Why determine the degree of relationship?

It may be necessary to determine the degree of relationship in life in the following cases:

- upon marriage to a person with the same surname,

- to receive an inheritance,

- for division of property,

- in case of divorce,

- in case of restriction or deprivation of parental rights,

- upon checkout from housing,

- to maintain medical confidentiality, in which only a close person has the right to know the details,

- when signing certain types of contracts,

- when applying for benefits, payments

- and in other cases provided for by legal practice.

There are situations when a person leaves an inheritance, but the written will states: “to all close relatives.” There are no first or last names in such documents. This case requires identifying close relatives and fulfilling the will of the testator.

conclusions

In jurisprudence there are many examples and cases related to family ties. The problem is especially pronounced in inheritance and family legislation and, accordingly, in taxation. Understanding family ties will help you avoid serious problems.

Attention! Due to recent changes in legislation, the legal information in this article may be out of date! Our lawyer can advise you free of charge - write your question in the form below:

Did you like the article? Share the link with your friends:

Close relatives - who are they?

Who are close relatives, and whether the husband and wife are such, is specified in the law. Although every letter and punctuation mark has its place and meaning in every law, the concept of consanguinity differs in different branches of law.

Important!

The line between the concepts of “close relative” and “relative” is within three generations along the vertical kinship and one generation horizontally. Thus, children of a brother or great-grandmother are not considered close relatives.

Full list of close relatives:

- father/mother of a citizen,

- spouse,

- son daughter,

- his mom and dad's parents,

- grandson/granddaughter of a citizen,

- brother/sister.

A citizen has the right not to testify in court against himself, his husband/wife and close relatives, even if they are guilty.

This is stated in the Constitution of the Russian Federation. It is this category of persons who can visit a citizen when he is taken into custody.

What does the law say?

Studying the Family Code of the Russian Federation, specifically Article 14, one can understand that not everyone falls under the legal definition, and the closest relative is not everyone with whom we communicate in the family circle. According to the Family Code of the Russian Federation, close relatives are citizens who are connected by blood ties in a descending and ascending line (parents with children, grandfathers and grandchildren), as well as full and half brothers and sisters (a common parent).

In addition to the Family Code, our country has other legal documents covering this concept, and in each of them, family relations are a complex tangle. Studying administrative, criminal, housing, civil, and tax law, you can notice that each area has its own ideas about this concept, which often overlap. However, a general interpretation cannot be found.

According to Russian legislation, close relatives are considered to be citizens united on the principle of consanguinity. They are divided into two categories:

- vertical – child, parents, grandparents;

- horizontal - brother and sister who have a full or half blood relationship.

According to the Tax Code of the Russian Federation

In the field of taxation, this concept is needed to determine the tax rate when registering transactions. If a grandfather gives an apartment to his grandson, the transaction is not subject to tax. In the same way, inheritance or sale of real estate between close relatives is formalized. The duty on property received as an inheritance has been reduced several times.

Estate duty:

- 0.3% for close relatives,

- 0.6% – for others.

Maximum duty:

- 100,000 rub. for close relatives,

- 1,000,000 rub. - for everyone else.

Real estate transactions require taxes. But if the purchase and sale, exchange, gift occurs between close relatives, then the transaction can be concluded by transferring the required amount of funds without paying taxes.

Rubric “Question/Answer”

Good afternoon Is my stepfather a close relative if he was legally married to my mother for more than 30 years? Now he is dead. I work in a government agency. Can I receive financial assistance in connection with his death? The organization’s wage regulations state that financial assistance is paid in connection with the death of a close relative. Thank you!

If my brother and I have the same father, but different mothers, can we legally be considered close relatives?

My father, with whom my brother and I did not communicate, died. The mother has been dead for a long time. The father lived with another woman and left a will after his death. He bequeathed all his property to her. Can my brother and I get a share as close relatives?

Detailed answers about who is considered close relatives:

- Due to frequent changes in legislation, information sometimes becomes outdated faster than we can update it on the website.

- All cases are very individual and depend on many factors. Basic information does not guarantee a solution to your specific problems.

That's why FREE expert consultants work for you around the clock!

- via the form (below), or via online chat

- Call the hotline:

- Moscow and the Region

- St. Petersburg and region

In case of divorce

A clear understanding of the closeness of kinship will help not to create illusions in the event of divorce. When a marriage is dissolved, the spouses lose their privileges as family members.

And even if relations between the former spouses subsequently improve, but they do not confirm them legally, they will not have any rights before each other. This is why the passport stamp is so important and it is not considered an outdated tradition. Officially formalized relations help to avoid a lot of problems regarding the rights and responsibilities of citizens.

It is known that citizens in open relationships are not subject to the rights and obligations inherent in married couples. These people cannot take advantage of the zero tax rate on income from transactions with loved ones. As soon as a marriage is dissolved, the privileges of close relationship between husband and wife immediately disappear. For example, even former spouses have questions about paying tax on gift items. Depending on your marital status, your tax liability may vary.

Civil marriage

Is a wife legally related to her husband? As a rule, they do not talk about biological kinship in the legislation of the Russian Federation. Can spouses be considered related to each other in a legal sense?

No, if we are talking about living in a civil marriage. More precisely, about cohabitation - when a couple lives together, leads a common life, sometimes even has children, but their relationship is not officially registered in the registry office.

Accordingly, the spouse in such a marriage will lose many rights offered by the state to official husbands and wives. But more on that a little later. To begin with, it is necessary to find out whether persons who entered into a marriage can be considered relatives.

Spouses who become grandparents to their grandchildren

Grandparents are close people to their grandchildren. This can be decisive in resolving a housing issue or in a custody issue if for some reason there are no parents.

The legislation of the Russian Federation protects the rights of children to the maximum extent possible. If the parents divorce, the grandchildren remain close relatives to the grandparents.

This is true even if the child lives with one of the parents. Who, if not the grandmother, will console, protect and shelter, and support with wise advice.

If the relationship between the sister or brother of a husband or wife develops well, this does not in any way affect the legal aspect of kinship. As before, these people remain distant brothers-in-law in relation to each other. They can be considered family members if they live in the same apartment. But this will not make them blood relatives.

Labor Code

A very mixed picture is emerging in the field of Labor legislation. Is the wife a close relative of her husband? It's difficult to answer. As practice shows, each employer decides on his own.

In the Labor legislation of the Russian Federation, close relatives are prohibited from working in the same municipal institutions, especially subordinate to each other. Also, when accepting a citizen for public service, all close relatives will be checked for criminal records.

In fact, in some companies, spouses are not considered close relatives. They work calmly together. When hired by government organizations, a husband/wife will most likely be checked for a criminal record. Therefore, we can come to the conclusion that the Labor Code of the Russian Federation does not provide an accurate definition of the relationship of spouses.

Division of inherited property

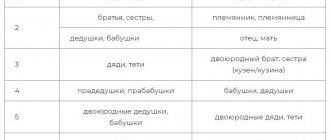

So, let's imagine that there is an inheritance, but no will. How and between whom will the property be divided? For these purposes, a queue was invented. All applicants are considered in this order. If there are no relatives from circle number one, then the turn moves to the second circle. There are six such circles of kinship in total.

Important!

To receive property in the form of an inheritance, you will need to prove the degree of relationship in relation to the deceased. For heirs of the first stage, this is not difficult to do, but the further the family roots go, the more difficult it will be to prove involvement in the family.

The first line of inheritance is the person's significant other, children/grandchildren and parents.

To prove the degree of relationship, a marriage or birth certificate is provided, depending on the specific case. To receive property, a spouse needs a document confirming the marriage.

In the second line are brother/sister, grandmother/grandfather, and nephews.

This and subsequent categories of persons can apply by right of representation. As a rule, things don’t go further than the second group, but to complete the picture you need to familiarize yourself with the rest:

- In the third line you can list uncles/aunts, cousins/brothers.

- The fourth group unites long-livers: great-grandfathers and great-grandmothers.

- If the family is large and there are really a lot of relatives, then even cousins and grandparents from the fifth line will be able to claim their right. Children of nephews are considered cousins.

- In the sixth line are cousins/aunts, nephews/nieces, great-grandchildren/great-granddaughters.

To document your relationship to the “family circle,” you need to collect a lot of documents. Sometimes this is a futile exercise, but if a good inheritance is at stake, there is a chance to try your luck and get it.

About family happiness and family unhappiness. Part 2.

Relatives and friends Usually young owners are very worried about the sovereignty of their home and are sensitive to family, that is, too frank criticism and persistent advice from relatives.

The older generation would act wisely if they began to look more leniently at the style of furniture or door handles in their children’s home, if they did not impose the need to include or exclude certain little things from the life of a young family. “Let us value unanimity in the family above all else, and we will do everything in this way and strive to ensure that peace and silence are constantly preserved in the marriage,” these words of St. John Chrysostom can be addressed to both spouses and their loved ones, because peace in the family depends a lot from relationships with relatives, with parents and from the attitude of parents to the children’s family and to their home.

Caring for children does not stop when they get married. But it takes other forms. Now constant supervision and prompting are no longer appropriate.

You will simply have to close your eyes to many mistakes and give the children the opportunity to “enjoy” some of life’s bruises and abrasions.

Economic councils should also have their limits. By the way, it is precisely unjustified petty interference in someone else’s household that often leads to confrontation between daughter-in-law and mother-in-law, son-in-law and mother-in-law, and sometimes between mother and daughter.

Of course, some mothers have enough strength, taste and skill not only for their own home, but also for their daughter’s house and daughter-in-law’s house. An elderly woman has both experience and skill, but... How much happiness, how much peace, how much hope in the words “my home”!

One of the most important stages in life is having your own home.

Wife and husband - who are each other?

Both the RF IC and the RF Tax Code exclude spouses from the terminology “close relatives”. It is logical that the husband is in no way related by blood to his wife. Single blood is considered the main criterion for the closest relationship of citizens; accordingly, those who enter into marriage do not belong to them. Thus, spouses are considered to each other not only as interdependent persons, but also as members of the same family, as well as children and parents. Accordingly, in all transactions, spouses will have the same rights or obligations (or will be exempt from them) as relatives called close.

According to the letter of the law, spouses are not relatives at all, and not even close

According to the country's Tax Code, lovers who live together, but have not registered their relationship in the registry office, are not considered relatives of each other, especially close circles, or family members. As for ex-wives and husbands, it’s a little more complicated. For example, if the husband gave his wife a Mercedes, and in the same year the couple divorced, for this tax period the owner of the foreign car is still not obliged to pay tax to the state treasury. To avoid paying a fee for an expensive gift, a woman must tell inspectors about the current situation and provide the Federal Tax Service with documents proving that when she accepted the keys to the vehicle, she was married to its donor. If the ex-husband gives his ex-wife a valuable gift after the divorce, it will be taxed, just like a gift from any other stranger.