A year ago, less than half of Russian workers received white wages. As the Rabota.ru study showed, over 12 months the ratio changed in a rather unexpected way.

Have Russian companies become more honest? At least, the basis for thinking so is given by counting the answers to the first question “Are you officially registered?” Over the year, the percentage of those who work without registration has almost halved – from 24 percent to 13 percent. Accordingly, the percentage of “legitimate” employees increased from 76 percent to 87 percent (see chart No. 1).

According to Rabota.ru, the proportion of salaries in the envelope also shows positive dynamics. In 2014, there were a good third fewer of them than the year before. However, more and more employers are ready to officially transfer only part of your salary, and now the probability of finding a job with a gray salary is 59 percent. In more than half of the cases, companies hide part of their employees’ salaries from taxes (see chart No. 2).

Responsibility for salary “in an envelope” may change. Innovations concern both organizations and employees. In particular, it is proposed to bring to criminal liability employers who hide the tax base and the base for calculating insurance premiums. And workers can be punished for failure to pay taxes and contributions from salaries “in an envelope.” The bill has been submitted to the State Duma for consideration.

It caused a strong reaction among users of Bukhgalteriya.ru. More than half of the respondents do not agree that the employee should be responsible for the gray salary. About a third are confident that nothing will change. And only 18 percent of respondents think this is correct (see diagram No. 4).

What are the salaries?

The employer is obliged to pay employees wages, from which income tax is withheld at the rate of 13%. But in addition to this, the employer pays:

- 22% of the income of each employee to the Pension Fund.

- 2.9% in the Social Insurance Fund.

- 5.1% in the Federal Compulsory Medical Insurance Fund.

- From 0.2 to 8.5% for other types of insurance.

The company contributes about 30% of employees' income to various funds, which some employers seem pointless or simply unprofitable. But deductions go only from official wages. Therefore, some companies, in order to reduce their own expenses in various funds and budgets, issue employees “gray” or “black” wages.

There are three options for monthly income for hired workers:

| Type of salary | Description |

| White | The official, net earnings of an employee, from the amount of which taxes and contributions are deducted to all funds provided for by law. |

| Gray | They legally pay only a minimal portion of the money earned. From this part income tax and other payments to the budget are deducted. The employee receives most of the salary in cash without deductions or accounting. |

| Black | A salary on which no taxes are paid and no money is transferred to funds. Typically, such calculations are carried out with employees without concluding an employment contract or official employment. The amount of payment for work is based only on verbal promises and decisions of the employer. |

Fraud with “gray” and “black” salaries is illegal. They can lead to big problems for the employee and his employer.

The difference between white and gray salaries

White salary - assumes official employment. Having legal income from which all mandatory contributions are deducted guarantees the employee certain benefits:

- The bank approves the loan on more favorable terms for the borrower.

- Paid vacation and sick leave.

- Maternity payments are also higher, because the official amount received before going on sick leave for childbirth is included in the calculation.

- You can apply for a tax deduction and return part of the money paid from your salary.

- There are no delays when receiving your salary card.

- Upon reaching the legally established age, the pension and accumulated points will be significantly higher.

Gray wages are beneficial only to the employer. This scheme allows you to save about 30% of an employee’s earnings on contributions to funds. But the money saved will not be received by the employee, but by the company or a certain group of people who participate in the scheme.

The dangers of a gray salary for an employee are that:

- There are no guarantees of payment of the amount promised by the employer or boss.

- The salary is given to the employee in cash, in some cases without a statement or signature, sometimes in an envelope, which is a violation of the law.

- Benefits for women during pregnancy and childbirth will be minimal and in some cases no more than those who have never worked or earned money at all.

- Vacation and sick leave will be significantly less than in the official calculation.

- The loan may not be approved or will be offered less favorable conditions than borrowers who can prove a high level of income.

With a gray salary, the employee is registered at work, but officially receives much less than in reality. Those who receive menial wages work entirely unofficially.

What to do if you haven’t paid a gray or black salary

If you receive a gray or black salary, it will be very difficult to prove the employer’s dishonesty. Everything is based only on a verbal agreement, so scammers can profit from gullible employees. If you find yourself in a situation where you are underpaid, there is only one way out - to file a complaint against the employer and defend your rights.

If you are not paid the promised money:

- Collect all documents that can be used to prove that you receive an unofficial salary. After this, contact your employer and offer to resolve the issue peacefully.

- File a claim with the courts if your employer refuses to resolve your problem. Hire a professional lawyer. This can be quite expensive, but then the employer will have to reimburse all costs if the court finds him guilty as a defendant.

- Contact your employer with a request to pay a penalty if it is calculated for months worked with delays. Interest for late payment is charged in the amount of 1/300 of the key rate established by the Bank of Russia for each overdue day.

Before going to court, collect as much evidence as possible that you worked honestly for the benefit of the organization. Otherwise, the court may consider you a fraudster too. To be guaranteed to receive protection, you can submit 2 applications. One to the territorial tax service, and the second to the prosecutor's office.

Be sure to indicate in the application that the employer is avoiding fulfilling its obligations. To confirm your honesty and express your reluctance to receive unofficial income, also submit an application to the labor inspectorate. After this, the organization where you work will begin thorough checks. Based on their results, a decision will be made on the payment of fines and penalties.

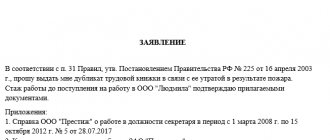

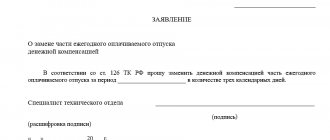

How to file a complaint

The document can be drawn up in any form. But in order for it to be accepted for consideration by government agencies, a number of requirements should be taken into account:

- Indicate information about the addressee and sender in the header.

- Briefly state in the text the reasons for filing the appeal. The full name of the organization, the offenses, their dates or duration and other information important to the case should be indicated.

- Use evidence to support the stated facts (preferably).

- Specify your requirements.

- Insert the date of compilation and signature with a transcript.

The complaint should be sent to the territorial office of the selected department in one of the following ways:

- send by Russian Post (it is advisable to use the service of sending a registered letter with notification and a list of attachments);

- bring it yourself and register it in the office or give it to management at a personal reception;

- use the electronic reception on the official website;

- communicate orally by phone.

What is the responsibility for issuing gray wages?

For settlements with employees under the gray or black scheme, the company will incur administrative penalties. If violations are detected, she will be fined. In the future, the issue of the activities of such an organization will be decided.

If taxes are not paid, then 20% of the total income of individuals for a specified period of time is withdrawn from the employer. And if the employer refuses to pay this money, he will also be charged a penalty. If insurance premiums are not paid, the company owner will also be fined from 5 to 10 thousand rubles.

If the total amount of unpaid taxes is more than 2 million rubles, then a criminal case will be opened against the company. In this case, penalties for paying black and gray wages may be as follows:

- A fine in the amount of 100 to 300 thousand rubles.

- Compulsory work 2 years.

- Imprisonment for up to 6 months.

- Restriction of freedom up to 2 years.

An employee who, in turn, does not pay income tax on income received also violates the law. He may be punished with correctional labor and fines. For refusal to pay 13% of wages, an employee faces a fine:

- 20% of the hidden salary, provided that the employee did not pay them out of ignorance;

- 40% of the amount of hidden income, provided that the employee deliberately evaded obligations.

The employee may also be fined up to 300 thousand rubles. Either he was arrested for 6 months, imprisoned for up to 1 year, or sent to forced labor.

Is there any threat to an ordinary worker?

“Salary” commissions do not threaten such things. At the same time, if the employer does not withhold tax from their income, they themselves are obliged to fill out a tax return by April 30 of the following year and pay all taxes themselves by July 15.

Legally, no one exempts an employee from paying personal income tax , so according to clause 1 of Art. 228 of the Tax Code of the Russian Federation, he is simply obliged to calculate it and pay it himself. Otherwise, he is also subject to liability based on the results of a tax audit.

Don't forget to add "FBM.ru" to your news sources

Advantages and disadvantages of gray salaries

There is only one advantage of gray and black wages - saving money on taxes and fees. Some employers share part of the money saved with the employee, but this does not always happen. In addition, illegal schemes have a large number of disadvantages:

- In case of conflict situations and labor disputes, the amount of material incentives from the company owner may be significantly reduced.

- Upon dismissal or parental leave, the amount of payments is calculated only in accordance with official income. That is, their amount will be significantly less.

- When applying for a loan, only the official part will be indicated in the documents. There is a high probability that you will be denied a loan or approved for an amount that will not be enough.

- Contributions to the Pension Fund are minimal, which means you shouldn’t count on a decent old age.

Payroll fraud results in audits, fines and criminal liability for both employer and employee.

Is it possible to prove in court the payment of unofficial wages?

Many employees deceived by their employers do not go to court, believing that if wages were paid to them unofficially in person, then it is impossible to prove anything. This is not entirely true: it is difficult to prove that the salary was paid in an envelope, but it is possible.

The main evidence can be voice recordings (and almost every mobile phone now has a voice recorder), testimonies of other employees, newspaper advertisements in which employers often carelessly write the proposed salary (higher than what employees with an official salary in a similar position usually receive), etc. similar.

Was the information interesting or useful?

Yes62

No8

Share online

Risks when using gray income

If an employer decides to use fraudulent schemes to defraud an employee's wages, they must be aware of the risks. An organization that practices shady salaries most often attracts the attention of inspection authorities. Company owners often decide to engage in such fraud because they are confident that employees will not file a complaint against them. And if they do, it will be very difficult for them to prove they are right. In fact, it is possible to prove the employer's guilt. This can be achieved in the following ways:

- Unscheduled inspection by tax authorities. Tax officials can recalculate the number of people working in the company and compare the resulting number with the one stated in the documents. After this, it will not be difficult to find employees who work illegally in the organization.

- Reaction to complaints from employees or competing companies . Moreover, such applications are accepted by different authorities: the labor inspectorate, the tax service, the prosecutor's office and the police.

You should not expect that you will be lucky and illegal workers will meekly comply with all the employer’s conditions. Grey and black salaries to employees is a serious offense, the consequences can be too serious, including for employees. If they prove fraud on the part of the staff, then after a criminal record it will be many times more difficult to get an official job.

about the author

Klavdiya Treskova - higher education with qualification “Economist”, with specializations “Economics and Management” and “Computer Technologies” at PSU. She worked in a bank in positions from operator to acting. Head of the Department for servicing private and corporate clients. Every year she successfully passed certifications, education and training in banking services. Total work experience in the bank is more than 15 years. [email protected]

Is this article useful? Not really

Help us find out how much this article helped you. If something is missing or the information is not accurate, please report it below in the comments or write to us by email

For live bait

The essence of the claims.

Well, for example, we all know: tax authorities have the right to request from the bank information about the movement in the accounts of an individual at a “camera room”, VNP or “oncoming traffic” (Article 86 of the Tax Code of the Russian Federation). To make a request, assumptions about envelope schemes and permission from the head of the Federal Tax Service are sufficient. They will ask and see that this individual, who officially earns the “minimum wage” or has no permanent income at all, replenishes his bank card every month with the same amount or regularly receives money from unknown people into his account. And they will suspect, of course. Well, for example, every 5th day of the month a citizen puts 50,000 rubles on his bank card. In order to understand that this money is his salary, you don’t need to be Commissioner Maigret or Major Pronin. Such a “quiet guy” will be called in for questioning at the inspectorate and they will try to find out “where the firewood comes from.” Many successfully “unlock”, but many also “pierce”, that is, they “surrender” their benefactor-employer - the hand that feeds - with all their guts.

It is noteworthy that a company where everything is paid “in white” can also fall under the “distribution”. One problem is that it employs a couple of employees (sometimes one is enough), let’s say, not very far-sighted, with a dull instinct of self-preservation, but who have additional income. For example, they rent out real estate or bake cakes to order in their free time from their main job. At the same time, these “Buratins” and “unaccounted for Rockefellers” do not take the money from additional income to the field of miracles, but carefully put it on the map. Salary. And in this case, there is a risk that inspectors will consider side income to be part of the salary that the company paid in cash. In principle, it will not be difficult to prove the opposite to the employer. But the nerve cells are not restored.

note

The salary in vacancies should not differ greatly from the reporting that the company submits to the tax office. Inspectors may come under suspicion based on their salaries. For example, if they decided to offer a new candidate more money than their predecessor.

How to avoid.

System administrators and other techies use the term “fool’s button.” That is, protecting software, etc. from obviously incorrect actions of a not very advanced user. In our case, only preventive measures can help. Oblige employees to use the salary card only for its intended purpose - to receive income from the company. Exclusively. There should be no extraneous receipts into the account. It is better in words: to include such a condition in an employment contract means to arouse the suspicion of labor inspectors.

Comments: 1

Your comment (question) If you have questions about this article, you can tell us. Our team consists of only experienced experts and specialists with specialized education. We will try to help you in this topic:

Author of the article: Klavdiya Treskova

Consultant, author Popovich Anna

Financial author Olga Pikhotskaya

- Irina

09.09.2020 at 21:17 Very useful article!! but...

Our legislation is strange... everything is done so that the deceived employee does not go anywhere to complain, otherwise he will be punished!! although from my own experience I will say that I would really like to punish my employer, who decided to pin a fine on the organization on me. And now it turns out that if I complain about it, I’ll get the heck out of it!! because I had no idea about the “gray salary”, but I thought since it was officially registered and taxes were paid for me, then everything was fair!!! but it turns out that no, I almost scammer!! and that someone sells out their unscrupulous employers on such conditions???? Reply ↓