Transferring to a new job, downsizing, and being fired for health reasons are difficult times in every person’s working life. And the state took care of material support for those who were left without a position by their own consent or by “coincidence of circumstances.” Severance pay is intended to mitigate the financial instability of the “transition period” and provide the opportunity to calmly find a new job.

In what cases can you apply for it? What determines the amount of severance pay upon dismissal in 2021? And who does the employer have the right to refuse? Marianna Filippova , associate professor at the Institute of Law of the Russian University of Transport, candidate of legal sciences, told FAN journalist about this

Benefit amount and payment period

Severance pay is a lump sum payment upon dismissal and is issued or transferred to an employee of the company regardless of the payment of remaining earnings and compensation for unused vacation. The benefit is paid according to certain rules, administrative acts and dismissal orders with corresponding payments are drawn up on the basis of ordinary personnel forms and their unified forms. The following must be indicated:

- reasons and grounds for making a decision;

- amount of benefits and other compensation.

Also necessary in the document is the signature of the employee, confirming that he has read the document.

Compensation upon dismissal, as well as the grounds for its provision, are provided for in labor legislation and regulations or in a collective and labor agreement. The legislation provides for different amounts of monetary compensation - from two weeks' average earnings or more. It depends on the reason for stopping work.

You need to pay taxes and insurance premiums on your severance pay! Find out for free in ConsultantPlus how to do this correctly.

Who is entitled to benefits upon voluntary dismissal in 2021?

The right to vacation (and payment of compensation for it), as well as to other types of benefits (sick leave pay, additional payments upon dismissal), is available only to those employees who have an employment contract with the employer.

Performers working under civil contracts (contracts, leases, provision of services, etc.) do not have the right to claim additional compensation at the end of the contract and payments upon dismissal, except for payment for the work done.

For other information about the peculiarities of concluding civil contracts, see the article “Contractor agreement and insurance premiums: nuances of taxation” .

Employees who have entered into employment contracts have the right to take leave:

- after 6 months of work;

- or earlier - in agreement with the authorities or in the presence of certain conditions (minors, pregnant women) in accordance with Art. 122 Labor Code of the Russian Federation.

Upon dismissal, the employer is obliged to calculate and pay compensation for all periods of unused vacation, regardless of their duration and reasons for dismissal (Article 127 of the Labor Code of the Russian Federation). If the vacation was taken in advance, the excess amount paid may be withheld from the final payment.

Payments to the dismissed employee must be made on the last working day, and if he is absent from work, no later than the next day after applying for payment (Article 140 of the Labor Code of the Russian Federation).

If you have access to ConsultantPlus, check whether you made the final payment to the employee correctly. If you don’t have access, get a trial online access to the legal system for free and switch to the Ready Solution.

Who will be paid for 14 days

A dismissal payment in the amount of two weeks' average earnings is due in the following cases:

- Upon termination of an employment contract for medical reasons. If an employee is recognized as completely disabled or for any reason does not want to transfer to a new workplace, then he is entitled to severance pay upon dismissal for health reasons, two weeks’ pay and wages for the time actually worked. It is important to note that if an employee quits due to health reasons, but at his own request, then compensation is not paid.

- The legislator established severance pay upon dismissal from the army, which is compensation in the amount of two weeks' earnings and is paid upon conscription into the army or assignment to an alternative service replacing it.

- In case of dismissal upon reinstatement of the employee in service by a court decision.

- If an employee refuses to take a position when the company moves to another city or region.

- If you disagree with changes to the terms of the employment contract in the manner prescribed by Art. 74 Labor Code of the Russian Federation.

Payments upon dismissal at one's own request

If an employee terminates the contract on his own initiative, as a payment upon dismissal, he is entitled only to payment for the period worked and compensation for unused vacation.

For information on how to make calculations in this case, see the article “Calculation of compensation for unused vacation according to the Labor Code of the Russian Federation .

If an employee has debt, including for vacation taken in advance, the employer has the right to withhold amounts previously paid in excess, but not more than 20% of the accrued salary (Article 138 of the Labor Code of the Russian Federation). If your earnings are not enough to pay off your total debt, you can take the following actions:

- obtain written consent from the employee to withhold the required amount;

- offer to deposit the amount of debt into the cash register;

- forgive the employee's debt upon dismissal.

Who will be paid the monthly income?

Compensation in the form of one month's earnings is paid:

- in case of staff reduction or liquidation of an enterprise (clause 1, 2, part 1, article 81 of the Labor Code of the Russian Federation);

- upon cancellation of employment contracts executed with violations (clause 11, part 1, article 77 of the Labor Code of the Russian Federation).

In case of downsizing or liquidation of an enterprise, payment is made along with the settlement and in the first month after the official severance of the employment relationship. But such payments are not available to seasonal workers, conscripts, and part-time workers.

When a larger amount is due

If the employee has not found a new job

For the second month, benefits are paid if the former employee was unable to find a job within 60 days (in case of staff reduction or company liquidation). In some cases, payment for 3 or even 6 months is possible if the employee applied to the employment center (two weeks and 30 days, respectively), but there was no vacancy and he did not find a job (Articles 178 and 318 of the Labor Code of the Russian Federation).

To confirm that the former employee has not taken a new job, he brings the relevant documents to the former employer. Their list depends on the month for which benefits are paid after dismissal.

| Period from the date of dismissal | Amount of payment and list of documents to be presented to the former employer |

| After the second month. After the second and third months - for workers of the Far North and equivalent territories | Average monthly earnings. Documentation:

|

| After the third month. After the fourth, fifth and sixth months - for workers of the Far North and equivalent territories | Average monthly earnings. Documentation:

|

If a citizen gets a job at this time, he will be paid only for the time he was registered with the employment service. In this case, instead of the original work book, they bring a copy of it, certified at the new place of work.

Also, the Labor Code (Articles 181, 278, 279) provides for special payments upon dismissal of the enterprise’s managers, their deputies and the chief accountant at their own request in 2020. In this case, for the period of employment, compensation is three monthly earnings.

Is severance pay available to part-time employees?

Guarantees and compensations provided for by labor legislation and other acts containing labor law norms, collective agreements, agreements, local regulations are provided to persons working part-time in full, with the exception of persons combining work with study, as well as persons working in the regions of the Far North and equivalent areas (Article 287 of the Labor Code of the Russian Federation).

Thus, the norms of the Labor Code of the Russian Federation establishing the payment of severance pay also apply to part-time workers.

But as for maintaining the average monthly earnings for the period of employment for no more than two months from the date of dismissal due to staff reduction, since the employee is already employed at his main place of work, the average monthly earnings, unlike severance pay, are not retained for him.

Dismissal of a manager or chief accountant

It happens that managers or chief accountants quit. Payments will be accrued in the following cases:

- they were removed from office by the founders without any guilt;

- The new owner of the business decided to fire them.

There are several situations when a change of ownership of a company occurs:

- privatization of state and municipal property (sale or provision into private ownership);

- retransfer of property belonging to the organization in favor of the state;

- sale of the enterprise as a whole complex of property.

A change in the composition of the company's participants (inclusion of new participants or withdrawal, exclusion of old ones, including a complete change in composition) does not constitute a change of owner.

The employer in accordance with Art. 278 of the Labor Code of the Russian Federation pays the manager money in the amount established by the employment agreement, but not less than three times the average monthly salary.

But there are also nuances in the payment of benefits upon dismissal of managers, their deputies and the chief accountant - amounts of money are not paid if:

- there are illegal actions on their account;

- they made decisions that negatively affected the financial position of the organization.

When they will only pay if agreed upon with the employer

Upon resignation of one's own free will

If the contract is terminated at the request of the employee, then no incentive or compensation payments are provided for by law, that is, severance pay is not provided for voluntary dismissal. But if management wants to reward an employee for long and fruitful work, they will award a bonus on their own initiative; such cases are known.

By agreement of the parties

Typically, dismissal by agreement occurs on an individual basis. The amount of the fee is not established, so payment is made by mutual agreement of the parties. The problem of the amount of payment, how to calculate severance pay upon dismissal by agreement of the parties, is solved within the framework of individual agreements.

But the salary, which was not paid to the employee for the period worked, is issued without fail on the last day of work.

Upon retirement

Labor legislation does not provide for severance pay upon retirement, but in accordance with Part 4 of Art. 178 of the Labor Code of the Russian Federation, similar bonuses are allowed to be prescribed in the employment contract or they may be provided for by internal regulations of the organization itself. Such payments are provided at the request of the employer and are not regulated by law. The organization has the right to establish any number of financial assistance measures without restrictions. This type of help is, rather, gratitude for the work.

Compensation for unused vacation

In addition to payment for days actually worked, the dismissed employee receives compensation for unused vacation. Such a refund occurs when a person has already taken vacation for the current calendar year and then decides to quit. So, depending on the situation, the payment of vacation pay upon dismissal occurs as follows:

- if the working year has not been completed and vacation has not been taken, then its days are calculated in proportion to the months worked;

- if compensation must be paid for previous years, then the standard calculation is based on 28 days of vacation per year;

- if the dismissal occurs before the end of the period for which the person has already received vacation, then the days will have to be calculated proportionally and the paid vacation pay will have to be withheld on the basis of Article 137 of the Labor Code of the Russian Federation.

It is important to remember that the payment required by law in these situations is considered not based on actual earnings, but on the basis of average earnings for vacations in accordance with Decree of the Government of the Russian Federation No. 922 of December 24, 2007. The online calculator for calculating vacation pay compensation on our website will help you understand how it is calculated upon dismissal - use it to calculate the amount of compensation.

As a general rule, the number of unused vacation days is determined by the formula:

Days for rest compensation = the product of the number of vacation days allotted to the employee for each month of work (on average 2.3 for each month), and the number of months worked at one workplace, minus the days already taken off during this period.

According to the norms of Article 115 of the Labor Code of the Russian Federation, annual paid leave of 28 calendar days for one year of work is provided to all Russian employed citizens. There are categories of citizens for whom additional paid time is legally established by virtue of Article 116 of the Labor Code of the Russian Federation. These, in particular, include personnel with a special nature of work, employees with irregular working hours, persons working in the Far North and equivalent areas, and other persons in cases expressly provided for by the Labor Code and other federal laws. For such categories of persons, the calculation formula does not change, but it should take into account not 28 calendar days, but the rest period due to a specific employee.

It is important to take into account that there are features of calculating the number of months that a citizen worked for a particular employer; they are formulated in the rules approved by the People's Commissar of the USSR on April 30, 1930 N 169. For example, if less than half a month has passed from the beginning of the month to the date of dismissal, then this month is calculated from excluded, and if a person managed to work half or more, then this month is taken into account when calculating vacation pay as a whole month. That is, there is no need to divide vacation days for one month in proportion to days worked.

In addition, there are a number of categories of employees who earn their vacation not in calendar days, but in working days. These include, in particular:

- employed under a fixed-term employment contract for a period of 2 months, as defined in Article 291 of the Labor Code of the Russian Federation;

- seasonal workers by virtue of Article 295 of the Labor Code of the Russian Federation.

Upon dismissal, such citizens are also entitled to compensation for unused vacation, and the principle of its calculation does not differ from the main one, but establishing the number of unused vacation days is a little more difficult. It will help to determine how vacation pay is paid upon dismissal; in such special cases, the following formula:

According to the provisions of Article 217 of the Tax Code of the Russian Federation, the amount of compensation for unused vacation is subject to personal income tax in full. The employer transfers the withheld tax to the budget no later than the day following the day of payment to the employee.

Other cases

If an employee was illegally fired and he is reinstated to his previous place of work, then he is entitled to severance pay upon reinstatement at work for the entire period of the employee’s absence (forced absenteeism). The organization is obliged to calculate the average salary (if it was an illegal dismissal) or compensate the difference in wages (if it was an illegal transfer).

Since an individual entrepreneur is not a company or a legal entity, a number of labor laws are not applicable to it. According to the decision of the Supreme Court No. 74-KG16-23 dated 09/05/2016, employees working for individual entrepreneurs count on benefits, but they are not always paid:

- upon liquidation of a business, termination of activities as an individual entrepreneur;

- when staffing is reduced.

However, an individual entrepreneur is obliged to notify the employee of the upcoming dismissal and pay him the amounts due if such conditions and guarantees are included in the employment contract.

The law enforcer proceeds from the fact that this employer is an individual, and severance pay for cumulative accounting of working hours is paid in the same way as for any other accounting.

Table of benefit amounts depending on the circumstances of dismissal

| Grounds for dismissal | Benefit amount |

| Liquidation of a company | In the amount of average monthly earnings for all categories of workers, with the exception of those specified in Art. 178 Labor Code of the Russian Federation:

|

| Reduction in headcount or staff | __//__ |

| Refusal to transfer for medical reasons | Average earnings for two weeks |

| Conscription into the army or alternative service | __//___ |

| Due to the reinstatement of an employee who previously performed work, by a court decision or labor inspectorate | __//___ |

| Refusal to transfer together with the organization to another location | __//___ |

| Recognition based on a medical report as completely incapable of performing relevant duties | __//___ |

| Refusal to work under new conditions | __//__ |

| Violation of the rules for concluding an employment contract established by law, which occurred through no fault of the employee, if such a violation precludes transfer or continuation of activity | Average monthly earnings |

Who is not paid severance pay?

The Labor Code directly establishes cases when severance pay is not paid. Thus, it is not paid to employees:

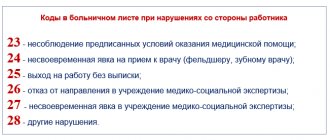

- dismissed due to unsatisfactory test results (Article 71);

- dismissed on grounds that relate to disciplinary sanctions (Part 3 of Article 192), or on other grounds established by the Labor Code or other federal laws related to the commission of guilty actions (inaction) by employees (Article 181.1);

- who have concluded an employment contract for a period of up to two months (unless otherwise established by federal laws, a collective or labor agreement) (Article 292).

In addition, in accordance with paragraph 62 of the Resolution of the Plenum of the Armed Forces of the Russian Federation dated March 17, 2004 No. 2 “On the application by the courts of the Russian Federation of the Labor Code of the Russian Federation,” severance pay paid to an employee is subject to credit if he is reinstated at his previous job if the dismissal is declared illegal .

The procedure for calculating the payment and the formula for calculation

The calculation formula looks like this:

Severance pay = average daily wage × number of working days in the month following the month of dismissal.

To calculate severance pay, you need to determine the following values:

- billing period;

- the number of days that the employee actually worked;

- total salary;

- the number of days recognized as workers during the period for which benefits are paid.

Calculated payment period

The 12 calendar months preceding the month in which the employee is laid off are taken.

Actual days worked

All working days when the employee worked are taken into account.

The time spent on annual leave and sick leave is not taken into account.

How to calculate the payment amount

As a general rule, when determining the average monthly earnings of a resigning employee, the employer is obliged to take into account all payments:

- salary, including salary and tariff rates;

- surcharges and allowances;

- bonuses - both one-time, quarterly or annual;

- all types of incentives and material incentives for work.

But compensation of a “social nature” is not taken into account in the calculation. We are talking about financial assistance paid by the enterprise, or payment for food, travel, training.

Accounting collects data on employee payments for the last 12 months and determines the “cost” of one working day. It is worth considering that periods when the person did not work are removed from the calculation. For example, time spent on vacation or sick leave will not be taken into account.

pixabay.com/

“This year, days declared non-working due to the threat of the spread of coronavirus infection are also excluded from the calculation period,” Marianna Filippova clarifies. — These are the periods from March 30 to April 30 and from May 6 to May 8 inclusive, as well as non-working days of June 24 and July 1. Also, the calculation of the average salary does not include downtime. And it doesn’t matter whether this happened through the fault of the employer or for reasons beyond the employer’s control.”

This rule has no relation to non-working holidays. They are included in the billing period and taken into account to determine average earnings.

To independently calculate the amount of severance pay, you need to know:

- number of working and non-working holidays of the billing period;

- the amount of daily earnings.

The latter can be calculated independently. To do this, all payment amounts for 12 months must be added up and then divided by the number of working days. When calculating the number of working days, do not forget to “throw out” sick leave, vacations and business trips from the total number.

For example, you calculated that you worked 205 days over the last year. During this time, you were accrued 650 thousand rubles in wages, bonuses and allowances. Dividing the amount of payments by the number of days, we get the average “cost” of one working day. In this case, it is equal to 3170 rubles.

Based on this amount, the amount of severance pay is determined in each of the following months. Count the number of working days in the next month and multiply by the cost of one day. For example, there are 21 working days in a month, then the amount of compensation should be 66,570 rubles. If the employer is ready to pay money for the second and third months, calculations are made for each of them.

Examples of calculations

Let us show with examples how benefits are calculated.

Example 1.

Svetlyachkov I.S. worked at Vesna LLC. On 10/16/2020 he was fired due to the liquidation of the organization. Svetlyachkov’s monthly salary was 23,000 rubles, and his vacation was used in full. Upon termination of the contract, Svetlyachkov must be paid:

- wages for days worked;

- severance pay.

In October 2021, there are 22 working days, of which the employee worked 10. His earnings will be:

23,000 rub. / 22 × 10 = 10,454.50 rubles.

To calculate severance pay, the average earnings are used. Over the past 12 months, Svetlyachkov worked 260 days.

23,000 × 12 / 260 = 1061.54 rubles.

There are 20 working days in November, which means the severance pay will be:

1061.54 × 20 = 21,230.80 rubles.

Example 2.

Romashkina Maria Petrovna was fired on September 31, 2020 due to staff reduction and immediately registered with the employment service. Upon dismissal, she was given a salary for September in the amount of 30,000 rubles. The vacation was fully used, therefore, there was no compensation for it.

During the previous billing year, she worked 249 days. Let's calculate monthly earnings:

30,000 × 12 / 249 = 1445.78 rubles.

In September there were 22 working days, therefore, Maria Petrovna received severance pay in the amount of:

1445.78 × 22 = 31,807.16 rubles.

But this month she was unable to find a job. Due to the fact that she contacted the employment service on time, she is entitled to benefits for another 30 days. There are 22 working days in October, therefore, Maria Petrovna will receive benefits in the amount of:

1445.78 × 22 = 31,807.16 rubles.

She will no longer be paid.