In this article we:

- Let's look at what industrial injuries are, what they are, in what cases injuries on the way to work are considered industrial;

- We will find out what the employer faces in the event of a work-related injury;

- we will determine how much time is given to complete documentation related to work-related injuries;

- Let's figure out why employers and employees are equally interested in timely registration of work-related injuries and investigation of the causes of their occurrence.

What injury is considered work-related?

According to existing labor legislation, an industrial injury is any event that causes harm to an employee’s health, occurring during the performance of work duties, while performing any actions performed for the benefit of the employer. In particular, these include injuries received independently and inflicted by another person, animal bites, lightning strikes and other events associated with industrial and natural factors. Such injuries will be considered industrial if:

- the employee was at the workplace specified in the employment contract or on a break;

- a company vehicle was used;

- the employee was on a business trip or en route to its destination.

The question of whether a work-related injury occurs when an injury occurs as a result of an accident on personal or public transport is decided depending on the purpose for which the transport was used. An injury is recognized as a work-related injury if the employee was using such transport to carry out instructions from the manager. It is worth remembering that one of the main criteria for qualifying injuries as work-related is the presence of an order from the manager, his financial interest in the employee performing certain actions.

Legislative regulation of issues

In Russia, cases of injuries sustained during work activities are regulated by the following standards:

- Art. 184 of the Labor Code of the Russian Federation (principles of registration and payment of monetary compensation to an injured worker);

- The Order of the Russian Federation dated February 24, 2005, developed by the Ministry of Health and Social Development, reflects a list of injuries that allow injuries to be recognized as a severe industrial injury;

- Federal Law No. 255 “On compulsory social insurance in case of temporary disability and in connection with maternity”, effective from December 29, 2006 (regulates the amount of required payments for a citizen);

- Federal Law No. 125 “On compulsory social insurance against accidents at work”, adopted on October 24, 1998 (contains the rationale for calculating payments: the victim must be an individual performing duties under a previously concluded employment contract).

Federal Law No. 125 also applies to citizens sentenced to imprisonment and brought to work by the insurer.

Important! The basic law that guarantees a person’s safety in the performance of his work duties is the Constitution of the Russian Federation.

Work injury: payments and compensation 2021

In Art. 184 of the Labor Code of the Russian Federation states what an employee has the right to claim in the event of an injury at work:

- to receive earnings that were lost due to injury (100% temporary disability benefit);

- for reimbursement of expenses incurred for the purpose of professional, social or medical rehabilitation.

In addition, a citizen receives insurance transfers in accordance with the accident insurance law FZ-125 of July 24, 1998, and has the right to count on compensation for moral damage caused by the employer.

In addition to the accident report, the basis for receiving funds is sick leave. In the column “Cause of disability” the code “04” is indicated. It stands for industrial accident or its consequences.

The amount and procedure for paying benefits and compensation for injuries is regulated by Article 184 of the Labor Code of the Russian Federation. The benefit is calculated on the basis of all payments received by the employee during the pay period, from which the injury contribution has been paid. The answer to the question: how much temporary disability benefits are paid in case of accidents at work is contained in Art. 9 FZ-125 - a citizen receives benefits in the amount of 100% of his average earnings. The benefit does not depend on the employee’s length of service, so it is calculated based on the average monthly daily wage.

Federal Law No. 125 dated July 24, 1998 indicates what payments are due for an industrial injury, except for sick leave, under social insurance:

- one-time insurance payment;

- monthly insurance payment in case of loss of professional ability to work.

According to current legislation, the victim is entitled to a one-time insurance payment. The procedure for its payment (including calculation principles and amounts) is in 125-FZ. It is paid once - upon receipt of injury. In 2021 (from February 1), its size is 108,600.52 rubles. Its size is established in Art. 11 125-ФЗ and is indexed annually (in 2021 indexed on the basis of Decree of the Government of the Russian Federation No. 73 of January 28, 2021).

The law provides for a monthly insurance payment. Its size depends on the degree of disability, if any, as determined by the results of the incident. This year, the maximum amount is 83,502.89 rubles, in accordance with the Federal Law on the FSS Budget FZ-384 dated 12/02/2019 and Art. 12 125-FZ. The indexation coefficient in 2021 is established by Decree of the Government of the Russian Federation No. 73 dated January 28, 2021.

In addition, the employer has the right, at his own expense, to pay the injured employee additional funds allocated for treatment and rehabilitation, if they are specified in the collective agreement or employment agreement.

ConsultantPlus experts looked at how an employee can receive benefits in the event of an accident at work. Use these instructions for free.

Calculation of sick leave if part day

If a person works only a few hours a day, the calculation is carried out according to the same rules, but taking into account some nuances. To determine average earnings per day, you need to divide the income for the billing period by 730 days.

If the average wage in the calculations was less than the minimum wage, then for the calculation you need to take the amount of the minimum wage. Average earnings per day, calculated from the minimum wage, must be reduced in proportion to the amount of time worked.

Online loan Creditplus, Persons. No. 004402

from 1% per day

First loan 0%

up to 30 thousand

5 – 30 days

Take out a loan

Types of payments

An employee has the right to claim the following payments and compensation in case of an industrial injury:

- benefit due to temporary disability: it is paid in the amount of 100% of average earnings, length of service is not taken into account;

- insurance payment made at a time;

- monthly insurance payments;

- compensation for moral damage caused. Carried out by the employer on a voluntary basis, the employee has the right to seek protection of his rights to receive it in court;

- material assistance if such a clause is contained in a collective agreement or other local regulatory act, and in the amounts established by this document;

- payment for further restoration of health after leaving the hospital, if it is not covered by compulsory medical insurance or other benefits (Article 8 125-FZ).

If an employee dies as a result of an accident, payments are made to his relatives.

Calculation of temporary disability benefits

The amount is affected by:

- cause of loss of health;

- insurance experience;

- salary amount;

- number of calendar days of incapacity.

Sick leave is calculated using the formula:

SD x PTS x D = Amount of monthly benefit.

- SD – average daily earnings;

- PTS – percentage of experience;

- D – number of days spent on sick leave.

To calculate the average daily salary, you need to calculate the total amount of income received and divide it by 730 days.

The next required indicator - the percentage of work experience - is defined by Federal Law No. 255.

It depends on the length of service and the reason for losing the opportunity to work. Table of dependence of length of service and percentage of sick leave payments

| Cause | Experience | Percentage of salary that is taken into account when calculating benefits |

| Illness or injury, quarantine, prosthetics, rehabilitation | Up to 5 years | 60% |

| From 5 to 8 | 80% | |

| From 8 | 100% | |

| If a child under 15 years of age is sick, treatment at home | Up to 5 years | 60%. |

| From 5 to 8 | 80% | |

| More than 8 years | 100% | |

| If a child under 15 years of age is sick, treatment in a medical institution, as well as care for an adult family member at home. | Up to 5 years | 60% |

| From 5 to 8 | 80% | |

| More than 8 years | 100% |

Loan secured by CarMoney (Karmani), Persons. No. 005203

from 0.09%

rate per day

up to 1 million

730 - 1,431 days.

Take out a loan

The numbers in the third column are the percentage of average earnings that is taken into account when calculating material compensation.

If a person has had several jobs over the last two calendar years, the amount will be calculated taking into account all income that was subject to insurance premiums.

Procedure for assigning payments

They are designed to compensate an injured worker for lost earnings because he is unable to work (or work at full capacity) for a certain period of time. If a person dies, financial assistance is provided to his relatives, who have the right to receive it in accordance with the law.

A one-time payment is made no later than a month from the date of its appointment, and to the relatives of the deceased - no later than two weeks from the moment the entire set of documents is provided. The injured specialist will need to provide the Social Insurance Fund with a medical and social examination report, and the relatives of the deceased will need to provide documentary evidence of the occurrence of death and the acquisition of the right to financial assistance.

In accordance with Art. 7 125-FZ, the following relatives of the deceased acquire the right to receive funds:

- recognized as dependents entitled to receive maintenance from the deceased on the day of his death;

- children of the deceased employee born after his death;

- dependents of an employee who have lost the ability to work within five years from the date of death of this citizen;

- non-working family members caring for young or disabled children of the deceased.

Transfers are made according to the general principle until the moment of restoration or acquisition of working capacity, if this is not possible - for life.

Form of certificate of incapacity for work

The document is issued at the medical institution. It states:

- Address and name of the medical organization.

- Full name of the patient.

- Cause of disability.

- Type of employment.

- Data on average income, information about employer, length of service.

- Period of release from work.

The sheet is filled out by the medical professional, then by the employer.

Sample certificate of incapacity for work

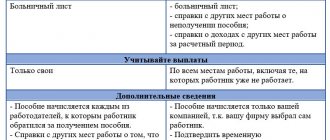

Who pays

The legislation establishes who and how much must pay for an industrial injury: the Social Insurance Fund and the employer in the amount established by law, taking into account regional coefficients, but not more than legal limits. Sick leave is paid 100%.

Payments are made by both the employer and the Social Insurance Fund. For example, compensation for moral damage caused, quite logically, is paid by the administration of the enterprise, and insurance payments, both monthly and one-time, are made by the Social Insurance Fund. In addition, sick leave is paid at the expense of the Fund, and the employer makes payments stipulated by the labor or collective agreement (material assistance, for example).

The Social Insurance Fund is obliged to bear the financial costs of the citizen for further rehabilitation (in the case of undergoing treatment and restoring health in sanatoriums, purchasing medicines). Such expenses will be reimbursed only after the provision of payment documents confirming the costs incurred.

Principles of calculation

The amounts of compensation for industrial injuries are established in 125-FZ, but are revised annually. In Art. 11 of the law indicates the maximum amount of 94,018 rubles, but it is subject to indexation annually in accordance with Part 1.1 of the same article. In 2021, the indexation coefficient is established by Decree of the Government of the Russian Federation No. 73 dated January 28, 2021. The amount of compensation depends on the degree of loss of professional ability after injury. In the event of the death of a citizen, it is one million rubles. Regional coefficients are also taken into account when calculating.

Calculation of sick leave if the length of service is less than 6 months

The benefit for a full month cannot be less than the minimum wage, regardless of length of service, i.e. 12,792 rubles .

In this case, when calculating the average income for 6 months, it is not the salary level that is taken, but the minimum wage amount. Calculation formula:

Payment amount = minimum wage x 0.6.

Where:

- Minimum wage – minimum wage;

- 0.6 is 60%.

According to this formula, persons without experience can count on small benefit payments.

Payment calculation

When paying for sick leave, the calculation procedure includes the following steps:

- determination of average earnings, income for two years before going on sick leave is divided by 730 (the number of days of the specified period);

- the employee’s income is included in the calculation in full, without observing the maximum amount of earnings;

- the resulting value is multiplied by the number of days of sick leave;

- if the average earnings are below the minimum wage, the minimum wage is used in the calculations;

- Personal income tax is withheld from the benefit, this follows from Art. 217 of the Tax Code of the Russian Federation (about this in the Letter of the Ministry of Finance of Russia No. 03-04-05-01/42 dated 02.22.2008).

In 2021, there are changes to the payment procedure. Now the answer to the question: how is sick leave paid for a work-related injury in 2021? The calculation and payment are handled directly by the Social Insurance Fund; the employer’s responsibility is to obtain documents from the employee and transfer them to the Fund. Personal income tax is retained by the Social Insurance Fund.

Types and severity of damage

The amount of payments and the rules for drawing up working documents depend on the type and nature of industrial injuries, the conditions of injury.

It is customary to distinguish two types of injuries: severe and mild. All damage is usually classified taking into account the conditions of its receipt:

- chemical;

- electrical;

- temperature;

- technical.

An examination and diagnosis is carried out by medical personnel, followed by the preparation of documentation reflecting the nature and conditions of injury.

Severe form

In 2021, work-related injuries generally include injuries that threaten the health and life of an individual:

- shock;

- injuries that resulted in heavy blood loss (more than 20%);

- damage to the spinal column;

- fractures of the skeleton with displacements;

- coma;

- damage to internal organs leading to disruption of their functions;

- joint dislocations;

- brain injuries;

- abortion;

- mental illnesses and conditions.

Burns, damage to the eyes and speech apparatus are also considered to be severe types of injuries.

Light form

Cases of occupational injuries falling under the “mild” classification:

- sprain of the ligamentous apparatus;

- uncomplicated bone fractures;

- concussion.

A person can be injured in the workplace either through his own fault or as a result of unlawful actions of a manager. Each case is considered individually: a commission is assembled.

In case of a minor work-related injury, the duration of the consideration of the case is 3 days. Severe injury or death of an employee requires an extension of the period to 15 days.

Types of industrial injuries

Important! The duration of the process is affected by the time at which the employer is notified of the occupational injury that has occurred. If the information was provided the next day, then all activities are carried out within a month.

Mandatory actions of the employer

The employer's responsibilities in the event of an accident are stipulated in Article 228 of the Labor Code of the Russian Federation. Taking into account this standard, step-by-step instructions for work-related injuries are determined:

- Take measures to organize first aid to the victim.

- Prevent further development of the emergency situation.

- If possible, keep the scene of the incident intact.

- Interview witnesses.

- Conduct an investigation into the circumstances of the incident, for which purpose form a commission, and based on the results of the investigation, draw up a report on the industrial accident (the report is drawn up according to the number of victims).

- If the accident was a group accident (two or more people were injured) or serious (resulting in the death of a person), the employer is obliged to report it within 24 hours to the prosecutor's office, the labor inspectorate, and the regional government by sending a notice. It is imperative to report any accident to the Social Insurance Fund, since the Social Insurance Fund makes payments to the injured citizen.

- Fulfill your legal obligations to compensate the victim.

This is exactly the sequence of actions of the employer in the event of an accident at work in 2021: first prevent the accident from developing, provide assistance on the spot, and then conduct an investigation and pay compensation.

Actions of the organization's administration in the event of an accident with an employee

The order of priority actions of the enterprise management in the event of injury to a worker is defined in Art. 228 Labor Code of the Russian Federation.

Injury at work: what should an employer do?

In the event of an injury at work, the employer must:

- provide the necessary assistance to the victim, and if serious harm is caused, take him to a medical facility;

- take all possible measures to eliminate the causes of injury in order to avoid injury to other workers;

- preserve the situation at the time of the accident before the start of the investigation, and if this is not possible, then capture it using photo and video recording equipment.

Further actions of the enterprise management will depend on how many workers were injured and what harm was caused to them.

How to file a work injury with minor consequences

In the event that only one employee is injured and his health is not seriously harmed, the company is obliged to investigate the incident on its own. According to Part 1 of Art. 229 of the Labor Code of the Russian Federation, for this purpose, a commission must immediately be created in the organization by order of the employer to investigate the accident. The commission must have three or more members (including a representative of the company administration, a representative of the employees, and a labor protection specialist). The commission is headed by a representative of the company administration.

The victim has the right to participate in the work of the commission and get acquainted with all the documents compiled by it.

To conduct an investigation by the commission, in accordance with Part 1 of Art. 229.1 of the Labor Code of the Russian Federation, three days are allotted.

As part of the investigation, the commission, in accordance with Part. 1 and 2 tbsp. 229.2, performs the following actions:

- collects explanations about what happened from the victim and eyewitnesses of the incident;

- draws up a protocol for examining the place where the injury occurred, a diagram, conducts photo and video recording;

- checks the legality of the victim’s admission to the work he performs, whether he has the necessary protective equipment, and provides him with the necessary instructions;

- checks whether there have been comments regarding the given employee and employer from the labor inspectorate, complaints from employees, or whether there has been other evidence of violations of labor safety standards;

- Performs other necessary actions and collects all documentation related to the incident.

Based on the results of the investigation, the commission draws up an act in form N-1, in which it determines the causes of the incident, the perpetrators (if any), the presence of violations of labor safety standards, and also qualifies the injury as industrial or not related to production.

Important! Documents drawn up by the commission during the investigation of an emergency (protocols of interviews, inspection of the emergency site, report form N-1 and other documents) are drawn up on standardized forms approved by the Resolution of the Ministry of Labor “On Approval...” dated October 24, 2002 No. 73.

Administration actions in the event of severe injuries

According to Art. 228.1 of the Labor Code of the Russian Federation, if an employee has suffered serious harm to health, he has died, or if there are 2 or more victims, the administration must notify the following authorities about the incident within 24 hours from the moment of the incident:

- the prosecutor's office;

- labor inspection;

- local administration;

- local branch of the Social Insurance Fund where the organization is registered;

- territorial trade union body (city or district, if absent - regional);

The notification form was approved by Resolution of the Ministry of Labor of the Russian Federation No. 73. The investigation commission is formed by order of the organization with the inclusion of representatives of all listed bodies. The commission is headed not by a representative of the enterprise administration, but by an employee of the labor inspectorate, based on the requirements of Part 2 of Art. 229 Labor Code of the Russian Federation. The victim or his representatives also have the right to take part in the activities of the commission and get acquainted with all the materials collected by it.

To ensure the activities of the commission at its request, the employer is obliged to:

- carry out the necessary calculations, laboratory and expert studies and involve relevant specialists for this at your own expense;

- ensure the drawing up of plans, diagrams of the emergency site, as well as photo and video shooting;

- provide the commission with the necessary transport, communications equipment, personal protective equipment, and special clothing.

The investigation period is 15 days. Based on the results, an act is drawn up in form N-1, in which the commission’s conclusions about the causes of the tragedy, the perpetrators, the presence of violations of safety regulations, etc. are drawn up.

Registration of accidents

All accidents under investigation, in accordance with Part 1 of Art. 230.1 of the Labor Code of the Russian Federation, are subject to registration in the appropriate journal. The form of the journal is approved by Resolution No. 73.

In the event that the investigation was carried out under the direction of a representative of the enterprise, the act of form N-1 is signed by all members of the commission and certified by the seal of the enterprise and made in two copies. One of them with all materials is stored at the enterprise, the other is given to the victim.

If the investigation is carried out by a commission with the participation of representatives of the labor inspectorate, prosecutor's office, etc., then the act is drawn up in four copies for the employee, prosecutor, labor inspector. The fourth copy, along with the materials of the commission’s work, remains with the employer.

After the employee recovers (is declared fully or partially disabled), his employer, in accordance with Part 4 of Art. 230.1 of the Labor Code of the Russian Federation, sends a message in the form approved by Resolution No. 73 to the labor inspectorate, which indicates the consequences of the accident, and also informs the inspection about the preventive measures taken to prevent similar situations in the future.

What should an employee do if injured at work?

When injured at work, an employee must take care not only to restore his health, but also to ensure that during treatment and rehabilitation he receives compensation, that is, compensation for lost wages. In accordance with Article 184 of the Labor Code of the Russian Federation, the employer is obliged to compensate for the earnings that the employee did not receive during treatment. Law No. 125-FZ of July 24, 1998 speaks about this. Such compensation is recognized as temporary disability benefits.

An employee who has been injured at work should remember: in order to receive all the benefits due, you must provide:

- sick leave;

- documents confirming expenses for treatment and rehabilitation;

- an application requesting reimbursement of the amounts specified in the documents provided (application for a one-time or monthly payment for a work-related injury).

Payments due to certain categories of employees

Government employees: firefighters, military, and police receive more compensation for injuries than other workers.

According to Federal Law No. 52 “On Compulsory Insurance of Military Personnel,” the amount of payments varies depending on the insured event:

- death during service, or death within a year due to injury: 2,000,000 rubles;

- establishment of 1 group of disability (15,000,000 rubles), 2 groups (1,000,000 rubles), 3 groups (500,000 rubles);

- mild injury, concussion: 50,000 rubles, if the injury is severe, then compensation increases to 200,000 rubles;

- dismissal as a result of work-related injuries by decision of the VKK: 50,000 rubles.

All payments are indexed taking into account the year and region, the conditions of the injury and its consequences.

Who makes the payments

Part of the payments for a work injury is made at the expense of the Social Insurance Fund:

- disability benefits;

- monthly allowance;

- compensation for expenses incurred by the employee during rehabilitation in sanatoriums and the purchase of medicines.

As for payments made by the employer upon the occurrence of a work-related injury, some managers try to evade this obligation. In this case, it is necessary to file a complaint with the labor inspectorate and then with the court.

ConsultantPlus experts examined whether payment of additional leave to an employee during the period of treatment due to an injury at work is subject to personal income tax and insurance contributions. Use these instructions for free.

Causes of injury in the workplace

All cases of injury at work are studied individually. Common causes of injury:

- neglect of established safety rules;

- performing work duties while under the influence of alcohol (drugs);

- performing operations without appropriate qualifications.

Responsibility for conducting and following safety instructions rests with the individual employee. But in each case of industrial injury, the degree of guilt of the injured worker is considered.

Causes of injury in the workplace