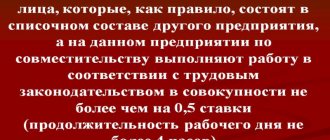

The definition of part-time work is given in Art. 282 Labor Code: this is the performance by an employee of other regular paid work under the terms of an employment contract in his free time from his main job. There are two types of part-time work:

- internal (one employer at the main place of work and part-time);

- external (in addition to the main job, the employee performs other work for another employer).

Elements of part-time work are indicated in Part 1, Part 2 and Part 3 of Art. 282 TK:

- performing other, in addition to the main, regular paid work;

- work is performed in free time from main work;

- the work is performed under a part-time employment contract;

- the number of employers with whom an employment contract for part-time work is concluded is not limited;

- work can be performed both for a single employer at the main place of work on an internal part-time basis, and with other employers on an external part-time basis;

- the employment contract contains an indication that the job is a part-time job.

Who should not work part-time?

For some employees, there are prohibitions or restrictions on part-time work. These categories of workers include those who have not yet turned 18 years old - they are prohibited from working part-time. Also, part-time work is prohibited for an employee who performs activities for the main employer that involve harmful or dangerous working conditions, if the part-time work is also associated with similar working conditions. Art. warns about this. 282 TK.

In Art. 329 of the Labor Code states that part-time work related to driving vehicles or controlling the movement of vehicles is not allowed for those employees who perform similar work for the main employer.

For the head of an organization, part-time work is possible only if there is permission from the authorized body of the legal entity or the owner of the organization’s property, or a person authorized by the owner (Article 276 of the Labor Code).

In addition, part-time, according to Art. 2 of Law No. 63-F3 of May 31, 2002, a lawyer cannot work.

Employees of a private security organization are not allowed to combine security activities with civil service or with an elected paid position in public associations. In Art. 12 of the Law of March 11, 1992 No. 2487-1 will clarify that an employee of a private security organization cannot be the founder, director or other official of the organization with which this private security organization has entered into an agreement for the provision of security services.

An athlete or coach has the right to work part-time with another employer in a similar role only with the permission of the employer at the main place of work (Article 348.7 of the Labor Code).

Consequences for the holder of two work books

The law does not provide for liability for an employee having two Labor Codes, but consequences may arise depending on the purpose for which the second document is drawn up.

If an employee has created an additional labor contract in order to deceive the employer and obtain additional payments, he may be held accountable for fraud and the employment relationship with him may be terminated. If the presence of a second document is deliberately concealed, in accordance with Art. 81 of the Labor Code of the Russian Federation, an employee can be fired for false documents or providing knowingly false information during employment.

If the employee was issued a second copy due to the loss of the original, and then he found it, but did not take advantage of this situation for personal gain, then this does not face any consequences.

Specifics of part-time employment

To apply for a part-time job, you will need the same documents as for hiring the main job, except for the work book. In Art. 283 of the Labor Code states that “when applying for a part-time job with another employer, the employee must present a passport or other identification document.”

An education document or a certified copy of it will become necessary if the work requires special knowledge and it needs to be confirmed.

In some cases, additional documents must be requested from the part-time worker:

- a certificate about the nature and conditions of work at the main place of work - for work with harmful or dangerous working conditions (Article 283 of the Labor Code);

- a certificate about the nature and conditions of work at the main place of work - for work related to driving vehicles or controlling the movement of vehicles (Article 329 of the Labor Code);

- permission from the authorized body of a legal entity or the owner of the organization’s property from the main place of work - to the position of manager (Article 276 of the Labor Code).

How to choose an additional job?

This issue, like the moral and ethical aspects of additional employment, is not regulated by law. By and large, it all depends on two factors: the skills and knowledge of the employee and his conditions regarding future additional work. Some people would like to gain additional experience in their main profession in order to use it the next time they get a new job, while others, on the contrary, want to “turn off their brains” and replace mental work with physical work.

However, in all cases, one simple rule must be observed: the official formalization of labor relations must not be neglected - regardless of the volume of work performed and the agreed level of payment for it. As in the previous situation, which, however, can be considered a special case of this one, such advice is relevant for both the employee and the employer.

In this way, the employee will be able to insure himself against non-payment of the established remuneration, and if this does happen, he can appeal to the court or regulatory authorities. And the employer will be able to call to account an employee who failed to cope with his duties or violated the deadlines for completing work. And even if the matter does not come to trial, the very fact of having an official document always disciplines the parties, and also makes it possible to unambiguously record the agreements reached.

How to properly draw up an employment contract with a part-time worker

Letter of the Ministry of Labor dated 04.26.17 No. 14-2/B-357 reminds that in case of internal part-time work, in addition to the main employment contract with the employee, a second employment contract for part-time work must be concluded and, therefore, an additional order for employment must be issued for part-time.

The contract with a part-time worker is concluded within the same terms as with an employee for whom the work is the main one. Moreover, labor legislation allows a part-time worker to enter into a contract with an unlimited number of employers (of course, unless otherwise provided by federal law).

Mandatory elements of an employment contract with a part-time worker:

- an indication that the job is part-time;

- duration of working hours: it should not exceed 20 hours per week and 4 hours per day.

During one month (another accounting period), the duration of part-time work should not exceed half of the monthly (other) standard working time (standard working time for another accounting period) established for a part-time worker. But there are a number of exceptions to the general rule, fixed in Art. 284 TK:

- days on which the part-time worker is not employed at his main place of work;

- days when a part-time worker suspended work at his main place of work due to delayed wages;

- days when a part-time worker is suspended from work due to the fact that he is subject to transfer to another job according to a medical report, but this work is not available from his employer at his main place of work.

During all the periods listed above, a person can work part-time full time.

Entry in the work book of information about part-time work is made only by the main employer (Article 66 of the Labor Code), but under certain conditions:

- at the request of the employee;

- in the presence of a document confirming part-time work (a certified copy of the order for admission to part-time work or a certificate of admission to part-time work containing the details of the order for employment).

That is, a part-time employer does not have the right to make an entry in the work book about part-time work.

The employment contract with a part-time worker may contain an indication of its urgent nature. The conclusion of fixed-term employment contracts with a part-time worker by agreement of the parties is provided for in Part 2 of Art. 59 TK.

Two full bets – is this possible?

Is it possible to work two jobs officially at two rates? No, this contradicts the Labor Code of the Russian Federation. This can also be understood from the very definition of “part-time work,” which clearly states that additional employment should occur in free time from the main job.

According to the law, the time of additional work should not exceed half of the time of main employment.

However, there is the option of working two full-time jobs, which does not contradict the law. It is necessary to conclude not an employment contract with the employer, but a civil contract - about the provision of services within a specific period. This is not considered part-time work, and the parties to the agreement will be considered equal partners.

How are part-time workers paid?

Remuneration can be of different types:

- time-based - proportional to time worked;

- piecework - taking into account production;

- under the conditions established by the employment contract.

If a part-time worker is given time-based wages or wages for standardized tasks, then payments are made taking into account the final results for the amount of work actually completed.

Part-time workers are not covered by guarantees and compensation related to combining work with education. They are provided to employees only at their main place of work. The same rule applies to those who work in the Far North and equivalent areas.

But a part-time worker can count on the full scope of other guarantees and compensations provided for by labor legislation, collective agreements, agreements and local regulations.

Is it possible to have two work books at the same time?

The law does not prohibit having two copies of the Labor Code, but in this case there may be problems with calculating length of service, calculating pension payments, taxes, as well as paying for periods of temporary disability. If the second book is issued at another place of work for the purpose of obtaining material benefits, this is considered fraud and leads to criminal liability.

The procedure for maintaining Labor Codes and inserts for them is controlled by the employer and higher authorities, so it is impossible to officially issue a second copy of the employment document.

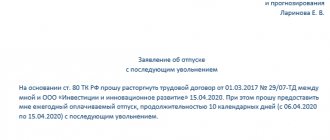

Vacation for part-time workers

The main rule that applies in this case is the following: annual paid leave is provided to a part-time worker simultaneously with annual paid leave at the main place of work. Moreover, this is the responsibility of the employer.

What to do if the employee has not worked part-time for six months at the time of leave from his main job? In this situation, the employer will have to provide him with leave in advance.

What is the right thing for an employer to do if a part-time worker approaches him with a request for leave without pay on the basis that leave for part-time work is less than leave at the place of his main job? The answer to this question is given in Art. 286 Labor Code: the employer is obliged to fulfill this request and provide leave without pay for the number of days short of the duration of leave at the main job.

Part-time work – what is it?

Much has been written about part-time work in the Labor Code of the Russian Federation. In fact, an entire chapter of the code (No. 44) is devoted to this phenomenon. And there are seven separate articles in it - from 282 to 288. Such a detailed description suggests that many citizens of our country have a second job. So what is part-time work? Is it possible to work two jobs officially?

The definition of this phenomenon is as follows: part-time work is the employment of an employee in another regular and paid job at a time when he is not performing his duties at his main place of employment.

The definition is quite simple and understandable. And it gives a clear idea of how to distinguish part-time work from other types of work. The main signs are regular employment and availability of payment.

Dismissal of part-time workers

An additional basis for termination of an employment contract is the hiring of an employee for whom the part-time job will become the main one, this is stated in Art. 288 TK. In this case, the employer is obliged to warn the part-time worker in writing about his plans two weeks before the termination of the employment contract.

It is worth paying attention to the fact that the law does not allow early termination of an employment contract with part-time workers working under a fixed-term employment contract in connection with the hiring of another employee, that is, on the basis provided for in Art. 288 TK. In this case, dismissal of the employee is possible only on general grounds.

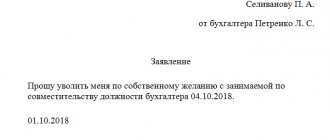

When dismissing a part-time employee, follow the following steps:

- Determine the basis for terminating the employment contract with a part-time worker, make sure you are not breaking the law.

- Provide the part-time employee with notice of dismissal at least two weeks before termination of the employment contract.

The notification text might look like this:

“In accordance with Art. 288 of the Labor Code of the Russian Federation, we warn you that the employment contract concluded with you on a part-time basis dated _________ (date and number) for an indefinite period will be terminated 2 (two) weeks from the moment you receive this notice in connection with the hiring of an employee for whom this work will be the main one.”

You will need to make two copies of the notice: for the employee and for yourself (on the employer’s copy, the part-time worker puts a mark of familiarization - date, full name and signature.

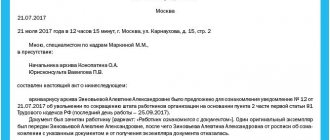

- Issue a dismissal order.

In the document, put the date and formulate the grounds for dismissal, indicating the details of the notice of termination of the employment contract.

On the last day of work of the part-time worker, familiarize his employee with the order for signature.

Enter information about dismissal into the employee’s personal card.

- Pay wages and required compensations, issue documents.

All payments must be made on the day of dismissal. If the person did not work on that day, then payments are made no later than the next day after the dismissed employee submits a request for payment.

- Send information about the dismissal of an employee subject to military registration to the military registration and enlistment office.

The information is sent within two weeks - in the form specified in Appendix No. 9 to the Methodological Recommendations for maintaining military records in organizations approved by the General Staff of the Armed Forces of the Russian Federation.

It is important to have written confirmation of sending information to the military registration and enlistment office.

- Notify the bailiff and the collector, as well as the person receiving alimony, of the dismissal of the debtor employee.

The employer is obliged to immediately notify the bailiff about the dismissal of the employee from whose wages deductions were made under the writ of execution, and return this document to them.

Information about the dismissal of the alimony debtor is sent within three days to the bailiff and the alimony recipient.

In both the first and second cases, it is important to have written confirmation of sending messages to the bailiff.

Temporary work

However, permanent work under an employment contract is not the only opportunity to earn additional income in difficult times. It is possible that the employee does not need such serious employment: perhaps he only needs a one-time injection into the budget, which will make it possible to repay a loan or make a large purchase, and the basic salary is quite enough for him to maintain his current standard of living.

In this situation, temporary part-time work may be a good form of additional income. Often it is related to the main activity and is carried out in project mode: for example, an electrical engineer is involved in the implementation of a lighting project at a major facility, or a purchasing manager prepares documentation for a tender. This option is also not prohibited by current legislation - if it is executed correctly.

To formalize such employment, a civil law contract is suitable. It is an agreement confirming the conclusion between the parties of an agreement on the provision of services, and the employer appears in it as the customer, and the employee as the performer.

The document specifies the scope of work, deadlines for completion, level of payment and other conditions. Moreover, this contract is of an urgent nature, that is, the work specified in it must be completed within a specific period.

For an employee, such a document is official evidence of an agreement between him and the employer in case problems arise, for example, with payment: it can be used in court or a government regulatory body to hold a negligent customer accountable.

However, in such an agreement, in comparison with a standard employment contract, there are also some disadvantages: yes, the employer is obliged to pay personal income tax (NDFL), contributions to the Compulsory Medical Insurance Fund and the Pension Fund on the amount paid, but other contributions, for example, for temporary insurance disability or due to maternity, he does not pay. Therefore, the employee will have to deal with such situations himself.

And, probably, the most important advice for both parties: do not try to replace a real long-term employment relationship with the appearance of a one-time transaction for the provision of services, concluding a GPC agreement instead of an employment one. This violation is fraught with serious negative consequences for both the employee and the employer.

In accordance with Part 4 of the Code of Administrative Offenses of the Russian Federation, in this case, a fine of 50 to 100 thousand rubles may be imposed on the organization, and the official who directly made the decision on such a substitution will be additionally fined in the amount of 10 to 20 thousand rubles. The employee will lose not only the opportunity to go on sick leave or maternity leave, but also other compensation and benefits provided for by law - for example, paid leave.