- Notification of the Ministry of Internal Affairs of Russia on the hiring and dismissal of foreign citizens

- Fines for late notification of the Ministry of Internal Affairs about the hiring and dismissal of foreigners

- Notification of the Ministry of Internal Affairs about hiring a foreign citizen

- Notification of the Ministry of Internal Affairs about the dismissal of a foreign citizen

- Procedure for notifying the Ministry of Internal Affairs

- Notification of the tax office and employment center about the hiring and dismissal of foreigners

- Form of notification of employment in 2021 and form of notification of dismissal of a foreign citizen dated July 30, 2020.

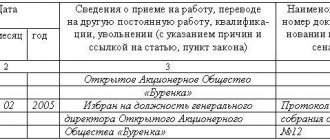

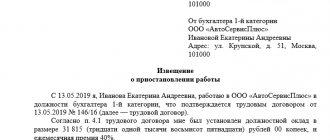

- Sample of filling out the notice of the Ministry of Internal Affairs on hiring and dismissal

Important!

Please note that on January 1, Order No. 536 of the Ministry of Internal Affairs of Russia dated July 30, 2020 came into force; in accordance with the Order, the old forms of notifications are no longer valid.

Also, from January 1, 2021, separate forms have been introduced for organizations providing employment services for foreigners in Russia.

You can download new valid forms of notification of the conclusion and termination of an agreement with a foreign citizen below.

Notification of the Ministry of Internal Affairs on the employment and dismissal of foreign citizens in 2021

Notification of the Main Directorate for Migration of the Ministry of Internal Affairs of Russia is mandatory in accordance with Federal Law No. 115.

According to the law, notification to the Ministry of Internal Affairs is submitted both by the employer and by the foreign citizen.

On the part of the employer - a legal entity or individual who employs foreign citizens for work, is obliged to notify the Main Directorate for Migration Affairs of the Ministry of Internal Affairs:

- on concluding an employment contract (civil law) when hiring a foreign citizen

- on termination of an employment contract (civil law) upon dismissal of a foreign citizen from work.

In this case, a notification to the Ministry of Internal Affairs about termination of an employment contract can be sent by the employer in the following cases:

- If you are not satisfied with the qualifications of a foreign worker / he ran away / disappeared, then a notice of early termination of the employment contract with the foreign worker is sent to the Ministry of Internal Affairs.

- If the employment contract has expired or the foreigner’s permits have expired.

- If a foreign worker resigns of his own free will.

In any of these cases, the employer is obliged to notify the Ministry of Internal Affairs of the termination of the employment contract.

Notification to the Ministry of Internal Affairs about hiring and dismissal must be submitted for each foreign employee separately.

On the part of a foreign citizen, a foreigner must notify the Ministry of Internal Affairs about his employment with an individual or legal entity within 2 months from the date of receiving a patent for work, sending a copy of the contract.

Important! The employer is obliged to notify the Ministry of Internal Affairs about the hiring or dismissal of all foreign citizens, including:

- Visa-free foreigners with a work patent.

- Visa-free foreigners with a work patent from the EAEU.

- Visa foreigners with work permits.

- Foreigners with a temporary residence permit in the Russian Federation.

- Foreigners with a residence permit in the Russian Federation.

- Refugees

Stage 2 - obtain permission to attract and use foreign labor

For further employment of a foreign worker, for which a visa must be issued, the employer must obtain permission to attract and use foreign labor (Clause 4, Article 13 of Law No. 115-FZ of July 25, 2002).

It is issued when the employer submits a corresponding application. In 2021, the application form regulated by Order of the Ministry of Internal Affairs dated August 1, 2020 No. 541 is used.

The completed application must be submitted to the territorial department for migration issues (Ministry of Internal Affairs). According to the updated rules, the employer can not only submit it personally, but also send it through the State Services website. The application must be accompanied by an extract from the Unified State Register of Legal Entities or Unified State Register of Individual Entrepreneurs, as well as a document confirming payment of the state duty (clauses 65-65.1.4 of Order of the Ministry of Internal Affairs No. 541).

The state duty in this case is 10 thousand rubles. for each foreigner hired (clause 23, clause 1, article 333.28 of the Tax Code of the Russian Federation). You can also pay it through State Services, and then the amount is reduced by 30% (clause 81.4 of Order of the Ministry of Internal Affairs No. 541). Accordingly, for each foreigner you will need to pay 7 thousand rubles if the payment is made through the State Services resource.

The permit is issued for 1 year, and a necessary condition for issuance is a positive conclusion from the employment service agency - it is issued at the request of the migration department (clause 3 of article 18 of Law No. 115-FZ).

Attention! If the employer does not submit an application for the need for foreign labor, he may not be issued a permit.

Fines for late notification of the Ministry of Internal Affairs about the hiring and dismissal of foreigners

For untimely notification of the Ministry of Internal Affairs about the hiring and dismissal of a foreign citizen, as well as for failure to notify the Ministry of Internal Affairs about the conclusion or termination of an employment contract with a foreign citizen, Part 4 of Article 18.15 of the Code of Administrative Offenses of the Russian Federation provides for punishment in the form of fines for legal entities and individuals, as well as other measures.

For example, if an employer does not submit a notification to the Ministry of Internal Affairs or violates the deadlines for filing or the form for submitting a notification, then in federal cities such as Moscow and the region, as well as St. Petersburg and the Leningrad region, a fine is imposed on him:

- from 5,000 to 7,000 rubles for citizens of the Russian Federation (individuals);

- from 35,000 to 70,000 rubles for officials;

- from 400,000 to 1,000,000 rubles for legal entities.

Also, as a punishment, it is possible to suspend the activities of the organization for a period of fourteen to ninety days.

Therefore, notification forms must be filled out with the utmost care, and notifications must be submitted to the Ministry of Internal Affairs on time.

And it is advisable to submit them in person to be sure that the Ministry of Internal Affairs accepted the notification. Thus, you will save yourself from penalties and problems with migration services.

How to submit a notification

It is better to submit the notification during a personal visit (or by a representative by proxy) to the Department, because if it is submitted late or with errors, it will not be accepted, which will entail penalties. And at a personal meeting, they will at least point out mistakes.

You can also submit a notification by mail, but here you need to very carefully check the correctness of filling in order to avoid inaccuracies in filling out.

An answer from the Main Directorate for Migration Affairs of the Ministry of Internal Affairs can be obtained at State Services, in person, through a representative by proxy or by mail.

Notification of the Ministry of Internal Affairs about hiring a foreign citizen

When hiring a foreigner, the employer must send a notice of employment of a foreign citizen to the Ministry of Internal Affairs.

The step-by-step process of submitting a notification to the Ministry of Internal Affairs about employment is as follows:

1. Filling out job notification forms. 2. Checking completed forms for errors. 3. Placing the organization’s seal on completed forms. 4. Submitting a notification to the Ministry of Internal Affairs in person, by mail or via the Internet. 5. Receiving the detachable part of the notice of hiring a foreigner with the seal of the government agency.

Important!

A notification from the Ministry of Internal Affairs about concluding an employment contract with a foreign citizen must be sent within 3 days from the date of signing this contract.

In other words, the employer has only 3 working days to notify the Ministry of Internal Affairs about hiring a foreigner, and the countdown begins not from the current date of conclusion of the contract, but from the next day after the conclusion of the contract with the foreign citizen.

For example, you entered into an employment contract with a foreigner on January 14, 2021, then the deadline for submitting a notice of employment to the Ministry of Internal Affairs will be January 17, since the countdown of the three-day period will begin on January 15, that is, the next day after the conclusion of the employment contract.

A notification of concluding an employment contract with a foreigner must be submitted for each employed employee.

A notification from the Main Directorate of Migration Affairs of the Ministry of Internal Affairs about hiring foreigners must be sent if you employ both visa-free and visa-free foreign citizens, as well as citizens with a temporary residence permit or residence permit.

In other words, notification to the Ministry of Internal Affairs is required when hiring any foreign citizen, regardless of his status in the Russian Federation, without exceptions.

This includes notifying the Ministry of Internal Affairs about the employment of foreign citizens with a residence permit (residence permit) in Russia, as well as notifying the conclusion of an employment contract with citizens of Belarus.

The employer can provide a notice of hiring a foreign citizen in person, by registered mail with acknowledgment of receipt and a list of attachments, or in electronic form via the Internet through the Unified Portal of State Services.

Important!

When sending notifications about the conclusion and termination of an employment contract in electronic form, an enhanced qualified electronic signature is used.

Important!

If you are going to send notifications about the conclusion of an employment contract or civil contract with a foreign citizen to the Ministry of Internal Affairs by mail, carefully check the completed employment notification form, since if there are errors, the notification will not be accepted by employees of the Ministry of Internal Affairs, which in turn will lead to the company fine and other liability for untimely notification of the Ministry of Internal Affairs about foreigners in the organization.

You can notify about hiring and concluding an employment contract with a foreign citizen in 2021 here or try to find the same form for notifying about the employment of a foreign citizen on the official resource of the Main Directorate of Migration of the Ministry of Internal Affairs.

You can download instructions for notifying the employment of foreign citizens here.

Will there be changes?

From January 1, 2021, a new Order of the Ministry of Internal Affairs of Russia dated July 30, 2021 No. 536 will come into force, approving new forms of notifications. Among them:

- notification of the conclusion of an employment contract or civil contract for the performance of work (provision of services) with a foreign citizen (stateless person);

- notification of termination (termination) of an employment contract or civil contract for the performance of work (provision of services) with a foreign citizen (stateless person);

- notifications about the fulfillment by employers and customers of work (services) of obligations to pay wages (remuneration) to a foreign citizen (stateless person) - a highly qualified specialist;

- notification of employment of a foreign citizen (stateless person) by an organization providing employment services for foreign citizens (stateless persons) in the territory of the Russian Federation.

Notification of the Ministry of Internal Affairs on termination of an employment contract and dismissal of a foreign citizen

When dismissing a foreign citizen, the employer must send a notice of termination of the employment contract with the foreign citizen to the Ministry of Internal Affairs.

The step-by-step process of submitting a notification to the Ministry of Internal Affairs about the dismissal of a foreigner is as follows:

1. Filling out notice of dismissal forms. 2. Checking completed forms for errors. 3. Placing the organization’s seal on completed forms. 4. Submitting a notification to the Ministry of Internal Affairs in person, by mail or via the Internet. 5. Receiving a detachable part of the notice of dismissal of a foreigner with the seal of a government agency

Important!

A notification from the Ministry of Internal Affairs about the termination of an employment contract with a foreigner must be sent within 3 days from the date of termination of this contract.

In other words, the employer has only 3 working days to notify the Ministry of Internal Affairs about the dismissal of a foreigner, and the countdown begins not from the current date of termination of the contract, but from the next day after the termination of the contract with the foreign citizen.

For example, you fired a foreigner by terminating the contract with him on January 14, 2021, then the deadline for submitting a notice of termination of the contract to the Ministry of Internal Affairs will be January 17, since the countdown of the three-day period will begin on January 15, that is, the next day after the termination of the employment contract.

Notice of termination of the employment contract must be submitted to each dismissed employee separately.

The employer can provide notice of the dismissal of a foreign citizen from work in person, by registered mail with acknowledgment of receipt and a list of attachments, or in electronic form via the Internet through the Unified Portal of State Services.

Important!

When sending notifications about the conclusion and termination of an employment contract in electronic form, an enhanced qualified electronic signature is used.

Important!

If you are going to send a notification to the Ministry of Internal Affairs about the dismissal of a foreign citizen in 2021 or about the termination of a civil contract with a foreigner by mail, carefully check the completion of the notice of dismissal form, since if the migration service employees find errors, the Ministry of Internal Affairs will not will accept a notice, which in turn will impose a fine on the organization for late notification of the dismissal of a foreigner from the company.

You can notice the dismissal of a foreign citizen here or try to find the same form of notice of termination of an employment contract with a foreigner on the official website of the Ministry of Internal Affairs.

You can download instructions for notifying foreign citizens of dismissal from this link.

The procedure for submitting notifications about the conclusion and termination (termination) of employment contracts or civil contracts for the performance of work (rendering services) with foreign citizens

- An employer or customer of work (services) who employs migrants is obliged to notify the Ministry of Internal Affairs about the conclusion and termination of an agreement with a foreigner within a period not exceeding 3 working days from the date of conclusion or termination of the agreement.

- The notification form must be filled out in Russian. If the form is filled out not on a computer, but by hand, the handwriting must be legible. Cross-throughs, abbreviations and corrections are not allowed.

- The notification must indicate information about each foreign worker with whom the contract was concluded or terminated.

- All relevant fields must be completed in the notification.

- If, when filling out, there is not enough space in the corresponding field, you must fill out an additional sheet to the notification, indicating the serial number and name of the field in which the missing information is entered.

- The notice and additional sheets are stitched and numbered. A certification note is made on the back of the last sheet.

- The notification can be submitted to the migration department of the Ministry of Internal Affairs, sent by post with a list of attachments and a receipt, or submitted electronically through the portal of state and municipal services (if there is a qualified electronic signature).

- When receiving a notification on paper, the official checks the correctness of filling out the notification form and the identity documents of the person who submitted the notification, as well as his powers. If the notification is accepted, the official makes an appropriate entry in the journal of notifications about the conclusion and termination of contracts with foreign citizens and issues a certificate of acceptance of the notification.

- If the notification was received in electronic form, the official sends back a message confirming receipt of the notification no later than the business day following the day the notification was received. A notification received in electronic form is printed and certified by the signature of an official, the entry “Received in electronic form” is made on it, after which the relevant data is entered into the information system of the Ministry of Internal Affairs of the Russian Federation within three working days from the date of receipt of the notification.

What to pay attention to when filling out the notification

Form 19 refers to unified forms that are mandatory for use.

It has a convenient structure and fairly clear content and includes all the necessary information about the company - the employer and the employee of foreign origin.

The notification must be issued only in Russian, in capital or block letters, clearly and legibly.

It is also possible to fill it out on a computer, but in this case the document should be printed on both sides on one sheet. All lines and cells must be filled in, gaps are not allowed.

The document must not contain any errors, corrections, blots, abbreviations or abbreviations - if there are any, it may be declared invalid and the migration service will require re-registration.

The form must be endorsed by a representative of the organization, and it must be stamped using a seal only in cases where the use of stamps to certify documentation is enshrined in the local regulations of the company.

Taxes and contributions from the salary of a foreign employee

The procedure for taxation of payments and contributions also depends on the status of a foreigner.

In order to determine the amount of personal income tax , check whether the foreigner is a tax resident or non-resident of the Russian Federation. If for 12 consecutive months a foreigner has stayed in Russia for 183 days or more, then he is a tax resident. Withhold personal income tax from his salary in the amount of 13%. If you stayed less than 183 days - 30%.

A special feature is that foreigners working in Russia on the basis of a patent pay personal income tax at a rate of 13%. The amount of the advance payment paid by the employee under the patent reduces the amount of personal income tax that the employer withholds from him in the current month. The employer needs to receive a notification from the Federal Tax Service about the right to reduce the employee’s personal income tax by the amount of the advance payment that he has already paid towards future taxes.

Another exception for citizens of the Republic of Belarus, Kazakhstan, Armenia and Kyrgyzstan is that the personal income tax rate is always 13%.

Insurance premiums for payments to foreign employees are calculated in accordance with their status.

- The salaries permanently residing and temporarily residing foreigners are subject to contributions for pension, medical and social insurance in the general manner according to the organization’s tariff.

- From payments to temporarily staying foreigners, contributions are calculated only for pension insurance at the organization’s rate and for temporary disability at the rate of 1.8%. Health insurance premiums are not assessed or paid. The exception is citizens of Belarus, Kazakhstan, Armenia and Kyrgyzstan. Insurance premiums for them are deducted in the same way as for Russian employees according to the general tariffs of the organization.

Foreigners who are tax residents of the Russian Federation are entitled to standard tax deductions for personal income tax.