date of the plaintiff’s first appeal.

The employer will have a month to appeal the verdict, and if he does not prove his innocence, the court decision will enter into legal force.

Are wages delayed or not paid? Contact the prosecutor's office

Another authority where you can turn if your salary is delayed is the prosecutor’s office, a body that oversees compliance with legislation, rights and freedoms of citizens on behalf of the state.

Here you will also need to fill out an application. Its composition and form will be advised by the prosecutor on duty, to whom you will be referred when visiting the prosecutor's office. The application is written addressed to the chief prosecutor and must contain the following information:

The content of the application may look like this:

The prosecutor's office independently verifies the facts stated in the application or forwards it to the labor inspectorate.

Features and differences

Official employment of an employee requires the conclusion of a special contract (Labor Code of the Russian Federation, Article 67). It must contain the following information about the employee: position, work schedule, right to leave.

When an officially employed employee is faced with a situation of non-payment of wages, he can reasonably contact the labor inspectorate, which monitors compliance with labor laws, or the prosecutor’s office. If the employee is officially employed, the employer is obliged to pay taxes for him:

- health insurance 5.1%;

- contributions to social insurance of citizens 2.9%;

- personal income tax 13%;

- contributions to pension insurance 26%.

At enterprises with working conditions harmful to human health, an additional contribution may be introduced; its amount depends on the level of danger.

ATTENTION! A maximum of 13% is withheld from the salary of an officially employed employee. The rest (about 34%) must be paid by the employer.

Not every director of a private company wants to pay employees wages and mandatory contributions. Therefore, a significant part of the owners of Russian organizations of various directions prefer to bypass the law of the Russian Federation and not formalize labor relations.

In case of unofficial employment, an employment contract is not signed with the employee, and no order is issued to hire the new employee. In this case, no entry is made in the work book. Quite often, an unscrupulous manager first does not formally register an employee and then does not pay him a salary.

Obtaining a court order is one of the ways to collect wages

If an employee individually fails to resolve issues of wage arrears, you can use another relatively quick way to collect funds - apply to a judge for a court order (paragraph 7 of Article 122 of the Code of Civil Procedure of the Russian Federation).

A court order is a document issued by a judge without holding a court hearing and summoning the employee (claimant) and employer (debtor) to court for trial. The issuance of a court order by a judge to collect wages also allows the employee to solve his problems faster (the order is issued within 5 days after receiving the application) than during the usual judicial procedure for recovering earnings from the employer.

To obtain a court order, the employee must submit an application and supporting documents to the judge. See below for the required details of such an application:

The following documents must be attached to the application:

The judge issues a court order after carefully examining the application and attached documents.

This method of collecting wages has one nuance - it can be used only on the condition that (clause 1 of Article 121 of the Code of Civil Procedure of the Russian Federation):

- the amount of the collected salary does not exceed 500,000 rubles;

- the salary was accrued but not paid, and the employee does not dispute its amount.

If the employee does not agree with the amount of the accrued salary and the salary debt has exceeded the half-million dollar limit, in order to collect it, he will have to go to court with a statement of claim, following the standard judicial procedure.

How much notice do you need to notify your employer of dismissal?

As noted, the Labor Code of the Russian Federation establishes that you need to inform your superiors about your desire to quit at least 14 days in advance. But in the situation under consideration everything is different. Formally, the employee and the employer do not have an employment relationship. Therefore, the employee can leave at any time - whenever he wants. Even, for example, in the middle of the working day. And nothing will happen to him for this.

Another thing is that the employer may refuse to pay wages. He, too, is not bound to the employee by any obligations written down on paper.

Therefore, if you leave, then immediately after receiving your salary.

Deadlines and costs: how not to be late with collection and whether you need to pay a state fee

An employee should remember that he can go to court regarding unpaid wages within 1 year from the date of the established deadline for payment of wages (Article 392 of the Labor Code of the Russian Federation). What are these terms, see the figure:

These are general terms. There are also special deadlines for payment of wages established by law. For example, a resigning employee must pay all amounts due to him (including wages) on the day of dismissal (Article 140 of the Labor Code of the Russian Federation). And wages not received by the day of the employee’s death must be issued to his family members no later than a week, which is counted from the moment the relevant documents are submitted to the employer (Article 141 of the Labor Code of the Russian Federation).

Going to court is usually associated with additional costs of paying state fees. But when resolving issues regarding unpaid or delayed wages, you will not have to spend money on paying fees. This is expressly provided for in Art. 393 Labor Code of the Russian Federation.

Not registered at work: causes and consequences

There is one misconception among both employees and employers that informal employment makes it easy to violate the law. Remember that the manager is still responsible for his employees, and employees are also required to file income tax returns and pay payroll taxes, albeit unofficially.

According to Article 61 of the Labor Code of the Russian Federation, an employment agreement is considered concluded if an employee begins to perform his job duties without having a formal employment contract.

For the absence of an employment contract, the legislation provides for a fine for the employer, as well as obligations to pay taxes for the salary issued “in an envelope”. But the greatest consequences will be for the employee who worked unofficially. Which ones?

Employee rights when leaving

Official employment is more preferable, and not even because it does not violate labor laws. The main advantages of having an employment contract are:

- Future pension;

- Social package and financial stability;

- Full protection of employee rights.

Do you have a question about non-payment of wages during informal employment?

Ask an experienced employment lawyer as part of FREE consultation!

Hotline in Moscow: 8 (495) 131-95-79

Ask a Question

But in the absence of an employment agreement, contributions to the pension and insurance funds are not paid by the employer , which means that you should not expect a good pension and insurance. In addition, an employee who worked unofficially may lose his bonus and other benefits. What payments can an employee expect upon dismissal?

Upon final payment, the employer is obliged to pay:

- The full balance of wages for all days worked, taking into account overtime and bonuses.

- Compensation for vacation, sick leave and other benefits.

- Payment for forced dismissal in the amount of the average monthly salary.

Also, on the day of dismissal, the head of the enterprise is obliged not only to make a full settlement with the employee, but also to return to him all the necessary documents, including a work book, a certificate of income and an extract on the procedure for calculating wages.

If you are interested in a situation where an employer does not pay compensation upon dismissal, we recommend that you familiarize yourself with this material.

Why don't they give the payment?

If an employee has not been paid a salary (delayed or partially paid), then this is one of the reasons for a conflict with the employer. Often, employees cannot immediately receive a full payment and are forced to beg for their earned money from management. Non-payment of wages is usually associated with several things :

- The manager’s desire to save money by deceiving the employee and not giving him a salary;

- A conflict, because of which the employer, due to resentment, decided to take revenge on the former employee;

- Lack of free money, especially if the employer is an individual entrepreneur or a small enterprise.

And if the last reason can somehow be understood, then the first two are not. Full payment on the day of dismissal is the responsibility of the employer. And even if the employee worked unofficially, he must receive his wages.

One of the reasons for unofficial wages or “minimum wages” is taxes. Many employers do not want to pay an additional 30% of their salary to the funds, just like employees do not want to pay 13% of personal income tax, preferring to receive more.

Since paying wages is the responsibility of the enterprise, you should not give up resolving the conflict with management even after dismissal. An employee has the right to contact the prosecutor's office, court or labor inspectorate and file a complaint about violation of labor laws.

The employer does not pay wages: how to resolve this issue in court

Are your salaries being delayed? Do you have unsettled amounts of salary accruals and (or) your employer refuses to transfer you the payments and compensations required by law? We'll have to go to court.

Going to court is usually the most effective procedure. It begins with collecting documents and filing a statement of claim. The procedure for its preparation is subject to the general requirements for documents sent to the court (Article 131 of the Code of Civil Procedure of the Russian Federation).

Along with paying off the salary debt, you can ask the court to recover compensation from the employer for the delay. The application is accompanied by documents confirming the employment relationship with the debtor-employer (copies of the work record book and employment contract), the amount of debt, as well as the fact of non-payment (for example, a copy of the pay slip).

Features of working without official employment

The labor market is quite heterogeneous and in addition to reputable companies offering official registration, an acceptable salary and compensation package, there are quite a few small firms that work with their staff without concluding an employment contract. Citizens without sufficient qualifications, or those in difficult life circumstances, often get hired by a company, even if this employer does not formalize it and offers to pay for the work semi-legally.

The owners of such companies are confident that if there are no documents, then it is impossible to prove the existence of an employment relationship, and if something happens, they will not have problems. But this is a wrong opinion, since Art.

67 of the Labor Code of the Russian Federation makes it possible to establish the existence of an employment relationship even in the absence of a signed employment contract. To do this, it is enough to prove the fact that the applicant was allowed to perform his duties with the knowledge or on behalf of the employer.

The fact that a citizen worked without a contract only indicates a violation of legal requirements on the part of the employer, but not the absence of an employment relationship.

As for the calculation and payment of wages, in such companies there are two possible approaches to the procedure for calculating and issuing them. The most commonly used schemes are:

- A citizen works without a contract, while receiving a salary without any documentation at all;

- An agreement has been drawn up with the employee, which specifies the minimum wage, and he receives the rest in an envelope, without recording it in the accounting registers.

At the same time, workers often work under enslaving conditions, because their wages are not fixed anywhere and the employer can at any time reduce part of it or not pay it at all. By accepting such conditions of labor relations, a citizen must understand that he is deprived of:

- Opportunities to receive full vacation and sick leave;

- Contributions to compulsory insurance funds, and, consequently, he loses his pension experience;

- Personal income tax is not withheld from his salary, which is a direct violation of tax laws.

If a person finds himself in a similar situation and an unscrupulous employer does not pay wages, there is no need to remain idle. No one will know about a violation of a citizen's rights unless he himself declares it.

Moreover, if difficulties arise in defending his position, no one can prevent him from seeking legal assistance from a qualified agency.

Results

The question of where to turn if wages are not paid has long been resolved by law.

Employees are given the right to independently influence the employer through negotiations or suspension of work. A labor dispute commission will help resolve the issue of delayed wages if it exists at the enterprise and works effectively. Appealing to supervisory or judicial authorities will speed up the repayment of wage arrears. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

How to submit an application to the prosecutor's office against an employer

The prosecutor's office is a supervisory body authorized, among other things, to conduct prosecutorial checks on received complaints from citizens (see: How to file a complaint with the prosecutor's office (sample)?). Due to the fact that current legislation provides for several types of liability, the prosecutor has the right to conduct an inspection with a view to applying sanctions against the unscrupulous employer.

How to proceed:

- Come to the prosecutor's office.

- At the entrance, find out the name and office number of the officer on duty (the prosecutor or one of his assistants or deputies).

- Explain to the duty officer the essence of the problem.

- Write a statement with him.

If you do not have time for personal visits, you can write a free-form application and send it by mail.

Is it possible to hire someone without a contract?

Hiring involves concluding an employment contract with an employee. The contract may not be concluded on the first day of work, but within 3 working days, but it must be concluded.

Even if a person is not hired, but must perform some specific work, a contract must be concluded with him, but this is a civil contract.

Despite the direct obligation to enter into contracts with employees, not all employers fulfill this obligation, and not all employees require this, since some do not need it, since in this case the employer does not withhold 13% of personal income tax, some do not bother at all about this: came, worked, got paid for the shift, left.

Thus, it is impossible to hire someone without a contract. However, a fairly large number of employers do not comply with the legal requirement to formalize the employment relationship with the employee in writing, since it is beneficial for them to have employees without contracts, and in which case they may not be paid for their work, there is no need to make contributions to the pension fund, social security, etc. d.