Wages are the main type of income for most citizens, and for many even the only one. Therefore, this is a very important economic factor and a serious indicator not only of the cost of labor, but also of the country’s financial resource. In addition, this is the most real motivation for an employee’s work, a regulator of supply and demand in the labor market and a sign of professional status.

Let's consider the difference between the two main types of wages - real and nominal.

How is real wage ?

Scope of this concept

The types of wages are not specified in the Labor and Tax Codes, they are not distinguished in accounting, and are not used in reporting and working documentation. These terms are general economic terms and also relate to statistical information.

The general definition of wages relates to the reward for work. Looking at it from different points of view, one can define salary as:

- compensation for labor in cash;

- part of the total product in financial equivalent, which becomes the property of the worker depending on the quantity and quality of his labor costs;

- the cost of labor resources used in the production process;

- part of the expenses of a manufacturer or entrepreneur intended to pay for hired labor.

The state guarantees workers wages not lower than the minimum allowable amount established by law ( minimum wage ).

What is the minimum wage (minimum wage) ?

Comparative dynamics of growth processes

There are several options for how changes in wages depend on inflation.

| Nominal income | Inflation | Real income |

| Height | Equal pace | Stable level |

| Height | The pace is lagging | Increase. Occurs rarely and in certain groups of workers |

| The size does not change | Decline | Height |

| The size does not change | Height | Decline |

In the latter option, there is a gradual decrease in the real incomes of citizens. In the absence or delay of indexation, dangerous consequences may arise in the form of hyperinflation and commodity saturation of the market.

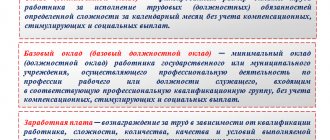

Nominal salary

The nominal value of wages denotes its numerical expression. This is the amount of money that is intended to be paid for the work of an employee in a given period.

Properties of nominal wages:

- reflected in special documents in the form of digital values (in the staffing table, payroll, etc.);

- has an absolute expression;

- includes not only the amount given to the employee in person, but also mandatory deductions in the form of taxes and contributions to social funds.

REFERENCE! The amount exempt from required deductions, which the employee receives as a result, is called “net” wages.

Forms of nominal salary

- Remuneration accrued specifically for work, depending on the time spent, the amount of work performed and its quality characteristics.

- Payment based on labor results:

- by the number of its products (piecework);

- at established rates;

- according to time worked.

- Compensation for special working conditions:

- additional payments for harmfulness and severity;

- overtime;

- business trips;

- overpayment for night work;

- bonuses for leadership work;

- payment for forced absences and/or downtime, etc.

- Payments for non-working hours:

- vacation pay;

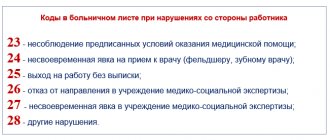

- sick leave;

- additional payments provided for by internal regulations, for example, health benefits, etc.

- Incentive payments:

- bonuses;

- bonuses;

- monetary awards;

- 13 salary, etc.

How to register non-payment of bonus to an employee ?

Real wages

The money received by a hired worker is the source of his existence. He buys clothes and food with it, spends it on travel, spends it on his family, and, if necessary, on treatment, and also provides for his entertainment and development. Therefore, the amount of wages should reflect the volume of values that can be purchased for it at a given time stage. The purchasing power of the amount received in hand is the real wage .

If prices for goods and services were constant, then there would be no need to distinguish between the concepts of nominal and real wages: a single figure would reflect the well-being of each individual worker, since it would be possible to determine exactly what he could buy with it.

However, the market situation with its constantly changing conditions makes the discrepancy between real and nominal wages inevitable. At different times and under different circumstances, you can live completely differently on the same amount.

What affects real wages:

- market price fluctuations;

- inflation;

- the relationship between supply and demand for goods and services in the consumer market;

- amounts by which the nominal salary is necessarily reduced (taxes, fees, deductions).

Factors of influence

Factors influencing the calculation of nominal wages

Below are the factors influencing the calculation of nominal wages:

- Employee's personal contribution to production. This is his experience, qualifications, existing skills, the quality of the work performed, as well as the volume performed.

- Various incentives for quality work done. These are additional payments for overtime work, increased productivity and quality of goods.

- Difficult working conditions. These are harmful production conditions, difficult working conditions and an intense work schedule.

- Methods of calculating remuneration - based on salary, a certain tariff, per unit of working time or product produced.

- The amount of time worked or the production rate.

- The minimum wage is the minimum wage. This parameter is the minimum threshold for calculating a nominal salary and depends largely on decisions at the state level.

Harmful working conditions

Factors influencing the calculation of real wages

Let's consider these factors:

- current tax burden. The higher the tax rates and the size of contributions to the Pension Fund, the lower the real wage will be. In addition to the personal income tax, the enterprise also pays the unified social tax from the salaries of its employees, the overwhelming share of which in the amount of tax payments;

- changes in the cost of consumer goods and services. This leads to a depreciation of the funds actually received by the employee;

- increase in tariffs for housing and communal services - these costs every year “eat up” an increasing part of the money received by the employee for his work;

- demand for certain specialties in the labor market. If any specialty becomes in demand, and there are not enough professionals, then the level of wages will increase;

- wage indexation is more applicable to budgetary organizations. Private organizations do not seek to revise salaries and tariff rates of workers;

- discrimination based on gender and nationality - women will be paid less than men in the same position. Migrants will be paid a minimum wage under “black” or “gray” schemes;

- delay in payment of wages. At the same time, the salary was accrued and even taken into account in statistical calculations, but the employee did not receive it;

- payment of part of the salary not in cash, but in kind - that is, in products. This method was widely practiced in the post-Soviet period. For the state system, such a factor is simply destructive - no taxes are received from barter transactions that workers were forced to engage in. It is possible that in the current crisis conditions the influence of this factor may increase.

Real and nominal wages in the current conditions of economic development are completely different things. Both of these indicators depend on each other, and each of them has its own impact on the economy.

Real wages directly affect the purchasing power of the population, and nominal wages directly affect the size of real wages. Theoretically, it is possible by legislative means to artificially adjust the level of real wages to the threshold of nominal wages, but in the current conditions this will not be possible due to growing inflation.

If you find an error, please select a piece of text and press Ctrl+Enter.

Real wage index

The value characterizing changes in real wages in a particular time period is called the wage index . It is calculated by dividing the actual wage index at par by the consumer price index . The latter is determined by comparing the base price of the consumer basket and its value at the specific time under study. The consumer basket is a set of goods and services established by the state that provides the necessary minimum for citizens.

FOR EXAMPLE. Let's take the nominal salary of 2015 as 100%. Let's say that on average in 2021 it grew by 15%. Then the nominal wage index in 2021 will be equal to 115%. At the same time, the cost of the consumer basket increased by 20%, that is, the consumer price index is 120%. Then the RRP index for the current year compared to the previous year, taken as the base, will be approximately 96%. This means that the purchasing power of citizens has fallen somewhat.

IMPORTANT INFORMATION! Indices of nominal and real wages, along with average monthly “nominal” indicators, are components of statistical information that must be provided by all member countries of the Eurasian Union to the Eurasian Economic Commission, according to Decision No. 175, adopted by the Board of this commission in Moscow on December 29, 2015.

Inverse relationship

If the rate of inflation outpaces the rate of increase in wages, the purchasing power of money decreases. At the same time, despite the growth of quantitative indicators, their true value decreases. This will be seen in the following situation:

- growth of nominal salary – 20%;

- inflation rate – 40%.

The change in real salary in this case will be negative; it will decrease by approximately 20% (120 - 140%). In this case, despite a fairly significant increase in the level of salary, its real value decreased - the entire increase was “eaten up” by inflation.

Therefore, in the new year, even taking into account the increase in the amount of funds received, it will be possible to receive less goods and services with them than in the previous year.

If the real salary increases, then the nominal salary always changes only in a positive direction. This is due to the fact that in the modern economy there are always inflationary processes and the general price level is constantly increasing, without a tendency to decrease.

To assess the well-being of an employee and the purchasing power of his wages, such forms as nominal and real are used. And if the first displays only the amount of money, then the second allows you to determine exactly what benefits can be purchased for them. These indicators should always be considered together, since there is a close relationship between them.

How is the consumer price index calculated? And what products are included in the set?

To calculate the consumer price index, the following is used:

- information on consumer prices for goods and services;

- information on actual consumer expenditures of the population on their purchase (data from household budget surveys).

First, for each type of product in a separate organization in the city being surveyed, a price index is calculated (the change in the price recorded in the reporting period compared to the previous one).

The resulting individual price indices for goods and services are multiplied by their share in the structure of consumer spending of the population to form the final price indices for groups of goods, for the constituent entities of the Russian Federation and Russia as a whole.

The study is carried out on a sample range of cities - in 282 cities of Russia. This:

- all regional centers of the Russian Federation;

- cities selected by the largest share of the urban population in the region (the total share of the population in the city must be at least 35% of the population in the region);

- cities that have a stable assortment and at least ten trade and service facilities.

Once a week, prices for 100 goods and services are recorded. Once a month, statisticians analyze 520 positions. The weekly list mainly includes food, medicine, housing and communal services, travel on public transport, and gasoline.

Rosstat employees in each city visit several dozen, and in large centers - several hundred retail outlets: supermarkets, non-chain stores and markets. Each year, statisticians select organizations that are monitored continuously throughout the year.

Is this set of goods and services sufficient to judge the economy?

Russia is approximately in the middle of the world ranking in terms of the number of goods and services. Judging by this list, there is no connection between its size and the health of the economy.

In Israel, prices are controlled for 1,357 items. In Moldova - at 1200. In China they are looking at 262 positions. In the USA - at 305. But it is worth clarifying that American statisticians work with enlarged categories - they combine several goods or services into one position. Bulgarian statisticians have the smallest set - they monitor prices for 124 goods and services.

What goods are taken into account? And which supermarkets are included in the sample?

Statisticians learn what people consume from household surveys. Next, the cut-off method is used - all goods whose share is more than 0.1% in total consumption are included in the set for accounting. Here, goods and services are understood as a specific class - milk, red caviar, a car (including its repair and washing). The only thing missing from the long list is things like stilts or a quadcopter, that is, things that are not bought in large numbers. Although even goods purchased in units and tens can be counted if statisticians decide to keep track of them.

In each category, several types of product are offered for accounting. Registrars are offered the brand, characteristics, and package size. If stores in the Far East do not have Romashka milk, then they can count milk with the same fat content, in the same package size, in the same consumer category.

Most of the products on the list belong to the mid- and low-price categories. Among the cars, foreign cars are considered, but the technical characteristics are given for mid-price models. In the smartphone category, models on Android and Windows are taken into account (apparently, this list was formed quite a long time ago), but on iOS - not.

Registrars are investigating large non-premium supermarket chains. Rosstat employees do not go to Azbuka Vkusa, but they go to Pyaterochka. Online stores are also taken into account, for example data is provided by Wildberries.

Rosstat cooperates with technological ones, including new sources - information systems of other departments, data from mobile operators, the largest online portals and aggregators, large retail chains and other sources of “big data”

The agency plans to use data from mobile operators for tourism statistics. Negotiations are currently underway to organize the process with the “Big Four” operators. The 2021 All-Russian Population Census will be held in a new way. Now there will be an online census - self-filling out surveys on State Services.

Codependence of nominal and real wages

It seems that nominal wages always directly reflect real wages. However, this is not the case in cases of economic crisis and currency depreciation, when the increase in the amount of accrued wages “does not keep pace” with the rise in prices for goods and services. For the same amount as yesterday, the consumer cannot afford to purchase the same volume of goods and services. In such a situation, the process of inflation .

NOTE! The experience of developed countries reflects the difference between real and nominal wages over a smaller base time frame. The amount accrued per working hour and its relationship with the number of labor results created during the same time are taken into account.

In Art. 22 of the Labor Code of the Russian Federation talks about the employer’s obligation to promptly and fully provide remuneration to employees for their work. In addition, the employer is required to strive to increase its actual content (Article 134 of the Labor Code of the Russian Federation, Letter from Rostrud No. 1073-6-1 dated April 19, 2010).

"Gray denomination"

Since the tax burden is tied to nominal wages, the employer is always tempted to set them as low as possible, down to the minimum wage. To compensate for the resulting gap between nominal and real wages, he pays employees additional funds outside of accounting documents or in another form.

Such schemes cause harm to the state and, if possible, are monitored and suppressed. If the wage fund is suspiciously low, and its nominal values are too far from real ones, the regulatory authorities will definitely become interested in this situation. A tax audit and explanation, and possibly more serious measures, are inevitable.