If a working citizen wishes to take sick leave, then he is entitled to temporary disability benefits. The provision of such a “service” is carried out from the “treasury” of a specialized insurance fund, which assumes the absence of any damage to the enterprise where the sick person works. Which groups of people are entitled to payments during illness, and how is the amount of financial support calculated?

Concept and types of temporary disability benefits

Loss of ability to work in the context of labor relations is a person’s condition in which he is unable to perform his professional functions.

Temporary disability benefits are monetary compensation for wages for the period of treatment, rehabilitation or care for a patient. This compensation is assigned to everyone who participates in the compulsory insurance system.

There are several types of payments:

- in case of illness, damage, insertion of a prosthesis;

- quarantine;

- treatment in a medical institution;

- rehabilitation after injuries and illnesses;

- patient care.

Loan for 1 hour secured by PTS/car Credeo, Person. No. -

from 0.06%

rate per day

up to 5 million

30 – 1,825 days

Take out a loan

Sick leave funds for the first three days are provided by the company where the person works, and the rest of the time they are accrued from the Social Insurance Fund.

Briefly

- Temporary disability benefits are issued to a citizen in the event of illness or injury to him or his family members. A citizen must be insured by the employer or on his own initiative in the Social Insurance Fund in accordance with the norms of Federal Law-255.

- The main document that guarantees the receipt of funds is a sick leave certificate. When applying for benefits, you must attach an application in the prescribed form. All information contained in the application about the identity of the recipient of payments, length of service, and income of the billing period must be documented.

- Hired employees apply at their place of work (for several jobs under the condition of part-time work), and individual entrepreneurs, private lawyers and notaries, members of peasant farms and other voluntarily insured persons apply to the Social Insurance Fund.

- If there is a pilot project in the region, the organization pays and takes into account expenses only payments for the first 3 days of illness, subsequent payments go through the Social Insurance Fund. If the region does not participate in the project, the organization first pays the employee both for the Social Insurance Fund and for itself, and then receives compensation for costs from the Fund.

- The benefits are accounted for in the company's expense accounts in correspondence with account 70, as well as in the account for settlements with the Social Insurance Fund (69), according to Kt 70.

- The benefit is subject to income tax.

The legislative framework

The right to compensation is prescribed in the Labor Code, Art. 183 “Guarantees for employees in case of temporary disability.” The main law regulating the rules for its provision is Federal Law No. 255 “On compulsory social insurance in case of temporary disability and in connection with maternity.”

Please note that 2021 has been declared a transition year. Benefits during this period will be accrued according to the rules approved by Government Decree No. 294 dated April 21, 2011, including on the basis of paper certificates of incapacity for work.

The law answers all questions regarding compensation:

- rights of the insured person;

- who can receive funds;

- period of provision;

- benefit amount;

- rules for calculating the amount;

- conditions for reducing or terminating compensation.

Based on this regulatory act, let us consider in more detail the procedure for calculating compensation, conditions and its amount.

Loan secured by PTS CashDrive, Person. No. 18-034-75-009039

from 0.05%

rate per day

up to 1 million

90 – 2,555 days

Take out a loan

Features of accruals in April-May 2021

In May 2021, the Government of the Russian Federation made some changes to the Temporary Rules for Registration of Sick Leave. They affected employees over the age of 65 who work on the basis of an employment contract. For the period of self-isolation in May 2020, these categories of citizens can apply for sick leave at a time from May 12 to May 19 (Decree No. 683 dated May 15, 2020).

The reason for these changes is due to recommendations to comply with the self-isolation regime. Temporary rules from Government Resolution No. 40 dated April 1, 2020 stipulate that during self-isolation, all personnel over the age of 65 receive paid sick leave. A mandatory condition is self-isolation throughout the entire period. If an employee violates the conditions of self-isolation, he undertakes to compensate the FSS for damages.

These monetary compensations are fully paid at the expense of the Social Insurance Fund. The employee will receive the entire amount as a lump sum payment for the entire period of incapacity. The transfer period is no more than 7 calendar days from the date of filing the sick leave.

The exception is for employees who:

- continue to work remotely;

- are on paid leave.

Who should

Material support is provided to persons working on the basis of an employment contract, and only if the institution makes contributions to the Social Insurance Fund for its employees. However, citizens who are not employed by enterprises can also become recipients of funds:

- persons engaged in legal practice, notaries and individual entrepreneurs;

- persons working on their own farms;

- representatives of communities of endangered northern peoples.

The main condition is the payment of contributions to the Fund from the income received. Moreover, it does not matter how exactly the contributions were paid - by the enterprise’s accounting department or by the person himself. Also, in order to receive financial compensation, the employee must confirm the inability to work.

Confirmation of incapacity for work is a doctor's conclusion.

Payments under a certificate of incapacity for work are not due or stop being transferred if:

- the person violated the treatment regimen;

- the sick leave was issued by an institution without a license;

- if the employee was suspended without pay;

- if the loss of health occurred as a result of an offense.

Online loan Monetkin Monetkin, Lits. No. 005894

from 0.27% per day

First loan 0%

up to 100 thousand

14 - 168 days

Take out a loan

Compensation is also not provided to unemployed citizens who do not receive unemployment benefits. But if a person quits his job, but within a month after leaving he loses the opportunity to work, then he is entitled to compensation.

Guarantees for the employee

For the period when a person, for established reasons, cannot fulfill his duties at work, he not only retains his position, but also receives compensation equal to the amount of average earnings. All these norms are spelled out in more detail in the Labor Code of the Russian Federation, Art. 183.

Important: the fact of developing a disease is not always the basis for calculating benefits. The employee must make monthly insurance contributions to the Social Insurance Fund. Only then can he claim monetary compensation.

Calculation of temporary disability benefits

The amount is affected by:

- cause of loss of health;

- insurance experience;

- salary amount;

- number of calendar days of incapacity.

Sick leave is calculated using the formula:

SD x PTS x D = Amount of monthly benefit.

- SD – average daily earnings;

- PTS – percentage of experience;

- D – number of days spent on sick leave.

To calculate the average daily salary, you need to calculate the total amount of income received and divide it by 730 days.

The next required indicator - the percentage of work experience - is defined by Federal Law No. 255.

It depends on the length of service and the reason for losing the opportunity to work. Table of dependence of length of service and percentage of sick leave payments

| Cause | Experience | Percentage of salary that is taken into account when calculating benefits |

| Illness or injury, quarantine, prosthetics, rehabilitation | Up to 5 years | 60% |

| From 5 to 8 | 80% | |

| From 8 | 100% | |

| If a child under 15 years of age is sick, treatment at home | Up to 5 years | 60%. |

| From 5 to 8 | 80% | |

| More than 8 years | 100% | |

| If a child under 15 years of age is sick, treatment in a medical institution, as well as care for an adult family member at home. | Up to 5 years | 60% |

| From 5 to 8 | 80% | |

| More than 8 years | 100% |

Loan secured by CarMoney (Karmani), Persons. No. 005203

from 0.09%

rate per day

up to 1 million

730 - 1,431 days.

Take out a loan

The numbers in the third column are the percentage of average earnings that is taken into account when calculating material compensation.

If a person has had several jobs over the last two calendar years, the amount will be calculated taking into account all income that was subject to insurance premiums.

Benefit recipients and paid periods

Benefits are received by those insured by the Social Insurance Fund if citizens:

- have an employment contract with the employer (Article 5-2 of Federal Law-255);

- enter into a social insurance agreement voluntarily and transfer contributions “for themselves” (Article 4.5 of Federal Law No. 255).

Their full list contains Art. 2 FZ-255:

- Employees who have signed an employment agreement with the company. This also includes the managers (founders in one person) of the company.

- Civil servants, municipal employees and their deputies.

- Participants in production cooperatives who directly work in them.

- Priests.

- Persons deprived of liberty by law and forced to work.

- Those paying insurance premiums voluntarily: individual entrepreneurs, members of peasant farms, notaries, lawyers, members of communities of indigenous small peoples of Russia.

The duration of payment and conditions depend on the insured event.

Illness or injury is paid until you return to work. Continuation of treatment in a sanatorium is compensated for 24 days, except for tuberculosis cases. If the employee is disabled as a result of an illness or injury, sick leave is paid only for 4 months in a row (or 5 months a year). Tuberculosis patients, however, can count on benefits until recovery or assignment to another disability group associated with tuberculosis.

If an employee has entered into a contract for up to six months and falls ill, he will be paid for no more than 2.5 months during the contract period.

Disability can occur not only due to personal health problems of the employee, but also due to the need to care for children. The payment terms here also vary:

- Caring for a younger family member under 7 years of age is compensated for no more than 2 months a year. In special cases specified in federal legislation - 3 months.

- Care for older children under 15 years of age is compensated: up to 0.5 months per case and no more than 45 days a year.

- If we are talking about a disabled minor, they will pay for up to 120 days a year.

- If a minor is a carrier of HIV, the yearly restrictions are lifted, and the period of incapacity for work is fully paid. There are no restrictions on days and in other cases of serious illness of a minor: complications after the introduction of a vaccine, malignant cases.

Care for other relatives, except children, is compensated for a period of one week for each sick leave. The general annual “limit” is a month. Benefits in connection with the need for prosthetics and quarantine are provided by law to the insured for the entire time he is disabled.

Important! The deadlines for payments are stated in Art. 6 FZ-255.

Calculation of sick leave if part day

If a person works only a few hours a day, the calculation is carried out according to the same rules, but taking into account some nuances. To determine average earnings per day, you need to divide the income for the billing period by 730 days.

If the average wage in the calculations was less than the minimum wage, then for the calculation you need to take the amount of the minimum wage. Average earnings per day, calculated from the minimum wage, must be reduced in proportion to the amount of time worked.

Online loan Creditplus, Persons. No. 004402

from 1% per day

First loan 0%

up to 30 thousand

5 – 30 days

Take out a loan

Simulation and Aggravation

It is worth noting that during the examination, the doctor sometimes encounters a manifestation of simulation or aggravation. The latter concept should be considered as a citizen’s exaggeration of the symptoms of an existing disease in reality. Malingering is nothing more than simulating the symptoms of a disease that a person does not have.

In the case of active aggravation, the citizen takes all possible measures to worsen his own health or prolong the painful condition. Passive aggravation only involves exaggeration of some symptoms. At the same time, such behavior is not accompanied by certain actions that interfere with the implementation of treatment. It must be borne in mind that aggravation in a pathological manner is characteristic of mentally ill people. It is an important manifestation that should be paid close attention to.

Calculation of sick leave if the length of service is less than 6 months

The benefit for a full month cannot be less than the minimum wage, regardless of length of service, i.e. 12,792 rubles .

In this case, when calculating the average income for 6 months, it is not the salary level that is taken, but the minimum wage amount. Calculation formula:

Payment amount = minimum wage x 0.6.

Where:

- Minimum wage – minimum wage;

- 0.6 is 60%.

According to this formula, persons without experience can count on small benefit payments.

Legislative acts protecting the rights of disabled citizens

The legislator has issued regulations that protect public health:

| NPA | Article |

| Constitution of the Russian Federation | 41: every citizen in the Russian Federation has the right to count on health protection, as well as the provision of medical care. 39: every citizen in the Russian Federation is guaranteed social security in case he loses his health |

| Code of Administrative Offenses | Art. 8.5 establishes liability for concealing information about the state of the environment, which may adversely affect public health |

| Fundamentals of the legislation of the Russian Federation on the protection of the health of citizens N323 Federal Law of 2013 | Art. 2 defines the basic principles related to the protection of the health of citizens Art. 24 - establishing the procedure for medical intervention |

| Criminal Code of the Russian Federation | Establishes liability for attempts on the life and health of citizens |

| N 52-FZ of 1999 | |

| N 326-FZ of 2010 | |

| N 61-FZ of 2010 | |

| N 99-FZ of 2010 |

Do I need to write an application for temporary disability benefits?

To apply for work benefits, you must present a sick leave certificate indicating your release from work. The application is only necessary when applying for benefits from the Social Insurance Fund. You only need to go to this body for payments in three cases:

- the organization in which the employee is registered is at the stage of bankruptcy;

- the organization was liquidated;

- the person has been on sick leave for more than 1 month.

In these cases, when contacting the FSS, an application will be required. When applying for benefits at your place of work, you only need to present a sick leave certificate.

Microloan online Moneza, Persons. No. 005464

from 1% per day

First loan 0%

up to 30 thousand

5 – 35 days

Take out a loan

Please note that sick leave can be issued both in electronic and paper form.

Arbitrage practice

Controversial issues regarding payment for periods of incapacity by employers are focused on the following areas:

- dismissal during illness,

- refusal to pay during forced absence,

- deadlines for submitting and paying sick leave.

As judicial practice shows, positive and negative decisions are approximately equally divided between employees and insurers. This situation is due to the fact that ordinary workers cannot always prove their case with reason and provide documentary evidence.

Form of certificate of incapacity for work

The document is issued at the medical institution. It states:

- Address and name of the medical organization.

- Full name of the patient.

- Cause of disability.

- Type of employment.

- Data on average income, information about employer, length of service.

- Period of release from work.

The sheet is filled out by the medical professional, then by the employer.

Sample certificate of incapacity for work

Work ability examination

Before determining the type of temporary disability, today a work ability examination is mandatory. Its main task is to establish the ability of a particular person to perform his own professional functions, depending on social and medical criteria. In addition, it is advisable to include the following points among the tasks of a medical examination of work ability:

- Determination of the duration, degree and type of temporary disability that occurred due to an accident, illness or other reasons.

- Establishing a regime and treatment that is necessary to improve the health and recovery of a citizen.

- Recommendation of the most complete and rational use of labor of persons with limited types of working ability without compromising their health.

- Identification of permanent or long-term disability and further referral of these patients to an expert commission of a medical and social plan.

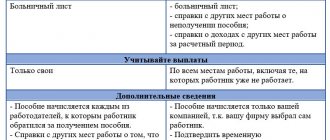

How is sick leave paid for an external part-time worker?

The general rule for taking into account earnings when calculating benefits for an external part-time worker is this: if the employee applied for benefits not only from you, but also from other employers, you take into account only your payments (that is, payments for part-time work), and if only to you - then payments from all employers for the billing period, including payments for work at the main place of work and part-time work in all organizations.

The place of work at which an employee can receive temporary disability benefits depends on the organizations in which he worked during the billing period:

- If during the billing period he changed jobs or was employed by the same employers for both years, but in the current year he does not work for at least one of them, then to receive benefits he can choose any employer for whom he currently works ( Part 2.1, 2.2 Article 13 of Law No. 255-FZ).

- If during the billing period an employee worked for the same employers with whom he is currently employed, then he must apply to all employers at the same time to receive benefits (Part 2 of Article 13 of Law No. 255-FZ).

Depending on where the external part-time worker worked and what documents he provided, the calculation will be different.

So, if an external part-time worker worked in the organization during the billing period (worked the billing period in full or part of it) and provided sick leave, the benefit is calculated by each employer to whom the employee applied. In this case, only your payments are taken into account. Certificates from other places of work stating that benefits were not accrued or paid there are not needed.

Earnings based on certificates from employers for whom the employee worked during the billing period are not taken into account (if the employee provided such certificates earlier).

If the part-time worker has provided the following documents:

- sick leave;

- certificates from other current places of work stating that benefits were not paid there;

- certificates of earnings from other employers for whom the employee worked during the pay period (including former ones) -

payments for all places of work are taken into account, including those where the employee no longer works. The benefit is paid by one of the employers chosen by the employee.

An employee can confirm temporary incapacity for work with other employers with a copy of the certificate of incapacity for work, certified by the employer paying the benefit.

The benefit is not accrued if the employee has not provided certificates from other current places of work stating that the benefit was not accrued or paid.

If an external part-time worker did not work part-time for the employer during the billing period and provided him with sick leave and certificates, payments for all places of work in which the employee worked in the billing period can be taken into account. The benefit is paid by one of the current employers chosen by the employee.

Payment of benefits is carried out depending on the specific situation: either for all places of work, or only for one of them at the employee’s choice, taking into account earnings from other employers.

If an employee falls ill on vacation at his own expense, on maternity leave or on parental leave, he will only be paid for sick days at the end of these vacations, if he has not yet recovered by that time: for days of illness coinciding with such vacation, he should not be given sick leave, since temporary disability benefits are not paid for the days of such vacation. Therefore, the employee must notify the doctor that he is on such leave.

If a certificate of temporary incapacity for work was nevertheless issued for periods of leave without pay, leave to care for a child under 3 years of age, for which the doctor should not have issued this document, but the employee did not warn him, then formally the FSS may not accept offset the amount of benefits paid under such sick leave. The best option is to replace such a sheet with a duplicate.

In any case, the benefit must be paid to the employee from the day when he was supposed to start work at the end of his vacation at his own expense.

What does the reason for disability code mean?

It shows in encrypted form on what basis the person was given a ballot. This code is entered on the sick leave certificate in the “Cause of disability” field. It consists of three blocks:

- Two cells labeled “code”. They indicate the code of the reason why the employee went to the doctor on the first visit and received a certificate of incapacity for work.

- Three cells with the signature “additional code”. They are filled out only in certain cases (see table).

- Two cells labeled “change code.” They are filled out in a situation where the cause of disability has changed (for example, when the original diagnosis is corrected).

All meanings with explanations are given on the back of the ballot form.

Work with electronic sick leave and submit all related reporting through Kontur.Extern

Table with decoding of disability codes on sick leave

| First block (initial reason for visiting a doctor) | |

| Code | Decoding |

| 01 | Disease |

| 02 | Injury |

| 03 | Quarantine |

| 04 | Accident at work or its consequences |

| 05 | Maternity leave |

| 06 | Prosthetics in hospital |

| 07 | Occupational disease or its exacerbation |

| 08 | Aftercare in a sanatorium |

| 09 | Caring for a sick family member |

| 10 | Other condition (poisoning, manipulation, etc.) |

| 11 | The disease specified in paragraph 1 of the List of Socially Significant Diseases (approved by Decree of the Government of the Russian Federation dated December 1, 2004 No. 715). For example, tuberculosis, hepatitis B, C, diabetes, etc. |

| 12 | Care for a child under 7 years of age, if his illness is included in a special list (approved by order of the Ministry of Health and Social Development dated February 20, 2008 No. 84n) |

| 13 | Caring for a disabled child |

| 14 | Caring for a child whose illness is associated with a post-vaccination complication or malignant neoplasm (indicated with the consent of the employee) |

| 15 | Caring for an HIV-infected child (indicated with the consent of the employee) |

| Second block (additional three-digit codifiers) | |

| Code | In what case is it indicated? |

| 017 | During treatment in a specialized sanatorium |

| 018 | During sanatorium-resort treatment in connection with an industrial accident during a period of temporary incapacity for work (before referral to medical examination) |

| 019 | When treated in a clinic of a research institution (institute) of balneology, physiotherapy and rehabilitation |

| 020 | With additional maternity leave |

| 021 | In case of illness or injury resulting from alcohol, drug, toxic intoxication or actions related to such intoxication |

Create electronic registers and submit them to the Social Insurance Fund via the Internet Submit for free

Who is eligible to receive benefits?

You need to know that the right to benefits is granted to persons who work in accordance with an employment contract, as well as citizens who are subject to compulsory state social insurance during their professional activities. It would be advisable to include members of cooperatives, lawyers, individuals engaged in individual entrepreneurship, and so on.

What codes should an employer provide?

The employer should put the subordination code in the bulletin and fill out the “Calculation conditions” field (the codes are given on the back of the sick leave form).

Doctors indicate all other codes, in particular: reasons for disability, notes on violation of the regime and the corresponding values in the “Other” field.

IMPORTANT. If doctors filled out a sick leave certificate with errors (including incorrect disease codes), and the accounting department paid for it, the Social Insurance Fund will most likely refuse to reimburse the benefit. But the courts support policyholders in such situations.

Common mistakes

Error: The person did not appear for the repeated medical and social examination.

Comment: If a repeat medical examination has been ordered, it means that there is a possibility that the patient’s condition will improve or worsen, that is, the disability can be removed or a different group can be established. If a citizen does not appear for the commission, the disability is removed, and the pension and benefits stop being paid.

Error: The employer did not transfer a disabled person of group 3 to an easier job after assigning him a disabled group.

Comment: After an employee has been assigned a disability, he must be sent for professional retraining and offered an easier job, if the company has such an opportunity.